BONUS!!

In case you scroll all the way to here. Here’s what we are giving you when you…

Reserve For A Seat Today & Receive The Following Items When You Attend!

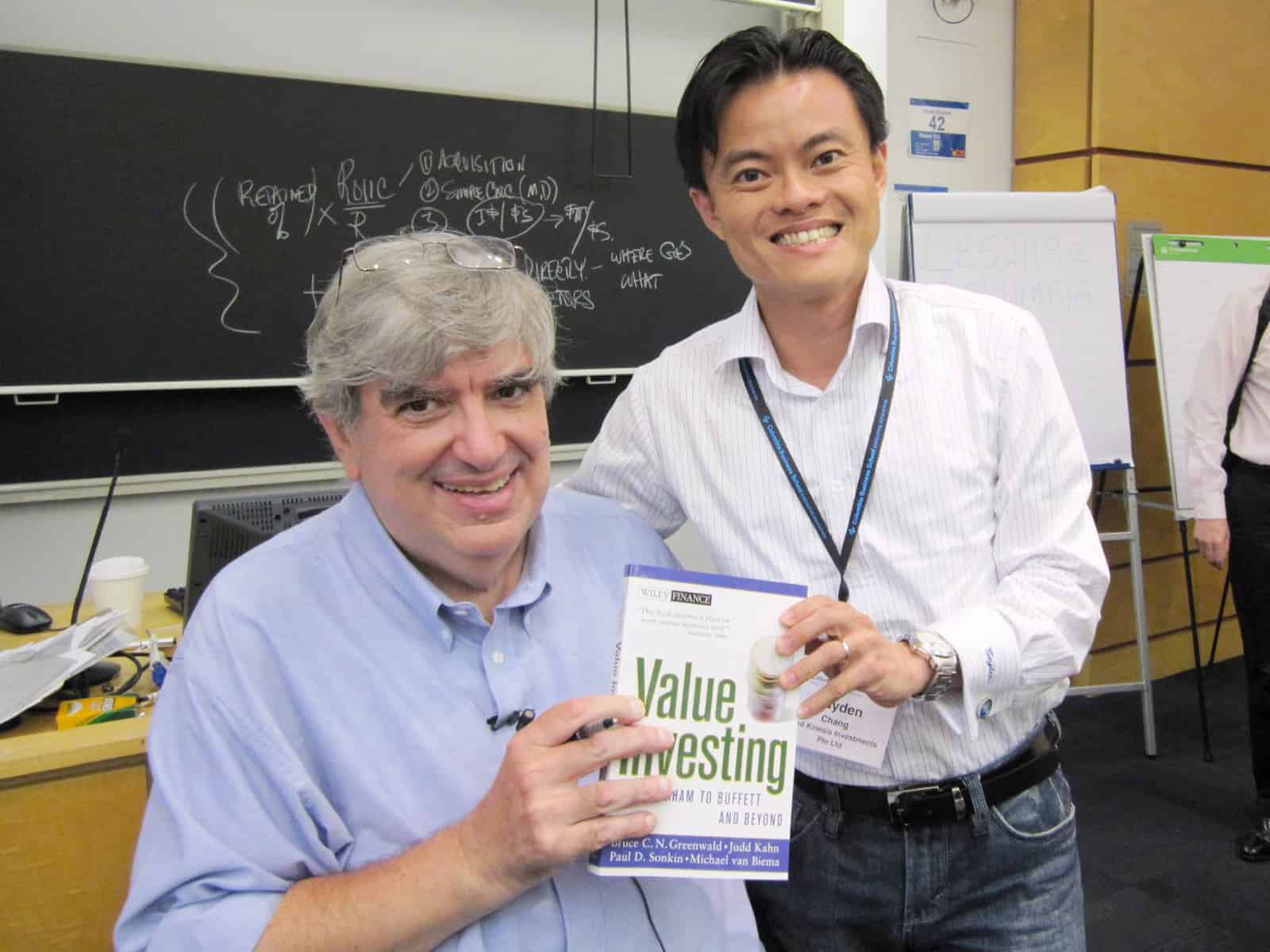

Our “Value Investing Simplified” Book worth $33.

$10 Starbucks Gift Card For Each Friend You Bring Respectively!