Methode Electronics Inc. (MEI) was trading at around $27+ during March 2020 when the pandemic of Covid19 was at its peak. Today it is trading around $32+, which shows a good 17%+ increase!

MEI stock is owned by a few top institutional investors such as BlackRock Inc, LSV Asset Management, Wells Fargo and Wedge Capital Management. However, at the same time, this analyst has also noticed some insider selling in the past 3 months.

Some of the upsides:

- PE ratio 9.7 times vs industry average 26.7 times (based on Gurufocus)

- Earnings growth +17% vs electronics industry negative growth -21% (quoted from Simply Wall St)

- Interest Coverage is 15times EBIT

These are all interesting facts about Methode. Now, let us zoom in further to the business to find out if this is a valuable investment.

HOW DOES MEI MAKE MONEY?

Methode is a small cap company with $1.23B market capitalization but displaying aggressive growth.

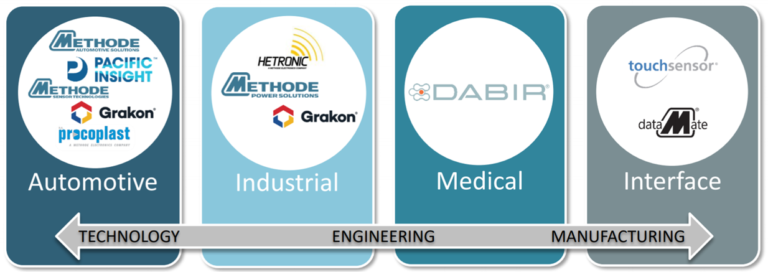

It is a global developer for custom-engineered and application-specific products and solutions. Methode designs, manufactures, and markets for devices employing electrical, radio remote control, electronic, LED lighting, and sensing technologies.

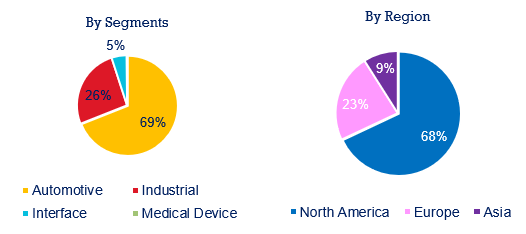

The business segments cover automotive, industrial, interface and medical fields.

Methode also has a focus on future fields such as Electric & Hybrid Vehicles, and data centres & appliances which will strongly bring the company to the next level of growth.

WHAT’S ONE THING UNIQUE ABOUT THIS COMPANY

One unique thing about this company is that the multi-business segments products are all interconnected. This makes it easy for the business to do cross-selling, which is one surefire way of increasing company’s revenue!

Apart from that, Methode’s partnership is broad, especially for such a small cap company. For example, in the automotive and industrial machinery segments, Methode partners with leading brands like Ford, GM, BMW, Tesla, etc. Methode has also won numerous excellence awards from these partners.

Moreover, due to its low-cost global manufacturing footprint and integrated network, Methode has managed to build an exceptional customer relationship with their numerous partners

REVENUE & GROSS MARGIN TREND

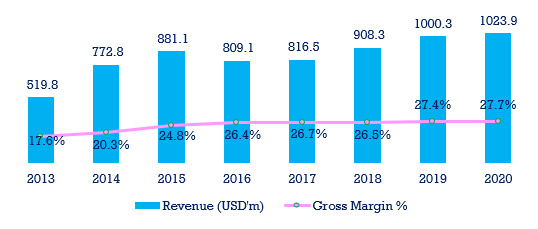

Revenue and Gross Margin has been trending upwards and showing positive growth for the past 5 years.

Methode’s revenue has crossed $1bn since 2019 and continues to grow.

Methode has a lower gross margin vs Industry average due to high product R&D cost and an inability to be the price setter. There could be a potential value trap here if the management is unable to get out of this perpetual cycle.

MEI’s revenue is mainly driven by the Automotive segment (c.69% of total revenue) focused mainly in the North America Region.

MEI has two key customers – GM (43.4%) & Ford (12.3%) with consolidated net sales contribution of 55.6%.

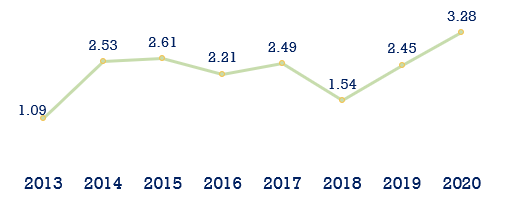

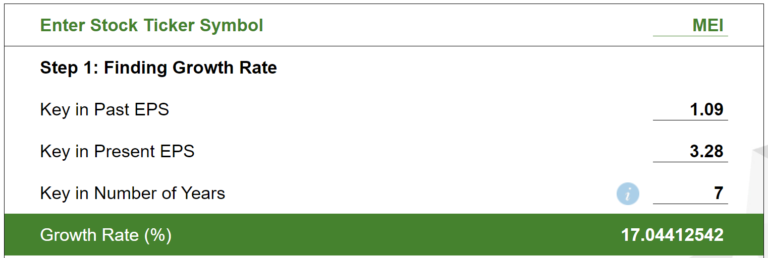

EARNINGS PER SHARE TREND

WHAT HAS IMPACTED THEIR PERFORMANCE RECENTLY? (BASED ON THE LATEST QUARTERLY REPORT)

- Late quarter rebound in automotive sales

- Cost saving actions partially mitigated the negative impact from Covid19

- Electric and Hybrid Vehicle Program is growing

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.