SATS shares plunged 21% after they announced the acquisition deal of Paris-based Worldwide Flight Services (WFS) to become the world’s largest global air cargo handler in Sept 28.

To add salt to the wound, the shocking news of Temasek’s Fullerton Fund Management disposed about 1.8m of SATS shares on Oct 12 had further pushed down the share price and possibly shadowed the future prospects of SATS.

Now that the world is opening up after COVID-19 and everyone can fly again, is now a good time for investors to look into air stocks, particularly SATS, to buy at the dip?

In this blog article, we will deep dive into Singapore’s leading airport service provider and determine if SATS is a good & profitable company to invest in.

SATS COMPANY BACKGROUND

Singapore Airport Terminal Services, also known as SATS Ltd. is Asia’s leading airport service provider, based in Singapore. It currently controls 80% of aircraft ground handling and catering services in Singapore’s Changi Airport.

SATS was first started as the ground operations and in-flight catering at Singapore Kallang Airport since 1947. Over the next few decades, the company has been growing along with Singapore as the young city-state transformed itself into a global business and aviation hub.

Some important milestones include SATS’ establishment as a subsidiary of Singapore Airlines (SIA) in 1972 and the company relocated to Changi Airport in 1981 to further expand their operation network.

They have also made strategic acquisitions to expand their operations, such as TFK Corporation (Japan) in 2010 for food catering services and GTR (joint venture with AirAsia) in 2018 for ground handling operations.

Currently the company has operations over 60 locations in 14 countries worldwide that offers food solution services, gateway services or both.

With the latest proposed acquisition of Paris-based Worldwide Flight Services (WFS) announced in 28th Sept 2022, SATS intends to become the world’s largest global air cargo handler.

Graphic Source: Investors Presentation – SATS acquiring WFS

SERVICES OFFERED BY SATS

SATS has 2 main business segments to support their aviation and non-aviation operations:

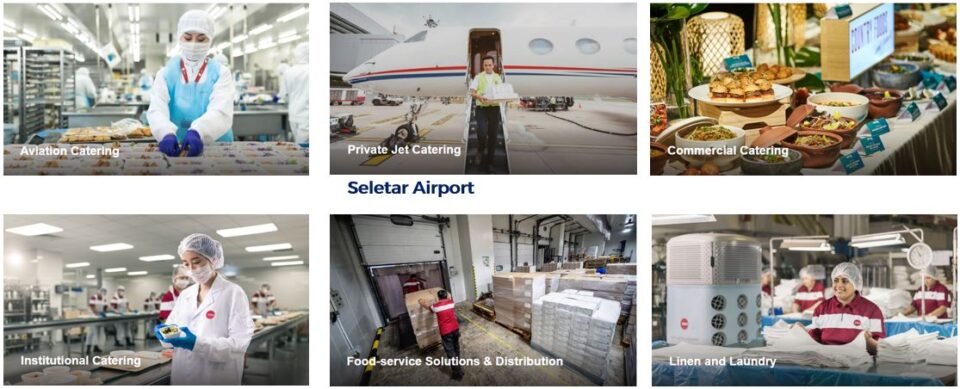

FOOD SOLUTIONS

There are 6 operations in their Food Solutions Segment:

- Aviation Catering – In-flight catering & airport lounge catering

- Private Jet Catering (at Seletar Airport)

- Commercial Catering – Main caterer for Singapore Sports Hub

- Institutional Catering – Provide catering for Healthcare, Educational institutions & Government agencies

- Food-service Solutions & Distribution – Importer of food & distribution network

- Linen & Laundry – for aviation sectors, healthcare & hospitality sectors and company uniforms

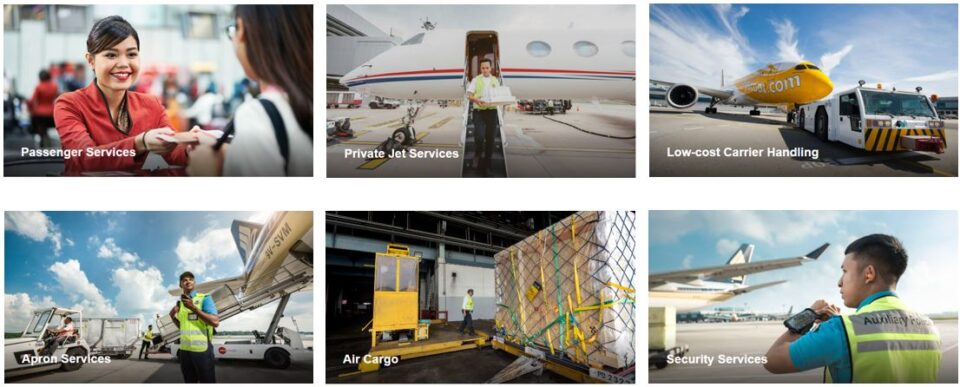

GATEWAY SERVICES

SATS offers both aviation and non-aviation related gateway services to their passengers and low-cost carrier clients, such as Scoot, JetStar.

For aviation related gateway services, there are:

- Passenger Services

- Private Jet Services

- Low-cost Carrier Handling

- Apron Services that include ramp services, baggage services & aircraft interior cleaning

- Air Cargo to transport goods via air carrier

- Security Services

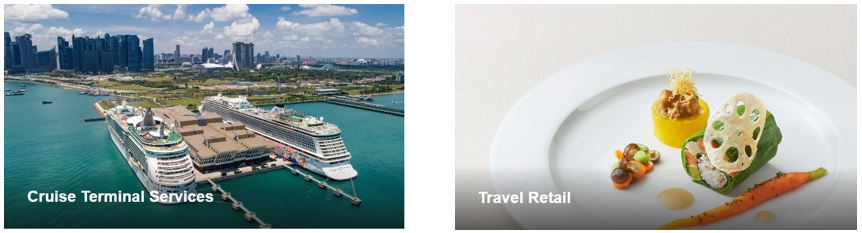

SATS also provide non-aviation related services such as:

Cruise Terminal Services, operate under SATS-Creuers Cruise Services at Marina Bay Cruise Centre Singapore. They provide the convenience of early check-in & boarding passes collection for cruise customers who have transit flight within the same day.

Travel Retail where SATS provide consultation and training services to their clients such as:

- Food & Beverage consultation for onboard menu planning

- Duty-Free for onboard retail sales

- Logistics support

- Account Servicing for onboard retail sales

- Digital Innovation to provide latest technology & business intelligence models, such as digital menu & in-flight shopping catalogue

- Crew Management, such as retail sales training

REVENUE GENERATION

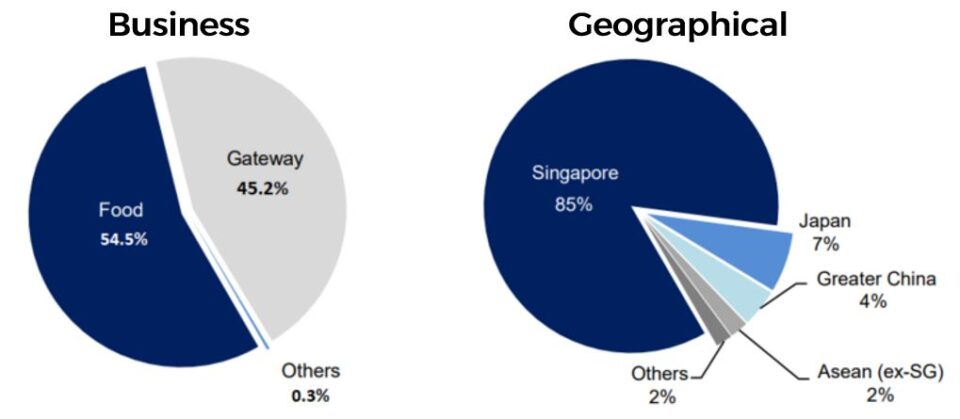

In their FY21-22, a total of SGD1,528 million revenue was generated. Majority of the revenue was generated from their Food Solutions segment (54.5%), followed by Gateway Services that contributed 45.2% and Others (0.3%).

From geographical perspective, Singapore had brought in about 85% of the revenue for FY21-22. Japan is the second largest contributor that generated 7% of the total revenue, then Greater China (4%), ASEAN countries (2%) and other worldwide locations also contributed 2%.

Revenue generated in FY21-22 (Data source from Annual Report FY21-22)

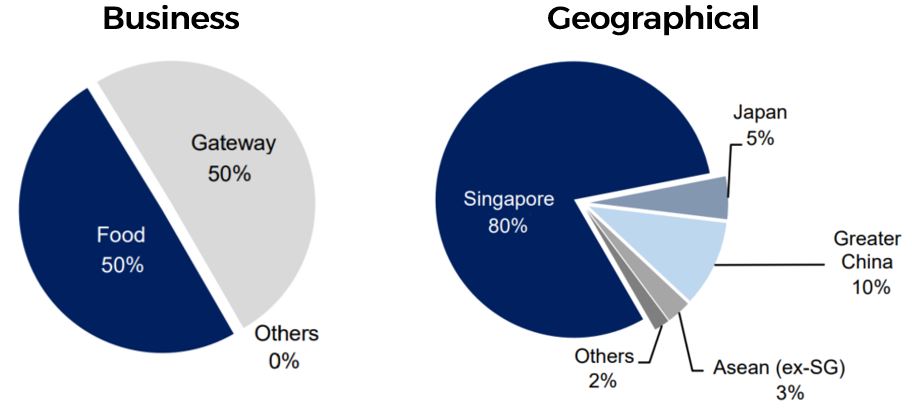

In their latest financial reporting of FY22-23 first quarter that ended in Jun 2022, SGD375.5 million was generated. Both Food Solutions and Gateway Services contributed equally (50%) in the first quarter.

Revenue generated in 1Q FY22-23 (Data source from Quarterly report 1Q FY22-23)

Singapore is still the major revenue contributor (80%) but Greater China (10%) has overtook Japan (5%) as the second largest revenue contributor in the 1Q. ASEAN and other regions generated 3% and 2% of the revenue respectively.

FINANCIALS OF SATS

In this section, we will be going through a few simple criteria to check on the fundamentals to determine if the SATS is a good company to invest in and require additional due diligence to investigate the company.

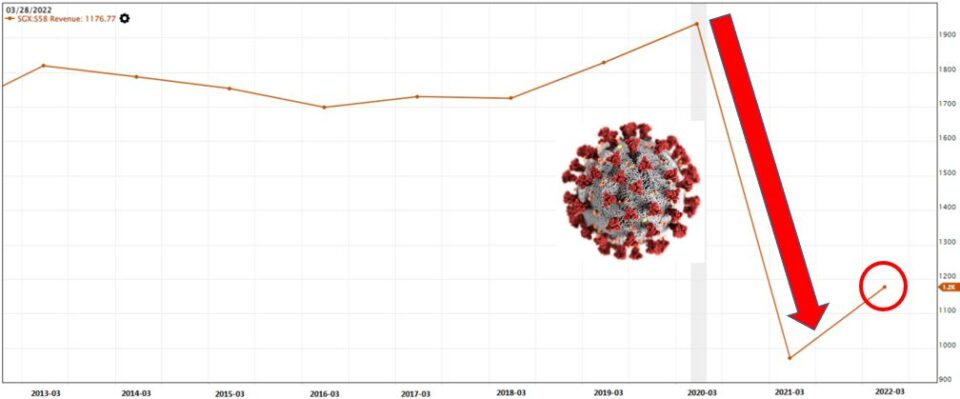

From 2013 – 2020, SATS’s Revenue has been stable with slight uptrend especially during 2018-2020. However, when COVID-19 pandemic struck in 2020, the company’s operation and revenue took a serious brunt as worldwide borders are closing. The impact was only reflected in 2021’s financial result where the revenue took a nosedive plunge in 2021. Nevertheless, we noticed that the revenue has recovered and increased slightly in 2022 when borders are starting to open up again.

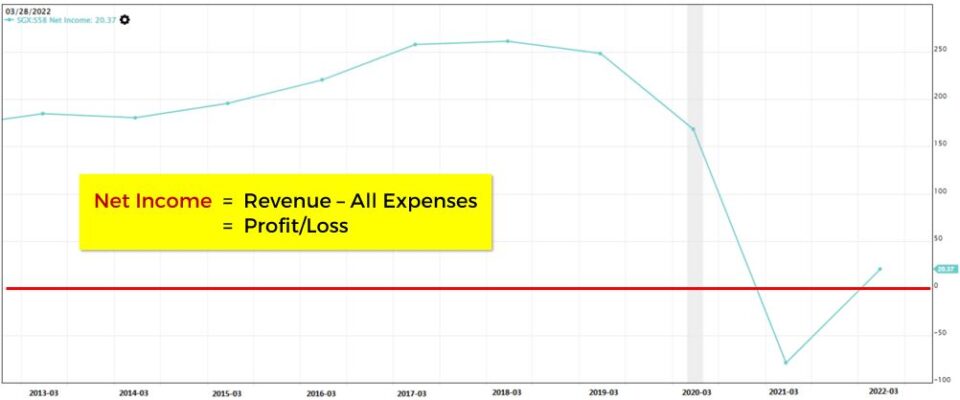

Next, we will check on their Net Income to determine if the company is profitable. Net income is the profit or loss that a company makes after deducted all expenses from their total revenue.

Since the start of the pandemic in 2020, SATS net income has suffered a huge drop, especially in 2021 where the company was having losses. Nevertheless, SATS’s net income is slowly recovering post-pandemic as we can see that the company is out of the red in 2022 to become profitable again.

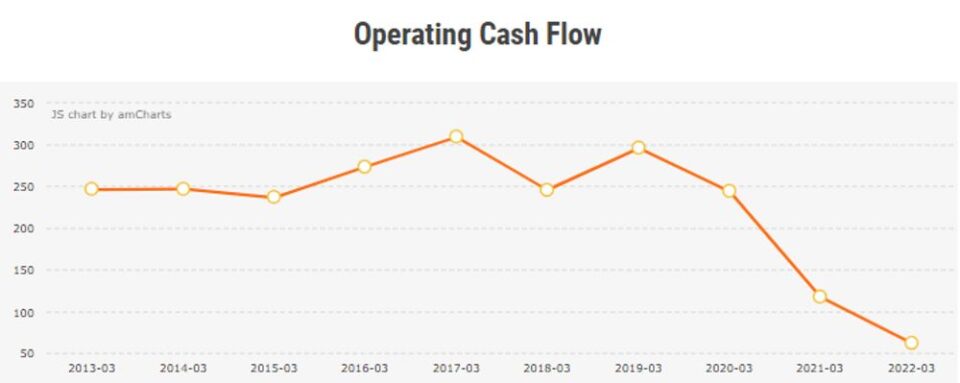

For their cash flow, we will be looking at their Operating Cash Flow (OCF) & Free Cash Flow (FCF).

OCF refers to the cash flow that was generated from the normal business activities. If the cash flow is positive, it means that the business operation is bringing in cash into the company. However, if the cash flow is negative, the company is bleeding cash to keep the business running.

Even though the OCF is positive for the past decade, we noticed that the trend has been sloping downwards since 2020 and have not yet recover based on their latest financial report in FY21-22.

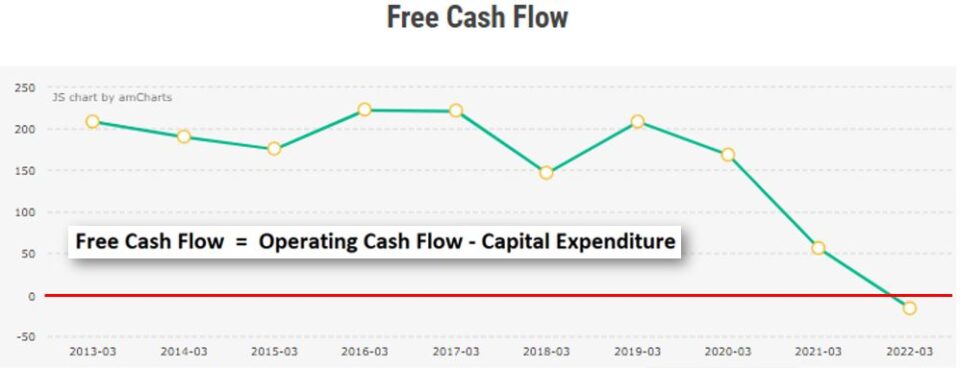

FCF is the freely available cash flow for the company to use after they have deducted the capital expenditure (CapEx) from their OCF. CapEx is the expenses used to purchase assets that will last more than 12 months. The FCF trend was similar to OCF, where downward slope was observed, and the trend further accelerated downwards since 2020. We were also alarmed to find that in 2022, the FCF has dropped below zero and it is now in negative. Should this trend continue, the company may encounter cash flow crisis in the next few years.

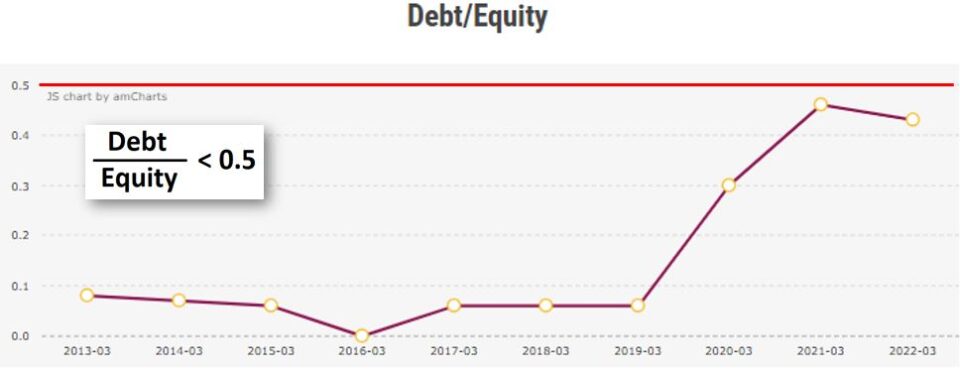

As the company’s recent financials do not look good, we are curious to know if the company is taking on any debt to keep the company floating. We checked on their Debt-to-Equity ratio (D/E ratio).

Based on Value Investing Methodology, a company’s D/E ratio should be less than 0.5, meaning that for every $100 of equity, the company cannot borrow more than $50 of debt.

Even though the company was experiencing losses for the past 1-2 years and the cash flow was trending downwards, the company’s debt level is still below 0.5 in 2022. This means that the company is still able to manage their debt despite the D/E ratio increased significantly from 2019 to 2021.

CONCLUSION

To conclude, SATS is Asia’s leading airport service provider where they offer a wide range of aviation & non-aviation services in over 60 locations worldwide.

However, the company’s financials were severely impacted during the COVID-19 pandemic, especially their cash flow is in downward trend for the past 2-3 years. As the pandemic situation is slowly ebbing and borders opening up, we will have to continue monitor if the company’s financial situation will recover to its previous stellar record.

As SATS has announced to acquire WFS, we are also pondering if this strategic acquisition will benefit the company’s future expansion as the world’s largest air cargo handler, making the company to become more profitable.

Investors are strongly advised to perform their own due diligence before investing their money into any stocks to avoid the loss of their capitals. But due to the uncertainty of the market conditions and unsure of how to determine a good & profitable company to invest in, this fear has stopped many people from taking action to invest.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.