Cryptocurrency has become a global phenomenon in recent years, and it is still an evolving space which witnesses ping pong movements in the prices while regulators are trying to rein in and/or understand the crypto beast.

A Binance chart showing Bitcoin plunged to $42843

$400 BILLION WIPED OUT BY THE RECENT CRYPTO CRUMBLE

Bitcoin (BTC) investors rejoiced on Monday when the price climbed to over $52000 for the first time since May. Ethereum (ETH) also traded close to $4000 and meme cryptocurrency, Dogecoin touched $0.31 per token. The happiness was short lived as the BTC price suddenly plunged roughly 17% to almost $43000 on Tuesday briefly before recuperating losses to trade down roughly 11% around $46,000. Ethereum, dogecoin and others saw similar drops in prices.

Bitcoin became legal tender in El Salvador on Tuesday. El Salvador is the first country to legalize Bitcoin for use as a currency. This means that citizens in the Latin American country may use BTC as payment for goods and services. They may also pay taxes in BTC, and crypto exchanges will not be subject to capital gains taxes.

The El Salvador government purchased around $20 million in BTC, and government-run wallets will be loaded with BTC equivalent to $30 for registered citizens. They have also installed 200 BTC ATMs across the country.

The roll out was peppered with glitches as the El Salvador government had to unplug a digital wallet to cope with demand. Some trading platforms suffered outages, delays and cancellations at higher prices. However, there were success stories too. If you walk into a McDonalds outlet in El Salvador, you can pay for your meal using bitcoin. In fact, when the price fell 15%, El Salvador went ahead and bought the dip to increase its bitcoin holding to 550 (latest) which came as a boost in morale for those holding on for dear life.

BUY THE RUMOR, SELL THE NEWS

It is believed that the El Salvador news was already priced in and investors “sold-the news” on Tuesday which made the price drop. Some believe that the rocky start in El Salvador was the cause of the crash while some also believe that the drop was due to manipulations or “shenanigans”.

BTC is not a traditional asset and such moves are not shocking for the crypto world as seasoned players have seen many ebbs and flows in bitcoin and other cryptocurrencies. They even have a host of inside jokes and jargons to describe such situations. For example, when prices fluctuate a lot, like on Tuesday, bitcoin enthusiasts may quip, “Stay strong and #HODL” (“hold on for dear life”).

Or if an official appears on tv and says that bitcoin is a bubble, Ponzi scheme or that it will eventually drop to zero, then bitcoin followers advise to HODL and ignore the FUD (“fear, uncertainty and doubt”) from the naysayers.

HODL strong, don’t cave to FUD

WILL BITCOIN REACH $100,000 BY YEAR-END?

Cryptocurrencies are seen as an alternative to traditional banking methods. It is cheaper to move money around due to not being regulated by the government or its banks. There is an enduring trend boosted by an increasing demand and adoption for cryptocurrencies. As the use cases for the cryptocurrencies rise, the demand and value are also likely to see growth.

The long-term trajectory of bitcoin is difficult to predict as the industry is still nascent, and it is evolving every day. We can observe regulatory developments and institutional adoptions to gauge popularity. Regulations by lawmakers is currently the biggest overhang. Lawmakers are trying to form laws and guidelines to make investments in crypto safe for everyone. They are wary of its use (or misuse) by cybercriminals.

The road is filled with uncertainties. The SEC issued a notice to Coinbase that they may be sued if they go ahead with the launch of their interest-bearing “lend” product for crypto assets. While the US has been taking a cautious stance, the case is not the same for others.

China accounted for more than half of the global bitcoin production until just a few months back because cheap electricity made it possible to undertake large scale operations. But the Chinese regulators do not look favorably upon bitcoin.

The Chinese government has launched a crackdown on crypto assets:

- They have warned against speculative crypto trading.

- They have also banned payment gateways from offering crypto related services.

- They recently stopped Bitcoin mining in the Sichuan province and Inner Mongolia because of environmental pollution and excessive resource consumption.

- Further, China’s central bank also shut down a company which was allegedly providing software services for virtual currency transactions.

On the other hand, Iran is lifting their earlier ban on crypto mining from September 22, in order to collect the world’s newest financial assets. They want to reduce their dependence on the globalized US dollar and other fiat currencies.

Going forward, increasing adoption by major institutions could drive up demand:

Facebook could provide support for NFTs (non-fungible tokens) on its digital wallet, Novi. The social network is also developing its own crypto asset, Diem.

Visa is also exploring NFTs. Tesla has been going back and forth on its decision to accept bitcoin as payment. Paypal and square will be allowing users to buy crypto on their platforms. AMC announced that it will be able to accept bitcoin payments by the end of the year.

A cryptocurrency ETF has been under consideration by the SEC in the US. Once approved, it could present a more conventional way to invest in diversified crypto assets, albeit the risk would still be the same as they would still be volatile and speculative.

As mentioned earlier, the adoption of bitcoin as legal tender by El Salvador could boost demand. However, the IMF believes that this could destabilize the economy and expose the country to additional exchange rate risk.

Musk has gone back and forth on this statement causing fluctuations in prices.

Since the crypto world is still in its infancy and is mostly unregulated, the price is sensitive to comments and actions by major institutions or celebrities like Elon Musk. Bitcoin and other crypto asset prices have been known to fluctuate on tweets by Elon Musk about owning crypto or using it to fund the next Mars mission.

On the flipside, conventional investors like Buffett, do not believe in crypto assets because they do not actually “produce” anything. In 1000 years, there will still be only 21 million bitcoins.

“They don’t reproduce, they can’t mail you a check, they can’t do anything, and what you hope is that somebody else comes along and pays you more money for them later on, but then that person’s got the problem.”

–Warren Buffett

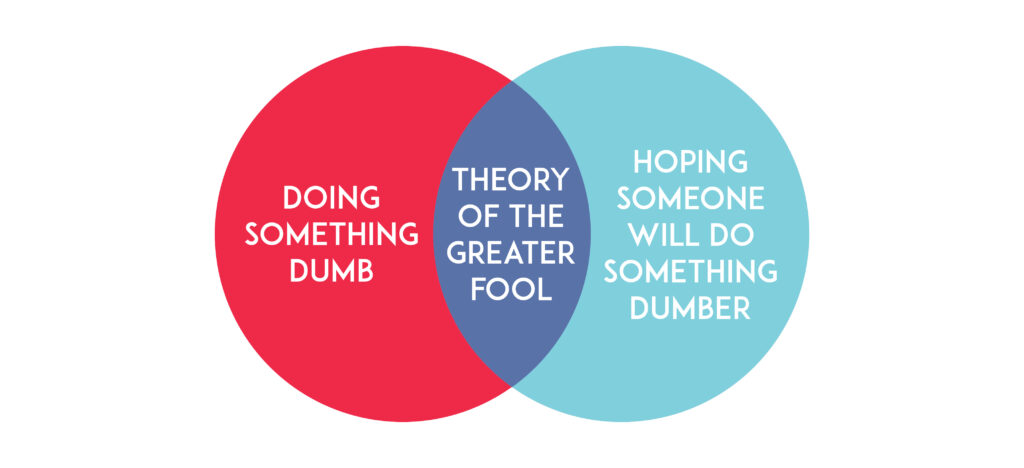

According to him, Bitcoin’s value comes from the optimism that someone else will be willing to pay more for it in the future than what you’re paying today. (The greater fool theory, if you will – The greater fool theory says that prices go up because people are able to sell overpriced securities to a “greater fool,” whether or not they are overvalued. That is, of course, until there are no greater fools left.)

Buffett says that it is an effective way of anonymously transmitting money. But: “a check is a way of transmitting money too. Are checks worth a whole lot of money just because they can transmit money?”

Further, Buffett doesn’t invest in things he doesn’t understand. Which is what has made him one of the most successful investors in history today.

“I get in enough trouble with things I think I know something about. Why in the world should I take a long or short position in something I don’t know anything about?”

Here’s what Charlie Munger said about cryptocurrency:

“I don’t welcome a currency that’s so useful to kidnappers and extortionists. The whole damn development is disgusting and contrary to the interests of civilization.”

While the moral dilemma cannot be disputed, it is the same as when you invest in companies which sell sugary drinks, cigarettes, alcohol, or gambling. Whether to invest on this basis is totally dependent on each investor’s own set of beliefs and understanding.

The main arguments against bitcoin are that they are consume a lot of energy, they have no inherent value, it is used extensively for money laundering and criminal activities, it has insane valuations and the most common one is that “I don’t understand it”. The huge volatility also makes it unviable at present as an everyday medium of exchange. Further, bitcoin mining centralisation in some countries may pose a systemic risk. Integrating a decentralised currency ecosystem within our existing laws and regulation framework is also a roadblock in the path to $100,000.

There are two schools of thought when it comes to cryptocurrency – the naysayers and the believers. One camp believes that it is all just hocus pocus, a hype and speculation, a Ponzi scheme. Simultaneously, there are those that believe that it could be a revolution in money and finance.

Which camp do you belong to?

No one can say for sure whether bitcoin will hit $100,000, or when, but the numerous above-mentioned hiccups need to be resolved before it can be used comfortable by the masses.

WHAT SHOULD INVESTORS DO?

Regardless of which camp you belong to, your crypto investments should not interfere with your other financial priorities. You should put in only what you are ultimately OK to lose. Don’t gamble an amount that would burden you or your family if the amount is lost. It is advisable to keep cryptocurrency investments to under 5% of your portfolio.

FOR THOSE WHO DO BELIEVE…

Ron Popeil popularized the term “Set it and forget it!” to sell the Ronco Showtime Rotisserie in late-night informercials since the 1950s. “Set it and forget it” is excellent for cooking chicken to get a juicy end result. It is also excellent for those who believe in the long-term potential of bitcoin but are stressed by the mood swings in the prices. So just set it and forget it. It is not worthwhile to stress about swings because they are going to keep happening. Volatility is part and parcel of investing in the crypto world, and it is something you must deal with.

Please note that investing in cryptocurrencies or tokens is highly speculative and the market is largely unregulated. Anyone considering it should be prepared to lose their entire investment.

Every investment and trading move involves risk, you should conduct your own research when making a decision.

Disclosure

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.