In this article, we will take a deeper look into whether investing in blue chip stocks are worth looking at.

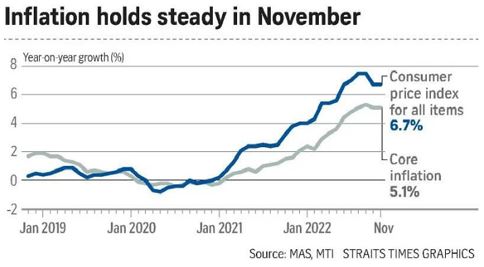

In 2022, the global economy faced severe challenges including recession, bear markets, and the ongoing Russian-Ukraine war which has driven inflation rates to near-decade highs. While Singapore’s CORE inflation has shown signs of slowing down in October 2022 and remaining steady in November, the future trajectory of the economy remains uncertain. As the saying goes, “prepare your umbrella before it rains.”

In this article, we will be deep diving into blue chip stock that is famous for well-established businesses and consistent dividend pay out as a source of regular income for their shareholders.

You can watch on our YouTube Channel to learn more about blue chip stocks and 5 blue chip companies’ analysis!

We have also written article on different potential investing opportunities to invest and grow your money. Click on to find out!

WHAT IS BLUE CHIP STOCK?

Blue chip stocks are stocks of high-quality companies with:

- Strong financial performance over decades

- Well-known brands popular among the public

In addition, these companies are top notched because of the managerial excellence to run a high-quality company.

Due to their stellar financial performance, the blue chip companies have shown resiliency and proven history of steady growth during recession or market downturns. As a result, blue chip stocks are capable to pay dividends to their shareholders consistently as regular income.

The 30 largest U.S. blue chip companies’ performance are tracked by Dow Jones Industrial Average (DJIA) index.

DOW JONES INDUSTRIAL AVERAGE (DJIA)

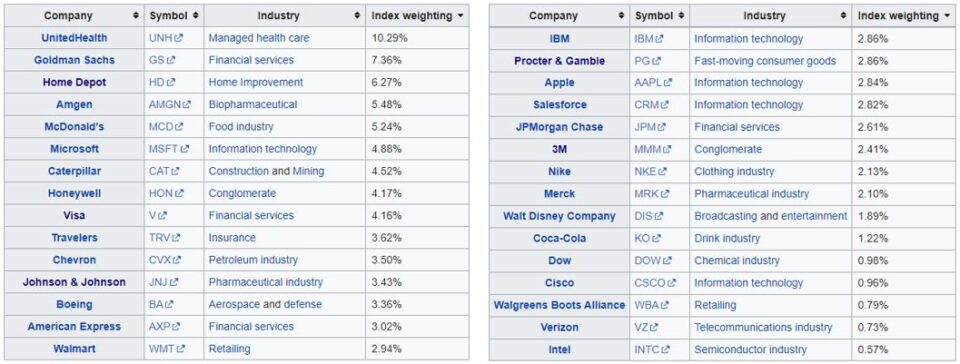

Dow Jones Industrial Average index is a stock market index that tracks the 30 largest U.S. blue chip companies.

It is one of the oldest stock market indices (since 1896) and also one of the most commonly followed equity indexes by financial experts. The index covers all industries except for Transportation & Utilities.

The 30 companies are listed in the diagram below:

Now, one may ask: “What is the difference between DJIA with S&P 500?”

Read on the next section to find out more!

DJIA VS S&P

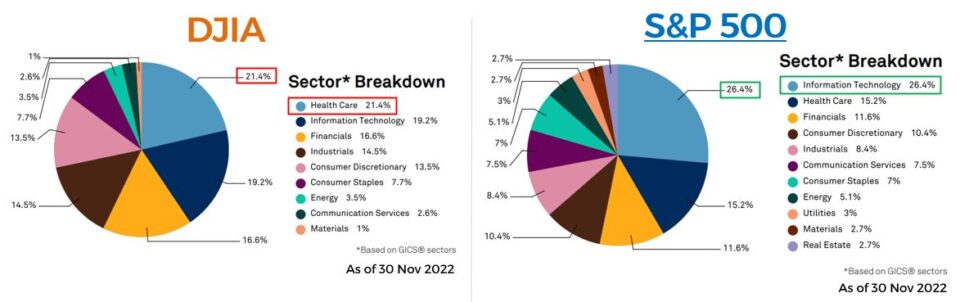

One of the main differences between DJIA and S&P 500 is the number of companies tracked by these 2 indices.

- DJIA tracks the performance of 30 largest U.S. blue chip companies.

- S&P 500 tracks the performance of 500 large-cap U.S. public companies.

In addition, DJIA tracks the share price of the 30 companies, but S&P 500 ranks the companies by size in terms of market cap. Market cap is the number of shares distributed by a company multiply by the current share price of the company.

From the chart above that shows the sector breakdown, we noticed that the largest sector of these 2 indices are Health Care (DJIA) and Information Technology (S&P 500).

We have also done an in depth research on recession proof sectors in the S&P 500. Click on the link to find out!

PROS & CONS OF INVESTING IN BLUE CHIP STOCK

After learning about blue chip stock, one might wonder if they should invest in one of these high-quality companies’ stock?

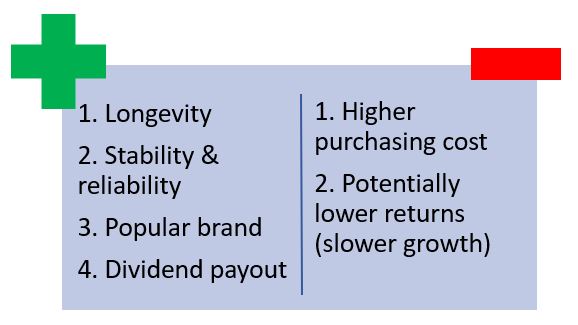

Here, we have done a simple comparison of pros and cons of investing in blue chip stock.

PROS

Blue chip companies are top notched companies with popular brands and strong financial record in good earnings, consistent financial performance over the long term. As a result, these companies have been in business for decades and shown their ability to survive through market downturns.

In addition, their stellar financial performance allows them to pay out dividends to their shareholders as a source of regular income. Compared to companies in Information Technology sectors and Communication sectors, these companies with shorter operating history need to retain their earnings to further grow their businesses and compete with their competitors to gain market share.

CONS

Nevertheless, these blue chip companies’ share price are much higher than the younger public companies (launched IPO less than 5 years). Hence, it may be costly for a new investor to purchase large number of stocks to start up their investing journey.

Moreover, the blue chip companies are usually market leaders and have well-established presence in their industry, they tend to have slower and even stagnant growth. As such, one may not see significant returns in short term as compared to growth stocks and may have to invest in the companies for long term, such as 10-20 years to have substantial returns in their investments!

WHAT ARE BLUE CHIP FUNDS?

Besides blue chip stocks, public or investors can also explore and learn more about blue chip funds! A blue chip fund is a type of mutual funds that invest in stocks of various blue chips companies.

By investing in blue chip funds, one will have exposure of other blue chip companies. This may prevent them from missing out of potential larger gains from other blue chip companies when the stock market is doing well!

But before one decided to jump in and start to purchase blue chip funds, they have to consider the cost of the funds (expense ratio) as these funds are actively managed by professional fund managers. If the expense ratio is higher than the returns generated from the fund, then one may need to think twice before investing their money!

We have done a deep dive on 5 blue chip companies and explored 3 blue chip funds recommended by famous financial sites on our YouTube channel!

CONCLUSION

As a conclusion, blue chip stocks may poise as a good investing opportunities for those who are looking for dividend payout as regular income and willing to invest for the long term to have strong and steady returns on their investments.

Even though blue chip funds is another good alternative for new investors who might have a hard time to determine if a blue chip stock is a good investment, the cost of investing in a fund may erode the gains over the long term if due diligence has not done properly to check on the funds.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.