WHAT ARE SGS BONDS?

These are bonds issued by the Monetary Authority of Singapore (MAS) on behalf of the Singapore government. Singapore Government Securities (SGS) bonds pay a fixed rate of interest and have maturities ranging from 2 to 30 years. When SGS bonds mature, they are redeemed at face value.

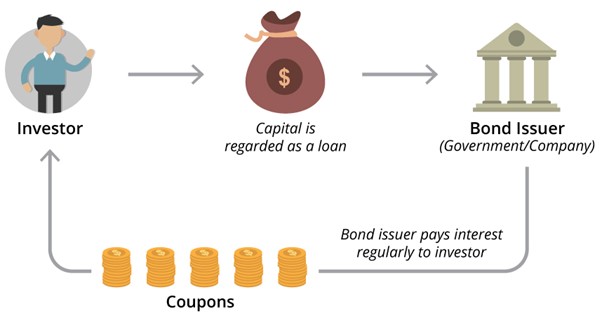

Quick recap on bonds:

- You invest in bonds

- The bond pays you interest (twice a year usually)

- The bond matures

- The original value of the bond is returned to you on maturity

Example: Suppose the face value of the bond is $100 with 2% coupon, then the investor will get $2 each year in 2 coupon payments of $1 every 6 months until maturity. On maturity, the investor will also receive the face value of the bond, i.e., $100. The longer the maturity period, the higher the interest rate received.

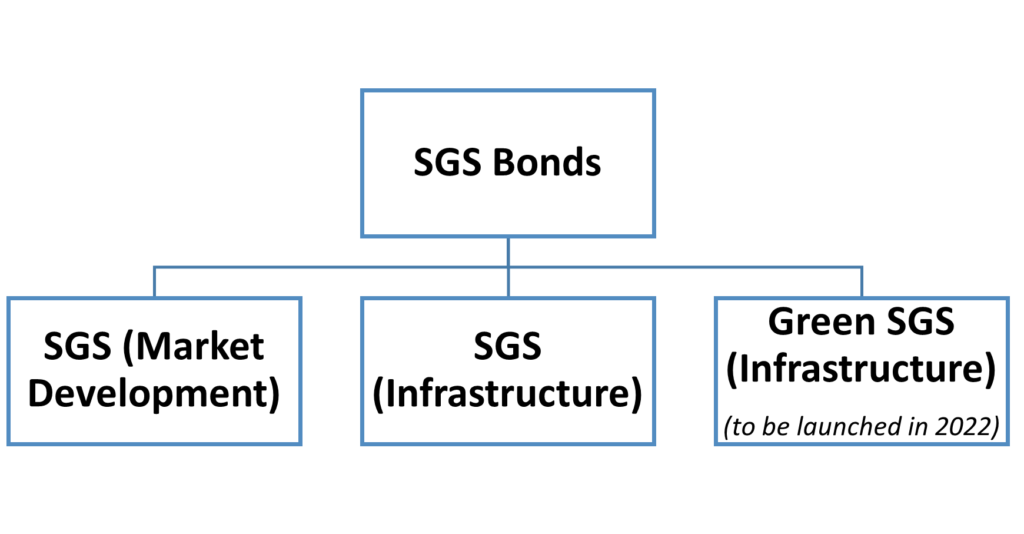

There are three categories of SGS bonds:

WHAT IS SINGA?

The Significant Infrastructure Government Loan Act (SINGA) was proposed in February 2021 and passed by the Parliament in May 2021.

The SINGA authorizes the Government to borrow up to S$90 billion over the next 15 years. There is also an annual interest threshold of S$5 billion. These measures will help ensure fiscal prudence while utilising SINGA.

WHAT CAN BE FUNDED BY SINGA?

The SINGA authorizes the Government to finance nationally significant long-term infrastructure projects.

Examples include the new Cross Island and Jurong Regional MRT lines, and pumping stations and tidal walls to protect the Republic against rising sea levels.

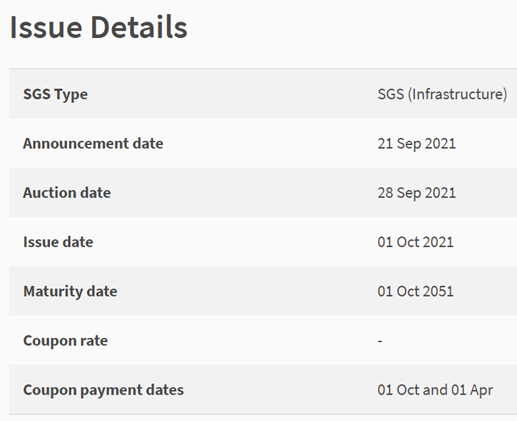

First SGS (Infrastructure) Bond under SINGA

The maiden SGS (Infrastructure) bond under SINGA is being issued by the government to raise $2.6 billion to be repaid over a 30-year period via fixed semi-annual coupon payments.

THINGS TO KNOW BEFORE YOU INVEST IN THESE BONDS

MAS

RISK & REWARDS

Government Backed: SGS bonds are fully backed by the Singapore Government which is politically stable and economically healthy. Singapore also consistently generates a budget surplus.

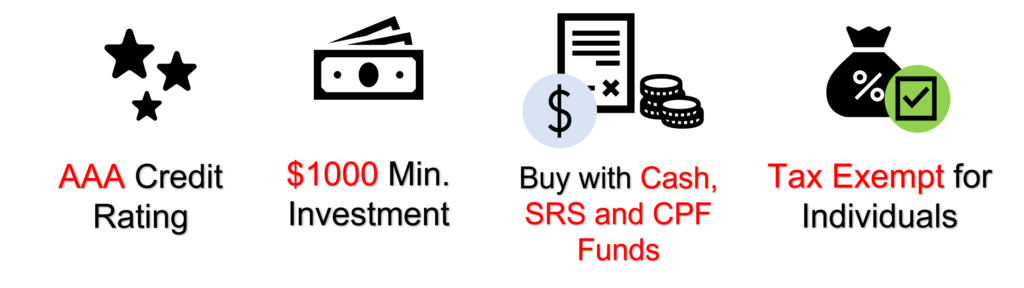

AAA Credit Rating: Singapore’s AAA credit rating and the lack of long-dated government securities of similar quality worldwide is a plus. Singapore is one of the nine countries in the world with the highest rating by the top three rating agencies – Moody’s, S&P and Fitch. (Singapore lies in the highest tier in the credit rating scale)

Stringent Criteria: There exist clear safeguards and well-defined, tightly managed criteria for what qualifies for SINGA.

Regular Payments: The investor is sure to receive fixed payments twice a year until maturity. The payouts are fixed and stable as compared to other risky investments. The longer one holds the bond, higher are the returns as the interest steadily increases.

Safest Investment: The biggest advantage of investing in SGS bonds is that your returns are not affected by markets (unless you trade the bonds in the secondary market), or the US$ fluctuations or even the Singapore economy. The only risk is if the Singapore government defaults which is quite unlikely given the AAA rating and ample reserves. So, these bonds are even safer than fixed deposits. You can sleep peacefully at night knowing exactly how much you are going to get.

No Lock-in: Unlike fixed deposits, one may sell SGS bonds at any time before maturity. These bonds are highly liquid, and you can get your money out anytime you wish (Note: There maybe price fluctuations when selling before maturity).

Capital Gains: There may also be opportunities to make capital gains when the price of the bond rises in response to fall in interest rates (Applies only when not held to maturity and sold in secondary market). One may also purchase bonds below the par value in the secondary market.

Capital Losses: On the flipside, there may also be capital losses if interest rates rise. (Applies only when not held to maturity and sold in secondary market)

Tax exempt: There is no capital gains tax in Singapore. You do not need to pay tax on the profits gained from trading in SGS.

- For individuals, interest income earned on SGS is tax exempt.

- Non-residents without a permanent establishment in Singapore do not have to pay taxes on interest income.

Low Starting Investment: Since the minimum investment amount is $1,000, one may invest even if they have a small capital to get started.

Diversification: These bonds also offer a sound way to diversify your investment portfolio.

Low ROI: These bonds have lower ROIs compared to stocks, unit trusts, REITs and ETFs. Inflation may also affect returns. (MAS has forecasted the CPI-All Items inflation range in 2021 to 0.5–1.5%).

CDP Account Needed: Buying/selling SGS bonds requires one to have a CDP account. Some people may be affected by this requirement.

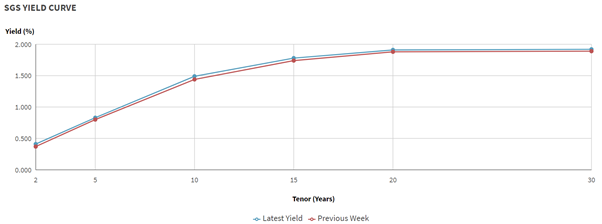

YIELDS

MAS

Based on data from MAS, the latest yield for a 30-year SGS Bond is 1.89%. Hence, a 30-year SGS bond issued today may be expected to have a yield of more than (or equal to) 1.89%. This is clearly higher than the fixed deposit rates (0.8% being highest in the sample) prevalent in major banks for September 2021 as shown below.

In fact, the yield on Singapore’s regular 30-year debt rose above the yield on US Treasuries, making them more attractive for investors.

Escalating concerns about Chinese bonds amid the Evergrande crisis may attract investors to the new SGS bonds. If the property and tech crackdown in China results in defaults, then a risk re-calibration could prove beneficial for these bonds.

HOW CAN A RETAIL INVESTOR SUBSCRIBE TO THIS BOND?

PRIMARY MARKET

Retail investors may bid for SGS bonds at the primary auctions on Tuesday, September 28, 2021.

They can buy the bonds using

- Cash

- Supplementary Retirement Scheme (SRS) funds

- CPF Investment Scheme (CPFIS) funds

MAS

SECONDARY MARKET

Individuals can buy or sell SGS bonds on the secondary market any time before maturity. One can trade SGS bonds on the Singapore Exchange (SGX) through a securities broker. One can also buy or sell SGS bonds and T-bills with any dealer banks.

One can buy/sell SGS bonds in the following ways:

Trade on SGX

- SGS bonds held in CDP/SRS accounts can be traded on the SGX through a securities broker.

- One can also buy SGS bonds on the SGX with cash or SRS funds.

- Trading on the SGX has transaction and brokerage costs

- Trading hours: From 9am to 5pm, with a break from 12 pm to 1pm.

- Investor will need a trading account with a securities brokerage firm.

- If using cash, an individual CDP account is needed.

- If using SRS funds, an SRS account with one of the three SRS operators (DBS/POSB, OCBC and UOB) is required.

- One should note that the bond prices quoted on SGX are market prices which include accrued interest.

- One should also note that prices in the secondary market may change from day to day according to market conditions. If you sell your SGS before maturity, the price may be higher or lower than what you paid for them.

Trade at Dealer Banks

- One can buy or sell SGS bonds through DBS, OCBC or UOB by visiting their main branches.

- One should indicate whether they are using cash, SRS or CPF Investment Scheme (CPFIS) funds.

- If using cash, an individual CDP account is needed.

- If using SRS funds, an SRS account with one of the three SRS operators (DBS/POSB, OCBC and UOB) is required.

- For CPFIS-OA investments, Investor will need a CPF Investment Account with one of the three CPFIS agent banks (DBS/POSB, OCBC, and UOB).

CONCLUSION

SGS bonds are a safe and secure, government guaranteed investment avenue. They are a safer alternative to equity investments and a better return alternative to fixed deposits. For someone who has a low-risk appetite, or is new to investing, instead of parking money in a low-interest savings account, one may invest in a SGS bond. These bonds may also be preferred by retirees for their safe and regular interest payouts.

You are strongly advised to assess your investment objectives and do your due diligence before deciding on any investments.

Every investment and trading move involves risk, you should conduct your own research when making a decision.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.