Since the start of 2022, consumer discretionary stocks have been tumbling due to high rising inflation and supply chain disruptions that led to declining consumer sentiment.

Nevertheless, the Internet & Direct Marketing Retail Industry has recorded superior performance than average S&P 500 for the past decade, compared to the other 11 industries within the sector.

Does this plunge in share price indicate a buy signal for value investors within this industry?

In this blog article, we will be deep diving into this industry, while looking for any potential good growth and undervalued companies that we can invest in during the impending recession.

CONSUMER DISCRETIONARY SECTOR

Consumer Discretionary sector is made up of companies from 11 different industries that manufacture or provide non-essential goods and services that people can splurge on. These expenses are commonly known as discretionary expenses – extra cash to spend on luxuries that you can indulge in but are not necessary for survival.

The list of 11 industries is illustrated in the chart below:

Examples of the products and services in this sector include:

- Vacations and travel expenses

- Automobiles

- Alcohol & Tobacco

- Restaurants and other entertainment-related expenses

- Coffee & speciality beverages

- Hobby and sports-related expenses, such as crafting, sewing and gym membership

Demand for these items tends to increase when the economy is booming. However, during a bearish economy or rising inflation, people will tend to cut down on their discretionary expenses as they may want to save money and spend on essential products.

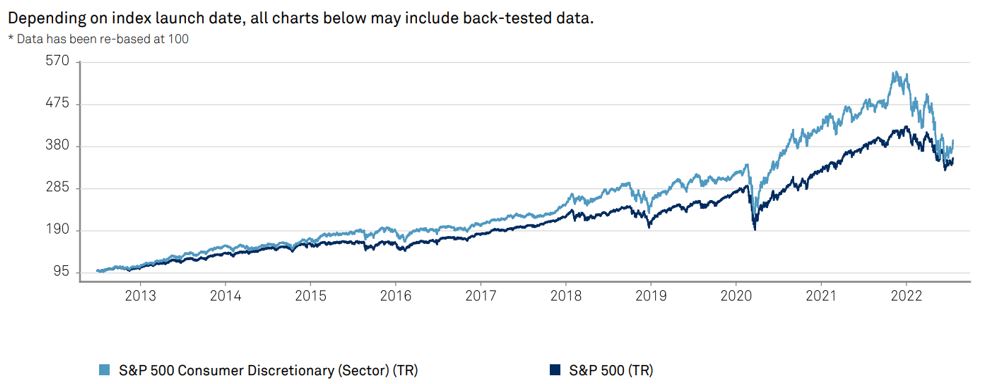

This scenario was clearly illustrated in the historic data for the past decade when we compare the Consumer Discretionary Sector ETF (XLY) against the S&P 500.

Since 2012, the XLY has been performing slightly better than the S&P 500 until 2020 when COVID-19 struck. During the pandemic, the economy was suddenly ground to a stop as people were instructed to maintain social distancing and businesses were forced to close in order to stop the pandemic from spreading. There were massive layoffs and people who lost jobs are struggling to survive. Thus, there was a sharp plunge in the XLY as people are not spending money on non-essential products.

Nevertheless, we saw a sharp rebound in XLY after 2020 and people are starting to spend money on non-essential items. One of the explanations for this scenario was that the government was giving out a stimulus package to help needy people to overcome these trying periods. With extra cash to spend, people can buy more things and splurge which further help to keep businesses running and boost the economy.

However, XLY saw another deep plunge in early 2022 as economists have reported that due to the massive amount of money printing to boost the economy from the pandemic downturn, inflation is expected to arrive in 2022 and also an impending recession coming soon. As a result of this, people have to stop spending money on discretionary items and try to save up more money to tide through the bad times. From these two scenarios, we can conclude that the consumer discretionary sector is sensitive to economic cycles.

INTERNET & DIRECT MARKETING RETAIL INDUSTRY

Internet & Direct Marketing Retail Industry is comprised of companies that provide retail services of consumer products & services on the internet. As there are various types of online businesses that sell different kinds of products and services, the companies are categorized into 3 types for simpler categorization:

- E-commerce

- Online Marketplace

- Omni-channels

E-COMMERCE

Businesses that retail products & services over online platforms are commonly known as e-commerce.

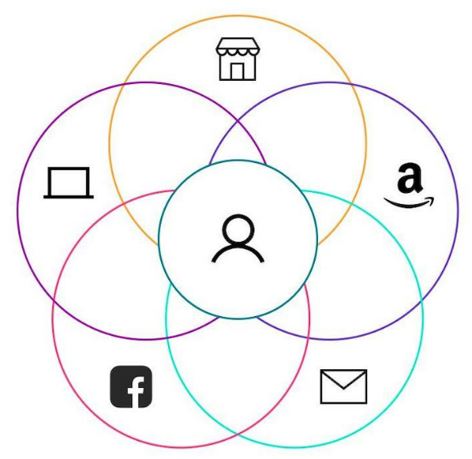

For this model, business owners will have to build their own websites and brands on the online platform. They can sell any goods that they want and directly engage with their customers via social media or online communication tools, such as mailing lists to promote their merchandise. Examples of companies that provide e-commerce platforms are Shopify and BigCommerce.

ONLINE MARKETPLACE

Online Marketplace also retail products & services over the internet but the businesses are performed over third-party platforms, such as Amazon and Alibaba.

In these platforms, business owners do not need to build their own online business websites. They can easily set up their online store with the settings that were pre-set by the third-party platform. However, they may have to compete against competitors that sell similar products and bid for advertisements to promote their products on the third-party platform.

OMNI-CHANNELS

For Omni-channels, business owners can sell their merchandise over all channels, platforms and devices to their customers. They can easily reach out to the mass public via social media, email, online websites or physical stores to promote and sell their products and services.

As a result, customers can easily shop online to learn more about the merchandise that they are looking for or go offline to try out the products personally in physical stores before purchasing. This provides an integrated and personalized shopping experience to their customers where they can easily shop online or offline seamlessly.

As value investors, we love to buy great companies at a discount price. Despite the sudden plunge in share prices for internet retail companies, does this mean that there are investment opportunities for investors to jump in and buy high-growth potential and good-quality companies?

Most of us would like to earn multiple streams of income from investing in a good and profitable company. However, we are not sure how or what are the criteria make a company profitable to invest in. In addition, we may also become indecisive to choose or analyze a good company to invest in with many different sectors and industries to choose from. This has stopped many people from taking action to invest due to this fear and uncertainty.

Fret not! Cayden has assembled a team of great passionate authors who have constantly been on the lookout for good growth and undervalued companies. If you’re keen to profit consistently from crates of good growth companies.

Click here to learn how to use minimal time and effort to profit more from good growth, undervalued companies.

Now let’s jump back right to discover potential companies in this industry!

HISTORICAL PERFORMANCE

In this section, we will look at the past performance of the internet retail industry and companies that performed better than the S&P 500 for the past 5 years.

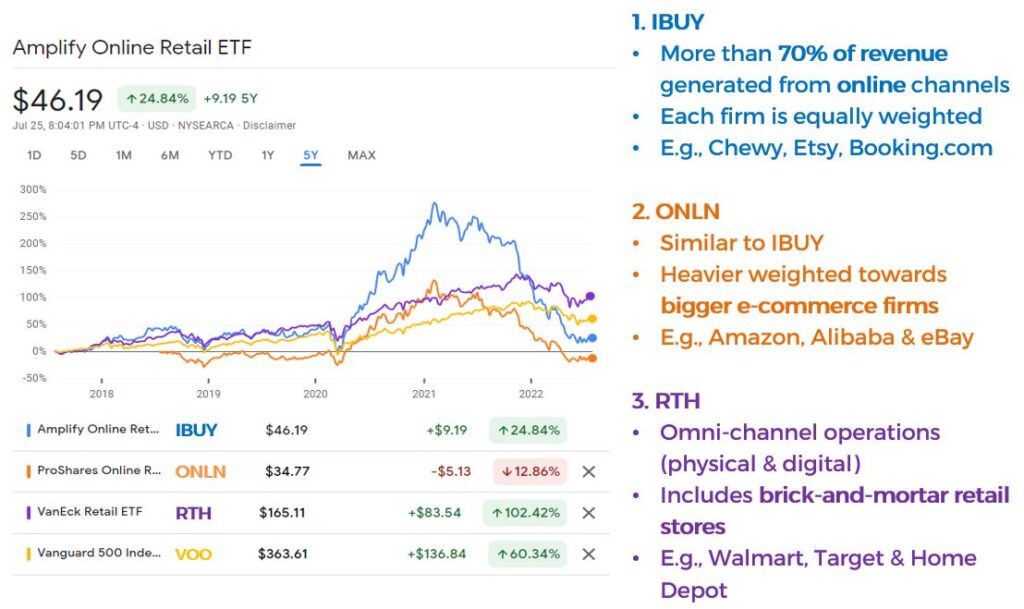

For the online retail ETF, we will be using Amplify Online Retail ETF (IBUY), Proshares Online Retail ETF (ONLN) and VanEck Retail ETF (RTH) to compare against the S&P 500 for the past 5 years.

From the chart, we can see that since 2020, at the start of the COVID-19 pandemic, the three ETF has been performing better than S&P 500 (yellow line). However, ONLN (orange line) and IBUY (blue line) have been performing worse than S&P500 since mid-2021 and early 2022 respectively. Only RTH (purple line) has been consistently performing above the S&P 500 since 2018.

When we look into the top 10 company holdings of these 3 online retail ETFs, we noticed that companies in the RTH ETF also include companies from the Consumable Stables sector, such as Costco Wholesale Corp. The reason that this company was included because it has exposure to online sales via Omni-channels.

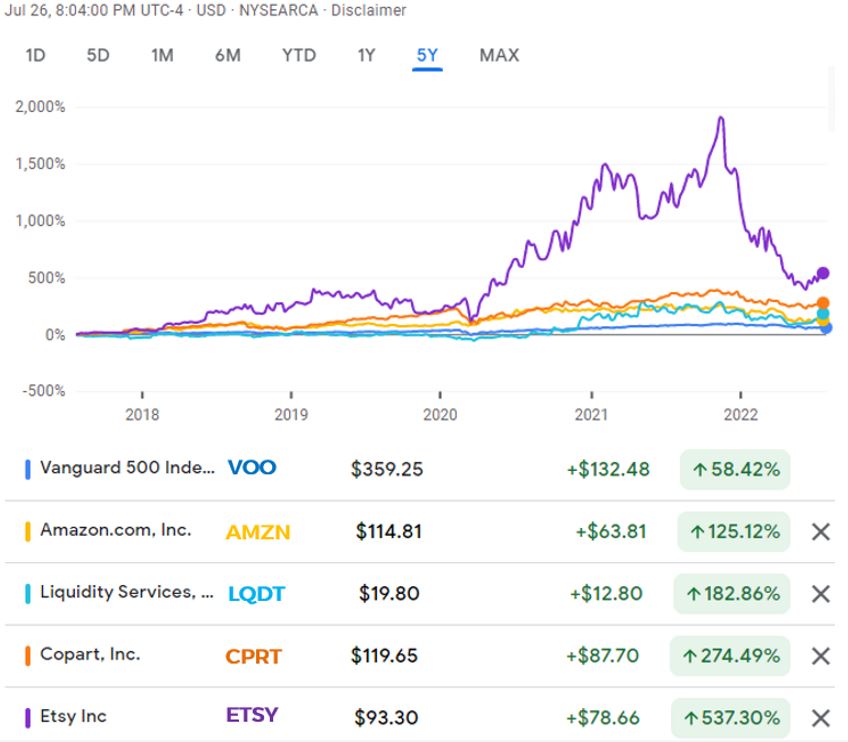

Now, we will compare the past performance of the companies within the ETF.

For online marketplaces firms, there are about 4 companies that performed better than S&P 500 – AMZN, LQDT, CPRT and ETSY.

This is the simplified synopsis of these company’s background:

AMZN – Amazon.com, Inc

- Online marketplace that offers a multitude of product categories

LQDT – Liquidity Services Inc

- B2B online auction marketplace

- It operated over a network of different e-commerce marketplaces to offer more than 500 product categories

CPRT – Copart, Inc

- Online auction marketplace that sells used, wholesale and repairable vehicles.

ETSY – Etsy, Inc

- E-commerce marketplace that sells vintage and craft goods.

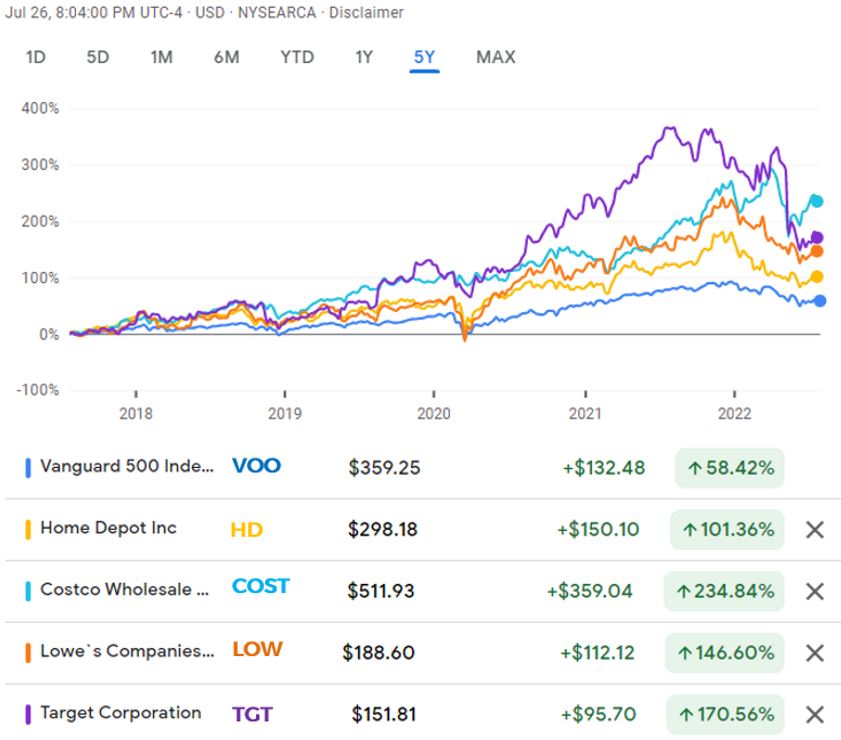

For this chart, we will compare firms that have omnichannel operations. Companies that performed better than S&P 500 for the past 5 years are HD, COST, LOW and TGT.

HD – Home Depot, Inc

- Home improvement retailer that sells building materials, home improvement & décor products

COST – Costco Wholesale Corp

- Warehouse retailer that offers heavily discounted essential products, such as groceries, household essentials, electronics, etc…

LOW – Lowe’s Companies Inc

- Home improvement retailer that sells hardware for home improvement, maintenance, repair & DIY

TGT – Target Corporation

- General merchandise retailer that sells essential products, such as F&B, beauty, household essentials, apparel & accessories and many more.

FUTURE TRENDS OF ONLINE SHOPPING

For the past decade, people are increasingly shopping online instead of heading down to physical stores to make their purchases. This trend has been the most obvious during the COVID-19 pandemic as people are stuck at home, unable to go to physical stores to do their shopping. According to new data from IBM’s US Retail Index, it was estimated that the pandemic might have pushed forward the shift from offline shopping to online shopping by roughly five years.

This may only be the beginning of online shopping as there are only under 60% of the world’s population is currently online. However, the accelerated growth of mobile usage in both first-world and developing countries may also potentially create a new trend of the e-commerce shopping experience, known as M-commerce.

From the chart illustrated above, there are about 10 exciting future e-commerce trends that we can look forward to. In the trends listed out, we can clearly see that the extensive use of technology will further enhance customers’ online shopping experience, such as shopping assistance with the use of voice technology (smart home speakers – Alexa, SIRI), chatbots and augmented reality.

POTENTIAL RISKS

Even though there is a bright future for online shopping, we will have to take note of any potential risks that may arise in this industry and better prepare for the downturn during the bad economy.

First, this industry is more sensitive to economic cycles. People will only spend when the economy is good and they have extra cash to splurge on things that they want. Thus, this industry’s performance will be doing well. However, whenever the economy is at a bad time, people will tend to shrink their spending and purchase essential items.

Next, supply chain disruption will also affect this industry. When there is sufficient inventory, the business owner can run their businesses as per normal. But when there is a disruption in the supply chain, the business owner is unable to replenish their stock in time and does not have sufficient stock to sell. With no stock available, customers may look for other businesses that offer similar products and business owners may end up losing the sale.

Finally, the internet & direct marketing retail industry relies heavily online to run the businesses. When internet access went out, it will also severely affects online retail businesses as customers could not make their purchases online. Recently there was a severe internet outage in Canada that impacted a lot of businesses and hotline services. Even though this may be a one-off incident, however, the impact of this incident is quite serious as most of our daily lives are slowly moving from offline to online.

CONCLUSION

This industry tends to do well when the economy is booming based on past performance records. Not to mention that the extensive use of mobile devices and apps will change the way how people shop online in the future. They can choose to shop in physical stores and pay online with their mobile phones or shop online in the comfort of their own homes.

However, like all industries within the consumer discretionary sector, they are sensitive to economic cycles. When times are bad, such as a recession, people will cut down their discretionary spending and this will severely affect the businesses’ profit. In addition, both supply chain and internet outages will also affect the business operation for online business owners.

All in all, this is an exciting industry to look forward to for the next few years but should the investors be interested to invest in this industry or companies, further due diligence is a must in order to find the glittering gold within the mud.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.