The recent collapse of several major banks due to a bank run has left many investors wondering if it is still a good opportunity to invest in bank stocks.

With confidence in the banking industry at an all-time low, it’s understandable that some investors may be hesitant to put their money into this sector.

However, there are still reasons to consider investing in banks, despite the recent events.

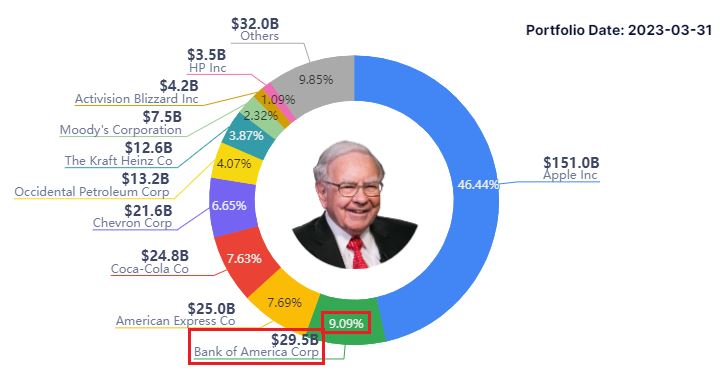

In this article, we’ll investigate Bank of America as it is one of Warren Buffett’s second largest stock holdings after Apple to determine if it still may be a good investment opportunity.

Warren Buffet’s Portfolio Breakdown (Source: GuruFocus; updated for Q1 2023)

We have also covered the financial analysis on Bank of America on our YouTube Channel. Click on the video below to watch!

If you are interested on the recent bank crisis in 2023, click on the link below to find out more!

BANK OF AMERICA'S BACKGROUND

Bank of America is one of the largest financial institutions in the United States, with its headquarters located in Charlotte, North Carolina.

The bank was founded in 1904 as the Bank of Italy in San Francisco by Amadeo Giannini. It later became the Bank of America in 1930. Over the years, Bank of America has grown through a series of mergers and acquisitions, including the acquisition of Merrill Lynch in 2009.

Today, it is a global banking and financial services company with operations in over 50 US States and international markets, serving millions of customers worldwide.

It is known for its innovative technology, including its mobile banking app and digital financial tools, and its commitment to sustainability and corporate responsibility.

PRODUCTS & SERVICES

Bank of America offers a wide range of financial products and services, including personal and business banking, wealth management, investment banking, and more.

It has 8 lines of businesses in 4 major operating segments:

- Consumer Banking

- Retail Banking – Provides checking and savings accounts, credit cards, mortgages, auto loans, and other banking products and services to individuals and families.

- Preferred Banking – Help small businesses and entrepreneurs to manage their finances, including loans, credit lines, merchant services, payroll, and cash management.

- Global Banking

- Serves mid and large-sized companies with banking and financial services such as treasury management, corporate lending, foreign exchange, and trade finance.

- Business Banking – For small and mid-sized companies with annual revenue of $5M to $50M.

- Global Commercial Banking – Middle market companies with annual revenue of $50M to $2B.

- Global Corporate & Investment Banking – Corporate with annual revenue of >$2B.

- Serves mid and large-sized companies with banking and financial services such as treasury management, corporate lending, foreign exchange, and trade finance.

- Global Wealth & Investment Management

- Provides advisory services and financing to help clients with mergers and acquisitions, debt and equity offerings, and other strategic transactions.

- Merrill – Offers wealth management for high-net-worth individuals and investment banking services to corporate clients.

- Private Bank – Wealth planning for high-net-worth individuals with investable assets of more than $3 million.

- Provides advisory services and financing to help clients with mergers and acquisitions, debt and equity offerings, and other strategic transactions.

- Global Markets

- Investing & trading activities such as hedging, analytics and competitive pricing in debt, equity, commodity, and Forex markets.

BANK OF AMERICA'S FINANCIAL ANALYSIS

REVENUE GENERATION

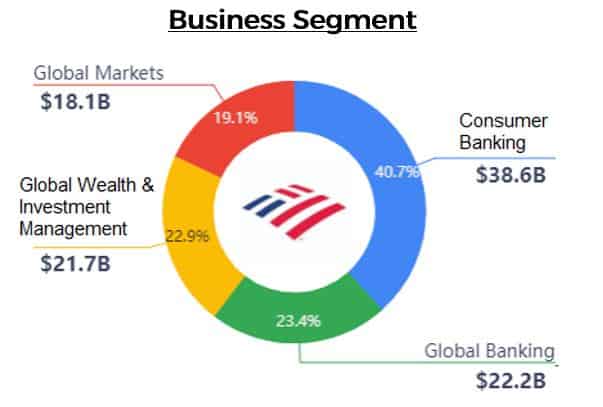

In FY 2022, BAC has generated a total of USD 95.0 billion revenue. The pie chart below further breaks down the revenue generated from BAC’s 4 main business segments:

BAC revenue generated from 4 business segments

The Consumer Banking segment generated the most revenue in 2022, where 40.7% (USD 38.6B) of revenue came from this segment.

Then followed by Global Banking (23.4%, USD 22.2B), Global Wealth & Investment Management (22.9%, USD 21.7B) and Global Markets (19.1%, USD 18.1B).

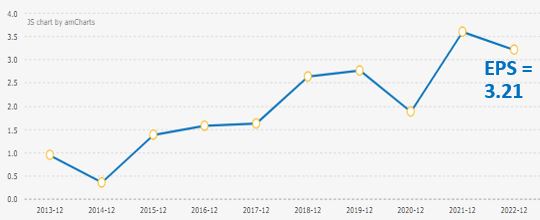

EARNINGS PER SHARE (EPS)

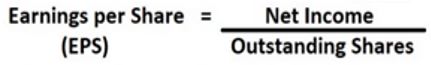

Next, we will check BAC’s earnings per share (EPS) as we want to know if the company is profitable from their banking business.

Mathematical formula of EPS

If the company’s EPS is on a positive and consistent uptrend, this indicates that the company can generate increasing net income from the business.

BAC’s EPS 10-year trend

The dip in 2020 EPS was due to a decline in their interest income which impacted their revenue in 2020 and increment in credit losses provision. Credit losses provision is the allowance for potential losses from loans that may not be repaid.

For the past 10-year trend, BAC’s EPS was on a positive and consistent uptrend. Based on Value Investing Methodology, this is considered a pass.

BANKS’ FINANCIAL METRICS

Next, we will investigate two other financial metrics that help us to further evaluate if the bank is performing well financially.

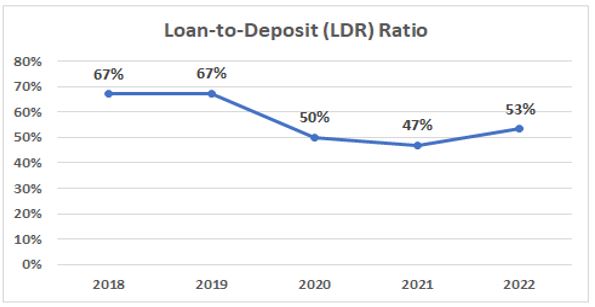

1. Loans-to-Deposit Ratio (LDR)

This ratio helps us to determine how much the bank loans out deposits to earn interest income.

The ideal LDR ratio for a bank is 80% – 90%. This means that for every $1 dollar that the bank receives as deposit, they can loan out $0.80 – $0.90 to borrowers and generate interest income.

Bank of America’s LDR Ratio

For the past 5 years, BAC has been conservative in offering loans as their LDR ratio is between 47% – 67%. This is much lower than the ideal benchmark of 80% – 90%.

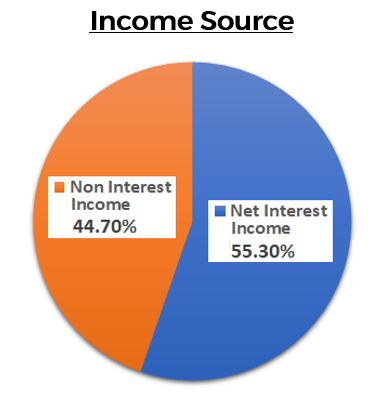

To find out if the low LDR will affect BAC’s revenue generation as interest income is the bank’s primary source of income, we want to find out how much percentage interest income was generated when compared against its other revenue sources.

In 2022, we observed that their income source generated equally from interest income (55.3%) & non-interest income (44.7%).

Bank of America’s income source in FY 2022

As such, even though BAC’s LDR ratio might be lower than benchmark, we can be rest assured that BAC does not rely solely on interest income. They are able to generate other sources of revenue for their banking business via non-interest income, such as service charges, investment and brokerage services, etc.

2. Net Interest Margin (NIM)

NIM is an important indicator in evaluating banks because it is a good indicator of a bank’s overall profitability.

It reveals a bank’s net profit on interest-earning assets, such as loan (interest income) or investment securities as the interest earned on these assets are the bank’s primary source of revenue.

The higher the net interest margin, the more profitable a bank is.

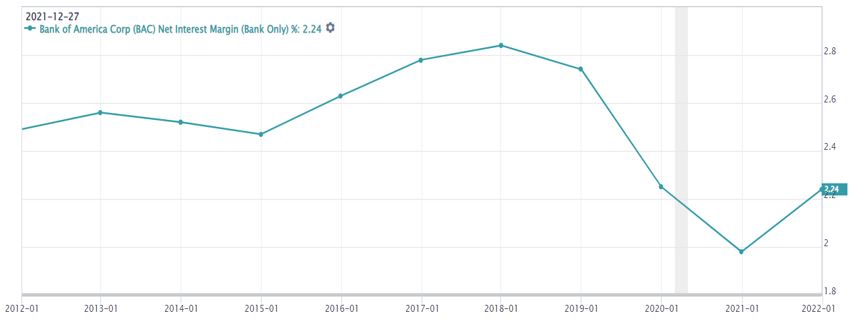

Bank of America’s NIM 10-year trend

From the chart above, BAC’s NIM has been steadily increasing from 2012 – 2018. However, due to the pandemic in 2019, BAC’s NIM has tumbled from 2019 to 2021, before it bounced back in 2022.

The sharp plunge (2019 – 2021) might raise some concern among investors as it may be perceived as the company is losing profitability.

However, BAC still has other sources of revenue to tide them over these trying periods instead of relying solely on interest income.

CONCLUSION

With FED increasing interest rates to dampen the high inflation, investors might be concerned that this high interest rate environment may eat into the bank’s profit margin and deter borrowers from borrowing from banks due to higher cost of borrowing. These double whammy incidents may cause a loss of confidence in the bank and worse, led to a bank run.

Nevertheless, with the right knowledge, one will be able to sieve out a good company to invest in, beat the high inflation rate and grow their wealth over the long term.

If you have always wanted to learn how to invest and grow your money, join us in our upcoming Masterclass where you will learn from Cayden how to generate 3 sources of income even though you have no knowledge of investing!

Click on the banner below to find out more!

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.