HOW DID SNOWFLAKE BEGIN?

Snowflake is a cloud data platform that provides a data warehouse-as-a-service designed for the cloud. It allows corporate users to store and analyze data using cloud-based hardware and software. The company is credited with reviving the data warehouse industry by building and perfecting a cloud-based data platform.

The company was co-founded by Thierry Cruanes, Marcin Zukowski, Bob Muglia, and Benoit Dageville in 2012 and is headquartered in San Mateo, California. It was publicly launched in 2014 after 2 years in stealth mode.

WHAT IS SNOWFLAKE? HOW IS IT DIFFERENT?

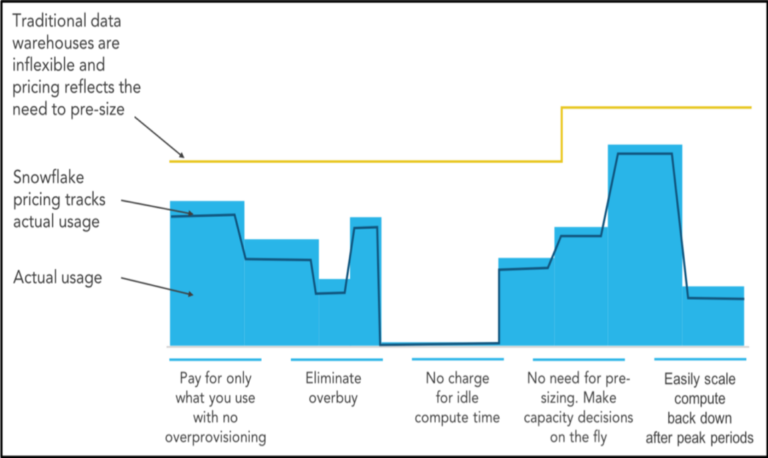

Snowflake helps blue chip companies analyse and share data in the cloud. It is essentially a data platform built specifically for the cloud. Almost a decade ago, the co-founders realised that data warehouses were rigid, complex and quite expensive. This was because data warehouses were generally on the company servers and hardware. This was costly since the companies had to bear the cost of the hardware, configuration etc. Furthermore, scaling was even more difficult, time consuming and expensive.

So, Dageville and Cruanes teamed up with Zukowski to solve these problems to build a platform that was quick, easy to use, cost-effective and “master the elasticity of the cloud.”

Snowflake separates compute from storage. This means that customers only need to pay for what they actually use. Also, customers can quickly spin up and readjust virtual data warehouses in real-time and easily share data sets across teams to avoid silos. It automatically scales, both up and down, to get the right balance of performance vs. cost.

Snowflake was built to function across clouds. Initially running on Amazon Web Services (AWS), Snowflake can also run on Microsoft Azure and Google Cloud Platform, making them customers as well as competition.

BUFFETT'S CONFIDENCE

Snowflake has inspired value-legend Warren Buffett to shift tradition and invest in an IPO prior to profitability. Berkshire Hathaway – led by Warren Buffett, the “Oracle of Omaha” – has refrained from participating in an IPO offering for 50 years. But the conglomerate broke with tradition specifically for Snowflake, purchasing $250 million worth of stock in a private placement (along with four million shares from the company’s previous CEO, Bob Muglia).

BIGGEST SOFTWARE IPO IN THE U.S

Snowflake had the backing of salesforce (CRM) and Berkshire Hathaway (BRKB) and the stock more than doubled on their first day of trading in the biggest software IPO ever. Initially priced at $120, the stock climbed higher to $300 before settling down on the day of the IPO (September 16, 2020). The company sold 28 million shares and raised nearly $3.4 billion from the IPO.

PRICING

Instead of using a Subscription model, like other SaaS companies, Snowflake used the utilisation model which means users will be charged based on their actual consumption. Compute is charged based on processing units (which Snowflake calls “credits”), and customers only pay for what they use. Storage is billed separately. This makes it flexible and not so complex for customers to use and understand, they don’t have to anticipate which subscription plan is best suitable for their upcoming needs.

PRODUCT

The use cases of the platform are listed below:

Data warehouse: provides reporting and analytics to increase business intelligence

- Support multiple users and activities concurrently

- Generate comprehensive data insights

- Simplify data governance

Data lake: provides central data repository without trade-offs in performance, security, or data governance

- Build a modern scalable data lake in the cloud

- Enact better governance and security to enable broader data access

Data engineering:

- Drive faster decision making

- Dynamically meet peak business demands

Data Science:

- Accelerate transformations across massive data sets

- Integrate with leading data science tools and languages

Data Application Development: power new applications and enable existing applications with capabilities for reporting and analytics

- Develop analytical applications

- Embed Snowflake into existing applications

Data Sharing: share, connect, collaborate, monetize, and acquire live data sets

- Create a private data hub

- Acquire data sets to enrich analytics

- Monetize new data sets

- Invite external parties to access governed data

- Easy data replication

COMPETITION

Competition in the tech industry has always been intense and with the introduction of new tech and innovations, Snowflake faces competition from:

- Large, established public cloud providers [Amazon Web Services (AWS), Microsoft Azure (Azure), and Google Cloud Platform (GCP)]

- Less-established public & private cloud companies

- Other established vendors of legacy database solutions or big data offerings

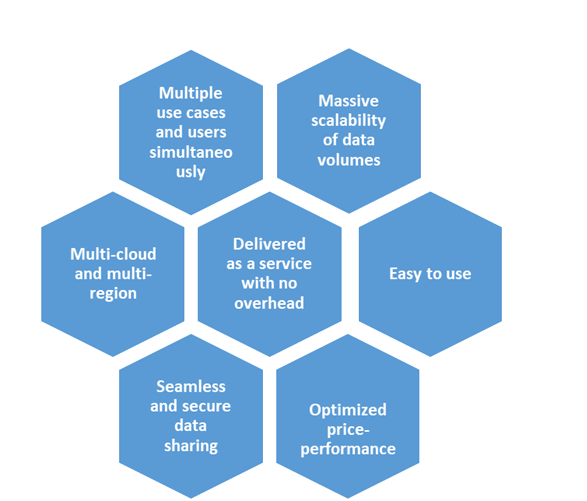

Snowflake has managed to build a platform which has the ability to fight competition with the following advantages:

- Architecture that is purpose-built for the cloud

- Ingest diverse data types in one location at scale

- Multiple use cases in one platform

- Access of data to many users simultaneously

- Share and move data across public clouds or regions

- Consistent user experience across multiple public cloud providers

- Pricing transparency and optimized price-performance benefits

- Elastically scale up and scale down in high intensity use cases

KEY RISKS

Highly competitive market: The company needs to stay abreast of latest developments in technology and constantly innovate in order to stay relevant in the face of competition

Operating history: The company has limited operating history which makes forecasts difficult gives limited visibility into future results, especially with a history of operating losses.

Breach of data: Snowflake runs the risk of harm to its reputation if there is data breach on its platform

COVID-19 impact: Slowing businesses of clients due to the pandemic may affect the business of Snowflake. Remote work by employees may lead to lesser productivity. The company may also have to keep incurring certain fixed costs which may lead to little or no benefit in costs.

Sales & marketing: The company shells out a lot for sales and marketing, which is typical for a new company as this strengthens the top line. But this could make it hard to reach profitability in the future.

Lack of hybrid platform: Another risk maybe that Snowflake is cloud-native and does not provide hybrid or on-premises platforms. This can limit the customer pool if clients prefer a hybrid.

Pricing pressure from big companies: Public cloud providers have competing databases but they may pose the risk of pricing pressure over time. Tech giants like Google Cloud, AWS and Azure can vastly undercut Snowflake on pricing leading to issues with margins going forward.

BUSINESS MODEL

Snowflake generates the substantial majority of revenue from fees charged to customers based on the storage, compute, and data transfer resources consumed on the platform as a single, integrated offering. For storage resources, consumption fees are based on the average terabytes per month of all customer data stored in the platform. For compute resources, consumption fees are based on the type of compute resource used and the duration of use or, for some features, the volume of data processed. For data transfer resources, consumption fees are based on terabytes of data transferred, the public cloud provider used, and the region to and from which the transfer is executed.

Customers typically enter into capacity arrangements with a term of one to four years or consume the Snowflake platform under on-demand arrangements in which the company charges for use of platform monthly in arrears.

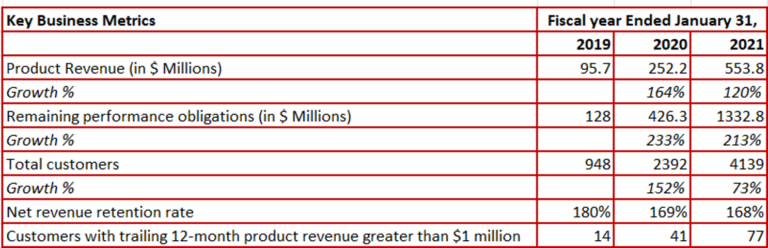

KEY BUSINESS METRICS

Product revenue: Snowflake recognizes revenue based on platform consumption which depends on the customers discretion. Product revenue includes compute, storage, and data transfer resources, which are consumed by customers as a single, integrated offering. The amount of product revenue recognized in a given period is an important indicator of customer satisfaction and the value derived from the platform.

As shown in the table below, product revenue was $553.8 million in 2021, which was 120% higher from last year. Although the growth in product revenue has declined in 2021 as compared to 2020, it is still a high growth percentage.

Remaining Performance Obligations: (RPO) represents the amount of future revenue that has been contracted with customers, but not yet recognized officially as revenue.

RPO of $1332.8 million in 2021 represents a growth of 213% Y-o-Y.

Total Customers: This represents the total number of customers at the end of each period and is an important indicator of the growth of the business and future revenue trends.

Total customers in 2021 was 4139, which was 73% higher than last year. As of January 31, 2021, Snowflake’s customers included 186 of the Fortune 500, based on the 2020 Fortune 500 list, and those customers contributed approximately 27% of the revenue for the fiscal year ended January 31, 2021.

Net Revenue Retention Rate (NRRR): The growth in use of the platform by existing customers is an important measure of the health of business and the future growth prospects. As a measurement of expanding spend from existing customers, a high net revenue retention rate suggests that Snowflake’s customers are using Snowflake’s platform more.

A high net revenue retention rate of 168% in 2021 suggests that customers are happy with the platform.

Customers with Trailing 12-Month Product Revenue Greater than $1 Million: Large customer relationships lead to scale and operating leverage. Compared with smaller customers, large customers present a greater opportunity for SNOW to sell additional capacity because they have larger budgets, a wider range of potential use cases, and greater potential for migrating new workloads to the SNOW platform over time.

The number of customers that contributed more than $1 million in trailing 12-month product revenue increased from 41 to 77 as of January 31, 2020 and 2021, respectively.

COVID-19 IMPACT

COVID-19 has had some impact on the business of Snowflake. It has caused the elongation of sales cycles, that may impact new customer acquisition, the timing of future revenue recognition, and future growth rates. It has also caused delays in the delivery of professional services and trainings to customers. There has however been a modest positive impact as well: an increase in consumption of the platform by existing customers. Further, there was slower growth in certain operating expenses due to reduced business travel, deferred hiring for some positions, and the virtualization or cancellation of customer, partner, and employee events.

FINANCIALS

REVENUE & PERFORMANCE

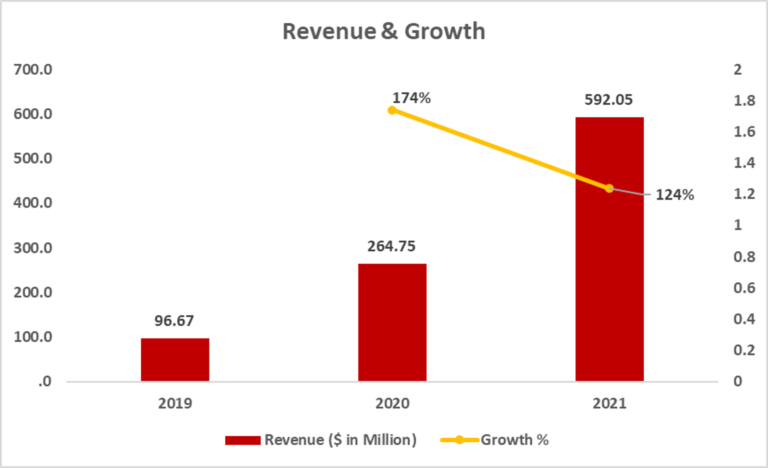

Snowflake has achieved significant growth in recent periods. For the fiscal years ended January 31, 2021, 2020, and 2019, revenue was $592.0 million, $264.7 million, and $96.7 million, respectively, representing year-over-year growth of 124% and 174%, respectively.

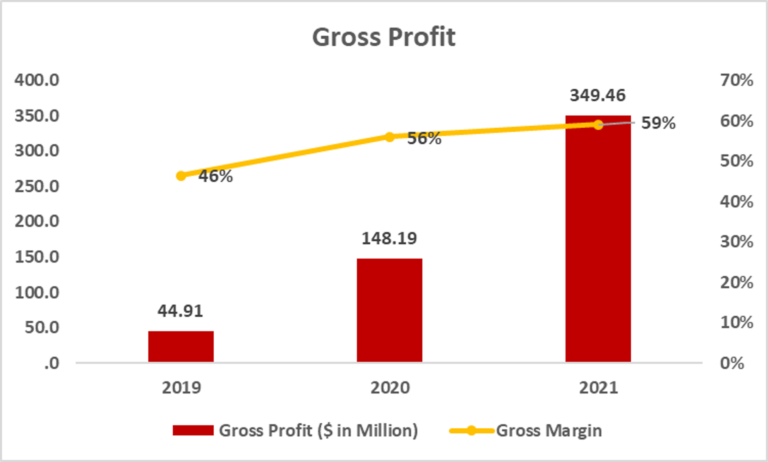

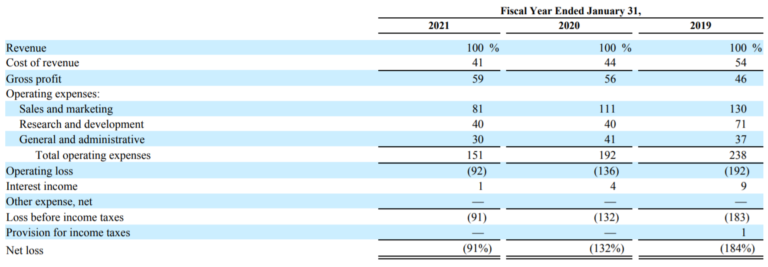

Gross profit increased to $349.46 million in 2021. The gross margin has improved in 2021 at 59% compared to 56% in 2020.

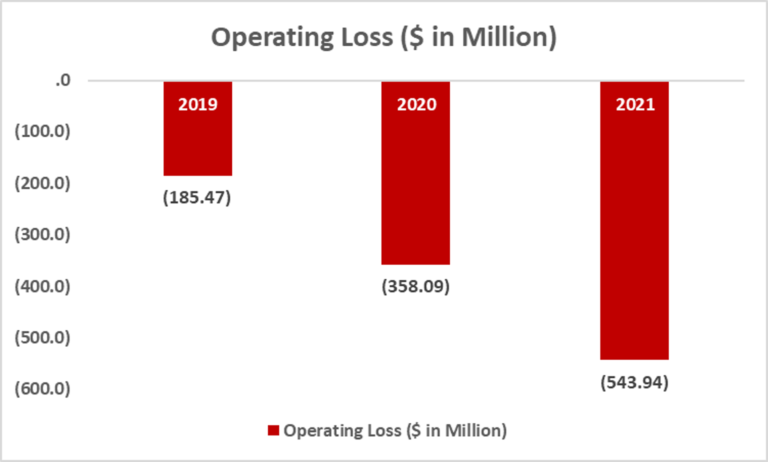

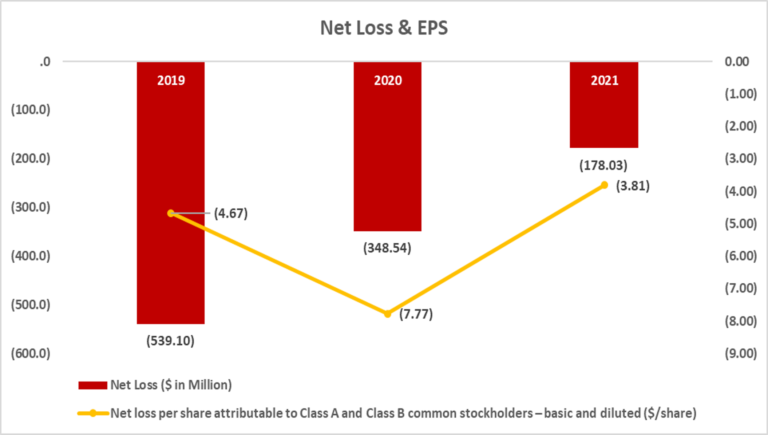

However, the company has been incurring operating losses since the last 3 years, although the loss itself has declined over the years as shown below.

The biggest problem with an otherwise solid company is that SNOW is still loss making. The net loss was $539.1 million, $348.5 million, and $178.0 million for the fiscal years ended January 31, 2021, 2020, and 2019, respectively.

REVENUE BREAKDOWN

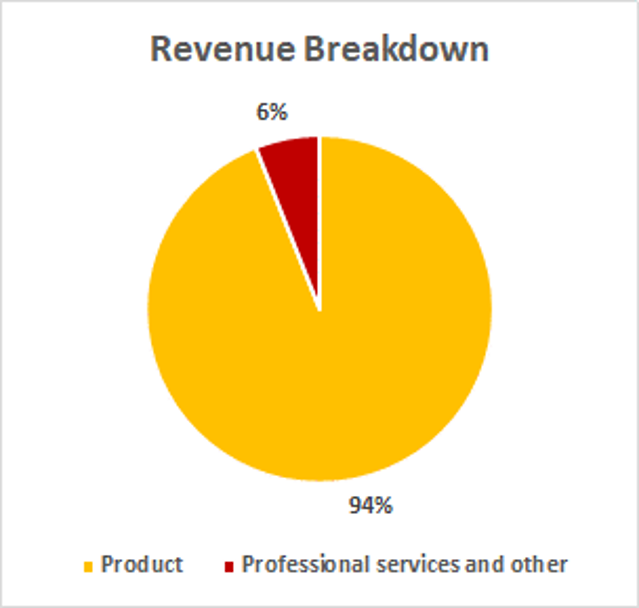

Snowflake derives more than 90% of its revenues from its product and the remaining comes from professional services and others. The professional services business performs implementation services for customers and has grown more than 200% in 2021 as compared to 2020. However, the gross margin from professional services and others is still negative (-27% in 2021 vs -59% in 2020), although improving gradually.

PERCENTAGE OF REVENUE DATA

From the table above, it is evident that Costs as a percentage of revenues has declined over the years to 41% in 2021 from 54% in 2019 as a result of which gross profit (% of revenue) has increased. Sales and marketing constitute a big chunk, 81% of revenues in 2021, which has declined from 130% in 2019. Because of this, Snowflake suffers operating losses which further translate into losses in the bottom line.

FREE CASH FLOW

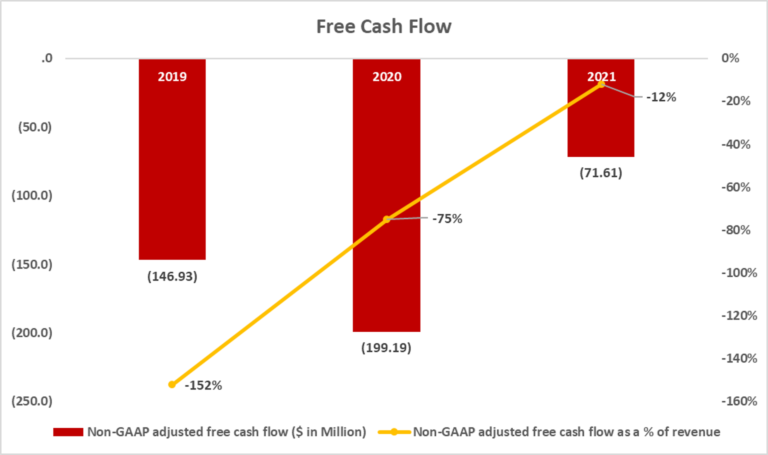

Despite having good fundamentals, Snowflake has negative free cash flows. Strong customer retention should help the company in generating internal revenue and hence cash flows. Cash flows were seen improving in 2021 along with the cash flow margins which improved from -75% in 2020 to -12% in 2021. In fact, the adjusted free cash flows have turned positive at $17.26 Million for Q4FY21 with a FCF margin of 9%. For the first 2 quarters of 2022, adjusted FCF was $26.2 Million with a FCF margin of 5%.

VALUATION

Snowflake has a market capitalisation of $119.76B and a Price/Sales ratio (ttm) of 140. The company is growing rapidly and the total addressable market for SNOW is huge (~$90B as per the company estimates) which points to a sizeable market opportunity for the cloud data platform of Snowflake. As companies look to transition their legacy on-premise databases to the cloud, and that coupled with the strong NRRR, is expected to drive sales substantially.

CONCLUSION

Despite the sky high PS ratio, Snowflake is operating in a hyper growth cloud industry. The company has disrupted the data warehousing market with a superior cloud data platform that delivers across key differentiators. Snowflake has displayed strong revenue generation along with a strong net retention rate; however, this rate may slow over time as customers become difficult to retain for the long term.

There is a huge growth potential due to the future of cloud, but another thing to be careful of is the competition from behemoths like Amazon, Google and Microsoft who are offering their own data warehousing solutions atop their respective public clouds. However, Snowflake’s platform is flexible to operate with any cloud operator and quite adaptable. Another plus point for SNOW is the consumption-based model which should further drive preference. Once the bottom line starts turning green, the stock may re-rate itself. Or not.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.