On 23 Jul 2021, PayPal share price experienced a drastic drop of about 39% from an all-time high of USD 308.53 to USD 187.79 on 26 Nov 2021. This has started a series of panic selling among investors that they frantically sold their PayPal positions to avoid incurring more losses.

However, the share price slump has not ended.

After the company released its disappointing earnings forecast on 1 Feb 2022, the share price further slid down another 47% drop from USD 175.80 until it reached an all-time low of USD 93.61 on 7 Mar 2022, losing 2 years of gains since the start of the COVID-19 pandemic in 2020.

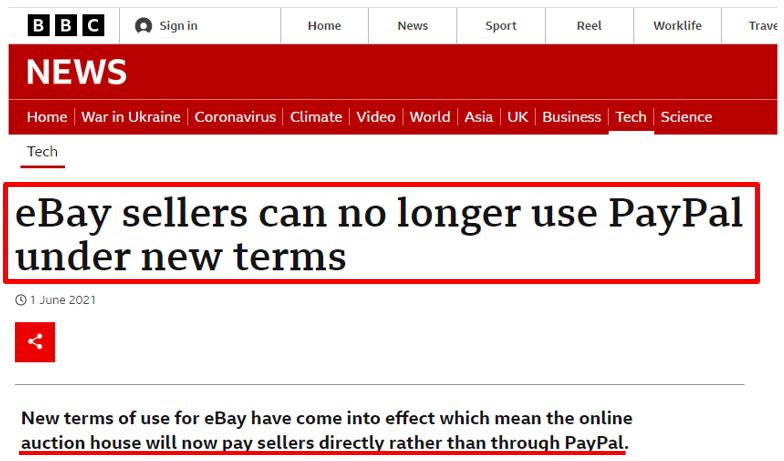

Some of the speculation for the plunge was due to eBay dropping PayPal as their primary payment processor and replaced it with Adyen, a Dutch payment processor company. In addition, eBay will pay their sellers directly to their bank account rather than through PayPal under the new terms.

These news had shrouded PayPal’s bright future as the market leader for FinTech payment and made investors doubt if PayPal can rebound from these slumps.

In this blog, we will investigate if PayPal is still a good buy after the plunge or if it is a value trap that investors have to beware of before investing their hard-earned money into the company.

INTRODUCTION

PayPal is a leading FinTech platform and global digital payment company that provides both digital and mobile payments for merchants and consumers worldwide to connect, transact, and complete payments.

PayPal users can send and receive payments via online, on a mobile device app, or in person. In the US, PayPal users can also buy and hold cryptocurrencies.

Nasdaq.com

Merchants can use PayPal’s payment solutions to process payments online or in-store. Consumers can manage and move their money by using their PayPal accounts to make payments for goods and services, exchange and withdraw funds anytime, anywhere and on any internet-connected devices.

PayPal also enables both merchants and consumers to transact and complete payments for cross-border shopping while minimizing the complexity of overseas payment and cross-border trade.

PayPal 2021 Annual Report

As of 31 Dec 2021, PayPal is serving a total of 426 million active accounts in 202 markets, consisting of 392 million consumer active accounts and 34 million active merchant accounts, an increase of 13% compared to previous year’s 377 million active accounts.

Their headquarter is located in San Jose, California. They also have two headquarters outside of the US: one in Luxembourg (European Union) and another in Singapore (International). They have operations centers, technology centers and customer support offices located worldwide.

COMPANY HISTORY

PayPal was first founded as Confinity by Peter Thiel, Luke Nosek and Max Levchin in 1998 that developed security software for handheld devices (e.g. personal digital assistant). The business model was changed to digital wallet and electronic payment system as the security software was not successful.

In 2000, Confinity merged with X.com, an online financial services company founded by Elon Musk and they focused on money transfer business. However, Musk was replaced by Peter Thiel as CEO in Oct 2000 due to internal dispute within the company and X.com was renamed as PayPal in 2001.

PayPal launched its IPO in 2002 under the ticker symbol PYPL at $13 per share before being acquired by eBay in the same year. However in 2014, PayPal was spin-off from eBay and became an independent company again.

During its days as eBay subsidiaries (2002-2014), PayPal expanded and evolved its business in three phases:

- Expand PayPal services to eBay users that are unable to transact credit card payments on the auction selling platform.

- Expand to eBay international sites and cater payment solutions to more business accounts.

- Build PayPal’s business off eBay by adding more users across multiple platforms.

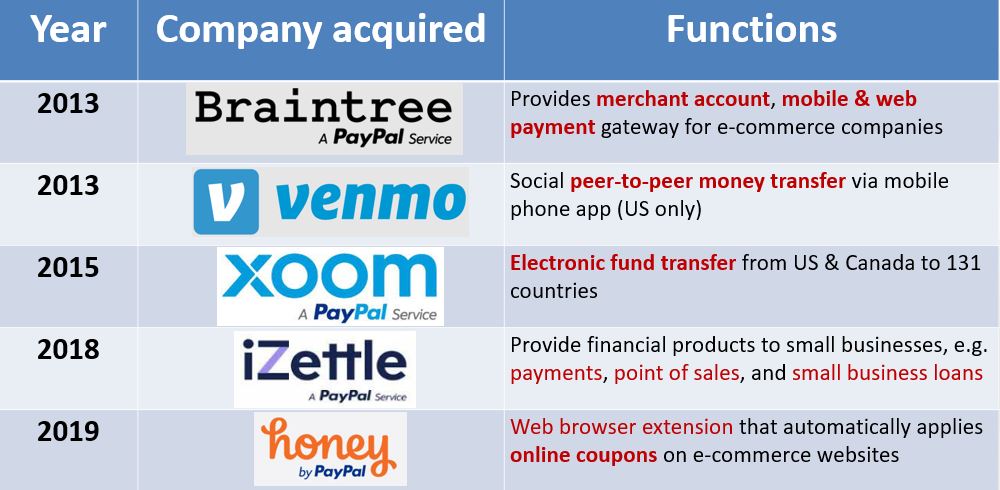

From 2008 to 2021, PayPal also made strategic acquisitions to further expand its payment solutions services to both merchants and consumers worldwide, such as Venmo (2013), Xoom Corporation (2015), iZettle (2018) and Honey (2019).

The chart below shows some of the strategic acquisitions by PayPal:

PRODUCTS

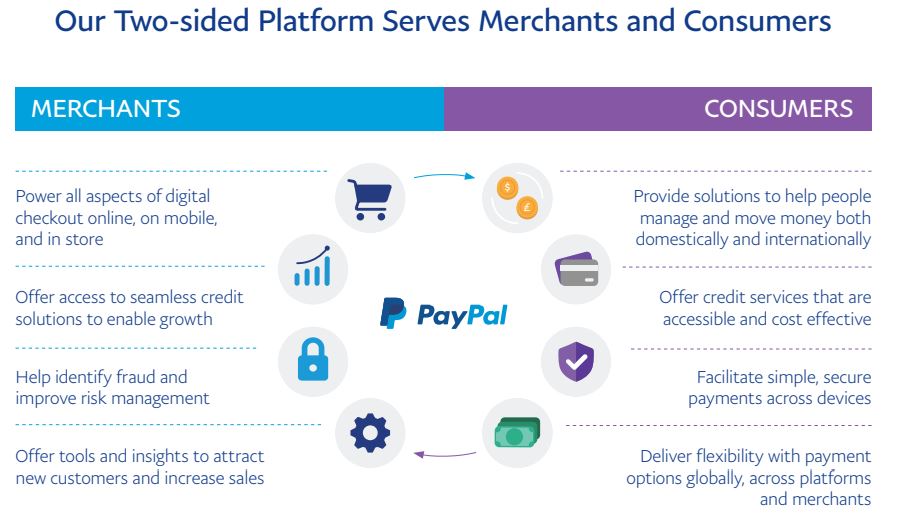

PayPal’s product range focuses on providing various payment solutions for both merchants and consumers to send and receive payments, known as “Two-sided Platform”.

PayPal Annual Report

MERCHANT VALUE PROPOSITION

PayPal provides various payment processing solutions and business support solutions to help merchants in their business. The list below shows some of the solutions provided:

- Digital checkout and alternative payment methods – online, in mobile app and in-store to receive payments securely

- Point of sale solutions (iZettle) and QR-code payments

- PayPal consumer credit offering, e.g. installment payment products

- PayPal business loan for small businesses

- Provide fraud prevention and risk management solutions (Simility & Chargehound)

- Offer tools and data analytics insights to attract new customers and improve sales conversion via higher consumer engagement (Honey Platform)

CONSUMER VALUE PROPOSITION

For consumers, PayPal also offers innovative payment solutions to help consumers better manage and move money in their daily financial lives.

- Digital wallet and mobile app (Venmo app) to make payments

- Peer-to-peer (P2P) money transfer solutions – domestic and international P2P transfers (Xoom)

- Simplify and personalize shopping experiences which enhances consumer engagement (Honey platform)

- Installment payment products with PayPal Credit products

REVENUE GENERATION

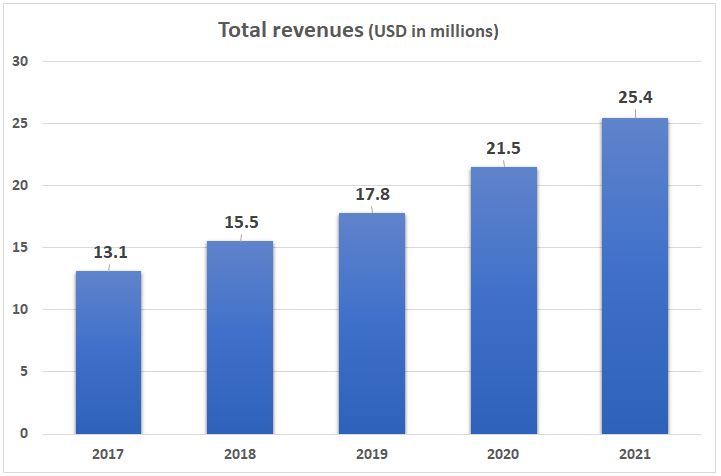

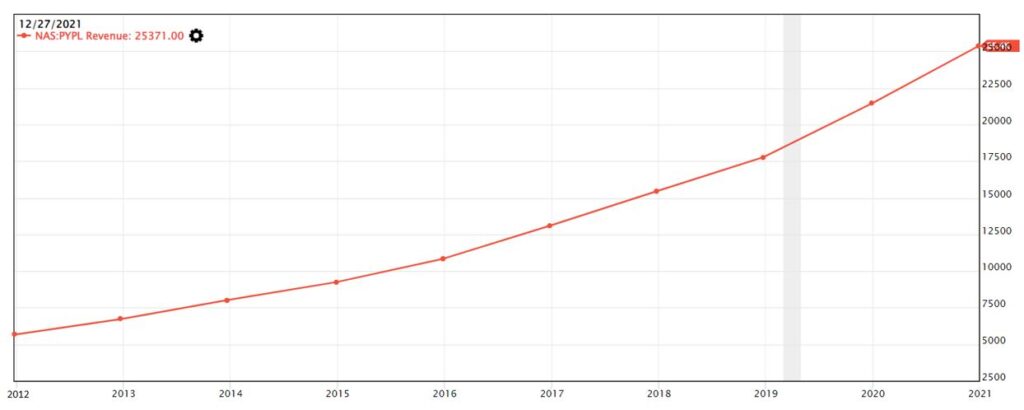

In 2021, PayPal generated a total of $ 25.4 million in revenues, an increase of 18.1% compared to 2020 ($21.5 million). PayPal’s revenue has been increasing year after year as shown in the chart below.

Total revenue from 2017 to 2021

REVENUES BY CATEGORIES

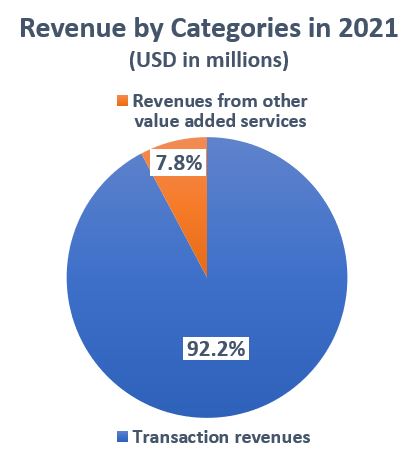

PayPal’s revenue is classified into two categories:

- Transaction revenues

- Revenues from other value-added service

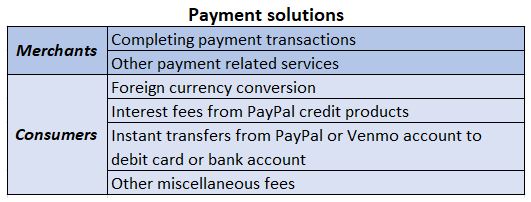

Transaction revenues refers to revenue generated by charging fees from merchants and consumers for using their payment platform. The table below summarizes the type of payment solutions used by both merchants and consumers:

Revenues from value-added services are generated by providing the following services:

- Partnerships with other brands

- Referral fees

- Subscription fees

- Gateway fees

- Other services provided to merchants and consumers

In 2021, 92.2% of total revenues was generated from transaction revenues ($23.4 million) and 7.8% was generated from revenues from other value-added services ($2.0 million).

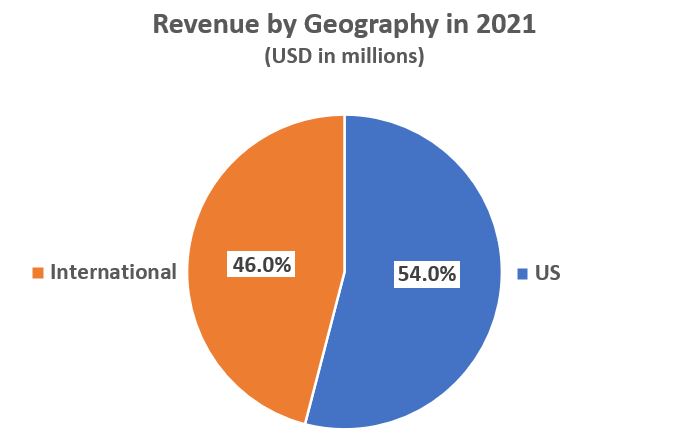

REVENUES BY GEOGRAPHY

For revenues by geography, PayPal has reported in two categories:

- US market

- International market

In 2021, the US market contributed 54% ($13.7 million) of the total revenue compared to the international market which contributed 46% ($11.7 million).

BUSINESS PERFORMANCE KEY METRICS

PayPal measured their business performance with three main metrics:

PayPal 2020 Annual Report

During their 2022 Q1 earnings forecast release in Feb 2022, PayPal added one more performance metric. This is because even though they reported the rapid growth of new account additions the past few years, the low engagement in using the payment platform did not really reflect the actual growth of the business.

PayPal 2020 Annual Report

This might be one of the reasons for the share price to plunge in Feb 2022 as investors are not happy to know that the number of account additions is slowing down and no longer enjoy two digit growth as shown for the past few years. The plausible explanation for the plunge was that if there are fewer users to use the PayPal platform, it will impact the number of payment transactions and Total Payment Volume (TPV). This may directly affect the company’s revenue as the majority of PayPal’s revenue was generated from payment transactions.

At this stage, PayPal intends to focus on offering payment solutions to more active, higher spending users, while moderating new account additions to pursue a more profitable and sustainable long-term growth trajectory.

After going through the background and the revenue generations of PayPal, it seems like this company has been working well for the past few years. But do we really know if PayPal is a good and valuable company to invest in with potential growth?

FUTURE PLANS

PayPal has planned four strategies to grow their business:

1. Grow core business

- Expand payment solutions to grow customer base

- Increase customer’s use of their products and services

- Credit card cash back

2. Expanding value proposition for merchants and consumers

- Merchants:

- Introduce QR code payments for quicker checkout during COVID 19 period

- Provide business support solutions, e.g. payment fraud prevention & easy product return for online stores

- Consumers:

- Provide consumers with simple, secure and flexible ways to manage and move money for everyday needs, e.g. mobile super-app

PayPal Newsroom

3. Forming strategic partnerships

- Offer greater choices and flexibility to provide better experiences, e.g. Visa

Visa Newsroom

- Reinforce their role in the payment ecosystems with merchants, e.g. Salesforce

PayPal Newsroom

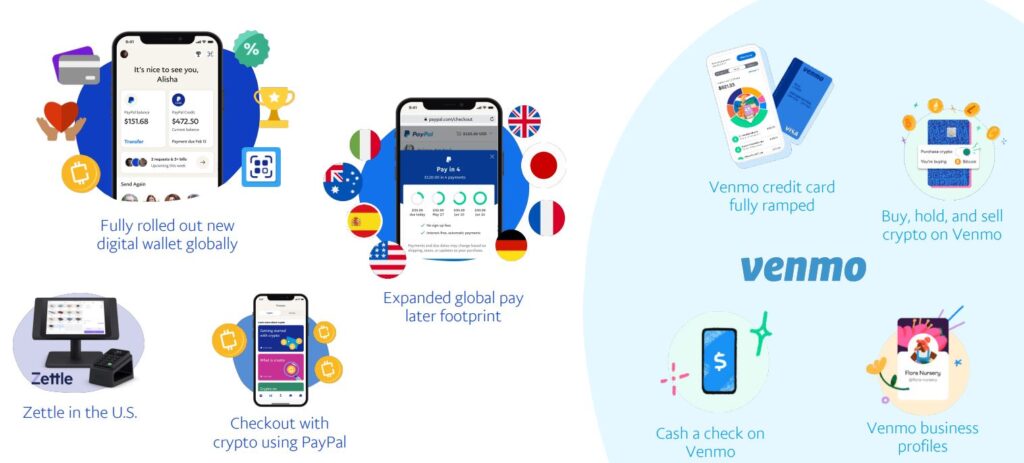

4. Seeking new areas of growth

- Growing organically or through strategic acquisitions in existing and new markets

- Focusing on innovation in payments both in the digital and physical world

PayPal 2021 Q4 Quarterly report

FINTECH INDUSTRY

FinTech is the acronym for Finance and Technology. It is a combination of using technology to enhance and improve the efficiency of financial services.

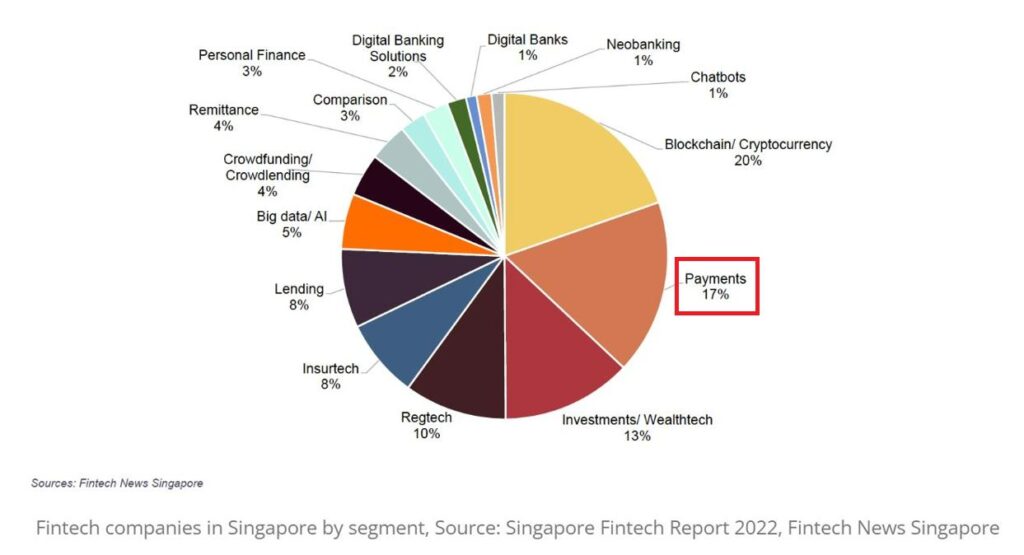

The pie chart below shows the overall FinTech companies by segment in Singapore. The payment industry takes up about 17% of the whole chart in 2022.

Payment industry involves the seller and the buyer, where the buyer makes a money transaction to the seller of the goods and services that they wish to purchase.

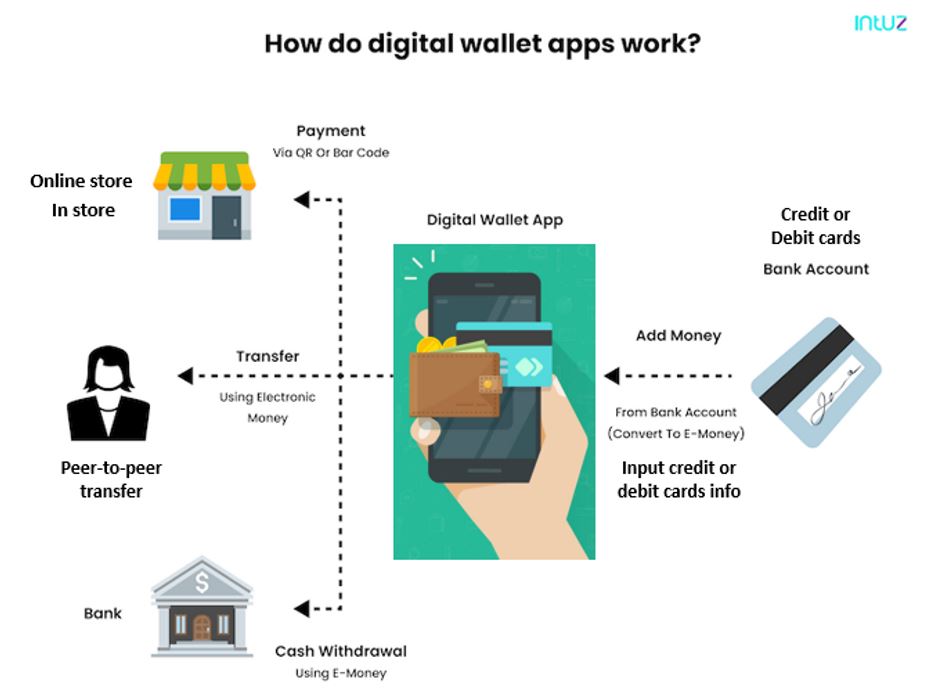

For the buyer, when they want to purchase the products from an online store or in-store without paying with physical cash, they will use a digital wallet, mobile app or credit card to make the payment. The diagram below depicts how a digital wallet app works:

businessofapps.com

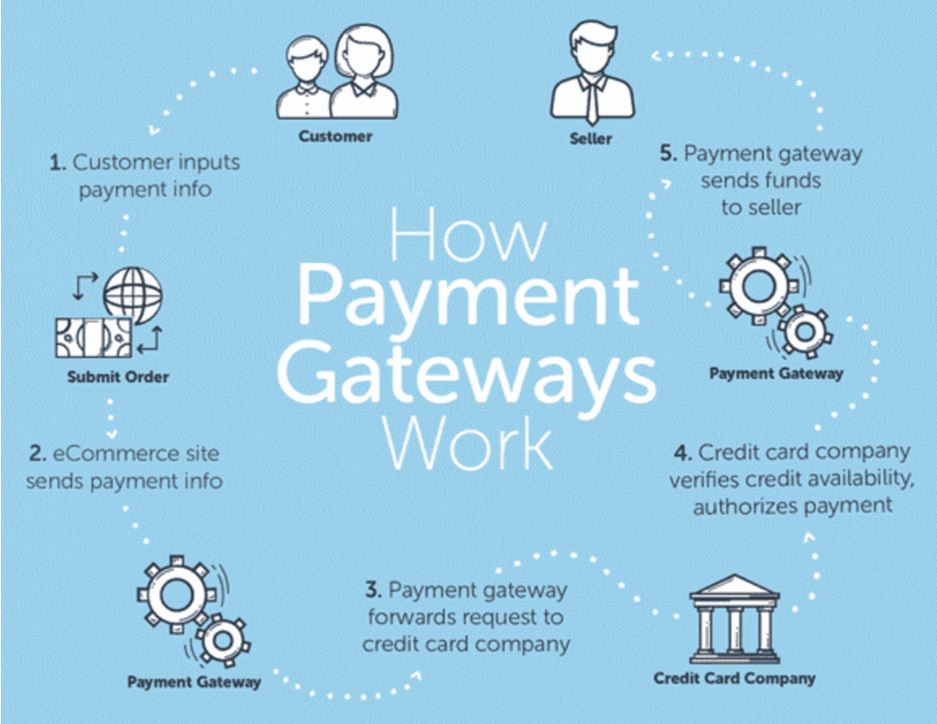

For the seller, when they receive payment from the buyer, via a digital wallet or credit card, the payment will go through the payment gateway to process the payments before the seller can receive the money. The diagram below explains how the payment gateway works in a simplified manner:

multichannelmerchant.com

COMPETITORS

PayPal is in a highly competitive payment industry where they are competing with various payment processing companies, such as banks and payment FinTech companies.

In the Payments Ecosystem, it is made up of five main categories:

- Acquirers/processors – middleman between merchant and financial institution to facilitate transaction process.

- Card networks – organization that facilitates payment card transactions between the merchant and issuer.

- Issuers – financial institutions that issued credit or debit cards.

- Gateways – facilitates and authorizes transactions between merchant and consumer with secure technology.

- ISOs / MSPs – a third-party company works with Visa or Mastercard to market and get new merchants for their services.

- ISO (Independent Sales Organization) – term used by Visa

- MSP (Merchant Service Provider) – term used by Mastercard

Business Insider Intelligence

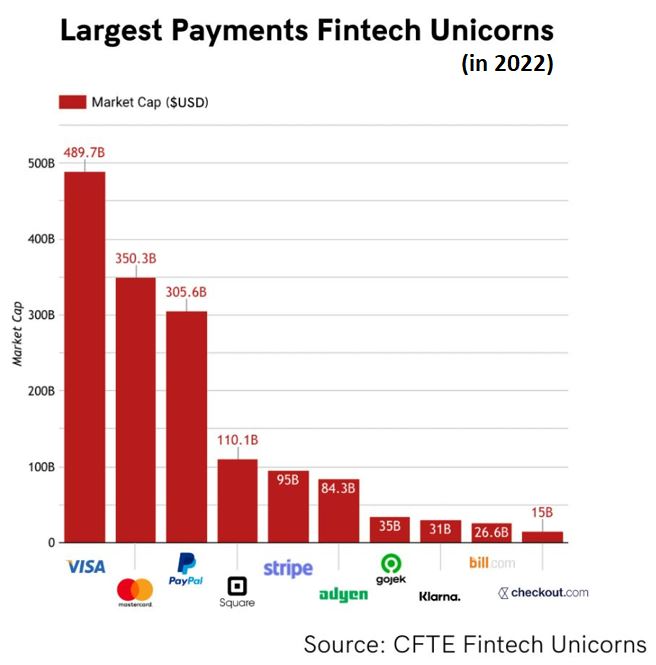

From research done by the Centre for Finance, Technology and Entrepreneurship (CFTE), PayPal ranked the third largest market cap company in 2022 after Visa and Mastercard, about USD 305.6 billion.

ECONOMIC MOATS

To stay competitive and leading ahead of other competitors in the payment industry, PayPal has been widening their economic moats over its competitors.

One of them is their two-sided network where they provide seamless end-to-end payment experience to both merchants and consumers. Their payment platform network reached out to 426 million active user accounts in 202 markets where PayPal users can easily move their money and make payments throughout the world anytime with convenience on their mobile phone or PC.

In addition, merchants who had been using the PayPal platform may have resistance to change to another payment processor service provider. This is because they need to do a major overhaul of the payment processor within their own operating systems and a lot of sensitive data needs to be meticulously transferred to the new system. The switching cost will be high to have the data correctly transferred to another new processing system and service provider.

PayPal also owns regulatory licenses, such as money transmitters in order to offer money transfer services to their customers. Without the licenses, their product offerings and value propositions to their customers will be limited.

From the exciting future plans and competitive economic moats, PayPal has been working hard to maintain their dominance in the payment industry and intend to keep its industry leading position!

FINANCIALS

Now we will look into the financial numbers of the company to determine if PayPal’s fundamentals as a company is strong.

The revenue chart shows that PayPal’s annual revenue has been increasing year after year since 2012 and reached an all-time high of USD 25.4 billion.

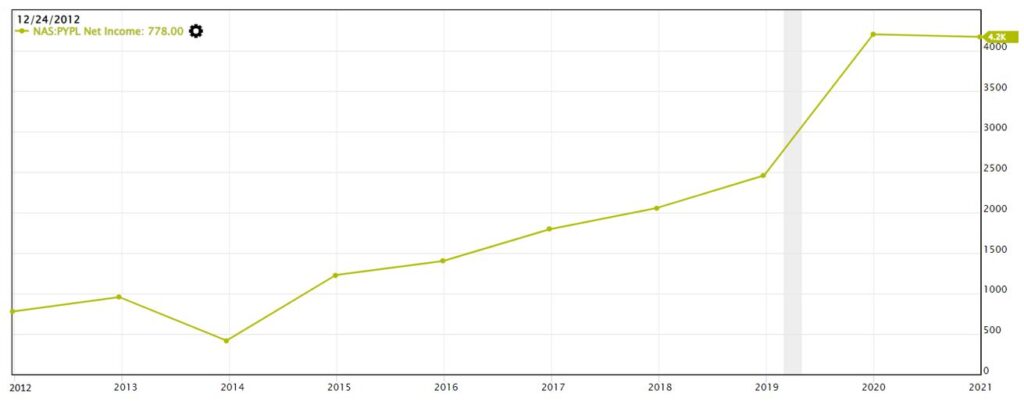

Even though the revenue is increasing year after year, we also look into their net income to determine if the company is profitable. Net income is the profit obtained after deducting the cost of goods sold and operating expenses from the total revenue.

From the chart, we observed that there was a dip in 2014 but a sudden spike in 2020 for their net income. Further investigation found that they had to pay higher income tax in 2014 and cause a dip in the net income. In 2020, there was an increase in non-operating income (strategic investment in equity securities) which lead to an increase in net income.

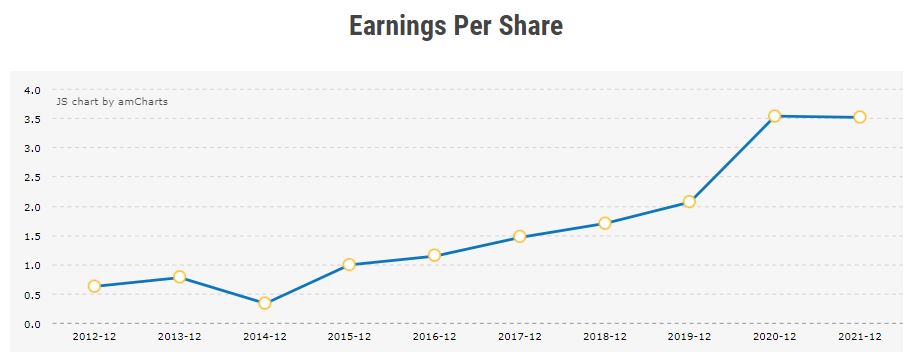

For the earnings per share (EPS), the same trend was observed where there was a dip in 2014, and a spike increase in 2020. Earnings per share is referring that for every share that the investor purchased, how much profit can the company generate. Thus, the EPS trend follows closely with the net income trend.

Putting aside the two anomalies for 2014 and 2020, we observed that the overall trend of the net income and EPS graph is on an increasing trend.

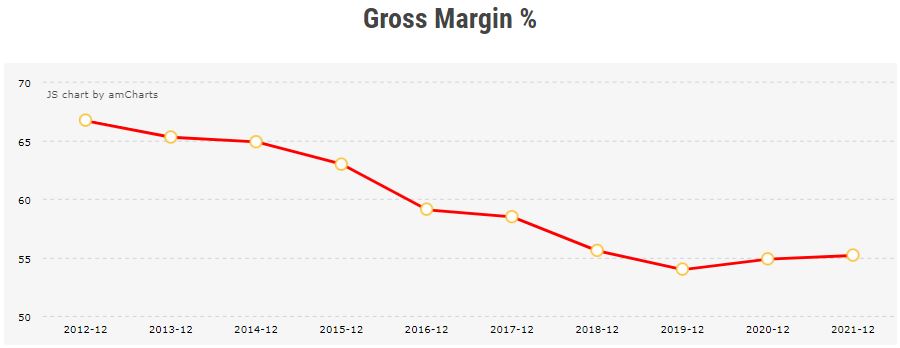

Gross margin % refers to the gross profit margin. It is an important criteria to determine the percentage of how much gross profit the company makes after paying off its direct production cost of products or services (COGS – cost of goods sold).

The mathematical formula is shown below:

According to Value Investing Methodology, if the gross margin % is more than 40% and on an increasing trend, it is a good sign that the company is doing well.

From 2012 to 2019, the gross margin chart was observed trending downwards. When we checked on the annual report, we noticed that the cost of good sold (COGS) was increasing year after year. After 2019, we noticed that the gross margin % trend has slightly increased in 2021.

In addition, the gross margin for PayPal is about 55%, which is above the Value Investing Methodology recommendation of 40%.

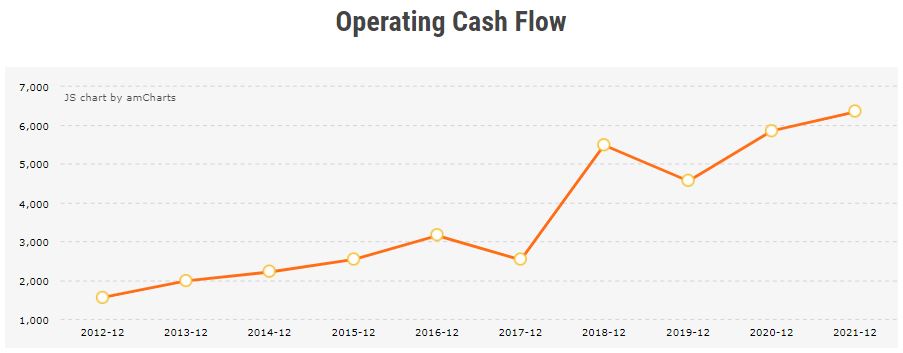

The operating cash flow is the cash flow generated from normal business activities.

From the graph, the overall trend of operating cash flow is increasing but the two abnormal points in 2017 and 2018 were due to changes in non-cash items, such as changes in stock-based compensation, depreciation and amortization.

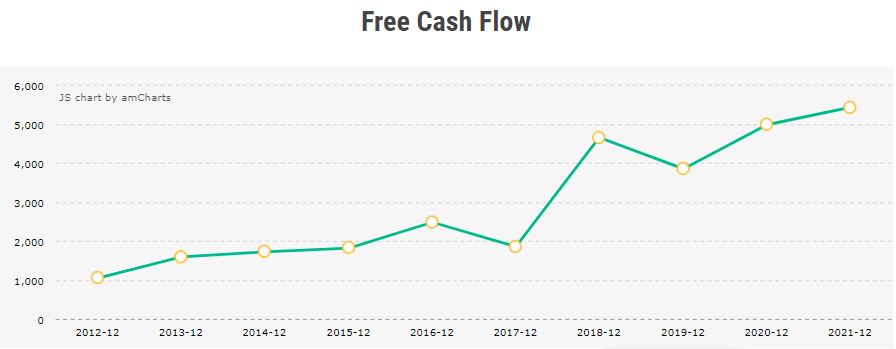

To determine how much cash can the company retain, capital expenditure (expense used to purchase assets that last more than twelve months) is deducted from the Operating Cash Flow, and we will obtain Free Cash Flow.

The mathematical formula is as below:

After deducting the capital expenditure, the free cash flow graph trend is similar to the operating cash flow, which is increasing from 2012 to 2021.

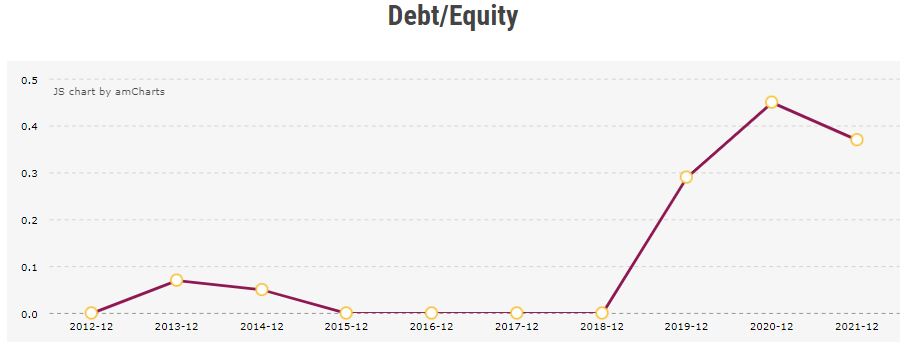

A company is doing well if the debt/equity ratio is less than 0.5, according to Value Investing Methodology. When debt/equity ratio is less than 0.5, it means that for every $100 of equity, the company can only take on a maximum of $50 of debt.

From 2019 onwards, the debt/equity ratio increased because there was an increase in the long-term debt. Although the ratio increased in 2019 (0.3) and 2020 (0.45), the debt/equity ratio is still below 0.5 in 2021 (0.38).

POTENTIAL RISKS

Besides understanding the financial numbers, it is also important for investors to find out any potential risks or concerns that might be lurking in the company that will derail the investment and lose money.

From the earlier investigation in this blog, we are aware that PayPal is in a stiff competition in the payment industry, where they had to compete with various banks, credit card issuers and other FinTech companies for users to use their payment platform.

To attract more users to use the platform, they have to constantly innovate new payment solutions as the technology is advancing very rapidly. People will prefer to use payment solutions that are convenient, fast and safe for their money transfer and personal identity.

There might be other new FinTech start-ups with better payment solutions that will draw the users to use the start-ups’ platform and reduce PayPal’s market share. With fewer people using the PayPal platform, they will encounter slower user growth and lesser payment transactions being performed on the platform.

In addition, high inflation also influenced customer spending. As products are getting more expensive, consumers might want to spend less and merchants will have fewer customers to purchase from them. As such, this will also affect the payment volume on the transaction platform and also impact the revenue generated.

CONCLUSION

After the thorough investigation on PayPal, we can say that the company is still strong in the fundamentals even though with the recent news that the company’s share price is not doing well.

From the future prospective of PayPal, it is working hard to provide various innovative payment solutions to attract users to use the platform and may have some potential growth from it. Will PayPal share price increase again in near future, only time will tell if the future plan strategies work.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.