Introduction

Semiconductor stocks like Nvidia have been leading news headlines this year. A global shortage in semiconductor chips has been wreaking havoc on the tech sector, automotive industry, consumer electronics industry, and others due to massive supply chain hiccups caused by the pandemic. This has in turn hurt production across several industries like cars, appliances, smartphones, personal computers, etc. The trade war between the United States and China has only served to make a bad situation worse.

(In fact, I experienced this firsthand because I recently broke my laptop and when I went to purchase a new one, I was told that the store does not have any inventory and I had to place an order online with an estimated delivery of 1 month out.)

Some experts expect the supply chain glitches to continue in 2022.

Even though this chip shortage has been a nightmare for manufacturers of cars, appliances etc. and the people who buy them, semiconductor stocks, and their investors are making merry.

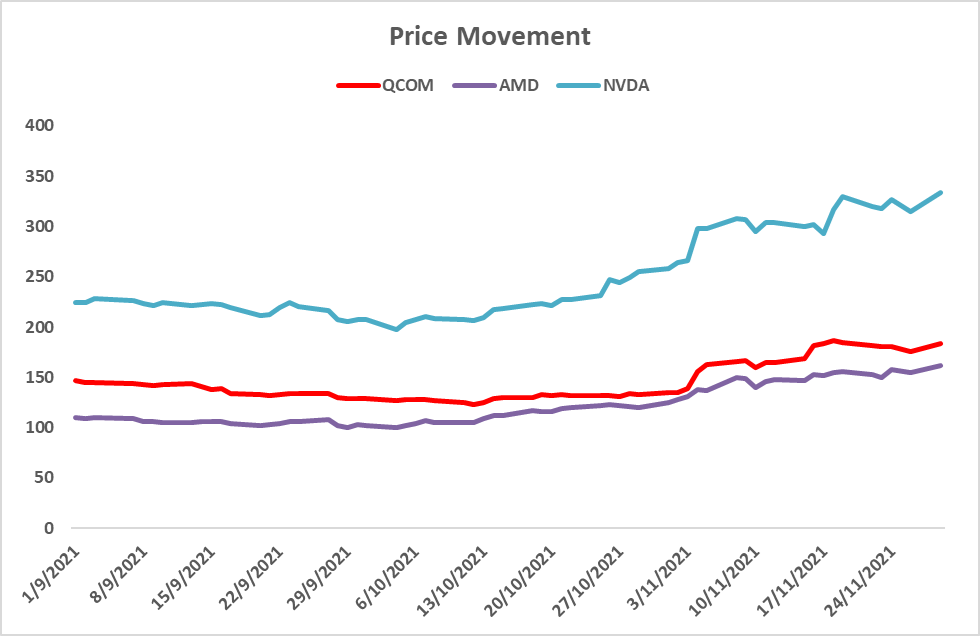

For example, in the last 3 months, Qualcomm Inc (NASDAQ:QCOM) has gained 25%, Advanced Micro Devices Inc. (NASDAQ:AMD) is up 47% and Nvidia Corp (NASDAQ:NVDA) has risen 48%.

Sustainable revenue growth, long term opportunities in games, EV, the metaverse etc., rich gross margins and strong balance sheets have been some of the key growth drivers for the chip companies. We will be taking a deeper look at one of these graphics chip companies – NVIDIA.

Company Overview

Nvidia was founded in 1993 by three American computer scientists, Jen-Hsun Huang, Curtis Priem, and Christopher Malachowsky. It is currently headquartered in Santa Clara, California.

NVIDIA is a GPU design company following a platform strategy, where together with its chips, the company provides the software toolkit to accelerate the performance of AI/ML applications built on top of its chips. So, it is not just a chip company. It has much more to offer which makes it different from its peers.

NVIDIA’s key focus is on design, development, testing, and manufacturing support for its GPUs.

Recently, Nvidia accelerated its investments and product development toward AI and cloud computing with the acquisition of Mellanox and the initiated acquisition of Arm.

NVIDIA Business Segments

- Graphics

- GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms

- Quadro/NVIDIA RTX GPUs for enterprise workstation graphics

- vGPU software for cloud-based visual and virtual computing

- Automotive platforms for infotainment systems

- Compute & Networking

- Data Centre platforms and systems for AI, HPC, and accelerated computing

- Mellanox networking and interconnect solutions

- Automotive AI Cockpit, autonomous driving development agreements, and autonomous vehicle solutions

- Jetson for robotics and other embedded platforms

- Major provider for Amazon AWS, Google Cloud, Microsoft Azure

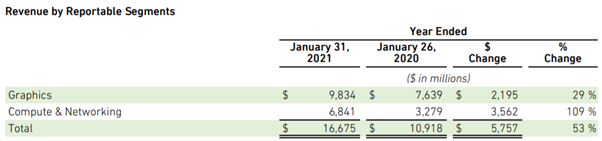

The revenue from graphics segment increased by 29% to $9,834 million in fiscal year 2021 as compared to 2020 mainly due to growth in GeForce GPUs and game console SOCs. The revenue from compute & networking grew 109% during the same period to $6,841 million. This was mainly due to the addition of Mellanox acquired on April 27, 2020 as well as growth of NVIDIA Ampere GPU architecture systems and new products.

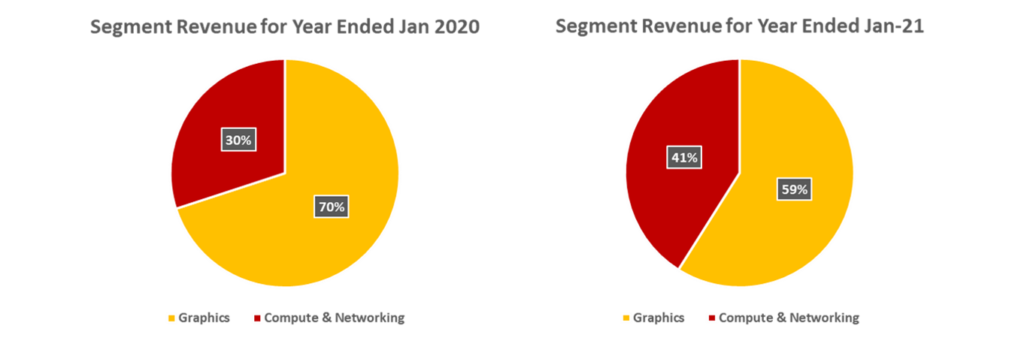

The graphics segment constitutes 59% of the revenue in Fiscal year 2021 which is down from 70% in 2020. The compute & networking segment has gained revenue share by rising from 30% in 2020 to 41% in 2021.

Market Platforms

Nvidia focusses on 4 key platforms:

- Gaming

- Data center

- Professional Visualization

- Automotive

Gaming

Computer gaming is the largest entertainment industry. Growth drivers for this segment are:

- New high production value games and franchises

- Continued rise of competitive gaming or eSports

- Social connectivity and demand for more content from game streamers, modders and creators

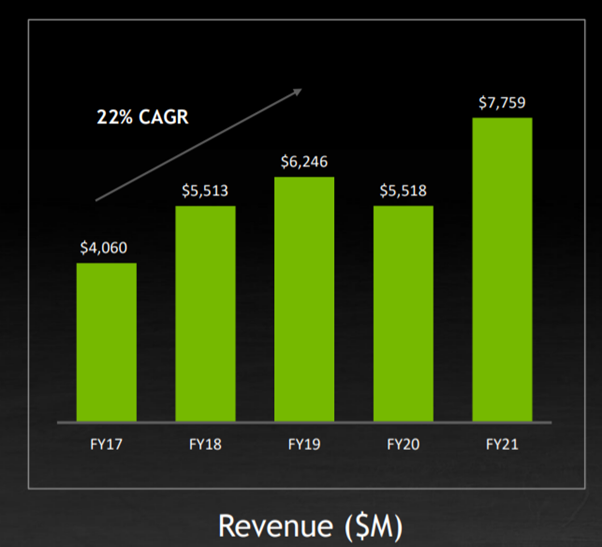

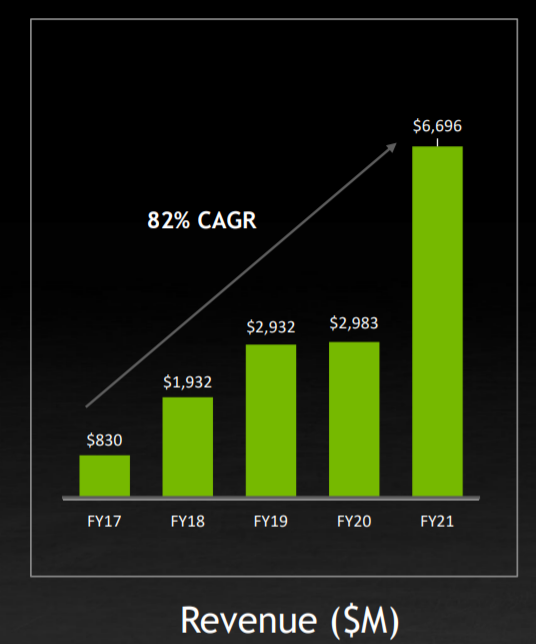

Figure 1- Gaming

This segment has been growing at a 5 year CAGR of 22%. Nvidia’s gaming platform uses the Nvidia GPUs and sophisticated software to enhance the gaming experience with smoother, higher quality graphics.

Nvidia products for the gaming market include GeForce RTX and GeForce GTX GPUs for PC gaming, SHIELD devices for gaming and streaming, GeForce NOW for cloud-based gaming, as well as platforms and development services for specialized console gaming devices.

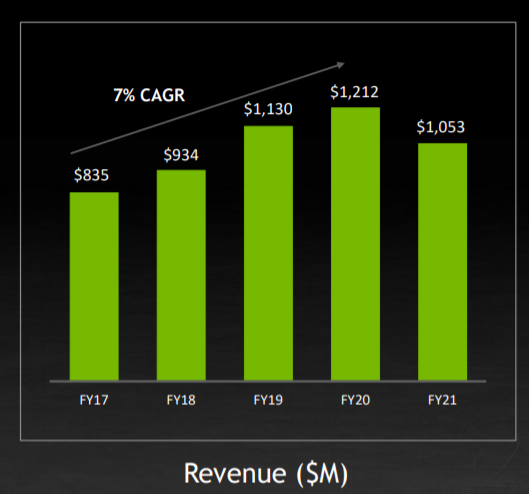

Professional Visualization

Nvidia serves the Professional Visualization market by working closely with independent software vendors to optimize their offerings for NVIDIA GPUs. Nvidia professional visualisation platforms are used in major industries like automotive, media and entertainment, architectural engineering, oil and gas, and medical imaging. They are also critical enablers in many fields, such as design and manufacturing and digital content creation including computer-aided design, architectural design, consumer products manufacturing, medical instrumentation, and aerospace.

Some examples are:

- The platform enables an architect designing a building with a computer-aided design package to interact with the model in real time, view it in greater detail, and generate photorealistic renderings for the client.

- It also allows an automotive designer to create a highly realistic 3D image of a car, which can be viewed from all angles, reducing reliance on costly, time-consuming full-scale clay models.

- It helps in professional video editing and post-production, special effects for films, and broadcast-television graphics.

- The platform makes it possible to render film-quality, photorealistic objects and environments with physically accurate shadows, reflections and refractions using ray tracing in real-time.

This segment has been growing at a 5 year CAGR of 7%.

Date Center

The NVIDIA computing platform consists of NVIDIA energy efficient GPUs, interconnects, and systems, the CUDA programming model, and a growing body of software libraries, Software Development Kits (SDKs), application frameworks and services. In the field of AI, NVIDIA’s platform accelerates both deep learning and machine learning workloads. The NVIDIA accelerated computing platform greatly increases the performance and power efficiency of high-performance computers and data centers.

Figure 3- Data Center

This segment has been growing at a 5-year CAGR of 82%. This platform helps in a multitude of industries, from automating tasks such as reading medical images, to enabling fraud detection in financial services, to optimizing oil exploration and drilling.

The company has partnered with industry leaders such as IBM, Microsoft, Oracle, SAP, and VMware to bring AI to enterprise users. These organizations include the world’s leading consumer internet and cloud services companies, which are using AI for critical tasks, enterprises that are increasingly turning to AI to improve products and services; and startups seeking to implement AI in transformative ways across multiple industries.

The Nvidia GPUs are the foundation of the accelerated computing platform and are available in industry standard servers from every major computer maker worldwide, including Cisco, Dell, HP, Inspur, and Lenovo; from every major cloud service provider such as Alicloud, Amazon Web Services, Baidu Cloud, Google Cloud, IBM Cloud, Microsoft Azure, and Oracle Cloud; as well as in our DGX AI supercomputer, a purpose-built system for deep learning and GPU accelerated applications.

NVIDIA follows a platform strategy, meaning that the hardware and software come together to offer a set of services and tools to enhance the ability of its GPUs. Its chips coupled with NVIDIA programming models (like CUDA and its acceleration libraries, APIs and tools) makes the NVIDIA offering compelling for enterprise customers.

Automotive

NVIDIA’s Automotive market is comprised of cockpit infotainment solutions, Autonomous Vehicle (AV) platforms, and associated development agreements. NVIDIA provides high-performance, energy efficient hardware (DRIVE AGX) and software for the vehicles including solutions for autonomous driving (DRIVE AV) and AI assistants (DRIVE IX).

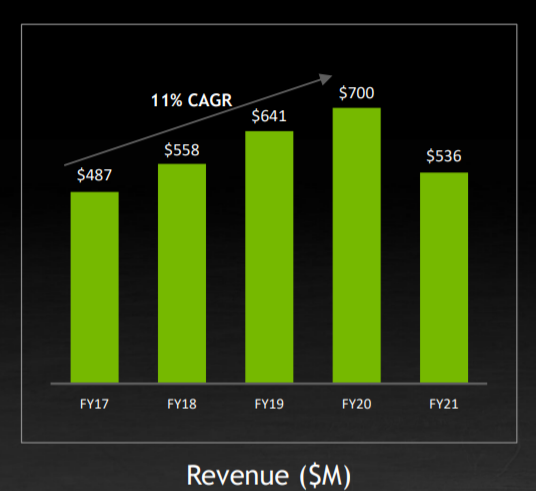

Figure 4- Auto

NVIDIA has demonstrated multiple applications of AI within the car: AI can drive the car itself as a pilot in fully autonomous mode or it can also be a co-pilot, assisting the human driver while creating a safer driving experience.

NVIDIA is working with several hundred partners in the automotive ecosystem including automakers, truck makers, tier-one suppliers, sensor manufacturers, automotive research institutions, HD mapping companies, and start-ups to develop and deploy AI systems for self-driving vehicles.

NVIDIA provides complete end to end solutions for the AV market under the DRIVE brand. NVIDIA DRIVE can perceive and understand in real-time what is happening around the vehicle, precisely locate itself on an HD map, and plan a safe path forward.

In addition, Nvidia offers a scalable data center-based simulation solution called NVIDIA DRIVE Constellation. This simulation allows testing and validating a self-driving platform before commercial deployment. The Automotive segment has been growing at a 5-year CAGR of 11%.

Omniverse Enterprise

NVIDIA Omniverse, the multi-media 3D collaboration platform that enables companies to collaborate in a metaverse using physically accurate “digital twins” of the product being developed or problem being simulated. It could be a car, a factory, the planet Earth, or a new Hollywood blockbuster.

Omniverse enables engineers and designers to build physically accurate digital twins of buildings and products, or create massive, true-to-reality simulation environments for training robots or autonomous vehicles before they’re deployed in the physical world.

Omniverse Enterprise, previously in beta, is now available from global system vendors, starting at just $9K per year.

Since its open beta launch in December, Omniverse has been downloaded by more than 70,000 individual creators. It’s also being used by professionals at over 700 companies, including BMW Group, CannonDesign, Epigraph, Ericsson, architectural firms HKS and KPF, Lockheed Martin and Sony Pictures Animation. In the emerging market for the metaverse, NVIDIA is unquestionably the leader.

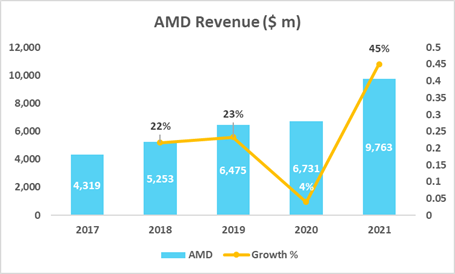

Competitors

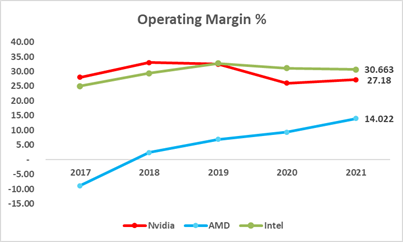

AMD and Intel are the 2 main competitors for Nvidia.

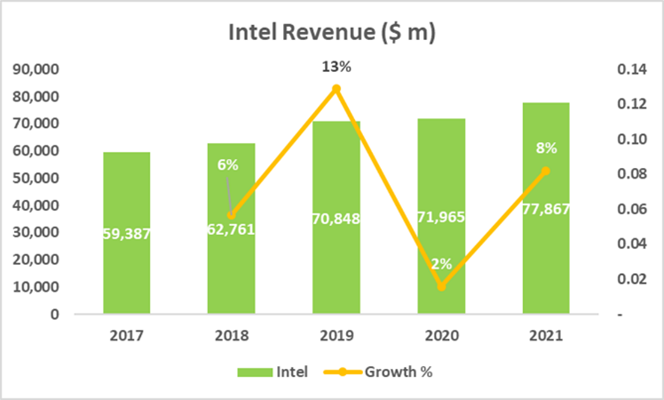

The revenue of Intel has not shown considerable growth even though it has the highest revenues amongst the 3 peers. The 5-year CAGR of NVIDIA is the highest (25%), followed by AMD (23%) and Intel (7%).

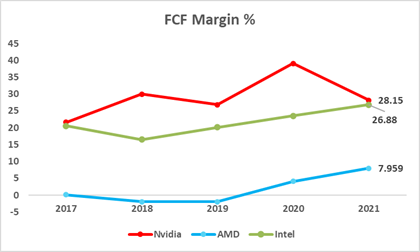

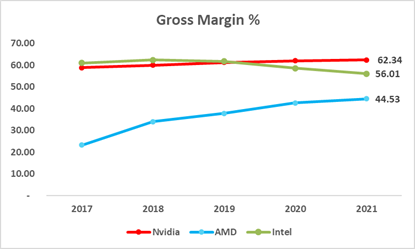

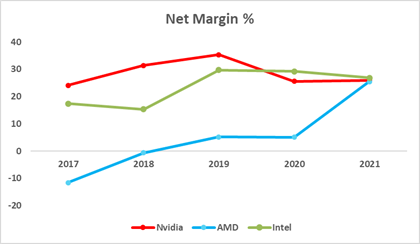

Comparing margins of the 3 companies, we find that NVIDIA leads the group in FCF Margins (28%) and Gross Margin (62%). The net margins of the all 3 companies are in the same range (25%-26%). Intel leads the pack in Operating Margin at 30% followed by NVIDIA (27%) and AMD (14%).

Covid-19 Impact

- Gaming and Data Center market platforms have benefited from stronger demand as people continue to work, learn, and play from home.

- In Professional Visualization, mobile workstations continue to benefit from work-from-home trends, and desktop workstation demand which was suppressed due to covid, has started to recover, although not back to pre-COVID levels.

- In Automotive, COVID is no longer having a significant impact on demand.

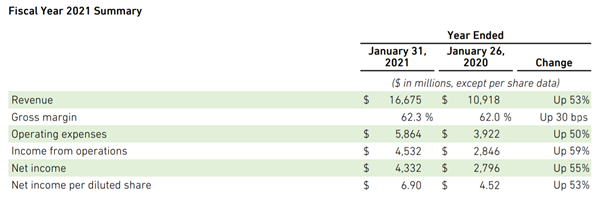

Overview of Financials

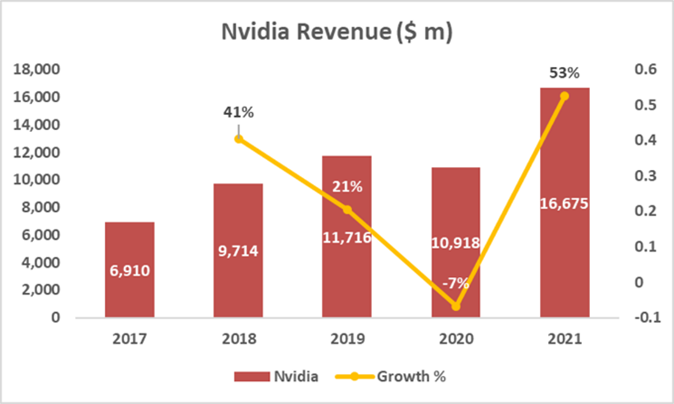

Revenue for FY 2021 was $16.68 billion which is 53% higher than last year.

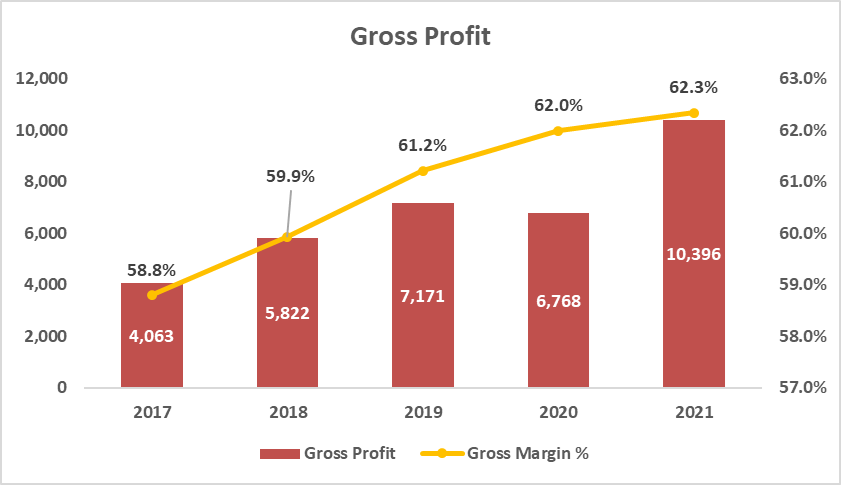

Gross margin for fiscal year 2021 was up 30 basis points from a year ago, mainly driven by a better product mix with higher Data Center and lower Automotive revenue, partially offset by Mellanox acquisition-related charges.

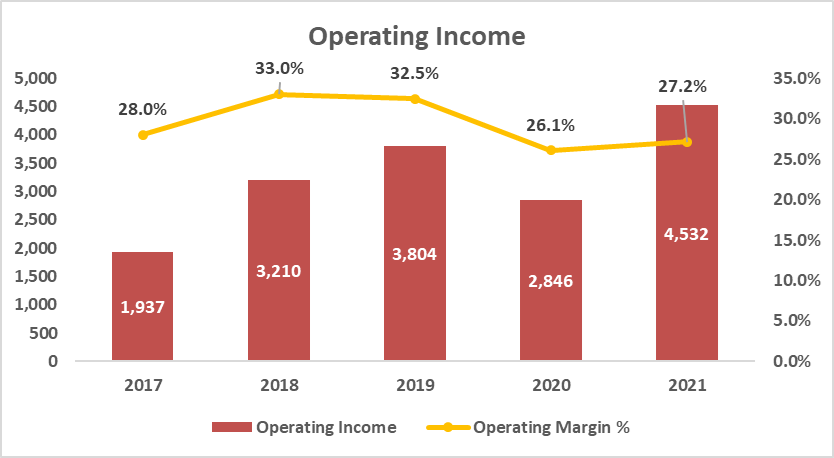

The increase in operating expenses was due to inclusion of Mellanox in the second quarter of fiscal year 2021, employee additions and increases in employee compensation and related expenses.

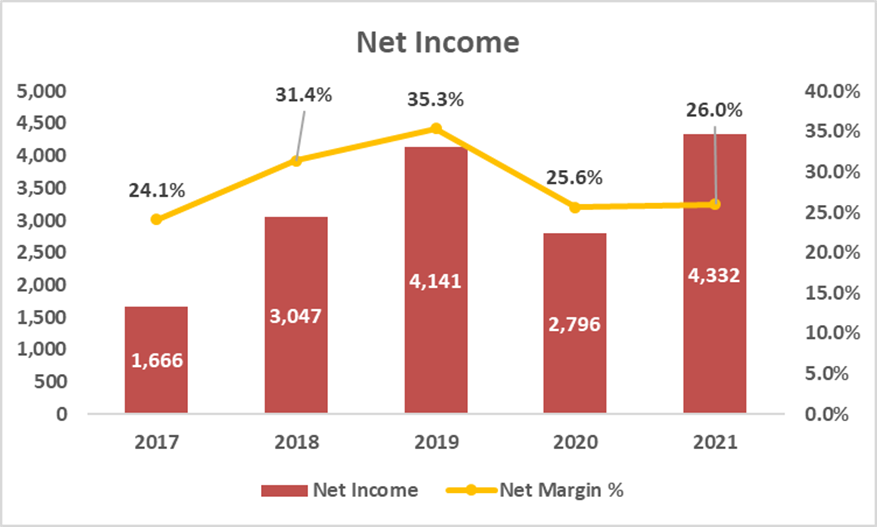

The net income for FY 2021 was $4.33 billion which is 55% higher than the previous year.

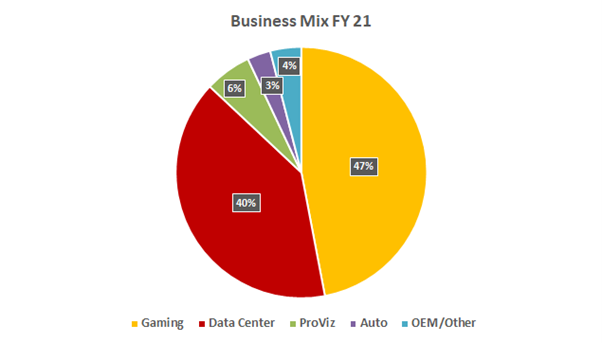

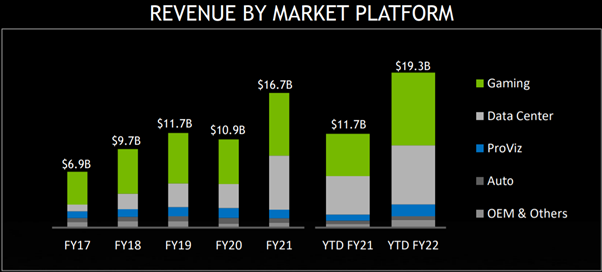

Revenue By Market Platform

Gaming is the leading source of revenue by market platform constituting 47% of the FY21 revenues, followed by Data Center with 40% of revenues.

Figure 5: Source – Company Presentation

- From a market-platform perspective, Gaming revenue was up 41% from a year ago, reflecting higher sales across desktop and laptop GPUs for gaming, and game-console SOCs. GPUs for gaming benefited from the ramp of the GeForce RTX 30 Series based on the NVIDIA Ampere architecture.

- Professional Visualization revenue was down 13% from a year ago due to lower sales of GPUs for desktop workstations as enterprise demand was impacted by COVID.

- Data Center revenue was up 124% from a year ago. Revenue growth was driven by the Mellanox acquisition and the ramp of the NVIDIA Ampere GPU architecture. In fiscal year 2021, Mellanox revenue contributed 10% of total company revenue.

- Automotive revenue was down 23% from a year earlier, reflecting lower revenue from the expected ramp down of legacy infotainment modules and autonomous driving development agreements, partially offset by increases in AI cockpit and autonomous vehicle solutions.

- OEM and Other revenue was up 25% from a year ago, primarily due to higher volume of entry-level laptop GPUs.

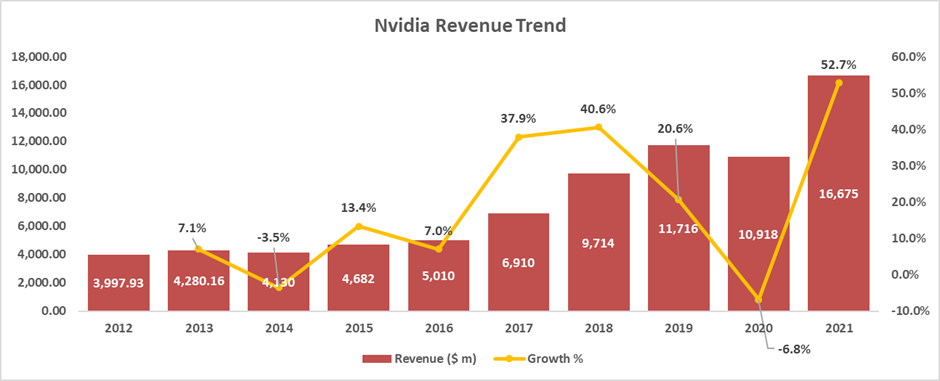

Performance Trends

The revenue growth was choppy in 2019 & 2020 (COVID) but has picked up in 2021. The 10-year CAGR is 17% & the 5-year CAGR is 25%. Although the company had a choppy start in terms of growth, the 5-year CAGR indicates that the company revenue is expanding at a healthy rate.

Figure 6: Figures in $m

The gross profit has been rising consistently except for the FY 2020 which was due to the pandemic. The gross margins have increased from 58.8% in 2017 to 62.3% in 2021.

Figure 7: Figures in $m

The same trend can be seen for operating income as well as net income. Except for the pandemic year FY 2020, the operating income and margins have been on a rising trend, showing healthy growth.

Figure 8: Figures in $m

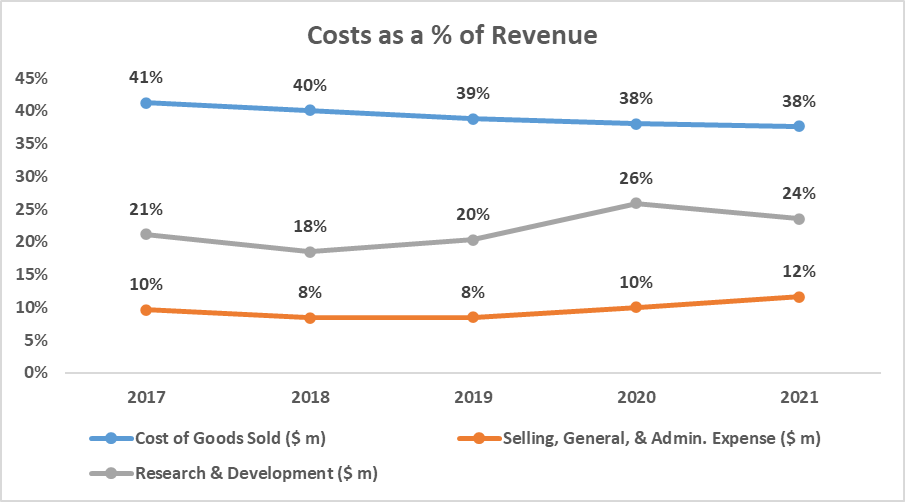

Costs as % of Revenue

Costs of goods sold as a % of revenue have declined over the years which shows that the company has been able to conduct operations with efficiency in costs. R&D expenses have remained stable, rising slightly in FY 2020 & FY 2021. Selling expenses have remained stable over the years with no major reductions.

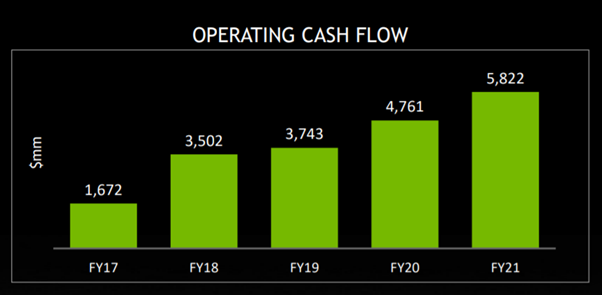

Liquidity and Cash Flow

The operating cash flow (OCF) is a measure of the amount of cash generated by the normal business operations of a company. NVIDIA’s operating cash flows seem healthy and rising which indicates that the company can generate sufficient positive cash flow to maintain and grow its operations going forward.

Figure 9: Figures in $m

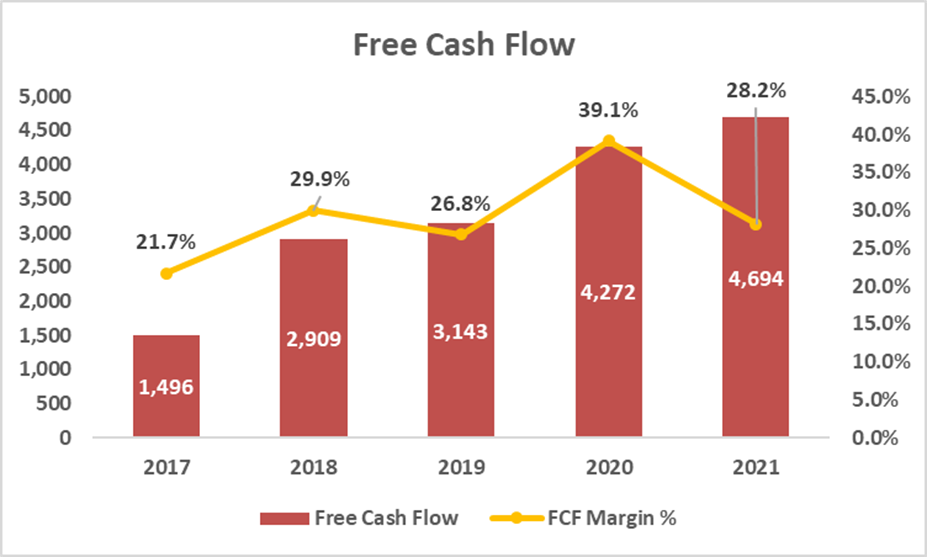

Free cash flow is defined as the cash generated from operations minus the capital expenditures. The FCF has been positive and rising since the last 5 years which is a sign of healthy operations.

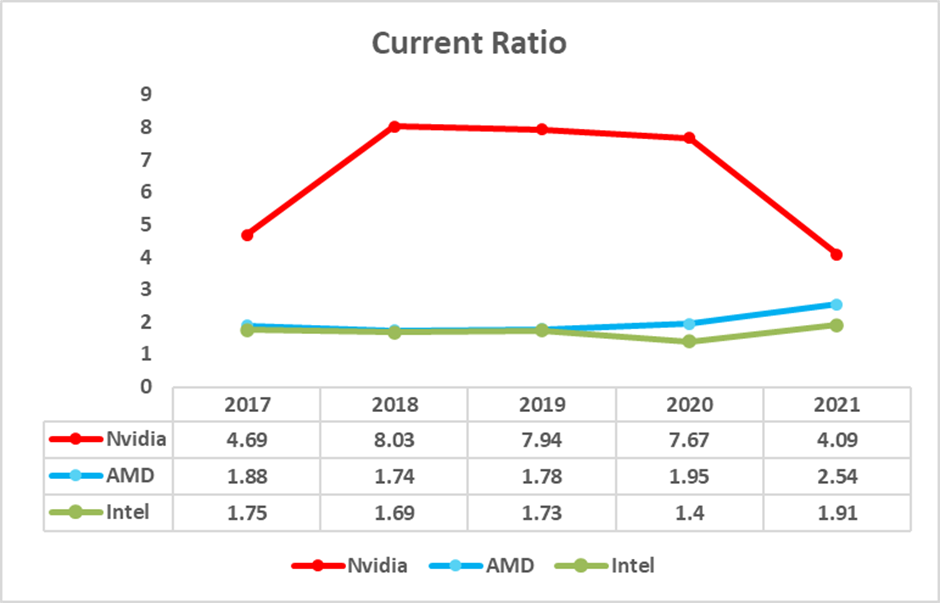

Ratio

Current ratio is liquidity ratio that measures a company’s ability to pay short-term obligations or those due within one year. NVIDIA has a healthy current ratio, higher than its peers.

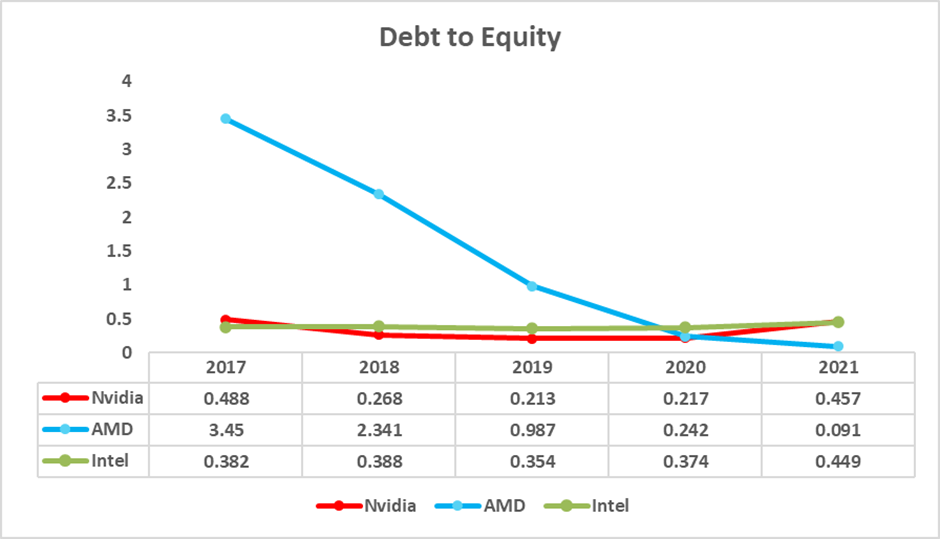

Debt to Equity ratio is a measure of the degree to which a company is financing its operations through debt versus wholly owned funds. NVIDIA’s D/E ratio is below 0.5 which is a healthy sign.

Results Update

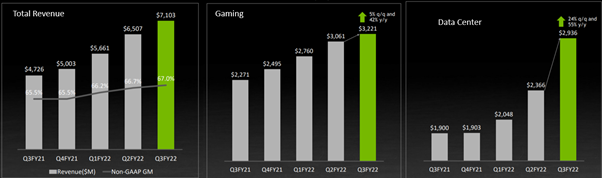

Nvidia recently reported the third-quarter results, and it did not disappoint. The company beat earnings expectations for another quarter with earnings per share of $1.17 and revenue at $7.1 billion.

- Nvidia’s earnings have increased 60% year over year

- Total revenue up 50% y/y to $7.10B

- Gaming up 42% y/y to a record $3.22B; Data Center up 55% y/y to a record $2.94B

The demand for artificial intelligence chips (AI) is on the rise and this led to the growth of its data center revenue by 55%. Nvidia witnessed a record quarter as demand was strong across desktop and notebooks. Laptop GPUs also posted strong y/y growth.

Conclusion

The fundamentals of Nvidia seem as strong as ever. The core business segments are showing accelerated growth. NVIDIA is not just a chip company. What makes Nvidia different is its presence across different industries and sectors – auto, electric vehicles, crypto, AI and most recently, the metaverse where it offers software, avatars, and language models. The company has been consistently innovating, expanding and investing in newer segments and it is open to inorganic growth as well.

However, the conservative investor may argue that the stock trades at a rich multiple. On the other hand, growth investors who believe in the long-term potential of the tech space may think otherwise.

In my opinion, this stock is worthy of being in your portfolio, but the timing may not be right. It is best to stay on the fence to wait for the correct opportunity to build a position gradually in this phenomenal stock.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.