Cathie Wood, once hailed for her focus on emerging innovation and disruptive technologies such as Tesla, is bullish on artificial intelligence (AI). She predicts that AI is going to be the next boom of the decade, powering future productivity to astounding levels.

Will her optimistic predictions on AI become a reality for the next decade?

In this article, we will find out more on how AI can help to improve work productivity and which field will benefit from the rise of AI.

We have also covered this topic in our YouTube Channel and explored 3 AI companies in Cathie Wood’s ARK Innovation ETF (ARKK)! Click on the video to watch!

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

Artificial Intelligence, or commonly known as AI, is the ability of machines to perform tasks that typically require human intelligence, such as reasoning, learning and decision-making.

AI systems are designed to learn from input data and improve their performance over time with minimal human intervention to program them.

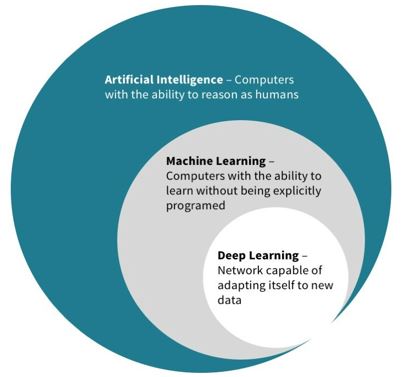

The diagram below outlines 3 learning levels of machines:

3 Learning Levels of Machines

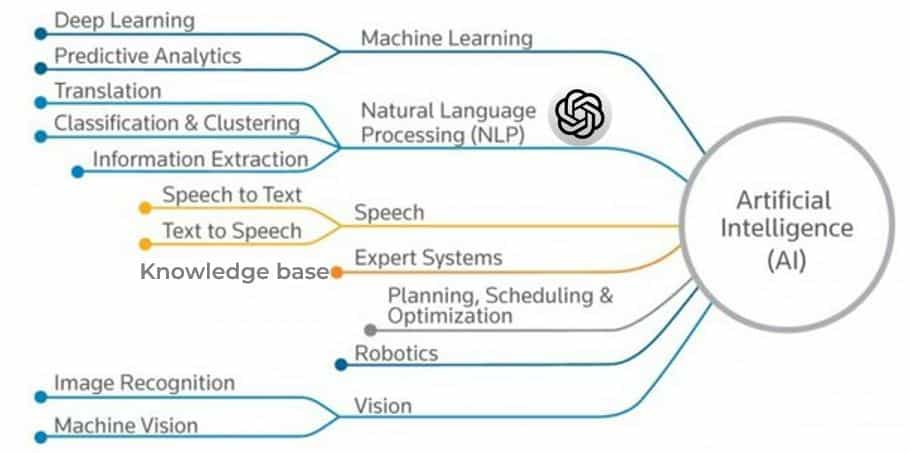

AI is a broad field with many subfields, each focuses on a specific aspect of artificial intelligence. The chart below shows the various subfields of AI:

Artificial Intelligence Subfields

Currently, there are at least 7 subfields within the AI field:

- Machine Learning – Machines are able to learn from data on its own, without being explicitly programmed by humans.

- Natural Language Processing (NLP) – Machines are able to understand and generate human language in the form of text, such as ChatGPT

- Speech – Machines are able to process and generate human language in the form of speech.

- Expert Systems – AI software that uses knowledge and reasoning techniques to solve complex problems in a specific domain, such as medicine and finance.

- Planning, Scheduling & Optimization

- Robotics – AI robots that can perceive, reason and act in the physical world.

- Vision – Machines are able to interpret and analyze visual data.

With these wide range of subfields, AI can be used in a various applications, from voice assistants, chatbots to self-driving cars and medical diagnosis.

FUTURE OF AI IN PRODUCTIVITY WORK

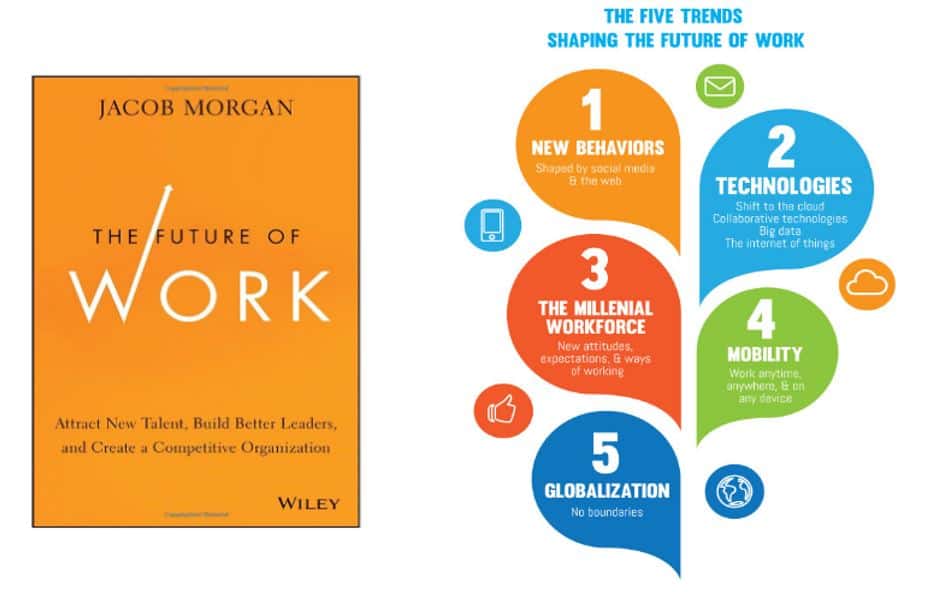

In 2014, Jacob Morgan published “The Future of Work” where the book explores how emerging technologies, such as AI, robotics, and automation will change the nature of future work. The book also discusses the impact of these technologies on the future workforce.

Morgan stated that the traditional model of work (rigid 9-5 schedule and a fixed physical location) is going to be outdated in the face of these technological advances. He suggested that the rise of these new technologies allow the workforce to be working in a more flexible and mobile environment, with a great focus on skills development, collaboration and creativity.

The Future of Work by Jacob Morgan

He also listed out the 5 trends that will shape the future of work:

- New behaviors – Desire for flexibility and work remotely.

- Technologies – Cloud, big data, internet of things (IoT).

- Millennial Workforce – Demographic shift from aging workforce to millennial generations.

- Mobility – Work anytime, anywhere.

- Globalization

Fast forward a decade later, what Morgan predicted in 2014 had come to fruition with the rapid development of technology. The emergence of COVID pandemic had also sped up the technological advancement in the workforce.

WHICH FIELD WILL BENEFIT FROM AI?

With the rapid rise of technology, we have seen AI helping workers to perform various tasks, such as automating routine tasks, streamlining workflows, and enhancing decision making.

In addition to that, many fields have implemented AI in their work routine to speed up work productivity and efficiency.

Here, we have listed out 7 fields that may benefit from AI:

As we can see the future trend is gearing towards AI, no wonder Cathie Wood has made such a bold statement that AI will increase productivity more than 4-fold by 2030.

Staying true to her bullish vision, she has established several ETFs that focus on different innovative and disruptive technologies in her management fund company – ARK Investment Management LLC.

Now, let’s deep dive into ARK Innovation ETF (ARKK)!

ARK INNOVATION ETF (ARKK)

ARKK focuses on new technological products or services that could potentially change the way the world works, such as AI applications in healthcare research.

It is an actively managed ETF where the fund managers will select companies with innovative technologies to allocate into the ETF portfolio. Hence, the ETF has an expense ratio of 0.75%.

An expense ratio of 0.75% means that for every $1,000 invested over the course of a year, investors will have to pay the fund manager $7.50 for managing the ETF fund. On a side note, the expense ratio of Vanguard S&P 500 (VOO) is only a mere 0.03%, which is significantly lower than ARKK!

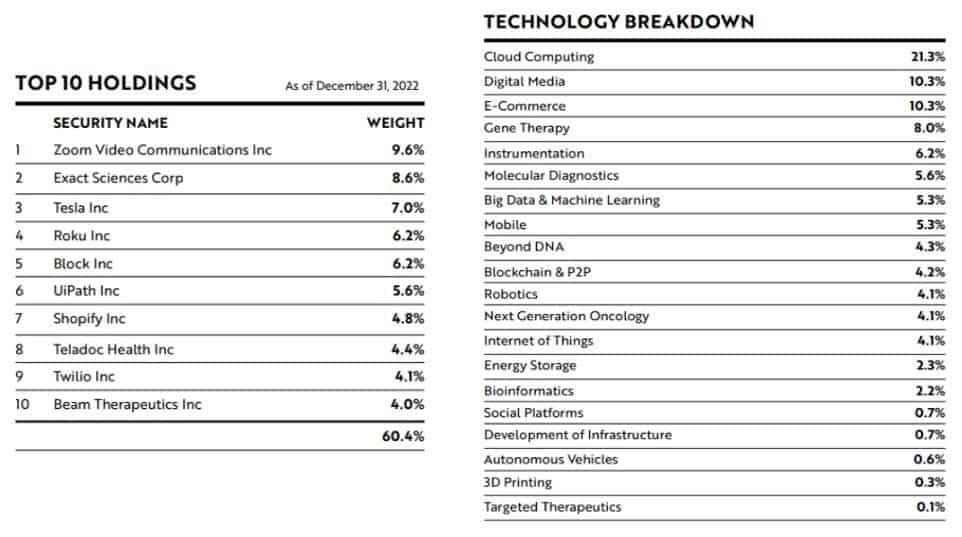

As of 14 October 2022, the ETF has a total of 28 companies that are involved in at least 20 technologies. The table below lists the top 10 holding companies and the technology breakdown within the ETF.

We noticed that there are numerous technologies related to genomics and healthcare makes up about 24.3% in this ETF. For AI technologies, it is about 14.1% and the rest of other applications is 61.6%.

ARKK PERFORMANCE

Next, we will look at how well has ARKK performed since being launched in 2014.

When we compared the ARKK performance in terms of share price against Vanguard S&P 500 (VOO), we observed that ARKK has performed exceptionally well over VOO during the pandemic. One of the reasons was because everyone was being forced to stay indoors and had to work from home during the pandemic.

To support the workforce working from home, various technologies such as online meeting and virtual collaborations were widely used. Hence, numerous technological companies benefited from the pandemic and saw massive share price increment in a short span of 1 year.

However in late 2021, there was a sharp plunge in ARKK and the decline continued into 2022 which performed below VOO. When the world started to open up with more people being vaccinated, they can now return to the office to work or travel abroad. This had indirectly cut down on the reliance on technology or indoor entertainment.

Tech companies which previously enjoyed a massive bull run during the pandemic were badly impacted by this sudden turn of event and saw their share price plunged in 2022. As most of the company holdings in ARKK are innovative tech companies, the ETF share price was also affected.

Nevertheless, companies with strong financial background and impactful technology that are beneficial to humanity will be able to weather through the tough ride. In our YouTube Channel, we have also investigated 3 AI companies within the ARKK with innovative AI technologies to help increase work productivity! Click on the video above to watch!

CONCLUSION

As a conclusion, technology has played an important role in our modern day lives, whether at home or at work. The rapid advancement of innovative and disruptive technologies will further boost work productivity and increase efficiency in various fields.

Companies that developed innovative and useful technologies may have a bright future due to the massive adoption in their life, such as Google and Zoom. Thus, the share price of these innovative tech companies have risen during the pandemic.

To determine if the future uprising tech companies are good to invest in, join us in our upcoming masterclass where we will showcase how you can apply a systematic and yet simple way to make investing decisions in these companies with Value Investing methodology!

Click on the banner below to find out more!

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.