When someone mentions “electric vehicle”, what is the first name that comes to your mind? Tesla.

You can’t talk about electric vehicles without mentioning Tesla.

Watch our deep dive into the EV space & Tesla here:

About Tesla, Inc.

Founded in 2003 by Americans, Martin Eberhard and Marc Tarpenning, Tesla is an American manufacturer of:

- Electric automobiles (“high-performance fully electric vehicles”), and

- Solar panels, and batteries for cars and home power storage (“infinitely scalable clean energy generation and storage products”).

The company was named after the inventor, Nikola Tesla who is best known for his contributions to the production, transmission, and application of electric power. The company is located in Palo Alto, California.

Concept Car

In 2008, Tesla released its first car, the Roadster. This was an all-electric car which could travel 394 km (245 miles) on a single charge and had a performance comparable to many gas-powered sports cars. However, a price tag of $109,000 made it a luxury car. In 2008, Elon Musk became CEO.

“Our goal when we created Tesla a decade ago was the same as it is today: to accelerate the advent of sustainable transport by bringing compelling mass market electric cars to market as soon as possible.” —- Elon Musk in November 2013

The company was listed in 2010 raising ~$226 million. The company sold approximately 2,500 Roadsters before ending production in January 2012.

Revenue Breakdown

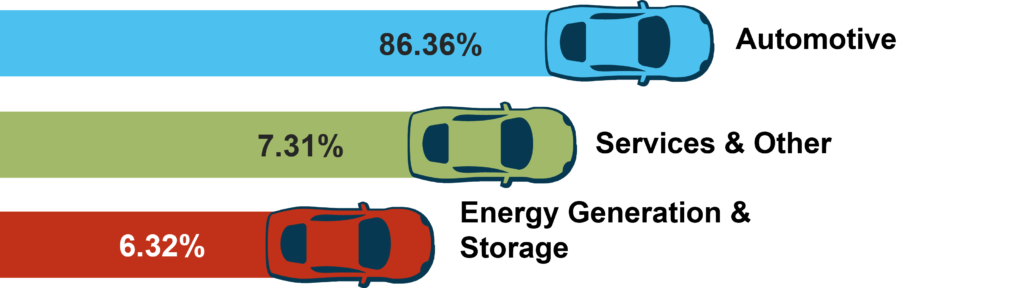

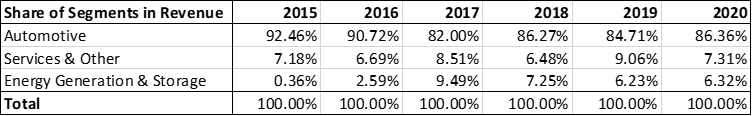

Tesla generates revenue from 3 segments:

Tesla, Share of Revenue, 2020

As on December 2020, automotive sales and automotive leasing together constituted ~86% of the total revenues (~$27 billion). The automotive segment used to contribute a higher percentage to revenue, for example in 2015, it contributed 92%. This share may be expected to fall gradually as other segments gain traction.

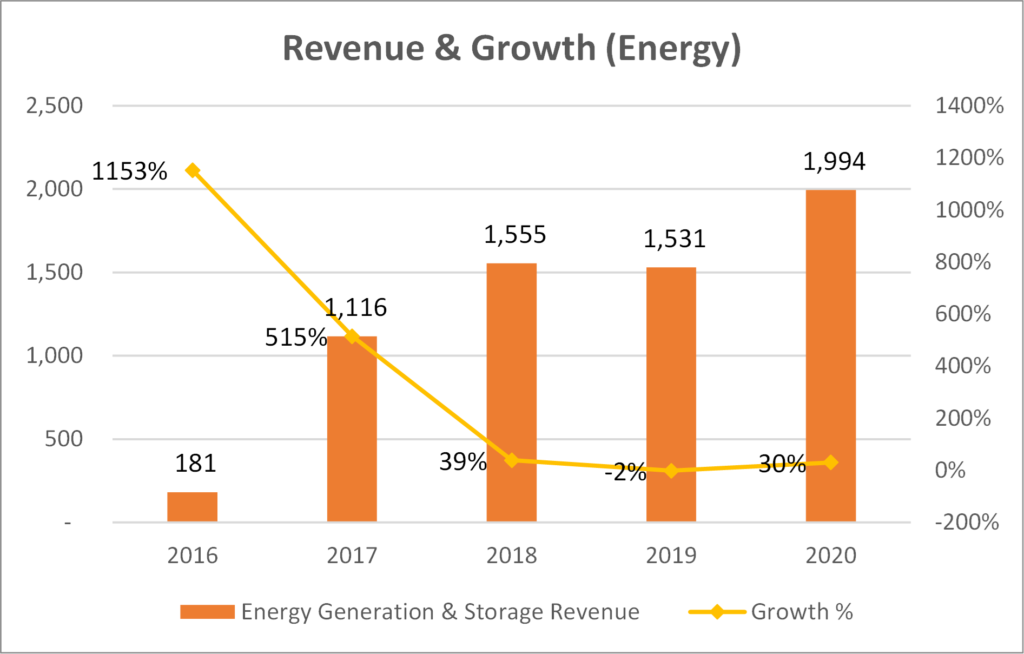

Energy generation and storage segment is still a small and growing segment, contributing only ~6% to revenues (~$1.99 billion). This segment is expected to outgrow the services segment going forward as the demand for low-emission renewable energy grows.

Tesla Products – Automotive Segment

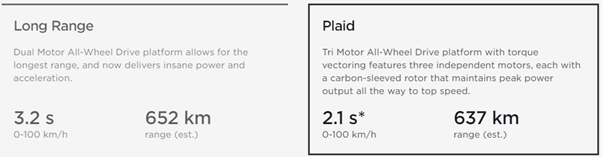

Model S

- The world’s first ever luxury all-electric sedan

- It has become the best car in its class in every category.

- The longest range of any electric vehicle

- Over-the-air software updates that make it better over time

- Record 0-60 mph acceleration time of 2.28 seconds as measured by Motor Trend.

- Starting price: $79,990 / £83,980

- Availability: US, UK, Europe

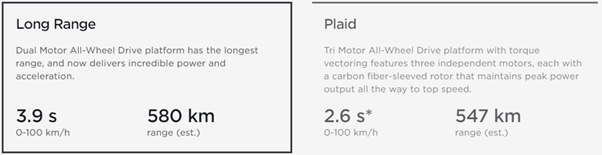

Model X

- The safest, quickest, and most capable, luxury sport utility vehicle (SUV) in history that holds 5-star safety ratings across every category from the National Highway Traffic Safety Administration.

- It has unique Falcon wing doors and a huge touchscreen inside. It truly looks like a car from the future.

- Starting price: $89,990 / £90,980

- Availability: US, UK, and Europe

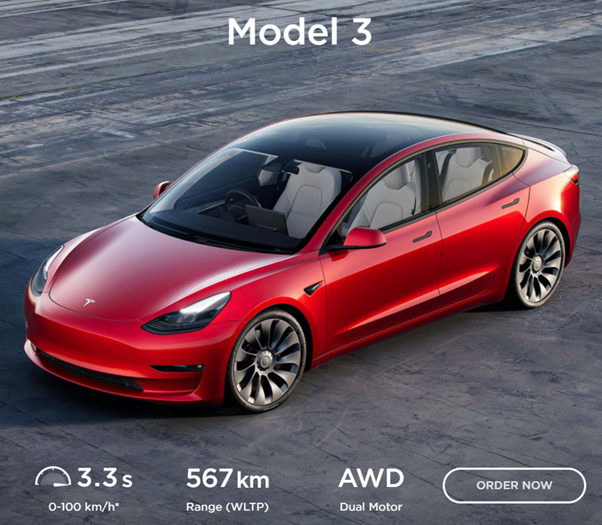

Model 3

- A low-priced, high-volume electric sedan that began production in 2017.

- Affordable alternative to Model S

- Most affordable Tesla.

- It can be recharged 270km in 15min in a supercharger location. Tesla has a network of 25,000 superchargers worldwide.

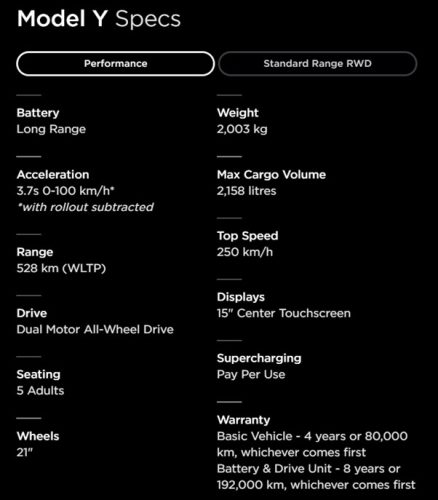

Model Y

- This fully electric vehicle is somewhere in between Model 3 and Model X

- It is a compact SUV and can carry 5 passengers and their cargo.

- It is less expensive than Model X.

Other models announced by the company are:

- The second-generation Roadster

- Tesla Semi: An all- electric semi-trailer truck

- Cybertruck – a pickup truck with angular design and steel construction.

Tesla Products – Energy Segment

Current energy generation products:

- Solar panels: Tesla sells and installs traditional solar panels, but the company does not build these itself. As of 2021, the company uses panels built by Hanwha Q Cells of Seoul, South Korea.

- Tesla solar roof: Tesla manufactures, installs and sells solar shingles which are solar panels designed to function as roofing materials while also producing electricity.

- Tesla solar inverter: It converts the variable direct current (DC) produced from solar panels into alternating current (AC) that can be fed into a commercial electrical grid or used by a local, off-grid electrical network

Battery energy storage products:

- Powerwall: It is a rechargeable lithium-ion battery intended to be used for home energy storage

- Powerpack and Megapack: large-scale rechargeable lithium-ion battery intended to be used by businesses or an electric utility company.

Tesla has also developed a software ecosystem to support its energy hardware products.

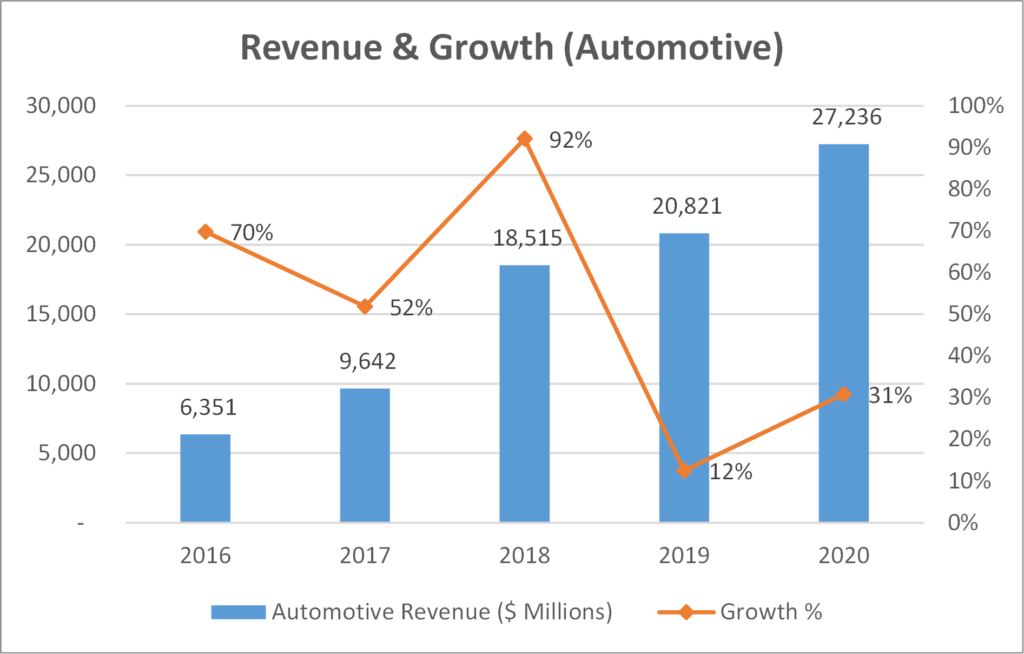

Revenue Growth

In 2020, Tesla’s automotive revenue grew by 31% primarily due to increase of Model 3 and Model Y deliveries despite production limitations in the first half of 2020.

We can see that in 2019, the energy segment fell by 2%. This was due to decreases in deployments of solar cash and loan jobs. But in 2020, the energy segment grew by 30%. This was mainly due to increase in deployment of megapacks.

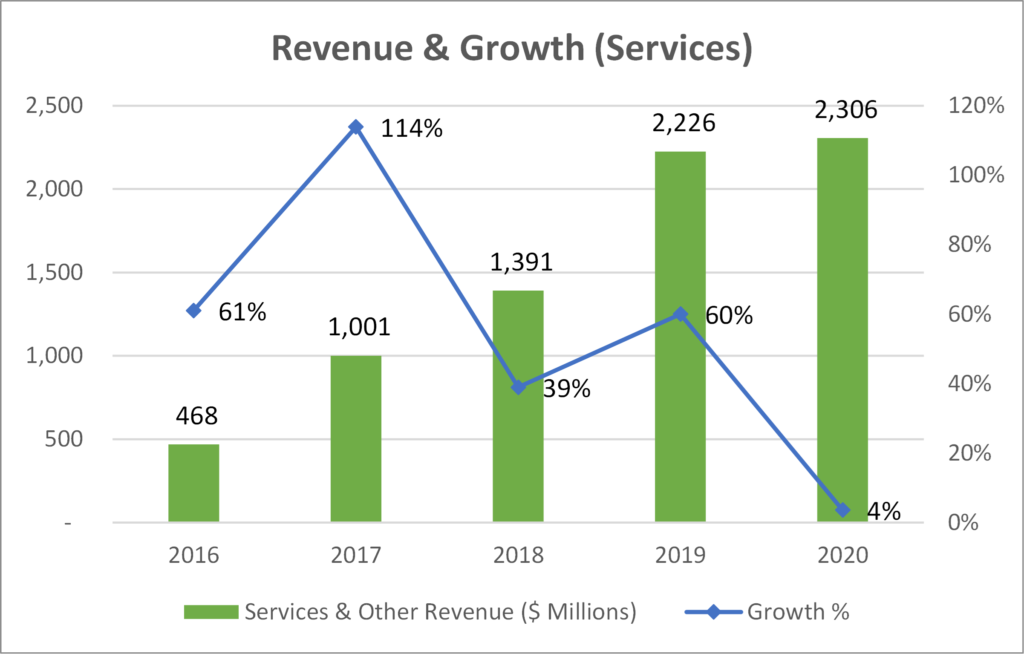

The services segment was lagging in growth with just a 4% growth in 2020.

Overall, in 2020, the total revenue grew by 28% mainly boosted by vehicle deliveries and growth in other parts of the business as well.

Average selling price of the vehicles declined owing to a change in product mix marking a shift from Model S and Model X to the more affordable Model 3 and Model Y.

Tesla Factories

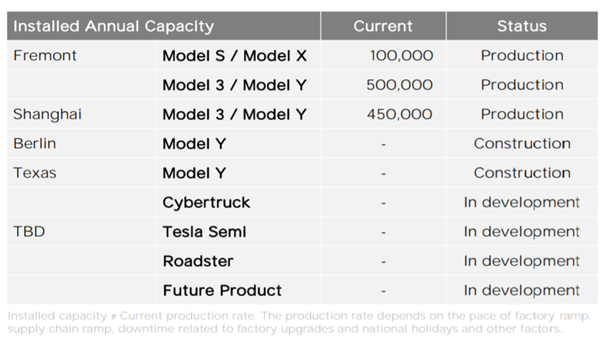

Tesla has a factory in Fremont, California spread across 5.3 million square feet. The company will nearly double the size of the facility to almost 10 million square feet in the coming years.

Tesla started building a Gigafactory in Sparks, Nevada in June 2014. To ramp production to 500,000 cars per year, the Gigafactory will produce enough batteries to support Tesla’s demand. Currently, it produces Model 3 electric motors and battery packs, as well as the Powerwall and Powerpack.

The Tesla Gigafactory 2 is a 1.2 million square foot facility in Buffalo, New York where it produces solar cells and modules and solar panels.

It has a Gigafactory in Shanghai, China spanning 9.3 million square feet which currently hosts the final assembly of Tesla’s Model 3 and the production of Model Y.

Other factories under construction are Gigafactory Berlin-Brandenburg, Germany and Austin, Texas. Giga Texas is planned to be the main factory for both the highly anticipated Tesla Cybertruck and the Tesla Semi.

Tesla Financials

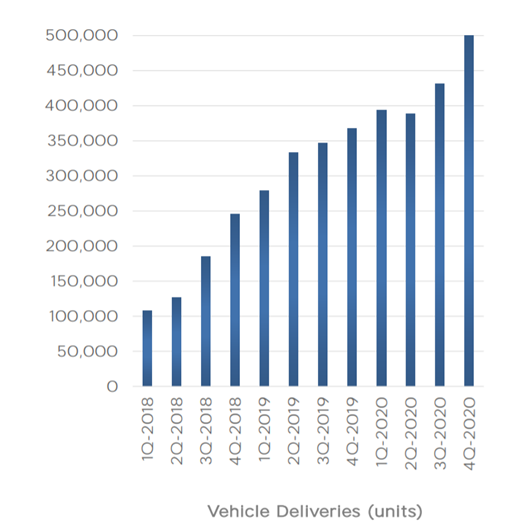

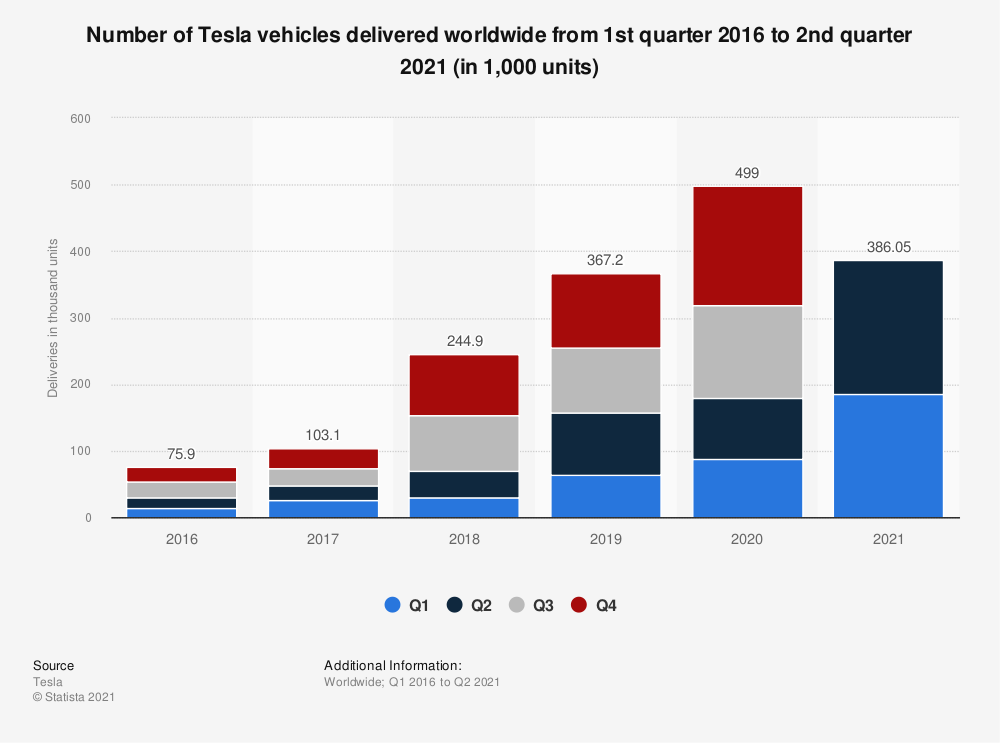

Tesla produced and delivered ~500,000 vehicles in 2020. This was 36% higher than last year’s ~367,200 deliveries.

From the chart below, we can see that the vehicle sales of Tesla have been growing steadily every year. In 2021, for the first 2 quarters, the company has produced 386,759 vehicles and delivered 386,181 vehicles. Over a multi-year horizon, Tesla expects to achieve 50% average annual growth in vehicle deliveries.

According to Tesla Management:

“We are currently focused on increasing vehicle production and capacity, improving and developing battery technologies, improving our FSD and Autopilot capabilities, increasing the affordability and efficiency of our vehicles and expanding our global infrastructure.”

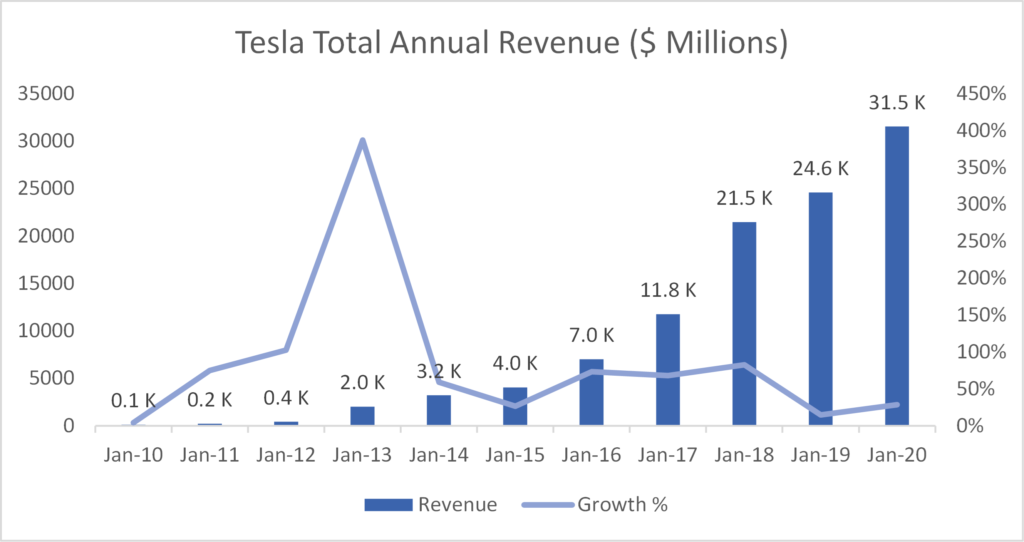

Revenues

From the above chart, it is evident that Tesla’s revenue has grown at a breakneck speed (CAGR ~50%) from ~$4 billion in 2015 to over $30 billion in 2020.

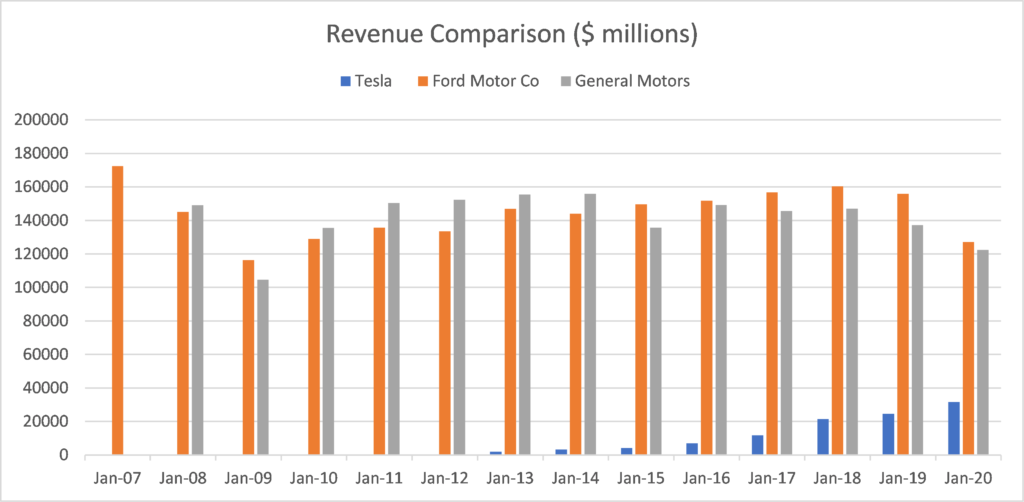

It is worthwhile to compare the revenue of Tesla with that of General Motor and Ford Motor.

As we can see from the chart above, Tesla is still far behind its peers in terms of annual revenue. In 2020, Ford Motors and GM each have ~$120 billion in annual revenue compared to ~$30 billion of Tesla. Many may say that Tesla’s growth story has just commenced, and it has a long way to go.

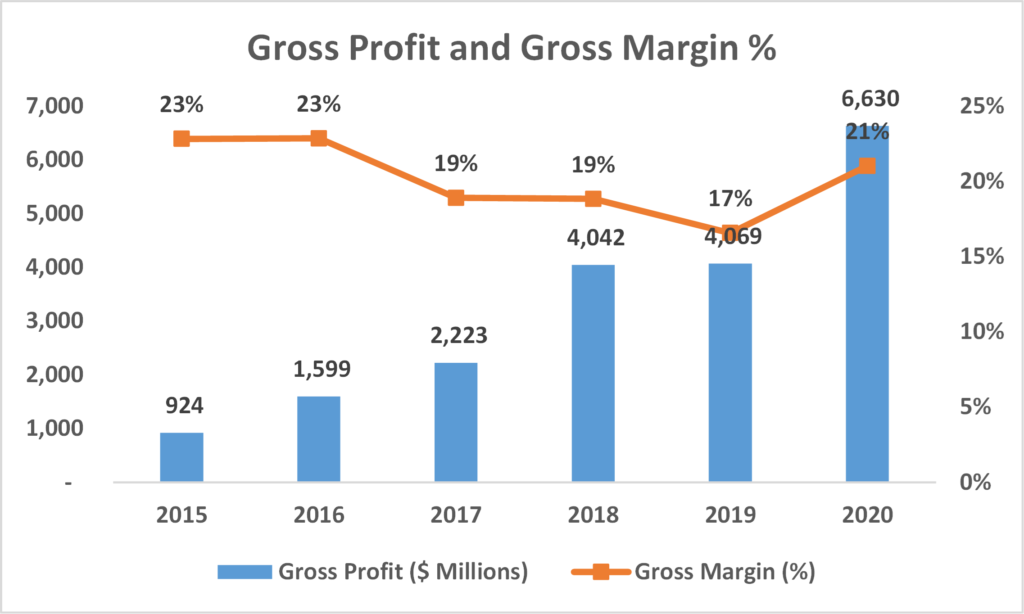

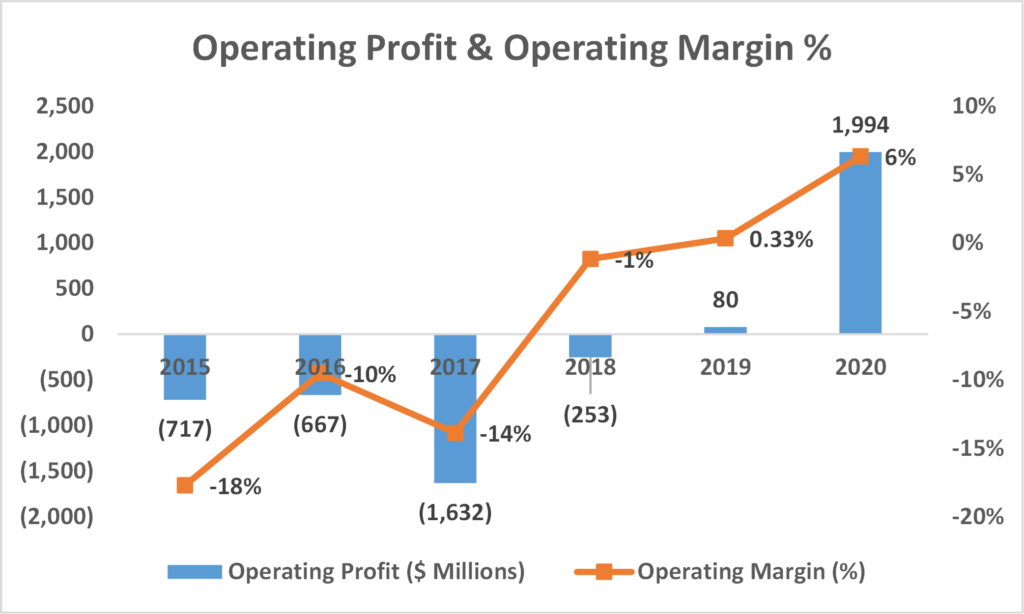

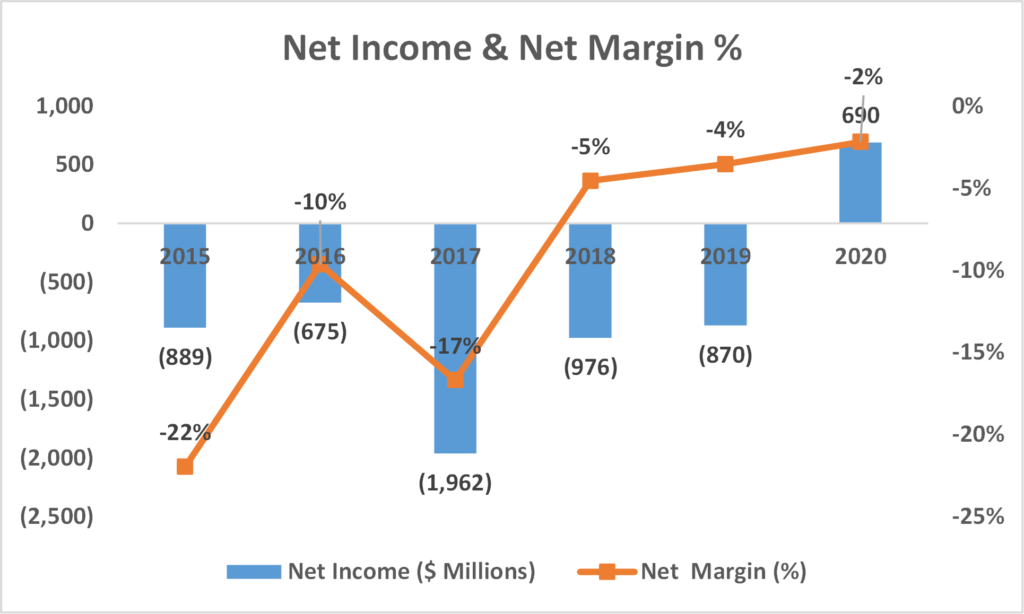

Gross Margins, Operating Profit and Net profit

Gross margins for 2020 improved from 2019 to 21%. This was due to lower material, manufacturing, freight and duty costs from localized procurement and manufacturing in China, higher margins from Model Y and increased operational efficiencies in services segment.

Gross margins for energy business decreased from 12% to 1% due to higher proportion of low margin solar roof in the product mix. The solar cash and loan business also had lower margins due to lower average selling prices.

Tesla finally made positive operating profit only in 2019. And the operating profit increased in 2020 to $1.99 billion, translating to a (industry leading) 6.3% operating margins.

According to Tesla, it expects its operating margin to continue expanding, eventually reaching “industry-leading levels with capacity expansion and localization plans underway”.

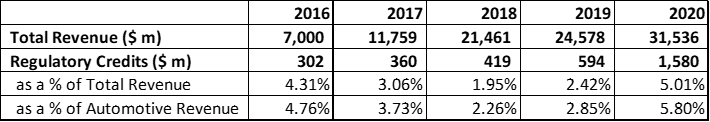

The company reported the first full year of profitability in 2020 with a net income of ~$690 million. However, it earned a $1,580 million revenue from selling regulatory credits, without which the company would still be in the red. The revenue from regulatory credits constituted 5% of the total revenue for 2020, and 5.8% of the automotive revenue. Further, it was ~228% of the net income for 2020.

In fact, Tesla’s reliance on regulatory credits to turn profitable is seen as a red flag by famous hedge fund manager, Michael Burry, who has a bearish stance on the stock.

What are regulatory credits?

In a bid to reduce carbon emissions, governments around the world have issued incentives under which credits are awarded to automakers that manufacture and sell zero emission vehicles (ZEVs). Longer range ZEVs receive more credits.

Each carmaker is required to meet a target number of credits each year, failing which they may purchase these credits from other companies which have excess credits.

Since Tesla only makes all-electric cars, it always has excess credits, and it can sell them at 100% profit to traditional automakers. So, this regulatory credit revenue is pure profit for Tesla.

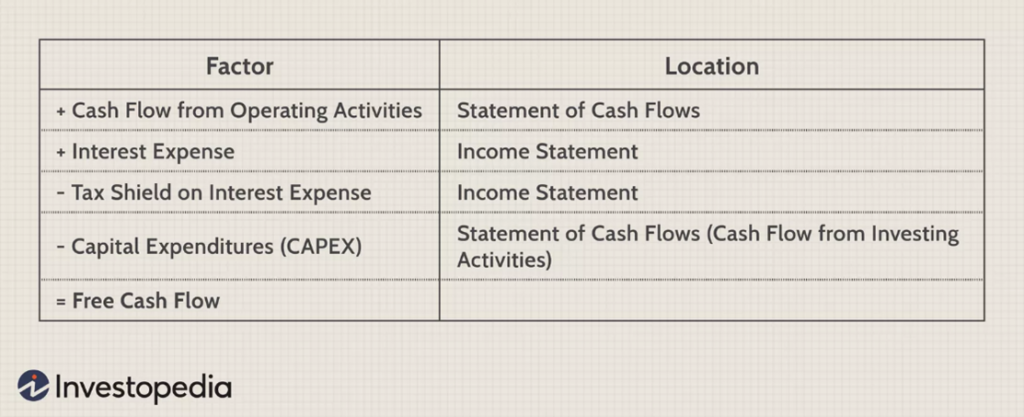

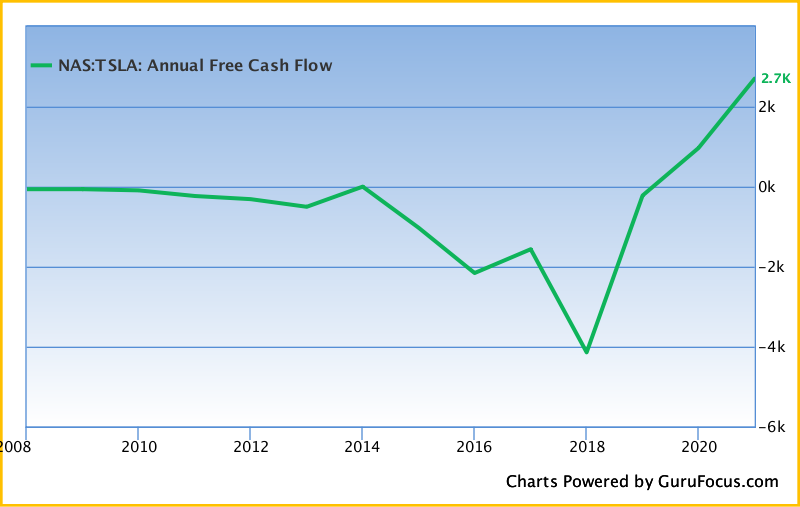

Free Cash Flows

Analyzing the free cash flow of Tesla, we find that FCF (Operating CF minus capital expenditures) has been negative since many years, finally turning positive in 2019 at $968 million. The FCF in 2020 soared to $2,701 million, an increase of ~170% from 2019.

According to the management, they have sufficient liquidity to fund their product roadmap and long term expansion plans.

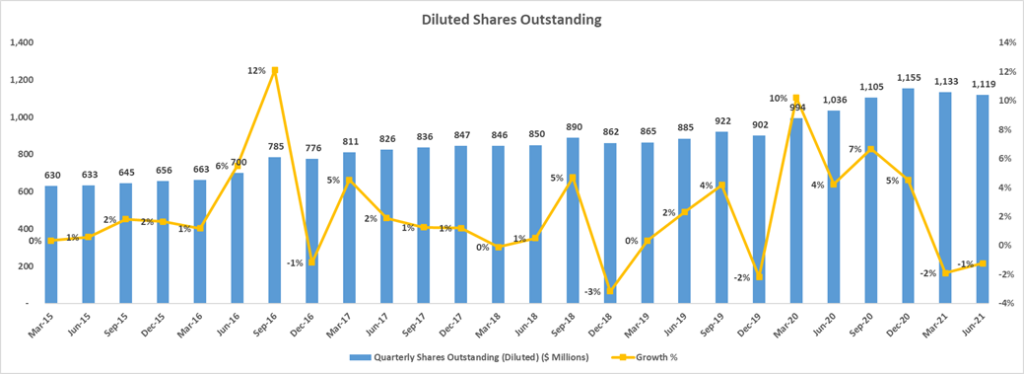

Stock Dilution

The chart above shows the quarterly diluted shares outstanding for Tesla from 2015 to the latest quarter in 2021. The blue bars represent the diluted shares outstanding, and the yellow line shows the growth every quarter. In the long term, the outstanding shares at Tesla have grown significantly in the past 5 years.

Over the years, Tesla has issued shares on many occasions. For example, in August 2015, Tesla issued 3m common stock to raise $738 million to pay to produce the new Model X. In 2016, it issued 5.5m shares to ramp the production of Model 3. In 2016 the company issued shares to employees as equity incentives, and it further issued 11m shares to buy SolarCity.

In 2019, Tesla issued ~900k common stock to acquire Maxwell Technology Inc. In February 2020, the company issued ~3m shares to raise ~$2 billion cash to “further strengthen its balance sheet, as well as for general corporate purposes.” In Q4 2020, Tesla issued ~8m shares to raise ~$5 billion in cash.

As can be seen from this trend, Tesla has been continuously issuing common stock to raise funds. That coupled with stock-based compensations as well as convertible securities, the shares outstanding may rise further, and this results in stock dilution for existing shareholders. This means that an existing shareholder will own a lower percentage of the company with every successive issue of stock.

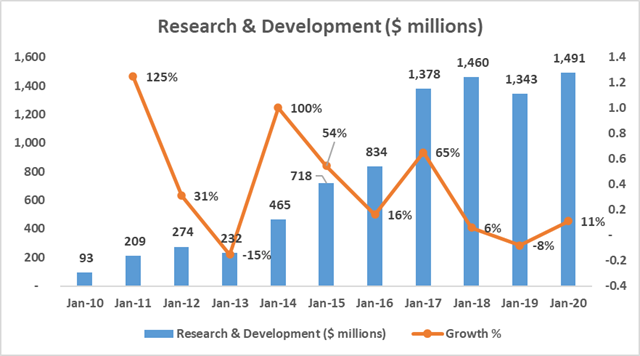

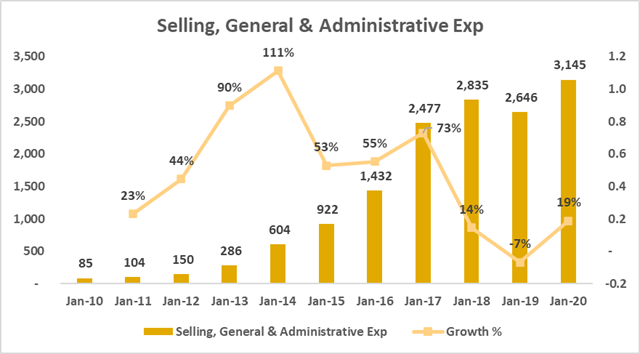

Expenses: R&D, SG&A

The R&D expense has increased by 11% in 2020 primarily due to increase in expensed materials to expand the product roadmap and increase in stock-based compensation related to issuance of equity awards.

SG&A expenses increased by 19% in 2020 primarily due to an increase of $625 million in stock-based compensation expense, of which $542 million was attributable to the 2018 CEO Performance Award.

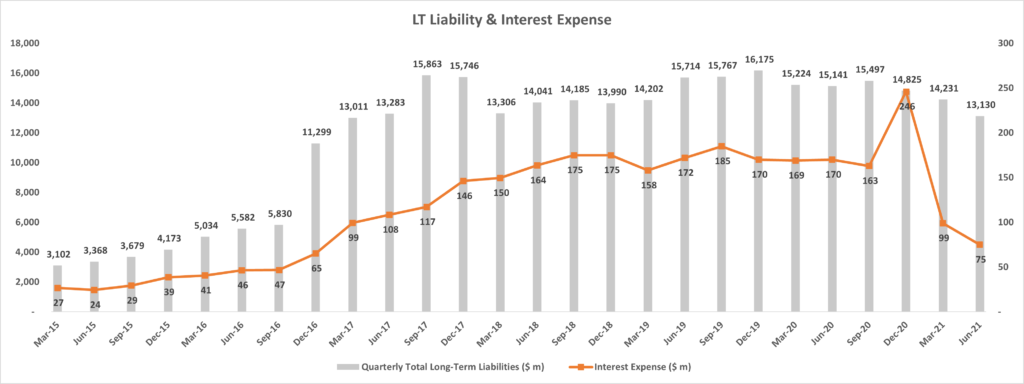

Debt & Interest

By the end of 2020, Tesla has incurred more than $700 million in interest expense. This is about 9% higher than the previous year’s charge.

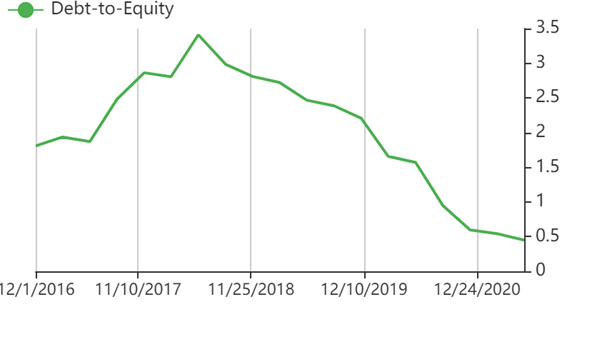

As seen from the chart above, the total long-term liabilities of Tesla were at $14,825 million on December 2020, however, it has declined in the subsequent quarters to reach $13,130 million in June 2021. The debt-equity ratio as shown on the chart below also signifies that the debt has been on the decline since recent quarters. This is probably because the company has switched to other alternatives to raise cash such as equity or maybe even its own earnings.

According to the management:

“Sustained growth has allowed our business to generally fund itself, but we will continue investing in a number of capital-intensive projects in upcoming periods.”

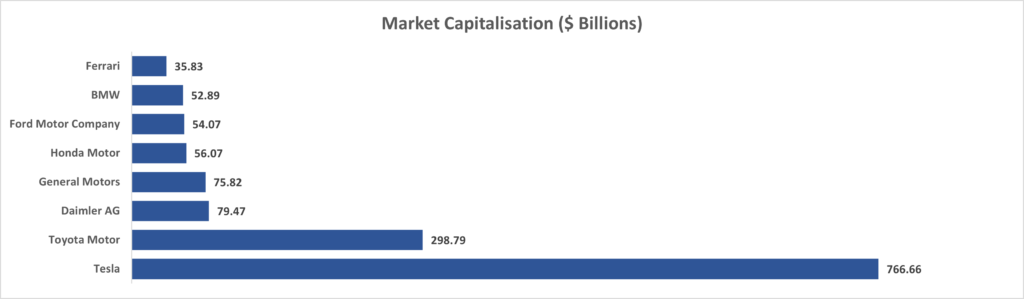

Market Capitalization

Tesla produces only a fraction of the vehicles as compared to established global players.

Yet, it’s market cap is nearly 2.5 times that of Toyota, ~10 times that of GM, almost 14 times the market cap of Ford and about 21 times that of Ferrari. (Market capitalization = No. of shares outstanding x Current Share Price)

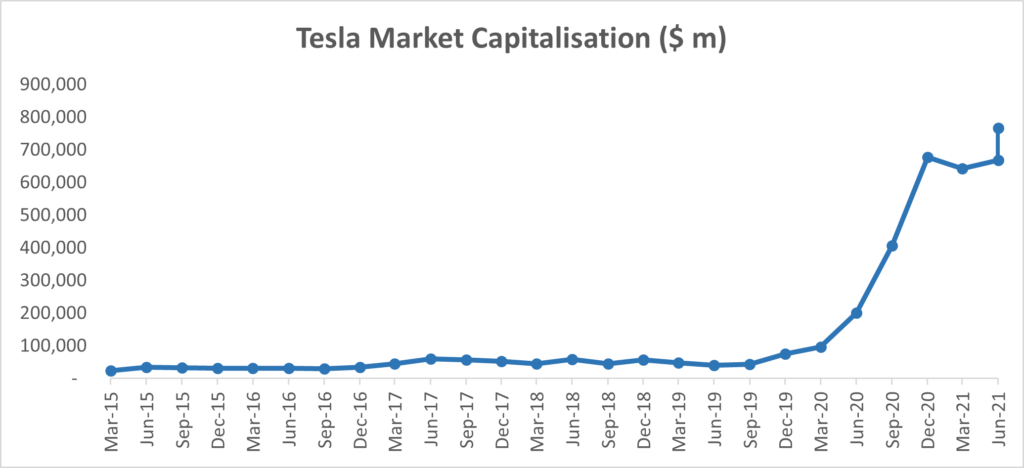

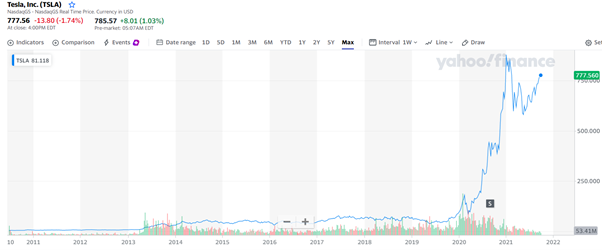

In fact, the Tesla stock has soared 116% since March 31, 2021, rising to $777.56 as on 28-09-2021.

The stock is trading at a PE ratio of 409.89 times.

Since the company went public, the stock has surged more than 20,000% turning many early investors into millionaires. Why does the Tesla stock keep soaring?

There are many reasons. Tesla is a tech company as well as a car company. Moreover, it is an electric car company. Plus, it is a company which has consistently beat expectations. Investors see an EV future ahead. Read our deep dive into the EV industry.

Moreover, many believe in the vision and charisma of Elon Musk who has inspired a loyal army through his adventures in memes, cryptocurrency, space travel, PayPal etc. and has quite an eccentric Twitter feed.

Here is what Musk said in an earnings call about the latest second quarter results:

“We achieved record production, deliveries, and surpassed over $1 billion in GAAP net income for the first time in Tesla’s history”

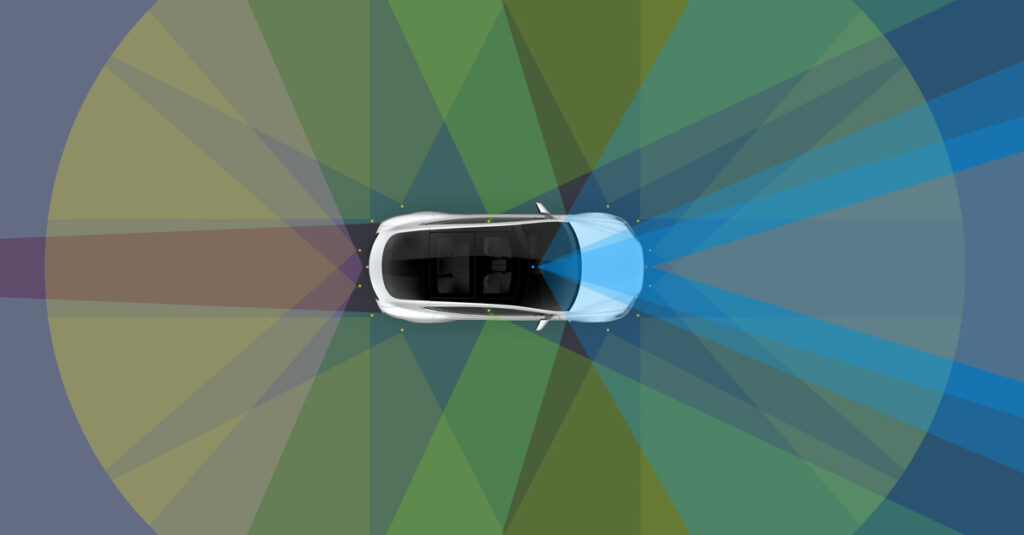

Tesla is expanding its manufacturing capabilities and it already has a dominant market share in the EV space (21%). It is also exploring self-driving technology through “Autopilot”. However, factors like product delays and crash probes, stock dilution and the case about regulatory credits make some people nervous. The semiconductor shortage and uncertainty over safety issues in China have also affected the stock price. Many analysts believe that the stock is overvalued, and the bubble may burst sooner or later.

Whether it is all smoke and mirrors or not, only time will tell, but instead of following the herd, an investor is strongly advised to assess his investment objectives and do his due diligence before deciding on any investments.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.