About Us

We Care To Make You

A Better Investor

Mind Kinesis Value Investing Academy (ViA) was established in 2010 as the 1st provider of the Value Investing Programme (VIP) in Singapore and conducted across 11 cities in Asia: Singapore, Kuala Lumpur, Kuching, Penang, Phnom Penh, Yangon, Ho Chi Minh, Hong Kong, Tokyo, Taiwan and Bangkok.

Investify Symposium

Robert G. Allen, Cayden Chang and Robert Kiyosaki

ViA 10th Anniversary Graduate Gathering

National Achievers Congress

Cayden with Lauren Templeton

Cayden with Mary Buffett

Wealth Summit Singapore

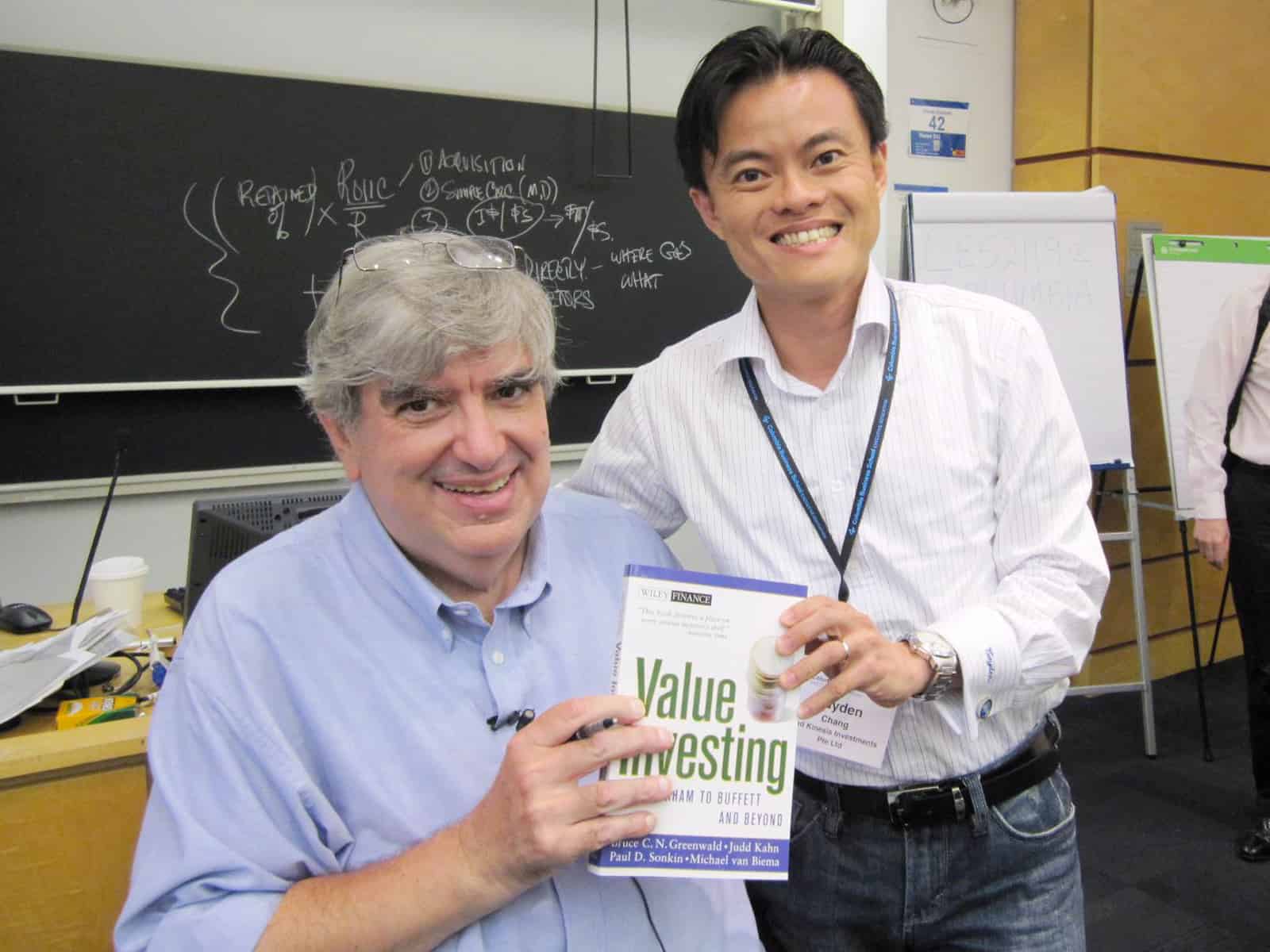

Professor Bruce Greenwald

What Makes ViA Special

Empowering you To Succeed

Vision

We dream to create a world where anyone can invest effectively, improve their lives and give back to the society.

Mission

We care to make you a better investor.

Monthly Gathering

We host monthly gatherings for our graduates where guest speakers will cover a range of topics.

Lifetime Support

At ViA, we want to see our graduates succeed so we have set up a system for continuous support. Opportunities for revisions are available for our graduates. Our community of trainers and coaches are always keen to share their insights and research during the monthly gatherings.

Notable Events

- Organised “Investify Symposium Online 2024” with key note speakers Robert G Allen, Lauren C Templeton and Todd A Finkle attended by over 2,000 investors worldwide.

- Organised “Investify Symposium 2018” with key note speaker Ms Lauren Templeton, & “Value Investing Online Symposium 2021”

- Organised “World Value Investing Fest 2015” & “Invest With Mary Buffett 2015”

- Co-Organised- first & largest “Asian Value Investing Conference 2013” with Phillip Capital in Singapore

- Featured in “Wealth Summit Singapore” 2012, 2013, 2014, Wealth Summit Malaysia 2013, 2014, Wealth Summit Thailand 2014, National Achievers Congress Singapore 2013, 2014 & National Achievers Congress Malaysia 2014

Our Books

All proceeds of Sales/Royalties are all donated to various charitable causes such as:

- The Straits Times School Pocket Money Fund

- Children Cancer Association of Japan

- National Cancer Centre of Singapore

- Singapore Cord Blood Bank

Value Investing Masterclass

Over 50,000 people across 11 cities in Asia have attended our signature Value Investing Masterclass and how you can learn to generate 3 sources of passive income even if you have zero experience in investing.

Signature Value Investing Programme (VIP) & CFOS

ViA's Signature Flagship 4-day Value Investing Programme (VIP) and Bonus Cash Flow Options Strategy (CFOS) course and is designed to guide you to become a successful value investor and start immediately with your personal portfolio by the end of the programme.

PNWA (Advanced)

A series of advance methodology designed to drive success. Enrolment is by invitation only.

VIP Online (E-Learning)

Value Investing Programme Online is an online pre-recorded course on ViA S.E.G.A. Funnel Analysis for those residing overseas, and for those who seek a refresher course at your own pace. Get started with a free preview.

ViA Atlas US/SG Case Study

The Case Study Membership is a subscription-based service that provides deep-dive case studies monthly on companies and their intrinsic value. Get started with a free company analysis.

Autopilot Webinar

Ready to invest effortlessly? This online webinar shows you how to set your investments on autopilot mode.

Tri-Portfolio Seminar

Ready to start passive investing? This seminar will show you how to set your passive investments with this session.

Investify Symposium

An annual multi-day, multi-speaker event featuring notable keynote speakers presenting various topics ranging from personal finance, investments to company case studies.

ViA Deep Dive

ViA Deep Dive is an informative live stream series hosted on Youtube providing insights into a range of topics, covering company analysis, market and industry trends. Catch it on our Youtube Channel.

YOUR TRAINERS

Cayden Chang

Founder of Value Investing Academy, BSc (Hons), Msc, Personal Brand Award 2017

Master Trainer

Cayden Chang

Founder of Value Investing Academy, BSc (Hons), Msc, Personal Brand Award 2017

Liu Feng

Master Trainer

Master Trainer

Liu Feng

BSc Beijing University, Self-made Millionaire, Professional Investor

George Mitsis

Investment Expert

Guest Trainer

George Mitsis

Investment Expert and Options Seller, Guest trainer at Value Investing Academy

Lauren C. Templeton

Author of International Best-Seller "Investing The Templeton Way"

Lauren C. Templeton is the founder and Chief Executive Officer of Templeton & Phillips Capital Management, LLC. Prior to founding the firm in 2001, Lauren was employed with Morgan Stanley, Homrich Berg, and New Providence Advisors, a hedge fund management company, based in Atlanta, GA.

“Author of “Investing the Templeton Way: the Market Beating Strategies of Value Investing's Legendary Bargain Hunter”, Lauren is also the great niece of Sir John M. Templeton and is a current member of the John M. Templeton Foundation, established in 1987 by renowned international investor, Sir John Templeton. She began investing as a child under the heavy influence of her father as well as her late great-uncle, Sir John Templeton.

About Sir John Templeton

Sir John Marks Templeton was born in 1912, in the small town of Winchester, Tennessee. He attended Yale University and graduated near the top of his class and as President of Phi Beta Kappa. He was named a Rhodes Scholar to Balliol College at Oxford, from which he graduated with a degree in law.

Templeton started his Wall Street career in 1938 and went on to create some of the world’s largest and most successful international investment funds. He was famous for picking companies that hit “points of maximum pessimism” (ie. Rock bottom prices). When war began in Europe in 1939, he borrowed money to buy 100 shares each in 104 companies selling at one dollar per share or less, including 34 companies that were in bankruptcy. Only four turned out to be worthless, and he turned large profits on the others.

Templeton established the Templeton Growth Fund in 1954. With dividends reinvested, each $10,000 invested in the Templeton Growth Fund Class A at its inception would have grown to $2 million by 1992. He eventually sold the family of Templeton Funds to the Franklin Group — scores of them with $13 billion in assets — in 1992, and turned to philanthropies that had engaged him for decades.

Investing the Templeton Way Podcast

Investing the Templeton Way with Lauren Templeton is a podcast that explores the world’s most intriguing investment topics from the overseas markets to mastering our own minds. Gather investment wisdom and educate yourself as you listen to interviews with exclusive managers, executives, and entrepreneurs on a wide range of engaging topics. Visit the Podcast Page.

Guest Speaker, Investify Symposium

Lauren C. Templeton

Lauren Templeton is the founder of Templeton & Phillips Capital Management.

Robert G. Allen

New York Times Best Selling Author of "Multiple Streams Of Income", "Creating Wealth"

As a public speaker, he has spoken to audiences worldwide as large as 20,000 people, sharing stages with the likes of Sir Richard Branson, Tony Robbins, Robert Kiyosaki, Oprah Winfrey, Prime Minister Tony Blair and Donald Trump. In America, the National Speaker Association gave him an award as America's Top Millionaire Maker.

As a trainer and educator, he has spoken to groups all over the world from United States, Singapore, Mexico, Canada, South Africa, Russia, Kazakhstan, Latvia, Slovenia, Australia, Italy, England, Japan, Taiwan, Hong Kong and China. He teaches on the subjects of personal finance, wealth creation, multiple streams of income, entrepreneurship, authorship, sales, marketing and personal growth.

He is a popular media guest appearing on hundreds of radio and television programs including Good Morning America, Regis Philbin, Neil Cavuto and Larry King. He has been the subject in numerous international publications including the Wall Street Journal, The Los Angeles Times, The Washington Post, Newsweek, Barons, Redbook, Money Magazine and The Reader Digest to name just a few.

Guest Speaker, Investify Symposium

Robert G. Allen

#1 New York Times Best Selling Author of “Multiple Streams Of Income”, “Creating Wealth”

Dr Todd A. Finkle

Todd A. Finkle, Ph.D. is the Pigott Professor of Entrepreneurship at Gonzaga University, and is an expert on Warren Buffett and Entrepreneurship.

Dr. Finkle is an expert on Warren Buffett and Entrepreneurship. His recent book titled," Warren Buffett: Investor and Entrepreneur," is published by Columbia University Press. The book traces the entrepreneurial paths that shaped Buffett’s career, from selling gum door-to-door during childhood to forming Berkshire Hathaway and developing it into a global conglomerate through the imaginative deployment of financial instruments and creative deal making.

Dr. Finkle's initial motivation for writing the book was to show the layperson how Buffett evaluates potential investments. Finkle also zeros in on Buffett’s longtime business partner Charlie Munger and his contributions to Berkshire Hathaway's success. Finkle draws key lessons from Buffett’s mistakes as well as his successes, using these failures to explore the ways behavioral biases can affect investors and how to overcome them.

Dr. Finkle is a pioneer and innovator in the field of entrepreneurship education. He has been an entrepreneur of six ventures and consulted with a wide variety of entities including countries and universities from all over the world. Dr. Finkle has been interviewed or appeared in a variety of media outlets including the Cleveland Plain Dealer, Entrepreneur Magazine, Forbes Magazine, Omaha World Herald, Wall Street Journal, The Washington Post, and several radio and television stations.

Guest Speaker, Investify Symposium

Dr Todd A. Finkle

Pigott Professor of Entrepreneurship & Author of ‘Warren Buffett: Investor and Entrepreneur

OUR GRADUATES

Frequently Asked Questions

Most frequently asked questions and answers

Q. I have a keen interest to invest but I have no investment knowledge. Where Should I start?

Having mentored thousands of people across 10 different countries, we’ve come up with a step-by-step process that works. The system caters to everyone — men and women, young and old.

Many of our students who started as complete beginners have progressed to investing like seasoned investors in a short amount of time, just by following the steps laid out in the program.

Q. Why should I learn Value Investing?

Value Investing has proved its worth, time and time again in its 100-year history. It’s the powerhouse strategy that made Warren Buffett one of the richest people in the world and turned Berkshire Hathaway into a $500 billion company.

Understanding the theory and methodology behind Value Investing will allow you to buy and sell stock with greater confidence, knowing that you have acquired safe and profitable stocks. When you are a knowledgeable investor, you can equip yourself with the most important piece of knowledge you need in life and take back control of your financial destiny.

Q. Who are ViA programmes suitable for?

The Value Investing Masterclass is for you if:

Q: There are so many so-called wealth experts and gurus out there, I feel really overwhelmed with all the information out there. Which advice do I listen to and who can I trust?

One should start with finding someone who has a proven process that already works and have achieved the results that you want to achieve.

Aside from that, the person must also be willing to impart knowledge over to you. A good mentor should help guide you in identifying where you went wrong and direct you in the right path towards your goals.

Q. I'm worried I don't have enough money to get started with investing.

The truth is you can start investing with just a few hundred dollars or less. In Singapore Exchange (SGX), an investor can invest in a quantum of one lot which is 100 shares. If a share costs $1, your capital will be $100.

In New York Stock Exchange (NYSE), you can buy a minimum of just 1 share. If one stock costs US$40, that is cheaper than a single full-course meal in a restaurant.

Q: Do I need a lot of capital and time to go into investing? If the returns are high, are the risks high as well?

This is a common misconception that I address with my students all the time. Having studied with the top professors who specializes in the field of investing and worked with numerous millionaire investors, I came to the following conclusion;

The knowledge of investing may be commonly known by most investors but the REAL science behind is rarely, truly understood.

The actual truth is that you can start with just a small amount of capital. You need only put aside a small amount of time daily to carry out a few specific tasks.

If done right, investing CAN be both low risk and high returns.

Q. Can I become a millionaire by investing? How fast will I see my first return?

In spite of what you heard from financial experts about the power of value investing, it is not a get-rich-quick method. While it is possible for many, not everyone will become a millionaire, simply because it takes time and discipline. In the masterclass, I share 4 factors for reaching the level of financial status most people can only dream about.

On the other hand, Cash Flow Options Strategy (CFOS) is one of the techniques we can use to generate shorter-term returns. Once you master the technique, most will start seeing returns immediately.

Q: I am unsure on which stock to invest or if I should even attempt to invest. I know that my potential decision could either make me money or severely risk the financial well-being of my family and loved ones.

The learning objective of a savvy investor is to know how to pick high performing investment stocks. By following just a simple 2 minute formula, you will be able to screen high value stock out of thousands with ease.

Stock investment will no longer seem like a high risk gamble but a well-thought through progression of steps that one follows with confidence and certainty.

Q. I already started investing and have questions whether to buy a stock or about my portfolio or stocks that I own.

If you are unsure of whether to buy a particular stock, or what to do about the stocks that you already own, you can consider coming for our Value Investing Masterclass where we will touch on what makes a stock a good purchase, when is the best time to buy or sell a stock and how to build a weather-proof portfolio. Registration is currently free for a limited time, up. SG$199.

For other enquiries, connect with us at our page – Contact Us