INTRODUCTION

Writing this blog gives me an opportunity to share with you the relevant information about investing because when I was first researching about investing, it was a tedious process in sieving out useful information. There were too many information everywhere and it was a difficult process to piece everything together.

Therefore, I wish that this blog would allow you to have a good overview of investing in Singapore as this would speed up your process towards achieving your investment dreams.

In part 1 of this blog, we would be having a broad overview of the investment world and the importance of starting out early. Part 2 of the blog would look at the workings of the stock market and lastly, in part 3, we would go through a step-by-step guide in setting up the necessary accounts to start investing in the stock market.

CHAPTER 1: ABOUT INVESTING

To find out whether you should be investing, lets answer a simple question. In the two cases below, which scenario would you prefer?

If you opted for scenario A, you are in for a treat as this book provides the details that you need to realise it. Whereas for those who have chosen scenario B, please give me a chance tell you more about investing in Part 1 of this book. Subsequently, if you wish to embark onto this journey with us, join me in Part 2 and 3 of the book. We would be exploring on the Basics of the stock market and the step-by-step guide towards turning scenario A into reality.

But how to start investing in Singapore? Before you start investing in Singapore, it is important to set your personal financial goals and how you need to save, invest to reach your target. Once you have figured your finances (how much money you must invest each month to achieve your goal), you have to scout for the best investing style in Singapore and how much risk you are willing to take. You have to make sure you keep track of your activities, automate your investments so that you save consistently and do regular checks on your investments. Your next few questions will be what is the easiest way to start investing in Singapore or how to start investing in Singapore stocks or stocks in general, with a small capital?

CHAPTER 2: DIFFERENT INVESTMENT PRODUCTS

There are many ways to “grow” your money in today’s society like what you have seen in scenario A and here are a few examples that you might be familiar with:

A) SAVINGS ACCOUNT

Everyone needs to have bank accounts in Singapore. Saving Account is an account that most of us have currently. You should always put your savings into accounts paying a good interest rate. Your money is going to sit idle anyway, so why not enjoy the best returns for it. Invest in some time to see which bank offers better interest rate on your savings. There currently many resources in the internet to help you decide which bank you could consider. Here a list of banks

with Development Bank of Singapore (DBS), Overseas Chinese Banking Corporation (OCBC), United Overseas Bank (UOB), May Bank, Commerce International Merchant Bankers (CIMB), Standard Chartered (StanChart) and many more.

Pros: Savings account would earn you interest over a fixed period of time and you do not need to do anything to earn this interest, just park your money with a bank and collect interest. Essentially, this is an extremely low risk way to grow your money. If offers you liquidity in times of need and urgent payments you may need to make on hand.

B) FIXED DEPOSITS

Unlike Savings Account, Fixed Deposits is less flexible (unable to withdraw the money out for a certain time period) but has a higher interest rate, which means it is also an extremely low risk way to grow your money at a faster rate.

Cash investments like Saving & Fixed deposit are generally safe and easily accessible. It is important to keep some cash savings for short-term and emergency needs.

But while you receive interest on cash savings in the bank, the amount is often less than the current rate of inflation. If the interest rate does not exceed the rate of inflation, the actual worth of your savings depreciates over time. You may find your financial goals end up being out of reach.

C) BOND

Unlike Savings Account and Fixed Deposits, Bond is a debt security. It is like a form of borrowing that governments and companies wish to get from the investors. In return, they would pay the investors an interest payment for lending them the money. Nonetheless, at the end of the lending period, they are required to pay you back the money they had borrowed at the start.

D) UNIT TRUST

This is another common investment that we might hold currently via our insurance policies. It is a fund which adopts a trust structure which means your money would be combined with other people’s money which together, would be used for investment purposes by a professional (fund manager). The types of investment would vary according to the unit trust’s objective.

E) STOCK (EQUITY)

Some of the fund managers invest in stocks (equities) using the fund that was created using our money. A stock (equity) is like a certificate that proves that you are an owner of the company, which means you would represent a claim on part of the corporation’s assets and earnings. Investors in stocks expect to make a return on investment through dividends which is an annual or semi-annual payment to shareholders and/or capital gains which is income that arises when a shareowner sells a stock for a higher price than he or she purchased it for. An Investor can experience varying levels of risk when owning a stock. If you buy stocks of an established company, it may be considered as blue chips stocks. These are lower in risk. However. If you buy stocks of a smaller company, it may be cheaper but offer higher risks. Ultimately, the value of the stock is pegged to the performance of the company, which can fluctuate a lot.

For high-yield dividends, Investors will look at long-term share investing where as short-term investors, usually follow a buy low, sell high policy. How you choose to approach trading of stocks really depends on your investment goals and what your time horizon is for investing.

F) EXCHANGE-TRADED FUND (ETF)

Exchange-Traded fund (ETF) is a collection of stocks, usually that of an index, that is traded on exchange, like Singapore Stock Exchange (SGX). The definition of what an index is goes like this: “An index is a statistical measure of the changes in a portfolio of stocks representing a portion of the overall market. It would be too difficult to track every single security trading in the country. To get around this, Indexes take a smaller sample of the market that is representative of the whole. Investors use indexes to track the performance of the stock market. Ideally, a change in the price of an index represents an exactly proportional change in the stocks included in the index.

Basically, an Index is a way to track how the market is performing on any given day, and each Index is comprised of several companies’ stocks. There are several different types of Indexes which measure the stock market’s performance in different areas depending on what you are interested in. An Index Fund is what you would buy if you wanted to own a portion of each of the companies which are included in that specific Index. They can be very expensive for new investors so there are alternative Indexes to invest in and they are called Exchange Traded Funds or ETFs.

ETFs track index funds and mirror their fluctuating rates but they trade like stocks. Meaning, their prices will change throughout the day and that they are usually cheaper then index funds.

THE KEY FEATURES OF INVESTING IN ETFS, IN GENERAL ARE:

- ETFs are Simple – can be bought and sold just like a normal stock. When you invest in ETFs, you are buying shares of the ETFs essentially owning a tiny portion of the total fund.

- ETFs are Liquid – Liquidity is provided by the buyers and sellers of the ETFs in the secondary market and also by market who buy and sell ETF units on a continual basis

- ETFs offer Transparency – the bid and ask prices can be seen at any time when the market is open

- ETFs allow diversification – you can buy a basket of stocks and diversify yourself from the vagaries of investing in a single stock

- ETFs allow access to complicated markets, sectors, assets classes and countrie

IN SUMMARY:

No doubt, investing in ETFs is growing popular in the recent years. For most investors, ETF investing can be seen as a logical first step towards getting started and subsequently, as a springboard into other investments. Because exchange traded funds track a stock or commodity index, it is typically a long-term investment.

CHAPTER 3: BEST TIME TO INVEST

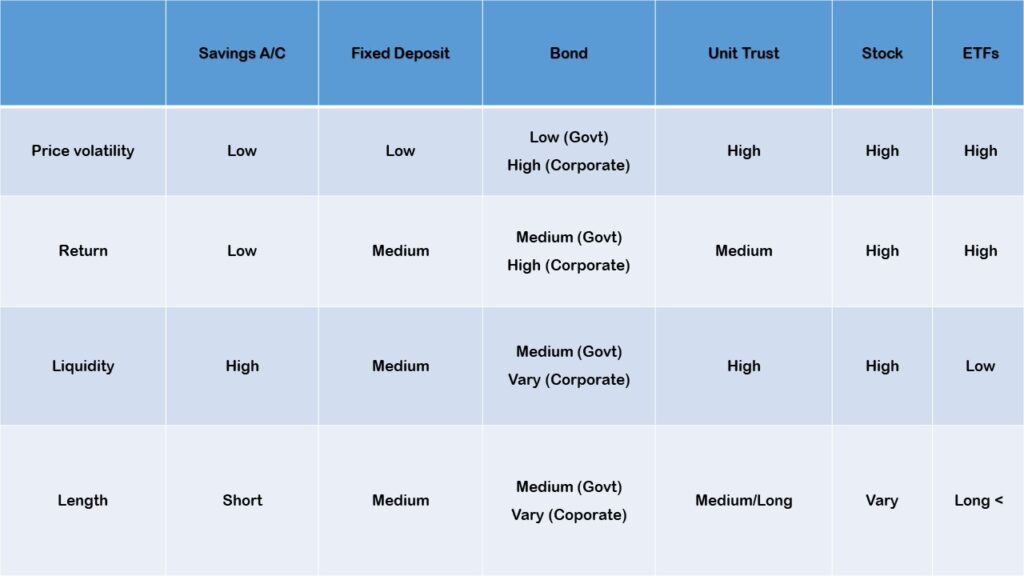

Definitely, there are investment products that caters to different kind of investors and these products could potentially “multiple” your wealth although at different rate of “multiplication”. Also, another area to watch out for is the liquidity of the investment products and this refers to how quickly the products could be converted to cash. Thus, when you are designing your own investment portfolio, have a good understanding of the above factors would put you in a favorable situation to not lose money in the future.

The best time to invest is as early as possible as the longer your period of investing, the greater the power of compounding. Referring back to the scenario A, compounding is the rate at which the money multiples.

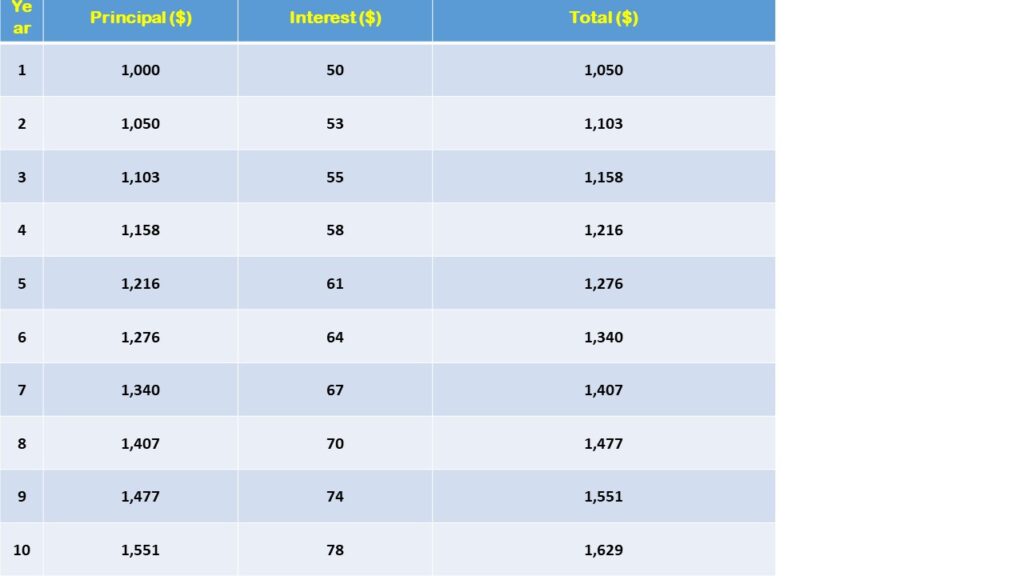

Here is a simple example of compounding assuming you invested $1,000 at a return of 5% per annum for 10 years:

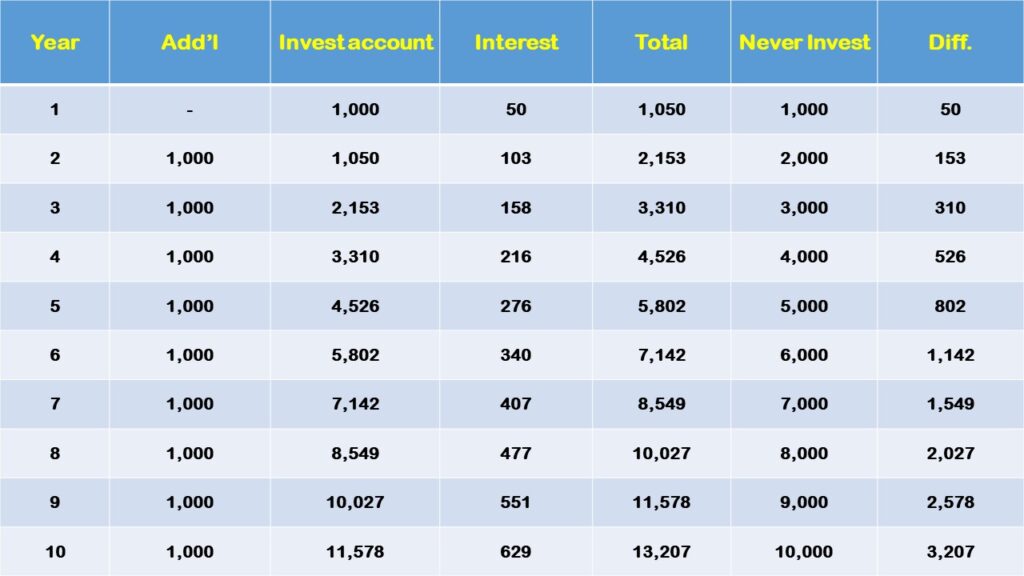

If you have saved and added $1,000 every year for 10 years, this what you would get compared to when you do not invest at all:Over the period of 10 years, the initial interest of $1,000 grows to $1,629 which represents a 63% growth from year 1.

Thus, the difference between investing and not investing at would be $3,207.

Now, having seen that your money could work for you, a good way to get started quickly is to categorize your spending. According to Garrett Gunderson, CEO of WealthFactory.com, expenses can be broken down into four categories:

- Destructive spending

- Productive spending

- Protective spending

- Lifestyle spending

Destructive spending are expenses incurred on credit, on vices such as smoking and excessive drinking and buying stuff he did not need or did not use after the initial novelty wore off.

Productive spending generates income. This are usually investments in stocks and businesses. They also include potential income generators such as training and education. It also includes personal well-being products such as nutritious food, physical fitness regimes and general health. Although this third group of productive expenses do not generate income as such, they prevent the leakage of money due to health issues.

Protective spending covered expenses for insurance – health, life, motor, and many more.

Lifestyle spending consists of vacations, clothing, gadget and trinkets. This adds balance to one’s life, and allows for enjoyment but in moderate portions.

Thus, cutting down on destructive spending and increasing your productive spending would definitely get you ready for the investment journey ahead.

CHAPTER 4: COMMON PLACES TO INVEST

Sticking to the previous investment products, we can observe that the Savings Account, Fixed Deposit and Unit Trust investment would most likely be straightforward to do. However, investing in the stock market is less known to us which is why in the following part, we would explore the stock market in Singapore.

The stock market is a place where you can buy and sell shares of stock of a publicly listed company. As of 2016, there are 759 listings in the Singapore Stock Market. While 3 years ago, there were 771 listed companies.

CHAPTER 5: THE STOCK MARKET

The size of the Singapore market is measured by market capitalisation. This is the total market value of all listed companies in that particular stock market. When compared to the other stock market in the world, Singapore is still very small. However, this does not limit the amount of money one can earn in the Singapore stock market. Getting listed in the stock market is another way of getting funding for the companies without having to borrow money outright. When the companies were first initiated into the Singapore stock exchange, they have to go through the Initial Public Offering (IPO) process.

However, unless you are

- 18 years old and above

- Not be in an un-disclosed bankrupt

- Have a bank account with one of the following banks in Singapore (Citibank, DBS, POSB, HSBC, Maybank, OCBC, Standard Chartered Bank or UOB), you would not be allowed access to the stock market by yourself.

There are many different stock markets in different countries. For example, the stock exchange in Hong Kong is called Hong Kong Exchange, Bursa Malaysia in Malaysia and Singapore Stock Exchange (SGX) in Singapore. SGX is located at

- 2 Shenton Way, #02-02 SGX Centre 1, Singapore 068804 and,

- 11 North Buona Vista Drive, #06-07 The Metropolis Tower 2, Singapore 138589

Like usual business hours, the exchanges around the world operates every working weekday from morning to evening. Specifically, for SGX, it opens from 9am to 5pm (SGT +8) and has a mid-day trading break from 12pm to 1pm.

Before you can buy shares listed in the Singapore Exchange, you first need the Central Depository (CDP) securities account. The CDP account is basically a place where it contains all the shares that you bought from the Singapore Exchange.

After which, a brokerage account has to be set up as this would allow you to communicate with the broker, who is a professional individual who executes buy and sell orders on behalf of clients for stocks and other securities in a listed market or over the counter, usually for a fee or commission. It is worth noting that only one CDP account is needed even if you have multiple brokerage account.

Thus, with an overview of the stock market, we are ready to proceed to the next section.

CHAPTER 6: MONEY IN THE STOCK MARKET

The two ways an investor could make money from the Singapore Exchange are via 1) Capital Appreciation and, 2) Dividend.

Capital appreciation is a rise in the value of an asset based on a rise in market price. It only occurs when the stock you have invested is worth at a higher price than when you first bought it.

On the other hand, dividend is a distribution of a portion of a company’s earnings, decided by the board of directors, paid to its shareholders. Dividends could be paid out as cash or shares of stocks.

The amount of money you make in the stock market mainly depends on the type of investment product you purchase.

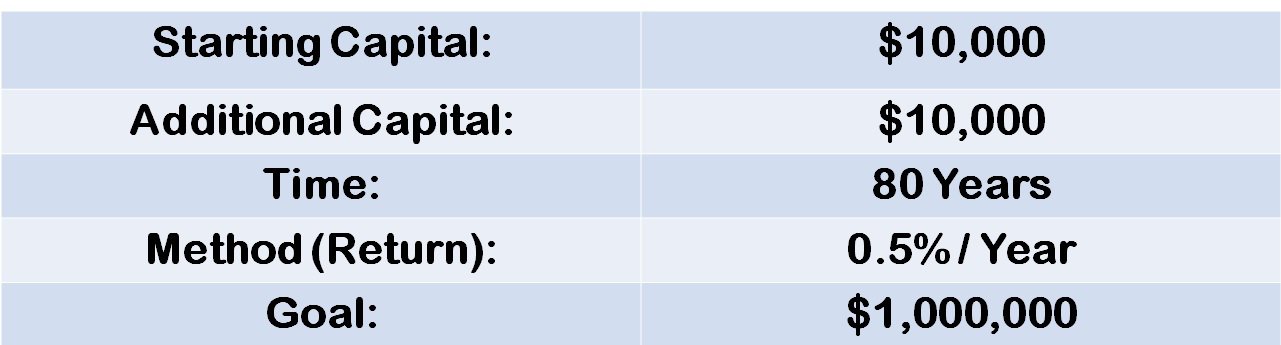

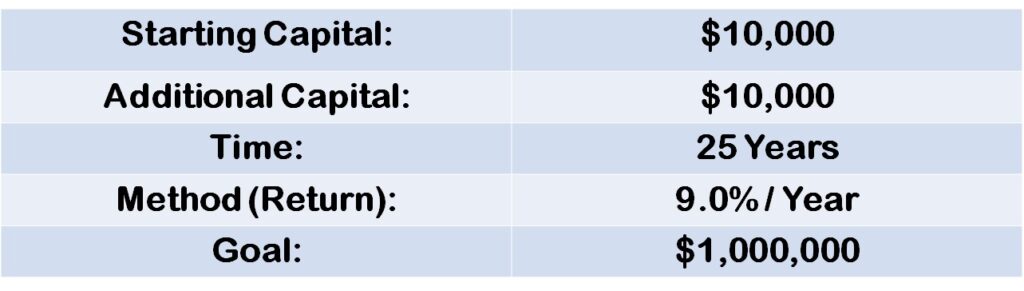

Imagine you would want to earn one million dollars with a starting and additional capital of ten thousand dollars growing at a 0.5% per annum, it would take 80 years to reach a million dollars. This means that if one is to start investing at the age of 25, one would get a million at only 105 years old.

If the returns were to increase to 9% per annum, it would take 25 years to reach a million dollars instead and the interesting thing about it is that the 9% per annum return investment product is available to be purchased.

Hence, finding the right stocks to invest in is really important as it reduces the time to reach a million by 55 years. In other words, one would become a millionaire at age 50 if one were to start investing at age 25.

Nonetheless, it is more important to learn not to lose money in the stock market than to find an investment product that gives a high return.

Usually, one requires a certain level of financial and investment knowledge to find positive return stocks in the Singapore Exchange. There are currently 2 famous analysis methods for a stock and they are fundamental and technical analysis.

Firstly, there is fundamental analysis where its objective is to find the enterprise value of a company which means finding out how much the stock (or company) is worth. In order to determine the price, industry, company and economic analysis has to be made to have a more calculated approach towards determining the price.

Fundamental analysis normally believes of buying an under-valued stock and then wait till the market correct itself. Secondly, technical analysis uses past price movements to predict its future price movements. Thus, this type of analysis focus primary on the trends and patterns of the stock price.

Weighing on several factors, I would prefer fundamental analysis than to technical analysis because there are actually a lot more successful fundamental analysis investors than technical analysis investors. Furthermore, on October 2009, a study by New Zealand’s Massey University tested more than 5,000 technical analysis strategists in 49 countries and not anyone of them generated returns that are not predicted by chance.

There are various methods of acquiring fundamental analysis knowledge which includes attending courses/seminars like the one conducted by Mind Kinesis (insert masterclass link), or reading up books like The Intelligent Investor and Security Analysis both by Benjamin Graham, Common Stocks and Uncommon Profit by Philip A. Fisher.

CHAPTER 7: ACCOUNT OPENING

STEP 1 - CDP VS NOMINEE ACCOUNT

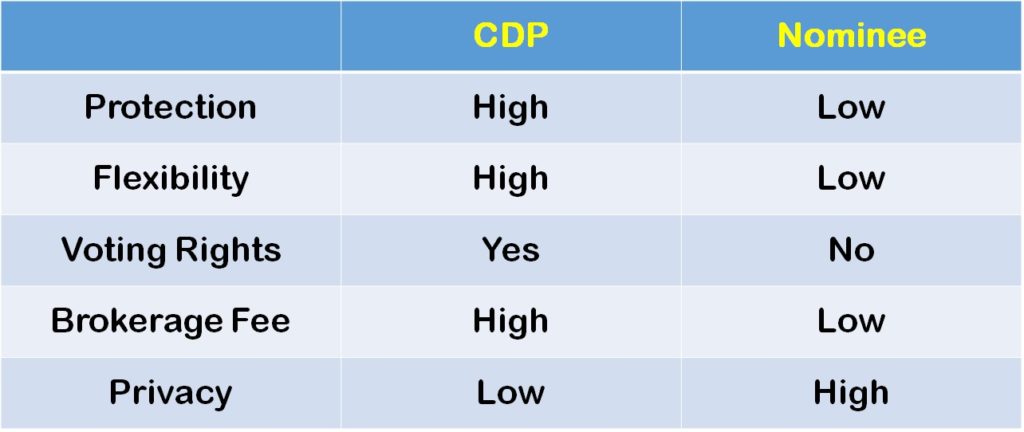

Before opening a brokerage account with a brokerage firm, one can choose between opening a CDP account or a nominee account. The difference between the two accounts is that CDP account is held directly by the investor (you) which mean you are the owner of the shares you purchase. On the other hand, a nominee account means that the shares that you purchased would not be held directly under you, instead, it would be under the broker’s name.

Flexibility – If you decided to switch broker, the CDP account allows you to bring over the shares you purchased before over to the new broker. Whereas for the nominee account, this is not allowed.

Protection – If the broker suddenly goes bust, the shares held in the nominee account would be wiped out.

Voting Rights – CDP account allows you to attend Annual General Meeting/Extraordinary General Meeting while nominee account disallow it. (However, some brokers allow you to attend AGM/EGM as a proxy. Also, the nominee account handles the paperwork for various corporate actions)

Privacy – Nominee account will shield your identity which means your name would not appear on the shareholder list

Brokerage Fee – Purchases made under the nominee account would pay less brokerage fee and some examples are Citibank Brokerage, SAXO Capital Markets, iFast, and Standard Chartered.

All in all, if you prefer to have more privacy and lower brokerage fee, then having a nominee account is best for you. Otherwise, CDP account seems like a better option as it feels safer and flexible.

Exposure – However, if you wish to purchase overseas shares, the brokerage fees would be different. Also, the overseas shares would also not be held in the CDP account. Instead, it would be held in the nominee account. Additionally, most local brokerage charge S$2 per month per counter for foreign stocks.

STEP 2: BROKERAGE ACCOUNT

Some factors to consider before choosing a broker

Brokerage Fee – Since one would get charged by the brokerage with every transaction, if you are a type of investor who transaction infrequently, the commission fee might not be your biggest concern.

Trading Platform – If you are a investor who wishes to invest on the go, identifying those brokerage firms who provides trading facility online might be a point to consider.

Reputation and Track Record – This is one of the most important factors one would lose all their shares if their brokerage firm becomes bankrupt. Nonetheless, even if your stocks are kept in the CDP account, things can get troublesome.

CHAPTER 8: GET STARTED IN INVESTING

A, B AND C

Now with the accounts set up, next is how do I get started in investing? In fact, it is as simple as A, B and C:

Assess – Assessing the business (stock) that we are investing in is important and usually, there are only 2 types of business that we would encounter, good business or bad business. Without a doubt, a good business is more attractive as it allows us to make money from it.

Buy – After finding out a good business, the next step is to buy. However, we do not purchase the business (stock) at an infinite price. For example, if a business (stock) is worth ten dollars, we should not be paying for anything above that. Instead, we only buy them when they are either at or below ten dollars.

Cashing Out – Going back to the example above, this refers to when you purchased the business (stock) at either ten dollars or below it and then selling it at above ten dollars. The difference between the purchased price and the selling price is called capital appreciation. However, this process do not always occur immediately. Thus, while waiting for the price to go up, you can collect dividend along the way.

CAPITAL REQUIRED FOR INVESTING

After understanding the principle of investing, some may be curious in how much money is required in investing. Ultimately, it all depends on the stock exchange you are buying and selling the stocks in. For example, in the Singapore Stock Exchange, every purchase made must be in quantum of 100 (1 lot). Thus, if the stock price is two dollars and you purchase 1 lot, you would have to pay two hundred dollars (two dollars multiple by 100). Additionally, a brokerage fee would also be charged. However, if you purchase stocks in the United States, you can buy stocks in small amount. For instance, you could simply just purchase one stock of Microsoft (NASDAQ: MSFT) at the price of 112.33 (as of 31 August 2018).

Thus, you could start investing at any amount.

NOT TO LOSE MONEY

Before making the purchase of investment products in the stock, it is vital to understand the following in order not to lose money: Income generating assets and Non-income generating assets. An example of an income generating asset would be a property or a good business which generates profit every year. Hence, if you purchase an investment product that has a history of earning profits, the chances of you losing money is slim.

Whereas for a non-income generating asset, it could be a block of gold or a business that is making loss for many years. For instance, investing a block of gold might be a non-income generating asset because there is a fifty percent change that the block of gold would be worth less than the day you purchase. At the same time, the block of gold did not generate any additional income along the way. Thus, the chances of you losing money is significantly higher. Therefore, if you wish to make a purchase of an investment product using your hard earn savings, would you choose an income generating asset or a non-income generating asset?

TIME REQUIRED

But how much time is needed? Time may not be a problem when it comes to investing because if you are a passive investor, all you need is less than a minute to invest. However, if you are the opposite of an active investor, definitely more time would be needed.

A passive investor normally are afraid of the movement in stock prices and they like diversification, in other words, they like to buy a whole bunch of stocks. Thus, choosing to invest in a basket of stocks such as the Exchange Traded Fund (ETF) like the S&P 500 ETF (which gives an average of 9% per annum over a long period of time), Dow Jones Industrial Average or the STI ETF. Very little time is needed for a passive investor because what they need to do is just to use a method called Dollar Cost Averaging which means to buy a fixed amount of the ETF, over a regular time period and repeat this procedure for the rest of their life. So, the time that is required is practically just based on the amount of time one spend on executing the trade.

For an active investor, it is directly opposite of a passive investor because they prefer a more concentrated portfolio, which means they like to buy a small bunch of stocks and watch them carefully. Also, they spend a lot of time monitoring the stock so that they could take advantage of any misprice in the stock that they are interested in.

Hence, it all depends on the type of investor one is to determine how much time is needed for investing.

CHAPTER 9: BONUS #1 SINGAPORE SAVINGS BOND

Singapore Savings Bond (SSB) is a type of bond and like any other bonds, if you buy a bond, you are essentially lending money to whoever issued it. In this case, the issuer for SSB is the Singapore government, which means you are lending money to the government.

Similar to how a loan works, we should expect a periodic interest payment from borrower. Thus, the government has set a six months periodic step-up interest payment to the lender (you). A simple illustration of the step-up interest payment is as below :-

Thus, because of the concept of “step-up interest rate”, you would get 1.68% interest rate during the first year and 2.14% in the second year, and so on. If you withdraw after Year 2, the actual return would be 1.91% because it averages out the 2 years of returns (1.68% in Year 1 + 2.14% in Year 2 divided by 2).

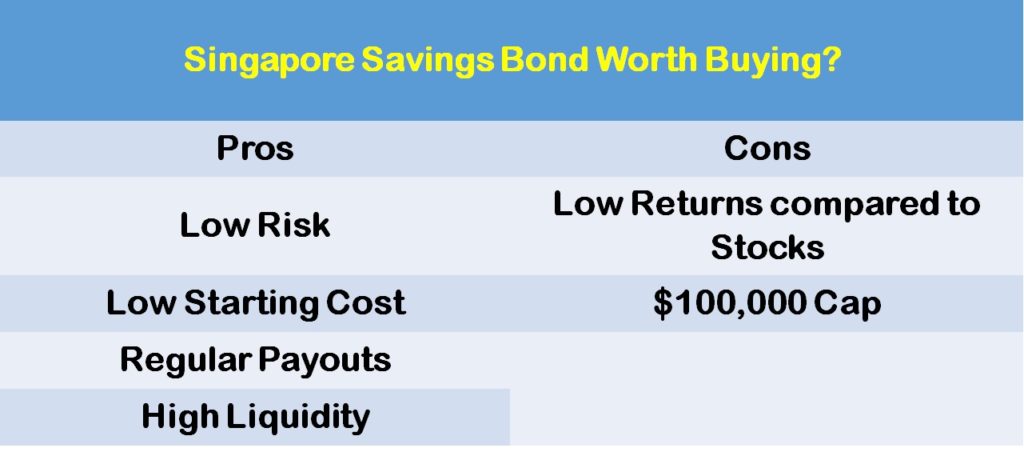

No doubt, the Singapore Savings Bonds (SSB) is always a good way to kick off your investment journey as it provides us a no risk alternative (principal guaranteed) that gives a higher return (based on 10 Year SGS rates), while at the same time, provides flexibility on redemption (no early redemption penalty).

However, SSB is not a product without any disadvantages. While SSB is highly liquid and low risk, the returns would be relatively lower if compared to investment like Exchange Traded Fund (ETF) and Real Estate Investment Trusts (REITs).

1) Inflation

Therefore, a few useful factors to consider before dedicating your money to the SSB.

Singapore has an average inflation rate of approximately 3% in the last 5 years. As SSB is only able to give us an average annual return of 2% to 3% over a 10 year period, the Savings Bonds does not beat inflation effective and we could run the risk of having our money getting eroded if we placed them in Savings Bonds. However, do note that the intention of SSB is not to beat inflation but to offer individual investor a safer alternative to invest their money.

2) Returns

If your time horizon for investing is long (you have longer period to invest), SSB may not be the ideal location to invest most of your money in because there are other investment products that offers a higher return. Thus, a recommended balanced portfolio should consist of more equities that are able to give higher rate of return. Whereas for the older people who are either retired or retiring son, it is recommended that they take up more bonds to serve as a capital protection.

3) Purpose

It is suitable for SSB to serve as a place to store one’s emergency funds as compared to the bank account because capital could be taken out easily without penalty. Furthermore, SSB provides a slightly less flexible redemption policy and a higher interest rate.

4) Other alternatives

Although the interest rate for normal bank savings account gives us a low return, there are certain unique ones that provides interest that is as relatively higher than SSB. For instance, the OCBC 360 account gives a 4.05% max rate (as of Sep 18) if certain criteria were met. Not only that, these savings account gives a greater flexibility as they could be withdrawn anything, compared to the second business day of the following month for SSB.

The Central Provident Fund (CPF) Ordinary Account offers 2.5% interest rate per annum, and the Special and Medisave Account offers 4%. CPF board will pay an extra 1 per cent for the first $60,000 of members’ combined balances, of which up to $20,000 can come from Ordinary Accounts. If there is no intention to use the money at all until you retire, you might be better off by putting your money in either CPF account (preferably the Special Account since it offer a much higher interest rate).

CHAPTER 10: BONUS #2 -

EXCHANGE TRADED FUNDS (ETFS)

Warren Buffett, the 3rd richest man in the world, has advised to “Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P index fund. (He suggested Vanguard.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors — whether pension funds, institutions or individuals — who employ high-fee managers.” Berkshire Hathaway Inc., 2013 Annual Report. Nebraska. Berkshire Hathaway Inc., 2013. pp. 21-22.

Before we talk about index funds, let me explain what are indexes in a simple manner. In the early days when stock exchange first started, analysts wanted to get a feel whether the stock prices are heading upwards (bullish) or downward (bearish). So they came up with an idea by taking some stock prices of big companies, average their stock prices and then use that average number to determine whether the market is bullish (horns of the bull pointing upwards) or bearish (the bear uses it paws and swipe downwards to kill its prey). But an investor can’t really invest in an academic number. So some Fund Managers decided to take money from investors, mimicked the components of an index in the exact way, so that the stock prices of this Index Fund moves in tandem with the index itself.

Let me give you an example. S&P 500 is an index, and it has a fund that mimicked this S&P 500 Index. We simply called it S&P 500 Index Fund or sometimes, it is also known as S&P 500 ETF (Exchange Traded Fund).

CHAPTER 11: BONUS #3 -

REAL ESTATE INVESTMENT TRUSTS (REIT)

One of the Investors hopes will be to invest in an asset which continue to appreciate in value over the long-term, while still delivering passive income in the form of rental in the short-term. However, In Singapore, property prices have surged incredibly shunning hopes of investment. So , property investors are increasingly looking to invest Real Estate Investment Trusts(REIT).

Singapore real estate investment trusts (or called S-Reits) are listed on the Singapore Stock Exchange and they could be invested in, similar to how stocks work. REITs use investors’ money to buy, operate and manage properties. These properties are then leased out to tenants in return for rent. Thus, REITs investors are entitled to have a share of the rental income from the property assets which are distributed quarterly. Apart from the regularly dividend pay-out, investors also have the chance to benefit from capital gain as the property value increases.

Singapore offers one of the largest REITs Markets in the world. There is huge demand for REITs as Investors look for ways to benefit from the investment in the booming real estate sector and earn a form of passive income.

Additionally, because REITs are required by law to redistribute at least 90% of their taxable income each year, this type of investment seem very exciting. One would get a 5 % to 7 % a year in dividends on S-Reits Hence, if compared to a SSB, it is quite similar as it provides a recurring income, except that S-Reits pays out more frequently and in larger amount. However, the share price of a REIT can go up and down, just like regular stocks.

Currently, there are 7 type of sought-after real estate investment trusts in Singapore: Healthcare, Office, Industrial, Hospitality, Retail, Residential, REITs ETF.

Firstly, healthcare REITs makes investment in healthcare facilities which includes hospitals, nursing homes as well as assisted living properties. Their success is tightly connected to the evolution of the healthcare system. One good point about healthcare REITs is that there is definitely a demand for healthcare services in Singapore as our society ages. Thus, the healthcare sector would have a great importance in catering to the needs of the elderly.

REITs: Parkway Life REIT, First REIT

Secondly, office REITs focus in office buildings and their income comes from the rental of office space. However, there are several factors that may affect the performance of offices. For instance, if the economic growth of Singapore is poor, there would be no demand for office spaces as less jobs would be available. Thus, although office space provides long term recurring income, the REITs is vulnerable to the effect of a non-performing economy.

REITs: CapitaLand Commercial Trust, Frasers Commercial Trust

Thirdly, industrial REITs manage and own industrial facilities, they rent these spaces to their tenants which include warehouses, distribution centers and specialised facilities. The industry players whom are renting the spaces, the occupancy rate and the location are some of the important factors to look out for in industrial REITs. Industrial REITs are driven by the manufacturing sector and due to the large volume of floor space each industrial facility holds, losing a tenant could result in significant drop in rental income.

REITs: Ascendas REIT, Mapletree Industrial Trust, Viva Industrial Trust

Fourthly, hospitality REITs operate properties such as hotels and serviced residences. Without a doubt, hospitality REITs is highly dependent on the tourist number entering into the country as more people would stay in the hotels and serviced residences, which would drive up revenue. However, this sector is especially susceptible to macro events. For example, major health outbreaks or natural disasters would have a negative impact on tourism and as a result, the revenue of the hospitality REITs would suffer.

REITs: Ascendas Hospitality Trust, Ascott Residence Trust, CDL Hospitality Trust

Next, retail REITs as you guess, contains a portfolio of shopping malls. Most shopping centres that you visit are likely to be owned by a REIT. For instance, Causeway Point, Northpoint City, Changi City Point are all owned by Fraser Centrepoint Trust. Since retail REITs generate profits by renting space to its tenants, if their tenants have cash flow issues, the REIT’s rental revenue would be affected. Thus, it is important to look out for strong anchor tenant in the shopping mall, the past occupancy rate and the rate of turnovers when analysing the retail REITs.

REITs: CapitaLand Mall Trust, Frasers Centrepoint Trust

Following which, residential REITs own and manage manufactured housing and rental apartments or buildings and it is the most uncommon REIT in Singapore. Residential REITs make the most profit in areas where home supply is low because this would drive up the rental fee. Also, in areas/country where the economy is improving, rental fees could rise as the demand for housing in these area would increase.

REITs: Saizen REIT

Lastly, REITs ETF combines all of the above REITs into a basket and this is especially attractive for investors who are looking to diversify and also, to those who are looking to spend as little time as possible to select the REITs to invest in. Thus, this ETF is less prone to fluctuations and does not require constant monitoring.

In order to differentiate the better REITs from the wide array of REITs available for investment, it is vital to analyse them based on a few factors.

Currently, there are 7 type of Reits in Singapore: Healthcare, Office, Industrial, Hospitality, Retail, Residential, Reits ETF.

Firstly, the macro outlook for the properties of the REITs. Some of the REITs are highly dependent on the macro events. For instance, if the economy is not doing well and unemployment rate is high, retail REITs would suffer because people would be less willing to shop and dine out in the shopping centres. On the other hand, if the economy is booming, there would be a higher demand of properties and offices which would cause the rental fees to increase and hence, the performance of the REIT would improve as well.

Secondly, the amount of loan that the REIT possess. Similar to how we view debt, if a REIT has high debt level relative to what they own, the REIT has a high risk of defaulting and higher interest payment. One of the ways to assess the financial health of the REIT is through dividing the amount of debt over the total asset (gearing ratio) that the REIT owns. Thus, a higher gearing ratio is would increase our risk level of not doing well overall.

Thirdly, the rate of return on a real estate investment property based on the income that the property is expected to generate (Capitalization Rate). It simply means how well the property can earn money. For instance, if property A and B are similar except that property A earns more money than property B, property A is the better property to invest in. In other words, property A has a higher capitalization rate than property B. A high capitalization rate is also a proxy to how capable the management is and whether they are good at helping investors earn money.

All in all, REITs regular dividend payout and chance to benefit from capital gain as the property value increases could be another investment product that one should consider when investing in Singapore.

CONCLUSION

Congratulations on finishing this simple guide book. To wrap up, we have gone through about investing and some of the different investments products out there. Furthermore, we got to understand that the earlier we start to invest, the better it is because of we would have more time to compound the returns we get. Subsequently, we dived into the basic of the stock market and discovered ways that money is generated from it and at the same time, discuss on ways on not to lose money from the stock market. After understanding about the stock market, we proceeded to the steps in opening the necessary accounts for investing before kick starting our investment journey. To end it off, we broadened our knowledge by looking at other possible investment products (Singapore Savings Bond and Real Estate Investment Trust).

I truly hope that you have benefited from this blog in one way or another. In this note, I will like to share more about Value Investing.

Value Investing was not a popular investing methodology in Singapore many years back and it’s only about 3 – 4 years ago when it becomes a topic people talk about. If you want to know more about what is value investing and how to do value investing in Singapore, you can read some of our past articles.

Through Mind Kinesis flagship Value Investing Course, called Value Investing Programme (VIP) which is conducted across 11 cities in Asia, we have trained thousands of people who ranges from someone who has zero experience in investing to experienced investors who have lost tons of money.

So, is Value Investing suitable for you?

First, we need to appreciate that there are many schools of value investing. Using martial arts as an analogy, there are many schools of martial arts. It can be Karate, Tae Kwon Do, Wing Chun, etc. Even though there are many different forms of martial arts, they can be broadly classified into Martial Arts. Same thing for Value Investing. There are different styles of Value Investing, and no doubt , there will be at least one style that will fit your needs.

VALUE INVESTING INCOME INVESTOR

This group tends to be very busy and do not have much time to do analytical work. They may also be more senior (More than 50 years old) and prefer to have a stable income generating machine without worrying too much about movement of stock prices. It’s like an investor owning a property and he just wants to collect the rental regularly every month without much worry. Then one way of using value investing is to invest in REITs (Real Estate Investment Trusts). Just dividends alone, the return can range from 5% – 9%. What’s good about investing in REITS as compared to traditional hard properties is as follows:

(i) ROI – ROI from investing in REITS (5% – 9%/year) in Singapore is definitely much higher than that of investing in properties in Singapore (Around 3%/year)

(ii) Income not taxable – Income collected from REITs either from capital appreciation or dividends are not taxable whereas rental collected from properties in Singapore are taxable

(iii) Low capital – To invest in REITS, your start-up capital can be as low as a few hundred dollars but for investing in properties, you will need hundreds of thousands of dollars. If you do not have enough cash, you will still have to take a huge loan from bank which will in turn incur interests. In addition, you will also have to wait for the property to be fully constructed which will take years, and take more months to rent out by paying commissions to real estate agents. There is a lot more risk and uncertainty in investing in properties versus using value investing to invest in REITS.

(iv) High Liquidity – Investing in REITs is highly liquid because REITs are examples of stocks which can be bought or sold via your broker with just a click away. But for properties, you have pay the real estate agents commission to help you sell away the property which may take weeks to months

(v) No worry about Tenants – Investing in REITs has lesser worry about managing your tenants as compared to investing in a property. I have friends who constantly worry that their tenant will spoil or dirty their new house when the house is rented out.

Overall, through our value investing course, Value Investing Programme (VIP) in Singapore, you can learn the basics of how you can get started to invest in REITS.

Value Investing Growth Investor

This group of investor tends to be young to middle age where they have sufficient time to do analysis to search for fast growth stock. Fast growth can means having a stock that has an earnings growth rate of 20% per year or more. Fast growth company tends to be small cap, and pays little or no dividend because they need more money to grow. But no stock is perfect. Since fast growth stocks are small, they tend to have higher risks as compared to much bigger companies that are growing slow and steady such as McDonald’s. Such styles of investing predominantly is Warren Buffett’s style of value investing. There was one interview where he said that there are two types of companies that he like to invest in – the first type being companies that have a high rate of returns on tangible assets that grow. The second type are companies that have a high rate of returns but do not grow. But as long as it’s a great company purchased at a discount, investors can still do alright.

Value Investing Deep Value Investor

This kind of investors love diversification. They cannot stand putting all their money in a concentrated portfolio. They have this belief that the more diversified their portfolio is, the safer they are. Then, value investing using the Benjamin Graham and Walter Schloss style might be of interest to you. Predominantly, such styles of value investing will involve some of the following:

Buying stocks below their Working Capital – It means taking the current assets of the balance and deduct its total liabilities. Whatever that is left, divide it by the total outstanding shares, so that you know how much the stock is worth. This number is known as Working Capital or sometimes known as Net-Net. But such stocks are difficult to find these days and even if you have found some, you need to be mentally prepared that such companies are usually have some challenges. This is why the stock is cheap and we need to have wide diversification to protect the downside risk.

Value Investing Auto-Pilot Investor

This is the simplest, laziest way and low risk method to make money in using Value Investing in Singapore stocks or US stocks. The trick is simply to invest in a low-cost index fund, also known as ETFs (Exchange Traded Funds). Every few months, Mind Kinesis will conduct a value investing course known as Auto-Pilot Investing Workshop where they teach people how to set up a simple auto-pilot system to invest in a basket of stocks. However, do note that not all ETFs are created equal. Some of the favourite ETFs are a few selected types of S&P 500 ETFs such as VOO (Vanguard 500 Index Fund), RSP (Guggenheim S&P 500 Equal Weight ETF) and MOAT (VanEck Vectors Morningstar Wide Moat ETF). Based on Berkshire Hathaway’s latest letter to its shareholders, S&P 500 has given an average annual return of 9.7% since 1965 which means that if you have invested $10,000 in 1965, you would have about $1.3 million today. That’s a lot of money for doing little.

There be more styles of using value investing in Singapore or any other parts of the world but the 4 styles can form a basic foundation of what types of value investing are there and which types suit you best.

Disclosure

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.