“One day I was in San Francisco in a coffee shop, and I was thinking Alibaba is a good name. And then a waitress came, and I said do you know about Alibaba? And she said yes. I said what do you know about Alibaba, and she said ‘Open Sesame.’ And I said yes, this is the name! Then I went onto the street and found 30 people and asked them, ‘Do you know Alibaba’? People from India, people from Germany, people from Tokyo and China… They all knew about Alibaba. Alibaba — open sesame. Alibaba — 40 thieves.” –Jack Ma

This is how Alibaba got its name. Interesting, right?

Today, anywhere you go, everyone does know Alibaba, but not just because they have read Alibaba and the Forty Thieves as a child, but because of this giant company, which is a force to be reckoned with.

“Open Sesame” is the magic phrase which famously opens the cave of magnificent treasures in the popular tale from Arabian Nights. So, what is the magic formula which transformed Alibaba Group Holding Ltd. into a magnificent, multinational company?

Let’s try to understand.

Figure 1: Vision, Alibabagroup.com

BRIEF HISTORY

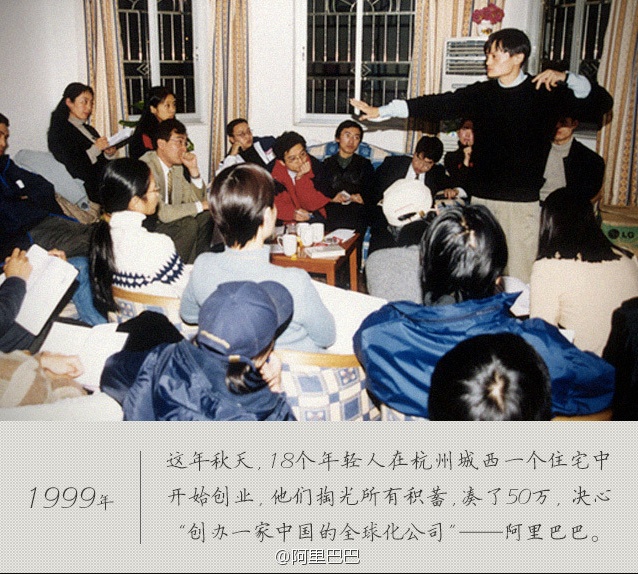

First, let’s briefly explore how it all began. Alibaba.com was founded in 1999 by 18 people who believed in the power of internet, led by Jack Ma, a former English Teacher in Hangzhou, China. Like several unicorns, it had a humble start in the apartment of Jack Ma. Its first website, Alibaba.com was a global wholesale marketplace, followed by a China marketplace for domestic wholesale trade – 1688.com (currently). It attracted investments of US$25 million from a consortium of investors including Softbank & Goldman Sachs.

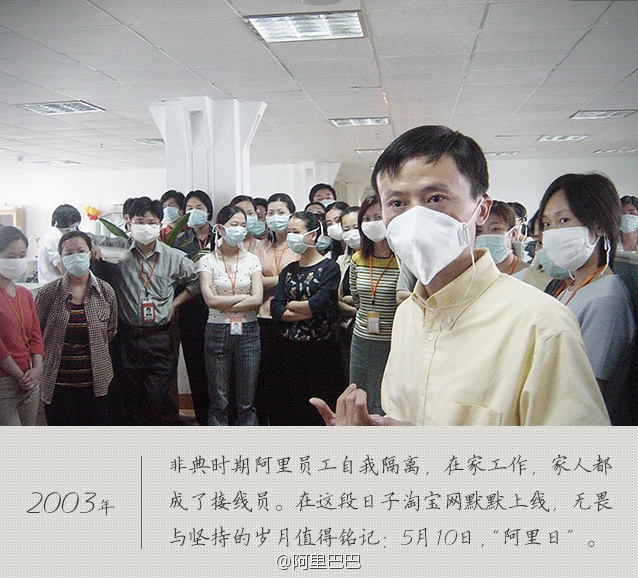

In December 2001, Alibaba.com crossed 1 million registered users and in 2002, just 3 years after its launch, the company became profitable. It is interesting to note that Alibaba has survived 2 epidemics – SARS in 2003 & COVID-19 in 2020.

Figure 2: Jack Ma motivates the Alibaba team to stand firm in the face of SARS

In fact, it launched its Taobao marketplace (an online consumer-to-consumer retail platform, quite similar to eBay) during the SARS quarantine in 2003. The homepage of the website unveiled with the slogan: “Think of those who start a business in trying times.”

Alibaba gradually attracted the interest of private equity funds and it started expanding its platforms. It introduced Aliwangwang, an instant messaging tool to aid the Taobao marketplace. Soon after, it launched Alipay’s digital payment services. The next section is a brief timeline compiling the key milestones of the company as it developed into the world’s largest e-commerce platform.

1999: Founded

2000: Raised US25 million from a consortium of investors

2001: Crossed 1 million users

2002: Became profitable

Alibaba2002- finally made money

2004: Introduction of Aliwangwang & Alipay

2007: Alimama (a monetization platform) is launched;

2008: Tmall is launched

2009: Launched Alibaba Cloud on its 10th Anniversary.

2010: Aliexpress (a global consumer marketplace) is launched; the mobile app for TaoBao is launched.

2011: Alibaba foundation is established which is dedicated to social causes.

2013: Jack Ma steps down as CEO and selected Jonathan Lu as successor.

2014: Tmall Global is launched as an extension to Tmall; Goes public on the NYSE and set a record as the world’s biggest public stock offering, raising $25 billion; Alipay’s parent company Ant group is established.

In the following years, the company continued to establish and acquire new platforms like Freshippo, Cainiao, Dingtalk, Lazada, Ele.me, etc and created for itself an enormous ecosystem with magnificent network effects, operating efficiencies and expanding markets.

2019: Listed on HK Stock Exchange; Alibaba Group CEO, Daniel Zhang succeeds Jack Ma as Chairman of the board of Alibaba Group.

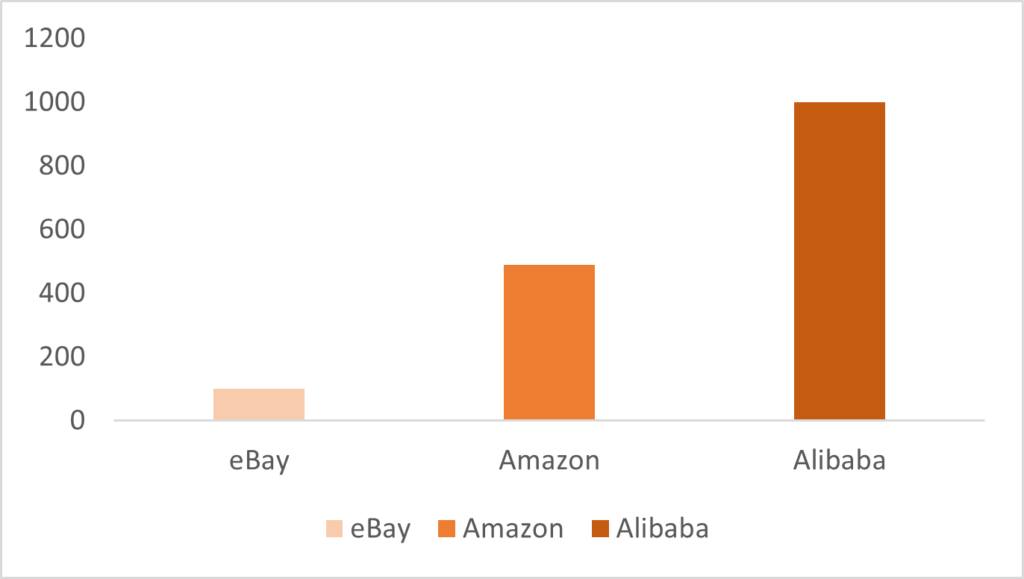

2020: The GMV transacted in the Alibaba ecosystem surpassed US$1 trillion in 2020. For the same period, Amazon had a GMV of US$490 billion and eBay had a GMV of US$100 billion.

Figure 3: GMV in US$ in 2020

2021:

Alibaba group has grown from a single website, helping small and medium-sized enterprises (SMEs) in China to sell internationally, into a digital ecosystem with businesses comprising commerce, cloud computing, digital media and entertainment, and innovation initiatives.

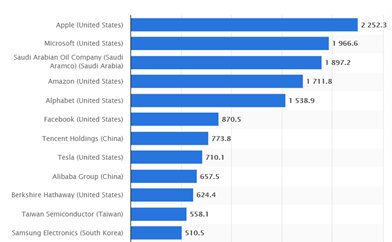

Alibaba is one of the top 10 valued companies in the world today.

WHAT IS ALIBABA'S BUSINESS MODEL?

Alibaba is not just an e-commerce company like eBay or Amazon. Alibaba does not directly sell products to consumers. It provides the infrastructure and the marketing capabilities to other companies to do business on its digital platforms.

It does not derive revenues from the sale or purchase of goods. It derives incomes through fees & commissions from its sellers / merchants for providing its platform and infrastructure. It also earns income through listings, advertisements and facilitating transactions & services.

So, the magic formula is that Alibaba is the middleman who facilitates transactions for all types of sellers and buyers. This makes the company scalable both geographically and into various segments.

The 3 main websites that generate revenue are:

- Alibaba.com

- Taobao

- Tmall

Other subsidiaries include AliExpress, 1688, Alimama, Alibaba Cloud, Ant Financial & Cainiao, among others.

These platforms provide the technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to leverage the power of new technology to engage with their users and customers and operate in a more efficient way.

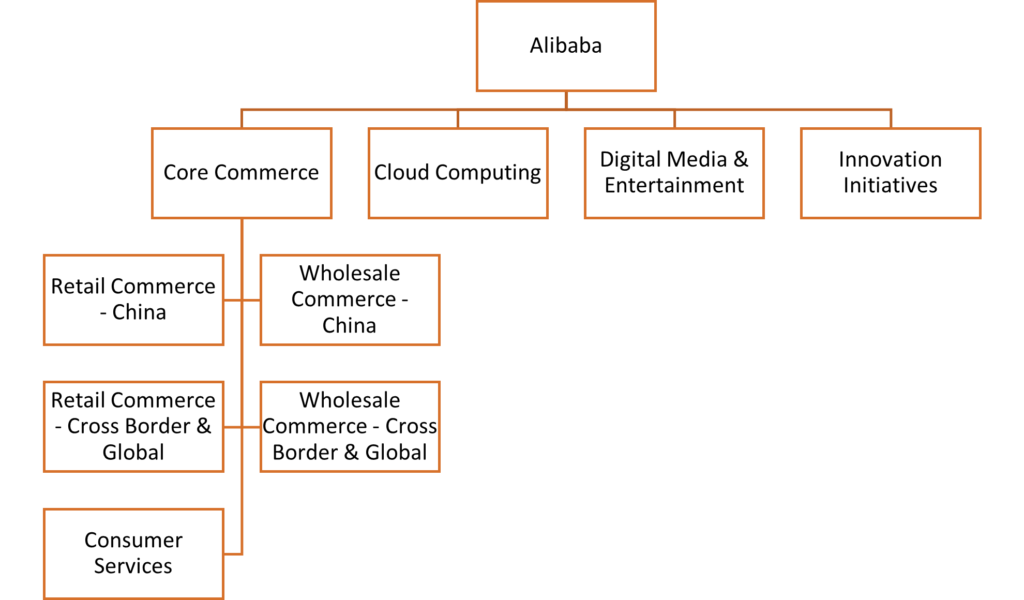

Figure 5: Major Businesses in Alibaba’s Ecosystem

Alibaba’s business is comprised of 4 main segments:

The key platforms operating under these segments are as shown below:

Figure 6: Annual Report, 2021

WHAT DO THE VARIOUS PLATFORMS UNDER THE ALIBABA ECOSYSTEM DO?

All the platforms under the vast Alibaba ecosystem unite various kinds of buyers and sellers in China and globally.

Core Commerce

- Taobao – it is a consumer – to – consumer (C2C) platform which allows small businesses and individuals to sell their products through the internet. It has no transaction fee for merchants. Merchants must pay for advertising or marketing to stand out in the searched listings (just like you place ads on google).

- Tmall – similar to eBay / Amazon, this is a business – to – consumer (B2C) platform for buying products from brands and retailers. It is targeted at the middle-income group of the economy.

- Freshippo – (known as “Hema” in Chinese) is Alibaba’s self-operated retail chain for fresh produce, that integrates online and offline operations as a part of their “New Retail” format.

- Sun Art – Alibaba has recently acquired a controlling stake in Sun Art, which is a significant supermarket chain in China. The physical stores of Sun Art are integrated with Alibaba’s Taoxianda and Tmall supermarket platforms. This means faster deliveries, larger selections and more efficiencies in operations.

- 1688.com – connects wholesale buyers and sellers in the Chinese domestic marketplace.

- Lingshoutong – connects FMCG manufacturers and their distributors directly to small retailers in China by digitalization of small retailers’ operation. This has helped small retailers in remaining relevant in the competition against big-box retail.

- Lazada – is a leading and fast-growing e-commerce platform in Southeast Asia that connects local consumers with local SMEs and regional & global brands.

- AliExpress – enables global consumers to buy directly from manufacturers and distributors in China and around the world.

- For import commerce, Tmall Global allows overseas brands and retailers to sell to consumers in China, and is the largest import e-commerce platform in China.

- Alibaba.com – is China’s largest international wholesale marketplace platform. Sellers can list their products on this website free of charge up to 50 products. There are also premium gold supplier memberships which provide unlimited listing of products and verification from 3rd parties.

- Ele.me – is a food delivery platform. In Chinese it literally means – “are you hungry?”

- Koubei – is a leading restaurant and local services guide platform for in-store consumption. It allows consumers to discover local services & content on the platform.

- Fliggy – is a leading online travel platform.

Digital Media & Entertainment

- Youku – the third largest online long-form video platform in China, it is a key distribution platform for digital media and entertainment content. It is similar to YouTube.

- Lingxi Games – develops, operates and distributes mobile games.

- Alibaba Pictures is an Internet-driven integrated platform that covers content production, promotion and distribution, intellectual property licensing and integrated management, cinema ticketing management and data services for the entertainment industry.

Innovation Initiatives

- Amap – is a simple one-stop-shop access point to services such as navigation, local services and ride-hailing.

- DingTalk provides a digital collaboration workplace.

- Tmall Genie smart speaker – provides an interactive interface for customers to easily access services offered by Alibaba’s ecosystem participants.

Logistics

Cainiao Network offers domestic and international one-stop logistics services and supply chain management solutions, fulfilling various logistics needs of merchants and consumers at scale – like real-time insights for merchants to better manage their inventory and warehousing, for consumers to track their orders, and for express courier companies to optimize delivery routes.

Marketing

Alimama – is a monetization platform – it matches the marketing demands of merchants/brands/retailers in the ecosystem with media resources on Alibaba’s own platforms and 3rd-party properties.

Cloud Computing

Alibaba Cloud – Alibaba Group is China’s largest provider of public cloud services by revenue in 2020. The cloud computing business offers a complete suite of cloud services, including elastic computing, database, storage, network virtualization, big data analytics, ML, IoT services, etc.

HOW DOES ALIBABA MAKE MONEY?

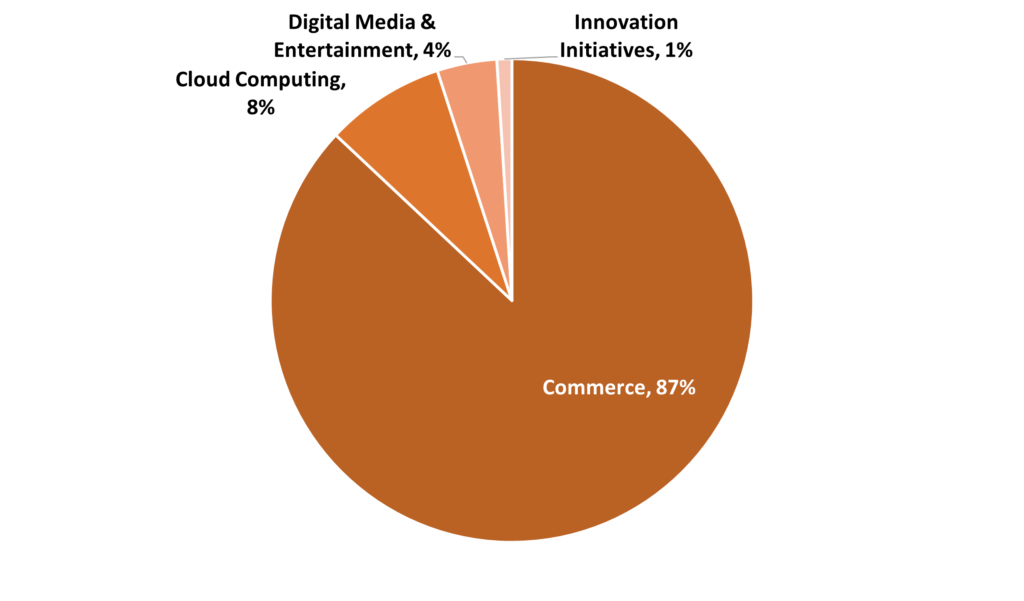

Alibaba’s businesses are comprised of 4 main segments:

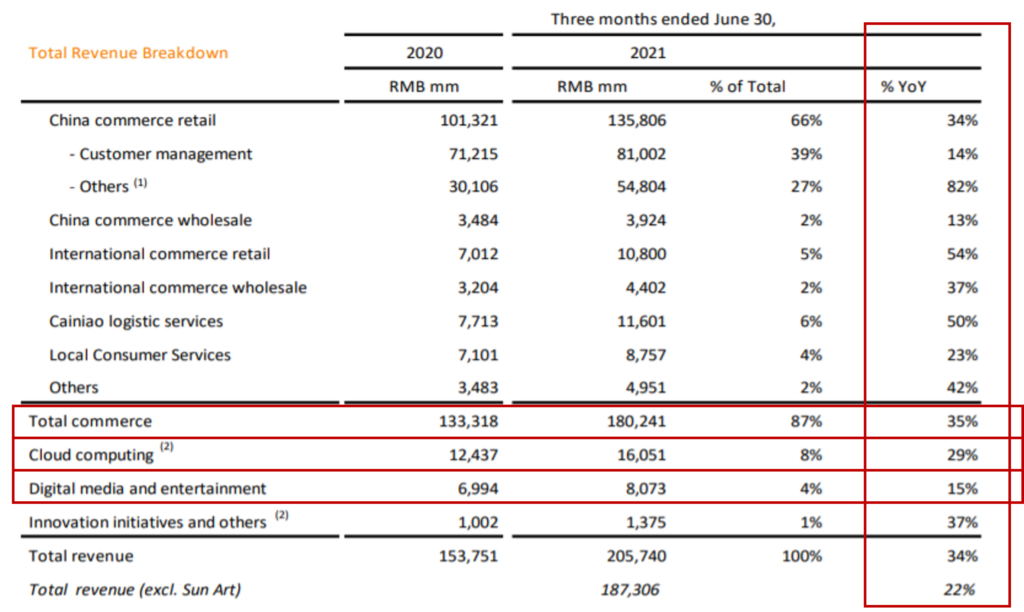

- Core Commerce is the biggest revenue generating segment with 87% contribution to revenues in the latest quarter.

- Cloud Computing is the second largest segment which contributes 8% to the revenues.

- Digital Media and Entertainment (4%)

- Innovation Initiatives which contributes 1% to the revenue.

Figure 7: Revenue Breakdown

PERFORMANCE OF THE COMPANY

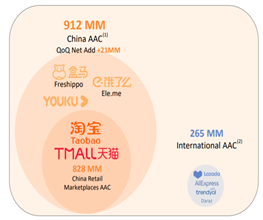

Alibaba is the largest retail commerce business in the world in terms of gross merchandise value (GMV: total value of the merchandise sold on a platform during a given period). It has over 50% market share in China in terms of GMV. The annual active consumers of Alibaba reached approximately 1.18 billion for the 12 months ended June 30, 2021. Out of the 1.18Bn, 77% are in China and the remaining 23% are international customers.

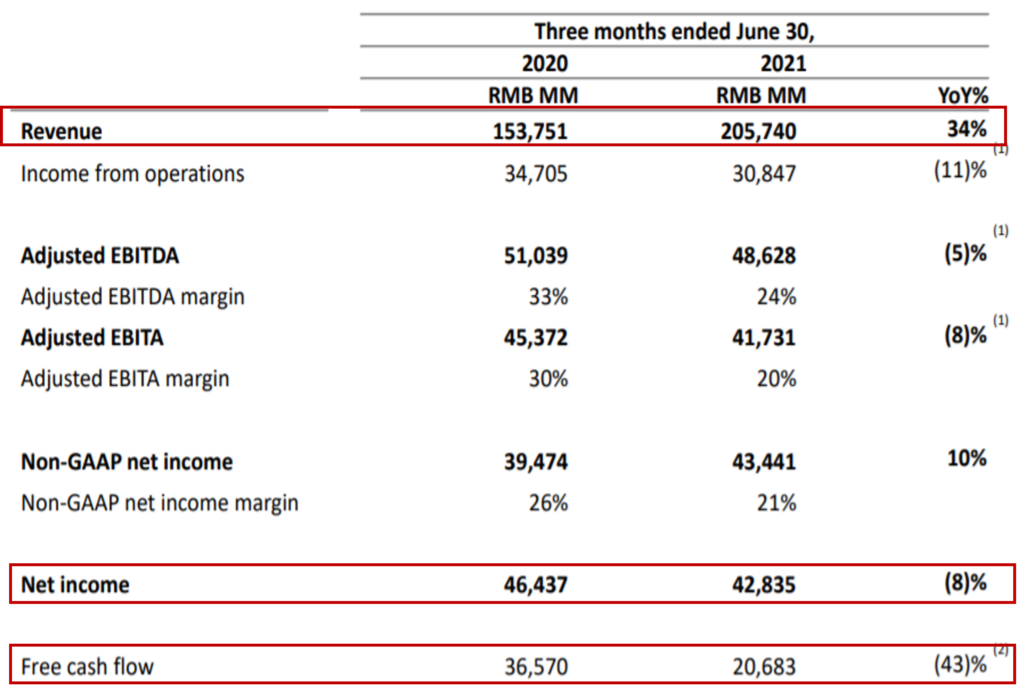

During quarter ended June 2021, the revenue of the company grew by 34% YoY, however the Net Income fell by 8% YoY and the Free Cash Flows also fell by 43% YoY. This is mainly due to investments in strategic areas to capture incremental opportunities. Another reason for the fall in cash flow was the partial settlement of the Anti-monopoly fine which was imposed in the company.

Figure 8: Quarterly Performance

SEGMENT WISE GROWTH

As shown in the figure below, the Total commerce segment grew 35% YoY. The main growth contributors to this were the consolidation of Sun Art, strong growth from Tmall supermarket and Hema, and higher online sales. Further, revenue from CaiNiao logistics grew 50% YoY mainly due to increase in volume of orders due to the fast growing cross-border and international commerce retail businesses.

Cloud Computing grew 29% YoY, which is less than the 59% YoY growth last quarter. This is because they lost a major client due to regulatory requirements. Going forward, the company expects more diversification in customers and industries.

Digital media grew 15% YoY due to increase in revenues from Youku and Ali pictures and improved quality of content.

Figure 9: Revenue Breakdown & Growth

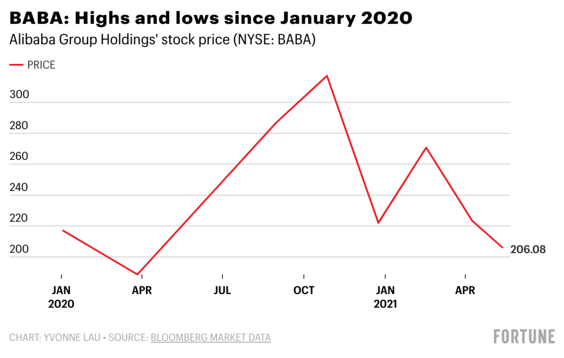

WHY DID ALIBABA STOCK FALL RECENTLY?

Leading up to the world-record $37 billion IPO of Ant Group, Jack Ma publicly criticised state banks for stifling innovation with “outdated supervision” and called for change in the “pawnshop mentality” of these “old men”.

This did not go down well with the authorities and the record IPO of Ant Group which would’ve valued the company at more than $300 billion, was suspended.

Moreover, an anti-monopoly probe was launched, and a $2.8 billion fine was imposed on Alibaba Group for platform exclusivity practices.

This made investors nervous, and BABA’s U.S. listed shares fell 13.9% in July, their worst monthly performance in more than 2 years.

The regulatory action was one of several events triggering a regulatory storm in China. The company saw temporary setbacks, due to this and investors became cautious their China investments.

THE ADVANTAGES OF ALIBABA GOING FORWARD

While there has been a lot of negative sentiment floating around Alibaba recently, there are some themes which work in its favour:

- The CCP’s vision to redistribute wealth to the masses should boost the purchasing power of the people in the long run, which should in turn boost sales on Alibaba’s platforms.

- The Chinese e-commerce landscape is thriving, and Alibaba may benefit from the growth of China’s consumption economy, which is flourishing from the acceleration of digitalization.

- The business fundamentals of the company seem to be largely intact and growing digitalization will also lead to growth in cloud business.

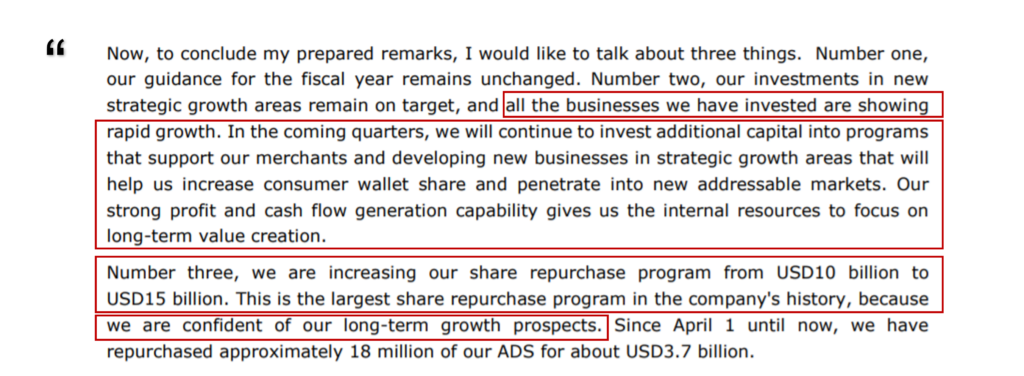

- The company plans to invest all its incremental profits back into the business. The company is putting money into strategic areas, for example, Taobao Deals, which is targeted at price-conscious consumers, and New Retail, which will merge the online and offline shopping experiences.

- Alibaba is already well positioned in the e-commerce space and boosted by the reinvestment in business expansions, the GMV of the company should grow meaningfully.

- Recently Alibaba launched its first NFT marketplace platform that lets musicians and artists sell the rights to their content via blockchain. This means that they are innovating new ways to make money and expand.

- The company is increasing their share repurchase program from $10 billion to $15 billion. This shows management confidence in the long-term prospects of the company.

Figure 10: Excerpt from Earnings Call – June 2021

These steps should expand Alibaba’s customer base into China’s lower tier-cities, less affluent population, propel engagement, frequency, and share of wallet.

This is also in-line with the Chinese Communist Party’s initiative of inclusion of the low-middle income population into the economy.

THE KEY RISKS FOR ALIBABA

- Alibaba has pledged to end anti-competitive practices, so the company may have to make significant investments or changes on the platform to keep merchants satisfied.

- This could hurt profitability in the short term. However, all the players would have to make similar changes. Further, several merchants even though already on multiple platforms, are attracted to Alibaba due to its strong ecosystem, traffic, and marketing effectiveness. For these reasons, the impact on Alibaba may be limited.

- There is also growing competition from companies such as com, Pinduoduo, Tencent, etc.

- A possible risk for the Cloud Business: the new regulatory regime for ed-tech companies will possibly curb their spending on internet services. Alibaba had also lost a major client last quarter. However, the company hopes to diversify and grow the cloud business so that concentration risk is minimized. [Bloomberg News has previously reported that the client is TikTok-owner ByteDance Ltd.]

- Alibaba’s U.S listed entity is a Variable Interest Entity (VIE).

[Very quickly, a VIE is a structure created by Chinese companies to circumvent the Chinese law which prohibits them from having any foreign ownership. They create a shell company in the Cayman Islands under the same name and then, complex agreements are made which give the new company a claim to profits. If you invest in a VIE, you will not get any actual ownership in the “real” company. This structure has been used by hundreds of companies for decades and the CCP turns a blind eye because it brings in foreign capital, but we are all familiar with the volatile moods of the CCP]

- As evidenced by the recent crackdown in China, uncertainty in the political and economic policies of the PRC government is a risk one should be mindful of.

- Similarly, there may be uncertainties regarding the interpretation and enforcement of PRC laws and regulations which one should be keep in mind.

VALUATION

“Price is what you pay. Value is what you get.” – Warren Buffett

Using the VIA Model for price valuation as shown in the picture below, on entering the past and the present EPS, it is evident that the company has grown 46% in 10 years. Assuming that the company grows for 10 years, and taking the discount rate as 10%, an inflation of 2%, with a 30% margin of safety, it results in an adjusted growth rate of 18% for the Target Buy Price of CNY 1097, i.e., USD 169.7. Hence, investment in this stock is justified only if one has the conviction that this company can grow at 18% p.a. or more.

Please note that All investors should generally refer to additional valuations as a prudent step to take, in the value investment methodology.

Figure 11: Screenshot of the VIA Price Calculator

Applying two other valuation methods using conservative assumptions and a 30% margin of safety, we arrive at the following valuations:

Perpetuity Growth Method (based on free cash flow projections of the next 5 years)

Intrinsic Value ($/share)

EBITDA multiple method

Intrinsic Value ($/share)

All investors should generally refer to additional valuations as a prudent step to take, in the value investment methodology.

So, we have a valuation range of $169.7 – $223.46/- and at the time of writing this article, the current market price is $170.3/- (Sept 3, 2021). (This is not an investment advice).

CONCLUDING THOUGHTS

- Alibaba dominates the e-commerce as well as cloud computing space in China.

- It is in growth mode with its focus on reinvesting profits into strategic areas. Moreover, the share repurchase program also shows management confidence.

- The one-time fine had a short-term impact on the company and Alibaba is now trying to stay within regulatory boundaries. As long as the company’s goals are aligned with the broad social objectives of the government about uplifting the social and economic class of the masses, it should sustain its long-term growth trajectory.

- Alibaba is a multinational technology company specialising in e-commerce, retail, Internet, and technology. It is crucial for the overall economic growth of China because it is an innovator, and it has roots in several aspects of life. The authorities would not want to cripple such a company permanently.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.