HOW DOES THE COMPANY MAKES MONEY?

Based in Atlanta, Georgia, Acuity Brands is a market-leading industrial technology company. They present themselves as service provider to all lighting related solutions across various applications such as residential, institutional, and commercial, along with comprehensive building management solutions. Since they cater to all types of applications, the products they offer range from light emitting diode to incandescent light sources, and their supporting hardware like sensors, inverters, and modular wirings.

WHAT’S THE ONE THING UNIQUE ABOUT THIS COMPANY?

The evolution towards artificial intelligence (AI) and internet-of-things (IoT) have also pushed Acuity Brands to incorporate these components in their product portfolio. Therefore, they uniquely position themselves as the market leader especially in North America, being the solution provider for both hardware and software related to lighting and building management.

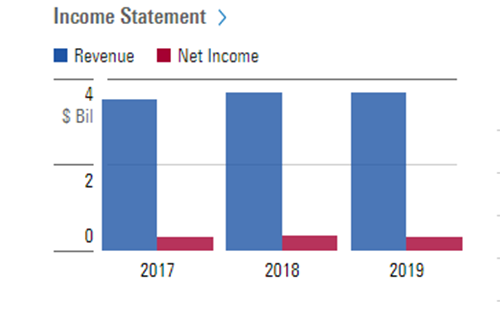

REVENUE TREND

With their vast portfolio of products, they have been reporting a slow and steady kind of incremental trend in terms of revenue. In 2017, they have reported a total of USD 3.51 billion and in 2019, the revenue grew by USD 160 million to USD 3.67 billion. Their net income has been relatively stable across these years with USD 0.32 billion in 2017 to USD 0.33 billion in 2019.

Revenue and Net Income from 2017 to 2019 – Morningstar

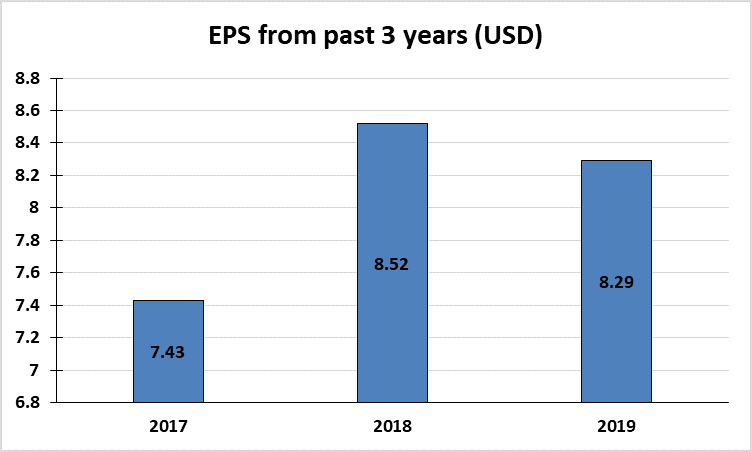

EARNINGS PER SHARE TREND

EARNINGS PER SHARE FROM 2017 TO 2019

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.