I heard some people talk about using a fund manager. Someone who is a professional investor. Couldn’t I just use them and save myself the trouble of doing all the work? Plus, shouldn’t they know the best stocks to invest in since they are professionals who do this for a living? I mean, wouldn’t my chances be better giving my money to an expert to invest for me so they can make sure I make a lot of money from my investments?

Well my friend, you’re both right and wrong. It’s true that fund managers are professionals who spend their days’ investing other people’s money with the goal of making more for their clients. However, a fund manager is not responsible for what happens to their client’s money. If the investments, they make for their clients don’t do well or under-perform the fund manager holds no responsibility. The fund manager gets paid everyday even when their clients are loosing money. The misperception most people have is that they only get paid if their clients make money.

Fund managing firms are set up to invest money for their clients while collecting fees from them. They collect a premium on everything they do for you, sometimes even calling them will be charged to your account. Fees for these managers often run between 0.6% to 2% which can add up.

It’s not to say that they won’t do their best to make you more money but their investment strategy is their own and may be very risky or a huge gamble. They will claim that they can make a lot of money quickly but what they don’t say is that it comes with a very real and very high risk.

Think of it this way. When you go to place a bet on a game of any kind, you usually have to give the money to a bookie to hold onto until the end of the game. So, if you win, you go back and collect your winnings, but if you lose, you don’t get anything back and the person who won gets your money. Now, regardless of what happens in the game the bookie makes money from you. That’s because they collect a fee from you anytime you make a bet and either way, win or lose, they make money.

Fund managing firms operate in a similar fashion. I know this is a crude example but by giving your money to a fund manager you are essentially making a bet and win or lose they will make money from you.

The best advice I have for you or any investor for that matter is to learn from Warren Buffett’s example on how to be a good investor. Start by investing in yourself and learn about how the market works, then research companies you might be interested in investing in.

Get advice from financial advisors if needed, but still do your own homework and learn about the investments before you put your money into them. It takes a little time and energy at first but it’s worth it in the long run.

Now, I understand that you like many other people don’t have a lot of time to spend researching how to invest in the stock market, but I would say to at least spend 10 minutes a day learning about the market. This way, you are always learning something about investing and you are moving forward toward your goal with investing.

The only word of caution I would have is to be weary of fund managers and stock brokers. This is because they’re not always clear about their fee structures, and they usually are paid regardless of how you do in the stock market.

“There are a few investment managers, of course, who are very good – though in the short run, it’s difficult to determine whether a great record is due to luck or talent. Most advisors, however, are far better at generating high fees then they are at generating high returns. In truth, their core competence is salesmanship. Rather than listen to their siren songs, investors – large and small – should instead read Jack Bogle’s “The Little Book of Common Sense Investing” – Warren Buffett.

John C. Bogle – The Little Book Of Common Sense Investing

WHAT’S BETTER?

FUND MANAGERS OR INDEX FUNDS?

There has been a debt concerning the profitability fund managers provide compared to the stock market index funds. Between them, there is a bright distinct line dividing these two fundamentally different approaches to investing. Numerous studies have shown that index funds, with their low costs and ability to closely mimic the returns of markets both broad and narrow, steadily outperform the returns of most actively managed funds.

To better understand why there is a difference between the two we need to look at the distinction between funds that are managed and those that are indexed. Actively managed funds are handled by an individual or team of managers. Successful management of a fund requires evaluations of a fund’s investing style, growth, risk and return profile, trading activity, costs, and performance. How well they score in these areas is important and can determine if an investor utilizes their services or not.

Index funds are passively managed, which means that their portfolios mirror the components of a market index. Because of this, the costs associated with an index fund are much lower then an actively managed fund.

For example, the highly well-known Vanguard 500 Index fund is composed of the same 500 stocks as it’s counter part the Standard & Poor’s 500 Index. It is also based on the same market capitalization scheme and costs much less then an actively managed fund. So, let’s look at why index funds are performing so much better then those funds which are actively managed by fund managers.

ACTIVELY MANAGED FUNDS

Really, the big difference comes down to where do you think your money will give you the biggest return? This is usually the argument most people will make when siding with fund managers to invest your money. The idea being, that a well-run actively managed fund with a long-term performance record which is above their peer and category benchmarks are excellent investing opportunities. There are even a number of top-rated fund managers that consistently deliver exceptional yearly results.

These are all fantastic things to hear and generally would be enough to convince someone with little or no investing experience to decide on using a fund manager. I mean, why wouldn’t you? If a fund manager can continually give their clients high yearly returns, then why not invest with them? Well, something they may not mention, is that despite their impressive long-term records, even top-rated fund managers can have bad years. Also, in recent years, a number of fund management-related issues have received more public attention in the financial press than in the past.

These fall under the general heading of fund stewardship and include such issues as a manager’s financial stake in a fund, performance fees and the composition of a fund’s board of directors.

When chosen properly, actively managed funds can bring significant benefits and advantages to an investors portfolio. Year after year however, the performance of most actively managed funds does fall short of whatever index is most appropriate for the funds’ benchmarks. Some will use the S&P 500 as a benchmark or various other indexes to compare against the performance of fund managers.

In 2015, both The Washington Post & CNN Money, reported findings to support why indexes outperform fund managers with data collected by Morningstar.

Morningstar is considered to be a highly respected and reliable investment research firm that compiles and analyzes funds, stocks, general market data, and provides a source of independent investment analysis for all levels of investors. They conducted a comprehensive study and found that in 2014, nearly 86% of all fund managers underperformed compared to the S&P 500. Not to mention that, almost 89% of fund managers underperformed over the past five years, and 82% underperformed over the past ten years.

But the real question is why? Are they just bad managers or are they taking huge risks and not doing their homework before investing their clients’ money?

Well, it’s possible some fund managers fall into these groups but most certainly not all of them. They consistently underperform compared to the S&P 500 Index because of two reasons. First, taxes are a major factor to take into account. High-turnover active funds can leave investors at a disadvantage, as more taxes are likely to be owed than with a low-turnover fund. Second, actively managed funds underperform because of their high expenses. While you might reasonably expect higher returns from a lower cost actively managed fund than from a higher-cost actively managed fund, both are still likely to underperform compared to index funds.

Thus, this is where the problem with actively managed funds exists. Yes, a fund manager can generate a lot of money with their investments because of their knowledge and background. Although, the fees you will pay so they can provide this service to you will be substantially high.

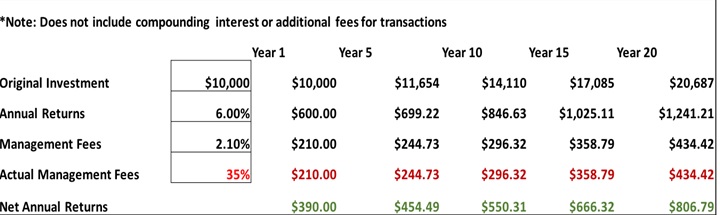

To show you how this works we’ll look at a simplified example which only looks at the costs for using a fund manager. For example, let’s say you had $10,000 to invest in the stock market and decided to use a fund manager to actively manage your investments.

They will earn you an estimated 6% yearly portfolio return on your investments and their fee to do this for you will range between 0.89% – 1.2%. I know this doesn’t sound like much, but keep in mind that the reason for the difference is due to how much money you give to them to manage. The less you give them the higher their fees, so, for our example we will use 1.1%, as your $10,000 is considered to be a rather small amount.

In addition, to that fee you will also need to pay another 1.0% to a financial advisor who works with the fund manager in assisting you with your investments. So far, that means, you are paying 2.1% from your annual returns on your $10,000 investment. Which doesn’t sound so bad, at least until you calculate what it actually means.

To know what this adds up to per year we will use the same formula they use. It’s calculated by taking the management fees (2.1%), divided by the yearly portfolio returns (6%), to get the total amount you pay in fees from your yearly returns, which actually totals 35%!

2.1/6 = 0.35 or 35%! Now, take that annual fee of 35%, which again, is the total you’re paying from the annual returns gained on your investment, and multiply it by your yearly returns. Not including compounding interest or any other additional fees added due to transactions, here is what your return would look like. First, let’s calculate your returns by taking, 6%(yearly returns) X $10,000(investment) = $600 (net yearly returns). Then, to get the total cost of management fees we can either take 35% X $600 = $210 (fees) or take 2.1% X $10,000 = $210 (fees). This means you actually only earn $390 (net yearly returns – fees = actual earnings) from your investment.

Imagine for a moment that in 10 years from now, your $10,000 has continued to earn you 6% annually and the management fees remain the same. You would receive $4,110 in returns but you would pay $2,510 in fees. If we look at 20 years from now, you would receive $10,687 in returns growing your investment to $20,687 but you would have to pay $6,189 in fees. Look, I’m not trying to scare you or say that all management companies are the same but this is a very real example of how their fee structures work. I just want you to be fully informed and prepared before you consider using their services. The chart below summarizes this information for you to see clearly how it works.

INDEX FUNDS

Since the fees attached to having a fund manager are so high, what then is the alternative? The simple answer is Indexes. Index funds are easily understood, and provide a relatively safe approach to investing in broad segments of the market. They are used by less experienced investors as well as lifetime institutional investors with lots of investments. An easy way to understand index funds is to think of them as investing on autopilot.

Index investing is simple, relatively cheap, and continually generates good returns. Index funds provide:

- Simplicity. An Index makes broad-based market asset allocation and diversification easy.

- Management quality. Indexes eliminate investor concerns over management issues and reliability.

- Low operational expenses. Indexing is less expensive due to a lack of management fees, fewer costs, and less taxes.

- Performance. Multiple studies show that index funds have outperformed the majority of managed funds over a variety of time periods.

For these reasons fund managers continue to struggle in their performance compared to Index funds. What I mean, is that, yes it’s true many fund managers’ will earn a great deal back from their investment strategies but due to their high costs, they continually under-perform compared to their benchmarks. Those benchmarks being the S&P 500 or Dow Jones Indexes which measure a fund’s returns against the returns of a benchmark appropriate for that particular investment category. Time and again, the under-performance of actively managed funds against these index benchmarks is significant.

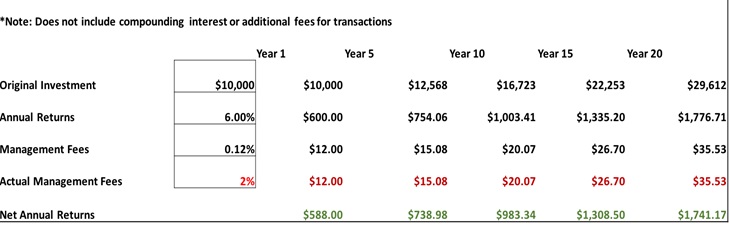

Let’s go ahead and take your $10,000 and see what your yearly costs would be if you invested in Index Funds. To start with, you don’t have a management fee so that is eliminated from the equation but you do have an operational fee. This fee can range from as low as 0.03% up to 0.12%. The great thing about this fee is that it only depends on the Index you invest in and not on how much you invest.

For our example let’s just keep it simplified and say your yearly return is the same as before at 6%. We’ll select 0.12% in operational fees just to give you an idea of the high end cost for owning an Index Fund.

Our calculations will remain the same, so 0.12% (operational fees) / 6% (annual returns) = 2% (total operational fees). Next, take 6% X $10,000 = $600 (net yearly returns). Then, take 2% X $600 = $12 (fees) or take 0.12% X $10,000 = $12 (fees). This means you actually earn $588 (net yearly returns – fees = actual earnings) from your investment. The chart below summarizes how much you could earn over the next 20 years.

To put it simply, after 10 years you would have earned $6,723 or $2,613 more from investing in an Index Fund versus using a fund manager. In 20 years, you would have earned $19,612 or $8,925 more! For some people, this may seem like a small amount to get excited over but to me and those who don’t like loosing money, these gains are huge! All I’m saying is that, you can earn a high amount either way but the costs associated with using a fund manager are much higher then that of investing in an Index fund. If you’re still not convinced, I’d recommend learning about the costs associated with both and then form your own opinion. That, or you can follow the advice of the greatest investor of all time, Warren Buffett. Let’s see what he has to say.

Want to learn more? Read up on the fees associated with actively managed funds:

- Investopedia: Pay Attention To Your Fund’s Expense Ratio

- Forbes: The Heavy Toll Of Investment Fees

- Bloomberg: An Investor’s Guide to Fees and Expenses 2014

- Betterment: Why Index Fund Portfolios Win

- AdvisoryHQ: Financial Advisor Fees in 2016

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.