With its exemplary design and phenomenal stock performance, Lucid Motors has been in the news for all the right reasons. Lucid is the new kid on the block in the Electric Vehicle (EV) space and here we will explore why is the stock turning heads already.

COMPANY OVERVIEW

Lucid Motors is an American EV manufacturer, headquartered in Newark, California, United States.

Founded in 2007, the company was originally called Atieva and was engaged in the production of EV batteries and powertrains. Eventually, it accumulated over 50 patents relating to its core battery system in the US alone. The company re-named itself to Lucid Motors in 2016 and shifted focus to building EVs.

CEO Peter Rawlinson is an auto industry veteran who engineered the Model S, the sedan that brought Tesla to the map. Now he is on the other side of the court with his new Lucid Air sedan as a direct competitor to Tesla.

Lucid Motors began commercial production of its first vehicle, the Lucid Air, in September 2021 and delivered its first vehicles in late October 2021. Lucid has plans for continued development of additional vehicle model types for future release.

Lucid’s backers include Saudi Arabia’s sovereign wealth fund, BlackRock, Fidelity including investments from Tsing Capital, Mitsui, Venrock, JAFCO, and others.

LUCID MOTORS IPO

Lucid was originally incorporated in Delaware on April 30, 2020 under the name Churchill Capital Corp IV (formerly known as Annetta Acquisition Corp) (“Churchill”) as a special purpose acquisition company (SPAC) with the purpose of effecting a merger with one or more operating businesses. On February 22, 2021, Churchill entered into a merger agreement with Atieva, Inc. (“Legacy Lucid”) in which Legacy Lucid would become a wholly owned subsidiary of Churchill. Upon the closing of the Merger on July 23, 2021, Churchill was immediately renamed to “Lucid Group, Inc.”

The Lucid Motors IPO debuted on July 26, as Churchill Capital Corp. IV took the luxury EV maker public. In February, Churchill Capital IV announced a deal to take Lucid Motors public, valuing the company at $24 billion.

Lucid Motors stock began trading on July 26 with the ticker symbol LCID on Nasdaq. Post IPO, the stock has rallied by more than 80%, generating lavish returns for investors.

WHAT IS A SPAC

A SPAC, also known as a blank-check company, is an alternative to a traditional initial public offering. These blank-check companies have no assets beyond cash. They trade on stock exchanges and then merge with private companies, taking those companies public.

PRODUCTS - LUCID AIR

Lucid Motors started production of Lucid Air — a high-performance, ultraefficient luxury EV sedan — in late September. Deliveries began in late October 2021.

As on November 15, 2021, Lucid touted more than 17,000 reservations for the Air, representing over $1.3B in estimated bookings as of September 2021.

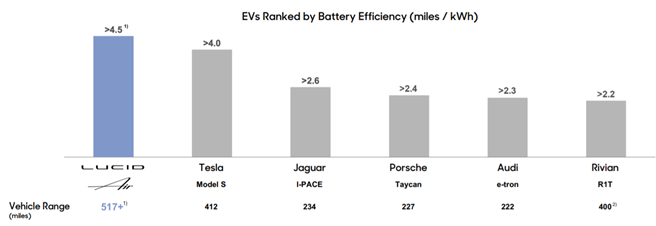

As per Lucid Motors, the Lucid Air beats the Tesla Model S and Amazon-backed EV startup Rivian’s R1T in battery efficiency. It also claims the Lucid Air beats luxury EVs from Jaguar, Porsche and Audi on the same metric.

Lucid has developed its EV technology in-house. It describes the Lucid Air as the “quickest, longest-range, fastest-charging electric car in the world,” delivering 500 miles of range(beating all Tesla models). The Environmental Protection Agency hasn’t certified that range yet. The Air also boasts high-end features such as a “glass cockpit.” The Lucid Air features an autonomous driving system using 32 sensors, including long-distance Lidar, a safety technology that Tesla long avoided.

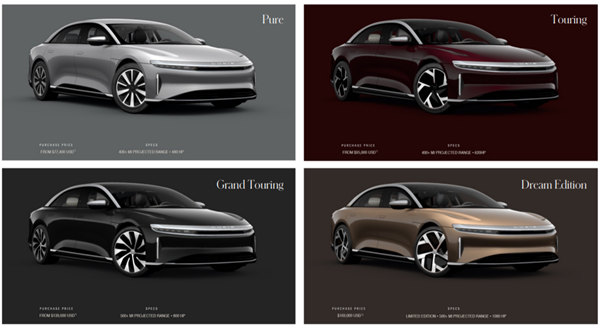

Lucid Air starts around $70,000 after tax credits but an initial Air Dream Edition will cost $162,000. Cheaper versions of the Air will be released, with a $70,000 version expected in 2022, according to the Wall Street Journal.

The Lucid Air is available in 4 models: Pure, Touring, Grand Touring & Dream Edition.

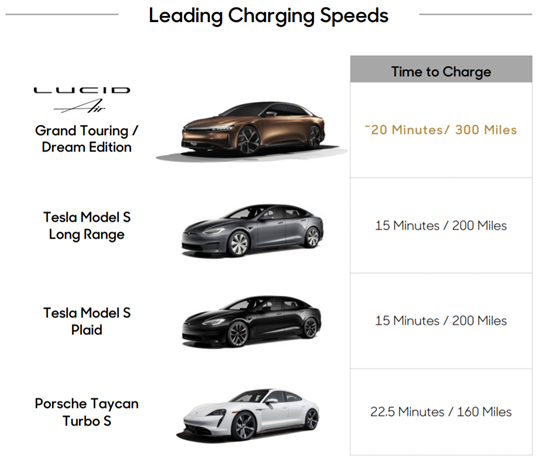

The Lucid Air charging time is just ~5 minutes higher than Tesla and already ~2 minutes less than Porsche and considering that this is the first car from Lucid, one may expect the charging time to get better than peers soon.

PROJECT GRAVITY

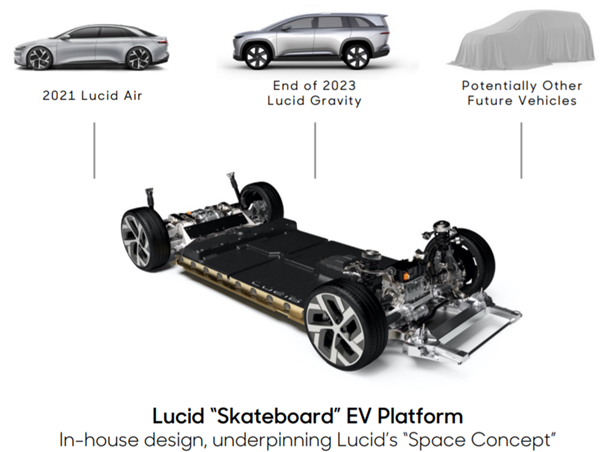

Lucid has already commenced engineering and design work for Project Gravity, a luxury sports utility vehicle (“SUV”) that is expected to leverage the same platform as the Lucid Air and many of the technological advancements developed for the Lucid Air. Lucid expects to begin production of Project Gravity at the end of 2023.

LUCID ELECTRIC ADVANCED PLATFORM (LEAP)

The Lucid Air uses the LEAP which is also designed to support other vehicle variants which will enable greater efficiency in capital deployment and speed to market.

The LEAP platform incorporates Lucid’s 6 key powertrain elements, designed and developed fully in-house:

- Battery Pack & Battery Management Software

- Electric Motors

- Power Electronics

- Transmission

- Control Software

- Two-way Onboard Boost-Charger

TESLA SUPERCHARGER NETWORK VS LUCID'S ELECTRIFY AMERICA PARTNERSHIP

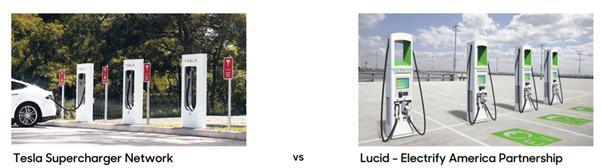

Lucid has a partnership with Electrify America — the most extensive network of ultrafast public charging stations in USA. They already have over 600 stations and over 2,400 chargers across the US and are planning for hundreds more. This is a capex light solution for Lucid where it gets access to a 900V second generation charging system as compared to Tesla’s 400V, first generation system. Tesla system and vehicles adopted 400V largely because of earlier technology. So Lucid has a second mover advantage here.

MOTORTREND 2022 CAR OF THE YEAR

Lucid’s proprietary EVpowertrain technology is so remarkable that the Lucid Air sedan was awarded MotorTrend’s 2022 Car of the Year. The Lucid air is the third EV to win this reward alongside the Tesla Model S and the Chevrolet Bolt. It is also one of the few companies (also Tesla) to win this award less than 15 years into its existence. Impressive!

Listed above are some of the winners of the same award in the last decade which makes this achievement even more commendable for Lucid Motors.

FINANCIALS

The financials do not look impressive right now because the company is at a nascent stage. This may be expected to change when the company begins full-fledged mass production of its sedans & SUVs.

Lucid’s revenue to date has been generated mainly from the sales of battery pack systems, supplies and related services. Through September 30, 2021, Lucid had not sold any vehicles. Lucid began commercial sales of Lucid Air Dream Edition in late October 2021.

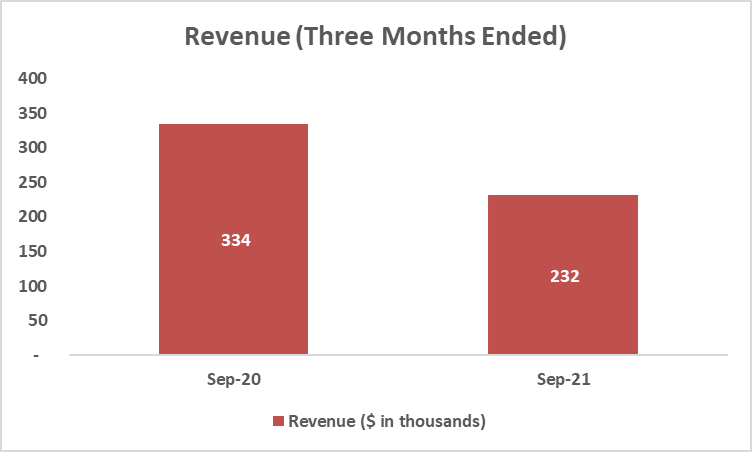

Q3 results of Lucid represent the first quarterly results after going public in July this year. The quarterly revenue has declined by ~30% from the same quarter last year. The decrease is attributable to a decrease in sales of battery pack systems and supplies for vehicles.

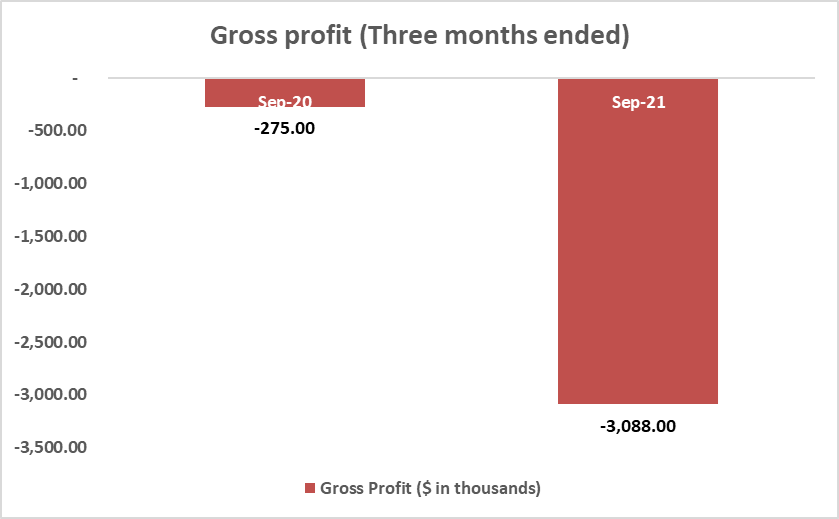

The gross profit for Q3 widened as compared to the same quarter last year mainly due to increase in COGS.

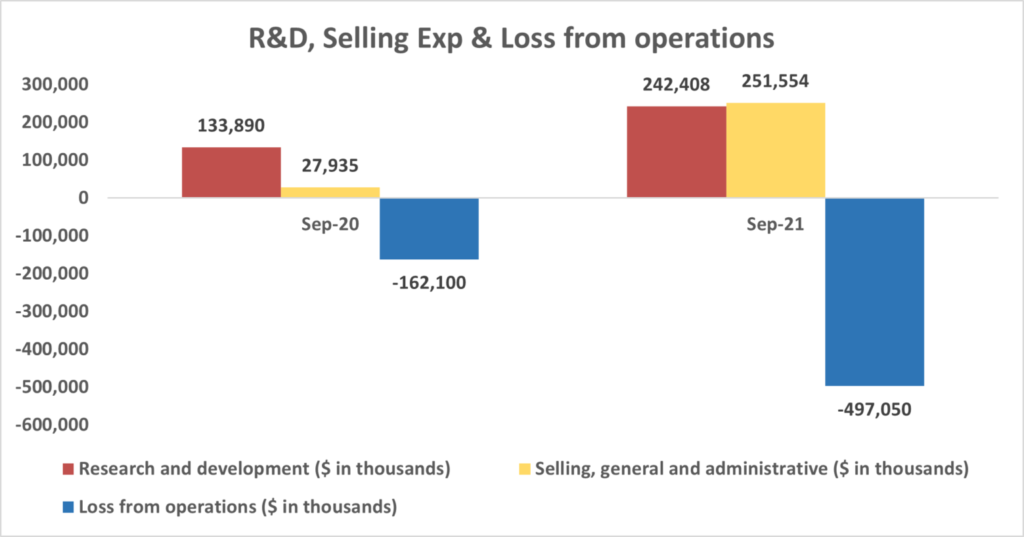

In the three months ended September 2021, the R&D expenses have increased by 81% and selling expenses have increased by 800% as compared to the same period last year. This has resulted in operating losses widening this quarter.

The company reported 13,000 customer reservations in the Q3, representing approximately $1.3 billion in business. And since the quarter ended, reservations have grown to 17,000 as of November 15, 2021.

CEO Peter Rawlinson said that “We see significant demand for the award-winning Lucid Air, with accelerating reservations as we ramp production at our factory in Arizona.”

Lucid is primarily loss making for now :

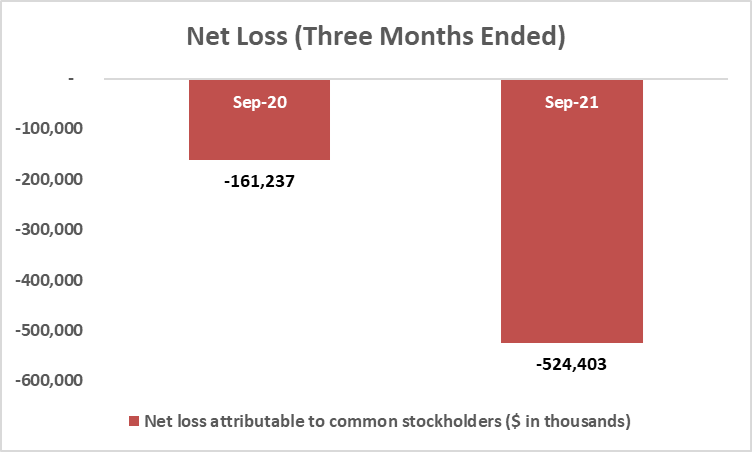

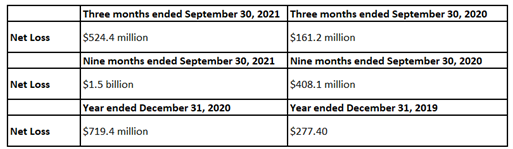

Third-quarter net losses widened t0 $524.4 million from $161.2 million from a year ago, as revenue fell to a nominal amount of $232,000 from $334,000.

Lucid expects to incur significant net losses for the foreseeable future.

From inception through September 30, 2021, the Company has incurred operating losses and negative cash flows from operating activities.

Lucid expects cash used in operating activities to increase significantly before it starts to generate any material cash flows from business as the company continues to ramp up hiring after starting commercial operations

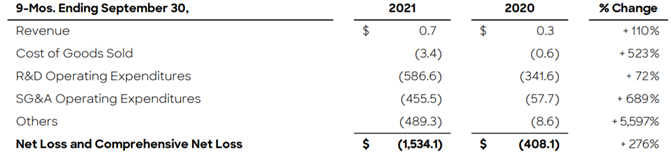

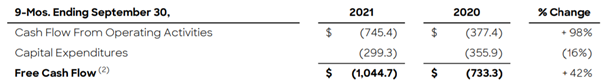

NINE MONTHS HIGHLIGHT

As mentioned earlier, the company began deliveries in October 2021 which resulted in revenues shooting up by 110% for the nine months ended September 2021 as compared to the same period last year. The increase is attributable to an increase in sales of battery pack systems and supplies for vehicles.

The COGS, R&D expenses and selling expenses have also increased significantly because Lucid continued to invest in the business in preparation for the production and deliveries of vehicles. The company also added personnel to grow the core operations.

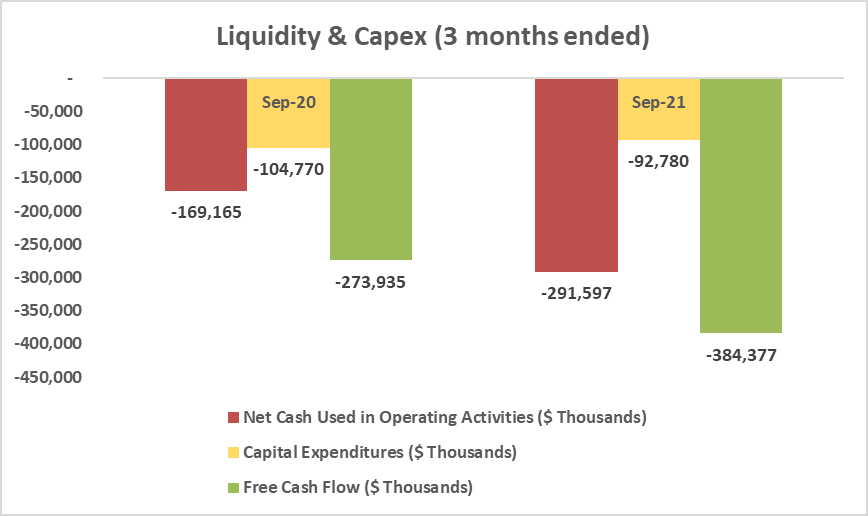

CAPEX & FREE CASH FLOW

The cash flow from operations for the nine months ended September 2021 is negative and rising from the same period last year. This is not surprising because the Lucid has just began generating revenue in October 2021. Lucid has made investments to augment manufacturing capacity, vehicle program development and expansion of retail, delivery and service capacities. As a result, the Free Cash Flow has decreased by 42%.

KEY RISKS

Yes, there has been quite a buzz about this company, but it is not without risks. To begin with, it is fairly new to the game and lacks experience in the mass production of cars. It has no service network, and the company is highly dependent on one man – CEO Peter Rawlinson. The EV space is brimming with new players, and you never know which one will last to see the dawn of the day when the bubble bursts.

Initial versions of the Lucid Air cost almost $35,000 more than a top-of-the-line Tesla Model S Plaid. Turning a profit after these production costs will prove a mighty task for the company.

Lucid needs to further develop technology, marketing channels, distribution channels, supply chain and manufacturing networks & facilities. Lucid will also need to hire skilled and experienced personnel and key management persons. The future profitability of the company is dependent on whether it can accomplish the above goals in a timely and efficient manner.

Moreover, Lucid operates in a dynamic, ever changing, technology industry. Future performance will depend upon the ability of the company to remain relevant in the face of innovation and fight the intense competition in this space.

LUXURY VEHICLE MARKET OPPORTUNITY

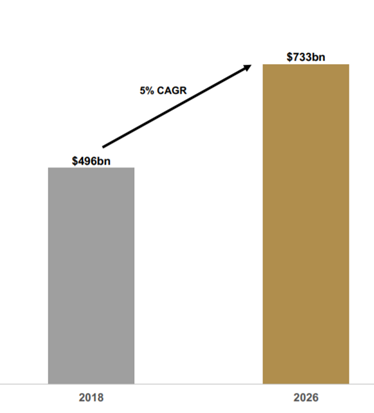

The global luxury car market was estimated to be $495.7 billion in 2018 and is projected to reach $733.2 billion by 2026, registering a CAGR of ~5.0% from 2018 to 2026.

This presents an opportunity for a true luxury EV company to address unmet needs and revolutionize this market.

With increased government mandates for electrification, combined with consumers’ growing desire for clean energy vehicles, electrification of the automotive industry is taking place globally at a rapid pace, representing 5% of all new car sales in 2020.

FUTURE GROWTH OPPORTUNITIES

Going forward, Lucid plans to augment revenue growth with the following 2 products in addition to the planned vehicle pipeline:

ENERGY STORAGE SYSTEM (ESS)

- Early prototype already operating at Lucid Headquarters

- Leverages Lucid’s extensive battery pack and battery management systems (BMS) experience

- Opportunity to leverage Lucid vehicle battery module and power electronics technologies

- Positioned to address the home, commercial and utility scale energy storage markets

- Opportunity to feed economy of scale back into the car cost structure

TECHNOLOGY SUPPLIER

All OEM racing teams in the world’s premier EV racing series are powered by Lucid battery packs and software

In-house technology designed for mass production at Lucid’s purpose-built manufacturing facility positions Lucid well for large scale supply to other OEMs

Potential for wide range of applications including aircraft, eVTOL, military, heavy machinery, agriculture and marine

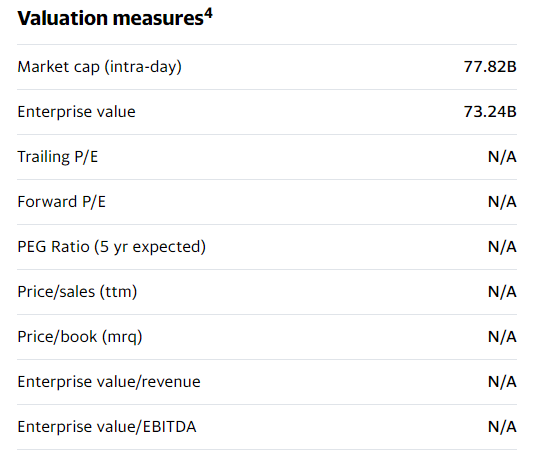

VALUATION

Lucid’s market cap is now roughly $77 billion, already beating Ford’s $76.49B valuation and inching closer to Rivian’s $93B valuation. The Lucid valuation had crossed $89B in November, surpassing the market cap of General Motors, but has now fallen owing to a subpoena by the Securities and Exchange Commission (SEC) probing for information in relation to their investigation of the SPAC merger.

Shares of Lucid had nearly doubled since they started trading on the Nasdaq.

INVESTORS BEWARE

Valuations and projections in the EV space are not without risks. Hindenburg Research accused Nikola of an “intricate fraud” in September 2020. It was later discovered that the founder misled investors and as a result, the stock tumbled 90% from its highs. Another electric truck start-up, Lordstown Motors, was also hit by a report from Hindenburg which raised questions about the orders for its trucks. Its CEO and CFO also were forced to resign. The stock prices saw a similar fate as Nikola.

Both these companies traded at lofty prices and went public through a SPAC. This serves as a reminder to investors that it is extremely crucial to study the fundamentals of the company thoroughly and check whether the company has any corporate governance issues. It is easy to get swept away in the herd or buy a stock out of “FOMO” (Fear of missing out). But such actions could have devastating results if the stock turns out to be in a bubble.

CONCLUSION

CEO Peter Rawlinson appears to know what he is doing considering his experience with Tesla before. Moreover, he has managed to build a car which beats a Tesla on most aspects.

Lucid has built a phenomenal car, however mass production of vehicles requires some capabilities which we are yet to see in Lucid. If the company can brave the winds of costs, competition and innovation and turn its bottom line green, then we definitely have a winner. We must wait to see if Lucid is another Tesla or a Nikola.

Disclosure

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.