Intel’s stock plunged 16% right after their release of their Q2’2020 earnings results. In addition to that, Apple also decided to end their 15 years partnership with Intel!

In their Q2’2020 earnings call, Intel announced the delay of their 7nm chips by about 6 months. With their rival AMD already selling their 7nm chips in the market, Intel is no longer the market leader in technology.

Another point to note in Intel’s Q2’2020 earnings call is that total revenue in the 3rd quarter of 2020 is expected to drop 5.16% vs same period last year. Again, not a favorable sign for this ex-Wall Street darling.

These are all the headlines that caused Intel’s share price to plunge. Now, let’s take some time to look into a little further beyond the headlines.

HOW DOES INTEL MAKE MONEY?

Intel is the world leader in manufacturing semiconductor chips. It is also the inventor and dominant supplier for x86 series microprocessor for PC. In essence, any companies that run on PC processors is highly likely to be part of the ecosystem that Intel created.

Intel has also recently had good growth in their data centre business, which has contributed to almost 50% of its total revenue.

WHAT IS ONE THING UNIQUE ABOUT THIS COMPANY?

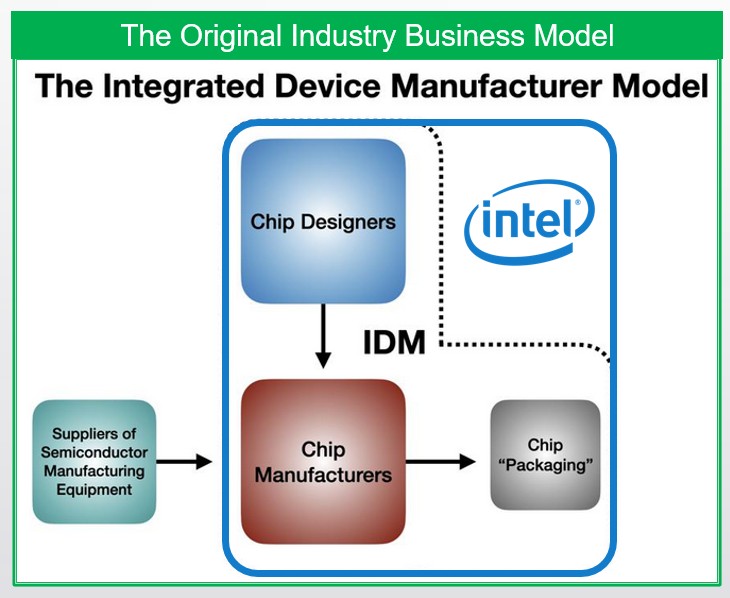

Intel is a semiconductor company that follows an “Integrated Device Manufacturer” model. This means that Intel has the capability to design, manufacture and package the chip in house. This allows Intel to provide an end-to-end solution to their customers.

REVENUE TREND

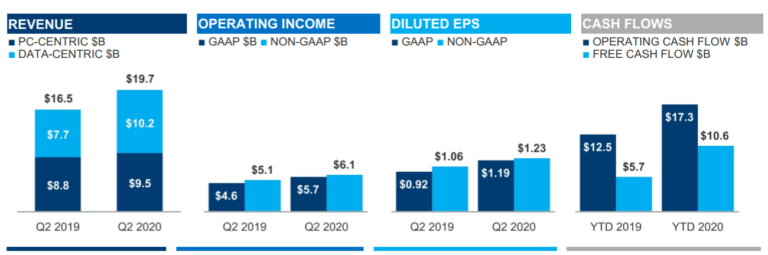

Revenue has been trending upwards and showing positive growth for the past 5 years.

Data Centres revenue covers 33% of the 50% Data-centric (DC) generated profit. This shows Intel is in a good direction for growth as, based on recent global research on data centric industries, the DC market is likely to grow for at least for the next 2 decades.

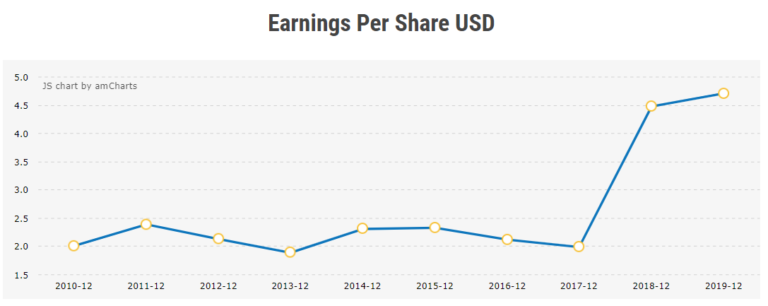

EARNINGS PER SHARE TREND

WHAT HAS IMPACTED THEIR PERFORMANCE RECENTLY? (BASED ON THE LATEST QUARTERLY REPORT)

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.