Famous successful investors in the world have the uncanny ability to generate market-beating returns in investing and create wealth. Especially for value investors who had religiously applied Benjamin Graham’s investing philosophy to realize tremendous gains and get rich, notably his famous disciple, Warren Buffett.

Based on Benjamin Graham’s definition of Value Investing, it is an investing strategy that allows investors to buy good businesses at a cheap price.

In our previous blog, we have explored 5 famous value investors’ investing styles and the latest stocks purchased in their portfolio in 2022.

Investopedia has also released an article on 5 Wildly Successful Value Investors that beat the market.

As such, we decided to further investigate on these 5 super value investors on how they manage to beat the market with their investing strategies in this blog:

- How their investing strategies able to beat the stock market

- Top holding stocks in their portfolio

- Latest stock purchase in 2022

MOHNISH PABRAI

Mohnish Pabrai is an Indian American businessman, investor and philanthropist. He is also the founder of the Pabrai Investment Funds and author of the “The Dandho Investor” book. Pabrai is famous for spending $650,000 to have lunch with Warren Buffett in 2007.

His hedge fund company, Pabrai Investment Funds has generated a return of 1,204% between 2000 to 2018, compared to S&P 500’s 159% return. To illustrate the impact of this massive return, we take an example that if we invested $100,000 with Pabrai’s fund in 1999, the investment would have grown to $1.8 billion in 2018! This is really a great way to grow our idle cash over 18 years’ time!

To generate such high returns, Pabrai has mentioned over interviews that he ‘shamelessly’ copied successful value investors such as Warren Buffett’s investing strategies. Here is a simplified list of investing strategies that Pabrai has applied in his investing journey:

Circle of Competence

- He only buys an existing and well-understood business with long history of operations.

- He also looks for mundane products that everyone needs.

Mantra – “Heads, I win; Tails, I don’t lose much”

- This mantra implies that he looks for low risk, high return investing opportunities.

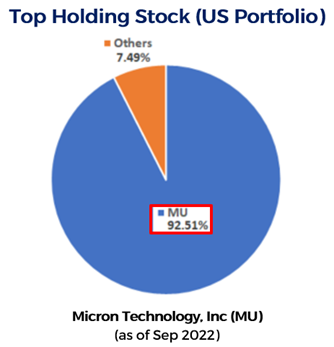

Since 2019, Pabrai has moved majority of his funds into India, Turkey and South Korea stock market. However, he still has some stock holdings in the US market.

His current top holding stock is Micron Technology, Inc (NASDAQ:MU), which takes up about 92.51% of his US portfolio.

LATEST STOCK PURCHASE IN 2022

In Q3 2022, Pabrai bought 180,303 shares of Brookfield Asset Management, Inc (NYSE:BAM) at an average price of $48.04. Currently he owns 7.46% of BAM in his US portfolio.

BAM is a Canadian multinational company in alternative asset investment management where their headquarter is located at Toronto, Canada. They invest in high quality assets & businesses over 30+ countries where they focus in 5 main areas:

- Renewable Power & Transition

- Infrastructure

- Private Equity

- Real Estate

- Credit & Insurance Solutions

TOM GAYNER

Tom Gayner is the Co-CEO & Chief Investment Officer of Markel Corporation (NYSE:MKL).

MKL is a holding company for insurance, reinsurance and investment operations around the world. Its performance is often compared against Warren Buffett’s owned company, Berkshire Hathaway, where its main business is also in insurance.

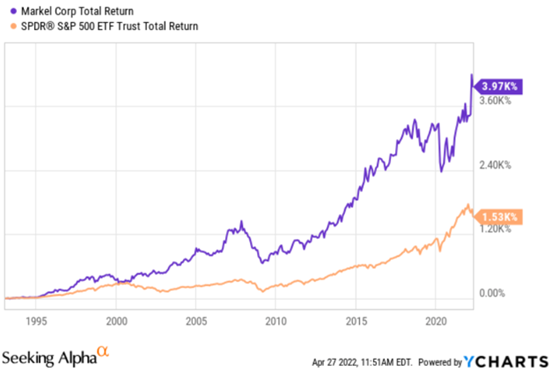

From the chart above, we observed that MKL’s performance is relatively comparable to Berkshire Hathaway’s A shares (NYSE:BRK.A). Nevertheless, in the mid of 2014, MKL’s (131.7%) price % change managed to beat BRK.A (118.6%) by 13.1%.

In the latest total market return, MKL had generated a total of 3.97K% of total return when compared to SPDR S&P 500 Trust fund (1.53K%) for more than two decades.

Gayner favours large-cap companies with global ventures when he is looking for investing opportunities. In addition, his other investing strategies involved looking for undervalue or cheap companies that have outstanding management team.

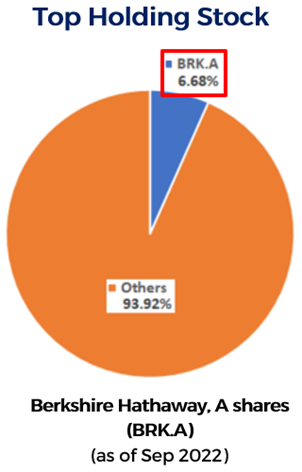

The top holding stock in his portfolio is BRK.A, which takes up about 6.68% of his portfolio.

LATEST STOCK PURCHASE IN 2022

Gayner has bought 2,000 shares of RenaissanceRe Holdings Ltd (NYSE:RNR) in Q3 2022 at an average price of $138.75.

RNR is an American provider of insurance solutions, reinsurance and other insurance-related businesses. Reinsurance is the insurance to be bought by insurance companies to reduce its exposure to potential financial risks. The core products offered by RNR include property catastrophe and specialty reinsurance risk.

DAVID ABRAMS

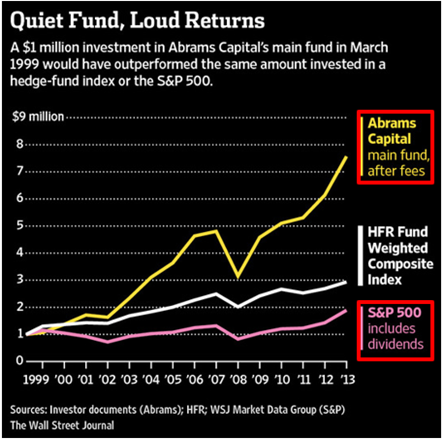

David Abrams is an American investor and hedge fund manager, where he is the head of Boston-based hedge fund company, Abrams Capital Management.

He is hailed as the “one-man wealth machine” by Wall Street Journal as he had generated an annualized return of 15% for the first 15 years since he founded Abrams Capital Management in 1999.

He applied 3 key principles for his investing strategies to generate such high returns:

- He invests across a diverse variety of asset types, market sectors, market cycles and industries to minimize risk, also known as diversification.

- His stock holding position is long-term oriented, which is approximately 10-year mark.

- He also focuses on risks first before considering rewards because lower the share price (undervalue stocks), the lesser risk he is taking and able to reap higher returns.

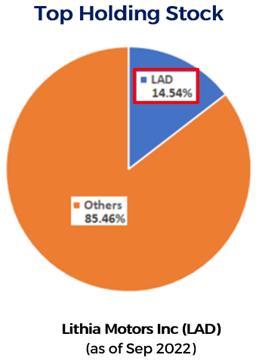

Abrams current largest holding stock position is Lithia Motors, Inc (NYSE:LAD), which is approximately 14.54% of his portfolio.

LATEST STOCK PURCHASE IN 2022

Abrams latest stock purchase in Q1 2022 is Coupang, Inc (NYSE:CPNG) where he purchased 3.9 billion shares at an average price of $21.39. However, as the company is currently still in deficit from their 2022 financial result, he sold 208,045 shares. Currently Abrams still owns 6.44% of the share in his portfolio.

CPNG is a South Korean e-commerce company based in Seoul. It is the largest online marketplace in South Korea, commonly referred to as “Amazon of South Korea”.

The services offered by CPNG includes:

- Rocket Delivery (Package delivery)

- Rocket Fresh (Grocery delivery)

- Coupang Eats

- Coupang Pay

- Coupang Play (sports live-streaming & movies)

MICHAEL LEE CHIN

Michael Lee-Chin is a Jamaican Canadian billionaire businessman, investor, and philanthropist. He is the Chairman & CEO of Portland Holdings, Inc, a privately held investment company in Canada.

Lee-Chin is currently ranked 12th out of 15 black billionaires by Forbes 2022. He generated his fortune in 1983 by borrowing half a million dollars and invested in one company – Mackenzie Financial Group. 4 years later, the shares values of the company increased sevenfold where he earned a capital gain of $3.5 million.

Lee-Chin then used his newly earned profits to purchase an investment firm, AIC Canada and grew the firm from $1 million to $15 billion in assets under management within 20 years. In 2009, AIC was sold to Manulife due to ‘08-’09 financial crisis and proceeded to incorporate Portland Holdings, Inc.

His investing mantra is “Buy, Hold and Prosper” where he applied 5 principles for his investing strategies:

- Own high-quality business

- Understand the business (Circle of Competence)

- Invest in business that focus on strong, long-term growth

- Invest with other people’s money

- Hold the businesses for long-term capital gains

With these 5 principles in place, his current portfolio includes owning a collection of businesses that are operating globally in the following areas:

- Telecommunications

- Financial Services

- Media

- Tourism

- Agriculture

- Waste Management

LATEST STOCK PURCHASE IN 2022

As Lee-Chin’s investment company is a privately owned, there is no official data being released on his latest business investment. However, he had revealed in an interview in June 2022 that he had invested in ITM Isotope Technologies Munich SE.

This is a privately owned biotechnology and radiopharmaceutical group of companies The company develops, produces, and provides global supply of targeted diagnostic and therapeutic medical procedures in cancer treatment.

One of the reasons he disclosed that he invested in this company was due to the fact the baby boom cohort is approaching retirement. Thus, he foresees that there will be a spike in interest in health.

ALLAN MECHAM

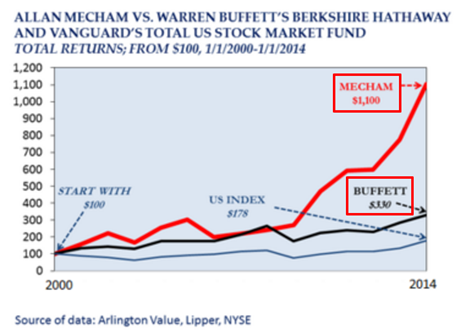

Allan Mecham is an American value investor and the head of Arlington Value Management. His massive success in investment performance has dubbed him as “the 400 percent man” and being tapped as the “Next Warren Buffett”.

From 2000 to 2012, he has realized a 400% return over 12 years. In addition, during the financial crisis of 2008, he also managed to turn a profit for his investments when S&P 500 fell 40%.

His successful investing strategies involved viewing stock as ownership in a business (Owner-like mindset) and focus on long-term success. He mainly focusses on businesses that he thoroughly understands (Circle of Competence) and looks for honest, intelligent management teams with proven track records. Only then he will invest in those undervalue companies with a margin of safety.

However, due to family and health reasons, he has shut down his fund in Apr 2020. Before shutting down, he has transferred his funds to another value investor that share the same investing philosophy with his and also familiar with their top holding stocks.

CONCLUSION

From these 5 massively successful value investors, we can see that each of them has their own unique investing strategies to generate massive returns for their investments.

Nevertheless, there are common traits that we can garnered from their expertise:

- They invest in good quality businesses that they understand (Circle of Competence) as they view stock as ownership in a business.

- They invest long-term in the high-quality company for compounding effect instead of short-term speculation.

- They will perform their own due diligence and buy when the share price is undervalued by applying margin of safety.

As a result, for an investor to buy shares from a high-quality company at a cheap price, it is important for the investor to understand the financial statements to assess the financial health of the company.

Want to know more and find out the exact strategies top investors use today to generate 3 streams of passive income?

Simply sign up for our exclusive Value Investing Masterclass and transform your investing strategy for a lifetime.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.