With the desire to increase wealth and diversify portfolios to counter rising inflation, the popularity of investing in different financial instruments has grown in recent years. Among the frequently referenced funds is the Hedge Fund.

In addition to hedge funds, mutual funds and exchange-traded funds (ETFs) are often discussed as alternative investment vehicles that individuals frequently consider to diversify their portfolios.

However, one might wonder what is the difference between these funds and how does one choose the fund that best suits their investment needs?

In this article, we will delve into the world of hedge funds, exploring how they work and highlighting the key distinctions between these three funds.

WHAT IS A HEDGE FUND?

A hedge fund is an investment vehicle that pools capital from accredited investors, such as high-net-worth individuals and institutional investors.

The primary objective of a hedge fund is to generate significant returns by employing various investment strategies that may not be available to traditional investment vehicles.

As such, hedge funds are typically managed by experienced investment professionals who aim to achieve above-average market returns.

We have deep dived into the world’s largest hedge fund – Bridgewater Associates. Click on the link to find out how to build a risk-balanced portfolio!

MECHANICS OF HEDGE FUNDS

In this section, we will look into how does a hedge fund work and who is eligible to invest in one!

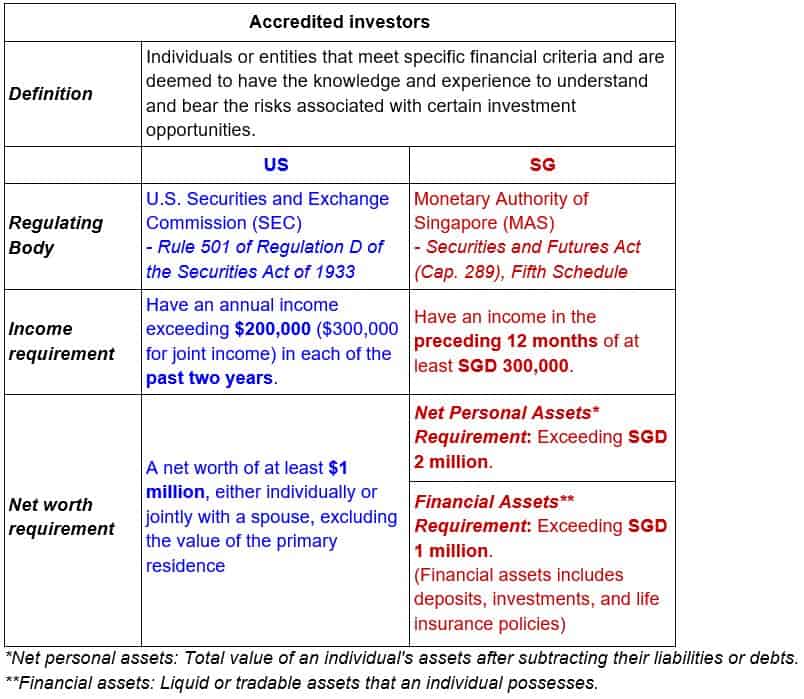

- Accredited Investors: Hedge funds are typically available only to accredited investors, who must meet specific income or net worth requirements, set by regulatory authorities, to participate. This exclusivity provides hedge funds with the flexibility to employ higher-risk strategies that may not be suitable for all investors.

(Information as of June 2023)

- Investment Strategies: Hedge funds utilize a wide range of investment strategies, including long and short positions, leverage, derivatives, and alternative assets. These strategies enable hedge fund managers to potentially profit from market volatility, arbitrage opportunities, and other complex investment techniques.

- Performance Fees: Hedge fund managers typically charge both a management fee and a performance fee, depending on the hedge fund firm. The management fee is a percentage of the fund’s assets under management, usually around 1-2% annually. The performance fee is a percentage of the fund’s profits, often around 20%, which incentivizes managers to deliver superior returns.

DIFFERENCES BETWEEN HEDGE FUND, MUTUAL FUND & ETFs

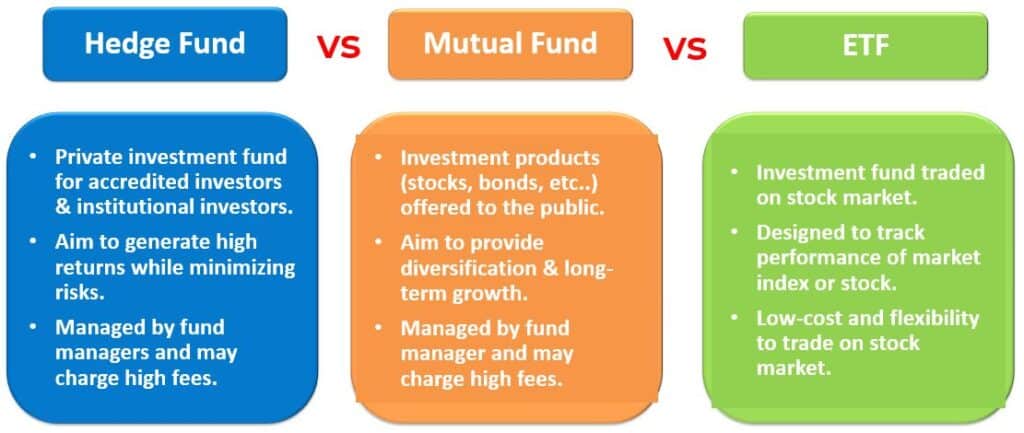

The mention of hedge funds, mutual funds, and ETFs can often lead to confusion due to the similarities between these three types of funds.

The chart below simplifies the difference between the 3 funds:

- Investor Accessibility:

Hedge funds are usually available only to accredited investors due to their higher-risk strategies and more sophisticated nature. In contrast, mutual funds and ETFs are more accessible to retail investors or the public.

- Investment Strategies:

- Hedge funds employ a broader range of investment strategies, including alternative investments, leverage, and derivatives, to generate higher returns.

- Mutual funds aim to provide diversification and long-term growth which is managed by fund managers.

- ETFs are designed to keep track of the performance of the market index where the index consists of various companies or industries, depending on which market index it keeps track of. For example, the S&P 500 keeps track of the 500 largest US companies in the stock market.

- Costs:

Both hedge funds and mutual funds are managed by fund managers and thus they may charge higher fees compared to ETFs. ETFs are relatively low-cost and have the flexibility to trade on the stock market by retail investors instead of managed by fund managers.

CONCLUSION

Hedge funds, mutual funds, and ETFs are distinct investment vehicles that cater to different types of investors and investment strategies.

Hedge funds target accredited investors and employ higher-risk strategies to generate above-average returns, whereas mutual funds and ETFs offer more accessible options to the retail investors.

Understanding the mechanics and differences between these investment vehicles is essential for investors to make informed decisions based on their financial goals, risk tolerance, and investment expertise.

If you’ve ever had the desire to actively engage in your investment journey, acquire skills in company analysis, and construct your own portfolio from scratch, join us in our masterclass by clicking on the banner below to learn more how to:

- Generate 3 Sources of Passive Income even if you know Nothing about investing.

- Invest with minimal capital.

- Create a Cash Dispensing Machine to replace your existing salary.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.