SEA Ltd. was hailed as the next super stock for its superb performance during the pandemic. However, the recent stock slump has triggered fear and panic among investors who had sang praise on this stock as the next big thing.

Both good and bad news have also been reported on this super stock for the past years, following closely on its ups and downs performance. How much should you trust the news to make a wise investment decision in this company?

In this blog article, we will put on our investigative hat to deep dive into SEA Ltd. and find out if this company is really a good investment opportunity as claimed by the news channels.

SEA LTD. BACKGROUND

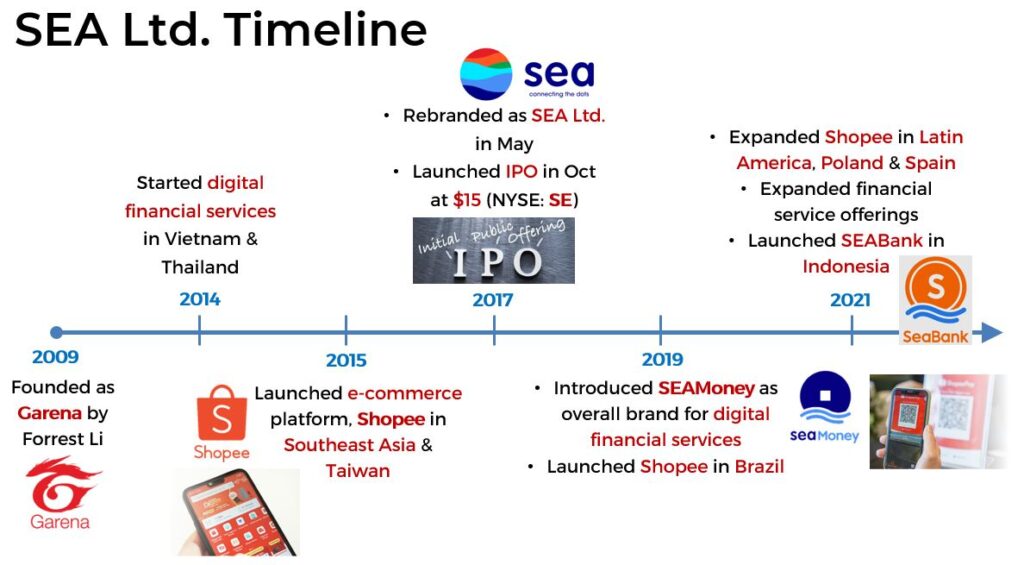

SEA Ltd. is the leading global consumer internet company, based in Singapore. It was founded by Forrest Li as Garena, a game development and publishing company in 2009.

The diagram below shows the brief timeline of the company’s history since established in 2009.

Currently, the business operations are conducted through 3 subsidiaries – Digital Entertainment, E-commerce and Digital Financial Services.

The three business subsidiaries have business operations throughout Southeast Asia, Taiwan, Latin America and the rest of the world.

PRODUCTS & SERVICES

As the company conducted their business operations through 3 different business segments, we will deep dive into the products and services offered by these 3 subsidiaries.

GARENA

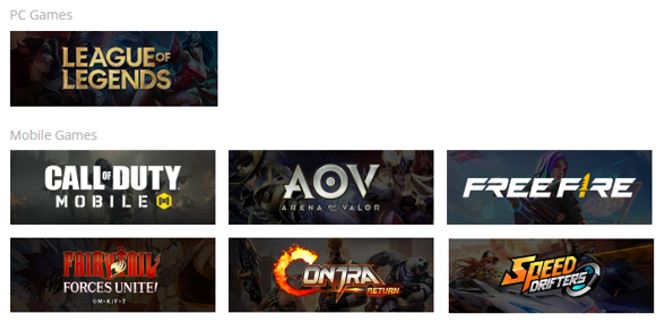

Garena is the digital entertainment arm of SEA Ltd. where they focus on developing, publishing, and distributing mobile & PC online games, such as Garena Free Fire & Call of Duty: Mobile. The games are available over more than 130 markets, including Android Google Play and iOS App Store.

The diagram above shows list of games that are being published and distributed on their website.

In addition, they also provide access to other forms entertainment content:

- Hosting e-sports events

- Livestreaming of online gameplay

And social features to build a gaming community for the games that they published, such as:

- User chats

- Online forums

SHOPEE

Shopee is the e-commerce branch of the company and provides a platform for easy, secure and fast online shopping experience. It is the leading e-commerce platform in Southeast Asia & Taiwan.

For the sellers, they offered seamless logistics infrastructure to help them deliver goods to their customers with less hassle and headaches.

SEAMONEY

SEAMoney offers various digital financial services to their customers in the Southeast Asia regions. The financial services offered are categorized into 3 segments:

- Payments

- Financing

- Digital Banking (only in Indonesia)

Out of the 6 countries that they operated in, currently Singapore (Dec 2020), Indonesia (2020) and the Philippines (Mar 2022) have obtained digital full bank license. What is the difference between a Digital Bank & Traditional Bank? Find out more about Digital Bank from our article on NuBank (largest Neobank in Latin America)!

Other countries such as Malaysia, Thailand and Vietnam have also obtained financial licenses and government approvals to provide electronic money services within these countries.

REVENUE GENERATIONS

As the 3 business segments offered different products and services, the way that they monetize their products and services are also unalike.

The chart below simplified the monetization model for each business subsidiary:

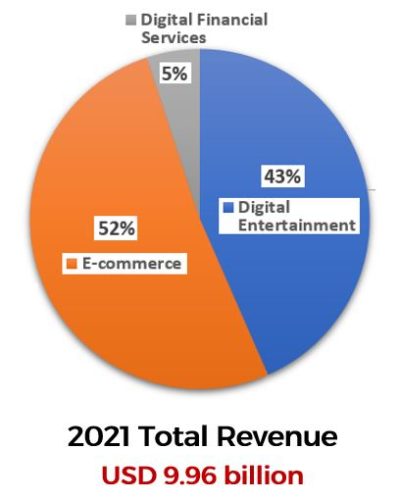

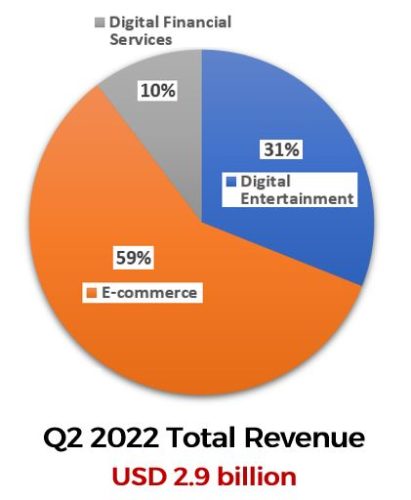

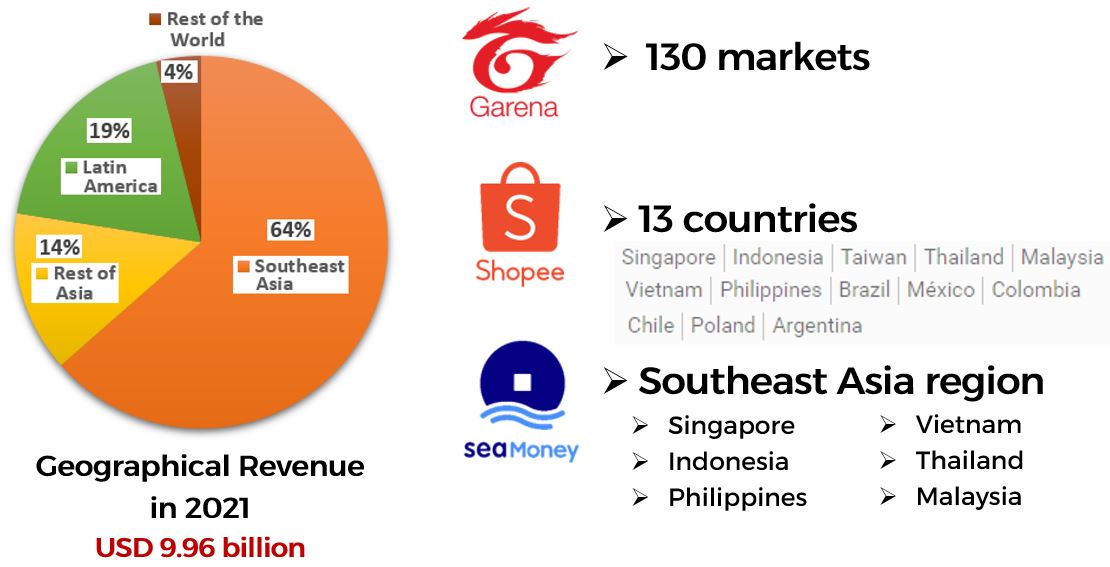

In 2021, SEA Ltd. has generated a total of USD 9.96 billion from the 3 business subsidiaries. E-commerce (52%) contributed more than half of the revenue, followed by Digital Entertainment (43%) and Digital Financial Services (5%).

In their latest quarterly report (Q2 2022), the E-commerce subsidiary still contributed more than 50% of the total revenue (USD 2.9 billion) generated for that quarter, which is 59%. However, we noticed that the Digital Entertainment has dropped to 31% and Digital Financial Services has increased to 10% for Q2.

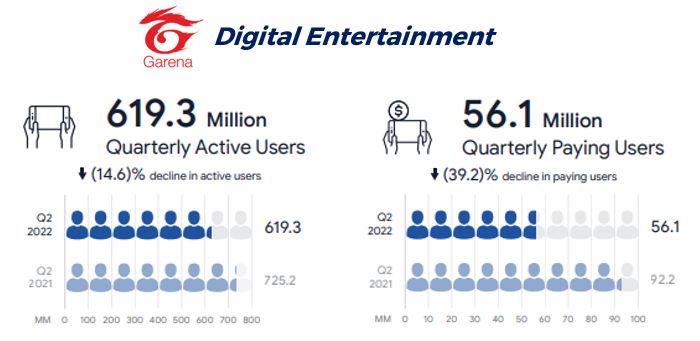

One of the reasons for the drop in revenue for the Digital Entertainment arm in Q2 2022 was due to a drop in their Quarterly Active Users and Quarterly Paying Users metrics.

As the games offered are freemium (free to download and play), they earned money by selling in-game virtual items and season passes to players who want to play with enhanced experience and full features in the games. If there are lesser players playing the games, there might be lesser players to pay for the games and thus, lead to a decrease in revenue for this segment.

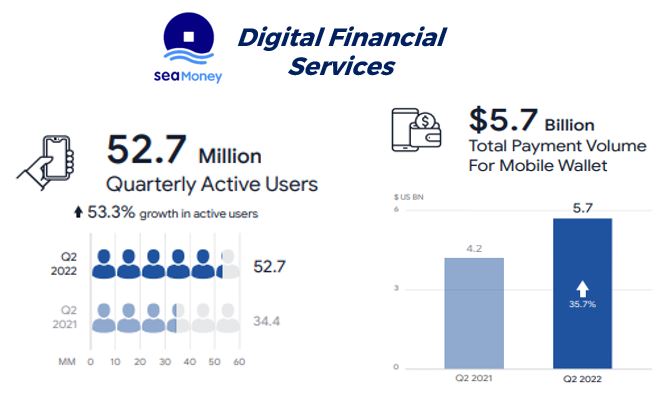

Whereas for the 5% increase for the Digital Financial Services in Q2 2022, we also noticed that there was an increase in the Quarterly Active Users using the platform and mobile wallet services.

When we investigate on the revenue source in terms of geographical regions, Southeast Asia contributed the most (64%) in 2021, followed by Latin America region (19%), rest of Asia (14%) and rest of the world (4%). The geographical revenue was not reported in their Q2 2022 quarterly report.

From the products & services offered by the 3 business segments, the company do seem to have some exciting potentials as the next global consumer internet company giant! However, there are some worrying signs, such as a drop in number of players for the Digital Entertainment (Garena) segment. Will this affect the financial performance of the company?

Most of us would like to earn multiple streams incomes from investing in a good and profitable company. However, we are not sure how or what are the criteria that makes a company profitable to invest in. This has stopped many people from taking action to invest due to this fear and uncertainty.

Fret not! We at Value Investing Academy have organized a Masterclass session to give you a sneak peek on how to invest safely and consistently with lower risk of losing money. You will be able to learn the skills on how to evaluate a company and become a intelligent investor. To find out more, click on the button below to learn how to invest with minimal capital and minimal time even though you know nothing about investing!

FUTURE PLANS

SEA Ltd. has ambitions to expand their business subsidiaries to the international stage, especially for Garena & Shopee. In this section, we will explore the expansion strategies that they had planned for each of the subsidiaries.

GARENA

For Garena, they had intention to tap into the global community via e-sports as e-sports can foster connections through shared experiences among players within the game. It has been reported that there is growing potential of mobile e-sports within the Western countries and Free Fire Pro Series America was launched last year to capture this market, according to the article below.

In addition, Garena also invested in the social game – Playwind as they saw tremendous potential in social games to establish connections and bond players together when playing the games.

SHOPEE

Shopee plans to launch more sales event, especially the luxury segment to encourage people to spend on the e-commerce platform.

Besides organizing more sales event for the year, Shopee has also strategize to expand their operations overseas, such as Europe, India and South Korea.

SEAMONEY

After launching SeaBank in Indonesia in H2 2022, SEA Ltd. has made plans to introduce SeaBank in the Philippines when they had obtained the banking license in Mar 2022, according to their 2021 annual report.

At the same time, they have also expanded their partner merchant network in the Philippines for their mobile wallet – ShopeePay to over 50,000 locations nationwide. The more merchant acceptance of ShopeePay will encourage more users to use the mobile wallet service to pay for their purchases.

ECONOMIC MOAT & COMPETITORS

After deep diving in SEA Ltd. so far, the company intends to expand their operations and gear up to become the next leading consumer internet company. Nevertheless, we would like to know that who are the competitors against SEA Ltd.’s 3 subsidiaries and is there any competitive edge (economic moat) over these competitors to secure the market share.

We will explore the economic moats and competitors for each of the business segments in this section:

GARENA

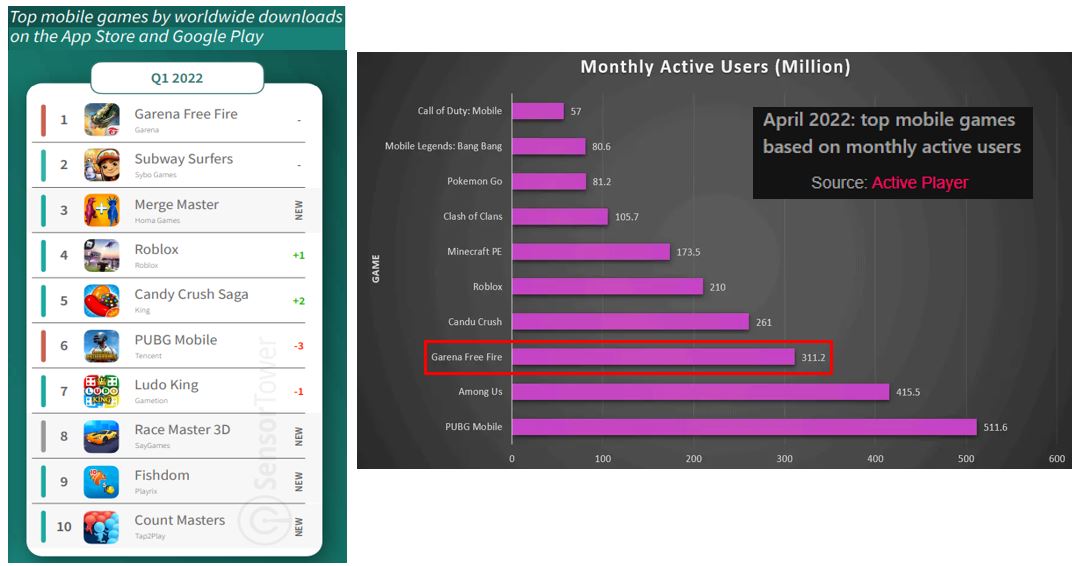

In Q2 2022, Garena Free Fire is the world’s top mobile game downloads according to statistics reported by SensorTower while having more than 300 million active players playing the game in April 2022.

The possible moats that we can observed for Garena is their Network Effect (highest downloadable), Copyright for the Garena Free Fire and Distribution Effect where the games is available over 130 markets.

SHOPEE

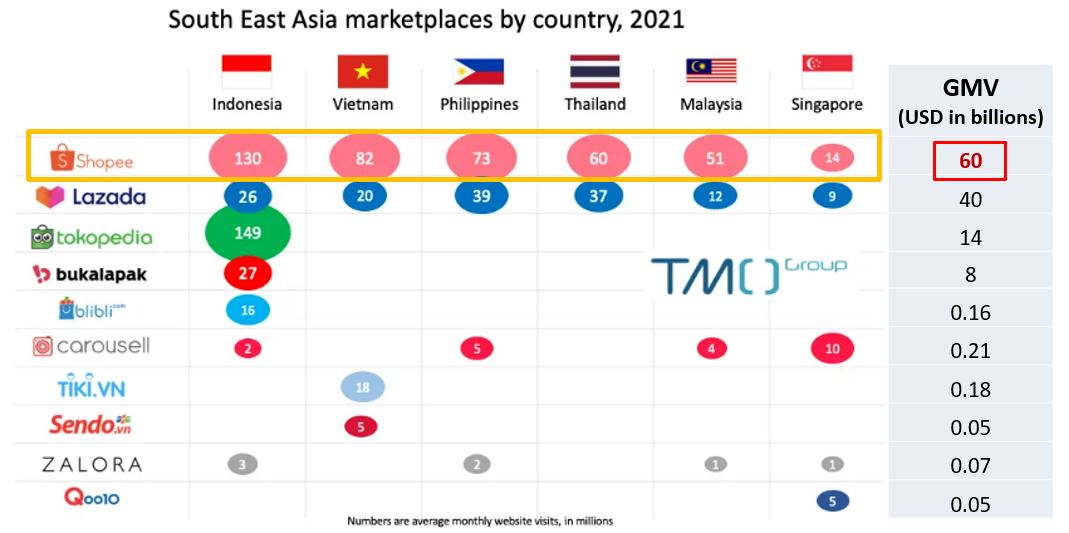

For Shopee, it is currently ranked first in the numbers of monthly website visits within the Southeast Asia region. The second place is taken by Lazada, then followed by Tokopedia, where the platform is only available in Indonesia.

Shopee also has the highest GMV (Gross Merchandise Value – metric that measures total value of sales over a period of time) compared to the other e-commerce platforms.

As a result, it seems like Shopee has Network Effect moat where they have the highest traffic that visited their website.

You can find out more about other worldwide internet retail companies!

SEAMONEY

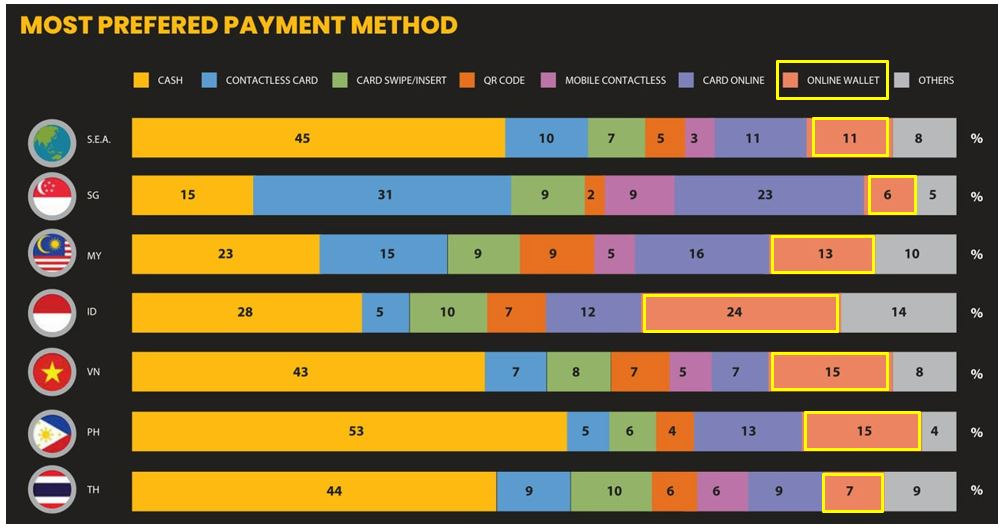

For SEAMoney, their competitors come in various forms of payment methods as the consumers can choose to pay with the method that they are comfortable with. The chart below shows the different type of payment methods that were being used by the Southeast Asian population.

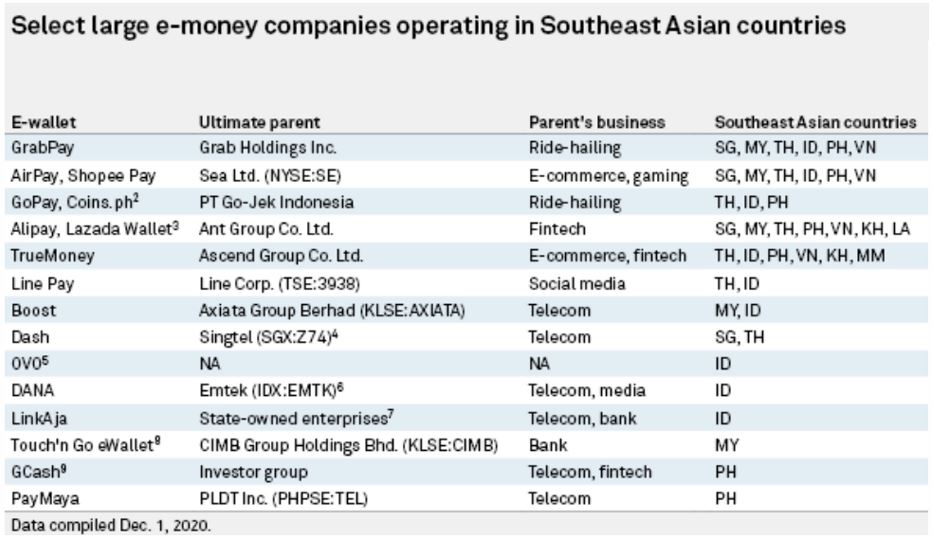

But for this section, we will only be looking into the Online Wallet (also known as Mobile Wallet or e-wallet), which is ShopeePay’s payment method. The list below shows the various e-wallets that are available in Southeast Asian countries.

Even though there are a lot of e-money companies offering e-wallet services, ShopeePay is available in 6 countries within the Southeast Asian region.

As SeaMoney has bank operations in Indonesia and the Philippines in near future, they have acquired digital bank Licenses (economic moat) from the respective countries and one of the four Fintech companies in Singapore to be awarded the digital banking license in 2020.

FINANCIALS

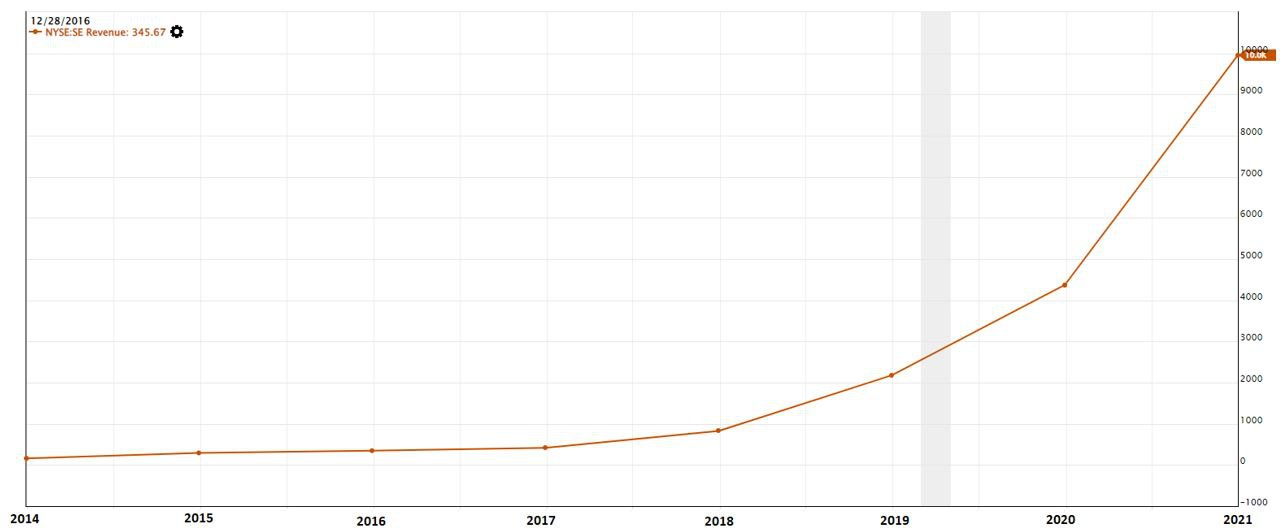

To understand if the company is doing well, there are a few financial criteria we need to check on. The first criteria that we look at is the Total Revenue generated.

Revenue refers to the total sales that a company can generate within a period of time. However, this is not the profit that the company is making. To determine if a company is making a profit or loss from their business operations, we will need to check on their Net Income.

From the chart above, we observed that the revenue has been increasing year on year and the curve has increased exponentially during the pandemic (2020-2021). This looks good as it shows that the company can generate more sales.

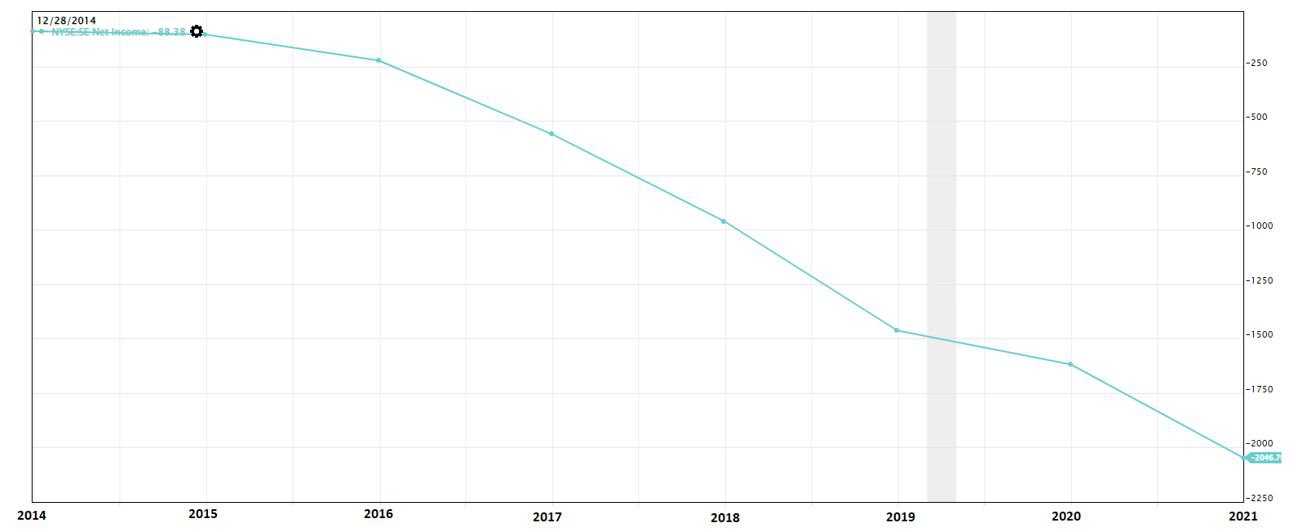

However, when we look into their Net Income section, we saw that the company was in fact experiencing loss since 2014. The loss has continued to widen, starting 2016.

We were surprised that if a company is able to generate incremental revenue year-on-year, why is the company still experiencing loss?

To answer this question, we will have to investigate into their annual report and look at the numbers.

From the Net Income formula shown above, the factors that can influence the Net Income of a company are the Revenue and Expenses. There are possible 3 outcomes:

- If the Revenue > Expenses, the company will be in Profit

- If the Revenue < Expenses, the company will be in Loss

- If the Revenue = Expenses, the company is neither profitable nor experiencing loss.

In the data shown above, we noticed that the Expenses (sum of Cost of Goods Sold & Total Operating Expenses) has been more than the Revenue earned. Thus, the net income for SEA Ltd. has been in the red since 2014.

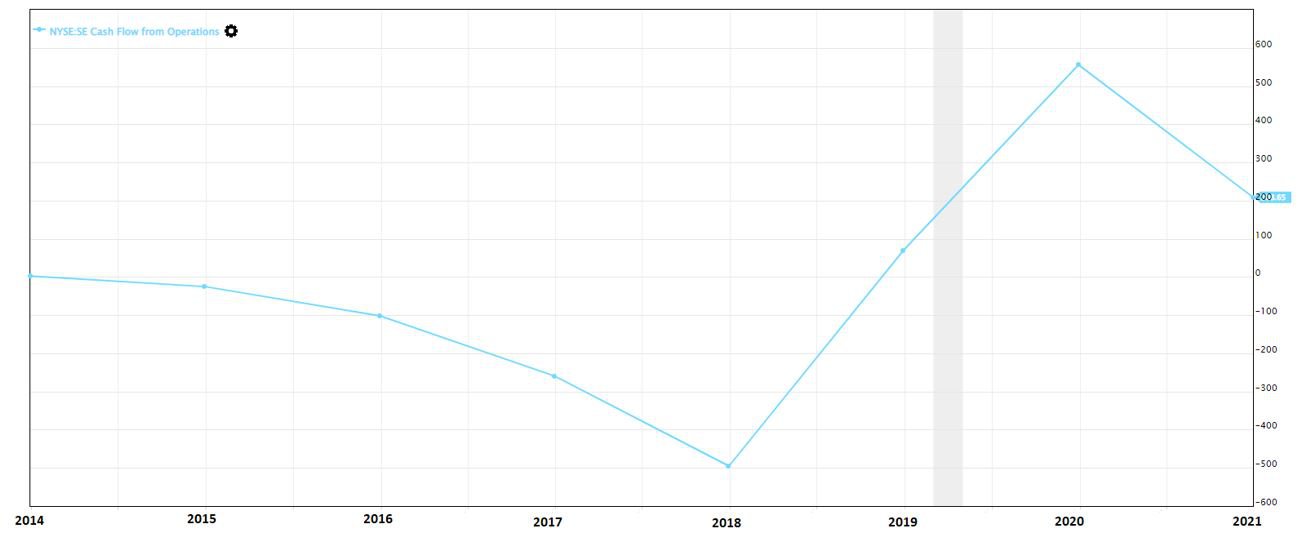

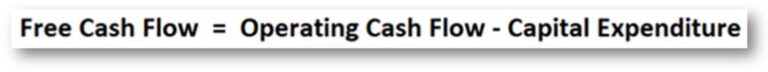

Since the company is in a loss, we are curious on the company’s cash flow situation. Hence there are 2 cash flow criteria that we will be looking into – Operating Cash Flow & Free Cash Flow.

The chart above showed their Operating Cash Flow, which is the cash flow generated from their daily business activities.

- If there are cash flowing in from their business activities, the cash flow is positive.

- If the cash are flowing out more than the cash flowing in from the daily business activities, the cash flow is negative.

Between 2014 – 2019, the Operating Cash Flow has been negative, but it became positive since 2019. This seems like good news that the company is now able to generate positive cash flow from their business activities.

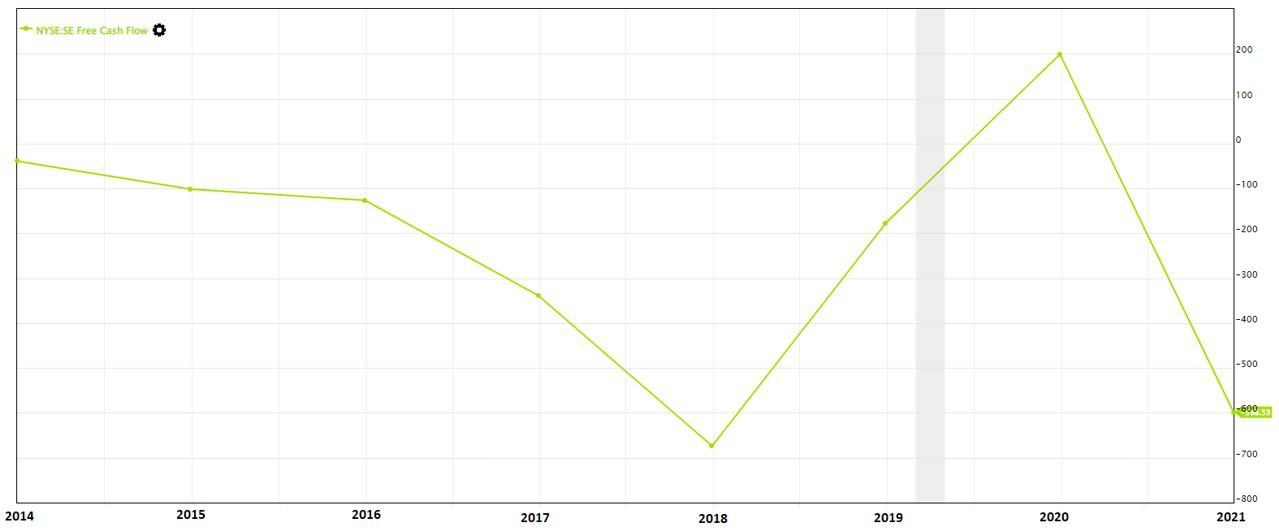

However, in their Free Cash Flow chart below, we noticed that most of the year it has been in the red zone, except for 2020, where the Free Cash Flow is positive.

Free Cash Flow refers to the cash that is freely available for the company to use after deducting Capital Expenditure (expenses used to purchase assets that will last for more than 12 months) from the Operating Cash Flow.

The negative free cash flow may imply that the company did not have much free available cash after deducting the capital expenditure. However, the company may also be focusing on expanding the business operations and thus investing the extra cash.

Investor will need to monitor closely if the company is able to generate profit for the subsequent years to decide whether the management is managing the company well and able to bring in cash from the business operations.

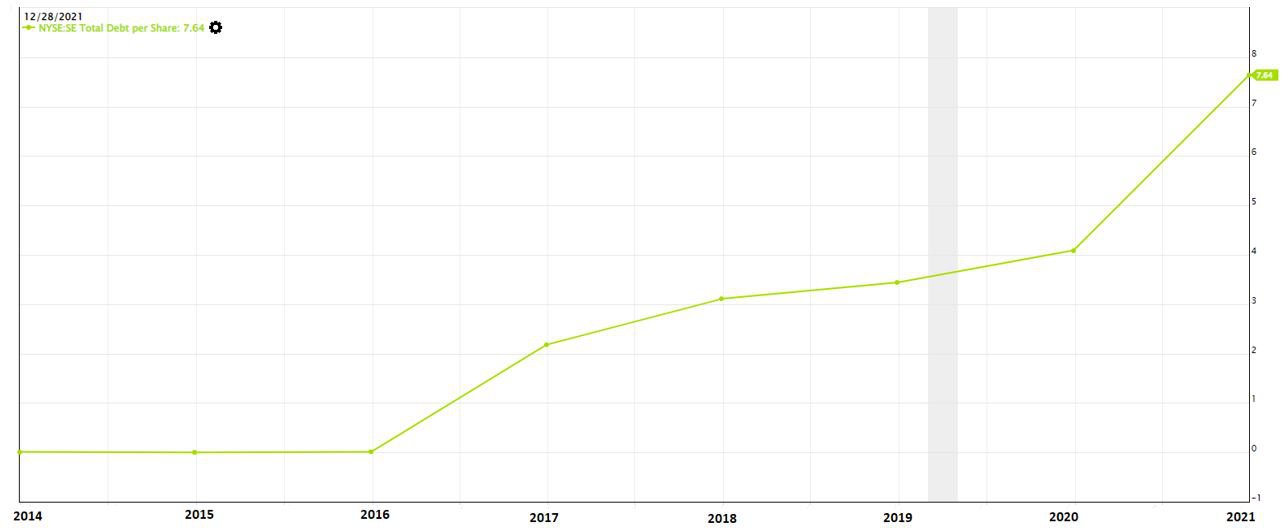

We also checked on the company’s debt level and how well is the management managing the debt. In this part, we will be checking on their Total Debt per Share.

In 2021, their Total Debt per Share is at 7.64. This means that for every share that the investor purchased at current share price of $62.00 (as of 31 Aug 2022), the investor will take on $7.64 of debt.

Debt is like a hole in the pocket. If there is no hole in the pocket, there will be no loss of money. But if the hole in the pocket is getting bigger, the money will flow out faster than the money brought in by the business operations and thus losing money.

Even though the current debt level is not something to be alarmed of, but investors will need to beware if the debt level continues to increase as the company is currently not generating profits from their operations at the time of writing.

POTENTIAL RISKS

Now that we have gleaned through the financial numbers of the company, we would also like to know if the company is having any underlying potential risks that we need to beware of before investing.

The first potential risks that we found out from the financial statements is that the company is experiencing huge cash losses due to their aggressive spending. From the article below, the company is burning cash while expanding their market share in the region.

This worked well for their e-commerce platform – Shopee as they have been promoting irresistible incentives, such as free vouchers for new users and free delivery in Southeast Asian market. The strategy was able to help them to grow the market share and Shopee is now the largest e-commerce platform in Southeast Asia. But one need to ponder if the same strategy is still workable when the company expand their operations worldwide.

The second potential risks that we identified was that one of the business subsidiaries – Garena is experiencing slowdown and even a drop in the user growth, based on their latest quarterly report in Q2 (Refer chart at the Revenue Generation section).

One of Garena’s famous game – Free Fire is a Battle Royale genre where players will have to fight against other players to become the last person standing within 10-20 minutes of game time. The Battle Royale game genre has seen its meteoric rise during the pandemic but currently is experiencing decline. As a result, this might be one of the reasons that the number of players playing Free Fire is decreasing as they are possibly switching to other games or entertainment content to spend their free time.

Finally, all 3 subsidiaries of SEA Ltd. are operating in a competitive landscape of digital economy where they are competing with other consumer internet company to grab the market share, especially in the e-commerce and digital payment space where we have covered earlier in the Competitors section.

CONCLUSION

To conclude, SEA Ltd. might seem like a potential super stock and local hero company here in Singapore due to its meteoric rise in share price during the pandemic, in addition to its leading e-commerce platform status in Southeast Asia & Taiwan. SEAMoney is also expanding rapidly within the Southeast Asia region and the increment of active users using the platform is an encouraging sign that the company may do well in this subsidiary.

Nevertheless, the company is still experiencing net loss due to excessive spending to expand the market share and compete against other consumer internet company. Investors are advised to monitor closely and perform extra due diligence before investing into this so-called Super Stock.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.