This is part II of a two-part series analysis of the electric vehicle industry. You can find part I of the article here.

In Part I, we discussed, among other things, the types of an electric vehicle, the composition of a battery and the main minerals required. In this second part, we will explore the major costs involved, the pros and cons of an electric vehicle, what are some steps investors may take and much more!

So, let’s begin!

WHAT ARE THE COSTS INVOLVED?

Vehicle Cost to Consumer

Although, electric vehicles (EV) are currently priced higher than their traditional internal combustion engine (ICE) counterpart, there are some cost savings related to fuel and maintenance.

- Fuel: According to AAA, if you drive 15,000 miles per year in the US in a compact EV, you will spend ~$546 on power, compared to $1255 in gas.

- Maintenance: EV owners also save on maintenance costs like oil changes and air filter replacements amounting to roughly around $330 per annum.

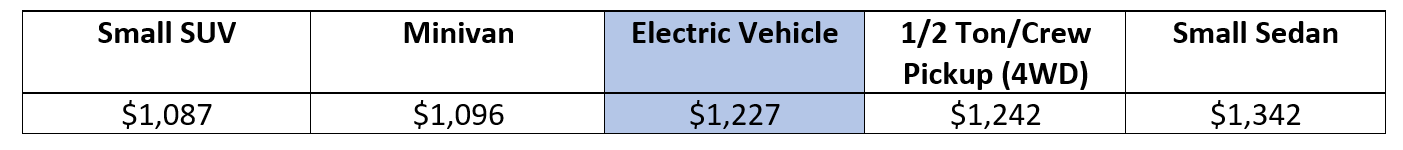

- Insurance: However, auto insurance costs maybe similar or even higher for EVs. The following table summarizes the full coverage insurance costs for various types of vehicles according to AAA. The insurance cost depends on the type of vehicle.

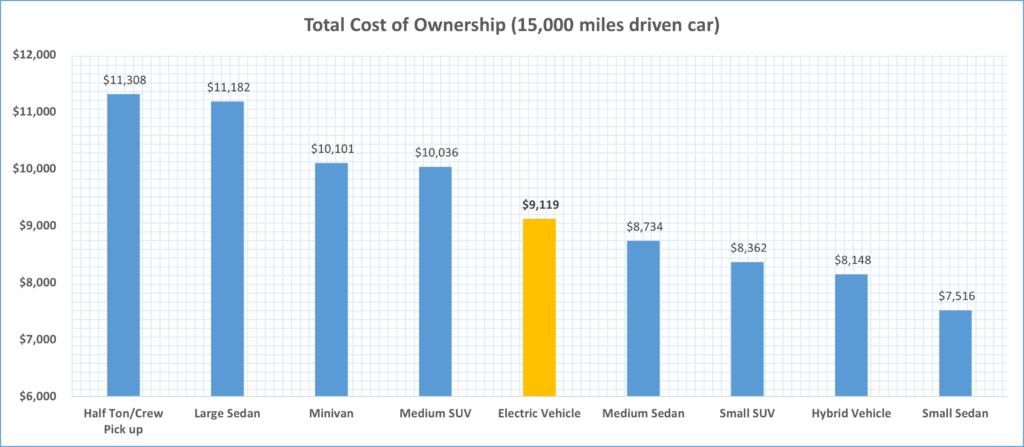

Overall, according to the study conducted by AAA, you may spend ~$9,119 per annum if you own an EV like — BMW i3, Chevrolet Bolt, Hyundai Kona Electric, Nissan Leaf, Tesla Model 3 (driven for 15,000 miles in a year). The comparable overall costs of owning other types of vehicles are summarized in the chart below:

These price differences should fall gradually as the penetration of EVs rises and auto manufacturers devise cheaper ways of making the car. Coupled with tax incentives and rebates given by various governments, it should gradually become cheaper for consumers to buy an electric car.

According to Kelley Blue Book, the average transaction price for an electric vehicle in April 2021 was $51,532. That’s ~ $11,000 higher than what you’d pay at the dealership for a full-size gas-powered car, and nearly $30,000 more than the average compact car sale in the US.

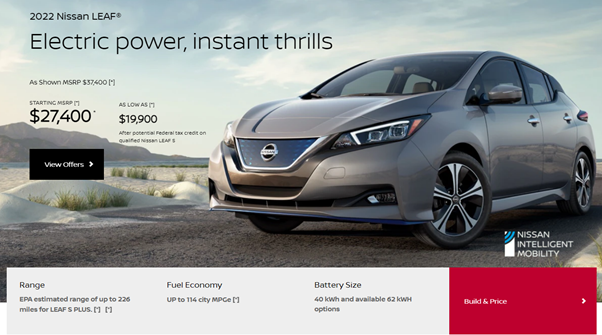

Currently, the Nissan leaf is the cheapest electric car in the US starting at $27,400. And, after the $7500 tax credit, the effective price will come to be around $20,000.

Battery Costs

Typically, batteries makeup a third of an electric vehicle’s cost. That’s because the metals required to make the battery need to be mined, processed, and converted into high-purity chemical compounds. With developing technology, this cost is expected to fall going forward.

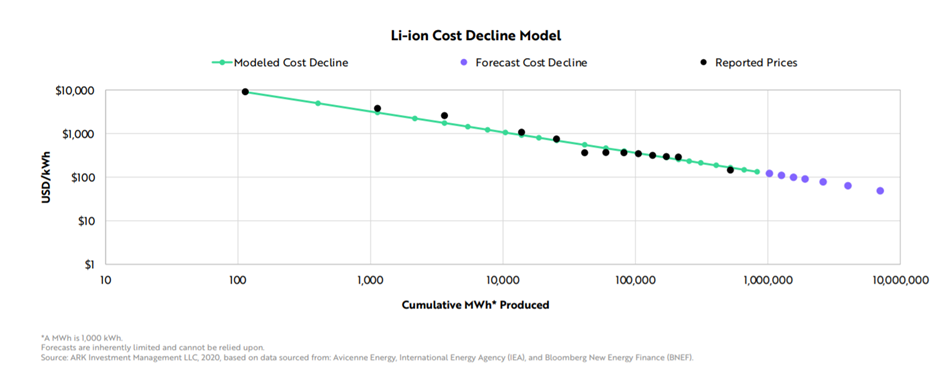

Wright’s Law

Lithium-ion battery pack prices fell 89% from 2010 to 2020. According to Wright’s Law (also known as the learning curve or experience curve), lithium-ion (Li-ion) battery cell costs will fall by 28% for every cumulative doubling of units produced. These cost decreases are essential for the prices of EVs to become comparable to gas-powered vehicles.

By 2023, the cost of Li-ion batteries is expected to fall to around $100/kWh—the price point at which EVs will be as cheap as conventional cars to manufacture.

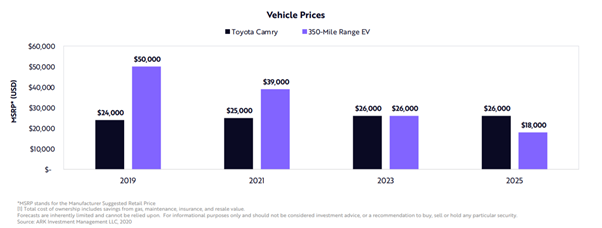

According to ARK Invest, the manufacturer’s suggested retail price (MSRP) of a 350-mile range EV will be at par with that of a like-for-like Toyota Camry in 2023. Furthermore, the price of a 350-mile range electric car is projected to drop by 53% between 2021-2025—making it $8,000 cheaper than the Camry.

Cheaper batteries and dedicated production lines are expected to make EVs cheaper on average

It is uncertain how much of the cost reduction in manufacturing Electric Vehicles will be passed on to the customers. Some of the savings might be utilised for improved battery capacity, advanced self-driving functions, investments in charging infrastructure, other improvements in the car, or even higher profit for the manufacturer. But in any case, electric cars will seriously begin to compete with traditional cars within the next few years.

KEY PLAYERS

Key players operating in the Electric Vehicle market include:

- Tesla Inc

- Volkswagen AG

- General Motors Company

- BMW group

- BYD Company Limited

- Daimler AG

- Ford Motor Company

- Nissan Motor Co., Ltd

- Toyota Motor Corporation

- Energica Motor Company S. p. A

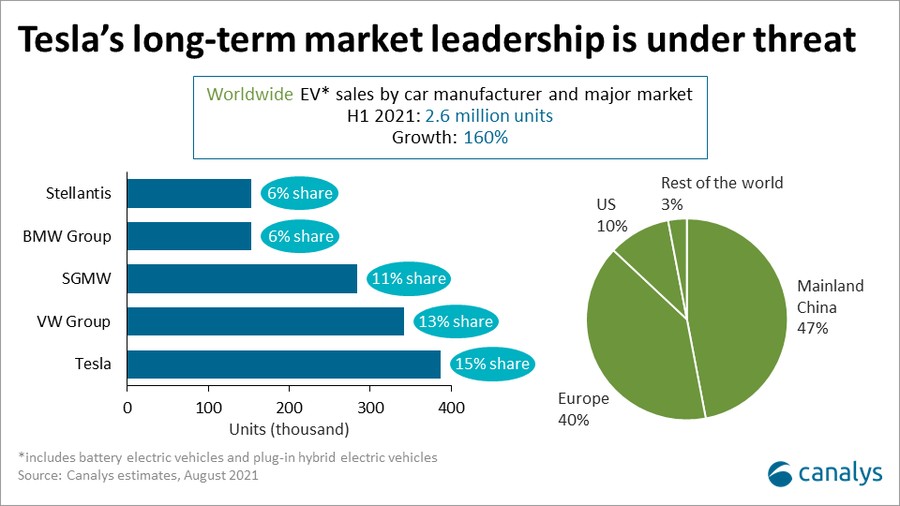

The chart above shows the market share of the top five auto makers selling electric cars as per Canalys estimates:

- Although Tesla was the leader with a 15% share, other players have been catching up. Tesla has been overtaken in Europe but continues to dominate in the US. Read our analysis on Tesla here.

- Volkswagen Group followed second with a 13% market share, and it led in Europe.

- SGMW, a combination of SAIC, GM and Wuling, came third with an 11% market share.

- BMW Group stands in the fourth place with a 6% share in H1 2021.

- Stellantis was fifth with 6% share.

FACTORS WHICH WILL ENCOURAGE LONG-TERM GROWTH

- Increasing investments by governments across the globe in EV charging stations and Hydrogen fueling stations

- Stringent government rules & regulations towards vehicle emissions

- Fiscal incentives offered to buyers like tax credits

- High demand for lower cost-efficient and low-emission vehicles

- Continuous developments in EV technology

- EVs require lower maintenance

- EVs are quieter than gas vehicles

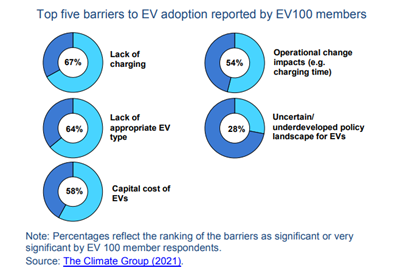

MAJOR HURDLES TO WIDER ADOPTION IN THE CURRENT MARKET SCENARIO

- The current low presence of Electric Vehicle charging stations and hydrogen fuel stations

- Higher costs involved in initial investments

- High manufacturing costs

- Performance constraints relating to range of the vehicle

- Long charging or “fueling” time.

- More expensive than the ICE counterpart

- Limited options in vehicle models

- Battery packs are expensive and may need to be replaced more than once

ELECTRIC VEHICLES IN KEY GEOGRAPHIES CHINA

- China is responsible for about 80 per cent of the chemical refining that converts lithium, cobalt and other raw materials into battery ingredients even though the metals are mostly sourced from Australia, the Democratic Republic of Congo and Chile.

- Chinese firms have monopolised mining rights in Congo without ensuring workers, who have no rights and work seven days a week in all sorts of conditions, are paid an appropriate wage.

- China also dominates processes to make battery parts including capacity for cathodes, anodes, electrolyte solutions and separators.

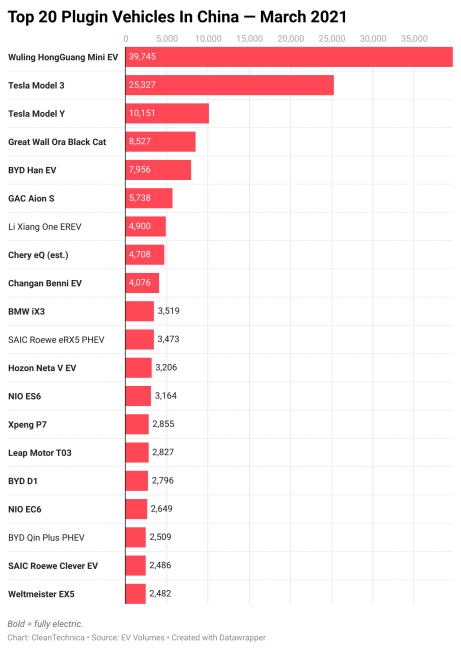

- Tesla’s success in China has motivated Chinese automakers to expand their EV offerings. EVs from brands such as Aion, BYD, Li Xiang, NIO and Xpeng are selling well, but it is the tiny Hongguang Mini EV from Wuling that is currently outselling all other EVs on the market. Four of the top 10 best-selling EVs in H1 2021 were small city cars. Read our analysis on NIO here.

- Because of interest from so many players, the choices of EVs in China is the widest. China was also the world leader in EV penetration until 2019, with Europe taking over in 2020.

- With strong consumer demand for EVs and huge long-term opportunity, one of China’s most successful consumer technology companies, Xiaomi, has set its sights on the Chinese EV market with a proposed US$10 billion investment.

- Industry and Information Technology Minister Xiao Yaqing has said that there are too many EV makers in China and the government will encourage consolidation in this sector. China also aims to improve its charging network and develop EV sales in rural markets. EV makers such as Nio, XPeng and BYD are expanding manufacturing capacity encouraged by the government’s promotion of greener vehicles to cut pollution.

ELECTRIC VEHICLE IN KEY GEOGRAPHIES EUROPE

The key challenge for expansion is keeping up with demand in light of the component shortages.

ELECTRIC VEHICLE IN KEY GEOGRAPHIES USA

Some major companies are making the transition to EV:

- Amazon has started making deliveries with electric vans in Los Angeles, as they’ve agreed to purchase 100,000 vans from EV start-up, Rivian.

- The United States Postal Service has signed a 10-year, multi-billion-dollar contract with Oshkosh Defense to produce thousands of electric mail trucks.

- United Airlines has placed a whopping $1 billion order with EV manufacturer, Archer, for a fleet of electric air taxis.

- Legacy automakers like Ford, Volkswagen GM, etc have all started venturing into EVs. In fact, General Motors has announced that they’ll stop making gas-powered vehicles altogether by 2035!

Recognizing the poor EV offtake in the US, especially compared with China, President Biden has proposed a US$174 billion investment with incentives and substantial charging infrastructure deployments to “win the EV market” and has set an aim that 40% – 50% of all new cars sales being EVs by 2030. Right now, only 3% of new car sales in US constitute EVs, out of which 55% are Tesla cars.

WHAT LIES AHEAD?

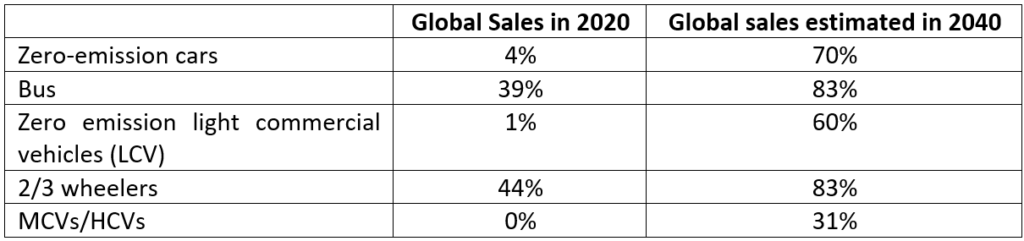

Global sales forecasts by 2040: Bloomberg forecasts that the global sales of zero-emission vehicles will rise in 2040.

- Bloomberg estimates that electric vehicles represent a $7 trillion global market opportunity between today and 2030, and $46 trillion between now and 2050.

- This further implies that the charging network needs to grow to over 309 million chargers across all locations by 2040. This would require significant investment over the next two decades.

- EV sales overtaking traditional vehicle sales depends on various factors:

- Price of EVs

- Charging infrastructure

- Mileage range of EVs

- Price of EVs:

- Policy & Incentives: Many governments have committed to achieving net zero carbon emissions by 2050, and so we can expect several policy changes to encourage higher EV penetration. Further, government subsidies, incentives and new regulations will also drive manufacturers to increase EV sales as a percentage of their total sales.

- Battery: Price of key raw materials have been volatile. The mix of metals used will depend on the type of batteries used. Mining capacities will need to be built to supply these material demands.

- Range and choice:

- Advancements in battery power density will allow for greater ranges, which is key for customer take-up. Advancements in battery power density will allow for heavier cars, taller cars, and so on. This would allow an ever-widening range of products to come onto the market, allowing more segments of the market to consider purchasing an EV.

- There has been a 40% rise in EV models available and so there will be more choices available going forward. Moreover, the driving range of the cars is also improving, up from 200 km in 2015 to about 350 km in 2020 as per IEA.

- Battery as a % of total cost: According to estimates, for a midsized US car, battery constituted 57% of the total car cost, which fell to 33% in 2019 and by 2025, it is expected to fall further to 20% of the total car cost.

HOW CAN INVESTORS TAKE ADVANTAGE OF THIS?

Investors can study companies which manufacture EVs like Tesla, NIO, Arcimoto, Workhorse Group, etc. There are also opportunities to invest in other companies in the supply chain which manufacture the parts required in making an electric car:

- Producers of semiconductor chips (NXP Semiconductors (NASDAQ:NXPI), Skyworks Solutions (NASDAQ:SWKS), and Taiwan Semiconductor Manufacturing (NYSE:TSM))

- Producers of metals like lithium, which is a key component used in making batteries. (e.g., Ganfeng Lithium Co. Ltd. (GNENF))

- Battery makers (e.g., Contemporary Amperex Technology Co. Ltd. (300750.SZ); Panasonic Corp. (PCRFY))

- Diversified auto parts makers

- Providers of charging stations and networks (e.g., Blink Charging)

It is difficult to predict which company will end up doing well because of the ever-changing technology and constantly evolving start-up space in this sector. Instead of choosing individual stocks, investors can put their money to work by investing in the following ETFs:

- Global X Lithium & Battery Tech (LIT)

- ISE Global Copper Index

- Global X Autonomous & Electric Vehicles ETF etc. (DRIV)

- KraneShares Electric Vehicles & Future Mobility ETF (KARS)

- iShares Self-Driving EV and Tech ETF (IDRV)

- iShares Electric Vehicles and Driving Technology Ucits ETF

- SPDR S&P Kensho Smart Mobility ETF (HAIL)

- Amplify Lithium & Battery Tech ETF (BATT)

- ARK Innovation ETF (ARKK)

Please note that this is not an investment advice. The information provided here is for educational purposes only. Every investment and trading move involves risk, you should conduct your own research when making a decision.

CLOSING THOUGHTS

Early man used to walk on foot. Then he learnt to use animals for transport. The invention of the wheel marked the beginning of a host of inventions which evolved over decades from boats, chariots, bicycles and roads to the modern-day cars, trains and airplanes…. And now even space shuttles. The advent of Electric Vehicles is one of the most revolutionary changes in the history of transport. It will transform driving habits and most significantly, it will enable sustainable energy usage as we evolve in technology.

As awareness about climate change increases, and human behavior evolves, consumers may begin to embrace the shift to EVs. When that happens, we will wake up to greener cities and a healed planet.

I leave you with this beautiful song from a great man:

“Heal the world

Make it a better place

For you and for me, and the entire human race

There are people dying

If you care enough for the living

Make a better place for you and for me”

—Michael Jackson

So, are you ready for an electric vehicle revolution?

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.