Seen as the closest competitor to Tesla in China, this young start-up has taken the EV space by storm. After a slew of regulatory measures rattled many Chinese stocks in the past few months, investors are now eyeing this stock, with only one question in mind: Is it time to buy NIO?

BLUE SKY COMING

NIO Inc. was founded in 2014 and is a pioneer in China’s premium electric vehicle market. Nio’s Chinese name is Weilai (蔚来), which means “Blue Sky Coming”. The name reflects their commitment to a more environmentally friendly future.

NIO designs, jointly manufactures, and sells premium electric vehicles with a focus on connectivity, autonomous driving, and artificial intelligence (AI). It also offers EV charging solutions and other services, including insurance, maintenance, roadside assistance, and an enhanced data package.

The company currently sells vehicles in China and plans to expand into international markets in the near future to capture the fast-growing EV demand worldwide. If you want to read more about the EV industry in general, we covered that here.

NIO PRODUCTS

EP9: The first model developed by NIO was the EP9 supercar in 2016. With an attractive design and strong driving performance, the EP9 delivers extraordinary acceleration and exceptional electric powertrain technology, helping position the company as a premium brand.

ES8: NIO launched their first volume manufactured EV, the ES8, in December 2017. The ES8 is a 6-seater or 7-seater all aluminium alloy body, premium electric SUV that offers exceptional performance, functionality, and mobility lifestyle. The ES8 can accelerate from zero to 100 kph in 4.4 seconds and brake from 100 kph to a complete stop in 33.8 meters.

In December 2019, NIO launched the all-new ES8 with more than 180 product improvements. It can accelerate from zero to 100 kph in 4.9 seconds.

ES6: NIO officially launched the ES6, a 5-seater high-performance premium electric SUV, in December 2018. It can accelerate from zero to 100 kph in 4.7 seconds and brake from 100 kph to a complete stop in 33.9 meters.

EC6: The EC6, a premium smart electric coupe SUV was launched in December 2019. The EC6 achieved the best safety rating among all models tested by C-IASI in 2020. the EC6 is capable of accelerating from zero to 100 kph in 4.5 seconds. It also features a 2.1 square meter panoramic all-glass roof.

ET7: The ET7, a flagship premium smart electric sedan, was launched in January 2021. The ET7 features NIO’s latest NAD (NIO Autonomous Driving) technology including NIO Adam, a super computing platform, and NIO Aquila, a super sensing system. Deliveries for this model will begin in 2022.

INNOVATION

NIO has been constantly innovating and investing in new technologies which differentiates it from its Chinese peers. NIO has developed NOMI – a voice activated AI digital companion – which according to NIO is one of the most advanced in-car AI assistants developed by a Chinese company.

Further, NIO provides innovative value-added services and charging solutions –

- Power Home – home charging solution

- Power Swap – innovative battery swapping service

- Power Mobile – mobile charging service through charging trucks

- Power Express – 24-hour on-demand pick-up and drop-off charging service

POWER SOLUTIONS

The power solutions offered by NIO are:

Power Home: Through Power Home, NIO installs home chargers at users’ homes. Currently they are offering a standard 7 kW (included in cost) and a high-speed 20 kW (additional cost) smart home chargers.

Power Swap: These are battery swapping stations. The power swap station 1.0 has a typical size of approximately three parking spaces and accommodates 5 battery packs. Once a vehicle is parked in the swap station and the swap function is activated, battery swapping will take place within minutes. The Power Swap station 2.0 is designed to accommodate up to 13 battery packs.

Power Charger: Power Chargers are of a slim design and are located in parking lots and other locations easily accessible to users, with a maximum output power of 105 kW and 250 amperes. As of December 31, 2020, NIO had 792 Power Chargers in operation, covering 53 major cities. Payment for charging can be done via the NIO app.

Power Mobile: Charging services are provided through fast charging vans. As of December 31, 2020, 318 Power Mobile vans were in operation.

One Click for Power: Through the NIO app, a user can have a team pick up the vehicle at the user’s designated parking location for valet charging or swapping.

Nio is an industry leader in battery swapping technologies and autonomous driving technologies.

BATTERY SWAPPING TECHNOLOGY

NIO’s vehicles have been equipped with a battery swapping technology since 2017 providing users with a “chargeable, swappable, upgradable” experience.

Battery swapping allows users to recharge easily by swapping the batteries. In addition, users can enjoy the benefits of battery technology advancements with upgraded options.

BATTERY AS A SERVICE

In 2020, NIO launched Battery as a Service, or BaaS, an innovative model which allows users to purchase EVs and subscribe for the usage of battery packs separately.

BaaS enables users to benefit from:

- Lower vehicle purchase prices

- Flexible battery upgrade options, and

- Assurance of battery performance

BaaS has flexible subscription options regarding battery capacity as well time period – monthly, yearly, etc.

NIO’s Power Swap station 2.0, which will be rolled out in the second quarter of 2021, will shorten the battery swapping time to under three minutes and will carry up to 13 battery packs. As of December 31, 2020, the company had 172 Power Swap stations across 74 cities.

AUTONOMOUS DRIVING

Autonomous driving has been the focus of NIO from day one which culminated in NIO Pilot, an enhanced ADAS (Advanced Driver Assistance Systems) making NIO one of the 1st companies in China to offer enhanced ADAS capabilities.

NIO pilot includes features such as:

- NOP (Navigate on Pilot)

- Shiftless automatic parking assist with fusion

- Nearby summon

- Forward collision warning

- Automatic emergency braking

- Automatic high beam

- Auto lane change, lane departure warning

- Blind spot detection

- Front and rear cross-traffic alert, side door opening warning, and

- Side distance indication

It is evident from above that NIO cars are all-electric cars with impressive specs and innovative design. Moreover, NIO is exploring self-driving technology, battery swapping solutions and BaaS. It is an impressive feat for a young company with only 6 years under its belt.

COLLABORATION WITH JAC

NIO has a collaboration with Jianghuai Automobile Group Co., Ltd., or JAC (a major state-owned automobile manufacturer in China) for the manufacture of the ES8, the ES6 and the EC6. NIO itself does not have a manufacturing license from the Chinese government.

To strengthen its management of the production and to improve quality, NIO has created a joint venture (JV) with JAC called Jianglai Advanced Manufacturing Technology (Anhui) Co., Ltd., or Jianglai. NIO holds 49% equity interest in this JV. This will allow NIO to have a greater say in the alliance with JAC.

Initially, when NIO wasn’t sure about the marketability of its products, it outsourced production since it was risky to build a capital-intensive plant. Now, it is slowly bringing production under its control.

REVENUES

NIO Annual Report, Amounts in RMB

NIO began generating revenue in 2018 with its sale of ES8. Currently, vehicle sales consist of revenue from the sale of models ES8, ES6 and EC6.

In 2020, revenues increased by 107.8% mainly due to an increase in the number of vehicles sold in 2020, and an increase in revenue from user rights and service packages, which was in line with the growth of vehicle sales.

NIO Annual Report

NIO derives more than 90% of its revenue from vehicle sales. Other categories include revenue from charging piles (i.e., stations). NIO also offers energy packages which includes a range of charging solutions, including charging and battery swapping. The service package provides repair service, routine maintenance service, an enhanced data package, etc.

In January 2021, NIO launched the flagship smart electric sedan NIO ET7 which is expected to start generating revenues from Q1, 2022.

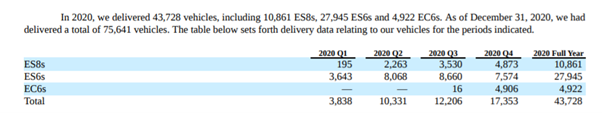

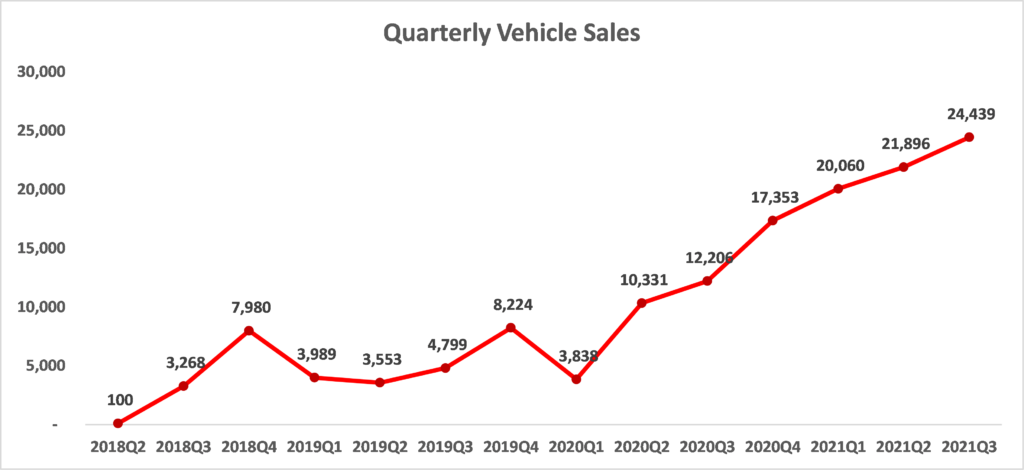

VEHICLE DELIVERIES

Vehicle deliveries in Q1 were impacted due to COVID. But NIO achieved satisfactory delivery results in the next 3 quarters of 2020.

NIO has been working closely with JAC, the manufacturer of the ES8, ES6 and EC6, to resume productions and minimize the impact of COVID-19 on production. As a result, manufacturing and delivery capacities recovered to the level prior to the COVID-19 pandemic by the second quarter of 2020.

NIO Annual Report

Vehicle deliveries have been growing every quarter and in Q3 of 2021, deliveries grew strongly by 100.2% on a YoY basis.

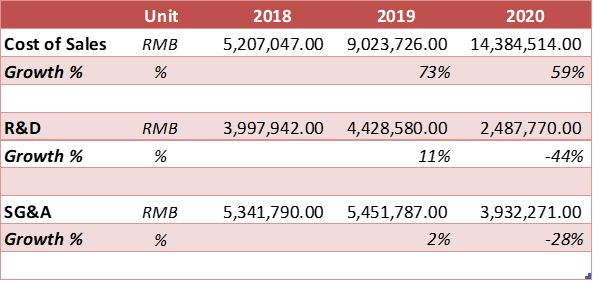

COST OF SALES, R&D AND SG&A

The cost of sales increased by 59.4% due to higher deliveries of ES6, the ES8, and the EC6 in 2020.

NIO Annual Report

R&D expenses decreased in 2020 by 43.8%. This is because design and development expenses decreased because most of it was incurred before the launch of ES6 and ES8 in 2019. The pandemic was also a reason for the reduced expenses. Further, the company has been employing cost control measures by reducing the number of employees and hence the expense.

Selling, general and administrative expenses decreased by 27.9%. This was due to decrease in number of admin employees as a part of cost control measures. Additionally, marketing and promotional spend was reduced due to the pandemic.

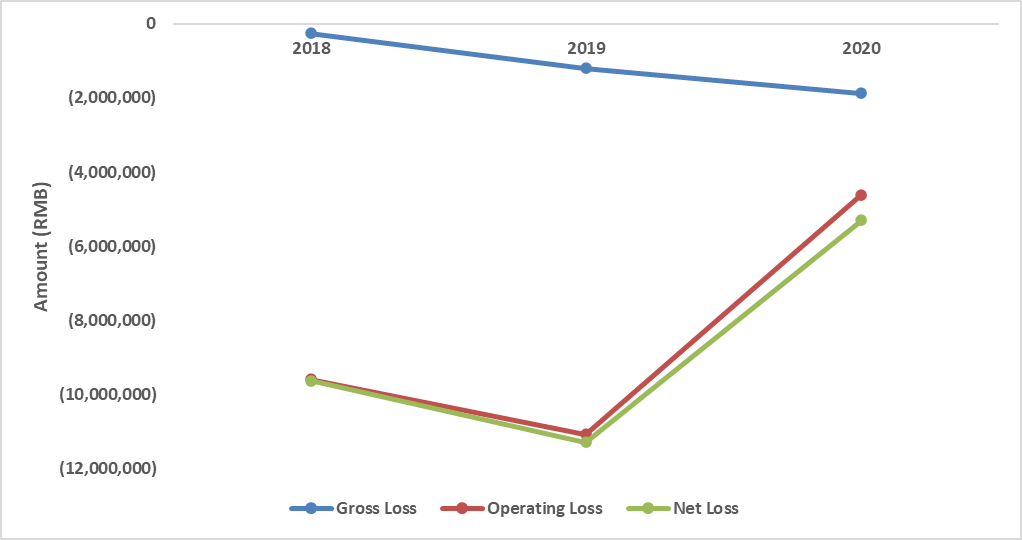

PROFIT AND MARGINS

Although the company has been making losses in the last 3 years, the operating loss and net loss have recovered in 2020 as compared to 2019. The operating and the net profit margins have also shown recovery in 2020 which bodes well for the company.

DEBT

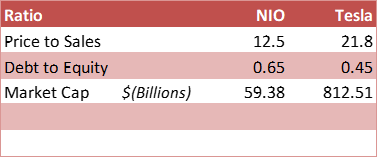

NIO has a relatively high debt (0.65 debt to equity ratio as of June, 2021). Given that it is still loss making, a high debt level makes investing in the stock riskier.

CASH BALANCE

The main source of liquidity for NIO comes from proceeds of the shares issued in IPO, private placement, notes offerings and from bank facilities. The company has a high cash balance and this should abate some risk of the high debt as the cash is high enough to cover the debt. As of December 31, 2020, NIO had cash and cash equivalents of RMB38,425.5 million (US$5,889.0 million). This level of liquidity can be expected to be sufficient to successfully navigate an extended period of uncertainty.

CAPITAL EXPENDITURES

NIO made US$172.8million in capital expenditures in 2020. The company expects the capex spend to be significant in the foreseeable future since the company is still in expansion mode.

Gurufocus.com

MARKET CAPITALISATION & VALUATION

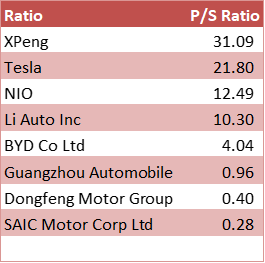

The current market price of NIO is $36.24 with a market cap of $59.384B which is 7% of the market cap of Tesla. The price to sales ratio (P/S ratio) is an indicator of the value that investors have placed on each dollar of a company’s revenues. A low ratio could indicate that the stock is undervalued, while a higher-than-average value could signal an overvalued stock. The P/S ratio of NIO is lower than that of Tesla as shown in the table above.

Gurufocus.com

LATEST QUARTERLY & MONTHLY NUMBERS

- NIO delivered 10,628 vehicles globally in September 2021, increasing by 125.7% year-over-year.

- NIO delivered 10,628 vehicles globally in September 2021, increasing by 125.7% year-over-year.

simplywall.st

NIO has recorded the highest ever monthly deliveries in September. The record number in deliveries gives confidence about the company’s prospects in the EV market. On September 30, 2021, NIO also opened its NIO House and completed its first batch of vehicle deliveries in Norway.

The company is progressing towards profitability, but the big question remains as to when will it reach breakeven? Analyst consensus suggests that breakeven is near (2-3 years). NIO is in an investment phase and a high growth momentum may be attained in this phase. However, if the company is unable to achieve high growth rate, then break even maybe pushed a little later.

LISTING UPDATES

NIO was listed in US about 3 years ago and has filed for a second listing in Hong Kong in March, but the listing is expected to happen in early 2022.

CHINA MARKET AND PEERS

The EV demand in China remains strong and with the semiconductor shortage easing, major EV players in China stand to gain: NIO (NYSE: NIO), Xpeng (NYSE: XPEV), Li Auto (NASDAQ: LI)

These China-based manufacturers account for over 50% of global EV deliveries. Demand for EVs in China is likely to remain robust as the Chinese government wants about 25% of all new cars sold in the country to be electric by 2025, up from roughly 5% at present.

While Tesla is a leader in the Chinese luxury EV market driven by production at its new Shanghai facility, the 3 players mentioned above have been gaining traction. You can read more about Tesla’s business.

The outlook guidance given by the companies appears strong, although these companies may not necessary be at reasonable valuations.

Li Auto has surpassed NIO in local deliveries, however, NIO is eyeing the international markets which should boost sales going forward.

NIO rolled out it’s 100,000th car in April this year, and Xpeng reached the milestone this month, in October, 2021. Both these companies started in 2014 which means they reached the mark of 100,000 vehicles in about 6 years. Elon Musk’s Tesla took 12 years from 2003 to produce 100,000 cars. This proves that as technology improves, supply chains streamline itself and innovations rise, there will be newer, cheaper, better and faster ways to produce cars.

WHAT ABOUT THE MOUNTING RISKS OF REGULATORY CRACKDOWN BY THE CHINESE GOVERNMENT?

NIO is not facing the same nervousness and volatility as other Chinese stocks like Alibaba. Investors are focusing on fundamentals like vehicle deliveries and future outlook. EVs are crucial in achieving the aggressive emissions reduction targets of China. Further, EV players usually strive to compete against global names such as Tesla and they would aim to capture western markets as well, which is unlikely to be disrupted by the government.

You can read more about the Chinese regulatory crackdown.

GLOBAL EXPANSION

The Nio ES8 was launched for sale in Norway on 30th September, 2021 with its first showroom in Oslo. The Nordic nation is Nio’s first export market outside China. Although a small country, Norway is a crucial destination with its policy of banning ICE vehicles by 2025. Nio’s success in Norway could prove as a crucial step in its journey of expansion into other European destinations and eventually the world.

CATALYSTS FOR GROWTH:

- The company has multiple new launches slated for 2022, including its first sedan, dubbed the ET7, which is expected to offer a range of around 1,000 kilometers (621 miles). As revenues go up with volume growth, it should translate to a higher bottom line as well.

- Demand should hold up in the long term, as the Chinese government wants about 20% of all new car sales to come from new energy vehicles that do not run on gasoline, from 2025 onward.

- Nio’s early mover advantage in the Chinese premium EV space, and its investments in charging stations and related infrastructure, should give it an edge as the market expands.

- Nio is also poised to become more profitable going forward with improving margins and stronger sales.

- Nio has been innovating constantly: it is developing a self-driving technology and it also offers unique solutions like BaaS which allows users to subscribe for batteries rather than paying upfront.

- With its global expansion plans, it can tap the growing global demand, and this should boost sales going forward. It has already begun vehicle sales in Norway.

HEADWINDS:

- Unlike Nio, its peers WM Motor and Li Auto acquired automakers with production licenses to be able to manufacture the vehicles on their own. Nio has recently entered into a joint manufacturing agreement as mentioned earlier.

- The company has faced hiccups: it had to recall 5,000 vehicles in 2019 after multiple battery fires were reported. In August, 2021, one person was killed while driving his Nio ES8 SUV in the Navigate on Pilot mode (automated driving function).

- The company is still loss making as costs related to R&D and SG&A are still quite steep as compared to revenues.

- Chinese regulatory storm casts a dark cloud over the stock in the short term. The semiconductor chip shortage is also a hindrance.

- The Evergrande crisis may cause lower disposable incomes in the economy leading to lower sales offtake since NIO vehicles are premium segment vehicles.

CONCLUSION

Despite a chip shortage, NIO reported strong deliveries in the latest quarter (all-time high in monthly deliveries). This should have sent the NIO stock flying, but it is still trading around $36, down almost 40% this year from its January highs of $61. Short term weakness exists due to regulatory headwinds in China, the Evergrande fiasco, the global chip shortage, and the delay in HK listing of the NIO stock.

However, on a longer-term basis, the following catalysts could support robust growth for the company:

- Global expansion plans

- Robust demand in Chinese EV market boosted by policy

- Ample cash buffer to fund investments in tech and innovation

- HK listing is also expected to boost funds

- Strong deliveries and new launches

The company is well on its way to profitability, and it will be interesting to see when it reaches the crucial level for investors. As the negative cloud around Chinese stocks dissipates, we may see higher investor interest in the stock.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.