During the COVID-19 pandemic, worldwide companies and workers are being instructed to maintain social distancing and minimize physical contact. This had led to a new way of working where workers are working remotely from home (WFH). Due to this abrupt change, people are scrambling to get laptops and PCs to work. As such, the sudden increase in PC sales has led to high chip demand in the semiconductor industry since April 2020.

Google Finance

After the chip boom bull runs for the past 2 years, the share price of the semiconductor companies had been plunging since the start of 2022. One of the reasons was that people are going back to the office to work and there was a drop in PC sales, thus bringing a halt to the chip boom. We will explore other reasons in the later part of the article.

As our modern lives are intertwined closely with technological devices to work and connect socially, there could be a bright future for the semiconductor industry as they manufacture the key component for these devices – integrated circuits (ICs). Despite the recent plunge in semiconductor share prices, people are wondering if now is a good time to scoop up some great chip stocks at discount prices.

In this blog, we will be deep diving into the semiconductor industry and find out if this is a good industry to invest in during recession times.

INFORMATION TECHNOLOGY SECTOR – SEMICONDUCTOR INDUSTRY

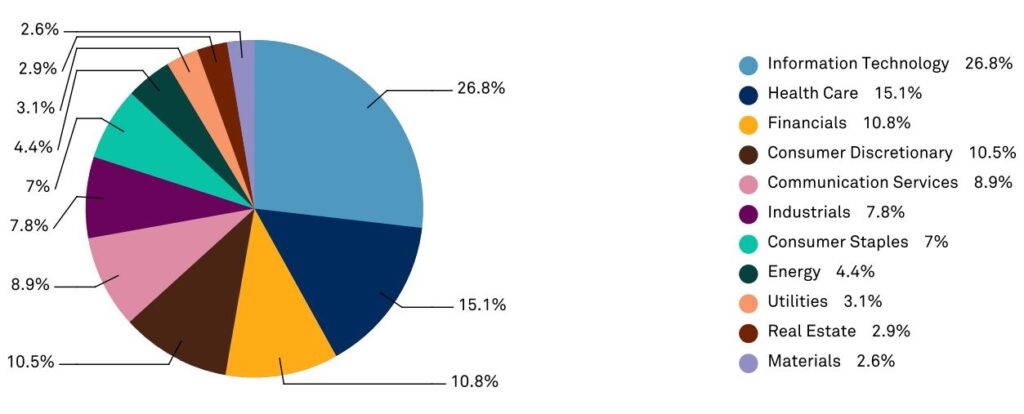

Standards & Poor 500 (S&P 500) is a US stock market index that tracks the top 500 US companies that span across different sectors of the US economy. It is made up of a total of 11 sectors (To find out more about the other sectors within the S&P 500, click on the link to read more on this blog).

S&P Dow Jone Indices (As Of June 30, 2022)

Companies that develop and distribute technological products such as computers, software, and smart devices are categorized under the Information Technology sector. To better segregate companies that produce different technological products and services, the Information Technology sector is categorized into 6 industries:

Companies that manufacture the vital components for most of the modern technologies and devices that we use today – integrated circuits (ICs) are categorized under the Semiconductor & Semiconductor Equipment Industry.

ICs is a microchip which contains a set of electronic circuits and electrical components, such as resistors, capacitors, and transistors on a small piece of semiconductor material.

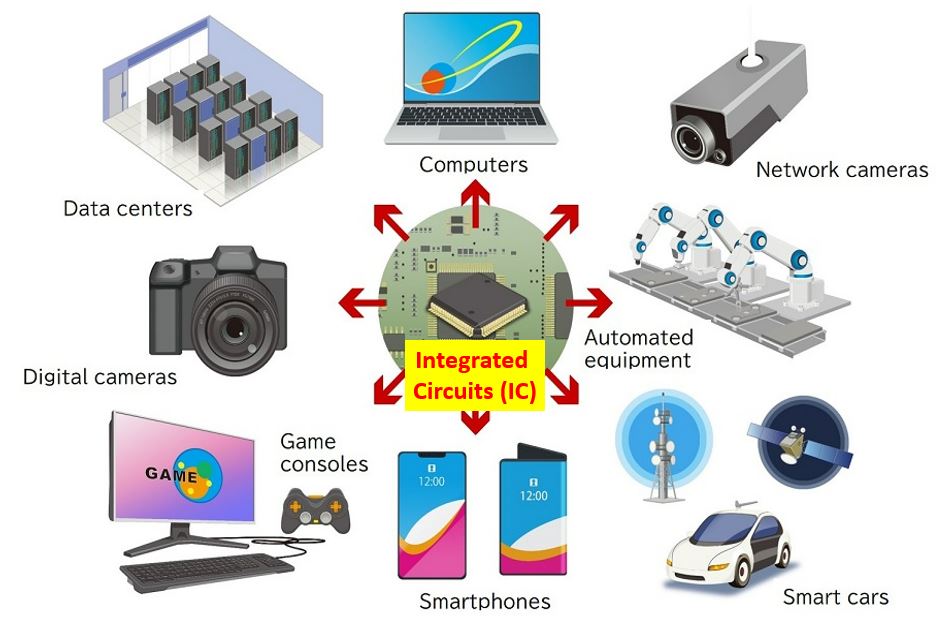

It is used in many modern-day technological devices as per shown in the diagram below:

These technological products have integrated seamlessly into our daily lives, making our lives much more convenient and enabling us to connect with people globally. Without these technologies, our modern-day lives may grind to a stop as we had been relying heavily on these products in our daily working and social lives.

HISTORICAL PERFORMANCE OF THE SEMICONDUCTOR INDUSTRY

The following chart shows the comparison of the semiconductor ETF (SOXX) historical performance against the IT sector ETF (XLK) and S&P 500 index (VOO).

Google Finance

Since April 2020, SOXX has had better performance compared to XLK due to the booming PC sales and high demand for ICs during COVID-19 as most workers were forced to WFH.

However, since the start of 2022, we observed that SOXX has been trending downwards. This has triggered some worrying doubts among investors, wondering if the chip boom is ending soon as there was gloomy news about declining PC sales and an oversupply of chips produced.

As value investors, we love to buy great companies at a discount price. Despite the scary news about the end of the chip boom, does this mean that there are investment opportunities for investors to jump in and buy some good-quality semiconductor companies?

POTENTIAL GROWTH OF THE SEMICONDUCTOR INDUSTRY

Before we jump in to pull the trigger to buy, we will also look at the potential growth in the semiconductor industry for the upcoming years.

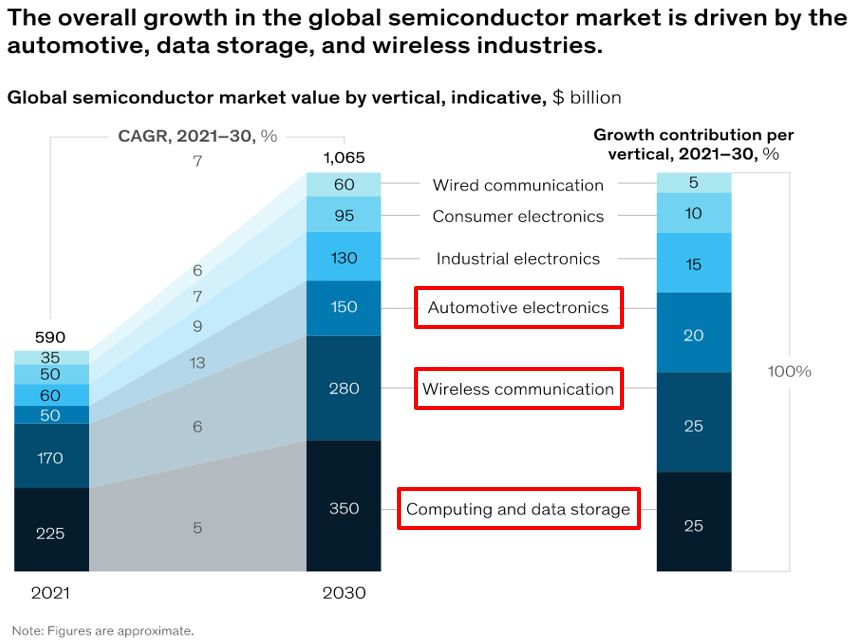

McKinsey Company

According to research by McKinsey Company, about 70% of the industry growth is predicted to be driven by these 3 areas in the upcoming decade:

- Computing & data storage

- Wireless communication (5G)

- Automotive electronics

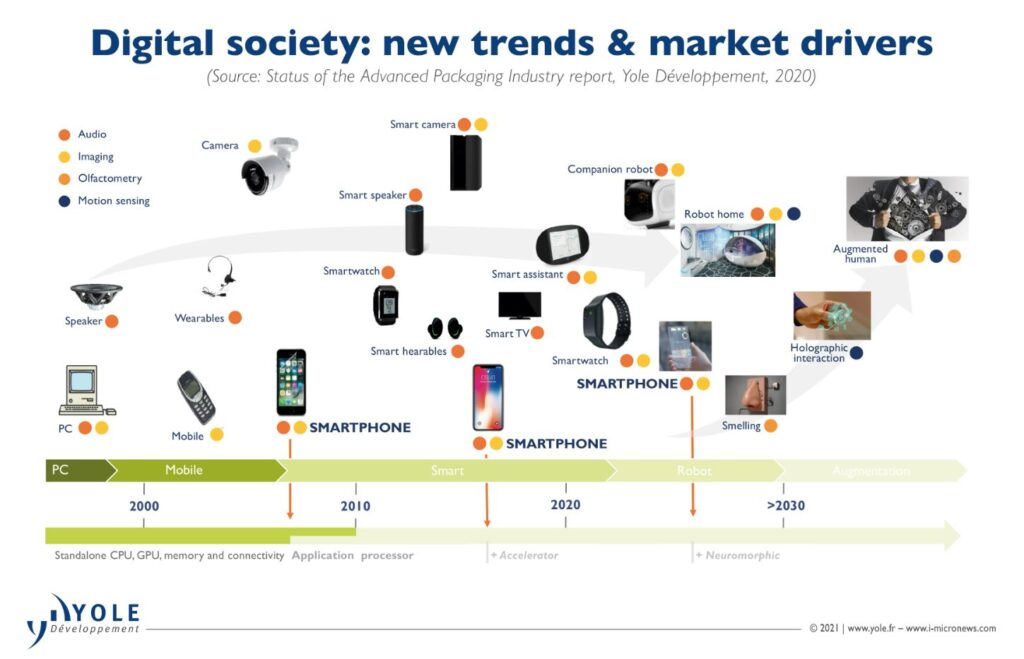

Based on the listed industry with potential growth, we noticed that the trend is moving forward to a digital society and globally connected world (e.g. 5G). Daily technological products are slowly, but surely becoming an important part of our daily lives.

CHIPS FOR AMERICA ACT

With the growing importance of semiconductors in our everyday lives that revolves around technological products, the US government has launched a new act – the CHIPS for America Act to boost the production of semiconductors within the US.

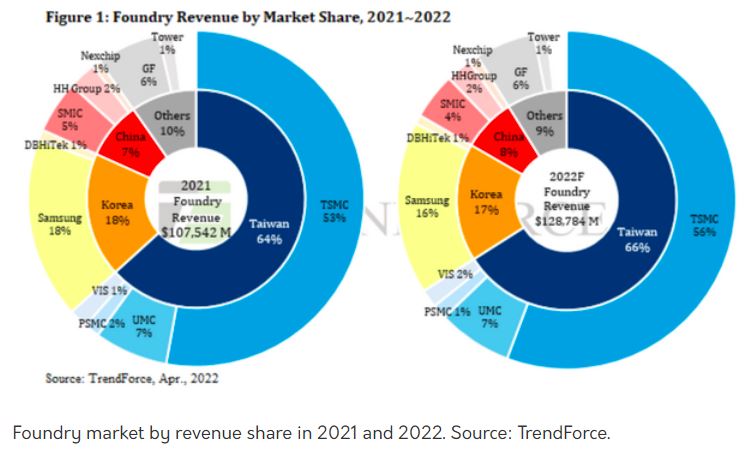

Currently, most of the global semiconductor chips were produced in Taiwan and other Asian countries outside of the US.

This is a worrying sign for the US because if there is any issue with the producing countries, such as war or political turmoil, this may affect the production supply of the ICs, which may also indirectly affect the production of the other technological devices. As the world is heavily relying on technological products, such as PC and smartphones, the impact of chip shortage will be detrimental to the economy.

To avoid over-reliance on another country for semiconductor production, the US is launching this CHIPS Act incentive for semiconductor companies to set up manufacturing sites to produce US-made ICs. This may create another chip boom period for the industry in the near future.

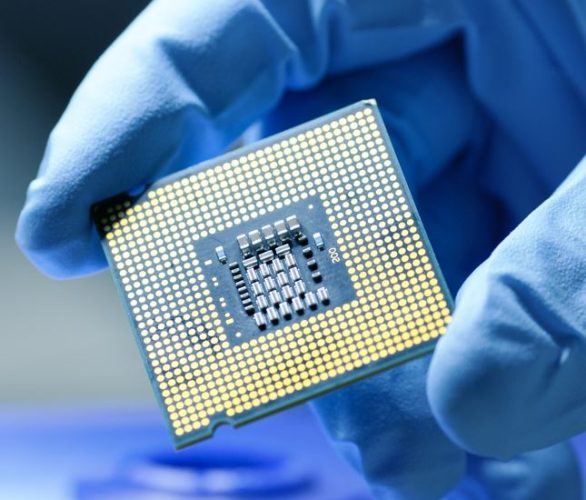

WHAT IS A SEMICONDUCTOR?

A semiconductor is a solid substance with electrical conductivity between a conductor and an insulator. It is commonly manufactured into highly specialized devices that serve as a foundation, yet an important part of modern-day electronic devices.

It is made mainly from silicon and manufactured into different forms of integrated circuits (ICs or chips) that works for different functions. The semiconductor products can be categorized into 4 main types:

Memory serves as a temporary storehouse of data, passing and storing information to and from the PC’s RAM to process code.

Microprocessor is the central processing unit (CPU) of the computer with basic logics to perform various tasks, such as computation, text editing, multimedia display and communication over the Internet.

Commodity Integrated Circuit is a simple chip that is commonly used to perform single and repetitive processing routines, such as barcode scanners.

Complex System on a Chip (SOC) is an integrated circuit that has most of the computer components (e.g. microprocessors, microcontrollers) and communication subsystems on a single chip, mostly used in smartphones and tablets.

SEMICONDUCTOR COMPANIES

The semiconductor industry is made up of various companies with different functions to support semiconductor ICs production. This is known as the Semiconductor Ecosystem.

steveblank.com

To keep things simple, we will be looking into 4 types of semiconductor companies within the semiconductor ecosystem.

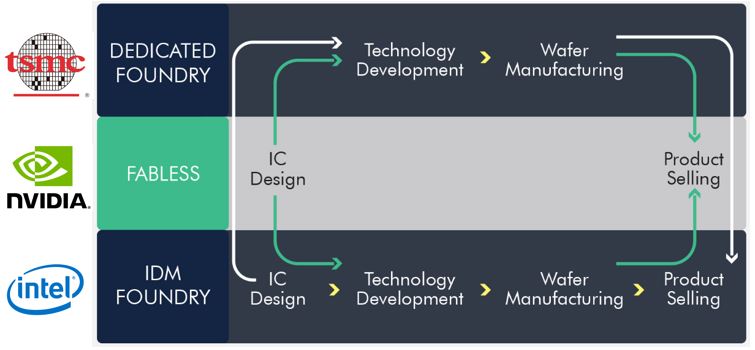

Semicon Talk

Fabless, also known as a chip designer, is a company that specializes in designing integrated circuits and outsources chip manufacturing to foundries. Examples of the companies are Qualcomm (QCOM), Broadcom (AVGO) and NVIDIA (NVDA).

Foundry is the chip manufacturer that mass produces ICs. The production site is known as fabs. Foundry companies are Taiwan Semiconductor Manufacturing Co Ltd. (TSM), Global Foundries (GFS) and UMC.

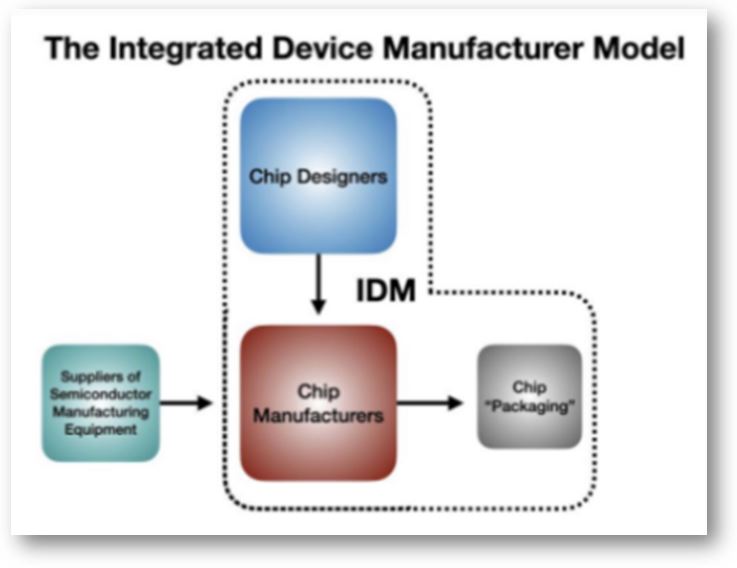

Integrated Device Manufacturers (IDM) is the manufacturer that comprised all the semiconductor manufacturing process, from chip designing to the final product packaging. Examples of companies are Intel (INTC), Micron (MU) and SK Hynix (XKRX:000660).

Outsourced Semiconductor Assembly & Test (OSAT) are companies that specialized in packaging, assembling and testing the manufactured ICs for final production. Example companies are ASE Technology Holding Co. Ltd, Amkor Technology, and Powertech Technology Inc.

The chart shows how the different semiconductor companies work together within the semiconductor ecosystem to produce ICs:

TSMC.com

The fabless companies (e.g. NVIDIA) or IDM (e.g. Intel) will first design the IC based on customers’ requirements. Then, fabless will outsource the IC manufacturing process to either a dedicated foundry (e.g. TSMC) or IDM foundry company (e.g. Intel). The IDM will continue with the ICs manufacturing in-house if they have the technical expertise to manufacture the chips.

After the ICs had been manufactured, assembled, and tested, the fabless companies will collect back the final products and sell them to their customers. Whereas the IDM will use the completed ICs in their own products or sell the completed ICs to their customers.

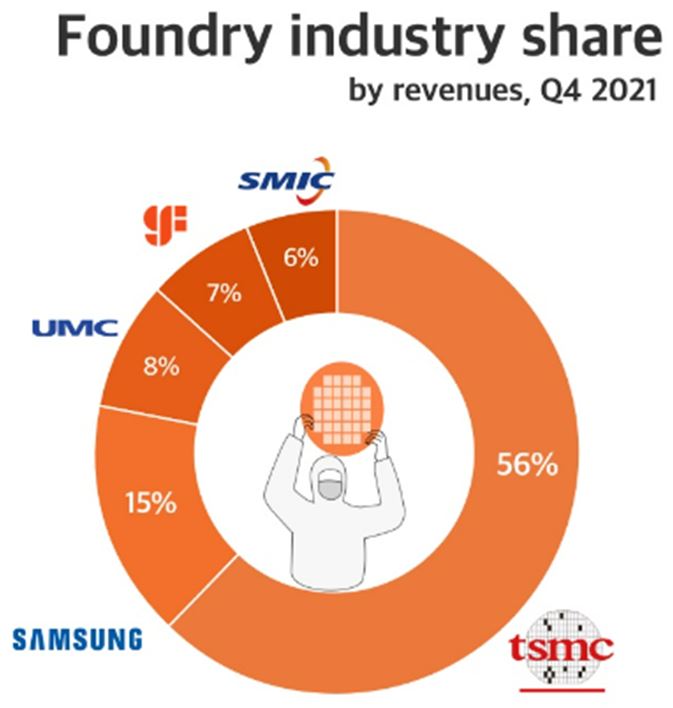

MARKET SHARE OF SEMICONDUCTOR COMPANIES

In this section, we will compare the market share of the top semiconductor companies worldwide. First, we look at the revenue that was generated in Q4 2021.

counterpointresearch.com

In 2021 Q4, the top 7 semiconductor companies are Samsung (19%), Intel (14%), SK Hynix (7%), Qualcomm (6%), Micron (5%), NVIDIA (5%) and Broadcom (4%). Pure-play foundries, such as TSMC are not included in this list to avoid double counting the industry’s revenue as some of the fabless and IDM companies may outsource the chip manufacturing process to these foundries.

Next, we will look into the top 5 foundry industry market shares in Q4 2021. From the chart shown above, TSMC took up 56% of the global foundry market share, followed by Samsung (15%), UMC (8%), GlobalFoundries, Inc (7%) and SMIC (6%).

POTENTIAL RISKS

In this section, we will also explore any potential pitfalls in the semiconductor industry before considering investing our money in this industry.

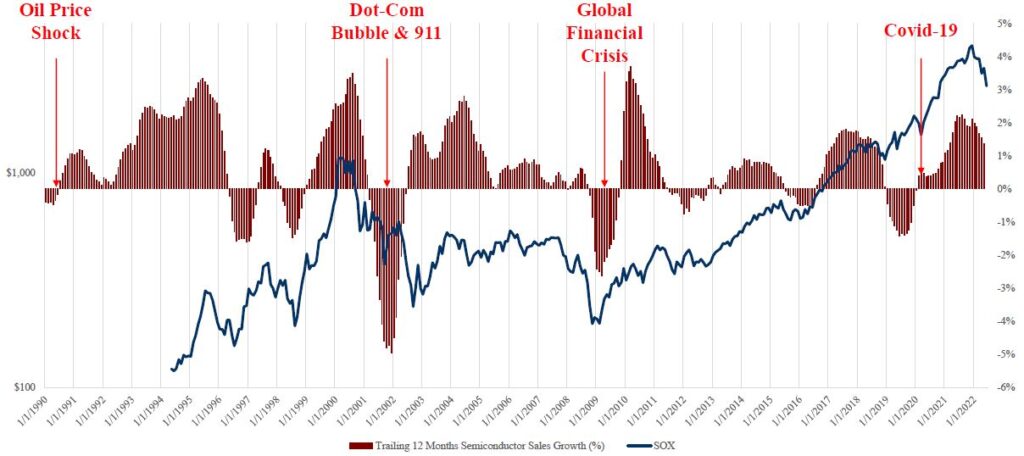

First of all, the semiconductor industry is cyclical in nature. From the chart below, we observed that there are boom times and bust times for this industry, shown by the fluctuation in sales growth (red shades).

semiconductor-digest.com

One of the main reasons for the cyclical nature of this industry was that the supply and demand for the chips were influenced by the manufacturer of the technological products. This situation was clearly illustrated during the Covid-19 PC boom period which was explained below.

Currently, the world is still facing a chip shortage and there was high demand for the ICs worldwide. This had driven up the price of the semiconductors and led to the chip boom in early 2020. The chip shortage is expected to last for another 2 more years.

However, there has been news about the slowing demand for the chips and major chipmakers have been sounding the alarm that the chip boom is coming to an end. This was all due to frantic chip stockpiling by manufacturers that led to an oversupply of chips and order cancellation to cut down the excess chip inventory.

In addition, the drop in PC sales also affected the revenue sales of the semiconductor companies. As ICs are an important component in PC, if there is lower demand for PC, the PC manufacturers will order fewer ICs from semiconductor companies and thus resulting in declining sales for the semiconductor companies.

CONCLUSION

There is massive potential for the semiconductor industry as the technological products have interwoven seamlessly in our modern digitalized world. However, due to the cyclical nature of this industry, investors have to beware and perform due diligence before putting any money to invest in the semiconductor industry.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.