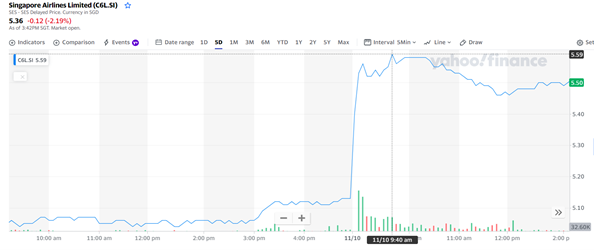

When PM Lee Hsien Loong announced that Singapore is expanding its Vaccinated Travel Lanes (VTLs) to 11 countries in total, there was a rush not just to book airline tickets, but also to buy the Singapore Airlines (SIA) stock itself! SIA shot up by almost 9% on October 11, during the first half hour of trading to hit a high of $5.59.

Source: Yahoo Finance

SIA engineering and SAT were other aviation related stocks to see a rise as Singapore moves to the endemic phase of living with Covid-19.

SIA attracted the highest institutional buying out of all SG listed stocks with $25 million of net inflows.

It appears as if the stock is reacting to this short-term news, but it would be prudent to analyse the company on factors other than just short-term optimism before hitting the buy button.

ABOUT SIA

In 1966, the governments of Singapore and Malaysia took majority control of Malayan Airlines Limited and changed its name to Malaysia-Singapore Airlines (MSA).

In 1972, MSA split into Malaysian Airline System (MAS) and Singapore Airlines (SIA) by mutual agreement owing to the difference in operating outlook and priorities.

Most airlines start out by serving the domestic needs, but SIA had to begin by competing with international airlines from the onset. This gave birth to a fighting spirit and a dedication to create a valuable brand.

Changi airport opened in 1981 and SIA moved to this new airport. It launched KrisWorld, an advanced in-flight entertainment system, across all classes in 1995. It was the first airline in the world to fly the Airbus A380 in 2007, the world’s largest airplane and the aircraft which would take over the role of Boeing 747 – one of the most legendary aircrafts in modern aviation.

Today, Singapore Airlines’ subsidiaries include Singapore Airlines Cargo, SIA Engineering Company, SilkAir (regional airline), Scoot (low-cost airline of SIA launched in 2011) and Tradewinds Tours and Travel (tour-operating arm of SIA and SilkAir).

SIA has employed a multi-hub strategy by investing in airlines outside of Singapore, for example, the investment in Vistara allows SIA to have a presence in India.

Singapore Airlines is 56% owned by Singapore state investment firm Temasek Holdings.

REPORTABLE SEGMENTS OF SIA:

- The Singapore Airlines segment provides passenger and cargo air transportation under the Singapore Airlines brand with a focus on full-service passenger segment serving short and long-haul markets.

- The SilkAir segment provides passenger air transportation under the SilkAir brand with a focus on full-service passenger segment serving regional markets.

- The Budget Aviation segment provides passenger air transportation under the Scoot brand with a focus on the low-cost passenger segment.

- SIAEC segment is in the business of providing airframe maintenance and overhaul services, line maintenance, technical ground handling services and fleet management. It also manufactures aircraft cabin equipment, refurbishes aircraft galleys, provides technical and non-technical handling services and repair and overhaul of hydro-mechanical aircraft equipment.

REVENUE

SIA principally earns revenue from:

- Passenger, cargo, and mail

- Engineering services: this includes revenue from repair and maintenance of aircraft, and engine and component overhaul

- Kris Flyer: The Company operates a frequent flyer programme called “Kris Flyer” that provides travel awards to programme members based on accumulated mileage. In addition, the Company also sells miles to programme partners for issuance to their programme members.

- Others: includes revenue from tour activities, sale of merchandise and rental income from lease of aircraft

REVENUE TREND

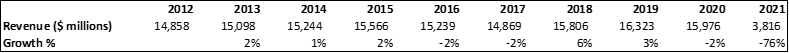

As we can see from above, the revenues for the past 10 years have been stable but not growing.

The revenue of SIA has declined massively in 2020-21, by about 76% due to scaling down of operations in the wake of the Covid-19 pandemic. SIA had to suspend services to various destinations. The pandemic has had an unprecedented impact on the aviation sector. With borders between countries closed and stiffening travel curbs, the passenger traffic for SIA has fallen ~97%.

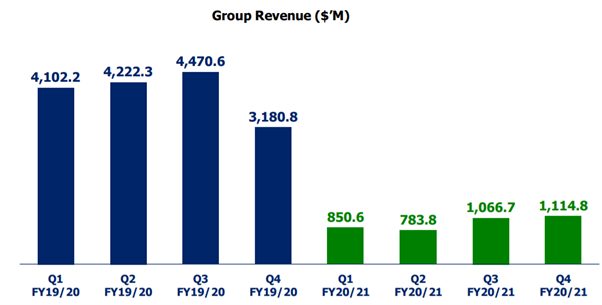

Passenger flown revenue in the second half of the year was more than triple of the first half due to progressive capacity injection.

CARGO

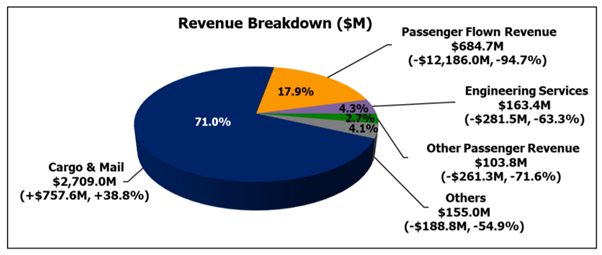

SIA Cargo, which posted a 39% increase in cargo flown revenue has cushioned the pandemic blow to some extent. Increase in cargo revenue was driven by both higher yields due to a shortage of freight capacity, as well as strong demand in segments such as e-commerce, pharmaceuticals, and electronics.

Cargo yield increased 116.1%, partially offset by cargo load (in load tonne-kilometres), which saw a decrease by 35.6%.

Cargo flown revenue rose 18.5% in second half of the year compared to the first half.

REVENUE BREAKDOWN

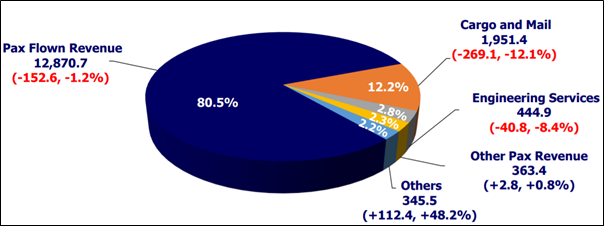

Revenue Breakdown 2020-21

The chart above shows the revenue breakdown of 2020-21 where due to the pandemic, Cargo & Mail is the highest revenue generating segment with 71% of the revenue share. This is completely opposite for the pre-pandemic FY 2019-20 where passenger flown revenue is the highest revenue generating segment (80.5%) as shown below. Moreover, this shows the drastic drop in revenue from passengers flown this year and even if the company returns to pre-pandemic levels, revenue was stagnant and not growing.

Revenue Breakdown 2019-20

OPERATIONS

The integration of SilkAir’s narrow-body operations with SIA began in March 2021 and will be completed this year.

As at 31 March 2021, Singapore Airlines operated 245 weekly services to 47 destinations, with at least a daily flight to key cities such as Jakarta, London, New York, Sydney and Tokyo.

SilkAir operated 11 weekly flights to five destinations, namely Cebu, Kathmandu, Kuala Lumpur, Medan, and Singapore, by the end of March 2021.

As at 31 March 2021, Scoot operated 53 weekly frequencies to 18 destinations, mainly in the North Asia and South East Asia regions.

KrisFlyer, the Singapore Airlines Group’s loyalty programme, continued to expand its global membership base in FY2020/21. KrisFlyer’s membership increased by 1.7% from the previous year, reaching over 4.76 million members worldwide as of 31 March 2021.

PERFORMANCE

Due to the same reasons mentioned earlier, the company suffered massive losses during the year. Passenger load factor for the Airline declined by 68.5 percentage points to 13.4%.

Passenger carriage and passenger load factor for SilkAir decreased 98.9% and 40.8 percentage points respectively. Scoot reported a 99.2% decrease in passenger carriage and its passenger load factor decreased by 75.8 percentage points to 9.9%.

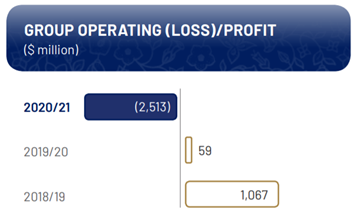

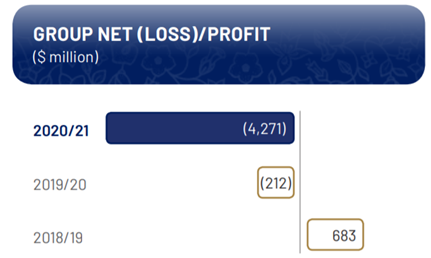

The plunge in passenger traffic resulted in an operating loss of $2513 million for the year. Net fuel cost also declined for the year due to capacity cuts and lower fuel prices in the first half of the year. The net losses declined in the second half of the financial year compared to the first half.

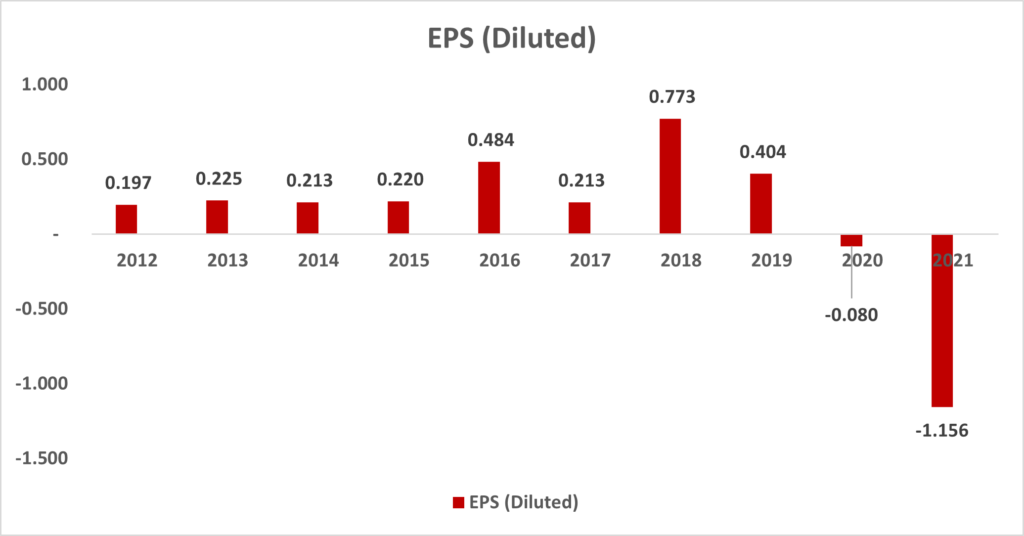

EPS

As we can see from the chart above, even before the pandemic, the EPS was not very high or growing. In fact, it has been on a declining trend since 2018.

LIQUIDITY

SIA prioritised liquidity and the company raised $8.8 billion from shareholders through a rights issue in 2020. Further, $6.6 billion of fresh liquidity was added through various sources including secured financing, bond issuances, and aircraft sale-and-leaseback transactions.

SIA has also undertaken cost cutting measures. For example, they have deferred more than $4 billion of capital expenditure through agreements with aircraft manufacturers.

These measures have reduced the cash burn rate for SIA to S$100-150m per month which is a huge amount despite being lower than last year.

In June 2021, SIA raised a further $6.2 billion through the Rights 2021 Mandatory Convertible Bond (MCB) issuance. These MCBs allow the company to navigate prolonged Covid-19 uncertainty and support future growth. According to SIA, MCBs are not immediately dilutive and will provide the Company flexibility for redemption over the next 9 years. The MCBs will mandatorily convert into ordinary shares of the Company on the conversion date.

The Group also has $2.1 billion in untapped committed lines of credit.

This liquidity gives some confidence that the company may be able to navigate through this crisis.

The funds raised by the company have the following intended purposes:

(1) to fund fixed costs and other ongoing operating expenses;

(2) for aircraft purchases and aircraft related payments; and

(3) debt service and other contractual payments.

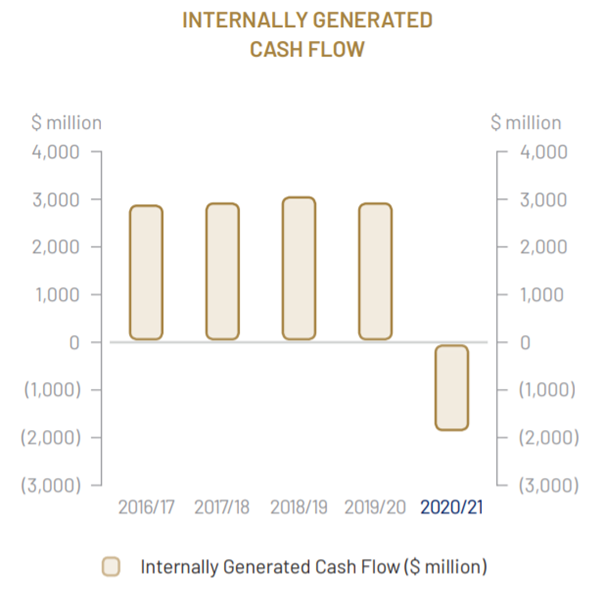

Internally generated cash outflow of $1,848 million declined from $4,925 million which was last year’s cash inflow. The drop in internally generated cash flow was attributable to lower cash flow from operations and dividends received from associated and joint venture companies, partially offset by higher proceeds from sale and leaseback transactions and from disposal of aircraft, spares and spare engines.

CASH FLOW FROM OPERATIONS

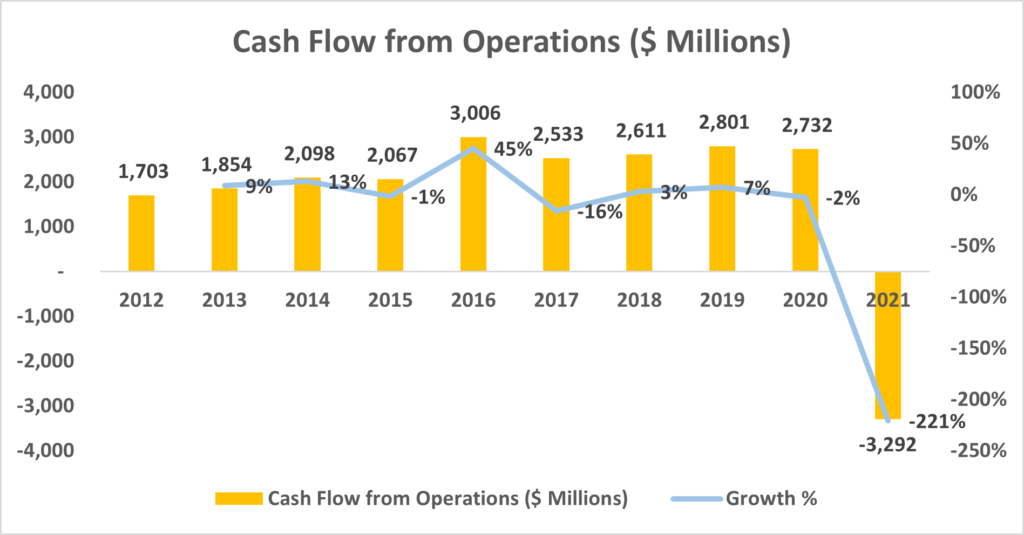

The cash flow from operations has always been positive for the last 10 years , however, for the year 2020-21, it has declined by more than 200% from the previous year to reach -$3,292 million.

DEBT

The Group’s net debt was $6,282 million as at 31 March 2021, a decrease of $2,394 million from the prior year. The total debt increased in 2021 to $ 14,336.9 million from $ 11,784.5 million, an increase of 22%.

Total debt to equity ratio decreased from 1.27 times to 0.90 times as at 31 March 2021.

REMUNERATION OF SENIOR MANAGEMENT

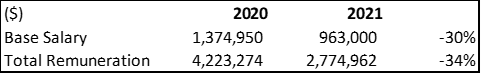

In line with the Company’s measures to mitigate the impact of COVID-19 on the international aviation industry, Base Salary cuts were implemented for Senior Management.

Base Salary cuts of 30% for CEO, 25% for Executive Vice Presidents (“EVPs”) and 20% for Senior Vice Presidents (“SVPs”) were implemented from 1 April 2020, and subsequently adjusted to 35% for CEO, 30% for EVPs, and 25% for SVPs from 1 August 2020.

The Chairman of SIA is Mr Peter Seah, and the CEO is Mr Goh Choon Phong.

As shown in the table above, For the FY 2019/20, the CEO base salary was $1,374,950. After including bonus, shares and benefits, total remuneration amounted to $4,223,274.

For the FY 2020/21, the CEO base salary was 30% lower at $963,000 after the salary cuts. The total remuneration was 34% lower at $2,774,962 after including shares and benefits.

FIRST QUARTER 2021-22 UPDATE

- The Group’s passenger traffic (measured in revenue passenger-kilometres) grew year-on-year on the back of a calibrated increase in passenger capacity (measured in available seat-kilometres), which rose to 28% of pre-Covid-19 levels by the end of the quarter in June 2021.

- The passenger load factor (PLF) for the first quarter increased 4.6 percentage points year-on-year to 14.8%.

- An increase in both passenger and cargo flown revenue resulted in Group revenue increasing by $444 million (+52.2%) year-on-year to $1,295 million.

- SIA Group recorded a first quarter operating loss of $274 million, an improvement of $763 million (+73.6%) from the $1,037 million operating loss recorded last year.

- The Group reported a net loss of $409 million for the quarter, an improvement of $714 million (+63.6%) against last year.

- The MCB issuance was completed. In total, the Group has successfully raised $21.6 billion in fresh liquidity since 1 April 2020.

- Debt-equity ratio fell from 0.90 times to 0.67 times.

- As at 30 June 2021, the SIA Group had an operating fleet of 164 passenger aircraft and seven freighters with an average age of five years and 11 months. This makes it one of the youngest fleets in the airline industry, helping to improve underlying operating efficiency and lower carbon emissions.

SWOT ANALYSIS

STRENGTHS

- Majority-owned by the government of Singapore and therefore, enjoys a strong backing from the government

- Premium and unmatched customer service, hospitality and strong brand equity is a valuable asset for the company which allows it to charge premium prices.

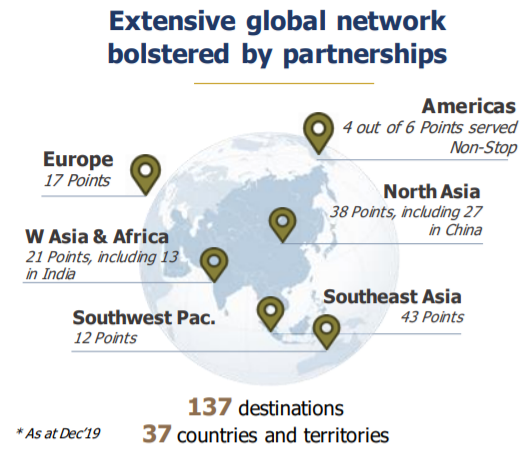

- SIA has a strong position in Southeast Asia. Moreover, based out of Singapore, it has a good access to Europe, Asia and Australasia. SIA is the largest Asian airline in Europe. Such a position helps the airline gain competitive advantages over other Asian competitors.

- SIA has codeshare agreements and partnerships with several airlines around the world which gives consumers enhanced frequency and greater choice of destinations as one of Singapore Airlines’ product offerings.

- SIA has an advanced, modern, and fuel-efficient fleet of airplanes. The average age of its fleet is about 5 years which provides it a competitive advantage with some of the lowest fuel costs in the airline industry. This is crucial since up to 40% of an airline’s total costs comes from fuel.

- SIA hedges up to 60% of their fuel requirements two years in advance to avoid cyclical and often large volatility in fuel prices.

- A strong cash position allows the company to fund purchases internally thus decreasing interest costs. It also allows it to maintain its strong brand image in the face of competition. Temasek Holdings recently issued a rescue package to SIA to keep it floating and competitive.

- SIA has been constantly innovating to present the latest in seats, service, in-flight entertainment, lounges, and many other features to stay ahead of the game. Responding to the Covid-19 pandemic, SIA converted one of its A380 into “Restaurant A380@Changi”. It also provided tours of the airline training facilities and flight simulations.

WEAKNESSES

- SIA has a premium brand image, making it quite expensive for many customer segments.

- SIA relies a lot on international travel. If international demand decreases due to some macro changes, it may affect the airline significantly.

- It is costly to maintain and deliver on the brand promise, all services intact, in times of down cycles when the revenues are not that high. This requires heavy on-going investments, and healthy cash flows which may be hard to come by when passenger load factors are not very high.

- Weak presence in USA and China markets due to growing competition and location disadvantage in case of USA.

- Growing popularity of low cost airlines affects margins of luxury airlines like SIA.

OPPORTUNITIES

- Can leverage more international destinations using its brand image.

- SilkAir and Scoot will help the airline in fighting competition in the low-cost segment. With Scoot, SIA will be able to tap routes which would otherwise have been unprofitable for a full-service airline.

- Opening of borders presents hope of resuming normal operations.

- Promising growth in India with investment in Vistara. Vistara’s domestic operations have resumed to 70% of pre-Covid-19 capacity in March 2021 and reached 65% passenger load factor.

- Expanding partnerships may provide a more comprehensive network and improve connectivity.

THREATS

- Fluctuation in Aviation Turbine Fuel (ATF) prices may affect margins

- Government regulations may impact operations

- Increasing competition from middle east players such as Airlines like Emirates, Etihad Airways and Qatar Airways may affect market share. There is also strong competition in the Asian region itself which may lead to overcapacity.

- Pace of recovery from pandemic is uncertain

- The risk of new variants and fresh waves of Covid-19 infections in key markets remains a concern.

WHAT ARE ANALYSTS SAYING?

Some believe SIA may receive about 68% of the pre-pandemic traffic by next year. Some expect the enhanced VTLs to boost demand for SIA, so much so that it could turn an operating profit by Jan-March 2022 provided load factors remain above 60%.

Some analysts believe that fundamental demand is robust with travel-starved consumers ready to splurge on tickets. This was also evidenced by an uptrend in airfares and heavy volume on SIA and other travel websites. Pent up demand and the upcoming festive season may also have boosted volume and price.

However, the new daily arrival is currently capped at 3,000 travelers. This may subdue the impact to some extent.

Majority believe that there may be limited upside and the stock may remain range-bound around current levels.

Market Consensus:

- CGS-CIMB: $5.54

- JP Morgan: $3.70

- Credit Suisse: $4.40

- DBS Research Group: $4.90

CONCLUSION

Temasek Holdings wrote a rescue package for SIA which the company is using to modernize its fleet to save fuel, reduce maintenance costs and meet environmental goals. It is using the money to maintain its industry leading position while other airlines are still struggling to stay above water by trimming their fleets.

Although signs have emerged that the tide is slowly turning against the virus, it will be a slow and protracted recovery that may see further unexpected twists. The outlook for the aviation industry remains cloudy, with the International Air Transport Association (IATA) projecting that aviation revenues may not rebound to pre-COVID levels even by 2024.

Maybe the prudent investor should stick to purchasing airline tickets rather than the stock.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.