HOW DOES THE COMPANY MAKE MONEY?

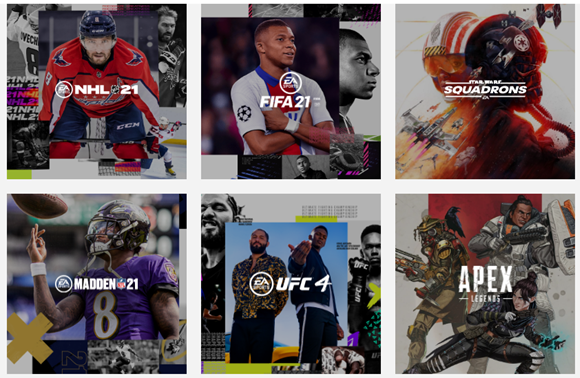

In essence, this company has a portfolio of services, contents and established gaming products like FIFA, Star Wars, Need for Speed, the Sims, Battlefield, and many more which can be played on various interfaces including personal computers, tablets, consoles or mobile phones.

These products are intellectually-protected and are available via their own Origin platform alongside with third party distributors (Google Play, Apple App Store) and retail channels. The following image depicts the top featured games by this company:

WHAT IS ONE THING UNIQUE ABOUT THIS COMPANY?

Extracted from EA’s annual report, the company strategic pillars have been revolving around the following themes:

- Delivering contents and amazing games to global audiences

- Presence of multiple products and services, addressing various depth and breadth of audiences

- Presence of strategic advantage via unique business model and distribution channels

- Engaging high number of players from different geographies/distribution channels

- Strengthening revenue from sport franchises on annual basis across multiple platforms

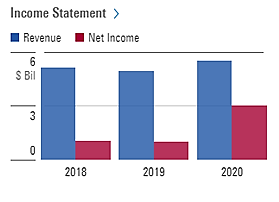

REVENUE TREND

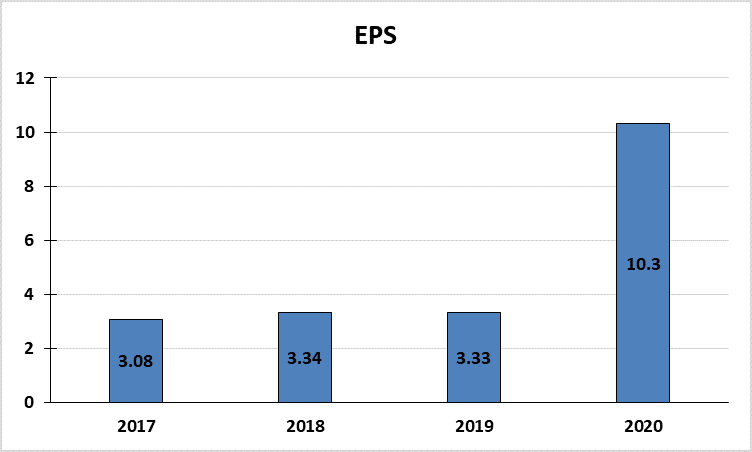

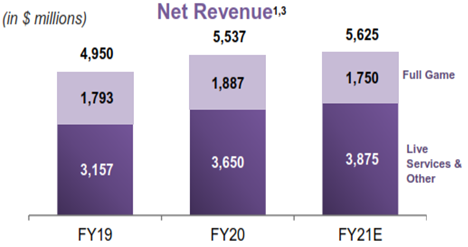

The outcome of EA’s business models can be seen reflected in their financial statements. Their revenue for instance, has been on up-trend since 2018 with USD 5.15 billion to USD 5.54 billion in 2020, an increment of 7.5%. In terms of their net income, a total of USD 1.04 billion was reported in 2018 and it grew by 292% to USD 3.04 billion in 2020 while their operating income being relatively stable at USD 1.43 billion and USD 1.45 billion in 2018 and 2020, respectively. The increased profits have been translated to higher reward for the shareholder whereby USD 3.34 was granted per share in 2018 and it grew by 300% to USD 10.3 per share in 2020.

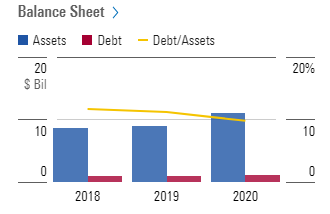

As we look into EA’s balance sheet, a similar trend can be identified. Their assets for instance, has been increasing over the years from USD 8.58 billion in 2018 to USD 11.11 billion in 2020, which represents 129% growth. Interestingly, as their assets increased, their debt however showed a marginal change from USD 990 million in 2018 to slightly above USD one billion in 2020. In other words, with this trend of debt and increasing assets, their overall debt-to-asset proportion (yellow line in chart) appears to be on a downward trend, indicating solid financial strength. The liabilities on the other hand showed a decreasing pattern whereby in 2018, it was reported to be USD 3.99 billion and by 2020, it was reduced by 9% to USD 3.65 billion. This in turn reflected the opposite pattern in its equity where by in 2018, the total equity was reported as USD 4.6 billion and it grew by 162% to USD 7.46 billion in 2020.

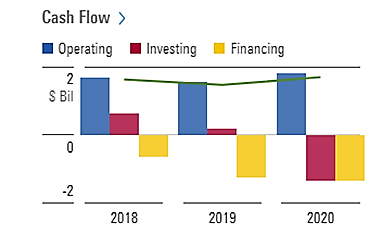

Moving to their Cash Flow allocations, it is interesting to note that their Operating cash flow presented an increment from USD 1.69 billion in 2018 to USD 1.80 billion in 2020, which grew by 106%. On the contrary, both Investing cash flow and Financing cash flow revealed a decreasing pattern over these years. For instance, Investing cash flow was reported as USD 0.62 billion in 2018 and it shrank by 219% to USD -1.36 billion in 2020. For Financing cash flow, it was reported that USD -0.64 billion was spent in 2018, and it got reduced to USD -1.36 billion in 2020. Despite the mixed allocation of financial resources observed over here, it is important to note that their free cash flow was on an up-trend over these years whereby it was reported with USD 1.59 billion in 2018 and it grew to USD 1.66 billion in 2020.

EARNINGS PER SHARE TREND

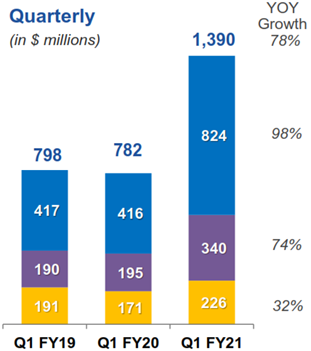

WHAT TOOK PLACE IN THEIR PERFORMANCE RECENTLY

- Being in industry which is highly competitive, the company is in stressful condition to deliver successful and engaging product.

- The products and services they provide are exposed to geopolitical, economy and market conditions.

- Business disruption is possible with the presence of catastrophic event.

- Possibility of not delivering live services or products as scheduled especially when tied up to specific events such as sport events or movie release

- Speed in implementing new technologies which may hamper business strategies as well as distribution channels

- Potential breaches especially in form of cyber threat or security breach

- Presence of strict regulation and complex requirement especially with regards to data protection

- Potential of facing disruption in products or services as well as technology involved

- Being strictly regulated with government rules which may impact the business

- Presence of negative perception with regards to products and services and this will incur higher cost of marketing to address these concerns.

- High dependence of devices, products, systems, and consoles which are developed by third parties

- Game developers may not deliver the content as obligated which may hamper business workflow

- Retention of talented pool of people

- Insufficient marketing campaigns may not attract customers as intended

- Demand for products or services may decrease which may hamper business revenue

- Ability to develop content or services to cater larger group of audience

- Having strong relationship with strategic partners such as Sony, Microsoft, Apple App Store or Google Play Store

- Having faced tough competition by companies such as Activision Blizzard, Take-Two Interactive, Ubisoft, thus promoting innovation among the developers in EA

- Having numerous trademarks, trade secret, copyrights, license agreement and various contractual provision to protect in-house intellectual know-hows

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.