As the old saying goes, ‘ There are no problems, only opportunities’. While I realized that the Novel Coronavirus has affected many people, whether it be a disruption to normal life or even as serious as a possible fatality, I feel that this virus has also opened up many opportunities in the world of investing.

Investing is as much an emotional game as it is about fundamentals. Howard Marks of Oaktree Capital dedicates a whole chapter in his book, ‘Mastering the Market Cycle: Getting the odds on your side’. In this chapter, he mentions that Investor’s Psychology is one of the strongest reasons why prices can gain and drop so much when news of an event breaks out even if the fundamentals don’t change.

Any problem in the world has benefits for some companies while it harms others. So when an unforeseen event occurs, the benefactors see a spike in their share price and some companies directly affected by the event, see a dip.

Usually, when an event affects a company negatively, two scenarios are presented to investors:

- A previously overpriced stock is now corrected back to fair value.

- A fair value stock is rendered even cheaper than before.

Meaning that in every problem, we may find a company in which we can invest with a margin of safety.

One such opportunity, I found, is in the company Straco Corporation Limited (Ticker Symbol: S85). For simplicity, we will refer to the company as SCL from now onwards. Listed on the SGX (Singapore Exchange), Straco saw a drop of 10% in share price because of the recent spread of the nCoV.

Let us understand SCL Straco.

ABOUT THIS COMPANY

“Straco Corporation Limited (“SCL”) was listed on the Mainboard of the Singapore Exchange on 20 February 2004. Since then, the Group has been one of the first few foreign companies that have managed to build up significant presence and influence in the tourism industry in China. The Group showcases high quality tourism-related projects, incorporating entertainment, education, and culture to create a unique experience for visitors and audiences. These projects include giant observation wheels, large-scale public aquariums, cable-car facilities, the protection and redevelopment of historical sites.”[1]

The notable assets that SCL has:

- Singapore Flyer: The group’s flagship product in Singapore. It is one of the world’s largest observation wheels.

- Shanghai Ocean Aquarium: The group’s flagship product in China. A major tourist attraction in China, the aquarium attracts over 1 Million visitors yearly.

- Underwater World Xiamen: Another aquarium owned and maintained by the group.

- The Lixing Cable-Car Service: Situated on the mountains of Mount Li’shan in Xian, the attraction is a premier cable car attraction leading people up to Cha Yuan Ge.

- Chao Yuan Ge: SCL owns the development rights at Chao Yuan Ge. The site will be an integral part of the restoration project for the “Hua Qing Palace”.

COMPETITIVE ADVANTAGE

The next part of this analysis is to determine if the company has what Warren Buffet calls an ‘Economic Moat’.

Usually, a company with many subsidiaries will show patterns of trade and business amongst each other just like Uber has local rental car companies that rent out cars to its drivers.

In SCL, the links between the attractions seem to come in pairs. The Shanghai Ocean Aquarium and Underwater World Xiamen are both aquariums and may have some partnership in sharing information, knowledge, and tips. The Lixing Cabler Car service leads tourists to SCL’s very own land site, the Chao Yuan Ge.

Of course, these attractions in China and Singapore come with strict licensing deals with their respective countries. Thus the economic moat is in knowledge sharing and licensing.

RISKS TO THE COMPANY

While the Shanghai Ocean Aquarium is one of the largest aquariums in the world, it faces strong competition from the Ocean Park attraction in Hong Kong, the Chimelong Ocean Kingdom in Zhuhai and the Beijing Aquarium in Beijing. All of these attractions see a visitorship rate of approximately 1.5 Million.

However, while there are other aquariums to visit, the geographical separation and population density of each city makes it unlikely that visitorship/tourists will overlap with each other. Simply put, it is unlikely that visitors can easily choose between which aquariums to visit (without having to travel a lot).

Furthermore, the group also has the right to operate the only observation wheel in Singapore. No competitors to this experience.

CUSTOMERS

According to SCL, The National Bureau of Statistics of China reported that China’s gross domestic product (“GDP”) grew 6.0% year-on-year in the third quarter of 2019, dragged mainly by the manufacturing sector and weak domestic demand. For the year-to-date, the economy grew 6.2% year-on-year. Despite the economic slowdown, domestic tourism remains resilient. According to a report released by China Tourism Academy, domestic visitor arrivals are expected to grow 8.8% to reach 3.08 billion in the first half of 2019. [2]

MANAGEMENT

The company is spearheaded by Executive Chairman, Mr. Wu Hsioh Kwang. He serves as the CEO of the company. Mr. Wu has been with the group since the beginning. He is also the largest shareholder in the group. Looking at the financial reports of 2017 and 2018, Mr. Wu has received compensation of less than 5% of Revenue, which is fairly respectable.

Interestingly, the next two highest-paid executives in the group were Ms. Wu Xiuyi and Mr. Wu Xia Zhuan. They are the Executive Chairman’s daughter and son respectively. They are titled as Alternate Directors in the Annual reports and hold positions as Senior Vice Presidents in the group.

Usually, companies with strong leadership tend to grow. Mr. Wu Hsioh Kwang has demonstrated that he can lead a company with a good show of earnings over the years. (refer to fundamentals below)

VALUATION

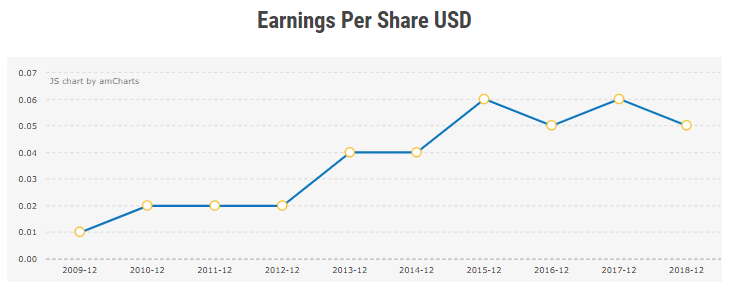

Earnings Per Share

We see a good upward trend lasting a decade thus far.

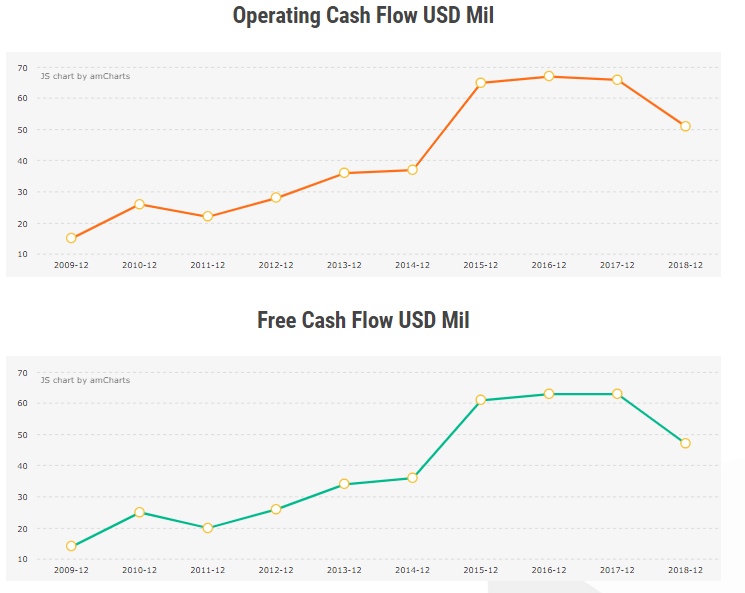

Operating Cash Flow

A steady upward trend in the Operating Cash Flow.

Free Cash Flow

Free Cash Flow trends also looks positive. Furthermore, according to the Balance Sheet, the group is sitting on $46 Million of cash. A significant amount considering that Net Profit for 2018 was $40 Million.

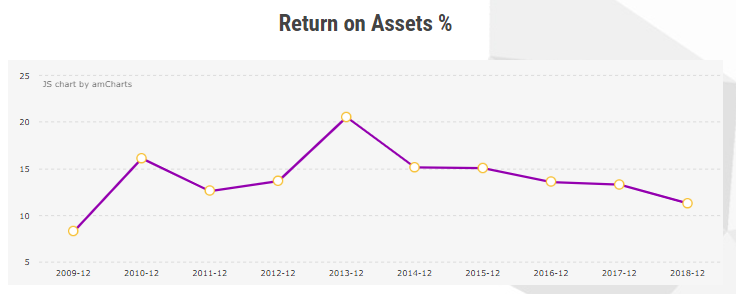

Return on Assets

ROA has been comfortably above 10%. The group has seen a decline in ROA. Earnings have been consistent. However, the company has been building up its assets (land and equipment) in recent years. The group should see a rise in revenue and income once some of these assets come to fruition.

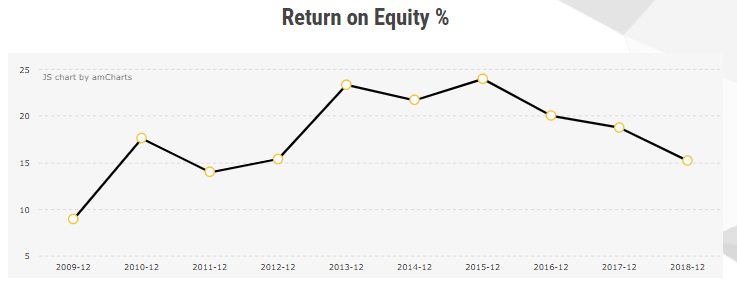

Return on Equity

ROE also has seen a dip but remains at healthy levels above 15%.

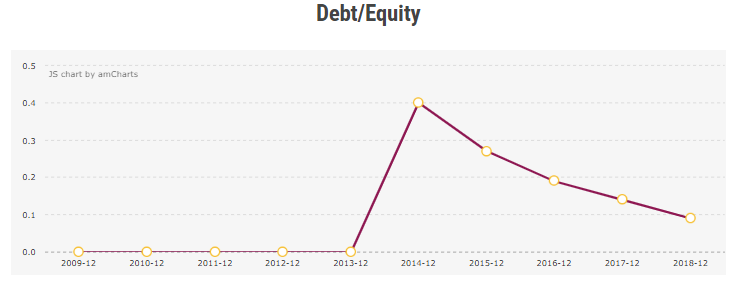

Debt to Equity

Debt to Equity is on a downward trend as the company commits to its plan of paying off $12Million / year to service its loan. Considering that the group is cash-rich, the debt is a non-worrisome trend.

Other Statistics

Price to Book: 1.65

Current Ratio: 8.48

Dividend Yield: 4.55%

Payout Ratio: 41.52%

INTRINSIC VALUATION

Just a few months ago, the company was trading at a stock price of close to $0.77. However, bad news from the spread of the nCoV has provided us with an opportunity. Assuming that the company grows at an 11% growth rate yearly, the Intrinsic Valuation of the company is calculated as $0.63 with a 30% Margin of Safety. As of 10/2/2020, the share price of SCL is $0.565.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.