In the wake of NVIDIA’s remarkable stock surge driven by their revolutionary AI chips fueling ChatGPT, a new contender steps onto the scene – AMD. This formidable player has unleashed their own potent AI chips, aiming to challenge NVIDIA’s dominance in this dynamic AI landscape.

The pivotal question emerges: Is now the ideal time to invest in AMD and capitalize on the AI revolution?

In this blog article we’ll delve into:

- Unveiling AMD’s essence through a blend of qualitative and quantitative analysis.

- AMD’s strategic vision and future roadmap to seize the burgeoning AI boom.

- A high-stakes showdown: AMD’s chips vs. NVIDIA’s in the thrilling AI race.

Get ready to unravel the dynamic interplay of technological giants and explore the potential opportunities in the captivating world of AI revolution!

To gain a deeper understanding, we’ve dedicated a section on AMD in our YouTube channel. Don’t miss out on the opportunity to gather additional insights by watching the video provided below.

QUALITATIVE ANALYSIS OF AMD

AMD, formally recognized as Advanced Micro Devices, Inc., is a prominent American fabless semiconductor enterprise. Its primary concentration encompasses chip design, software bolstering, and comprehensive marketing initiatives.

This company extends a diverse spectrum of offerings, encompassing both hardware and software realms. Among its offerings, semiconductor chips stand as notable hardware products, complemented by a suite of software solutions. These innovations find extensive utility across a multitude of sectors, including:

- Consumer electronics, such as personal computers and desktops.

- Data Centers – Centralized facility designed to house and manage a large amount of computing hardware, data storage, networking equipment, etc.

- Gaming – Dynamic realm of digital games, catering to avid gamers and enthusiasts.

- Robotics & Edge AI devices – Integration of AI and automation into robotic systems for intelligent automation and real-time decision-making.

AMD’s inception traces back to 1969, and a significant milestone was reached when it conducted an IPO in 1972. During this milestone moment, the company debuted on the Nasdaq stock exchange under the ticker symbol “AMD”.

PRODUCTS & SOLUTIONS

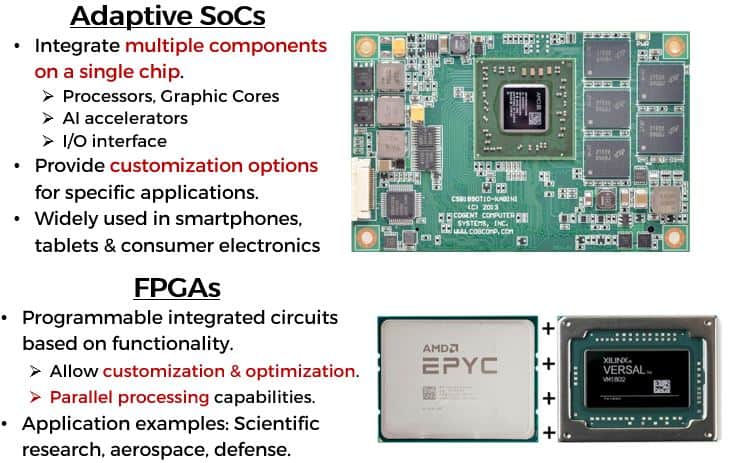

AMD primarily designs semiconductor chips for their hardware products, categorized into four main groups:

- Processors

- Brain of the PC (e.g. CPU)

- Graphics

- Chips for graphics, visuals and performing parallel processing (e.g. GPU)

- Adaptive System on Chips (SoCs) & Field Programmable Gate Arrays (FPGAs)

- Accelerators, SOMs & Smart NICs

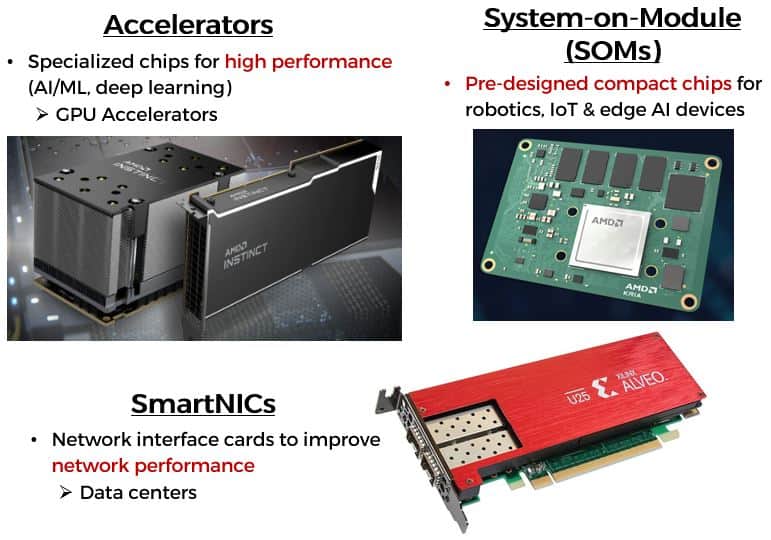

In addition to their hardware chip design endeavors, they provide solutions tailored to six key market platforms within the industry:

FUTURE PLAN OF AMD

In 2022, AMD unveiled its 5-year growth strategy (2022-2027) centered around expanding five key areas, as depicted in the graphic below:

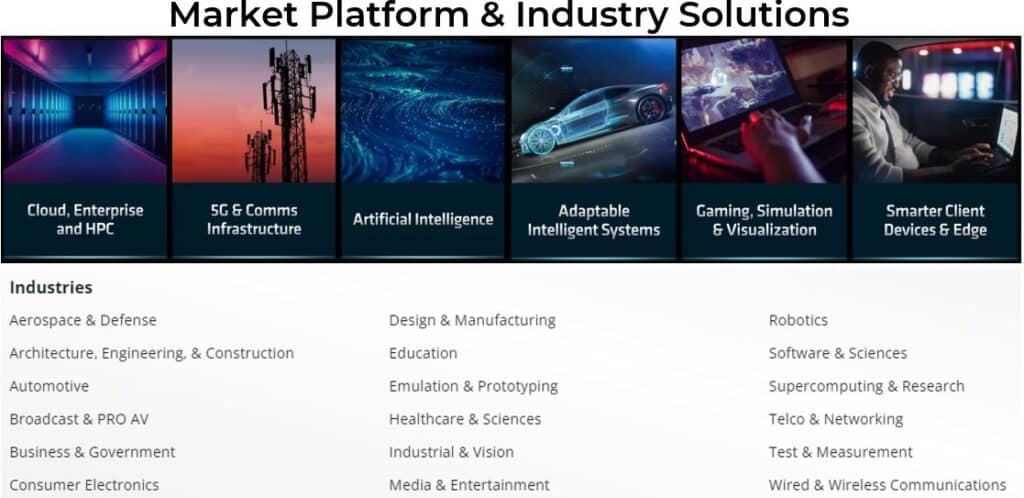

5 YEARS PLAN – PERVASIVE AI & DATA CENTER

Among these pillars, “Advancing Pervasive AI“, AMD aims to seamlessly integrate AI technology into various aspects of modern life.

Graphic source: AMD Investor Presentation

To realize this ambitious vision, AMD has outlined strategies that involves enhancing their training and inference chips across cloud, edge, and endpoint environments, as depicted in the diagram below:

Graphic source: AMD Investor Presentation

Apart from their drive to enhance their AI capabilities, AMD is also directing their efforts towards advancing their position in data center dominance. This strategic emphasis is attributed to the data center’s pivotal role in fostering the progress of AI, particularly concerning machine learning & deep learning.

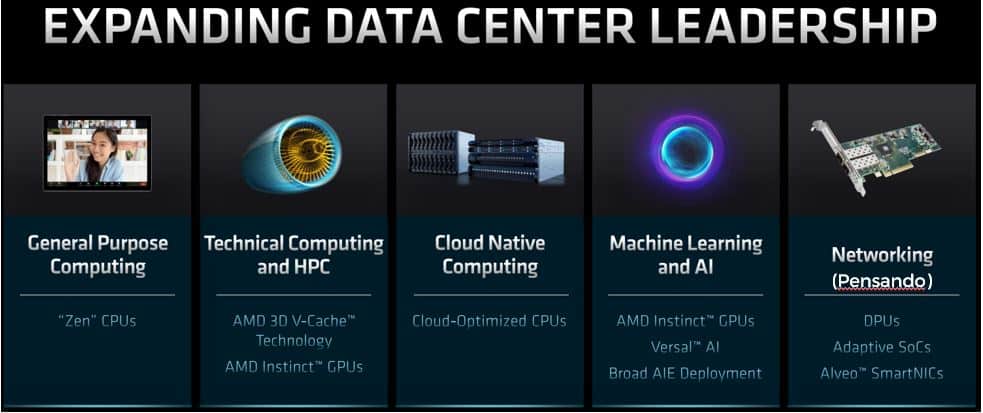

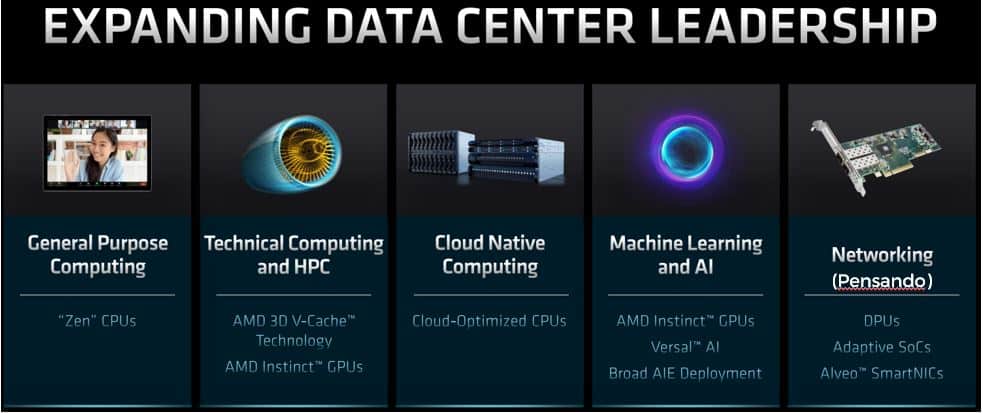

In pursuit of an extended footprint in the data center realm, AMD presents an unparalleled array of data center computing solutions, solidifying their stance as an industry leader:

Nvidia is also focusing on their data center leadership expansion. Click on the link to find out more!

MERGER & ACQUISITIONS

During 2022, AMD further broadened its portfolio of chip offerings through the acquisitions of both Xilinx and Pensando.

Xilinx stands at the forefront as the primary supplier of FPGAs and SoCs. These chips boast exceptional customization capabilities, allowing for post-deployment functional modifications.

Xilinx‘s chip solutions find extensive utilization across domains like data centers, telecommunications, automotive, aerospace, and industrial sectors. AMD acquired Xilinx in February 2022, thereby reinforcing AMD’s portfolio in high-performance computing.

Pensando specializes in crafting solutions for software-defined infrastructures in data centers and cloud settings. Their range of products and technological innovations plays a pivotal role in reshaping and contemporizing data center architectures, with a particular focus on enhancing networking and security within cloud environments.

Reflecting this objective, AMD completed the acquisition of Pensando in May 2022, marking a strategic move to augment AMD’s prowess in data center solutions.

AMD VS NVIDIA

AMD and Nvidia, two industry giants, stand as prominent players in the realm of advanced computing and graphics solutions. As such, it is beneficial for us to compare their potential advancement in the AI field and their market share respectively.

Here’s a brief comparison between the two based on key pointers:

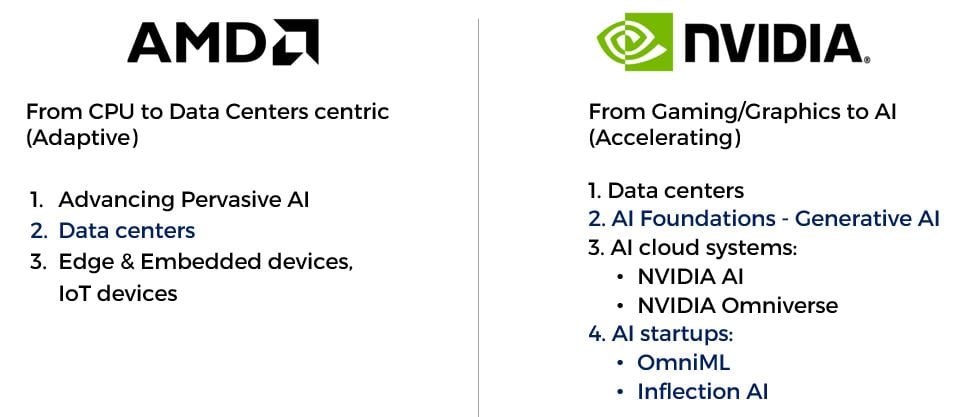

AI PLAN

AMD has been actively pursuing AI advancements, aiming to expand its capabilities in artificial intelligence. While its focus on AI is evident, Nvidia has traditionally been recognized as a pioneer in AI development, consistently pushing the boundaries of GPU-accelerated machine learning and deep learning technologies.

The diagram below shows the recent progress in AI between the two companies:

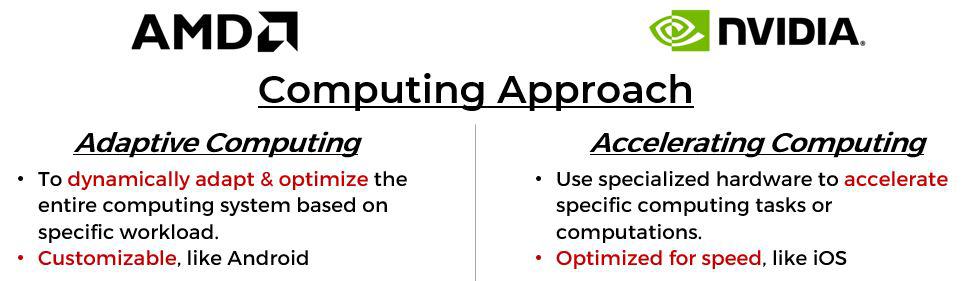

COMPUTING APPROACH & SOFTWARE SUPPORT

The computing approach pertains to the fundamental hardware structure employed for AI computations. This involves distinct hardware elements like CPUs, GPUs, or dedicated AI chips, along with their capacity to enhance AI tasks.

The illustration below presents a comparison of the computing approaches adopted by AMD and Nvidia:

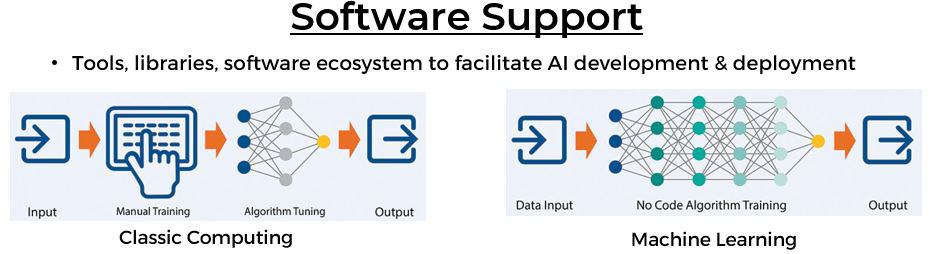

Software support for AI frameworks is like having a toolbox full of helpful tools for people who want to create and use AI technology. These tools make it easier to build, train, and use AI models, so that computers can learn and make smart decisions. It’s like having special tools that help AI technology work better and faster.

The diagram below shows the comparison between classic computing and machine learning when developing the AI frameworks:

In traditional computing, algorithms need hands-on training. Whereas in machine learning, algorithms can be trained with less human involvement, which accelerates the AI framework creation process.

CHIPS COMPARISON

Nvidia’s GPUs, such as the GeForce series for gaming and Quadro/Tesla for professional workloads, have been pivotal in AI development. Nvidia’s data center GPUs, like the A100, are renowned for their AI and high-performance computing capabilities.

AMD, with its Radeon Instinct GPUs, is carving a space in data centers for AI and HPC workloads. The acquisition of Xilinx further enhances AMD’s data center capabilities.

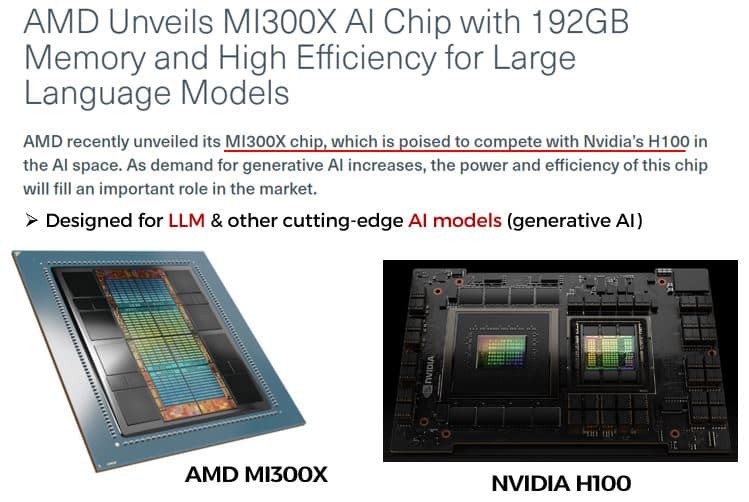

While Nvidia has traditionally led in AI and GPU-accelerated computing, recent developments reveal that AMD has introduced the MI300X AI chip, positioning it as a contender against Nvidia’s H100 chip.

Source: Sourceability

Although Nvidia’s GPUs have held the spotlight for AI training, software company MosaicML revealed that AMD’s AI chips are approaching similar speed, potentially becoming competitive due to the crucial role of software in large language model (LLM) training.

MARKET PRESENCE

Nvidia has historically enjoyed a significant presence and market share in both gaming and professional graphics markets. Its GPUs have become synonymous with high-performance computing, AI, and deep learning. In 2022, 87% of Nvidia’s revenue came from GPU sales.

Source: CNBC

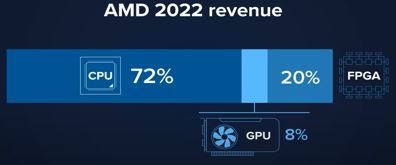

In terms of market reach, AMD has a wider presence than Nvidia. Even though many AMD chips power gaming consoles, the company has also expanded through Ryzen processors and Radeon GPUs, competing well in gaming and professional markets. In 2022, GPU revenue contributed only 8%, significantly less than CPU (72%) and FPGA (20%).

Source: CNBC

This leads us smoothly to the next section, where we’ll delve deeper into AMD’s financial performance in the fiscal year 2022.

QUANTITATIVE ANALYSIS OF AMD

REVENUE GENERATION

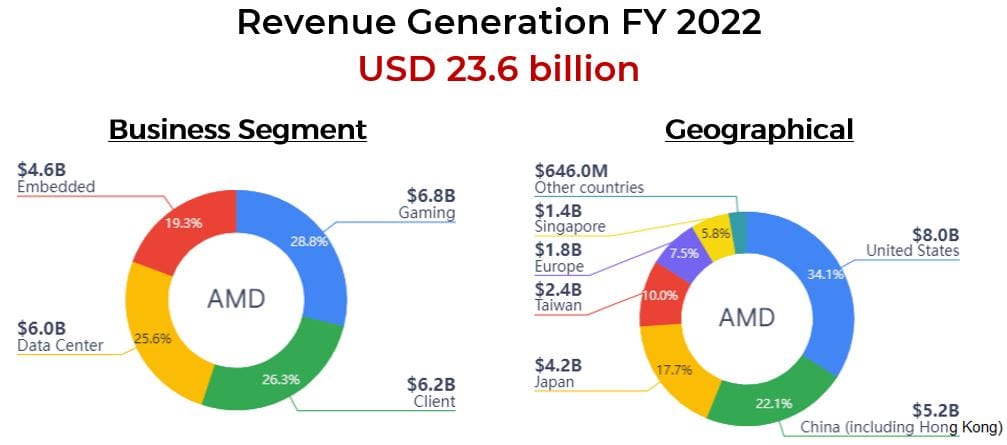

AMD has 4 main reportable business segments to record their revenue generation:

In FY 2022, AMD has generated a total of USD 23.6 billion from these 4 business segments:

Graphic Source: GuruFocus

In the fiscal year 2022, the primary revenue sources were led by Gaming, constituting the majority at 28.8%, closely trailed by Client at 26.3%, Data Center at 25.6%, and Embedded at 19.3%.

In terms of geographical distribution, the United States emerged as the leading contributor, accounting for 34.1% of the total revenue. China (including Hong Kong) secured the second position, contributing 22.1%, followed by Japan at 17.7%. The remaining 26.1% originated from various other global regions.

Graphic Source: AMD Q1 FY23 Quarterly Report

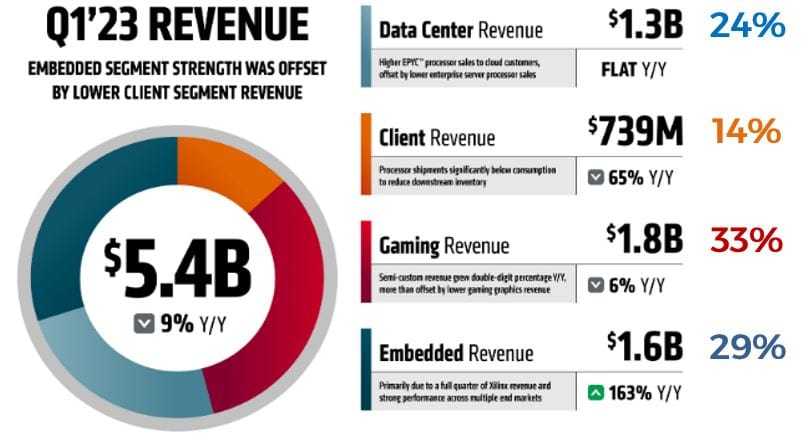

In their most recent quarterly report, the revenue breakdown was presented solely for four specific business segments. The Gaming segment retained its leading position in Q1 2023 revenue, comprising approximately 33% of the total.

Interestingly, in comparison to the preceding fiscal year (FY 2022), the Embedded segment emerged as the second-highest contributor, accounting for around 29% of the overall revenue. This surpassed the Data Center segment, which constituted 24%, and the Client segment, which contributed 14%.

A significant factor behind the substantial revenue decline in the Client segment can be attributed to the broader downturn in the semiconductor industry, causing a decline in PC sales. This industry-wide slump impacted the Client segment’s performance notably.

For a more comprehensive insight into AMD’s financial performance across various metrics and their potential risks, watch them on our YouTube channel!

CONCLUSION

In conclusion, AMD stands as a dynamic player in the semiconductor realm, showcasing their expertise in chip design, software solutions, and potential AI growth. Despite challenges in the Client segment due to industry trends, AMD’s strategic innovation sets a promising path.

Their commitment to research and development, exemplified by the ROCm platform for software support and acquisition of Xilinx and Pensando, places them well in the competitive GPU-accelerated computing and AI field.

As AMD progresses by broadening its offerings and building partnerships, it holds the potential to shape the future of computing. With a steadfast dedication to innovation and growth, AMD is positioned to influence the trajectory of technology.

Are you in search of growth and undervalued companies? Dive into our US Case Study Subscription to:

- Discover companies meticulously researched from thousands in the US market.

- Bypass the tedious research process; we evaluate and pinpoint the intrinsic value using various tools.

- Harness advanced options strategies for a new stream of passive income.

Click on the banner below to find out more!

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.