In the wake of the highly successful launch of ChatGPT in November 2022, the world of artificial intelligence (AI) has captured the attention of the public like never before. The recent surge in interest has been fueled by significant developments in the AI industry, including the skyrocketing stock of C3.AI, a major player specializing in enterprise AI.

With their Q4 2023 preliminary results surpassing expectations and the CEO’s optimistic outlook on the future of AI, C3.AI has emerged as a strong contender against Palantir’s Foundry offerings.

As the public become increasingly curious about the potential dominant force in the field of enterprise AI, questions arise regarding which company will claim the largest market share and shape the future of this rapidly evolving industry.

In this article, we will explore the company, C3.AI, in depth with the following key questions to be explored:

- What exactly does C3.AI offer in the realm of enterprise AI?

- How does C3.AI stack up against Palantir?

- Will C3.AI become the potential leading AI stock for the next decade or a mere hype?

We have covered this topic in our YouTube Channel’s Deep Dive Series. Click on the video below to watch!

QUALITATIVE ANALYSIS OF C3.AI

C3.AI is an American software company that specializes in enterprise AI software. It uses AI technology to solve complex data analytical problems within enterprise operations, such as data integration, predictive analysis and workflow automation.

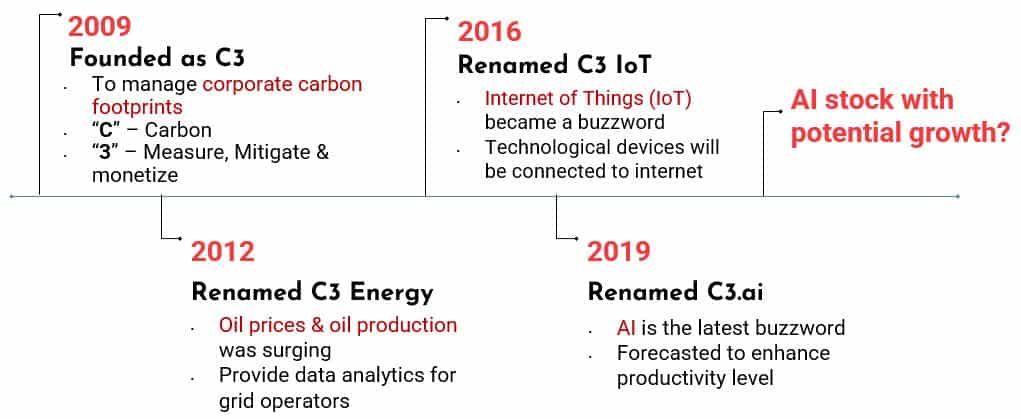

The company was founded in 2009 by Thomas Siebel, originally named “C3”.

- “C” in the company’s name was a reference to “carbon”.

- “3” was a reference to “measure, mitigate and monetize” because the company’s original goal was to help manage corporate carbon footprints.

Why did the company decided to rename will be explored in the upcoming sections under “Potential Risks of C3.AI”.

Then it went public in Dec 2020 with the ticker symbol – NASDAQ:AI.

Products & Services

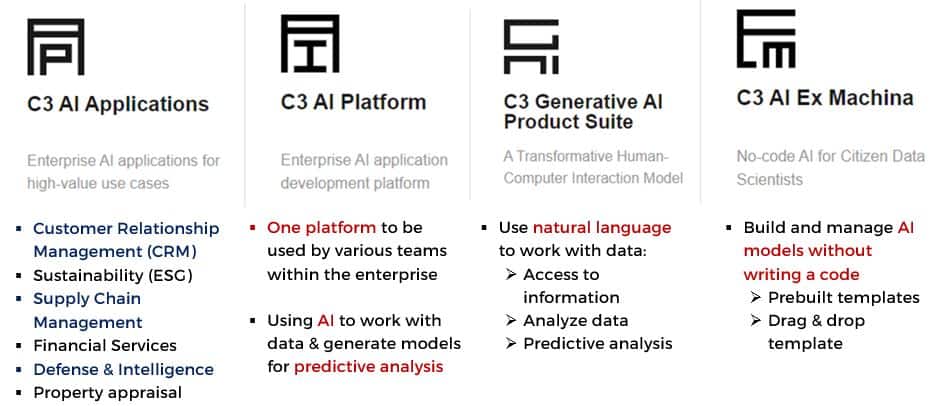

The company’s enterprise AI software are being categorized into 4 main types:

C3.AI’s current software solutions are designed to significantly enhance operational efficiency and workflow within enterprises. Here are some key ways in which their solutions contribute to increased efficiency:

1. Advanced Analytics: C3.AI’s software leverages advanced analytics capabilities, including machine learning and data modeling, to analyze vast amounts of data and derive valuable insights. By automating complex data analysis processes, enterprises can make faster, data-driven decisions, leading to improved operational efficiency.

2. Process Automation: C3.AI’s software enables process automation by streamlining manual and repetitive tasks. By automating these tasks, businesses can reduce errors, improve accuracy, and free up valuable human resources to focus on more strategic and value-added activities.

3. Workflow Optimization: C3.AI’s solutions provide workflow optimization by analyzing and optimizing end-to-end business processes. By identifying bottlenecks and inefficiencies, enterprises can streamline their workflows and eliminate redundant steps which helps to improve overall efficiency.

4. Predictive Maintenance: C3.AI’s solutions utilize predictive maintenance algorithms to monitor equipment and identify potential failures or maintenance needs in advance. By proactively addressing maintenance issues, businesses can minimize downtime and optimize resource allocation. This boosts the overall operational efficiency.

5. Real-time Monitoring and Optimization: C3.AI’s software offers real-time monitoring capabilities, allowing businesses to track performance metrics and operational parameters in real-time. This enables timely interventions and optimizations to maximize efficiency, minimize waste, and optimize resource utilization.

By incorporating these features and capabilities, C3.AI’s software solutions enable enterprises to achieve significant improvements in operational efficiency, leading to enhanced productivity, cost savings, and competitive advantage.

Customer Base

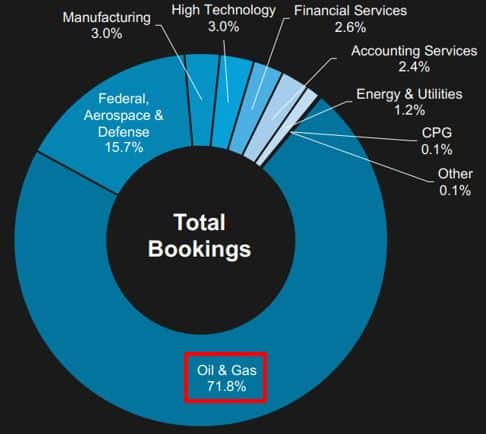

C3.AI works with Fortune 500 companies and industry leaders worldwide. The diagram below shows the industries that use their software:

C3.AI uses a customer acquisition strategy that centers around targeting Lighthouse customers—esteemed organizations that are widely acknowledged as leaders in their respective industries. This strategy allows C3.AI to lock in large corporations as lighthouses to draw in smaller customers.

By assisting these Lighthouse customers in addressing complex business challenges through digital transformation, C3.AI not only supports their operational improvement but also presents an opportunity to showcase their software, thereby attracting potential customers.

When these organizations experience successful resolution and enhancement of their operations with C3.AI’s software, they become more enticing for other customers within the industry to adopt their software solutions.

FUTURE PROSPECTUS OF C3.AI

To foster further corporate growth, C3.AI maintains a steadfast commitment to investing in research and development, driving innovation across their existing product line. Moreover, they actively develop new applications with innovative features and functionality to both broaden their current customer base and attract new clients.

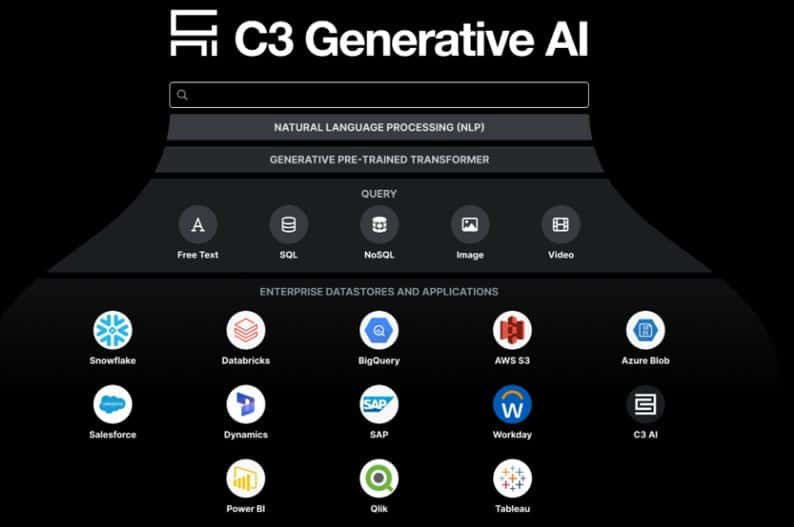

A notable example of their new application is C3 Generative AI. This innovative tool empowers customers to manage and access data using simple language instead of coding. By eliminating the need for coding expertise, individuals without a programming background can accelerate their workflow and analysis, opening doors for increased efficiency and productivity.

To enhance their brand visibility, the company has outlined plans to bolster their marketing efforts to reach a wider audience. They anticipate making substantial investments in marketing activities over the coming years, such as:

- Digital and print advertising

- Actively participate in virtual and physical events

By undertaking these initiatives, C3.AI aims to establish and solidify its brand presence and reputation in the emerging market for AI-enabled digital transformation.

Finally, C3.AI has expressed their determination to expand their business on an international scale. To achieve this, they are actively investing in geographic expansion by augmenting their direct sales team in international markets.

Furthermore, they plan to bolster their reach and market coverage worldwide by collaborating with strategic partners, thereby complementing their direct sales efforts. This multi-faceted approach aims to significantly enhance C3.AI’s global presence and capitalize on new market opportunities.

C3.AI vs PALANTIR

Given that the company’s primary product is enterprise AI software, it is viewed as a strong contender to Palantir‘s Foundry software.

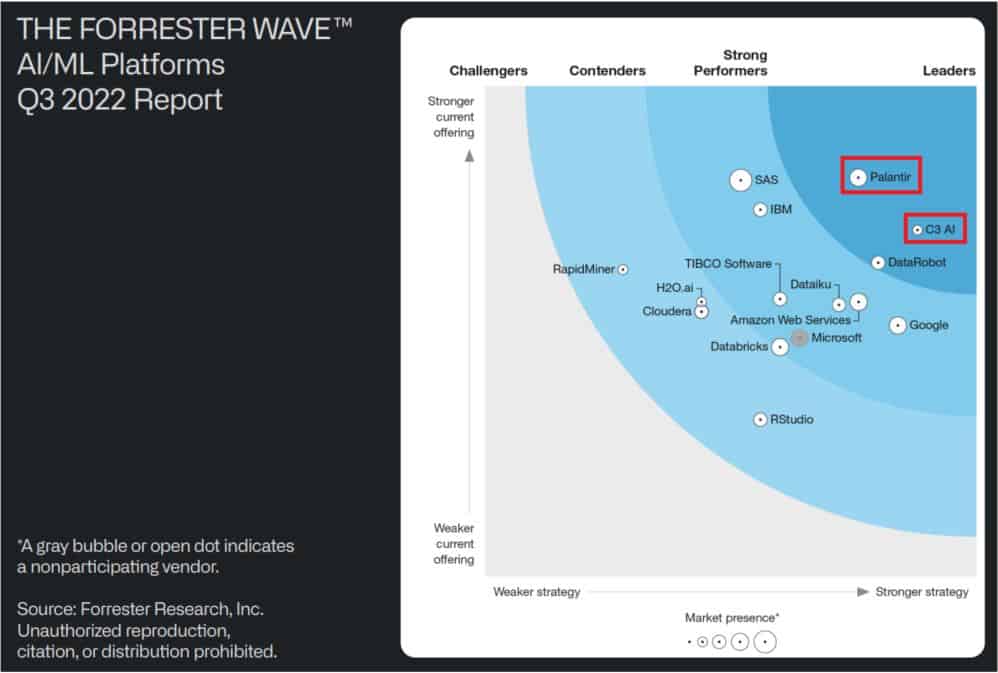

Upon analyzing the diagram provided above, we observed that while Palantir boasts stronger software solutions, C3.AI adopts a more expansive strategy in terms of their product offerings.

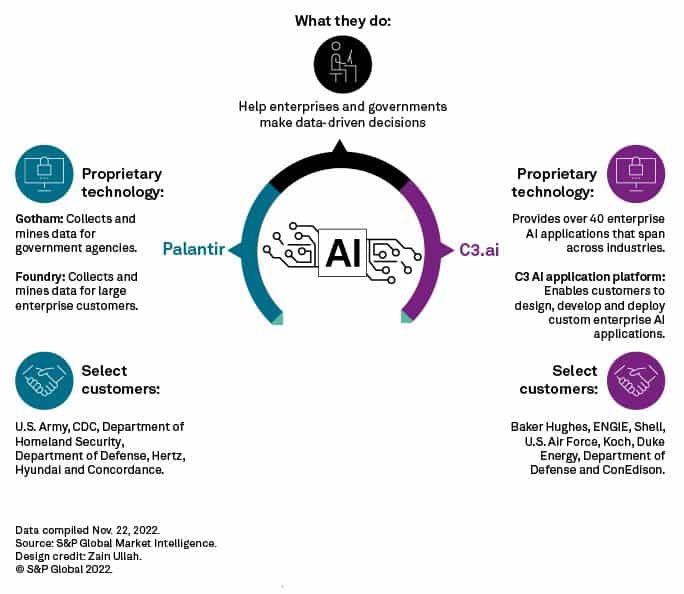

In this blog post, we will compare the technologies and customer bases of these two competing companies.

Graphic source: spglobal.com

Technology

C3.AI: Customers are able to design, develop and deploy their customized enterprise AI applications on the software platform.

Palantir: Data are collected and analyzed with Gotham platform for government agencies and Foundry platform for large enterprise customers.

Customer Base & Customer Counts

C3.AI has a significant portion of its customer base (71.8%) originating from the oil & gas industry. One of their key customers, Baker Hughes, accounted for nearly 30% of their revenue in both FY 2021 and 2022.

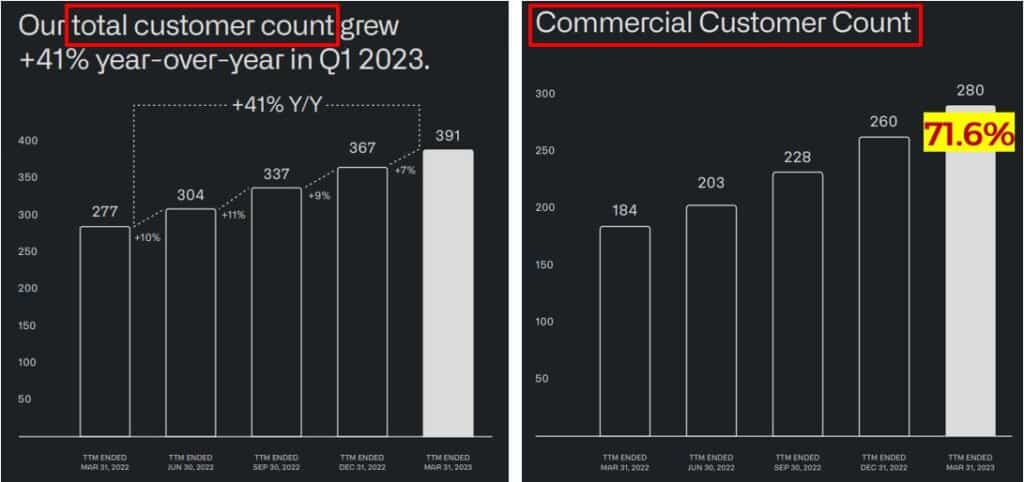

As of January 2023, their total customer count stands at 236.

In contrast, Palantir has highlighted that their software is utilized across a wide range of industries worldwide, spanning more than 60 sectors.

As of March 2023, their total customer count reached 391, with 280 of those customers being commercial clients, accounting for approximately 71.6% of their customer base. The remaining 28.4% consists of government customers, including defense and intelligence agencies.

POTENTIAL RISKS OF C3.AI

While C3.AI shows promising potential in the early stage of generative AI for corporate digital transformation, investors should be aware of certain risks before investing their funds into the company.

The first identified risk is concentration risk, as C3.AI heavily relies on its major customer, Baker Hughes, according to the latest research (Jun 2023). Not only does Baker Hughes contribute 30% of the company’s revenue, but approximately one-third of C3.AI’s projected revenue until FY 2025 could potentially originate from this customer.

Furthermore, there have been reports indicating that Baker Hughes has renegotiated lower annual commitments with C3.AI and has made investments in Augury, a competitor of C3.AI. This situation poses a potential risk to the company, as the potential loss of this major customer could significantly impact C3.AI’s revenue stream.

When a company changes its name, it usually indicates a significant transformation and expansion in its business approach. This change often leads to a wider customer base and increased opportunities in the market.

However, a shift in business approach can be seen as a lack of consistent product continuity throughout the company’s existence.

The timeline provided displays the historical changes in C3.AI’s corporate name and the company’s evolving direction.

In addition, the company has actually suffered 4 CFOs changes within 3 years besides the company’s name change since incorporation.

Since Dec 2021, the company had dealt with high turnover of their management where 3 CFOs were replaced. Rapid changes in CFOs or other key accounting personnel do not paint a rosy picture about the company as it can indicate irregularities or other problems in the company’s financial reporting.

These factors might raise concerns for investors regarding whether to consider long-term investments, given the rapid changes within the company.

QUANTITATIVE ANALYSIS

Operating Segments

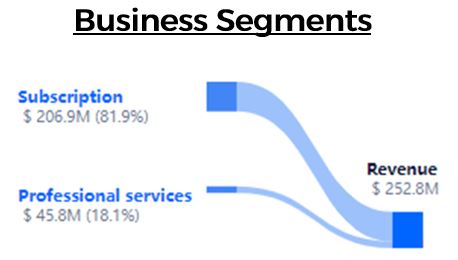

C3.AI’s revenue generation sources are categorized into two primary operating segments for reporting purposes:

1. Subscription: This segment encompasses revenue generated from software usage, maintenance, and support services. Customers pay a usage-based runtime fee for utilizing the software.

2. Professional services: Under this segment, C3.AI offers specified tasks either onsite or remotely. The revenue is derived from fixed-fee engagements for these services.

Revenue Generation

In FY 2022, C3.AI had generated a total of USD 252.8 million, where 81.9% of the revenue came from the Subscription segment. The remaining 18.1% of revenue came from the Professional Services segment.

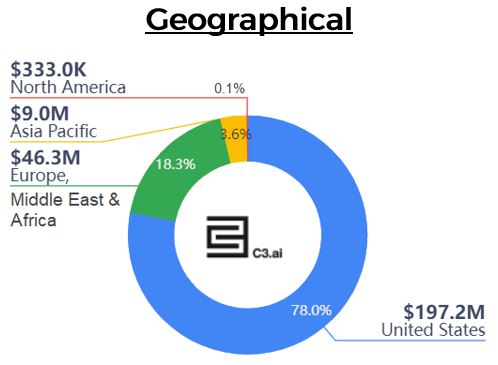

In terms of geographical region, the United States (78%) contributed the lion’s share of the revenue, then followed by Europe, Middle East & Africa (18.3%), Asia Pacific (3.6%) and North America (0.1%).

In addition, we have analyzed various financial metrics to assess C3.AI’s potential as a promising AI stock investment.

To delve deeper into our findings, we invite you to watch our YouTube video by clicking on the video above or watch it on our channel!

CONCLUSION

The world of AI is evolving at an unprecedented pace, with C3 AI emerging as one of the key players in the realm of enterprise AI.

As the battle for dominance of enterprise AI unfolds, it is essential to gain a comprehensive understanding of the offerings, financial metrics, and potential risks associated with these companies.

Are you in search of growth and undervalued companies? Dive into our US Case Study Subscription to:

- Discover companies meticulously researched from thousands in the US market.

- Bypass the tedious research process; we evaluate and pinpoint the intrinsic value using advanced tools.

- Harness advanced options strategies for a new stream of passive income.

Click on the banner below to find out more!

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.