When Palantir released news that their first-quarter earnings beat analysts’ estimates, their share price soared as much as 28% in extended trading Monday.

To keep up with the excitement, CEO Alex Karp predicts the company will remain profitable “each quarter through the end of the year”.

How true will this statement be?

In this blog article, we will thoroughly examine this AI company, which has garnered significant attention over its AI potential, to determine if the CEO’s claim of sustained profitability throughout the year holds true.

We have covered this topic in our YouTube Channel’s Deep Dive Series. Click on the video below to watch!

WHAT LED TO PALANTIR'S Q1 PROFITABILITY?

One of the main reasons for the phenomenal Q1 result was due to more deals being closed in that quarter.

- In Q4 2022, Palantir closed 55 deals that were worth at least $1 million. Among the 55 deals:

- 11 of which were at least $5 million.

- 5 of which were at least $10 million.

- The number of deals closed in Q1 2023 has increased to 64 deals (at least $1 million).

- 22 out of 64 deals were at least $5 million.

- 8 out of 64 deals were at least $10 million.

More deals were closed in Q1 2023 because more customers were adopting the Palantir software which can be set up and ready to use in days. If the companies were to develop their in-house software, it may take months and thus slow down the operation process.

In addition, Palantir’s software has also incorporated AI features, such as large language models or generative AI in their software solutions. This further helps to accelerate the data analysis and decision making for corporations.

Special Purpose Acquisition Company (SPAC) Investments

In addition, Palantir has also become a major SPAC investor where the company has participated in at least 8 SPAC-related transactions. Most of the companies that Palantir invested in are emerging businesses that should benefit from using Palantir’s big data analytics software.

The graphic below shows some of the SPACs that Palantir has invested in:

- Lilium – Electric-powered air taxis

- Pear Therapeutics – Prescription based digital therapies

- Wejo – Connected vehicle data

- Boxed.com – Online retailer (Costco-style)

Palantir invests in these innovative and emerging businesses by providing upfront capital, in exchange for a multi-year commitment to utilize Palantir’s software. The objective is to establish enduring business connections with promising, groundbreaking companies for the long term.

Nevertheless, the majority of these emerging businesses allocate substantial investments in their technology and have not yet demonstrated profitability. If these companies fail to generate sales, they may be inclined to terminate the deal, or worse, face bankruptcy and ultimately shut down operations.

Thus, this begs the question: “Is this strategy sustainable in the long term?”

Before making a decision to invest in the company, let’s gather more information about it, considering both qualitative and quantitative aspects.

PALANTIR'S QUALITATIVE ANALYSIS

Palantir Technologies is an American software company that specializes in developing big data analysis software. The company was founded in 2003 in Delaware, US and publicly listed in 2020, with the ticker symbol – PLTR.

Their software solutions enable clients to transform massive amounts of information into an integrated data asset that reflects their operations. This leads to optimized decision-making and streamlined operations.

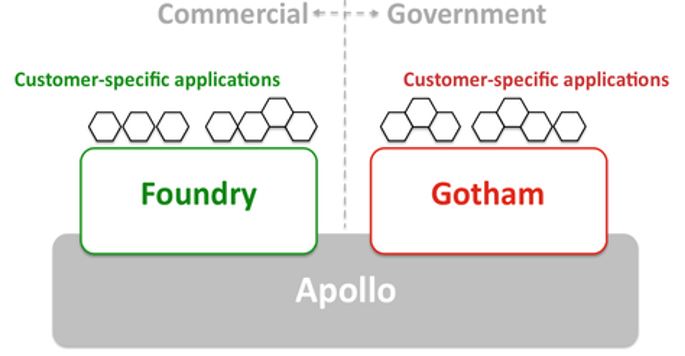

They currently offer 3 software platforms to their customer:

- Gotham

Gotham is an operating system for decision making where it is commonly used in counterterrorism investigations and defense operations, conducted by global defense agencies & intelligence communities.

Gotham software interface

Furthermore, it plays a crucial role in the finance industry by aiding in the detection and investigation of fraudulent transactions.

Given the extensive data involved in these operations, analyzing it can be time-consuming for users. Hence, this operating system serves to expedite decision-making processes by uncovering concealed patterns within datasets.

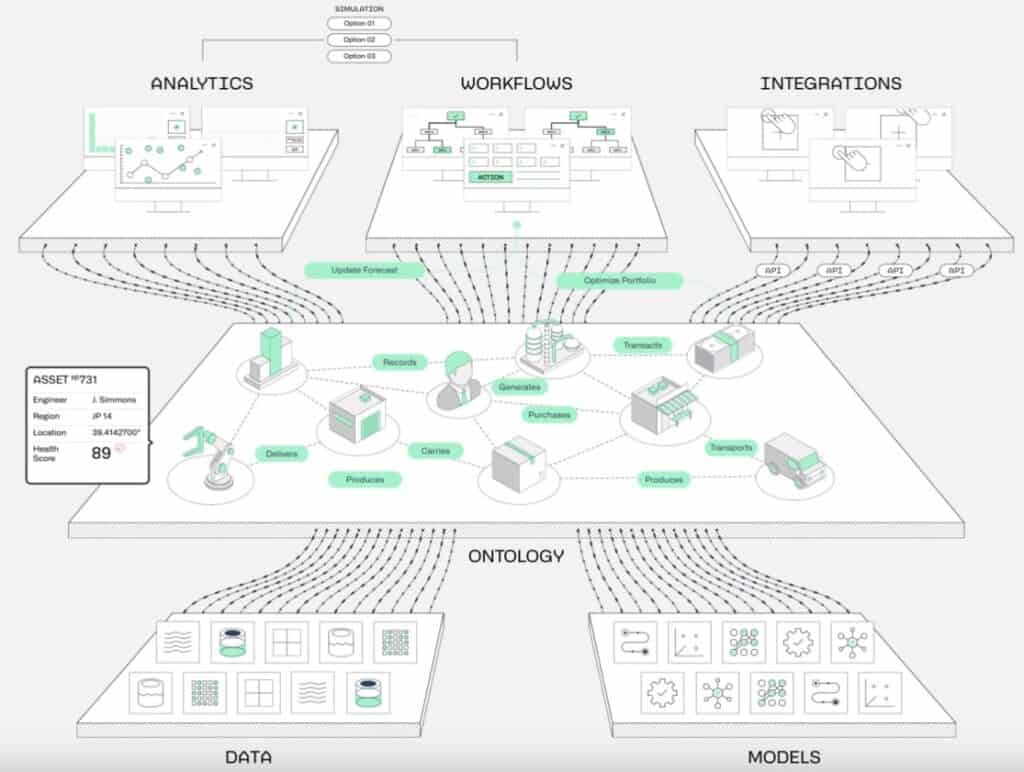

- Foundry

Foundry is designed to work with massive amounts of information, allowing companies to process and analyze data that would otherwise be challenging or time-consuming to handle.

As the platform is ontology-powered, it simplifies the process of managing, analyzing and deriving insights from the data. This allows users to analyze large & complex datasets within a short period of time.

Ontology is a way of organizing knowledge and providing a shared understanding of a domain for both humans and machines.

- Apollo

Apollo is the data integration and management platform where it connects and organizes information from different systems, like the central hub for various data sources. This allows the organization to gain a holistic view of their data and derive valuable insights from the data gathered.

This software also acts as a cloud platform that ensures rapid, secure delivery of software, updates and platform configurations.

BUSINESS SEGMENTS

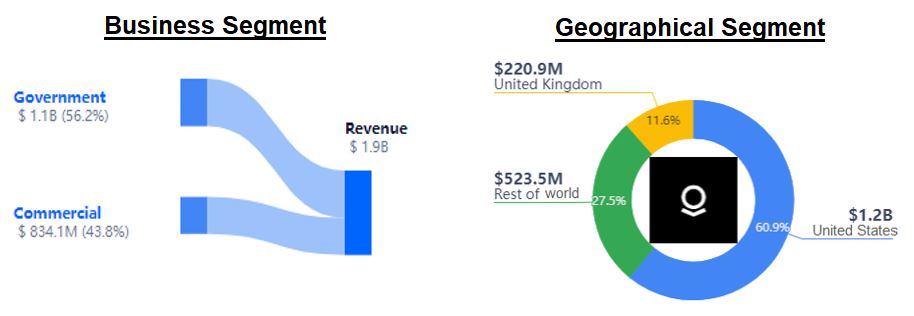

Palantir reports their operations into two main business segments: Government & Commercial.

Government: Primarily serves customers that are U.S. government and non-U.S. government agencies.

Commercial: Primarily serves customers working in commercial enterprises or non-government industries.

FUTURE OUTLOOK

Looking ahead, the future outlook for Palantir appears promising as the company continues to expand its offerings and diversify its customer base.

In this section, we will delve into the potential growth opportunities, emerging trends, and strategic initiatives that are shaping Palantir’s future trajectory.

AI PLATFORM

Palantir is now in the process of developing and releasing their newest offering – the Artificial Intelligence Platform (AIP).

AIP enables both commercial and government sectors to harness the capabilities of large language models (LLM) in a secure and protected manner.

By leveraging LLM, organizations can seamlessly integrate their data and processes, enabling decision-making through text input instead of coding. This streamlined approach accelerates overall enterprise operations and enhances efficiency.

EXPANSION IN COMMERCIAL SECTORS

Initially, Palantir predominantly served the Government sector as its primary customer base. However, in recent years, the company has undertaken a vigorous expansion strategy to broaden its clientele in the commercial sector.

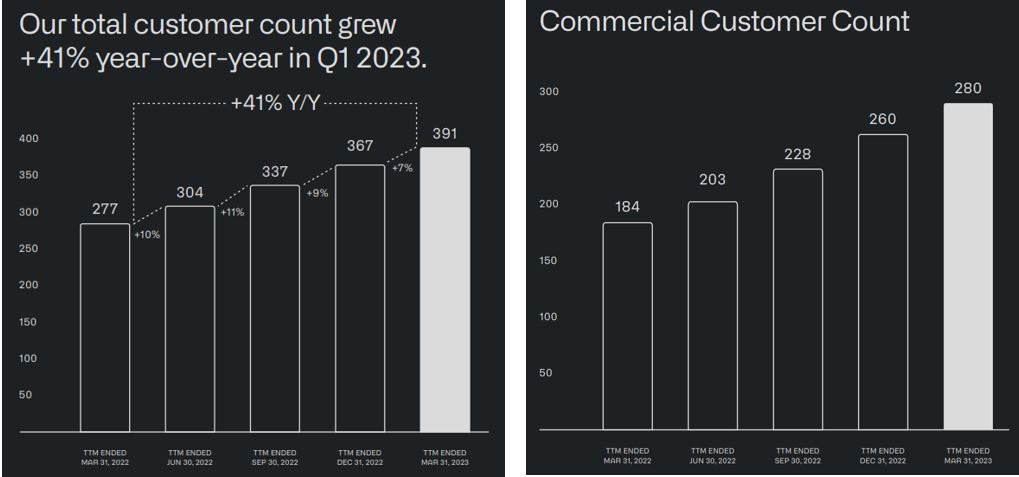

Since Q1 2022, their total customer count has grown 41% year-over-year till Q1 2023. Moreover, their commercial customer count also grew from 184 (Q1 2022) to 280 (Q1 2023).

Currently, their software solutions are used in more than 60 industries worldwide, that includes aerospace for aircraft production, healthcare organizations, manufacturing and many more.

List of Offerings

FUTURE S&P 500 COMPANY?

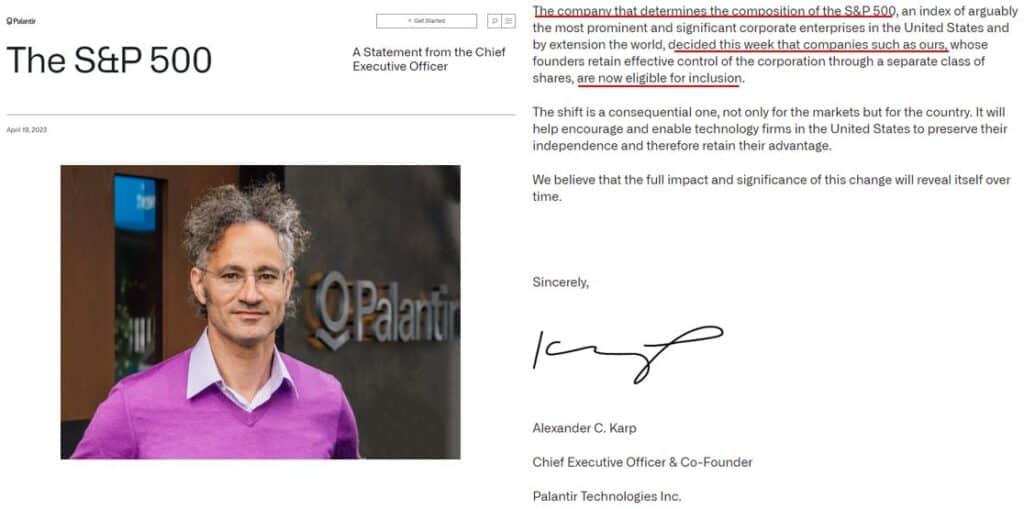

With the recent news of Palantir being considered for inclusion in the S&P 500, individuals are contemplating whether Palantir is now a favorable stock to possess.

Letter from Palantir’s CEO on S&P 500 inclusion

The S&P 500 is a widely recognized stock market index that tracks the performance of 500 large publicly traded companies in the United States. Inclusion in the index is often seen as a positive indicator of a company’s overall strength and attracts more attention from both individual and institutional investors.

Being considered for inclusion in the S&P 500 can be seen as good news for Palantir because it gains increased visibility and credibility among investors, potentially leading to more demand for its stock.

However, there are also worries that the company might prioritize short-term profitability to please shareholders if Palantir were to be included into the index. This is because short-term profitability focuses on generating immediate financial gains, often by cutting costs or implementing strategies that yield quick results.

The company might make decisions that sacrifice investments in research and development, innovation, employee training, or infrastructure improvements. This might potentially divert attention from their long-term goals of company growth and development to stay ahead of the competition.

Hence, striking a balance between short-term profitability and long-term growth is crucial for sustainable success and maintaining a competitive edge in the market.

QUANTITATIVE ANALYSIS

REVENUE GENERATION

In FY 2022, Palantir has generated a total of USD 1.9 billion where 53.2% of the revenue was generated from the Government segment. Commercial segment contributed 43.8% of the revenue.

In terms of geographical region, the United States generated USD 1.2 billion, which is about 63.2% of the revenue, followed by Rest of the World (27.6%) and the United Kingdom (9.2%).

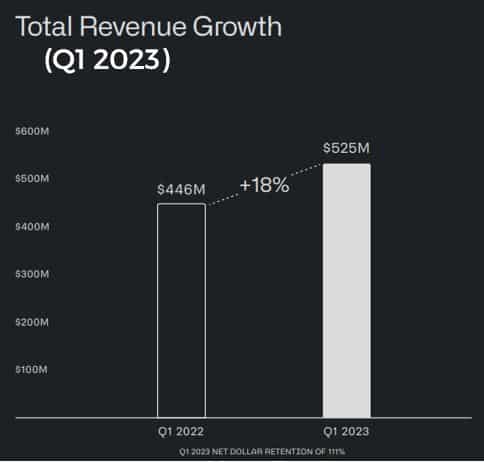

With their latest Q1 2023 just freshly released, we also observed that there was an 18% increment from the past Q1 2022 (USD 446 million) to Q1 2023 (USD 525 million).

Compared to the past quarter (Q4 2022), Palantir’s revenue growth increased about 3.1%.

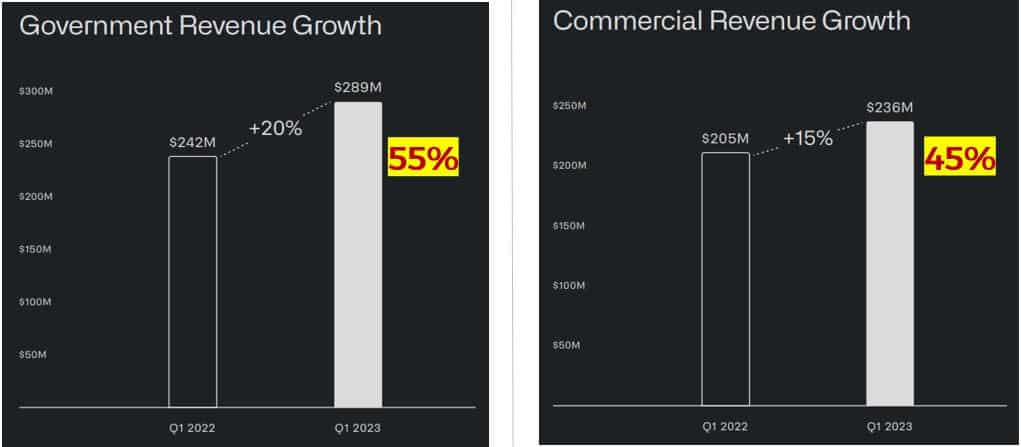

55% of this total revenue growth was contributed by the Government segment, whereas Commercial segment’s revenue contributed 45% in Q1 2023.

Although both of these segments witnessed an increase in revenue from Q1 2022 to Q1 2023, they exhibited contrasting growth rates during the period from Q4 2022 to Q1 2023.

Despite a minor decline in revenue growth within the Government segment, this may not be a negative indicator. This could be a sign that the company is actively diversifying its software offerings to target a broader range of commercial enterprises, aiming to reduce its dependence on the government.

On the other hand, the Commercial segment demonstrated a notable 9.5% increase from the previous quarter to the most recent quarter. We will further explore this in the Future Outlook segment!

Besides revenue generation, we have also done a deep dive analysis on the company’s other financial fundamentals such as EPS, cash flow and debt ratio!

Watch the quantitative analysis on our YouTube Channel!

CONCLUSION

In conclusion, Palantir has emerged as a prominent player in the field of data analysis and software solutions, especially with their development of AIP. This propels Palantir to be ranked no.1 in worldwide artificial intelligence software study in market share and revenue, according to research done by International Data Corporation (IDC).

With a promising future outlook and development in their software offerings, Palantir is poised to capitalize on growth opportunities and shape the landscape of data-driven decision-making in both commercial and government sectors.

Besides Palantir, if you have always wanted to learn how to invest and grow your money by evaluating other potential companies, join us in our upcoming Masterclass where you will learn from Cayden how to generate 3 sources of income even though you have no knowledge of investing!

Click on the banner below to find out more!

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.