This on-demand Webinar aims to solve common challenges faced by beginner investors.

Using the Value Investing methodology to investigate a stock in 6 different segments.

Circle Of Competence

Subject Area that matches your skill or expertise for analysis.

Economic Moat & Competitors

Distinct advantage a company has over its competitors.

Management

Leading staff of the company, important for its growth.

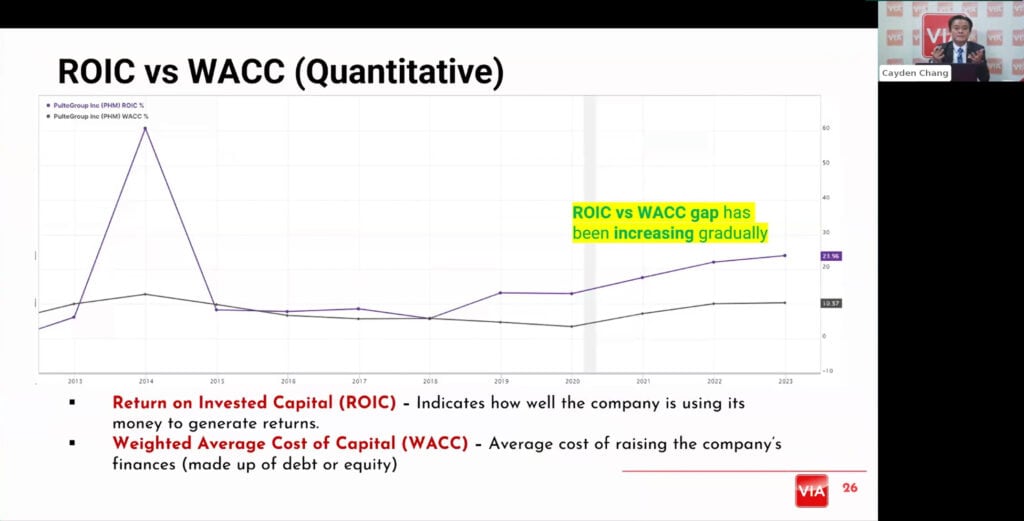

Financials

The numbers behind the stock that affects it.

Potential Risks

Risk that may occur in the future that affects the stock.

Valuation

How to determine what the intrinsic value of a stock is.

Learn How To Deep Dive Research A Company

In this webinar, he covers a multiple aspects of a company using the Value Investing Methodology covering 3 of the most important aspects:

• Circle Of Competence

• Fundamentals

• Valuation

Fast Track Your Investing Journey

Absorb the investing acumen of legendary figures. Gain practical lessons from the experiences of Warren Buffett and Sir John Templeton, enabling you to apply their market-beating strategies to your investment portfolio. Learn how to bulletproof your investments and navigate economic uncertainties.

Discover the system value investors use to get financial success in the stock market. Learn how to maximize your money in minimal time and learn the secret system that entrepreneurs have adopted to become millionaires today.

BSc (Hons), Msc, Lifelong Learner Award 2008, Personal Brand Award 2017

Cayden Chang Is the Founder of Value Investing Academy, which runs Value Investing workshops across Asia. His mission in life is to build an endowment fund for cancer research and hospice care.

Cayden has received the following accolades.

• Lifelong Learners Award 2008 recipient

Featured in

• “TODAY” newspaper

• “938Live Online News”

• “938Live Radio Station”

• “Mediacorp Xin.Sg”

• “The Straits Times”

• “938Live Breakfast Club” Radio

• “Channel News Asia AM Live”

• “Shareinvestment”

• “The Edge”

• “The Exquisite” Magazine

Cayden Chang

Cayden Chang is the Founder of Mind Kinesis Investments Pte Ltd and Value Investing Academy Pte Ltd, which runs the first and only Value Investing training that is recommended and endorsed by Mary Buffett, the internationally acclaimed author and speaker of how billionaire Warren Buffett invests. His company also runs Value Investing workshops across Asia. With over 50,000 graduates across 11 cities in Asia, his methodology is tested, proven and easily duplicable even for someone who has no prior experience in investing.

Cayden holds two Bachelors’ Degrees and a Masters Degree from National University of Singapore. He has also been trained in value investing by Professor Bruce Greenwald in Columbia University, the institution where Billionaire investor Warren Buffett met Professor Benjamin Graham, as well as by Professor George Athanassakos, the finance professor who holds the Ben Graham Chair in Value Investing at the Richard lvey School of Business, University of Western Ontario.

Cayden started investing to save money for his upcoming wedding, investing in what seemed like the hottest stocks at the time. While things were ok in the beginning, the investments made some profits but that quickly became losses and the more he lost, the more he poured into the market in hopes of hitting a jackpot.

The final stroke came during the dot.com crash in 2001 which resulted in him losing $50,000 just weeks before his wedding. All his savings were gone in a second and he couldn’t give his wife the wedding she wanted and even had to take a $50,000 loan from her to pay for wedding expenses.

He realized if predicting stock prices based on historical movement was viable, wouldn’t computer programmers become billionaires just by writing programs to predict prices.

At the same time, he learned of someone becoming one of the richest person in the world just by investing and doing so in a systematic way. That person is Warren Buffet and his strategy was value investing. Cayden became obsessed with studying his methods and investing strategy, even flying to the United States to learn from the only 2 professors in the world who were teaching Value Investing.

After learning, Cayden continued to compile the insights he learned and tested the methods rigorously…until he was able to develop his own unique tools and system that enable anyone to:

• build a winning investment portfolio in less than 7 days

• screen high value stocks out of thousands within minutes

• Know the exact time to enter and exit the market using a specially designed calculator

It was so effective that he went from net loss when the dot-com bubble burst in 2001 to a current 7-figure portfolio. Armed with this knowledge and real results, he started to teach people from all walks of life to create multiple streams of income and grow their investment portfolio. Many of them achieved financial independence simply by applying the same principles and strategy that he used to gain wealth.

The Value Investing Webinar

Hosted by:

Cayden Chang

Expert trainer and founder of Mind Kinesis Investments Pte Ltd.

Get Instant Access To webinar:

- Learn how to do fundamental analysis on a stock

- Learn how to determine a stocks' intrinsic value

- In less than 2 hours

Disclaimer:

The information provided by Mind Kinesis Investments Pte Ltd is meant for educational purposes, and is in no instance to be regarded as investment advice. You are advised to practice due diligence before making any financial decisions. All forms of investments carry risks and such activities may not be suitable for everyone. We are not liable for any losses incurred from your investment activities. Past investment performance is not necessarily indicative of future performance, even if the same strategies are adopted. The purpose of the case studies is solely to illustrate the application of value investing methodologies and various valuation methods in the context of real life companies, for continued learning of value investment methods and investor education. Under no circumstances does any information provided in the case studies represent a recommendation to buy, sell or hold any stocks. The illustrations in the case study demonstrate the general application of value investing principles, and do not take into account the individual characteristics, profile and/or risk appetite of a given investor.