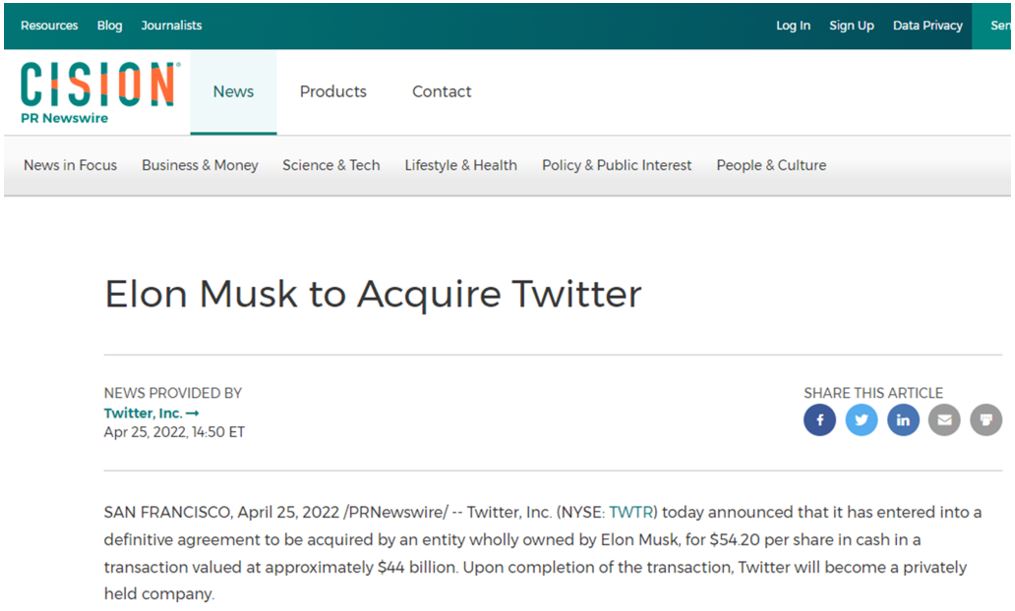

News that Elon Musk intends to acquire Twitter (NYSE: TWTR) for about $44 billion and convert it into a privately held company has stormed various news channels’ headlines and created hysteria in different social media platforms.

What is so special about Twitter that caught the modern day “Iron Man” – Elon Musk’s attention to buy the company for $54.20 per share?

Various speculations have been guessed for free speech but some articles suggested something much sinister, that it was due to certain personal agendas, such as Big Tech monopolies and control of information flow.

However, the latest saga about the Twitter acquisition made a drastic twist that Elon Musk suddenly wants to put “on hold” to buy Twitter as he is asking for more data about the spam and fake accounts on the social media site.

No matter the outcome of the acquisition deal, we will explore in this blog article if Twitter is really a good company to invest in. And maybe, the possible reasons that Elon Musk wants to purchase the company, whether it is really for Twitter’s yet to be unleashed future prospects or his personal own agenda.

INTRODUCTION

Twitter (NYSE: TWTR) is a global social network platform for public self-expression and conversation in real-time via microblogging with a wording limit of 280 characters.

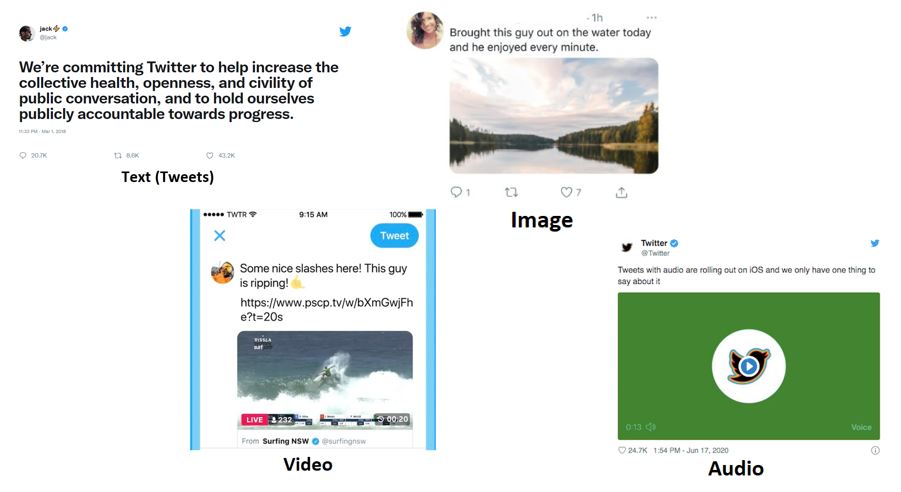

Twitter is all about “What’s happening & what people are talking about right now”, where it provides a free platform for real-time information sharing. People can create, distribute, and consume contents or events via four modes of media format:

The idea was conceptualized and created in 2006 by four founders while they are still working in the parent company, Odeo, a podcasting company before Twitter spun off to become an independent company in 2007. The four founders are Jack Dorsey, Noah Glass, Evan Williams and Biz Stone.

The headquarters is in San Francisco, US and had launched IPO in Nov 2013 at $26.

WHAT PRODUCTS DO TWITTER OFFERED?

Other than providing a free platform for real-time information sharing and public self-expression, Twitter also offered monetizable services for advertisers, developers and users.

ADVERTISING SERVICES

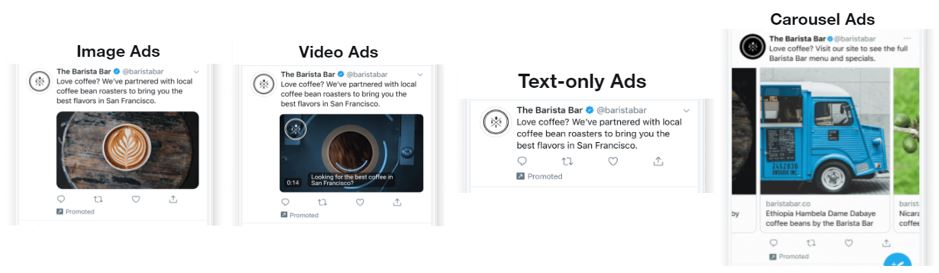

Twitter offered four main promoted paid ads products to the advertisers to promote and advertise their own products & services to Twitter users.

1. PROMOTED ADS

Advertisement in various media formats, such as image, video, carousel (collage of images) and text ads.

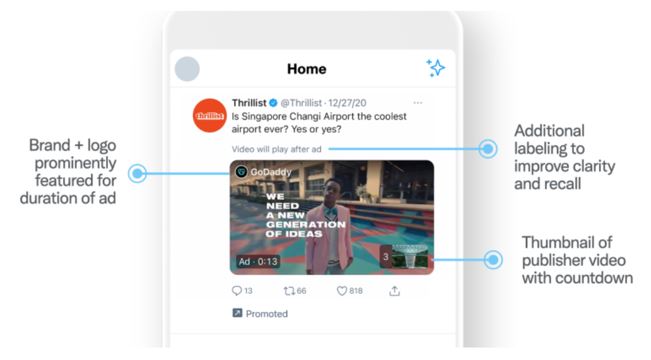

2. TWITTER AMPLIFY

Advertisers can add in brand, logo and additional labelling during the video ads screening to improve clarity & recall.

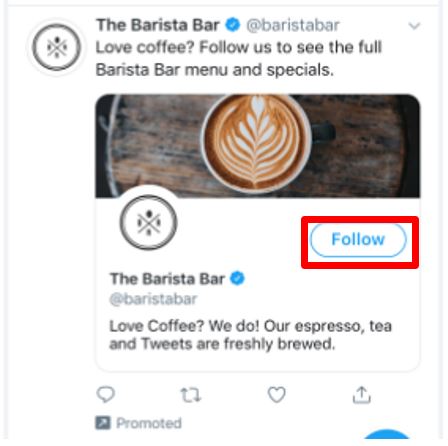

3. FOLLOWER ADS

Advertisement designed to increase visibility by promoting the account to targeted audience to build awareness and also to attract new followers with addition of ‘Follow’ button.

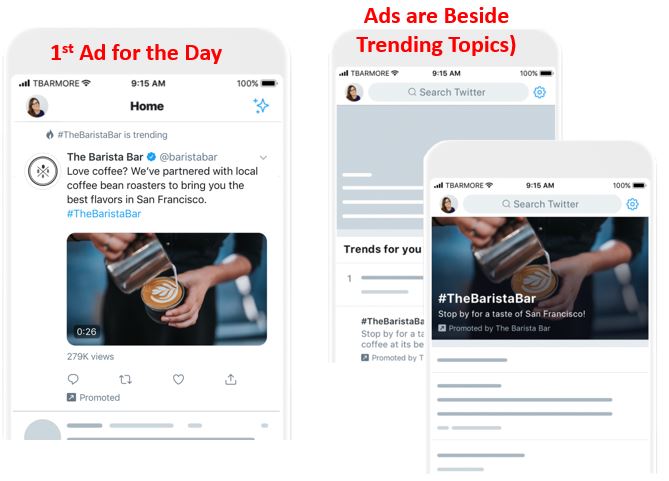

4. TWITTER TAKEOVER

The most premium advertisement offers where the advertisement will be the first ad of the day and show ads on the user’s Timeline or Explore tabs.

SUBSCRIPTION SERVICES

Twitter offered subscription services to both developers (Twitter Developer Platform) and users (Twitter Blue) for using the platform and services.

1. TWITTER DEVELOPER PLATFORM

Developers can use this service to analyze the data collected from Twitter to better understand the audience or followers’ preferences and glean their interests from their tweets.

With the information at hand, developers can build advertisements or interactive Tweets that cater to their followers’ interests and capture their attention. Three types of services are offered:

Twitter API

Real time access to analyze public conversation and use data to personalize followers’ preferences

Twitter Ads API

Build solutions that meet the needs of advertisers

Twitter for websites

Build beautiful and interactive Tweets on website and mobile app

2. TWITTER BLUE

Twitter users can choose to use the paid version of Twitter (with a monthly subscription fee of USD 3.00) to have exclusive access to premium features and app customizations. Some of the offered premium features are ads free articles only, undo tweets function, reader mode and bookmark folder to archive tweets.

HOW DOES TWITTER GENERATE REVENUE?

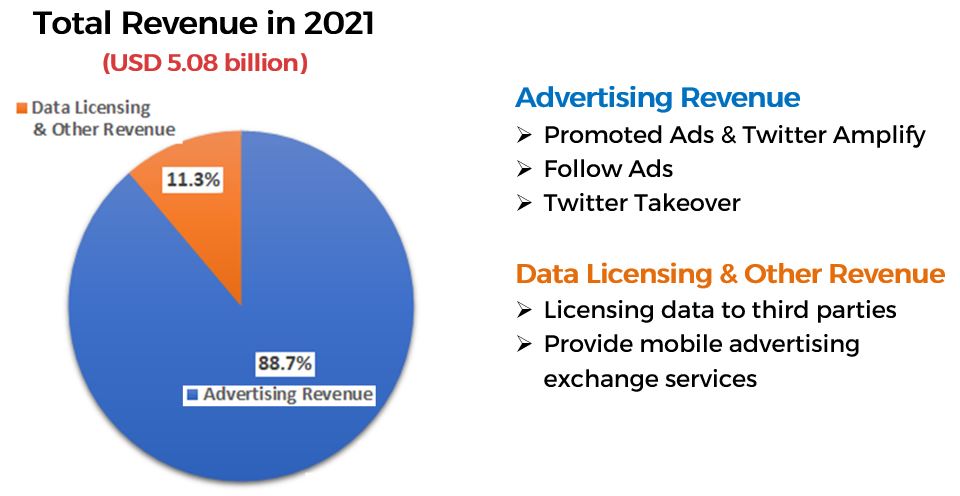

In 2021, a total of USD 5.08 billion of revenue was generated, with 88.7% was derived from Advertising Revenue, followed by 11.3% from Data Licensing & Other Revenue.

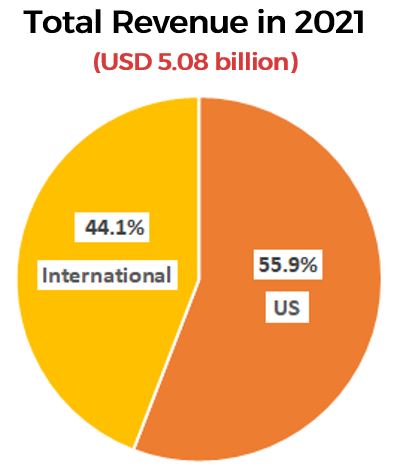

In terms of geographical region, about 55.9% of the revenue was generated from the US region, with the remaining 44.1% was from international countries, excluding China, Iran and North Korea as these countries have banned Twitter access.

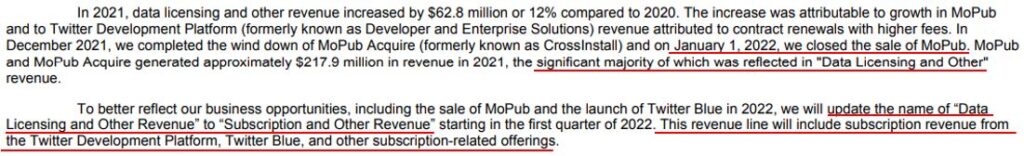

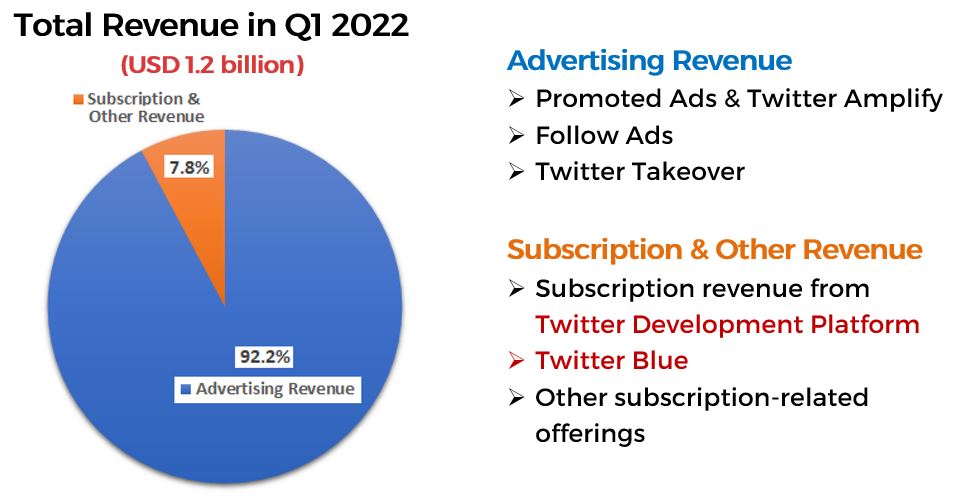

From Q1 2022 onwards, Twitter will be focusing on offering subscription services to developers and users after they have sold off MoPub to AppLovin for $1.05 billion. MoPub is a mobile monetization platform that helps companies and publishers to drive more revenue from advertisements and mobile transactions.

From their annual report, they also announced that Data Licensing & Other Revenue will be renamed to Subscription & Other Revenue.

In their Q1 2022 financial report, Twitter has generated USD 1.2 billion for that quarter, with Advertising Revenue still taking the lion’s share (92.2%) and the newly renamed Subscription & Other Revenue (7.8%).

After going through the background and revenue generations of Twitter, the company not only offers a free platform for people to express themselves and exchange information in real time, they also provide a platform for businesses to promote their own products & services via ads to the Twitter users. Nevertheless, is Twitter a good company to buy before it goes private??

TWITTER’S FUTURE PLAN TO GROW THE COMPANY

Twitter has set goals to increase the monetizable daily active users (mDAU) to 315 million by Q4 2023 and increase their revenue to over $7.5 billion by 2023.

To achieve those goals, Twitter has launched new features to keep users within the Twitter environment and tap into the growing creator economy where the creators can help to build more audiences and followers to use Twitter when they create content on the social media platform.

In 2021, they acquired Revue, a newsletter platform to allow creators to build audiences for their newsletter subscription and give them a way to monetize their audiences. They also acquired Breaker, a podcasting app in the same year to help build Twitter Spaces, a new feature where influencers can organize audio events with their followers on the Twitter platform.

In addition to that, Twitter also offered monetizing opportunities to creators with ‘Super Follow’ and ‘Ticketed Space’. In ‘Super Follow’, creators can provide additional exclusive contents to their followers with a monthly subscription fee.

For ‘Ticketed Space’, creators can generate revenue by selling tickets when they host audio events such as workshops, conversations and meet-and-greet events with their followers in Twitter Spaces.

WHAT ECONOMIC MOATS DOES TWITTER HAS?

In 2013, an article from MorningStar reported that Twitter may have some form of economic moat. They listed out that Twitter may have benefited from the network effects of the broad content distribution platform as many people are using the platform to gain information on the latest news or trends.

However, in the subsequent article published in 2017, author Ali Mogharabi reported that Twitter’s moat has eroded as Twitter’s user growth on the platform is slowing down. This is because various social media with newer features are popping up and people are switching over to other platforms to spend their time.

WHO ARE TWITTER’S COMPETITORS?

Social media has been growing by leaps and bounds for the past decades and many new features have been released for people to spend their time on the platform, either to keep in touch with loved ones or spend their leisure time. With many different social media platforms to choose from, Twitter is in a very stiff competition to fight for users’ time and attention to use their platform.

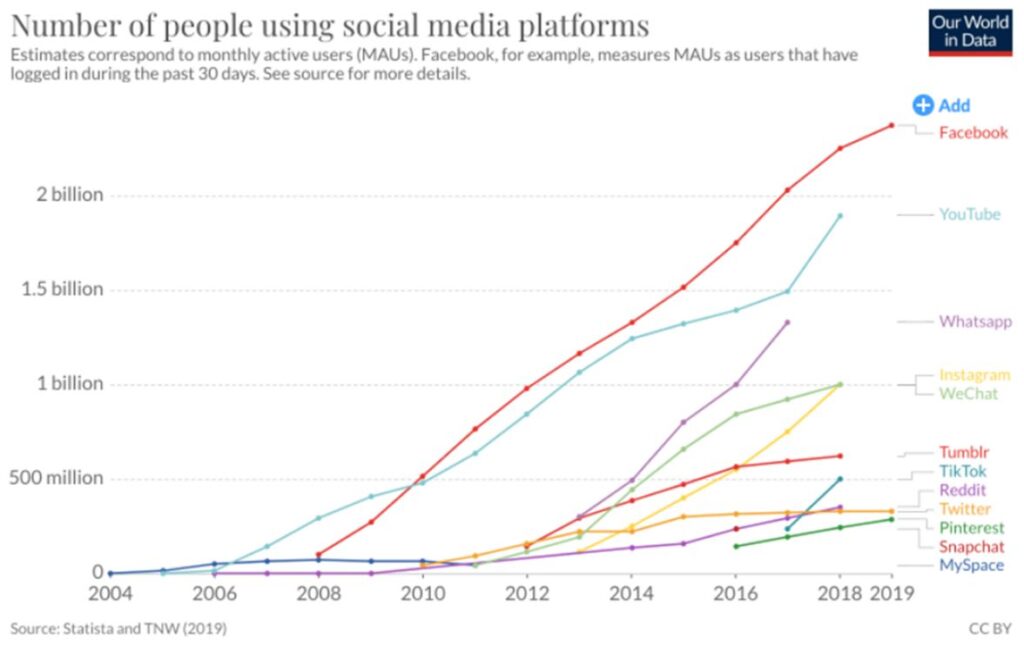

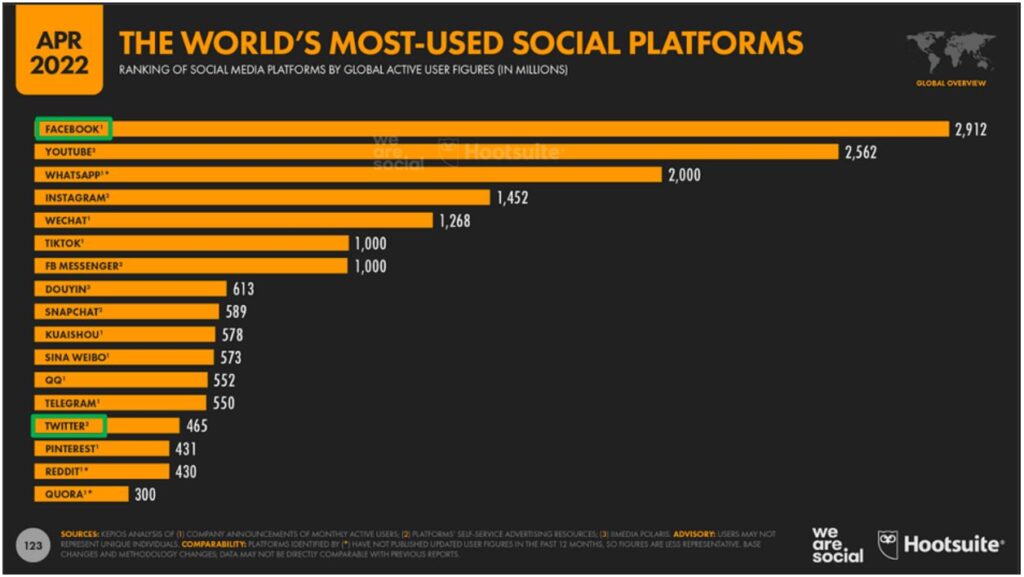

The diagram below shows the user growth of various social media platforms throughout the years since 2004.

From the chart, Facebook is taking the lead in the number of people using its platform, followed by YouTube in 2018.

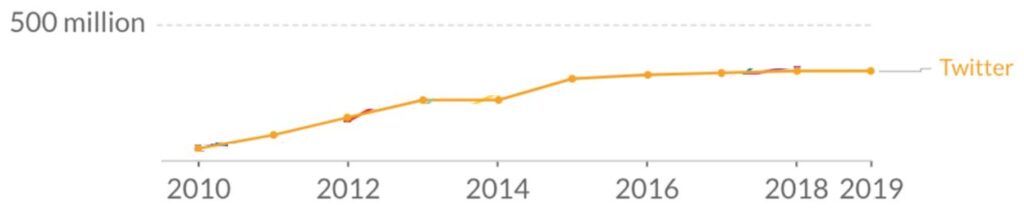

For Twitter, there was rapid growth in the number of users in the early years from 2010 to 2015. However, the user growth on the platform has plateaued since 2016.

From the latest figure collected by Hootsuite in April 2022, Facebook is still taking the lead with the most people using its platform. The number of users for Twitter is still below 500 million as we last saw in the chart above in 2019.

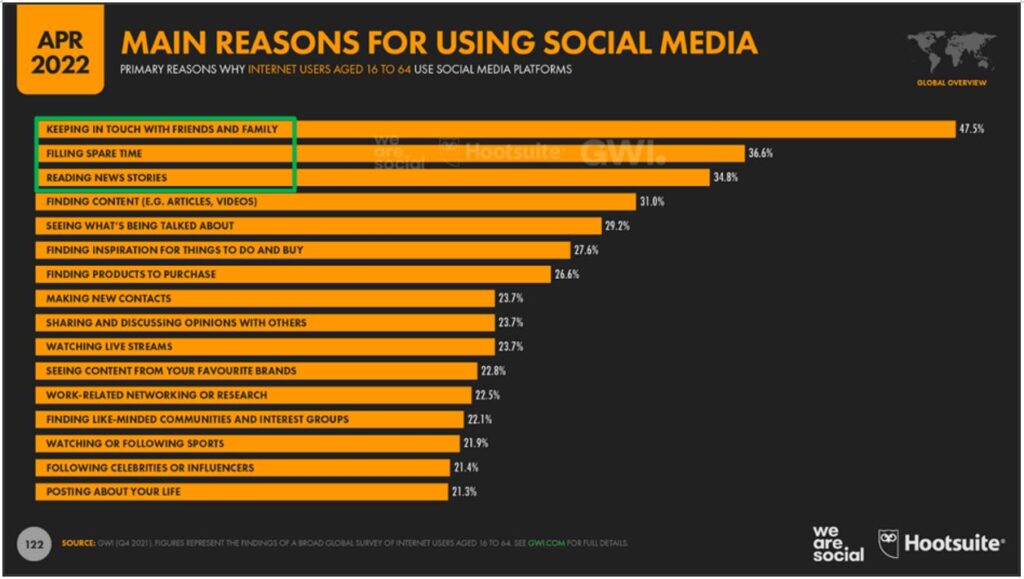

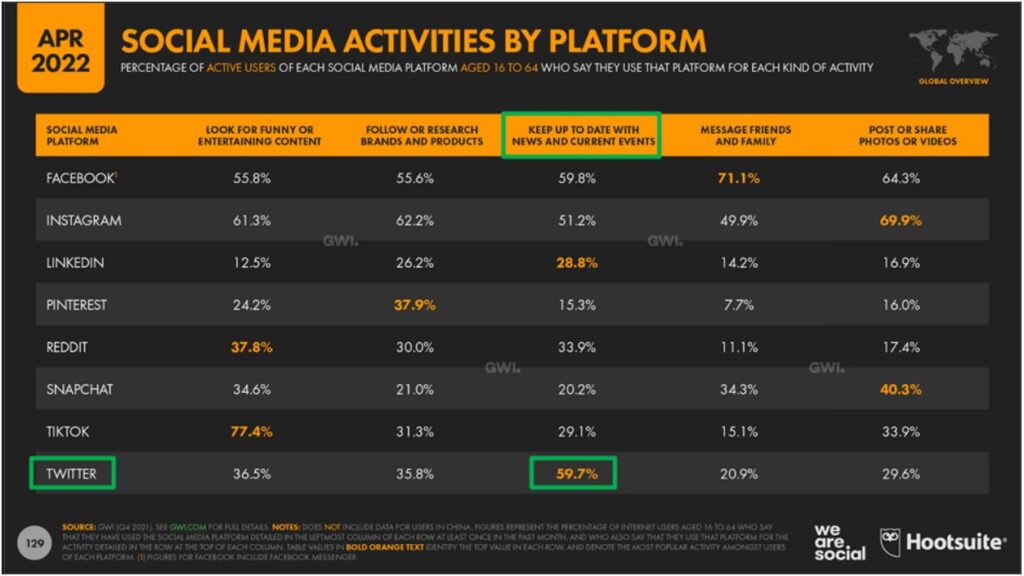

As there are many social media platforms that offer a myriad of features for users to use and spend their time, most of the users turned to social media to keep in touch with their loved ones. People also used social media to spend their spare time by scrolling through the contents posted on their timeline or reading the latest news stories that people posted on it.

In the chart below, we learned that about 59.7% of users turned to Twitter for the latest news and current events. But not many people use Twitter to spend their leisure time or looking for entertaining contents on the platform.

Even though Twitter has revealed exciting new plans to grow their user base and increase monetization opportunities for creators, the dismal situation of stiff competition with other social media platforms and no exclusive competitive moat made Twitter to be in a grim situation to carry out their plans.

However, other than looking at the competition aspect of the social media industry, it is also important for us to understand the company’s financial statements to better analyze the company and determine if it is a good company to invest our money. But alas, the financial terms and jargons might be too difficult and scary for a non-financial background person to understand and make an informed decision on the company’s financial situation.

FINANCIALS

Now we will look into the financial numbers of Twitter to make sense if the company is good and valuable to invest in before it goes private (if Elon Musk proceeds to buy the company).

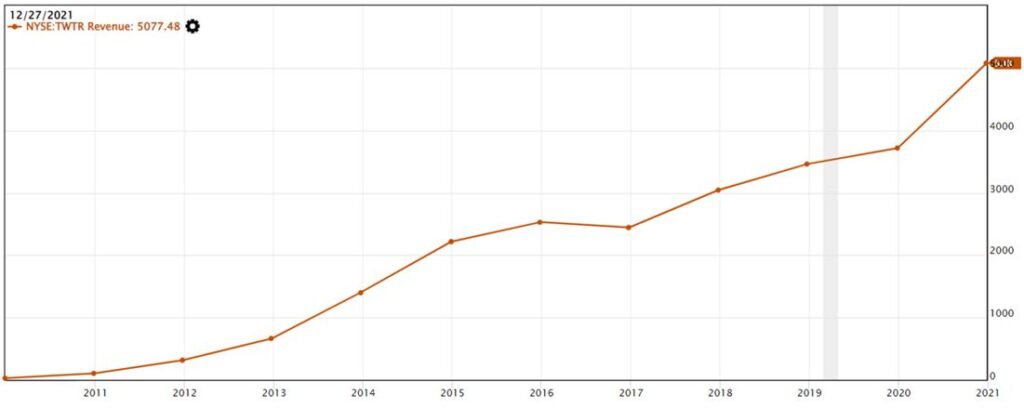

The total revenue for Twitter has been increasing year-on-year except for 2017, where they reported a drop of about 6% in their advertising services revenue.

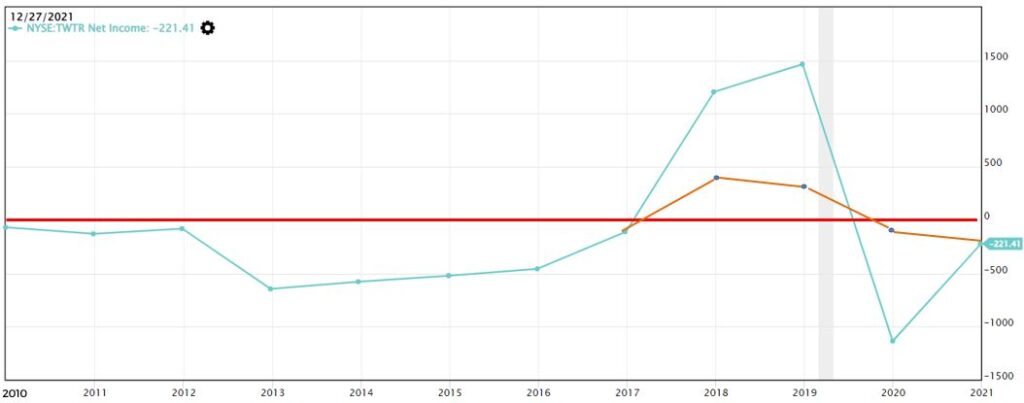

Nevertheless, the net income reported told another different story compared to the total revenue. Most of the early days of Twitter (2010-2017), it has not been profitable and was in the red. It was found that they have higher expenses than the revenue generated and thus the net income is in red.

In 2018 & 2019, the net income has become green, indicating it may have turned profitable before it took a nosedive to be back in the red zone in 2020. Further investigation in the annual report revealed that they had tax rebate on both 2018 & 2019 but had to pay higher taxes in 2020. If we were to remove the tax payments for the three years, the actual pre-tax income generated was shown in the orange line.

For the Earnings per Share (EPS), we wanted to know how much profit the company can generate for every share that the investor has purchased. Based on the mathematical formula below, if the EPS is $10, this means that for every share that was being purchased, the company can generate $10 of profit (net income).

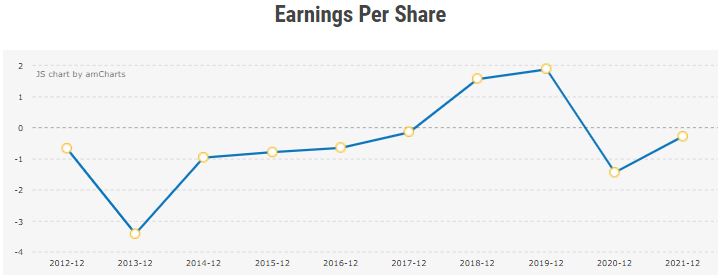

As the EPS followed closely with the net income, we observed that the overall trend of EPS is similar to net income, where most of the year is below zero, except for 2018 & 2019. This implies that Twitter may not be as profitable as it seemed to be.

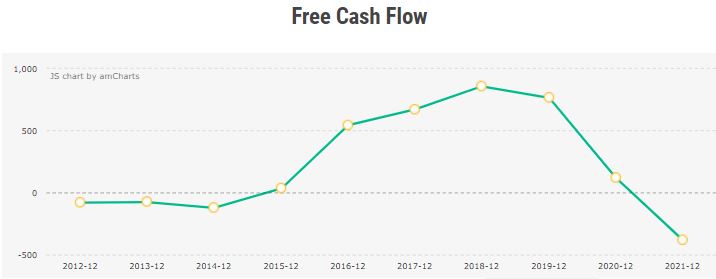

Since the company is not generating profit at the moment, we also look into their Free Cash Flow (FCF). Free Cash Flow (FCF) is defined as the cash left over after the company deducts the Capital Expenditure from the Operating Cash Flow.

Operating Cash Flow refers to the cash flow generated from normal business activities. Capital Expenditure (CapEx) is the expense used to purchase assets that will last more than twelve months.

From the FCF chart, since 2015, Twitter has positive free cash flow for the next few years before the FCF had a sharp drop in 2020 and becomes red in 2021. Investigation in the annual report showed that in 2020, they had spent high CapEx to support existing data centers and infrastructure needs. The same situation repeated in 2021 where the CapEx was still high but the operating cash flow also dropped. As a result, the FCF for 2021 is in the red.

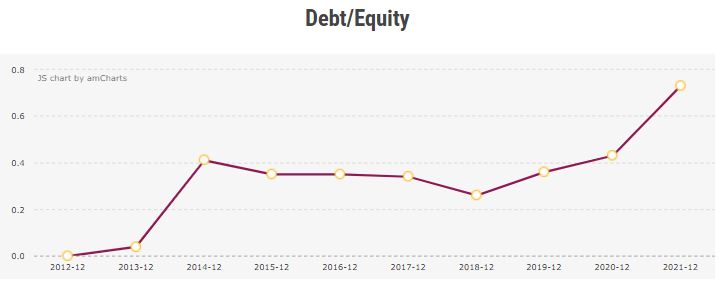

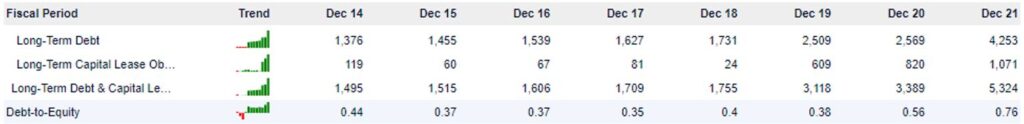

Next, we also look at the Debt-to-Equity ratio, which we wanted to know if the company is highly leveraged or how much debt did the company borrow to grow the company.

According to Value Investing Methodology, the Debt-to-Equity ratio should be below 0.5, meaning that for every $100 of equity, the company cannot take more than $50 of debt.

From 2012 to 2020, the debt-to-equity ratio for Twitter has been below 0.5, but it shoots up to about 0.75 in 2021. The annual report showed that Twitter has been accumulating long term debt for the past few years and it increased about 66% in 2021 to USD 4.29 billion.

This is because they had been issuing senior notes, which is a type of bond or debt a company issued to investors for taking the investors’ money to grow the company. The company promised to pay back the invested money with interest and in this case for Twitter, the interest will be paid back semi-annually. Should there be an event of the company files for bankruptcy, holders of senior notes will give investors a higher-priority claim back for their invested money.

“In 2018, we issued $1.15 billion in aggregate principal amount of 0.25% convertible senior notes due 2024, or the 2024 Notes. In 2019, we issued $700.0 million in aggregate principal amount of 3.875% senior notes due 2027, or the 2027 Notes. In 2020, we issued $1.0 billion in aggregate principal amount of 0.375% convertible senior notes due 2025, or the 2025 Notes. In March 2021, we issued $1.44 billion in aggregate principal amount of 0% convertible senior Notes and the 2027 Notes as the Notes. As of December 31, 2021, we had $4.29 billion in aggregate principal amount of Notes outstanding and an undrawn unsecured revolving credit facility providing for loans in the aggregate principal amount of $500.0 million.”

As the company has not been profitable at the time of writing (May 2022) and has been issuing senior notes to use debt to grow the company, we are doubtful if the company can withstand any potential financial turmoil in near future.

ANY POTENTIAL RISKS?

Until now for our deep dive in Twitter as a company, there are a few worrying aspects that we as investors need to take note of before investing our hard-earned money into the company.

First is that Twitter is in a stiff competition environment of social media where there is no switching cost for users to ditch Twitter and use other social media platforms. Younger generations prefer to use fun and interacting platforms such as TikTok and SnapChat to spend their time.

In addition to that, Twitter currently has no exclusive economic moat to stand out from the tons of social media platforms. It also encountered the stagnation issue of user base growth which also affected the growth rate of user monetization and their revenue as a huge chunk of the revenue was generated from advertisement. If there are no people using the platform, the advertisers saw no incentive to spend money to advertise on that social media platform.

To win back the crowd and grow their audiences, Twitter had tried to launch new features such as Vine (6-second video-loop format) in 2013 and Fleet (share contents that disappear in 24 hours) in 2020. Both features were not receptive by the Twitter users and were forced to shut down in 2016 and 2021 respectively.

To add salt to the wound, Twitter has not been profitable for the past few years as we had investigated their financial statements and used debt to grow or maintain the company operations. This is a bone chilling situation for investors as they may doubt that if they can get back their investment capital should the company encounter any financial crisis and go belly up.

CONCLUSION

To conclude, the maniac saga between Elon Musk and Twitter has stolen the limelight in various news channels and caught a lot of attention among investors and speculators. Even though there is a proposed buying price of $54.20 which lure speculators to buy the company and make a quick buck, it is not a wise move as recent news showed that Mr Musk may consider renegotiating a lower buying price due to the so-called doubtful reported numbers of spam and bots account.

All in all, to be able to make a good judgment call to invest in a company, it is always important to check on the company’s fundamentals and do due diligence on the company’s background before investing our hard-earned money and see it grow. Huat ah!

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.