As the largest neobank in the Latin America region, Nubank’s IPO debut on NYSE has made the headlines news for the past months in 2021. In addition, heated debates on newswires about Berkshire Hathaway’s USD 1 billion worth of shares invested in this “crypto-friendly” neobank has also grabbed investors’ attention on the companies’ future potential.

What is Nubank?

What is the difference between neobanks and traditional banks?

And what are the factors that entice investors to be willing to bet on this neobank even though the current financial numbers don’t look so good now?

We’ll investigate further in this article what’s so special about Nubank that everyone is eyeing this rapidly growing neobank in the emerging market of the Latin America region.

INTRODUCTION

Nu Holdings Ltd. (NYSE: NU) or Nubank is a Brazilian neobank and the largest FinTech bank in Latin America that is currently revolutionizing the financial services market in the region.

Its headquarters is in São Paulo, Brazil and has banking operations in 2 other countries – Mexico and Colombia. There are engineering offices located in Berlin, Germany, Buenos Aires and Argentina.

As of Feb 22, 2022, Nubank has about 52.5 million individual customers and 1.4 million SMEs, with 41.1 active customers using their financial services via mobile app. Nubank has achieved net promoter score (NPS) levels of 90 or above in Brazil, Mexico and Colombia. This has boosted Nubank’s customer base growth organically via word-of-mouth referrals from 3.7 million users in 2018 to 53.9 users in 2022. This also helps to cut down their marketing expenses to build their brand among the Latin American population.

Nubank officially launched its public IPO offering on the NYSE on Dec 09, 2021. It was valued at US$45 billion, making it the most valuable digital neobank at the time of writing. It is traded with the ticker symbol NU. Nubank is also traded on the Brazilian stock exchange, B3 under the ticker symbol NUBR33.

Nubank has undergone over 13 rounds of investing funding and the latest funding was raised on Feb 16, 2022. They raised a total of USD 3.3 billion to grow and expand their operations. Some of its notable investors include Sequoia Capital, Tencent, Dragoneer Investment Group, Goldman Sachs, Ribbit Capital and Berkshire Hathaway.

In Q4 2021, Warren Buffett owned Berkshire Hathaway invested 107.1 million shares, at an estimated average price of $9.82 per share of Nu Holdings Ltd. This has created a whirl storm of news that Buffett has invested in a crypto-friendly neobank where he and Charlie Munger had stated crypto as “rat poison”.

However, further investigation has discovered that Nubank actually does not allow trading in individual cryptocurrencies. On Nubank’s FAQ website, its investment unit – NuInvest only allows customer to invest cryptocurrencies via ETFs (index funds) as the Brazil stock exchange, B3 currently allows investors to invest in cryptocurrency ETFs, such as QBTC11. The investment portfolio that NuInvest offers to its customer to invest in are mainly stocks, futures, and ETFs at the moment of writing (Mar 2022).

HOW NUBANK BEGAN ITS JOURNEY

Nubank was started in Brazil in 2013 by three founders – David Vélez, Cristina Junqueira and Edward Wible, due to the frustrating experience and long hours of red tape processes to opening a new bank account in Brazil.

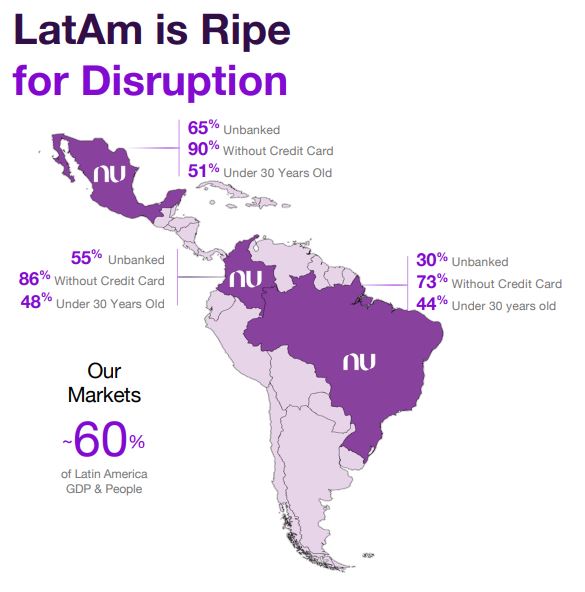

From a research done by World Bank in 2017, there were about 650 million people in Latin America. More than half of the population were underbanked or deeply unsatisfied with the banking services at that time.

At the same time, mobile penetration in Latin America was growing rapidly. The World Bank conducted research in 2012 and found that almost 98% of the Latin American Population has mobile cell signal.

David Vélez saw this opportunity of the low banking penetration in Brazil and wanted to reinvent the cumbersome financial services in the region.

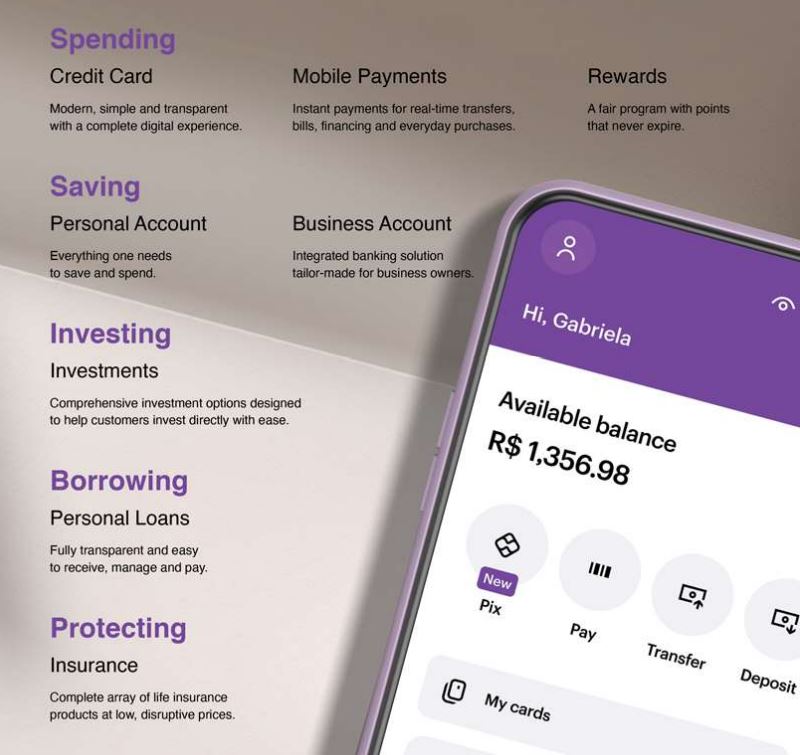

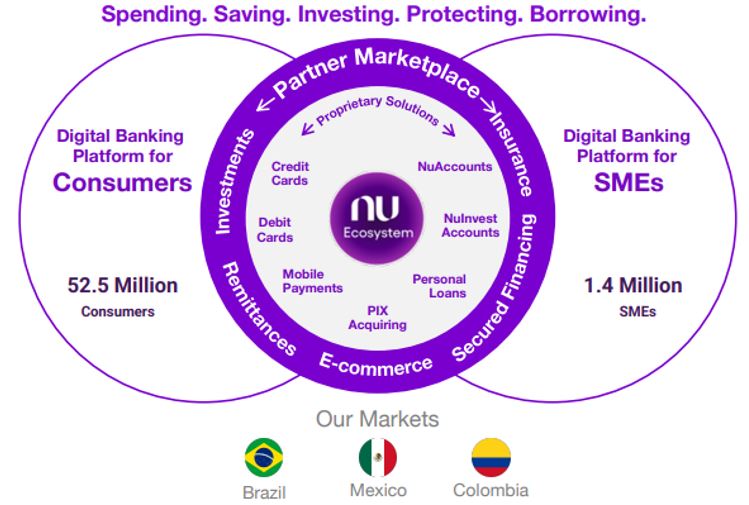

With its mission statement – Fight complexity to empower people in their daily lives, Nubank aims to simplify banking processes and make banking services accessible to average folks by leveraging mobile and digital-first banking platforms. Via their smartphone app, Nubank is currently providing five main financial services:

- Spending

- Saving

- Investing

- Borrowing

- Protecting

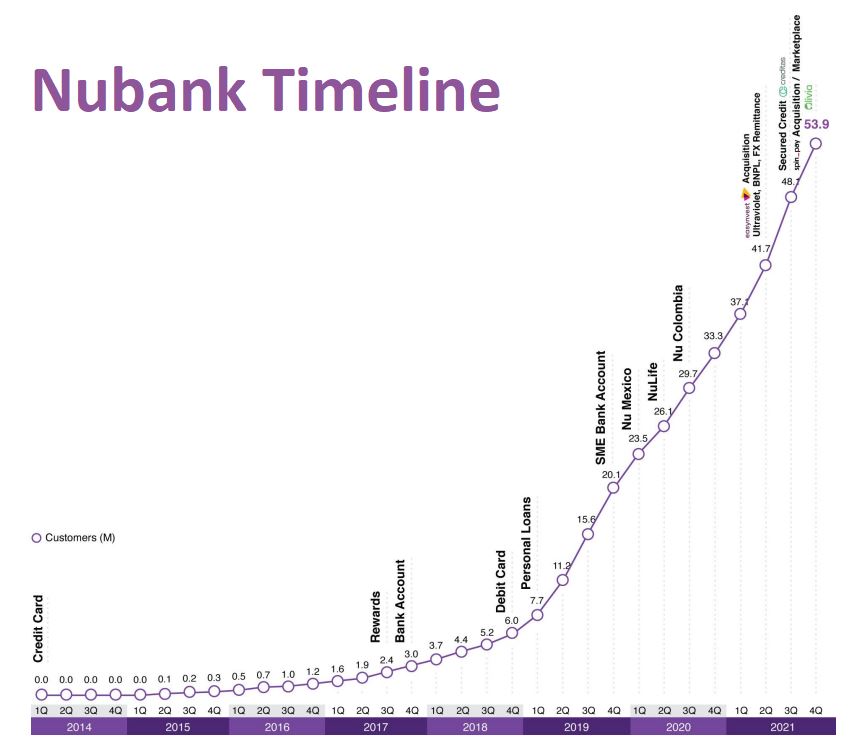

In 2014, Nubank launched its first financial product, an international Mastercard credit card with no annuity fees and fully managed via a mobile app. They started off with a banking partner to allow them to store customers’ funds as they did not have a banking license at that time.

In 2017, their loyalty program, Nubank Rewards was launched. The program’s points, which never expire, can be redeemed for products or discounts on services, travel, and entertainment. The program has a free trial for 30 days and after which the customers will be charged for a fee to further use it. In the same year, Nubank launched its first digital account, NuConta.

In 2018, Nubank managed to secure a banking license in Brazil, and they started to offer payments through debit cards. The following year (2019), personal loans were started testing with a few NuConta account users.

In 2020, Nubank started expanding its overseas operations to Mexico and Colombia.

To provide more financial services and create a financial ecosystem within the mobile app, Nubank also begin to acquire a few companies in 2020 & 2021 to further enhance and expand their mobile app platform technology. Examples of the acquisitions:

The chart below shows the timeline of product launching, the number of customers growth, and the strategic acquisition of companies & expansion of Nubank from 2014 to 2021.

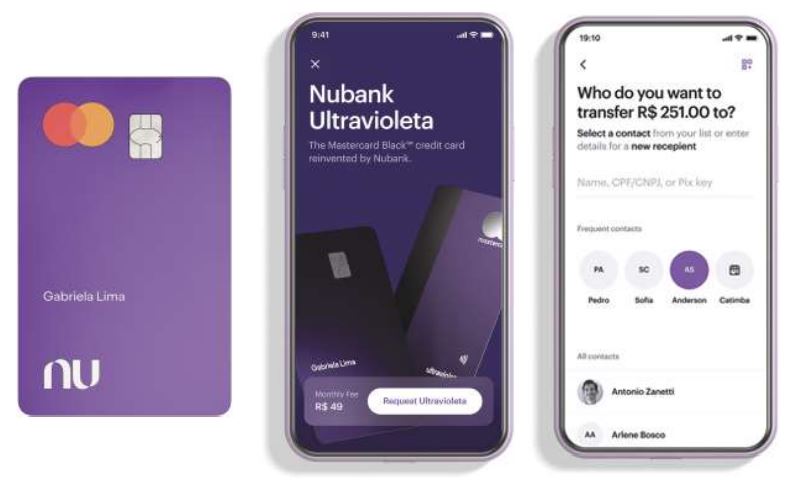

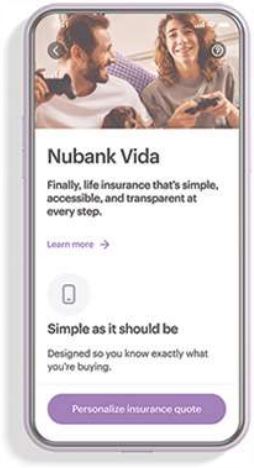

During 2021, Nubank launched many new products and features to grow their Nu ecosystem, including Marketplace (currently partnering with over 20 companies for e-commerce), Apple/Google/WhatsApp Pay, UltraVioleta (premium card), and Life Insurance, etc.

NU ECOSYSTEM

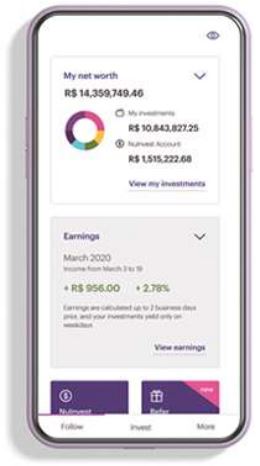

Nubank has established a financial ecosystem within their mobile app so that their customers can settle all their financial matters 100% digitally on their mobile app.

They categorize their financial services into five main categories, known as the Five Financial Seasons* – Spending, Saving, Investing, Protecting and Borrowing.

All these 5 financial solutions were provided by Nubank or their strategic partners such as Mastercard, Chubb (life insurance product) and Remessa Online (international remittance solutions) to serve their 53.9 million customers.

*Currently, only Brazil is offering all these 5 financial services, whereas, in Mexico and Colombia, only credit card service is available at the time of writing.

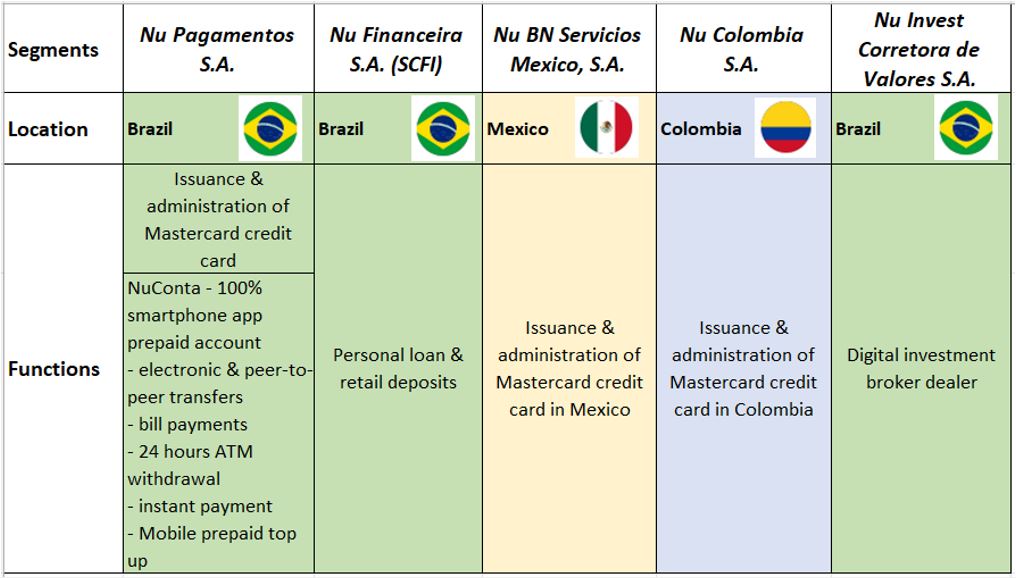

BUSINESS SEGMENT

The company has 5 main subsidiaries operating in three countries:

PRODUCTS

Nubank offers a wide range of products and financial services to cater for their customers’ financial needs under the Five Financial Seasons.

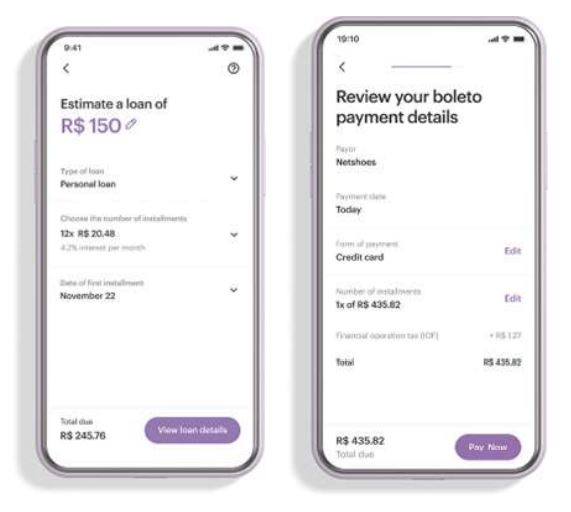

Spending Solutions – for goods and services payment via credit or debit card and mobile phone app.

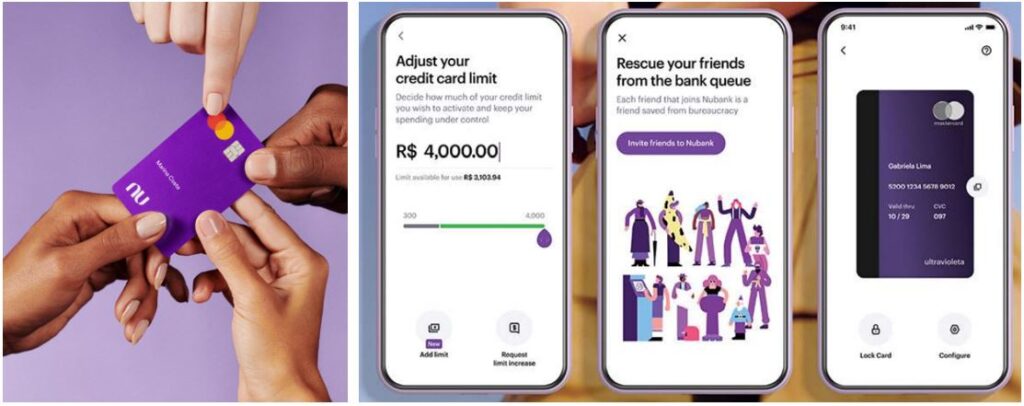

Nu Credit and Debit card

- 100% fully managed by mobile app

- No fees or annuity charges

- Accepted by more than 30 million merchants worldwide

Ultraviolet Credit and Debit card (metal designed)

- 1% cashback for miles, invest or transfer into NuAccounts

- Full Mastercard Black benefits

- Access to exclusive NuInvest products

Mobile Payments

- Real-time transfers through PIX (Brazilian payment system), Whatsapp Pay or NuAccounts

- Easy and secure payment with PIX keys and traditional payment methods

- No fees

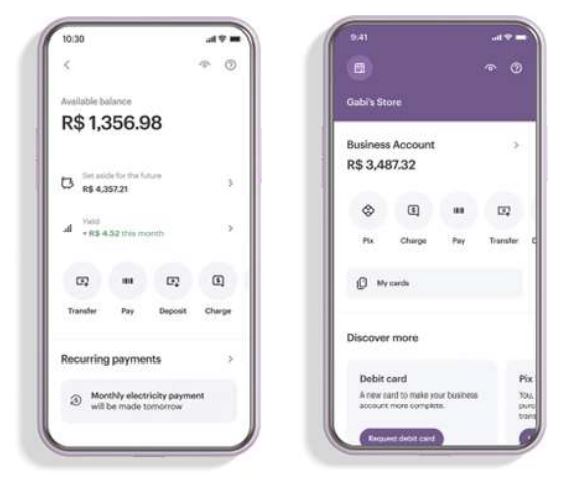

Savings Solutions – for customers to deposit, manage and save money in interest-earning accounts.

Nu Personal Accounts

- No annual or maintenance fees

- Access to the account via Nubank mobile app

- Cash withdrawals in 25,000 locations

Nu Business Accounts

- No annual or maintenance fees

- Receive payments from customers

- Business debit card

Investing Solutions – for customers to invest directly on the Nubank app, based on customers’ risk profile and financial position.

NuInvest Investment Accounts

- Wide portfolio investment choices – equity, options and ETFs

- Ability to invest as little as USD $1

- Transparent fee pricing

Borrowing Solutions – for customers to apply for loan instantly via digital approval process and instalment payments.

Personal Unsecured Loans

- Instantaneous digital approval process, with borrowed funds deposited in customer’s NuAccount

- Transparent loan terms

- Lower interest rates

Buy Now Pay Later

- Transparent and flexible payment terms in-app

- Flexibility for repayment terms for purchases that do not offer instalments

Protecting Solutions – to provide life insurance to customers at a low cost based on customers’ needs and budgets.

NuLife Insurance Policies

- Premiums as low as USD $2

- Fully customized packages to customers’ circumstances

- Easy claim process

- 24/7 customer service

REVENUE GENERATION

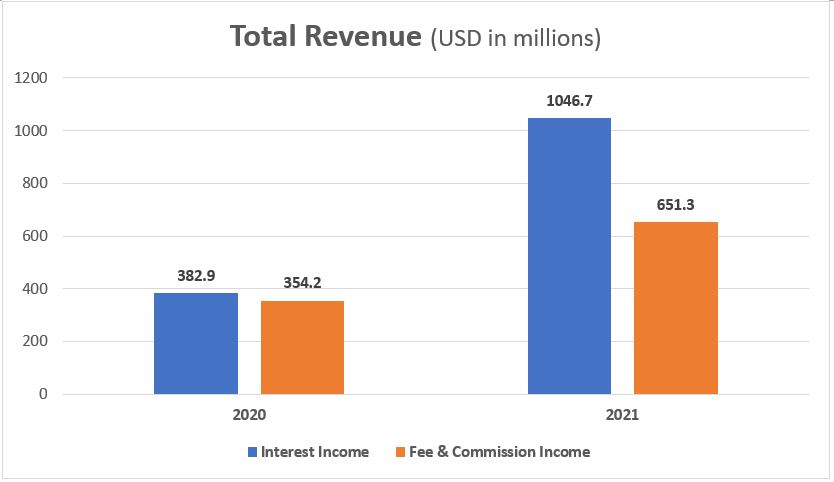

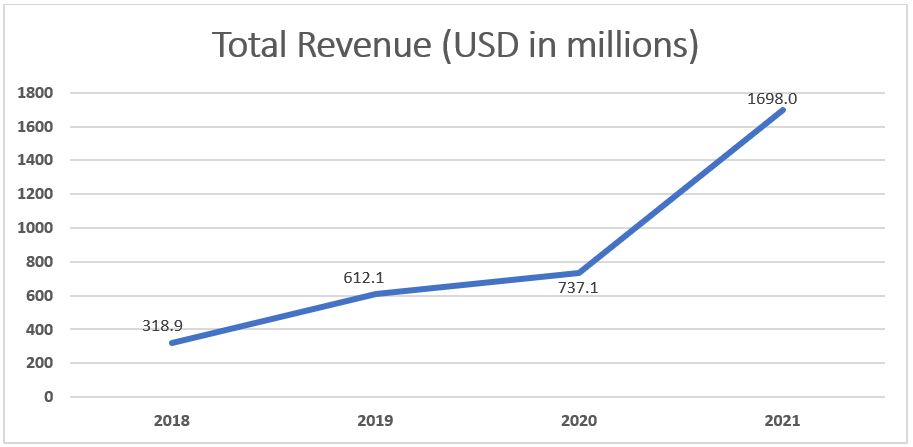

In 4Q 2021, Nubank’s total revenues were USD 1.7 billion, about 130.4% increment compared to 2020.

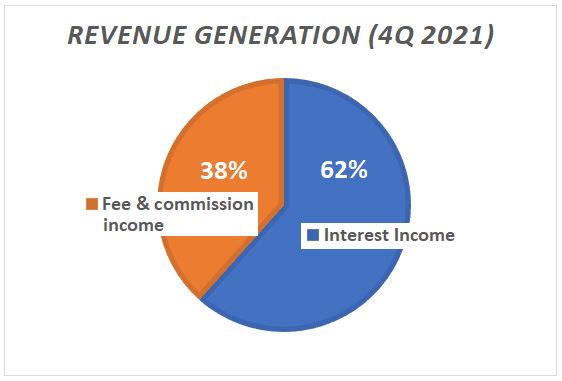

The revenues were generated from two main categories – Interest income (62%) and fee & commission income (38%) in 4Q 2021.

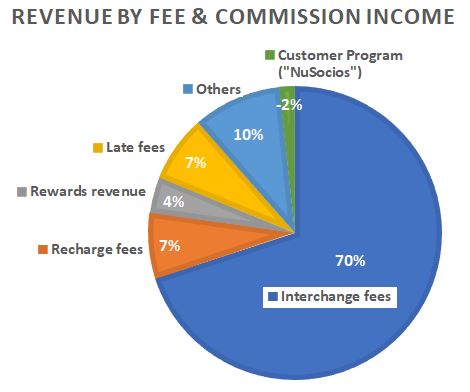

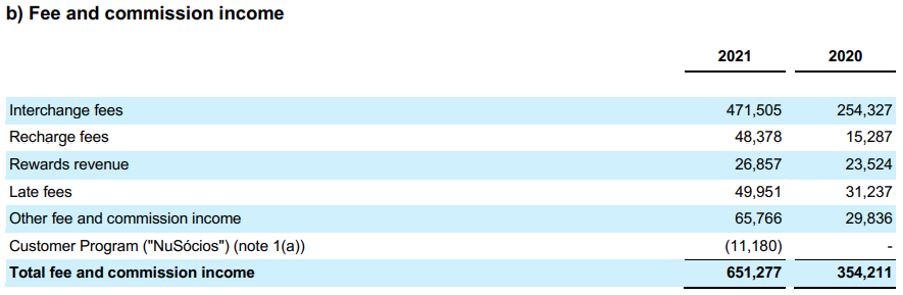

The following charts below show the components of the two main revenue categories:

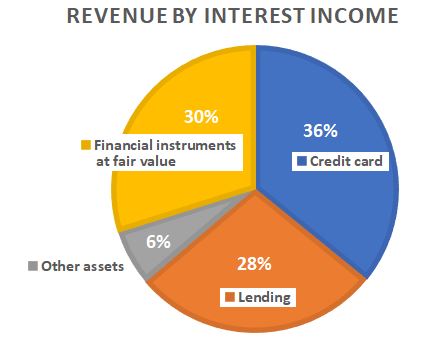

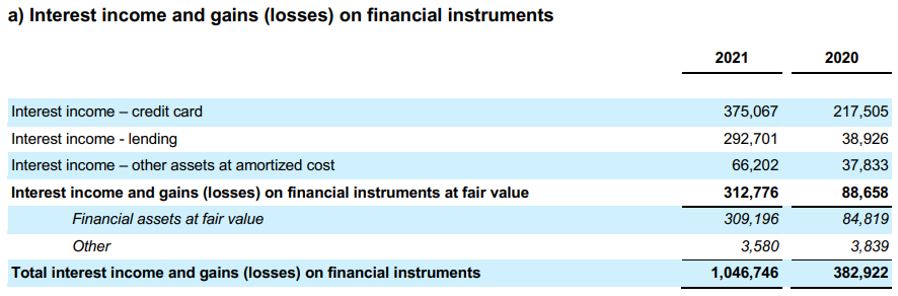

For the interest income category, credit cards (36%) contributed the most, followed by financial instruments at fair value (30%), lending (28%) and other assets (6%).

Both interest incomes for credit cards and lending have increased about 72.4% and 651.9% respectively in 2021 compared to the previous year. Interest income for other assets at amortized cost had increased about 75.0%.

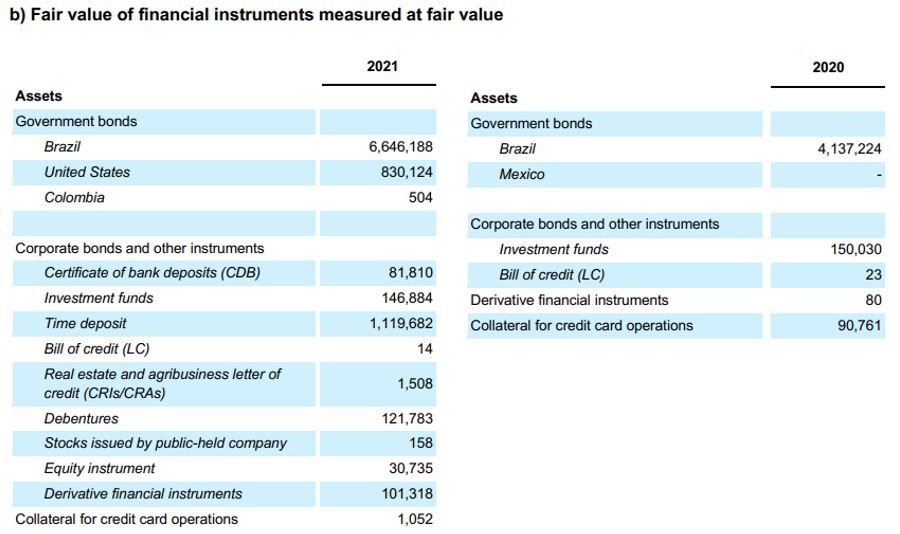

There was also a significant increment for interest income and gains (losses) on financial instruments at fair value from 2020 to 2021 (+252.8%). The financial assets at fair value comprise interest and the fair value changes on financial assets at fair value. From their quarterly report in 4Q 2021 (Note 25(b)), they have increased their financial assets in government bonds and corporate bonds.

Interchange fees (70%) contributed the most income for the fee & commission income category. Subsequently followed by recharge fees (7%), late fees (7%), rewards revenue (4%) and others (10%).

However, there was a deduction of 2% from the chart (- US$11.2 million) under the Customer program (“NuSocios”) as Nubank started this incentive reward program in 2021. They provided funds to cover the subscription and payment to the customers that participated in the program.

From 2020 to 2021, interchange fees increased from US$254 million to US$472 million (+85.4%), followed by recharge fees (+216.5%), rewards revenue (+14.1%), late fees (+59.9%) and others (+120.4%).

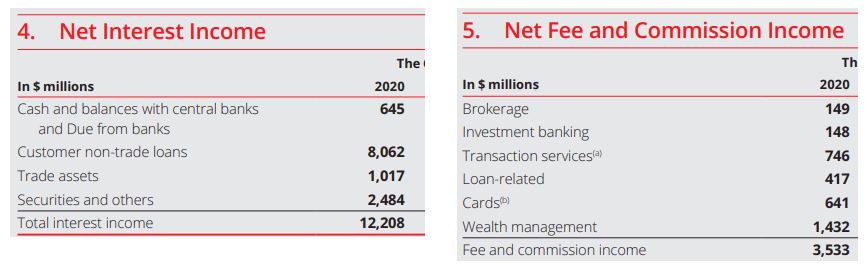

Compared to a local bank, such as DBS Singapore, the revenue generation for interest income and fee & commission income in 2020 are as per the diagrams above. Most of the interest income was generated from customer non-trade loans (66.0%), whereas for fee & commission income, most income was generated from wealth management (40.5%).

After going through the background and the revenue generations of Nubank, it seems like this company has a lot of potentials to grow and generate money for investors. But, do we really know if Nubank is a good and valuable company to invest in?

Let’s continue to further investigate!

DIFFERENCE BETWEEN NEOBANK, TRADITIONAL BANK & DIGITAL BANK

The definition of a bank is a financial institution that is licensed to receive deposits, store money and make loans for both individuals and businesses. It also provides financial services such as wealth management, currency exchange and money transfer, etc.

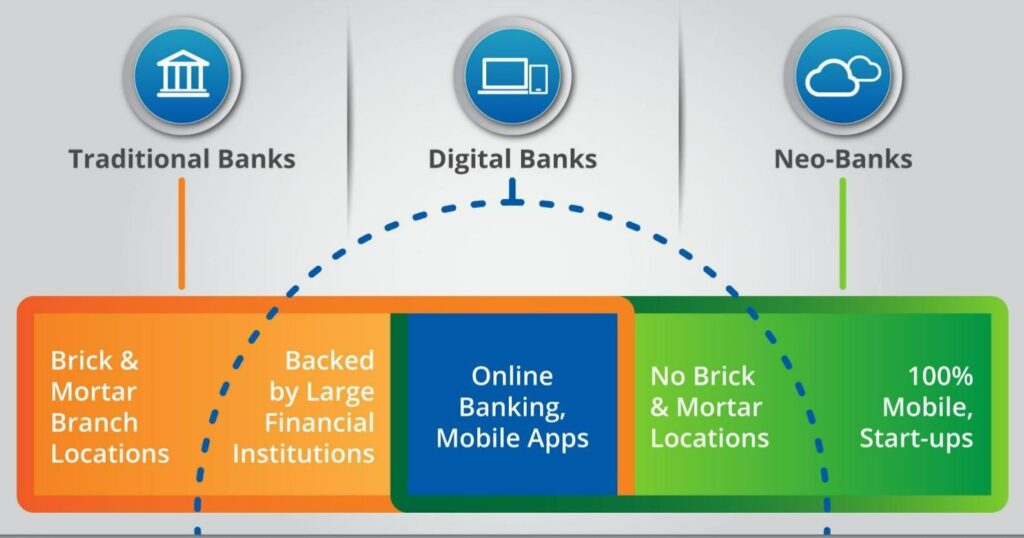

Currently, there are three types of banks available: traditional banks, digital banks and the emerging neobanks. It is easier to differentiate between traditional banks and neobanks but the distinction line between neobanks and digital banks are blur.

In this section, we will try to simplify and differentiate between these three types of banks.

Traditional banks have full banking licenses and physical branches to offer a wide range of financial services via in-person.

Digital banking is a digitization of traditional banking activities and offers financial services online. It aims to speed up the process of customer interactions with banks via smartphones and computers. However, digital banks are backed by traditional banks and tend to exist like a branch of larger traditional banks.

Neobanks, also known as an internet-only bank or virtual bank, are 100% fully digital and do not have any physical branches. All the financial services are performed on digital channels such as computers and smartphones. Neobanks are mostly independent start-ups and work in partnership with traditional banks. They are not subsidiaries of traditional banks.

Some neobanks have banking licenses but others without banking licenses will need to partner with traditional banks in order to provide banking activities. For example, Chime partners with Bancorp Bank and Stride Bank to provide banking activities, such as debit & credit card and online savings account to their customers. (In-depth explanation in the following section)

DIFFERENCE BETWEEN FINTECH & NEOBANK

Financial Technology (FinTech) is an integration of technology and financial services. It helps to increase the efficiency of the financial activity with software & algorithms, which enhances customers’ banking experience.

It is an emerging industry that uses a variety of technologies, such as artificial intelligence (AI), big data, robotic process automation (RPA), and blockchain, etc to improve and automate the financial processes for mobile banking, investing, borrowing services, and cryptocurrency.

With these technologies, fintech companies are rapidly changing the way people pay, send money, lend, borrow, and invest. Application examples of fintech include:

- Budgeting apps, spend trackers

- Payment services, e.g. contactless payment & digital wallets

- Robo advisers

- Wealth & investment apps

- Share trading platforms

- Open banking – access to personal financial data

Some FinTech companies only provide simple financial services, such as peer-to-peer lending (e.g. Zopa) or international money transfer (e.g. Transfer Wise) that address customers’ pain points and cumbersome processes with the traditional banks. Other examples are Block (formerly Square, NYSE:SQ), PayPal (Nasdaq:PYPL), and RobinHood (Nasdaq:HOOD).

Neobank is a subset of FinTech and conducts banking services 100% completely online via desktop or mobile app.

They provide various financial services like a traditional brick-and-mortar bank, but they are more technology-oriented and operate exclusively online with no physical branch. Algorithms and cloud-based tools are used to provide efficient and accurate financial services—all through mobile apps and data-driven processes.

They primarily focus on providing the best customer experience when customers are using their platform for banking services, such as ease-of-use app, fast application process and 24/7 access. There are two types of neobanks – full-stack neobanks and front-end focused neobanks:

Full stack neobank is a standalone bank with its own banking license and is able to operate 100% independently to provide banking services.

- They oversee the front-end (customer’s interface on apps) to back-end operations of the banking service. Examples are e.g. Nubank, N26 (Germany), Monzo (UK) and Atom Bank (UK), etc.

- With a banking license, neobanks can call themselves a bank and provide full banking services as the regulations of a bank are very strict. They need to meet the tough prerequisites such as minimum capital requirement, security and data protection, etc to obtain the banking license approval from central banks.

Front-end-focused neobank does not have a banking license and must operate in partnership with a traditional bank to provide banking services.

- They only have control over the customer’s interface on apps with application programming interface (API) to provide the banking services. The banking services (back-end operation) are provided by the partner banks. Examples of these banks are e.g. Chime, Qube Money and MoneyLion, etc.

- Without a banking license, FinTech companies that provide banking services are not allowed to call themselves a bank in their company name. They are not licensed to receive deposits, store money, and make loans for their customers. These front-end-focused neobanks will need to partner with a fully licensed bank to provide these services.

COMPETITORS

Other than Nubank, there are myriads of neobanks in the Latin American market. In South America, about 30+ neobanks are operating in the region and serving up to 50 million customers.

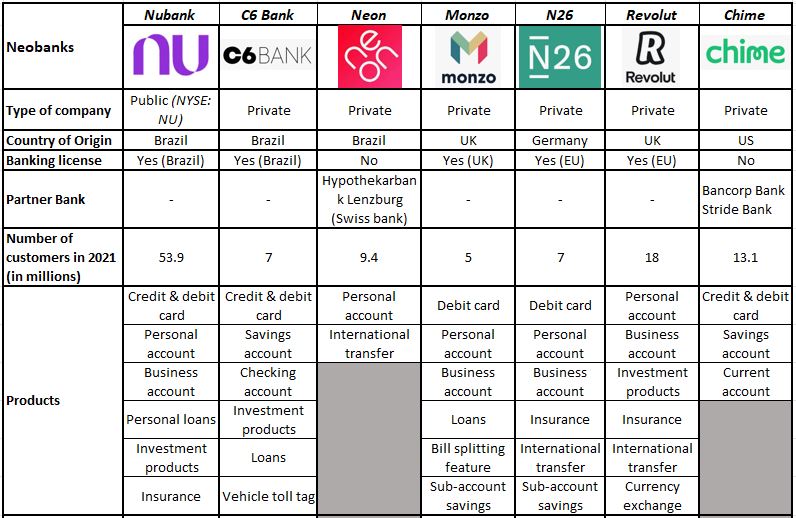

The chart below shows a quick comparison of three neobanks in Brazil, and also some other neobanks from Europe and US.

Currently, most of the neobanks are still private and thus most of the information is only available on their websites.

COMPETITIVE MOAT

Nubank is currently the largest neobank in Latin America, serving 53.9 million users across 3 countries in Latin America (Brazil, Mexico & Colombia), the highest number of neobank users in the world.

Nubank obtained a banking license from the Brazil central bank in 2018 which allows them to provide a wide range of financial services (Five Financial Seasons) for their customers in Brazil.

They also build their own cloud-based core banking platform to manage key functions, such as credit card transactions. Nubank has been strategically acquiring companies to enhance their mobile app functions to provide a seamless and intuitive user experience for customers since 2020. This allows them to expand their digital Nu ecosystem and partner with e-commerce brands to create a marketplace where customers can easily make a purchase and settle payments via the Nubank app with a click of a button.

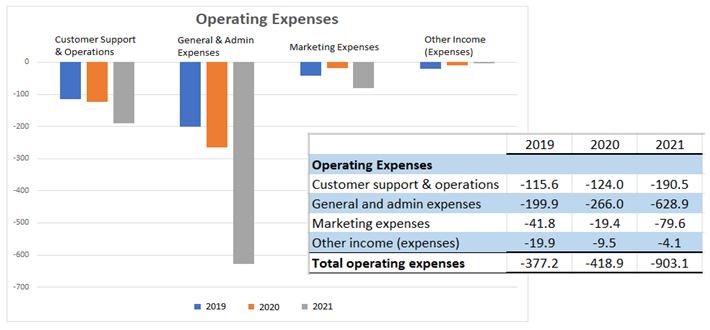

As there is no physical branch and the financial services are delivered on the mobile app, Nubank has lower operating costs (US$903 million in 4Q 2021) and is thus able to provide a lower interest rate for loans, and no annual fees for both credit cards and savings account.

Nubank achieved a 90+ net promoter score (NPS) in 2021, which is the highest within the industry. NPS is a measurement to determine how willingly are the existing customers to promote the products and services that they received to the people around them. As such, they have grown their customer base year-on-year via word-of-mouth referrals from 3.7 million users in 2018 to 53.9 million users in 4Q 2021.

FUTURE PLANS

Nubank is planning three main strategies to expand and grow its businesses:

Grow and expand Nu Ecosystem

- Build a customer acquisition engine via word-of-mouth referrals by loyal customers, social media presence and build a consumer brand to raise awareness.

- Increase revenue per customer by providing more financial products when customers accumulate more wealth and reach new life milestones by cross-selling and upselling higher-value products.

- Work with strategic partners such as Chubb (life insurance product) and Remessa Online (international remittance solutions) to provide more financial services in their ecosystem.

Enhance Nu Platform

- Innovate and develop new solutions to enhance customers’ experience and fulfil their wider financial service needs.

- Execute strategic acquisitions to expand more financial service offerings.

Expand into new markets

- New geographies expansion.

- Adjacent sectors such as e-commerce, healthcare and telecommunications.

FINANCIALS

Nubank has been showing strong revenue growth year-on-year from USD318.9 million in 2018 to USD 1.7 billion in 2021. From 2020 to 2021, there was a jump of about 130.4% increment in the total revenue.

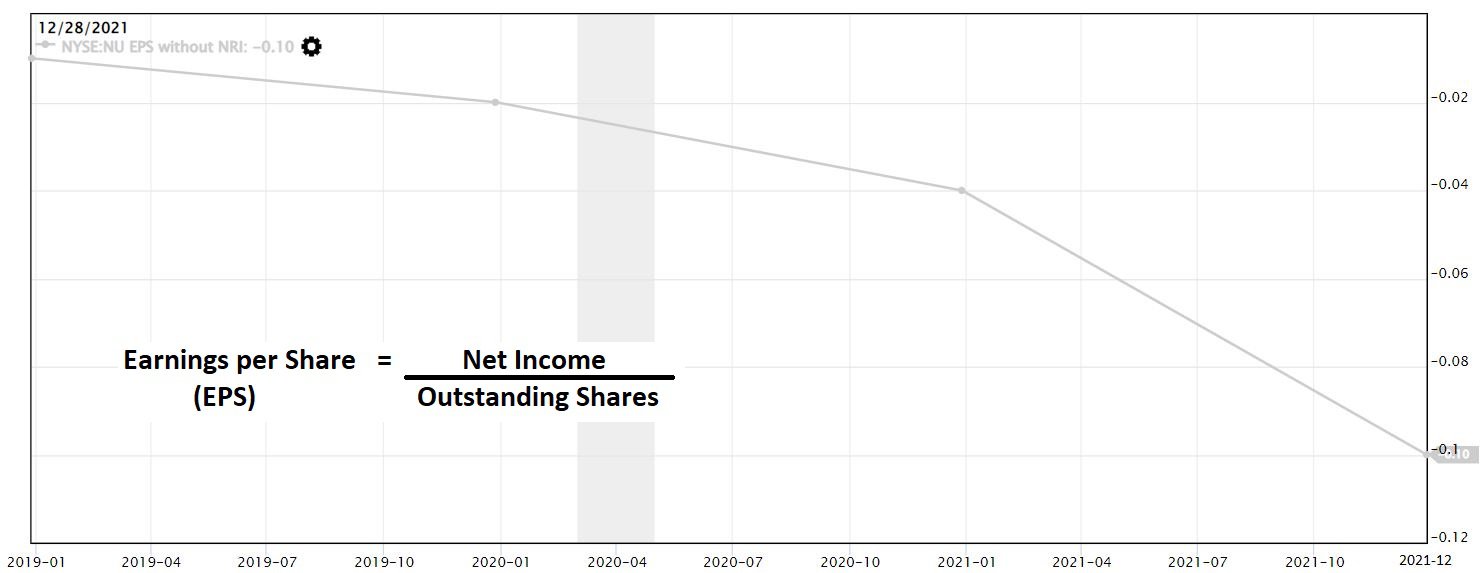

Nevertheless, the earnings per share (EPS) have been showing a negative downtrend since 2019. There has been a drop in EPS because the operating expenses have increased about 115.6% from 2020 to 2021, especially for the General and Administrative (G&A) expenses.

G&A expenses increased because Nubank has been heavily invested in research & development, back-office activities, and overhead salaries, etc to further expand their operations.

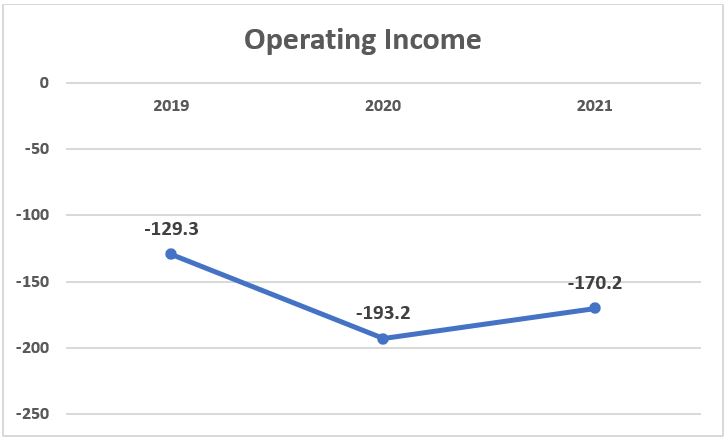

The operating income, also known as income before taxes is in the red for 2021, negative USD 170.2 million. They have managed to increase about 11.8% of the operating income compared to 2020, which is still negative USD 193.2 million. Operation income was obtained after the deduction of the cost of goods sold (COGS) and operating expenses from the total revenue.

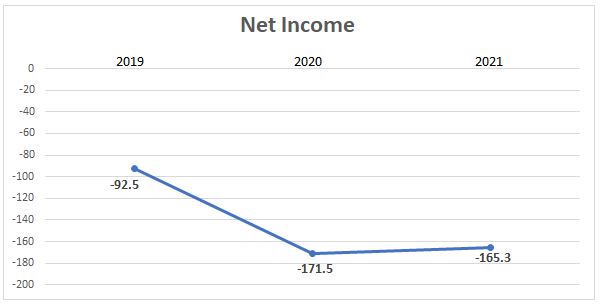

After deducting the income taxes, Nubank resulted in a net income loss of USD165.3 million in 2021. Compared to 2020, the net income (loss) has increased by about 3.7% in 2021. As the net income of Nubank is in the red for the past three years, this has also caused the EPS to be on a negative downtrend.

From the financial information provided until now, the numbers do not look really good on Nubank. But still, is there any investment opportunity in this high-profile neobank in Latin America?

To better analyze a company, it is important that we look at the company’s fundamental values and financial statements to determine if it is a good company to invest our money in.

Subscribe to our Case Study membership to discover good growth, undervalued companies to invest in.

FINANCIALS

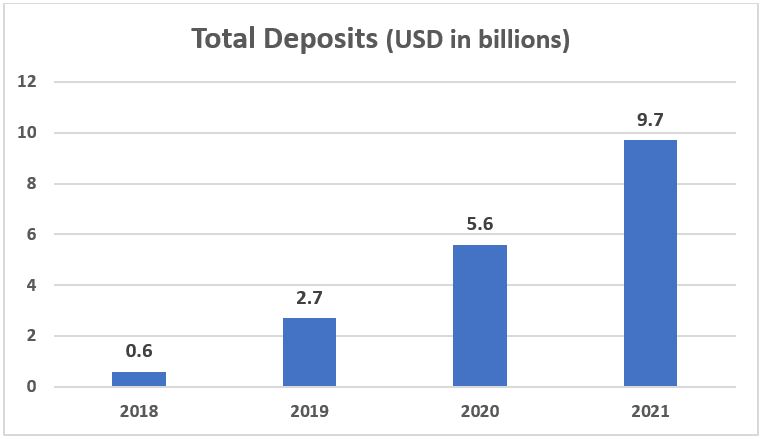

The total deposits from customers in Nubank have been growing year-on-year from USD 0.6 billion (in 2018) to USD 9.7 billion (in 2021).

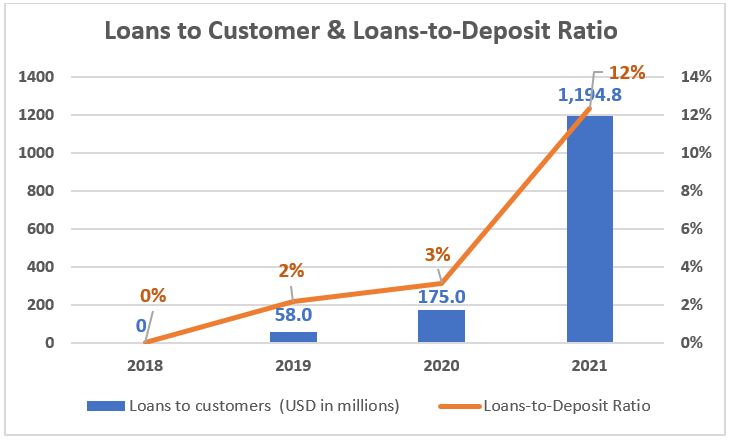

Since the start of 2019, Nubank has been increasing its loan services to its customers and there is a 582.7% increment of loans being provided from 2020 to 2021. The loans-to-deposit ratio has also been increasing year on year since 2019 from 2% to 12% in 2021.

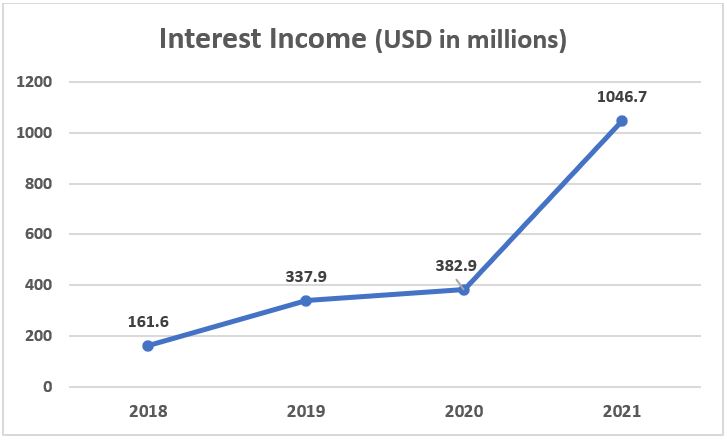

The increment of deposits from customers, allows Nubank to be able to lend out more money and increase their interest income, which was being shown in the chart below.

The interest income for Nubank has been increasing for the past 4 years, from USD 161.6 million to USD 1.04 billion.

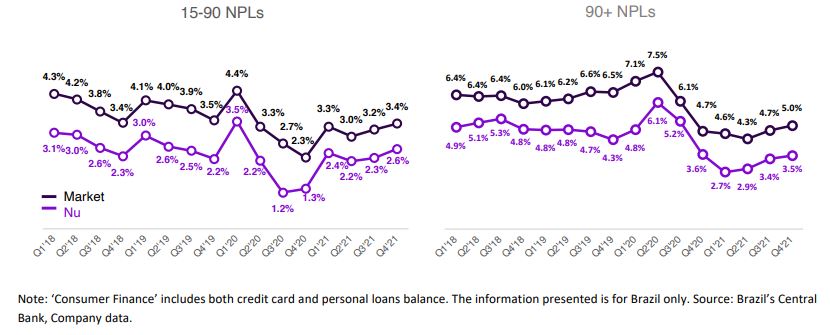

For nonperforming loan (NPL), it is a loan where the borrower is not able to make scheduled payments for a specified period and is in default. For both 15-90 days NPLs and 90+ days NPLs, Nubank (purple in colour) has lower NPLs compared to the average of the market (black in colour).

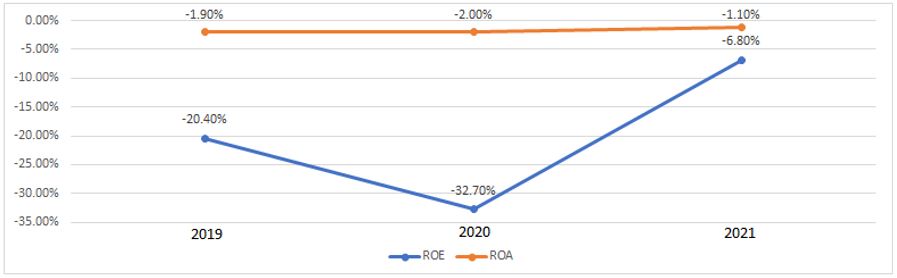

Return on equity (ROE) and return on assets (ROA) are used to determine how effective has the management been running the company to generate income.

The bank industry average for ROE and ROA is >13.8% and >1.0% respectively. This means that for ROE, for every $100 of equity invested, investors will expect to get more than $13.80 back. For ROA, it implies that for every $100 invested in assets, investors will expect to gain more than $1 in return.

From the charts, the ROE and ROA of Nubank is still negative, but as they are still in the expanding stage, they are investing the capital raised from investors to rapidly grow the company and increase their market share in Latin America’s banking industry. It may take some time before investors can start to see the positive numbers in ROE and ROA.

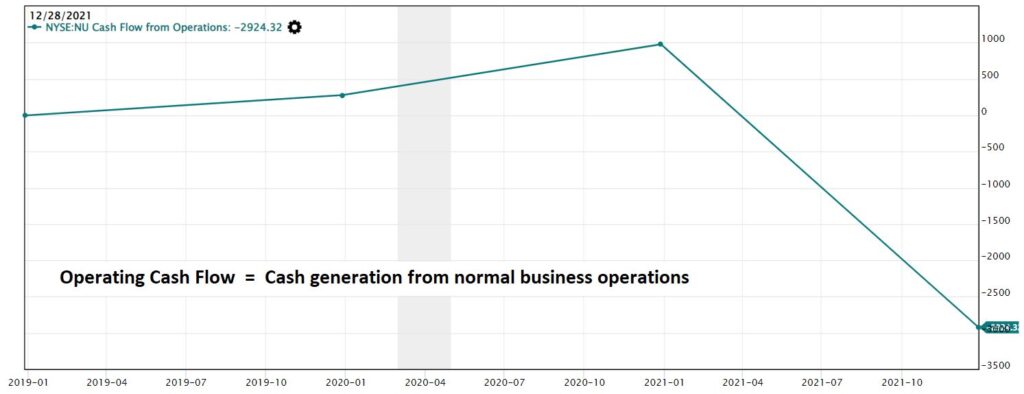

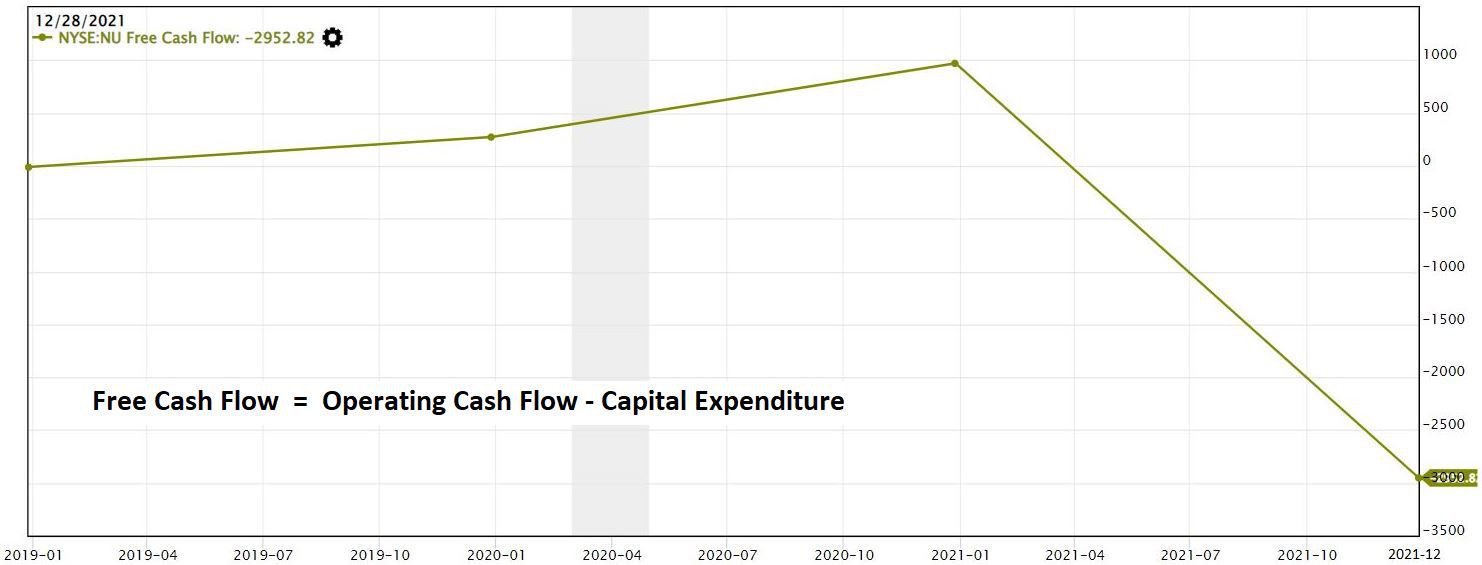

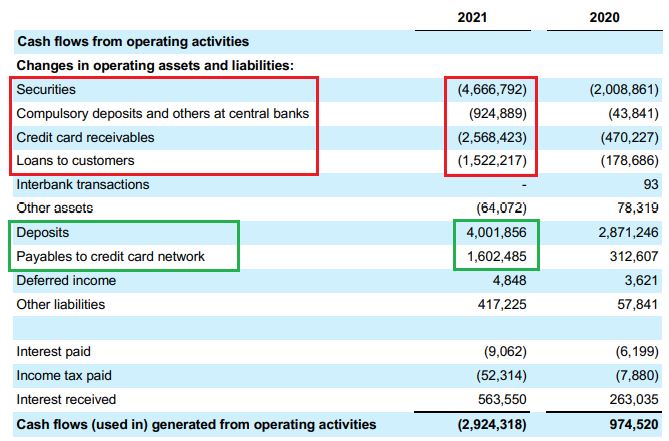

For the cash flow, there was a big drop in 2021 for both operating cash flow and free cash flow, from USD 974.5 million to USD 2.9 billion (-200.1%).

This was because there was a huge portion of cash has been paid to Securities (-132.2%), compulsory deposits and others at central banks (-2009.6%), credit card receivables (-446.2%) and loans to customers (-751.9%).

However, they have also increased their cash position in deposits from customers (+39.4%) and payable to credit card network (+412.6%). This is a good sign that more customers are using their platform for financial services, such as savings accounts and credit card payments.

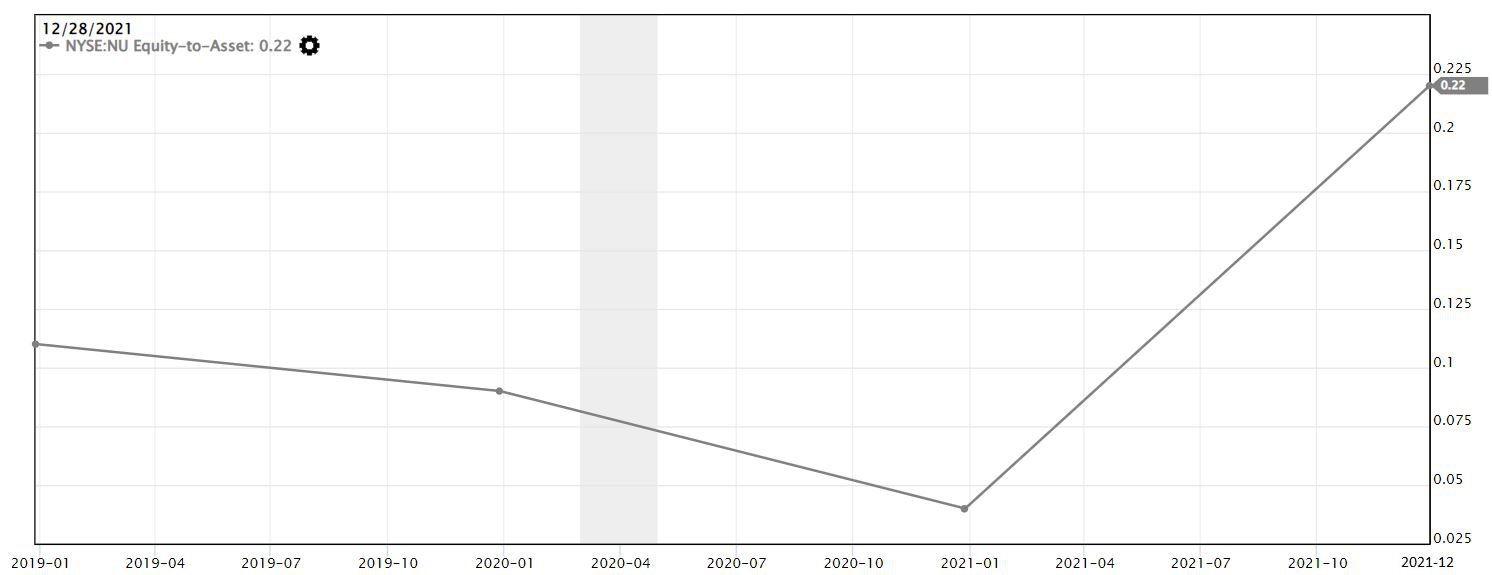

Equity-to-asset ratio is used to determine the percentage of a company’s assets that are owned by investors. A good and healthy company should have equity/asset ratio > 0.1.

From the formula shown above, the lower the liability, the higher the equity-to-asset ratio. Hence, this implies that a larger percentage of assets are owned by the investors and not leveraged.

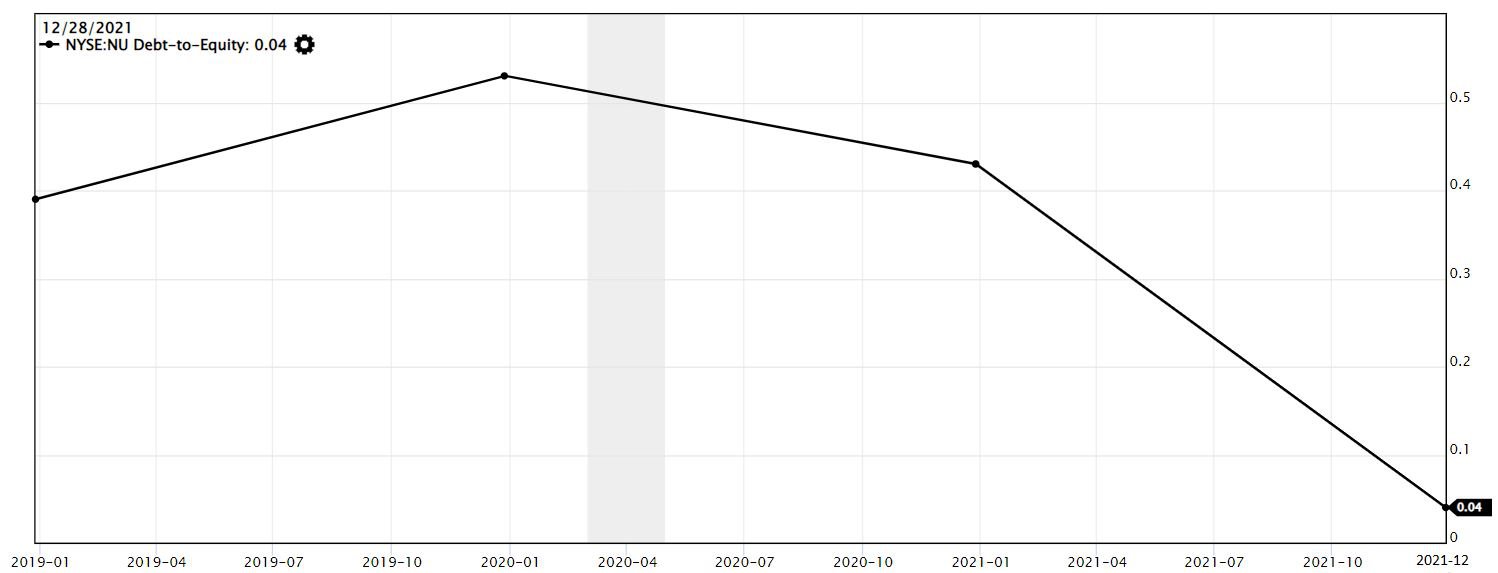

From the chart, Nubank has increased its equity/asset ratio from 0.04 (2020) to 0.22 (2021). When we compare to debt-to-equity ratio, the ratio that is lesser than 0.5 the better. This means that for every $100 of capital or equity, the company can borrow up to less than $50.

The chart shows that Nubank’s management is able to reduce the debt to 0.04 in Dec 2021 from the high of 0.53 in Jan 2020.

POTENTIAL RISKS

In emerging markets, such as Latin America, there are lots of people who do not have access to banking services and the existence of neobanks help fill the gap.

In Europe and the U.S., they’re trying to challenge existing incumbent banks where more than half of the population in the region has access to financial services. But due to their short operating history (they only started to emerge after the 2007-2009 financial crisis), it has not been proven that the neobanks can hold up during an economic downturn.

As some of the neobanks do not have banking licenses, one will need to check if there is any deposit insurance available for those neobanks in order to protect their hard-earned money from being wiped out in the event of a bank run or financial crisis.

Currently, most of the neobanks has not yet turned a profit and they’ve been reporting losses for years as they are investing aggressively on marketing and advertising to grow their customer base. Their strategy to grow the company is to get the company as big as possible in the shortest time in order to push out the competitors, the get-big-fast (GBF) strategy that is commonly used among unicorn start-ups.

CONCLUSION

Nubank has been growing strongly in terms of revenues and customer base each year. In addition, there is a reduction in the net income losses.

Nevertheless, conservative investors might be better off waiting to monitor Nubank’s performance in the coming quarters as any potential hidden risks might only surface after the passage of time.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.