MLR has had an upward trending CAGR of >20% for the past 6 years. With a strong showing of ROA >7% and increasing y-o-y, MLR’s ROE of 16% in 2019 is also looking good. Most importantly, MLR has very low debt. What a gem! Without further delay, let’s take a closer look at this company.

HOW DOES MILLER INDUSTRIES INC MAKE MONEY?

MLR is a world leader that provides innovative high-quality towing and recovery equipment worldwide.

WHAT IS ONE THING UNIQUE ABOUT THIS COMPANY?

MLR does not just provide solutions to its customers, but also provides financing services to customers, easing the customer’s capital tension on their purchase of MLR’s towing and recovery equipment.

Apart from that, MLR is also an authorized subcontractor to multiple governments, able to provide equipment and services in the towing and recovery field.

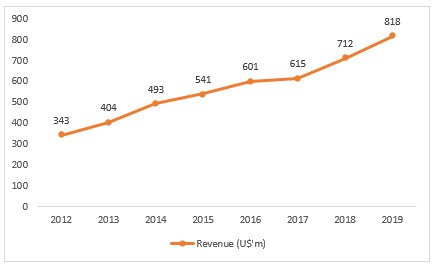

REVENUE TREND

The increase in revenue was primarily attributed to increased demand driven by a strong continuing economic environment in both the domestic (USA) and international markets before the Covid19 pandemic affected consumer sentiments. The company has also seen further growth and forward traction in their “government subcontractor” segment of the business.

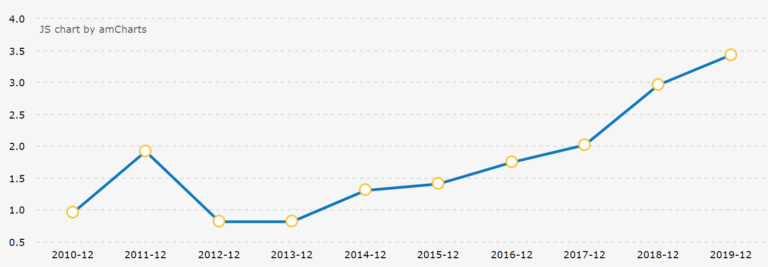

EARNINGS PER SHARE TREND

WHAT HAS IMPACTED THEIR PERFORMANCE RECENTLY? (BASED ON THE LATEST QUARTERLY REPORT)

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.