Recent high-rise inflation and impending recession looming around the corner had triggered fear among mass public.

Many are worrying if their livelihoods will be severely affected if the economy take a nose-dive for the worse in the next few years. In addition, people are wondering if there is anything that they can do to earn extra income during these peril times.

As value investing investors, we are interested in companies that can still generate value even during financial crisis and create long term gain for their shareholders.

In this blog, we will be exploring one company that supplies packaging products to consumer staples products companies. Read on to learn more about this company!

INTRODUCTION OF SILGAN HOLDINGS, INC.

Silgan Holdings, Inc. (NASDAQ: SLGN) is the leading manufacturer and supplier of sustainable rigid packaging solutions for consumer goods products, selling packaging products to many of the world’s best known consumer products companies.

The packaging products are used in a wide variety of end markets, which consists of six main categories as shown in the diagram above: Food, Beauty & Personal Care, Pet Care, Healthcare, Home Care and Beverages.

The company was founded by Phil Silver and Greg Horrigan in 1987 and the name of the company is a combination of their family name: “Sil-” & “-Gan”.

The headquarter is based in Connecticut, the United States. They have a total of 113 manufacturing facilities in four continents worldwide:

- 46 Dispensing & Specialty Closures manufacturing facilities in North America, Europe, South America and Asia.

- 44 Metal Containers manufacturing facilities in the US and Europe.

- 23 Custom Containers manufacturing facilities in the US and Canada.

WHAT ARE THE PRODUCT RANGE THAT SILGAN HOLDINGS OFFER?

Silgan Holdings has three main product lines, and they are categorized as the diagram shown below:

DISPENSING & SPECIALTY CLOSURES

Dispensing refers to devices that deliver precise amount of liquid from container, such as spray and pumps. Dispensing products are mainly used in healthcare, home & garden, personal care, fragrance & beauty and food products.

Specialty closures are made up of metal & plastic closures that is mostly used to seal food & beverage products in containers, such as caps, lids and covers.

METAL CONTAINERS

Metal containers are produced from steel plated tin & chromium coatings and aluminium. The containers are mainly used by food product processors and packagers.

Silgan Holdings is one of the largest manufacturers of metal food containers in the US as it takes up to more than 50% of the US market share according to their annual report in 2021.

CUSTOM CONTAINERS

The company manufactures custom designed rigid plastic containers to be used for shelf-stable food, personal care and healthcare products.

Moreover, they also produce thermoformed and non-barrier bowls, trays for food products as show in the diagram.

Their key customer base is made up primarily of world’s well known consumer products brand companies.

They developed long-term customer relationships by providing reliable quality products, service and technological support to their customer which helps them to retain their customers’ business with multi-year supply arrangements.

HOW DOES SILGAN HOLDINGS GENERATE REVENUE?

Silgan Holdings’ revenues are primarily derived from the sales of packaging products to their customers.

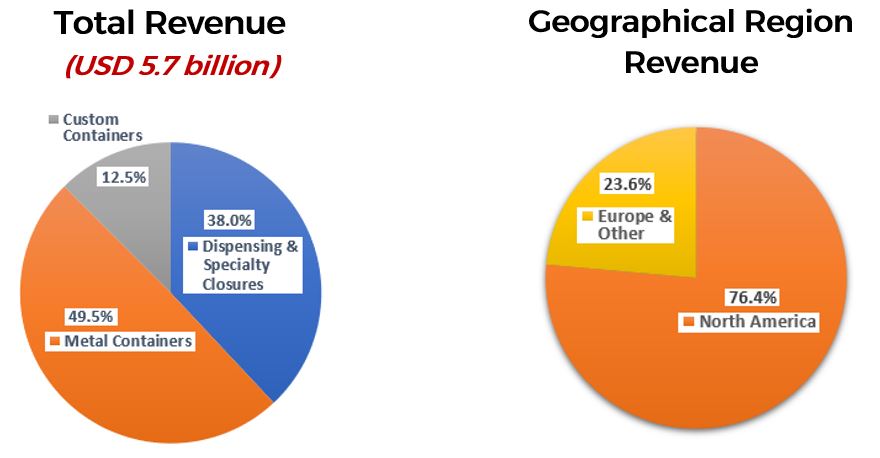

In 2021, Silgan Holdings generated a total of USD 5.7 billion in revenue, with Metal Containers segment (49.5%) contributed the most sales, followed by Dispensing & Specialty Closures (38.0%) and Custom Containers (12.5%).

In terms of geographical region revenue, North America took up the lion’s share of the revenue contribution in 2021, which is about 76.4%. The remaining 23.6% of revenue was derived from Europe and other countries.

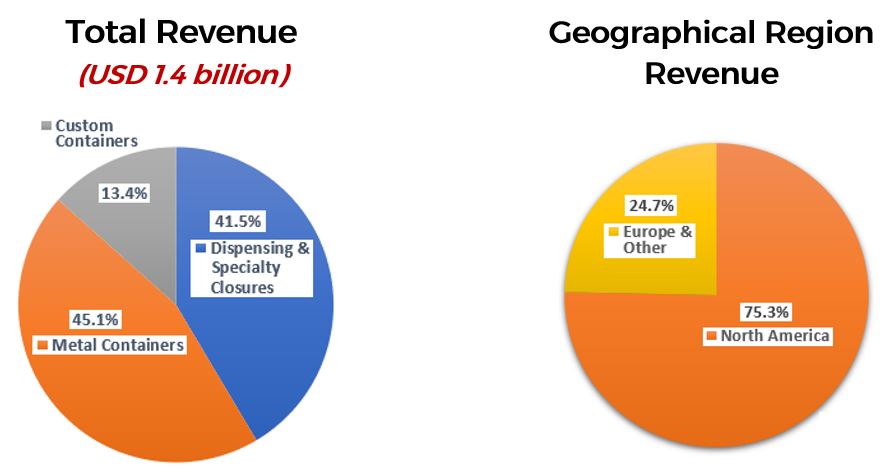

In the latest quarterly report, Silgan Holdings reported that they had generated USD 1.4 billion for Q1 2022 and 45.1% of revenue came from Metal Containers. Dispensing & Specialty Closures and Custom Containers contributed 41.5% and 13.4% of revenue respectively.

In Q1 2022, North America region has brought in about 75.3% of revenue, whereas 24.7% of revenue came from Europe and the Other regions.

After going through Silgan Holdings background and the revenue generations, the company offers a wide product portfolios to their customers and has a broad customer base. But do we really know if Silgan Holdings is a good and valuable company to invest in during the recession?

WHAT ARE THE FUTURE PLANS OF SILGAN HOLDINGS TO GROW THE COMPANY?

Silgan Holdings intends to enhance their position as the leading manufacturer of consumer goods packaging products. They pursue strategies that are designed to achieve future growth and increase shareholders’ value with the following key elements:

1. SUPPLY ‘BEST VALUE’ PACKAGING PRODUCTS

They continue to manufacture and offer high quality products with competitive pricing and exceptional service to their customers. Some of the plans listed out are:

- Manufacturing custom designed containers that cater to customers’ demands.

- Offer value-added features in their products, such as Quick Top easy opener for their metal containers.

2. MAINTAIN AS A LOW-COST PRODUCER

To offer competitive pricing to their customers, the company has maintained a flat, efficient organizational structure to minimize expenses. In addition, they also invested in new technologies that can improve the production efficiency which further reduces their operating costs.

3. ENHANCE PROFITABILITY

To increase company’s profitability and increase shareholder’s values, they frequently rationalize plant operations to better match supply with geographic demands and serve their customers from strategically located plants. This will help to improve manufacturing and logistical efficiency which will further reduce operation costs and increase profitability.

4. EXPAND THROUGH ACQUISITIONS & INTERNAL GROWTH

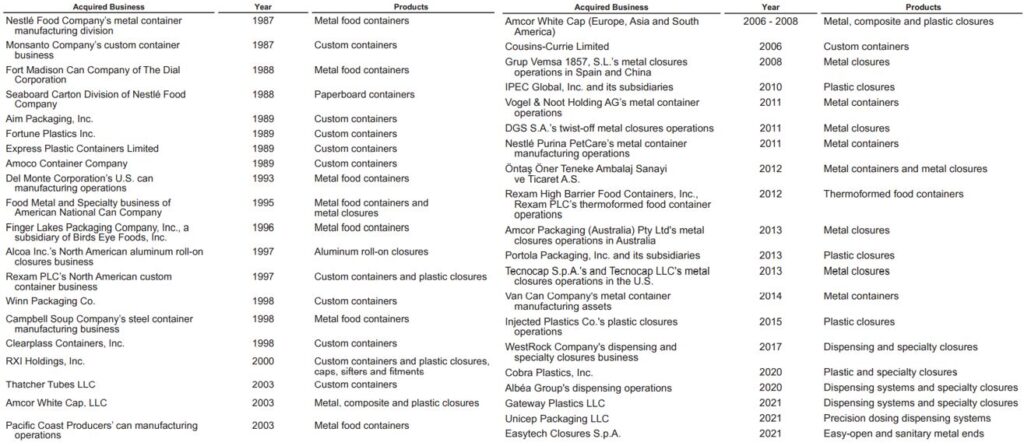

To keep increasing market share and establish themselves as leading packaging products manufacturer, Silgan Holdings had been strategically acquired companies that diversify their product portfolios and expand their customer base and geographic presence.

The diagram below shows the list of companies that had been acquired by Silgan Holdings throughout the decades to expand their business and product lines.

2021 Annual Report

WHAT ECONOMIC MOAT DOES SILGAN HOLDINGS HAS?

Economic moat refers to a company’s ability to maintain its competitive advantage over their competitors to protect the business market share and profits.

An analogy of economic moat is like the water moat that surrounded the ancient castle from being invaded by opposing knights or soldiers. If the moat is wide, the opponents will have a hard time to attack the castle. However, if the moat is narrow, it will be easy for the soldiers to attack and invade the castle.

To maintain their competitive advantage, Silgan Holdings relies on a combination of trade secrets, patents and trademarks to protect their intellectual property rights and technological innovations.

Another moat that Silgan Holdings utilizes is economies of scale. Economies of scale is the phenomenon where the company experience cost advantages when the production become efficient and able to increase its level of production output. Thus, the production costs can be spread over a large amount of goods which helps to further reduce the pricing.

As they had plans to improve manufacturing efficiency and optimize plant operations, the company can offer competitive pricing to their customers and maintain a long-term relationship with them. As such, Silgan Holdings has a large customer base with multi-year supply agreements with their major customers.

WHO ARE SILGAN HOLDINGS’ COMPETITORS?

Silgan Holdings is in a highly competitive industry of packaging as they not only compete with the manufacturers of similar packaging, but they are also competing with manufacturers of alternative packaging solutions and consumer products companies who produce their own packaging solutions.

They mainly compete against product quality, pricing, and meeting customer’s requirements, such as delivery, product performance and technical support.

The diagram below lists out some of the competitors for the three business segments.

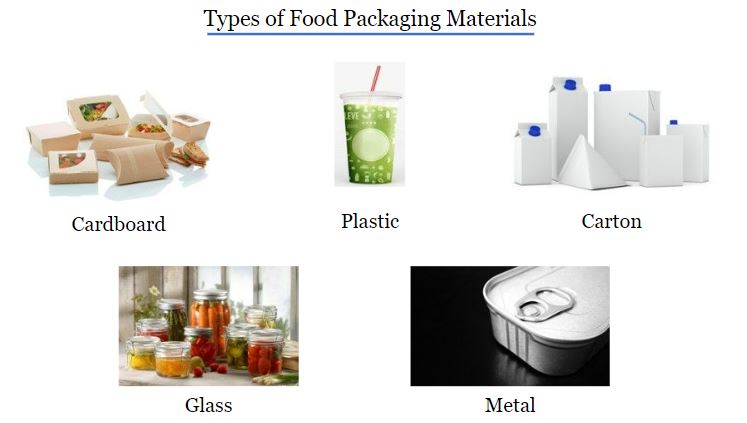

Other than competing against manufacturers, Silgan Holdings are also competing against other forms of packaging materials, such as glass, paper and composite materials for their metal containers.

Nevertheless, the company list out some advantages of using metal containers, such as durability for transportation and contents can be prepared at higher temperatures to maintain product quality for long term storage.

In addition, Silgan Holdings has their own in-house research & development team to innovate the raw materials of packaging products, such as resin composition for custom containers and containers manufacturing technology.

From the future plans listed out, we can see that Silgan Holdings has made strategic plans to further expand the company and enhance their position as the leading manufacturer for packaging products, in addition to the existing economic moats to maintain their competitive advantages.

FINANCIALS

Now we will investigate on the financial numbers of the company to determine if the company is profitable and a valuable company to invest in.

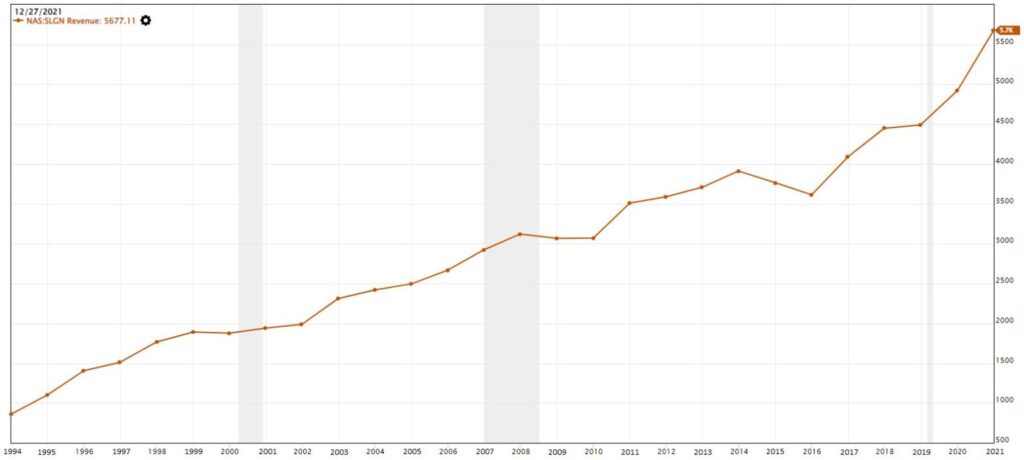

Since 1994, we observed that the overall trend of the revenue has been in a positive and upwards trend. According to the Value Investing Methodology, this is a good sign as it showed that the company can generate consistent and growing sales in the long run.

However, there was a drop in the revenue in 2016 as Silgan Holdings reported that they experienced decreased in sales due to lower unit volumes of products sold. Nevertheless, the sales rebounded back in 2017 and has been increasing year-on-year since then.

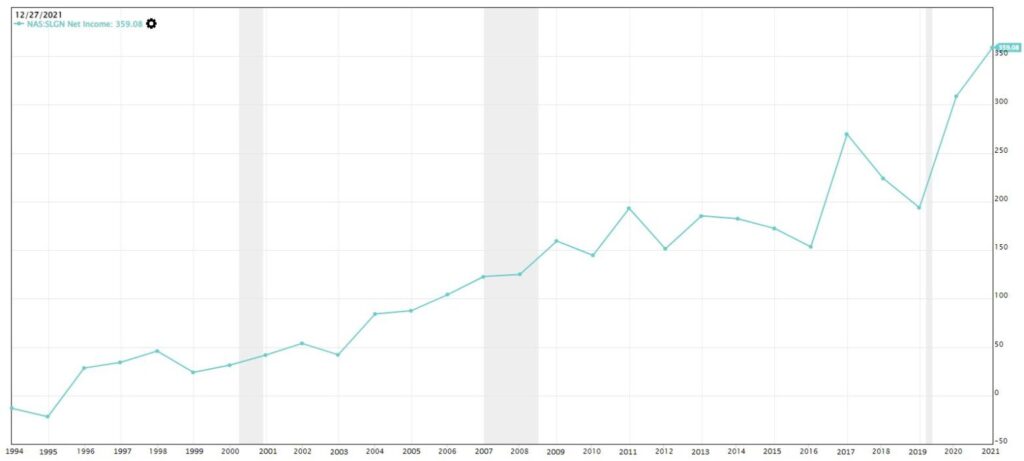

Next, we will look into the net income, which is the profit that Silgan Holdings made after deducting the expenses.

The definition of net income is the result of profit or loss that a company made after deducting all the expenses from the revenue generated.

Even though there was a recession during the Dot.com bubble (2000-2001) and Financial Crisis (2007-2009), the net income of Silgan Holdings was not affected but it remained in a positive and increasing trend.

However, the exceptional incidents of net income dropped in 2016 and 2019 were due to decreased in sales and organizational restructure of closing manufacturing facility in Spain as part of manufacturing footprint optimization plan respectively.

Whereas in 2017, the net income spiked up was because of acquisition of WestRock Company and tax rebates.

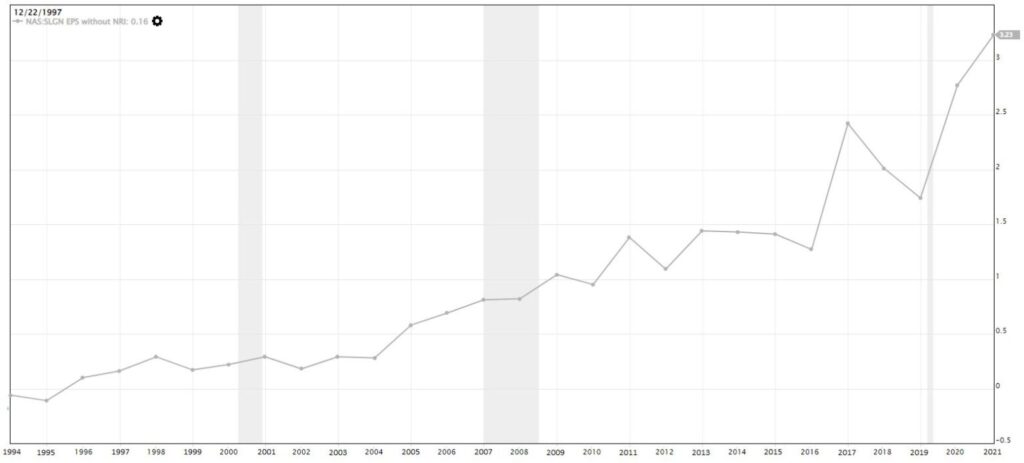

For their earnings per share (EPS), the trend was also observed to be following closely to net income’s trend, which is in a positive and increasing manner.

This is because the mathematical formula of earnings per share is defined as below:

A simple example to explain this formula is that if the EPS is 3, this means that for every share that the investor purchased, the company is able to generate $3 of profit for that one share.

According to Value Investing Methodology, both Net Income and EPS are considered a pass as they are in a positive and increasing trend.

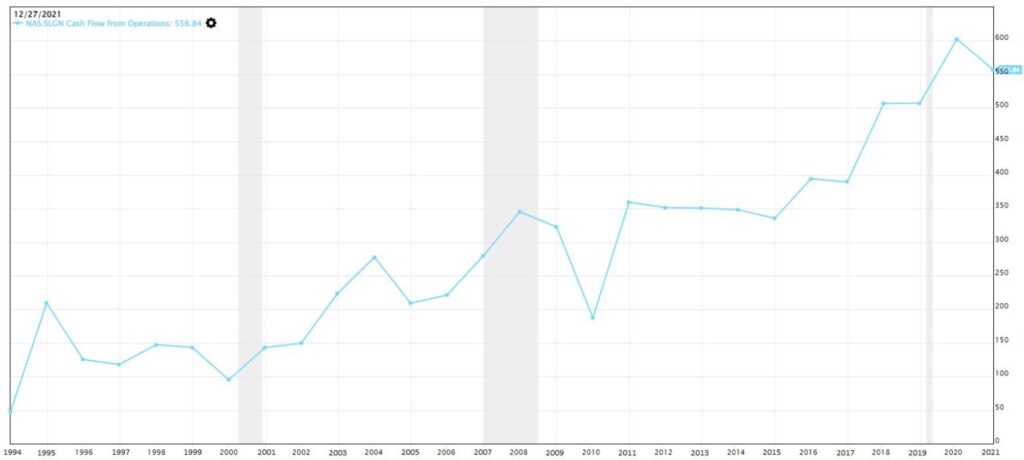

Now, we want to know if the company is also capable of generating positive cash flow from their business. With this, we will check on the Operating Cash Flow, which is defined as the cash flow derived from normal business activities.

From the chart, the operating cash flow has been on an increasing trend over the years in the long run although there was a sharp drop in 2010. Further investigation into the annual report revealed that there was a drop in the working capital where the cash earned was used to refinance their senior notes and repurchase shares. (Our blog article on Twitter has explained about senior notes.)

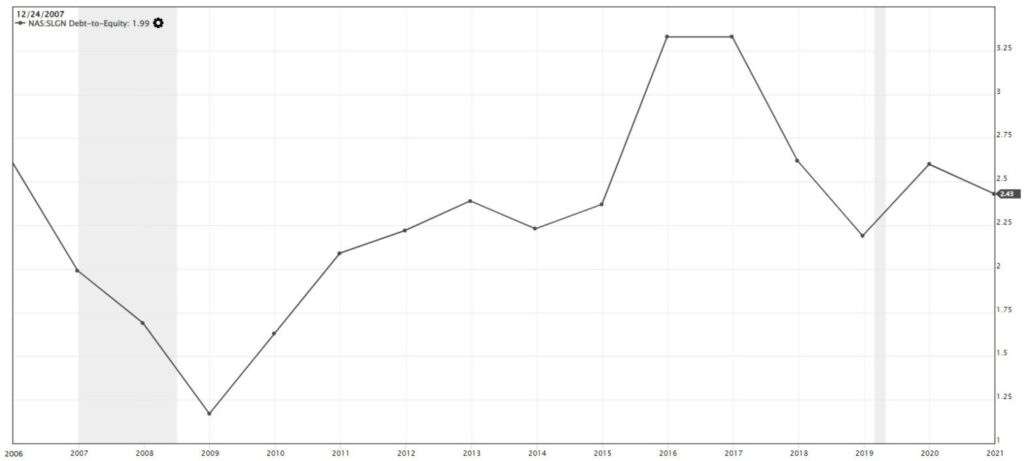

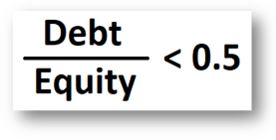

Following up, we will also investigate on the Debt-to-Equity ratio to determine if there are any significant liabilities or debts that will cause considerable outflow of cash from the company, as if there were “holes in the pocket”.

The definition of debt-to-equity ratio is shown below. In simple terms, the mathematical formula means that for every $100 of equity, the company should not take more than $50 of debt.

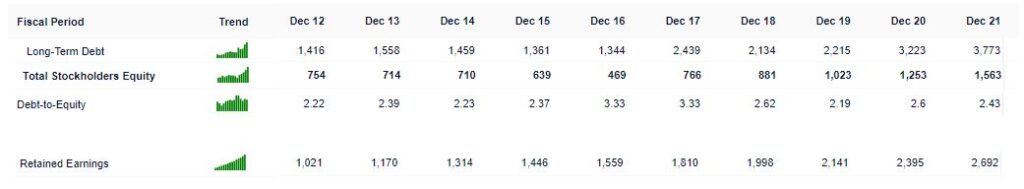

Based on the chart above, we were alarmed that the Debt/Equity ratio is more than 0.5 for most of the years. Investigation into the annual reports showed that they company had incurred debt to finance the acquisition of companies in order to fuel the company’s expansion and growth.

Although the Debt/Equity ratio is high and caused some concerns among investors, we noticed that the stockholders’ equity has also been increasing throughout the year. (To better understand about the stockholders’ equity, click on to read up our fundamental analysis deep dive on Tyson Foods.)

As long as the company remains profitable in the years to come and consistently increasing their stockholders’ equity, the debt/equity ratio will decrease in near future.

What are the Potential Risks that Silgan Holdings might have?

Despite the strong company background and stellar profitability performance that Silgan Holdings has been reported, we also need to find out if there are any potential risks that the company might have which could derail our investments.

The current high debt level of the company is one of the worrying aspects that investors might need to consider and perform further due diligence before investing their money into the company. This is because Silgan Holdings issued senior notes to fund their acquisitions and expand the company’s growth. Should the company encounter a drop in revenue or had cash flow issue during the financial turmoil, they might be having trouble to repay the debts incurred.

In addition, recent high inflation situation will also increase the cost productions as the high input cost, such as raw materials, energy and logistics will push up the manufacturing expenses. When the expenses increased, it will cut into the revenue and thus decrease the profit that the company made.

Silgan Holdings is in a very competitive packaging industry with low switching cost. Should the key customers find that the products produced drop in quality or the pricing is far too expensive for them, they may consider changing another supplier for their packaging solutions. Loss of major customer or multi-year contract will severely affect Silgan Holding’s revenue.

In the years of lower crop yield of fruits and vegetables, the food packagers and processors may reduce their demand for metal containers which will also affect the revenue of Silgan Holdings. This is because the majority sales of metal containers are sold to food packagers and processors.

CONCLUSION

Through the deep dive analysis on Silgan Holdings, we can conclude that Silgan Holdings is a stable company that was proven to be able to weather through financial turmoil based on their past stellar performances. As they are manufacturing daily necessity products that consumers needs, they are able to generate revenue and profit from their daily business activities.

Nevertheless, the outstanding past performances do not predict the future performance and investors are strongly encouraged to further investigate into the company before investing their hard-earned money.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.