Recent news on Berkshire Hathaway’s investment worth almost $1 billion in Activision Blizzard and Microsoft’s $68.7 billion all-cash acquisition deal has been the latest hot topic within both the gaming industry and investment world.

What’s so special about Activision Blizzard that it had attracted the “Oracle of Omaha” and the tech giant’s attention?

In this article, we will deep dive into the company and explore if this is still a good investment opportunity.

INTRODUCTION

Activision Blizzard is leading global developer, publisher and distributor of high-quality interactive entertainment content and services on video game consoles, PC, and mobile devices. They aim to connect and engage the world by delivering engaging entertainment experiences on a year-round basis.

The company has about 371 million monthly active users (MAUs) in 190 countries by December 31, 2021 and its headquarter is based in Santa Monica, California. There are sales offices & studios located in South America, Europe and Asia Pacific.

COMPANY OVERVIEW

The original Activision company was first founded by 4 software programmers in 1979 as a third-party game developer for Atari Video Computer System.

In 1991, Bobby Kotick and a group of investors purchased the company and restructure Activision after it failed to expand into non-gaming software (was renamed as Mediagenic) in 1988. Kotick then further expanded Activision’s products through the acquisition of 25 studios, which lead to the launching of a few successful games series: Call of Duty (first launched in 2003), Tony Hawk’s (first launched in 1999) and Guitar Hero (first launched in 2005).

Activision merged with Vivendi Games and integrated Blizzard in 2008 to have access to the increasing popularity of massively multiplayer online (MMO) games, which further launch the industry’s most successful gaming franchises, such as Diablo (first launched in 1997), Overwatch (first launch in 2016) and digital distribution platform: Blizzard Battle.net. When the acquisition deal completed in July 2008, the company was renamed as Activision Blizzard and opened for trading on Nasdaq stock market under the ticker symbol of ATVI.

In November 2015, Activision Blizzard also acquired social gaming company King, creator of Candy Crush and the leading developer of mobile free-to-play games. This acquisition gives the company immediate access into the growing audience of the smartphone mobile games platform.

In Jan 2022, Microsoft announced to purchase Activision Blizzard in a $68.7 billion all-cash deal and the deal is expected to close in fiscal year 2023.

BUSINESS SEGMENT

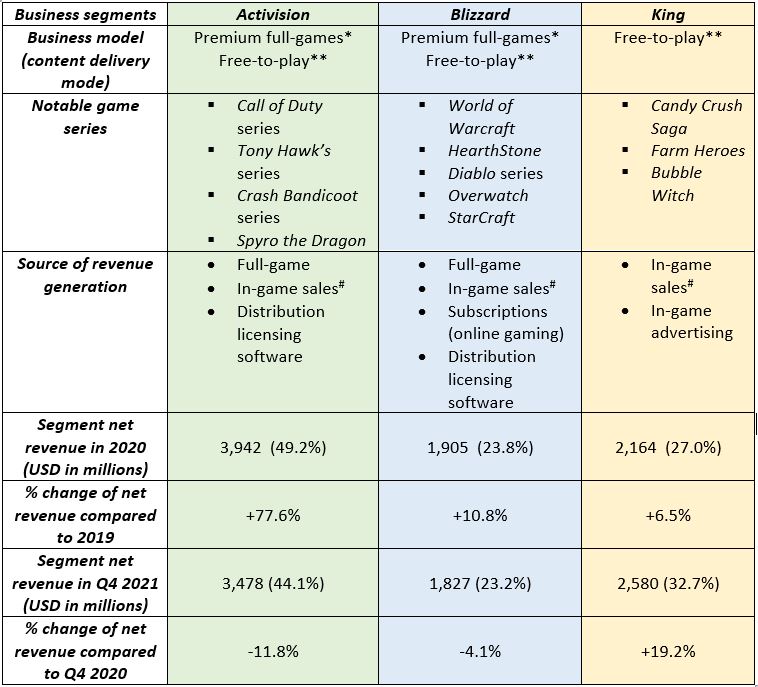

Activision Blizzard has 3 main reportable business segments:

*Premium full-games, which typically provide access to main game content after purchase.

**Free-to-play offerings, which allow players to download the game and engage with the associated content for free.

#In-game sales, which is in-game content for purchase to enhance gameplay (i.e. microtransactions and downloadable content)

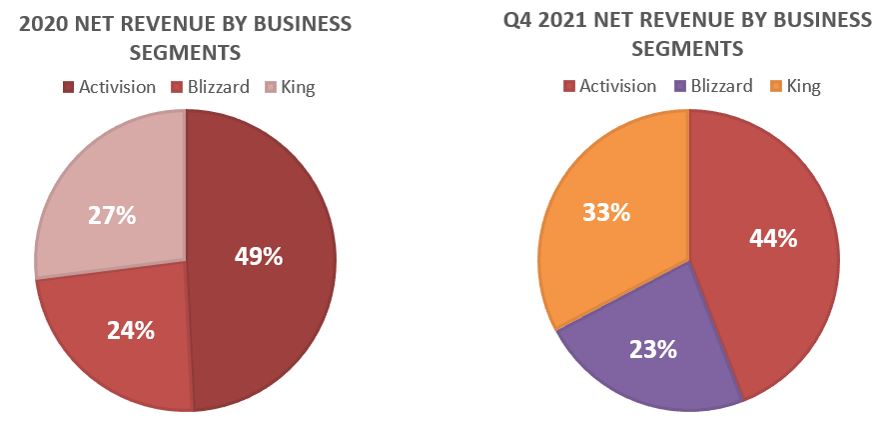

Activision has contributed the lion’s share of the net revenue in 2020 by 49.2%, then followed by King (27.0%) and Blizzard (23.8%). The total net revenue for 2020 was USD 8.1 billion.

In Q4 2021, Activision still contributed a big portion of the net revenues even though there is a decrease of 11.8% compared to 2020. However, there is a significant increase of net revenue from 27.0% to 32.7% for King which helps to push up the net revenue for Q4 2021 to USD 8.8 billion.

REVENUE STREAM / MONETIZATION OPPORTUNITIES

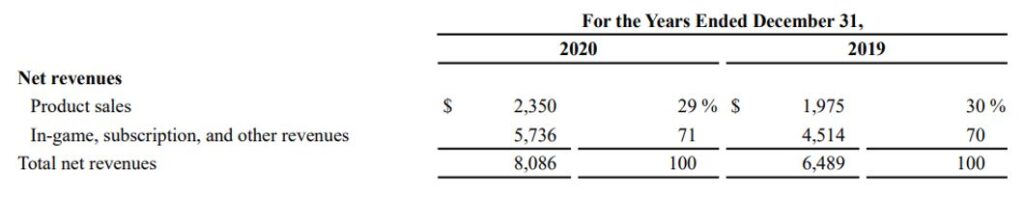

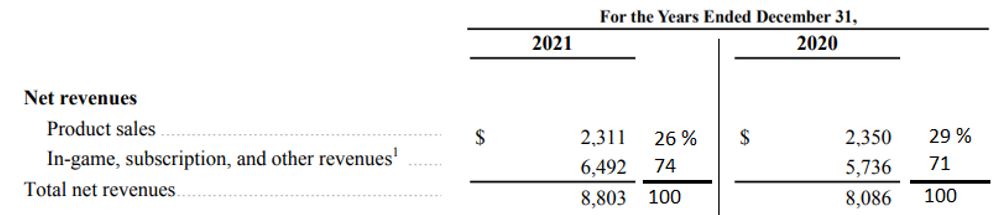

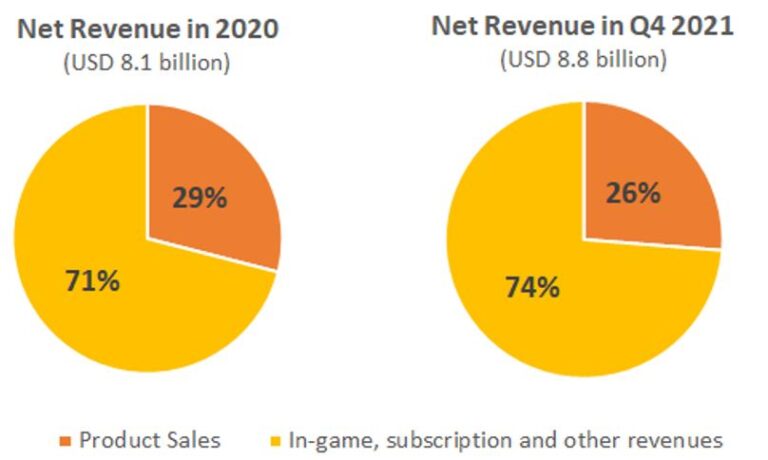

The net revenue for Activision Blizzard in 2020 was mainly generated from in-game, subscriptions and other revenues (71% of the total net revenues). The remaining 29% of total net revenue was generated from product sales of games in digital full-game downloads and physical products.

The same trend was observed in Q4 2021 where 74% of the net revenue was from in-game, subscription and other revenues.

- In-game revenues – revenue from microtransactions (sales of virtual currencies & goods to enhance gameplay experience) within the games and downloadable content.

- Subscription revenues – mostly from World of Warcraft, sold on subscription-only basis and playable online only.

- Other revenues – from software licensing and licensing of intellectual property other than software, such as brand, logo, franchise, media content.

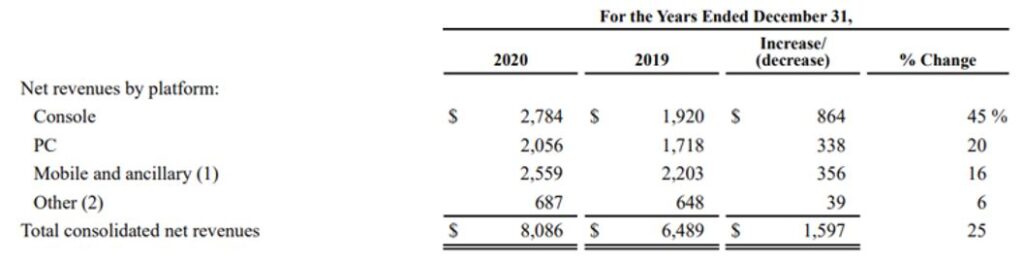

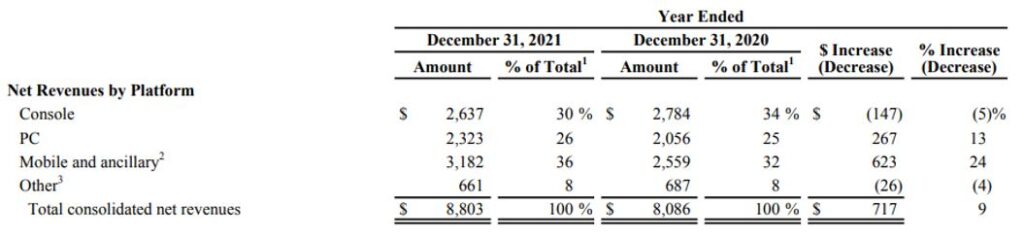

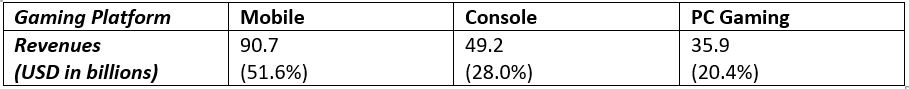

From the gaming platforms perspective, the total net revenue in 2020 was generated primarily through the console, PC, and mobile platforms, as well as through the licensing of intellectual property under Other.

The table below further illustrates that the revenue generated from the different platforms (console, mobile and PC) in 2020 are evenly distributed for Activision Blizzard. This indicates that should one of the gaming platforms is not performing well in one of the fiscal years, the other platforms can still bring in revenue for the company.

In Q4 2021, there was a rising trend of gamers playing on the mobile platform even though all three platforms are contributing almost equal share of net revenues.

For future plans, the company is exploring to bring their game franchises to multiple platforms, such as Call of Duty: Mobile, a free-to-play shooter game mobile app version to increase the franchise exposure to more gamers and induce them to play the full-game version on PC and console (e.g.Xbox) platforms.

After going through the background and the revenue generations of Activision Blizzard, it seems like this company still has potential to expand and generate money for investors. But do we really know if Activision Blizzard is a good and valuable company to invest in?

KEY PERFORMANCE METRICS

Activision Blizzard focuses on two main operating metrics as their key performance indicators:

- Net bookings & in-game net bookings

- Monthly Active Users (MAUs)

Net bookings & in-game net bookings

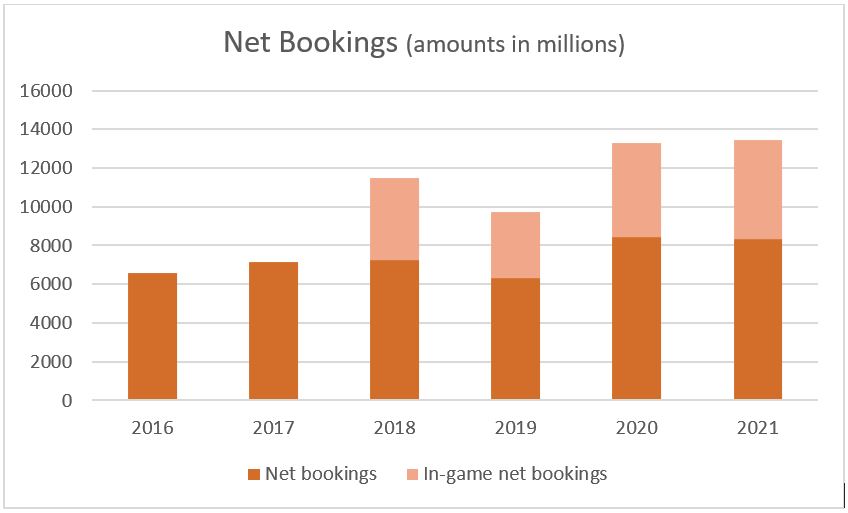

Net bookings and in-game net bookings was monitored as it provides a timely indication of the trends in their operating results. This enables them to analyze the sales performance based on the timing of actual transactions with their customers.

Net bookings refer to the net amount of products and services sold digitally or sold-in physically in the period, which is equivalent to net revenues (excluding the impact from deferrals).

In-game net bookings is the net amount of micro-transactions and downloadable content sold during the period and equivalent to in-game net revenues (excluding the impact from deferrals).

There was a drop in net bookings from 2018 to 2019 as the publishing rights for Destiny franchise game was sold to Bungie, another video game company in December 2018.

From 2019 to 2020, there was a huge increase of net bookings and in-game net bookings. This was due to various releases of Call of Duty series between 2019 and 2020, and World of Warcraft: Shadowlands that was released in November 2020.

Monthly Active Users (MAUs)

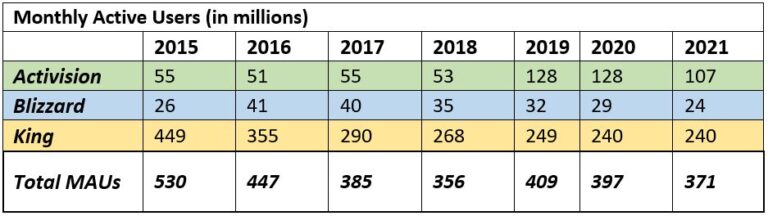

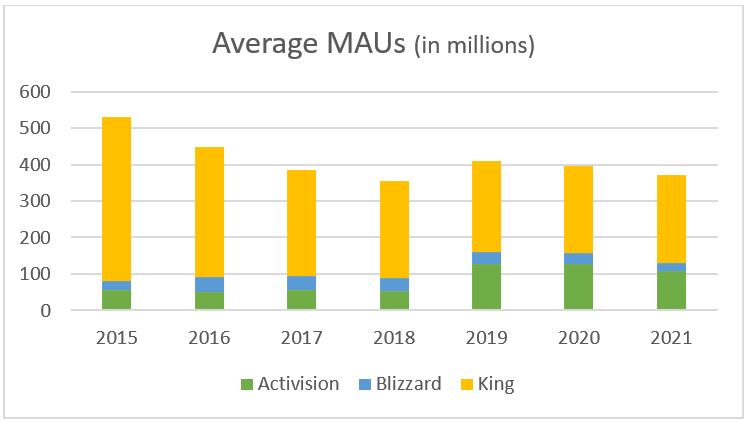

Monthly active users (MAUs) is a key measure the quantify the overall size of user base playing games published by Activision Blizzard. The chart below shows the start of the MAUs tracking in 2015 as King was acquired by Activision Blizzard in Nov 2015.

From the chart, a downward trend was observed from 2015 to 2018 which was mainly due to large numbers of less engaged users leaving the King’s franchises network and maturity of the titles.

The average MAUs for Activision games remain fairly constant throughout 2015 to 2018, but there was a slight increase for Blizzard in 2016 due to release of Overwatch in May 2016. In 2019, there was an increase for Activision’s average MAUs due to the launch of Call of Duty: Mobile and Call of Duty: Modern Warfare in October 2019.

OVERVIEW OF GAMING INDUSTRY

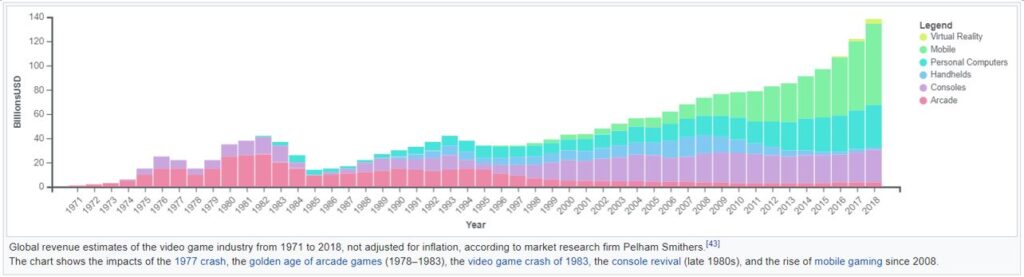

The video games industry has been a billion-dollar business for many years and the chart below illustrates the gaming industry’s historic revenue record since 1971 till 2018.

The revenues from gaming industry are mainly derived from 3 sources:

- Hardware (consoles, screens, processors, controllers and accessories)

- Software

- The actual games (in-game purchases & live services)

In 2021, the total revenue from the global gaming market raked in about 175.8 billion USD. The chart below shows the revenues generated from different platforms in 2021 of the gaming worlds.

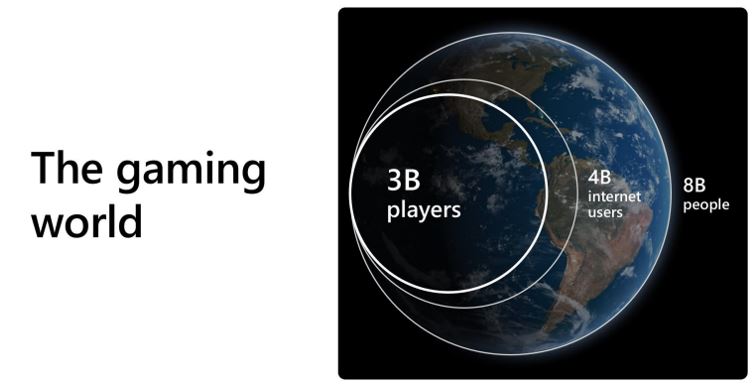

The diagram below also clearly illustrates that half of the human population (8 billion people) on Earth have access to the internet and 75% among the 4 billion of internet users are game players.

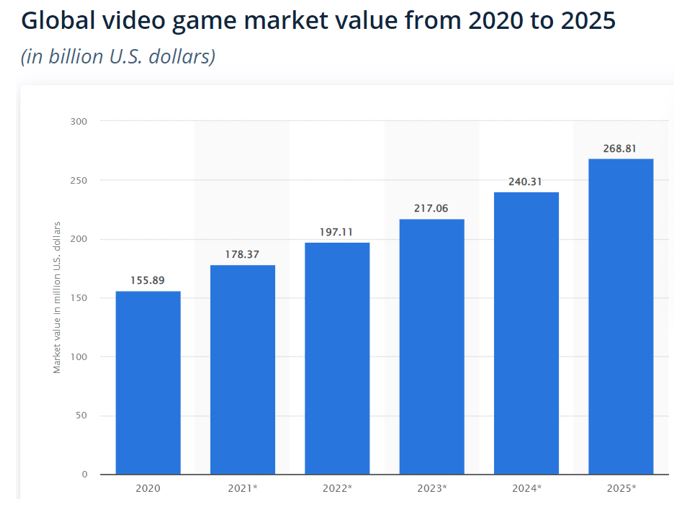

In 2020, the gaming industry has generated approximately $155 billion in revenue. According to analysts in Statista, they predicted that the industry will generate more than $260 billion in revenue by 2025. The chart from Statista website shows the potential market value of the gaming industry from 2020 to 2025, where the gaming market is expected to grow to an estimated of 268.81 billion USD in 2025.

COMPETITORS

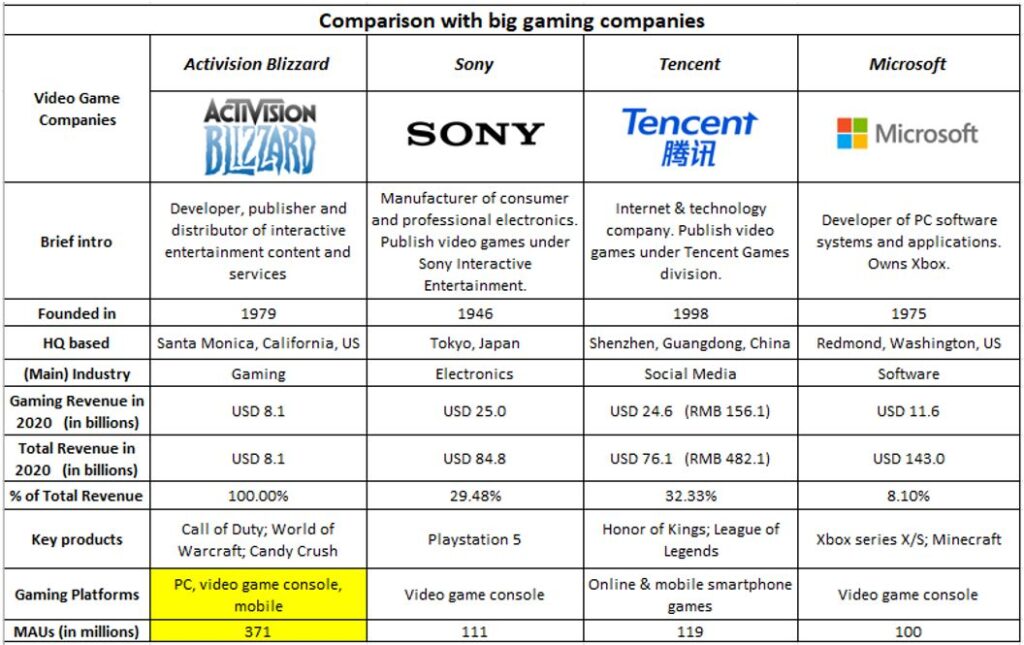

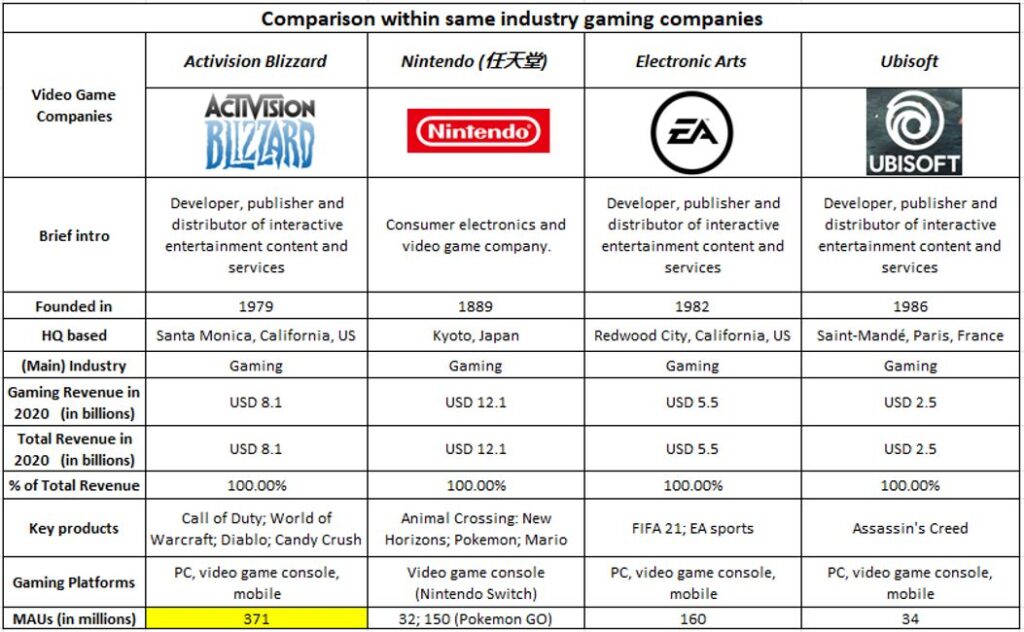

A study done by Entertainment Software Association (US) in 2017 estimated that there were over 2300 development companies and over 525 publishing companies in the US, excluding gaming companies based in overseas, such as Japan, China and Europe. This shows that the gaming industry in US alone is highly competitive. The two chart below shows the comparison of Activision Blizzard with the big gaming companies and other gaming companies within the industry.

Activision Blizzard has games published and distributed on all three gaming platforms – PC gaming, console and mobile. In addition, the number of MAUs is also higher for Activision Blizzard compared to other three big gaming companies in 2021.

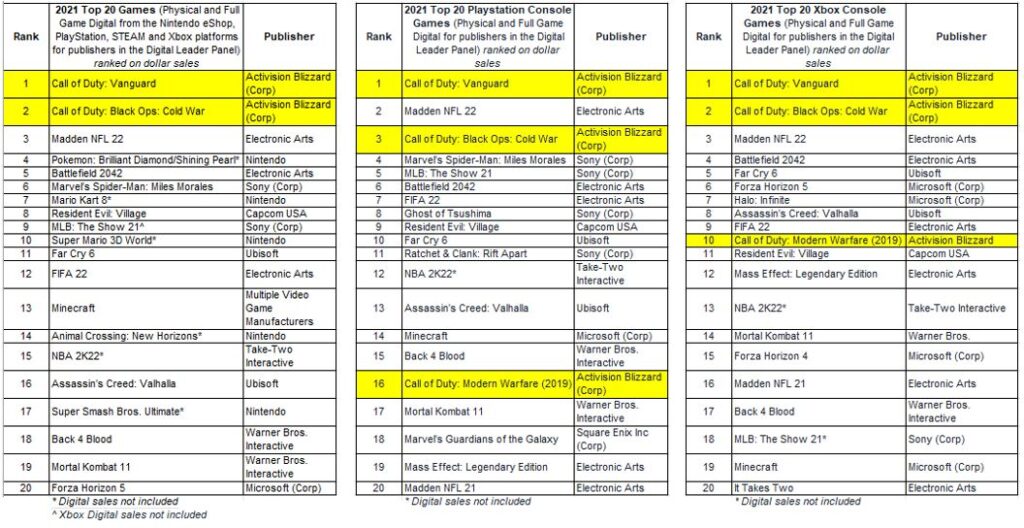

When comparing with other gaming companies, Activision Blizzard is the second highest grossing gaming company after Nintendo and ahead of EA and Ubisoft in 2021, but still, it has the highest MAUs across three gaming platforms. When comparing the top selling games in 2021, Call of Duty series ranked within the top 3 position among the other top 20 games.

The same trend was observed where Call of Duty: Vanguard still ranked first for both console games in January 2022.

COMPETITIVE MOAT

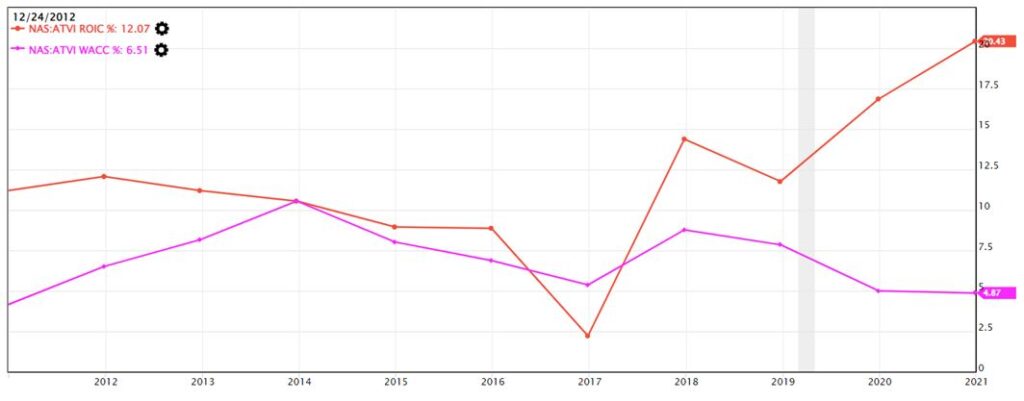

From the chart of ROIC vs WACC, there is a widening gap trend from 2019 to 2021 that indicates that the company has some form of competitive moat against other gaming companies.

One of the moats is the game franchise branding, such as Call of Duty: Mobile in 2019 where the average MAUs for Activision increased from 53 million in 2018 to 128 million in 2019 and the revenue also increased 49.2% in the next following fiscal year from 2019 (USD 2,219 million) to 2020 (USD 3,942 million).

The other competitive moats will be the intellectual property of the gaming software, the franchise brand and logo. They also have software license and service agreements with the third party for the distribution network.

The huge gaming community (400 MAUs) also provides a moat where multi player online games, such as World of Warcraft requires a group of gamers to work together to play the game. If one of the gamers were to switch to play another game, he or she may have to start from zero or play with another game community in a new game and there may be high switching cost involved.

FUTURE PLANS

To continue to drive company’s growth, Activision Blizzard will focus on three strategic pillars:

Expanding audience reach

- Intend to increase the engagement of gamers via multiple platforms and free-to-play entry, such as Call of Duty: Mobile. This is to broaden the community through business model and growth initiatives across platforms.

Deepening consumer engagement

- Designing games with depth of content that keep players engaged for a long period of time after the game’s release.

Increasing player investment

- Other than full game or subscriptions, players can invest in in-game transactions to have more downloadable contents to play.

In addition to that, they have made plans to hire over 2000+ developers in the development team to create more high-quality content games and expand franchise growth. They have also planned to have two more gaming franchise in the next few years and focus on Esports League, Battle.net online gaming services.

POTENTIAL RISKS

On July 20, California’s Department of Fair Employment and Housing filed a lawsuit of numerous complaints about unlawful harassment, discrimination, and retaliation within the company against Activision Blizzard. This lead to more than 3,000 Activision Blizzard employees signed an open letter to the management to acknowledge these allegations and threatened to stage a walkout if no action is being taken.

As Activision Blizzard relies on employees (developers) to create and design new games, should there be a massive resignation and brain drain from the company, the company may lose the competitive edge to develop and publish high-quality franchise games.

The gaming industry is a fast and dynamic industry, if the players are no longer interested in playing matured gaming titles or the games that are no longer captivating, the less engaged gamers will drop out from the games and reducing the MAUs count. Thus, the company will need to keep on creating new games to entice gamers to continue playing the existing franchise or new franchise games.

FINANCIAL OVERVIEW

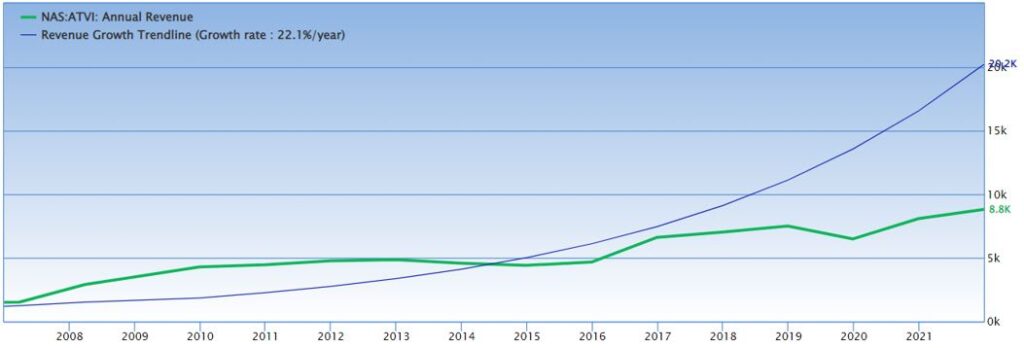

For the annual revenue, it has been on a steady upward trend from USD 2.9 billion (2008) to USD 8.8 billion (Q4 2021), about 179.3% of increment. This was due to the launch of various high-grossing game franchises that had attracted gamers to play those games and thus, directly influenced the revenue of the company.

These two charts showed that most of the revenue generated are mainly from the in-game, subscription and other revenues, where gamers make microtransactions within the game to download more gaming contents to enhance their gameplay experience. Product sales are referring to the digital full-game downloads and physical game products.

From 2020 to 2021, there were about 3% increment of revenues coming in from the in-game, subscription and other revenues categories.

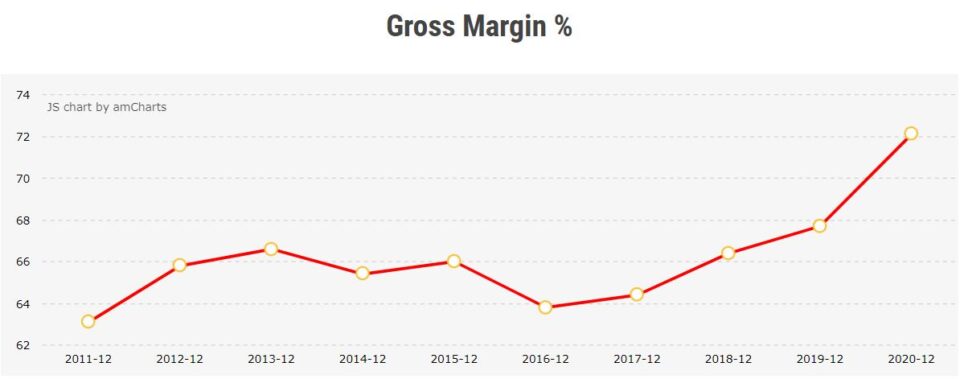

The overall trend for gross margin % has been increasing since 2016 and the latest gross margin % is at 72% in 2020. The upward trend of gross margin % showed that the company is able to retain more money after minus off cost of goods sold (COGS), which can then be used to pay for other expenses or debt obligations.

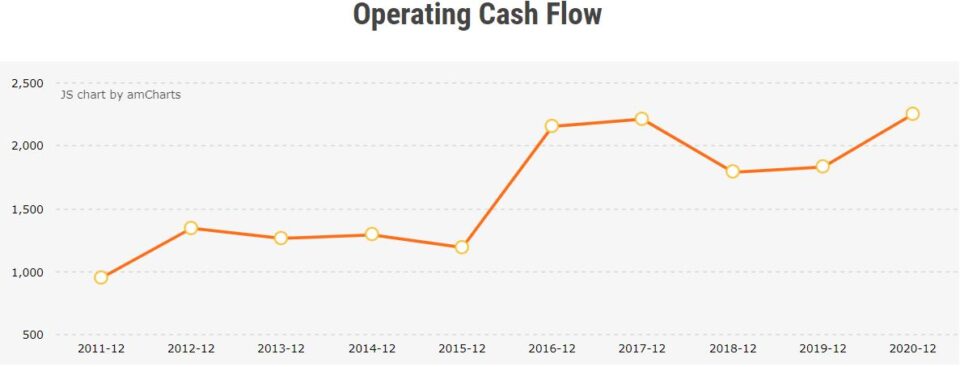

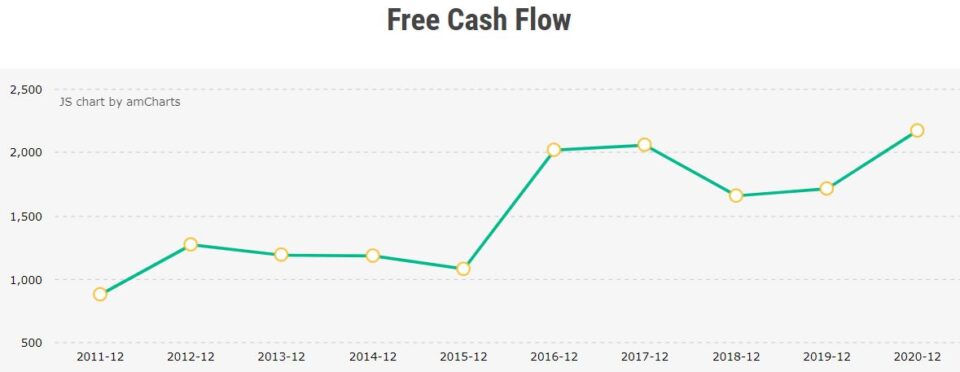

Both operating cash flow and free cash flow within the company is at positive and increasing trend. This indicate that the company is able to generate cash from business operations and the cash flow within the company is healthy.

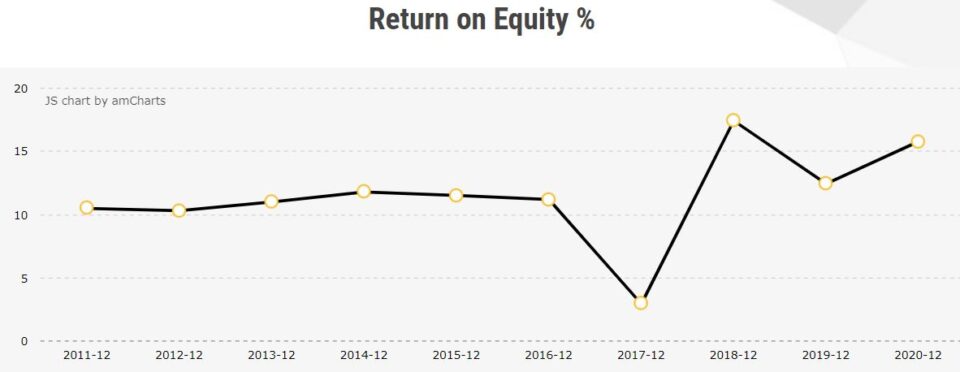

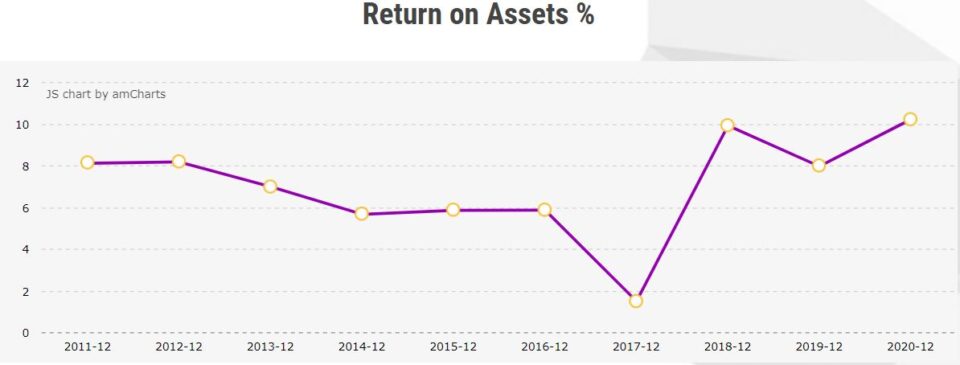

ROE and ROA are used to evaluate how effectively a company’s management team is managing the capital that was entrusted to them. The latest ROE and ROA are 15.78% and 10.23% respectively which is a good sign that the company is profitable and utilizing the resources well.

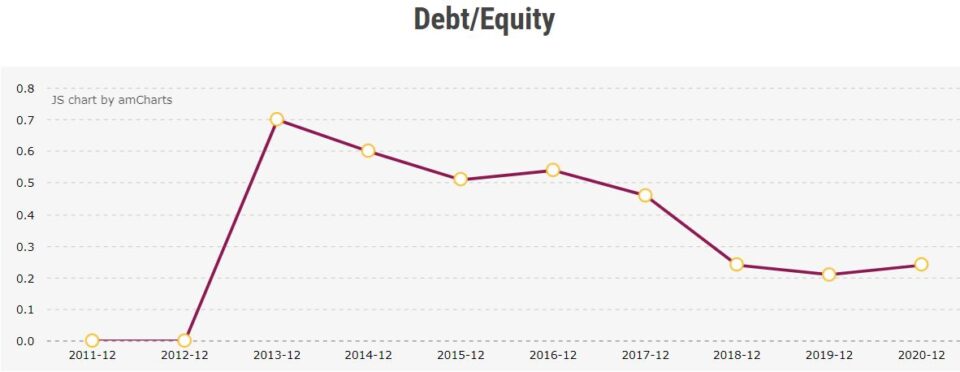

Even though the debt/equity ratio was high in 2013, at 0.7, it has been on downward trend since then, reaching 0.24 in 2020. This implies that the company’s management is able to manage the company’s debt and reducing it year after year since 2013.

CONCLUSION

From the financial standpoint, the company has strong financial fundamentals with strong revenue growth year after year since 2008. In addition, it owns multiple well known game franchises and IPs with large gaming communities playing in all three gaming platforms – PC, console & mobile.

Nevertheless, due to the fast-paced nature within the industry and stiff competitions, in addition to the recent harassment scandals that shrouded around the company and gaming industry, further caution and due diligence are strongly encouraged to be done before investing.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.