INTRODUCTION

Palantir Technologies (PLTR) is a data analytics software company. It was founded in 2003, by Peter Thiel and cofounders Stephen Cohen, Gary Tan, Nathan Gettings, Joe Lonsdale and Alex Karp. The company started building software for the intelligence community in the United States to assist in counterterrorism investigations and operations. They later began working with commercial enterprises.

PayPal Co-Founders Peter Thiel & Elon Musk

The company is named after an all-seeing stone in The Lord of the Rings called “Palantiri”. It brands itself as providing similarly ominous powers of surveillance to its clients which mainly include national security, defense, and law enforcement agencies.

The all-seeing stone from LOTR

Palantir Technologies is headquartered in Denver, Colorado. It is known for its secrecy and it is quite difficult to ascertain which governments or companies it works with. It recently began trading publicly on September 30, 2020.

PRODUCTS OF PALANTIR TECHNOLOGIES

Palantir Technologies has 2 primary products:

- Gotham

- Foundry

These software products help government agencies as well as enterprises manage their data efficiently and facilitate informed decision-making.

Gotham

Gotham enables users to identify patterns hidden deep within datasets. These include signals from intelligence sources to reports from confidential informants, and helps U.S. and allied military personnel find what they are looking for. Gotham’s use has now extended beyond intelligence analysis into defense operations and mission planning

Foundry

Companies routinely struggle to make sense of the data involved in large projects. Foundry was built for them. The platform transforms the ways in which organizations interact with information by creating a central operating system for their data. Foundry is becoming the central operating system not only for individual institutions but for entire industries.

Gotham and Foundry enable institutions to transform massive amounts of information into an integrated data asset that reflects their operations. Users can build on top of this asset to make data accessible and actionable. The platforms enable people to work with data, even if they have no coding knowledge whatsoever.

Palantir Technologies has invested heavily in developing Apollo, a continuous delivery and product infrastructure platform, which it uses to deliver software updates to customers and to run it’s software in any environment. The investments in their software platforms have yielded a significant decrease in the time of installation. For instance, the time required to install software and begin working with a customer has decreased more than five-fold from 2019 to 2020. In some cases, customers can now be up and running in just hours.

CUSTOMERS OF PALANTIR TECHNOLOGIES

Palantir Technologies software is used by customers across 40 industries and in more than 150 countries. As of December 31, 2020, their platforms were used by 139 customers. The U.S. Army uses their software to ensure the readiness of more than one million military personnel and to make decisions across dozens of command structures. Similarly, one of the world’s leading auto manufacturers deploys Palantir’s software across its factories in North America to help ensure quality control on the production line.

Commercially, the clients are from across industries, including in the consumer, energy, financial services, healthcare, industrials, telecommunications, and transportation sectors.

BUSINESS MODEL OF PALANTIR TECHNOLOGIES

The timing of customer billings and receipt of payments varies from contract to contract. the company generally recognizes revenue over the contract term.

The business model of Palantir Technologies has 3 phases: (1) Acquire, (2) Expand, and (3) Scale.

In the acquire phase, the company enters initial pilots with customers, generally at its own expense and without a guarantee of future returns. Palantir operates the accounts at a loss during this time.

In the expand phase, the company tries to understand the problems faced by customers and ensures that the software addresses them. In this phase too, the company operates at a loss in contribution margin.

In the third phase, which is scale, the investments relative to the revenue fall, and the software provides more value to customer. Customers become more self-sufficient in operation of the software and benefit from the operations and maintenance (“O&M”) services offered by the company. in this phase, the contribution margin is positive.

The contracts are generally long term, extending from 1-5 years, however, the contracts generally include terms that allow the customer to terminate the contract for convenience.

SEGMENT WISE REVENUE BREAKUP

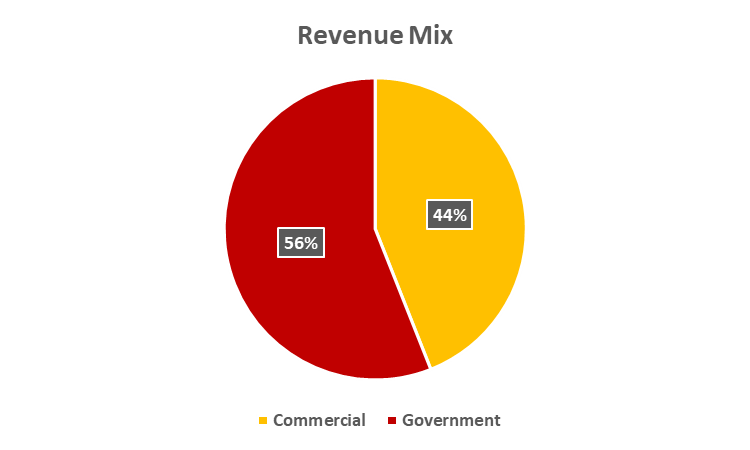

Palantir Technologies has 2 operating segments:

- Commercial – serving non-government customers

- Government – serving agencies in the US federal government and non-US governments.

Palantir Annual Report, 2020

In the year ended December 31, 2020, 44% of total revenue came from commercial customers and 56% came from government agencies.

Palantir Annual Report, 2020

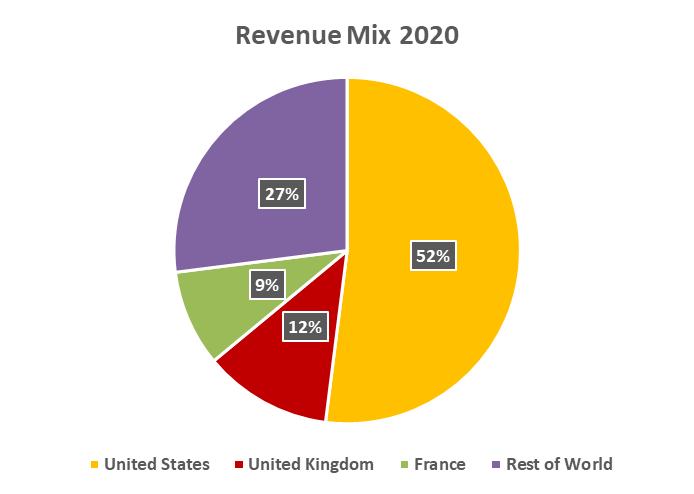

The company has also expanded geographically but US remains the largest market, generating more than half of the revenue. In the year ended December 31, 2020, the company generated 52% of revenue from customers in the United States and the remaining 48% from customers abroad.

REVENUE PER CUSTOMER & AVERAGE REVENUE FROM TOP 20 CUSTOMERS

In 2020, the average revenue per customer was $7.9 million, and the average revenue for top twenty customers, by revenue generated in 2020, was $33.2 million. This is up from 2019, when the average revenue per customer was $5.6 million, and the average revenue from top 20 customers, by revenue generated in 2019, was $24.8 million.

COSTS AS A PERCENTAGE OF REVENUE

The costs to manufacture or produce the software and services (cost of revenue) formed 32% of the total revenue in 2020. The company spent 63% of revenue on Sales & Marketing in 2020 which has decreased from the expenditure in 2018 when it was 78% of revenue. The company has increased R&D expenditure which was 41% of revenue in 2019 versus 51% of revenue in 2020.

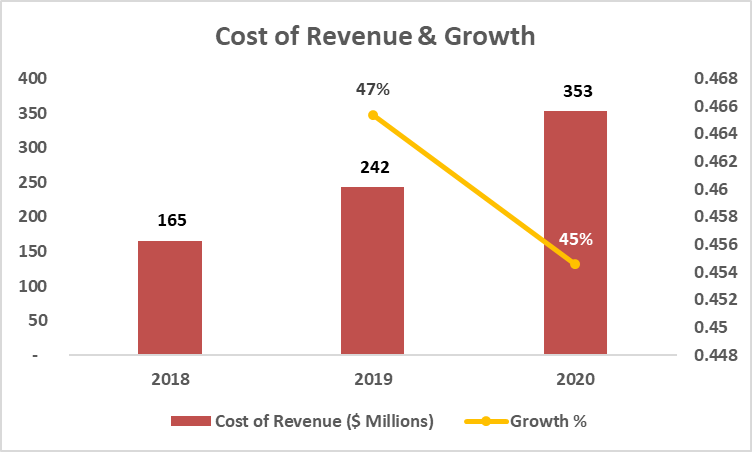

Cost of revenue increased 45% in 2020 compared to 2019 which was mainly due to increase in personnel costs which were partially offset by decrease in travel related expenses and volume-based discounts in third-party cloud hosting costs.

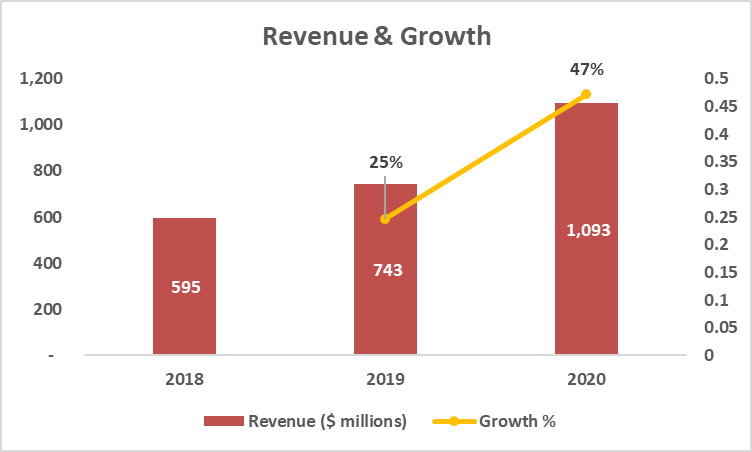

REVENUE & GROWTH

Total revenue was $1,092 million in 2020, up 47% from 2019. Under this, the revenue from Government segment grew 77% primarily from customers in the United States. Revenue from commercial segment grew 22% in 2020.

PERFORMANCE & MARGINS

Contribution margin was 21% in 2019 and it increased to 54% in 2020.

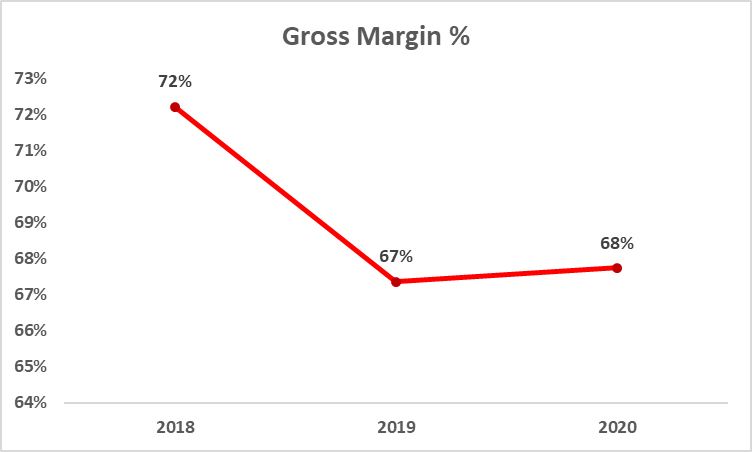

Gross Margin increased by 1% in 2020 because of efficiencies in supporting the revenue growth at customer deployments and was partly offset by increase in stock-based compensations.

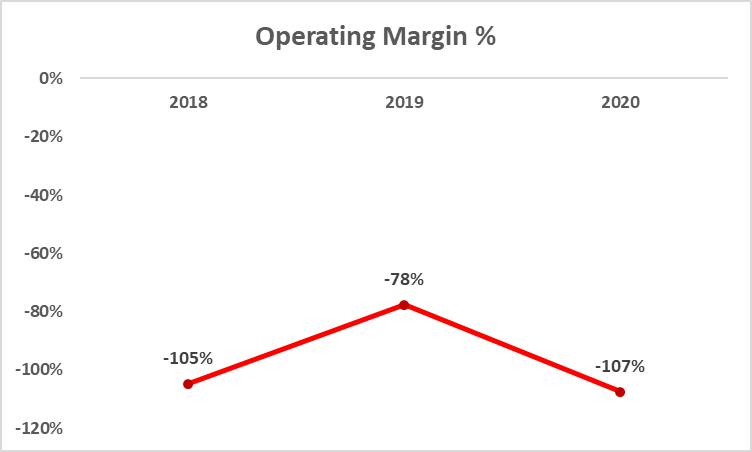

Operating expenses increased by 78% in 2020 which resulted in a lower operating margin of -107% for the year.

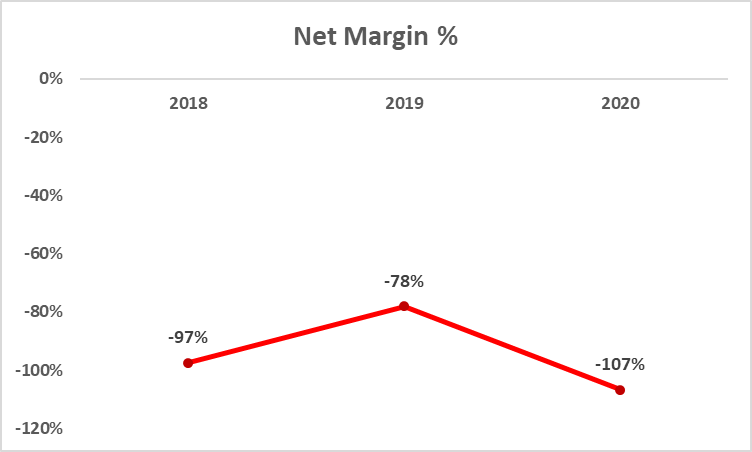

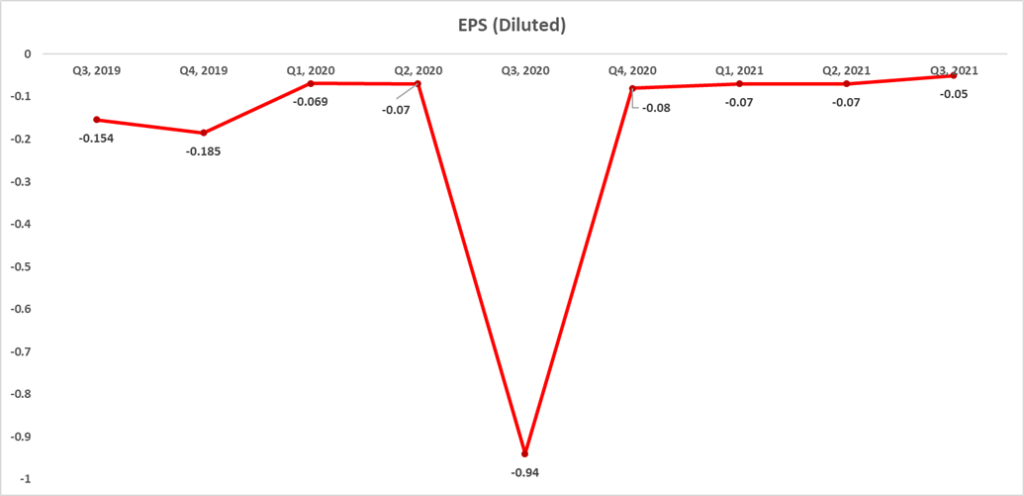

The company is currently making losses with net loss amounting to $1,166.391 million in 2020 which rose 101% from the net loss of $579.646 million in 2019. Consequently, net margins are also negative.

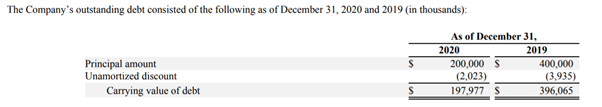

DEBT & INTEREST

Interest expense increased by $11.1 million for the year ended December 31, 2020, compared to 2019. The increase was primarily due to the absence of outstanding debt until December 2019.

The debt has been falling over the quarters and in the latest quarter Q3, 2021, the company reported zero debt.

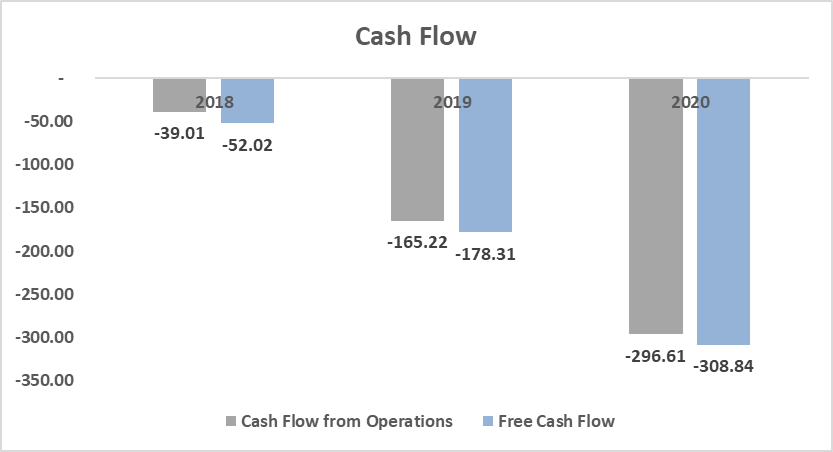

CASH FLOW

Since inception, the company has generated negative cash flows from operation and financed operations mainly through sale of equity shares, borrowings, and payments from customers.

The main reasons affecting negative cash flows seem to be the net loss, lengthy billing cycle and accounts receivables. The company may be expected to have choppy cash flows because of its business model where it invests heavily in the first two phases and the only starts generating a profit from the last phase onwards. Going forward, the company will be expected to make similar investments to acquire new customers and the cash flows and consequently profitability will depend upon the stickiness of the customers continuing till the 3rd phase.

EPS

RECENT QUARTERLY UPDATE

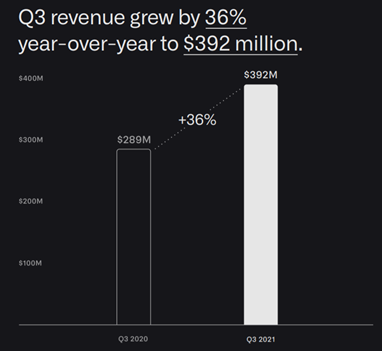

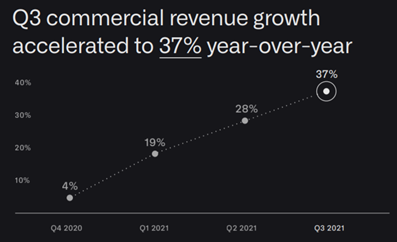

Palantir Technologies reported a Q3 revenue growth of 36% YoY to $392 million.

Out of this, commercial revenue increased 37% Y-o-Y but Government revenue grew only 34% Y-o-Y in Q3, 2021 and the company signed new deals with US Air Force, HHS and NIH.

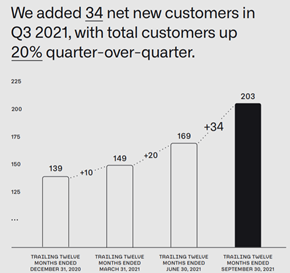

Palantir added 34 net new customers in Q3, up 20% Q-o-Q. Commercial customer count increased 46% Q-o-Q.

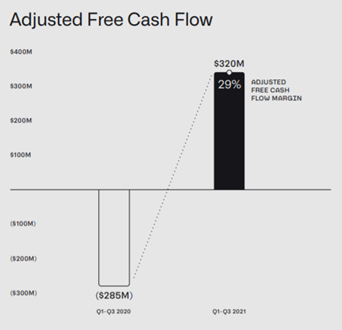

Adjusted free cash flow turned positive in the latest quarter results which is a good sign indicating improving performance.

PROS & CONS OF PALANTIR TECHNOLOGIES

The company is expected to have high stickiness of customers considering most of them are large enterprises and government clients which are more likely to sustain solid long-term relationships as compared to relatively smaller commercial clients. However, the concentration of customers remains a concern (In 2020, top 20 customers generated 61% of the total revenue). Loss of one key customer may have a significant impact on revenue.

The company helps clients analyze sensitive and confidential data. Any data breach could tarnish the reputation of the company. it also puts restrictions on the kinds of clients it can deal with, for example, it would be unethical to have clients which are against or rivals of the US Government (maybe China).

The sales cycle of the company is lengthy and expensive. The company customizes solutions for clients by building bespoke solutions which restricts quick scalability to some extent. Further, although the installation time has become lesser and more efficient, the initial investment in onboarding a client is still high and the time consuming.

The highly customized solutions also come at a high price and so the company may focus only on large clients, and sometimes even large clients may be wary of spending so much. On the flipside, the high switching costs associated with the products should help retain customers for the long-term.

The company has shown evidence of client onboarding (the total is now 203) even during the pandemic which is an encouraging sign. The cash flows have also improved in the most recent quarter. However, the fact that the company has not been able to achieve profitability is still a cause for nervousness.

PALANTIR TECHNOLOGIES: VALUATION

Palantir Technologies has a market capitalization of $44.902B and the Price to Sales ratio has expanded to 37.91 times. This seems rich considering that the company is focused on low-margin government clients and is still turning losses ($102 million loss in Q3, 2021). Moreover, the cash flow has just recently turned positive in Q3, 2021. Palantir is a strong company with an amazing technology and capabilities. However, while positive sales trends are encouraging, it would be prudent to wait until business improves with high-margin commercial business expanding, before jumping in.

Disclosure

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.