HOW THE COMPANY MAKES MONEY

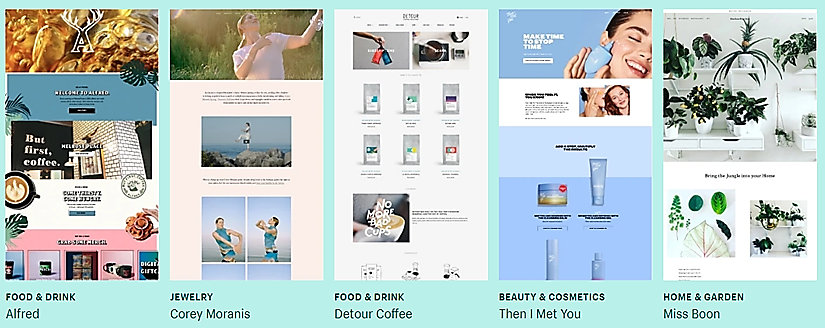

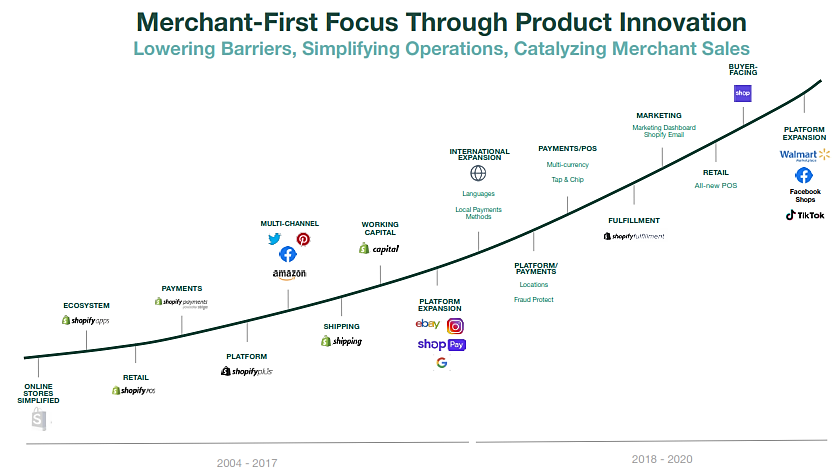

Shopify is not a new name in the e-commerce industry as it serves as an excellent toolbox for small and medium-sized business owners. In short, Shopify provides cloud-based solutions for subscriptions and merchant. From merchant stand-point, Shopify allows business owners to manage their ventures via mobile, Web-based, social media, physical retail and marketplaces. Merchants also are able to view their customers across variety channels and keep track of their products and related processes such as payments, ordering, inventories, shipping, customer relationship, and many more. It also provide back office services integrated with analytics to help improve business strategies. This includes enabling checkout system which is mobile-optimized for attracting customers who might not have access on desktops websites. The following shows some examples of the where Shopify can help businesses:

WHAT’S ONE THING UNIQUE ABOUT THIS COMPANY

When business owners decide to adapt towards digitalizing their stores, they are actually being backed by Shopify’s strength in the following aspects:

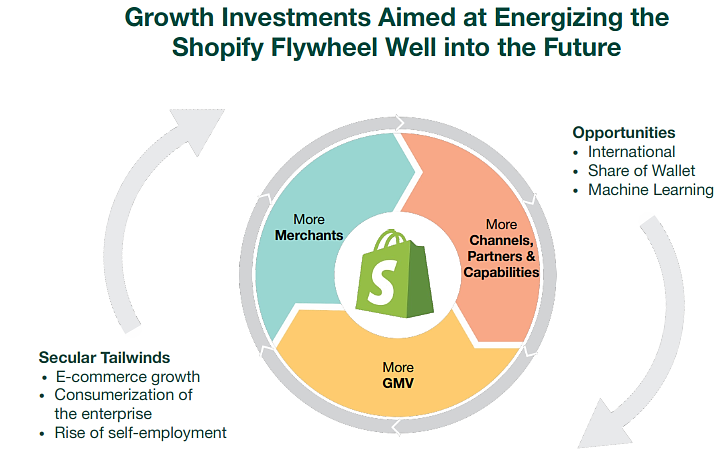

Large and Growing Opportunity

- The operating system along with additional capabilities that Shopify provides allow merchants to sell virtually to anyone, anywhere in the world

World-class Product

- The platform is rather simple, easy to use and more importantly, it is much easier to scale based on business requirement

Data Advantage

- Shopify takes advantage of machine learning to help business owners understanding consumer behavior and adapt accordingly

Powerful Business Model

- The variety packages Shopify offers indicate that they want to truly allow merchants to capitalize on this business model

Vast Ecosystem

- The ecosystem behind the scene such as app developers, designers, and others are constantly improving themselves so that merchants can try out different strategies while leveraging on Shopify platform

Mission Driven

- With massive team working behind the scene, Shopify strives to provide commerce opportunities to everyone, even for non-business owners.

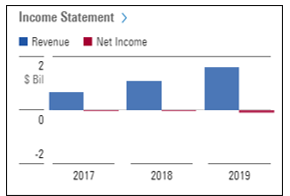

REVENUE TREND

Looking into the financials of Shopify, we can understand their performance from business standpoint. Their revenue over the years has been on an uptrend, which was recorded at USD 0.67 billion in 2017 and grew by 235% to USD 1.58 billion in 2019. Their net income however portrayed a slowdown whereby in 2017, it was reported to be USD 40 million loss in 2017 and in 2019, it went to USD 120 million loss in 2019. The same pattern was also observed in operating income whereby in 2017, it was reported to be USD 50 million loss and this figure grew to USD 140 million loss in 2019.

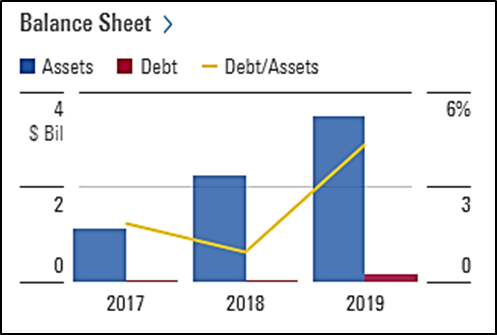

A peek into Shopify’s balance sheet revealed that their assets grew by 314% from USD 1.11 billion in 2017, to USD 2.25 billion in 2018 and to USD 3.49 billion in 2019. As the portion of the assets grew, so did their liabilities. In 2017, total liability was reported to be USD 110 million and this figure grew by 427% to USD 470 million in 2019. Nevertheless, the equity portion has shown to be growing whereby in 2017, it was reported to be USD 1 billion and it grew by 302% to USD 2.09 billion in 2018 and USD 3.02 billion in 2019. It should be noted that debt/asset ratio is clocking on an uptrend, indicating that Shopify is constantly investing in their business possibly to provide the best service to their clients.

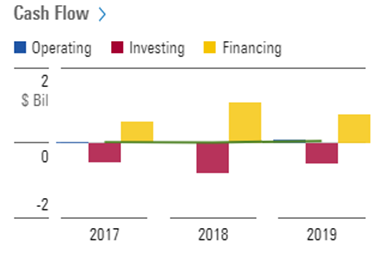

Moving on to their Cash Flow allocations, it is observed that their cash flow from operating grew from USD 10 million in 2017 to USD 70 million in 2019. This represents an increment of 700% in two years’ time period. Next, their investing cash flow showed a consistent trend whereby in 2017, it was reported to be USD 530 million loss and this amount went to USD 570 million loss. This might be indicative that Shopify has been allocating resources to re-invest in their platform to generate more future revenue. With regards to financing cash flow, an uptrend was observed whereby in 2017, it was reported to be USD 570 million and this figure grew to USD 740 million in 2019.

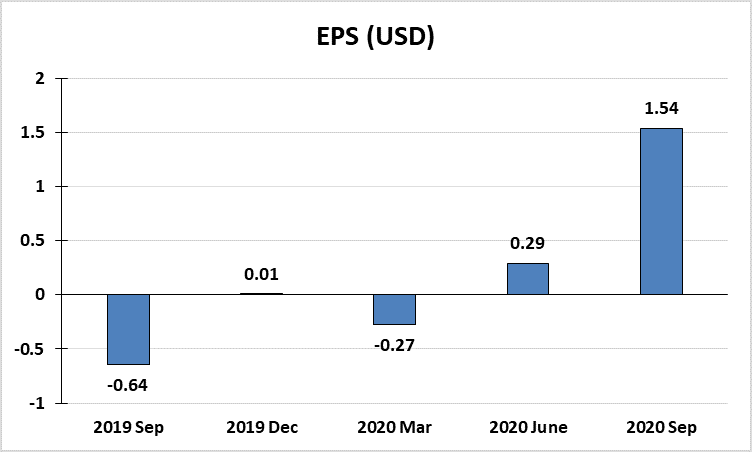

EARNINGS PER SHARE TREND

WHAT TOOK PLACE IN THEIR PERFORMANCE RECENTLY

- Revenue grew by 96% to USD 767.4 million based on quarter-on-quarter

- Revenue from subscription solutions grew by 48% based year-on-year to USD 245.3 million, indicating presence of more merchants joining Shopify

- Revenue from merchant solutions grew by 132% based on year-on-year to USD 522.1 million, indicating improvement in terms of Gross Merchandise Value

- From the gross profit standpoint, an improvement of 87% was noted based on year-on-year basis, from USD 216.7 million to USD 405.1 million

- In addition, the adjusted gross profit also grew by 88% from third quarter 2019 to third quarter 2020, from USD 219.4 million to USD 412.6 million

- Shop Pay Installment, which is an initiative especially for ‘buy now, pay later’ products, thereby offering merchants wth more flexibility and to increase conversion rate

- Continue the extension of Shopify Fulfillment Network, which includes network connection, node partner addition, and merchant-facing app development

- Expansion of partner ecosystem to about 37,400 partners based on last 12 months , which is an increment from 23,000 partners in 2019

- Collaborates with Operation HOPE to facilitate Black business owners to venture into entrepreneurship by providing up to USD 130 million resources

- Started TikTok channel to provide avenue for merchants to use social media and promote their products and boost their sales

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.