FUN FACT:

- By end of 2019, they were said to have about 4500 operational stores across China, as compared to Starbucks which has 4300 stores.

- The astounding growth within two short years is indeed mind boggling and recently, they have targeted to increase their store count to 10,000 by end of 2021.

- Their secret to this amazing growth lies in their big data analytics as well as artificial intelligence where they churn huge amount of data from their operations and made use of them to further improve existing systems.

- In addition, with their exclusive mobile app plus with other third party platforms, they were able to provide 100% cashier-less environment to their customers.

- This in turn improves experiences of customers while allowing to stay engaged with them regardless of time and location.

- Another thing to note is their business model. They do not operate as typical coffee shop but rather as small kiosks to serve more like takeaway windows.

- This way, clients can grab their favourite drink on the go from the window, or they can have their drinks delivered to home, office, and other locations within the vicinity.

INVESTMENT SUMMARY

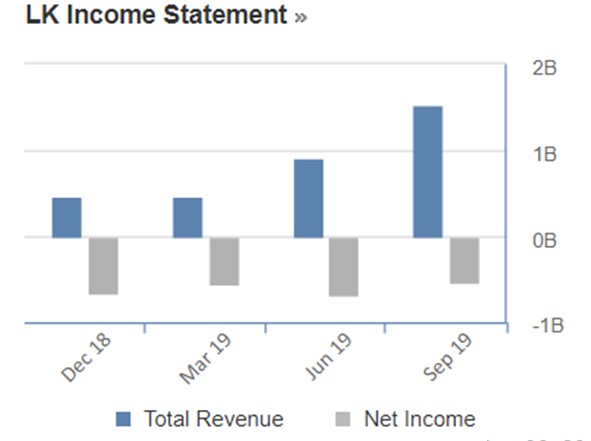

The financials of Luckin Coffee is something investors have been looking forward to at every earnings call. For the year 2019, total revenue was observed to be climbing upwards from CNY 465.43 million in Dec 2018 to CNY 1.54 billion in September 2019. Despite having amazing total revenues, their net income seems to be inconsistent over time.

On Dec 2018, the net income was found to be CNY -669 million and as of September 2019, it had increased slightly to CNY -530 million. Their Trailing Twelve Months (TTM) gross margin, operating margin, and net profit margin was reported as 6.53%, -72.22%, and -71.7%, respectively.

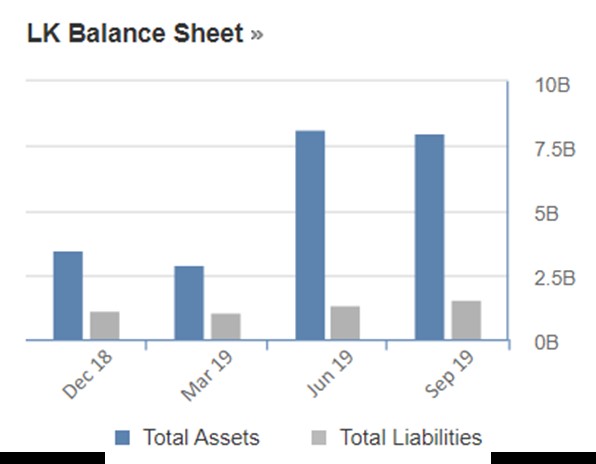

LK’s balance statement however seem quite healthy whereby in December 2018, total assets were reported as CNY 3.49 billion and it grew a whopping 230% to CNY 8.03 billion by September 2019. Their liabilities in December 2018 was shown as CNY 1.13 billion and it raised marginally to CNY 1.6 billion. Their most recent quarter quick ratio, current ratio, and total debt to equity was reported as 4.09, 4.23 and 4.15%, respectively.

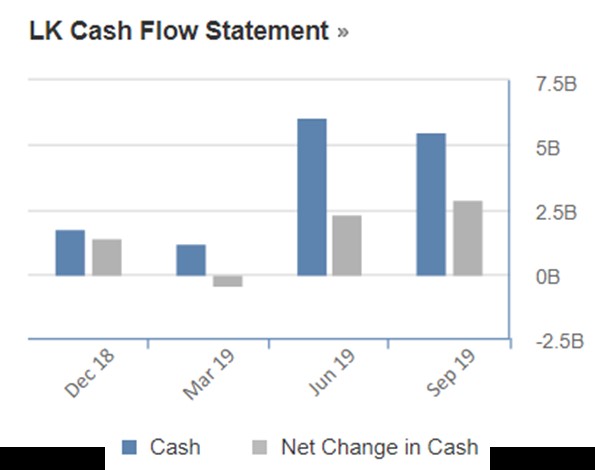

Their cash flow seems to be inconsistent in the last few quarters with CNY 1.7 billion cash in December 2018 and after a roller coaster ride, it climbed 325% to CNY 5.54 billion in September 2019. Similar profile was noted with net change of cash whereby in December 2018, it was reported to be CNY 1.41 billion and rose 204% to CNY 2.88 billion. Further digging into their cash details revealed that their cash from operating activities displayed a decrement pattern whereby in December 2018, it was reported as CNY -1.3 billion and it decreased slightly to CNY -1.1 billion in September 2019. Their cash from investing activities also showed decreasing pattern over time whereby in December 2018, it was reported as CNY -1.3 billion and it went downwards to CNY -1.6 billion in September 2019. This could be due to their expansion plan where they are said to have the capability to open three new stores every day.

Their cash from financing activities showed an increment over the course of time with CNY 4 billion in December 2018 to CNY 5.5 billion in September 2019. This is possibly due to very optimistic investors who are willing to buy LK’s shares despite having price-to-sales ratio of 18.77 and price-to-book ratio of 10.43 (based on Morningstar).

Risk

LK has indeed displayed tremendous progress being just two years in the industry. However analysts believe that LK has challenges ahead of them and should they choose to ignore, then it will be the beginning of their downfall.

- The first being the coffee business in the communist country is just a fraction as compared to USA consumers who drink much more coffee.

- Increasing their presence by launching more and more outlets will perhaps be a temporary spike in their overall sales.

- Secondly, with such a dramatic growth in short duration of time, it comes with a great cost of managing all these stores.

- LK should begin to realize that adding a lot of location may look good in terms of quantity but without the quality metrics in place (the demand for such stores), LK may need to burn their cash just to stay afloat in the near future.

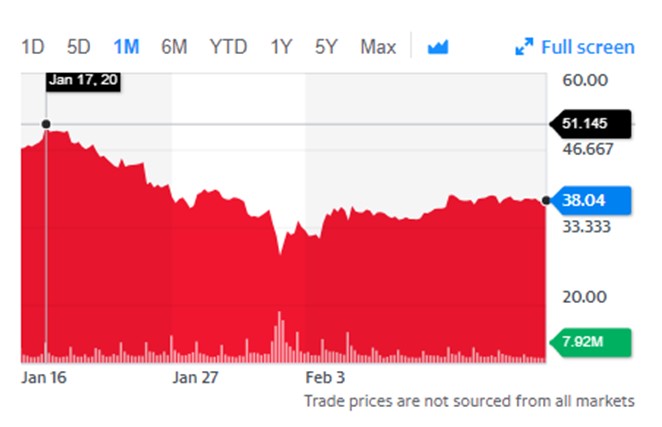

- Last but not least, with the recent havoc regarding the coronavirus, their share price displayed 25% reduction from 52-week high price of USD 51.15 per share (as of January 17th 2020) to USD 38.04.

- The steep discount seen in price is regarded as a temporary bump due to coffee shop operators being forced to close their stores.

- In addition, the travel restrictions imposed by the authorities also hampered LK’s delivery service which boosted LK’s sales in the beginning.

(Source: https://finance.yahoo.com/quote/LK/)

- It was known that LK’s drinks are sold at lower price than Starbucks by providing ample of discounts as a means to bring in new customers.

- This strategy was why their revenue grew mostly during new store openings; therefore their strategy in the long run seems hazy for the time being.

- Perhaps having more varieties in their drink menus might help to keep their sales on the upper side but these will only hold true should they retain their promotional rate.

- Similarly, should the virus crisis take similar time frame as SARS outbreak more than a decade ago, then we can only foresee a nearly two year-long recovery period for things to go back to its original state.

- In other words, as investors we should be worried for LK as they might not be able to pull off the same trick until the outbreak is contained. Therefore, giving LK some time to strategize should be our strategy before investing our hard-earned money in LK.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.