Photo of a US Dollar Bill with the words U.S. Treasury shown (Updated in 8th Nov 2023)

Due to the recent rising inflation happening worldwide, public can feel the pinch of money’s shrinking purchasing power.

In 1970s, a person can easily purchase a cup of coffee at a mere $0.25 based on the illustration below from Investopedia.

Nevertheless, the price of coffee has been increasing steadily over the years. The recent jump from $1.25 to $1.85 (about 48% increment!) in just 2 years span has many people baffled that how significant the money’s purchasing power has eroded due to inflation.

Warren Buffet, renowned for his investment wisdom, has once famously quoted this prudent approach to enhance the resilience of a beginner investor’s portfolio:

“Allocate 10% of the cash to short-term government bonds and the remaining 90% to a very low-cost S&P 500 index fund.”

As a result, the public have been looking to find safe & low-risk investment avenues to invest their excess funds and protect their purchasing power for future retirement in the current high inflation environment.

One of the low risk bonds that was offered by Money Authority of Singapore is Treasury bills (T-bills).

In this blog article, we will be deep diving into T-bills’ key features, and also comparing against other MAS bonds to determine which investment instruments that can best fit in our portfolio to invest and grow our money!

WHAT IS T-BILLS?

KEY DETAILS

T-bills is a short term, tradable government debt securities that investors can buy at a discount upfront. It is also known as “zero-coupon bonds”, which means that T-bills don’t pay interest during the bond duration. We will explore more on “How does T-bills work?” in the next section.

The bond durations (also known as Tenor) for T-bills are 6 months and 1-year. (Refer to MAS website issuance calendar for the actual date)

- 6 months T-bills issued twice per month.

- 1-year T-bills issued quarterly.

All of the bonds offered by MAS have AAA credit rating, which means that these bonds are fully backed by the Singapore government.

In addition, T-bills are tradable on secondary market, such as SGX exchange. As a result, the interest income and capital gain earned by individuals from T-bills are tax exempted.

HOW TO BUY?

Public can purchase T-bills via Auction with cash, SRS and CPF funds. They can submit for competitive or non-competitive bids through DBS/POSB, OCBC and UOB ATMs or internet banking. The bidding format will have to be in yield terms (estimated return/interest rate of the bond), up to 2 decimal places.

The minimum amount to apply for T-bills is $1,000 and in multiples of $1,000. However, there is no stated maximum amount an individual can apply, but there are allotment limits for each auction. If there is high demand for the bonds in a particular auction, the max. allotment limit may be lowered in order to cater for more acceptance of the T-bills bid. Nevertheless, the actual result will only be released on MAS website at the end of the auction.

The interest rate for T-bills, known as Cut-off Yield will also be announced at the end of the auction. It is determined by the highest accepted yield of successful competitive bids. The non-competitive bids will accept the Cut-off Yield of the successful competitive bids.

HOW DOES T-BILLS WORK?

After knowing some of the key details about T-bills and how to purchase it, what is the process flow of T-bills and how does one earn interest income from T-bills?

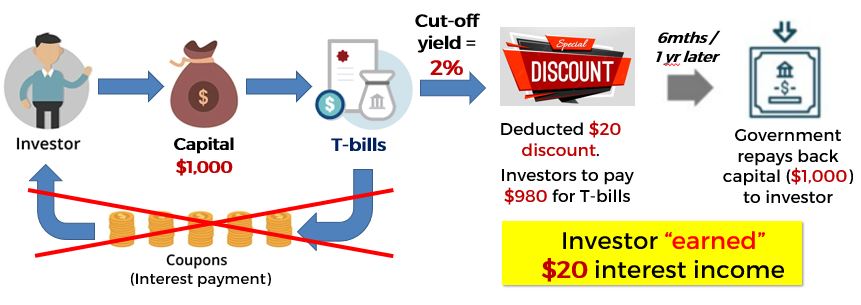

We will use a capital of $1,000 as an example to illustrate how T-bills work with the flow chart below:

When an investor has $1,000 of idle cash and want to invest in government bonds, such as T-bills, they will first apply for the T-bills through banks and wait for the auction outcome.

Should the investor’s bid be successful and allocated, they will be notified of the interest rate for their bids, which is the Cut-off Yield. In this example, we will be using 2% of cut-off yield. As T-bills do not pay interest income, the investor receives a 2% discount upfront for the $1,000 worth of T-bills. This means that when they only need to pay $980 for the T-bills (deducted $20 as discount).

After the bond has matured 6 months or 1 year later (depends on the bond agreement), the investor will receive back the full value of $1,000. This is as if the investor has “earned” $20 of interest income in a duration of 6 months or 1 year!

PROS & CONS

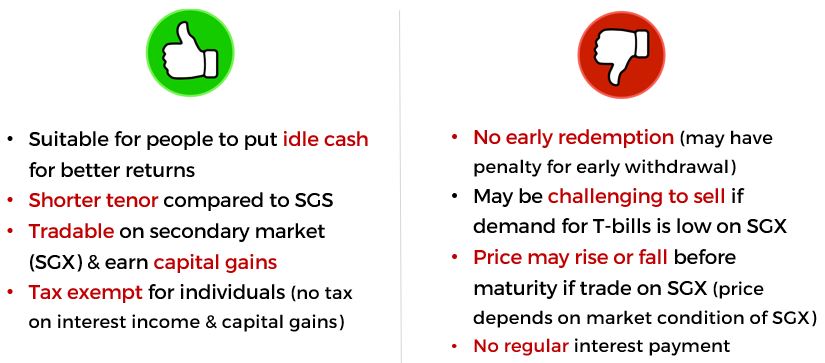

Now that we understand how T-bills work, we should also consider the advantages and disadvantages of T-bills to determine if this instrument is the best fit in our portfolio.

T-bills has similar pros and cons as Singapore Government Securities (SGS) bonds, but one of the advantage of T-bills against SGS bonds is that the tenor duration is much shorter, and public can get back their invested money faster in 6 months or 1 year time.

However, investors should also take note that if they want to earn regular payment of interest income from their invested capital, they may consider choosing other forms of investment alternatives as T-bills do not pay regular interest payment.

MAS also offer another low risk bonds – Singapore Savings Bond (SSB) which we covered in this article. Click on to read more about SSB!

RATES COMPARISON

SG INFLATION RATE

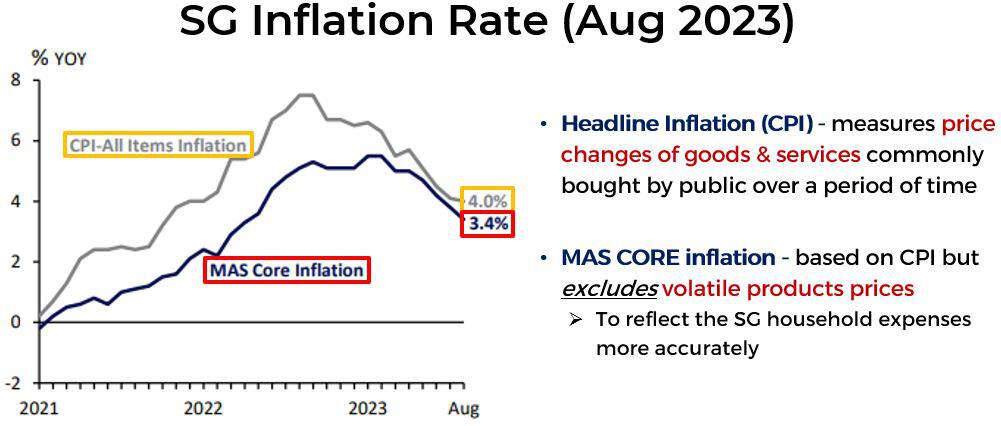

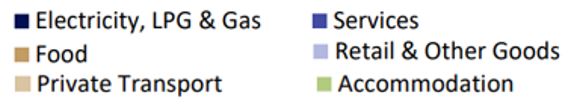

In the latest inflation rate report released by MAS in August 2023, Singapore’s core inflation has dropped to 3.4%.

Source: MAS, MTI Estimates

MAS keep tracks on the Consumer Price Index (CPI), which measures the price changes of goods & services (6 categories listed below) commonly bought by public over a period of time, but MAS core inflation excludes volatile product prices, such as Private Transport and Accommodation category.

CPI categories of goods & services measured by MAS

The reason that the core inflation has been decreasing since 2023 was due to a few CPI categories’ inflation has been increasing slower in recent months.

In Aug 2023’s key CPI categories, we observed a few categories’ rate has been increasing slower when compared to Jul 2023, such as Services, Food, Electricity & Gas and Retail & Other Goods. These helps to lower the core inflation in Aug 2023.

SG BANKS’ INTEREST RATE (2022)

For the banks’ interest rates, we will also compare against the fixed deposit rates and savings account interest rates in Oct 2023!

The chart below shows the summary of some of the highest offered FD rates and the big 3 banks in Singapore:

From the chart, we observed that currently Maybank bank offered 3.65% of interest rate for $20K deposited with them for the next 12 months. However, there is a catch where one will need to deposit $1,000 into the Maybank Current or Savings accounts in order to enjoy this high interest rate.

The next highest fixed deposit rates are followed by RHB (3.60%), DBS bank (3.2%), UOB bank (2.7%) and OCBC bank (2.7%) with different tenor duration and minimum deposit amounts.

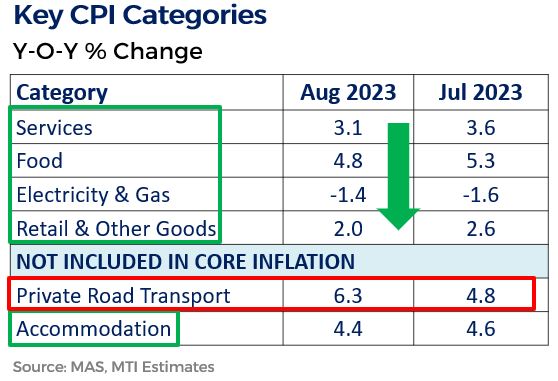

For the savings account, we have also made a quick comparison of the interest rates that were being offered by various SG banks in Oct 2023!

In the chart below shows the max. savings interest rates offered by various local lenders:

Currently, Standard Chartered offered the highest maximum interest rates of 7.88% for their Bonus$aver account!

However, to qualify for the 7.88% high interest rate, one needs to fulfil the following criteria:

From the criteria listed, the public may need to jump through a few hoops to meet the eligibility criteria to hit the max savings rate. As such, the more realistic interest rates that they can earn from the savings account might be lower.

To have a better understanding that how much of the potential interest rates that one can earn from their savings account, they can try out the interest calculators that are available on the banks’ websites for their respective savings account!

T-BILLS VS SGS BONDS VS SSB

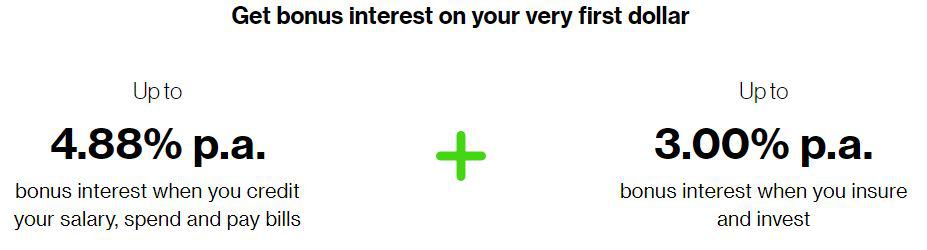

MAS also offered 2 other types of bonds for the public to invest their idle cash besides T-bills – Singapore Government Securities (SGS) Bond & Singapore Savings Bond (SSB).

Let’s compare the rates and features of these 3 MAS bonds!

From the diagram, T-bills and SGS bonds are debt securities with no early redemption, but SSB allows investors to have flexible investment period. In addition, the 3 bonds offer different tenor and min. investing amount for the public to cater to different investing needs.

One of the main differences between T-bills and the other 2 bonds is that SGS bonds & SSB have regular interest payments. T-bills have no interest payments as it is purchased at a discount upfront.

Finally, the interest rates offered for the 3 bonds are different, with T-bills offering the latest cut-off yield at 3.95% p.a. (6 months) in Oct 2023, followed by SSB’s average return of 3.4% for 10 years and SGS bonds in Sep 2023 with coupon rate of 1.875% p.a. (30 years).

CONCLUSION

As a conclusion, with the latest released T-bills’ cut-off yield at 3.95% p.a., it has attracted a lot of attention from the Singaporean community to consider invest their idle cash in this short-term (6 months or 1 year) debt securities.

Nevertheless, the high cut-off yield was due to the high demand for a low-risk investment options amid the high inflation & volatile environment. Should the T-bills mature after 6 months or 1 year, investors may not get the same interest rate when they apply for the new issuance.

If you have always wanted to learn how to invest in stocks and earn higher returns than T-bills, our masterclass will showcase how you can use value investing methodology to help you to sieve through companies and find the potential gem to invest and grow your money.

Join us in our masterclass to learn more about value investing by clicking on the banner below to learn more how to:

- Generate 3 Sources of Passive Income even if you know Nothing about investing.

- Invest with minimal capital.

- Create a Cash Dispensing Machine to replace your existing salary.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.