The astounding rise in technology for the past decade has brought tons of convenience and ease into our modern life, such as PCs, smartphones and artificial intelligence (AI).

In the world of wealth management, financial institutions and Fintech startups have also launched Robo-advisor. It is an automated form of portfolio management where the public can spend minimal costs and little effort to start up their investing journey.

In this blog article, we will be deep diving into Robo-advisor to determine if this is a good platform for us to invest our money.

We are honored to have Syfe as our special guest speaker on our YouTube Channel to share more about their Robo-advisor platform. Click on the video to find out more!

WHAT IS A ROBO-ADVISOR?

A Robo-advisor is a digital investment platform or app where it offers automated, algorithm-driven financial planning & investment services to their customers.

Unlike traditional advisory, only individuals of high net worth can seek financial advice from wealth managers to plan for their financial future. A layperson can now have access to financial planning with Robo-advisor to invest and grow their wealth.

As Robo-advisor is operated on a digital platform, it involves minimal human intervention and thus the management fees are lower compared to traditional human advisors. In addition, the start-up capital to invest in a Robo-advisor can be as low as $100 or no minimum amount for certain platforms!

With these attractive features, one might be curious about how does a Robo-investor work before making a decision to invest in one.

In the following section, we will have a general overview of how a Robo-advisor works.

HOW DOES A ROBO-ADVISOR WORK?

To better understand how a Robo-advisor works, let’s see an example of John & Jane, a newly married couple who have big life goals and dreams to achieve together.

Both John & Jane are starting out their married life together, dreaming of owning their own house, traveling overseas and saving up for their future children’s education.

In order to achieve their life goals, one of the first thoughts is to start investing for their future as they know that solely working and saving are not the only way to achieve their dreams. After some research, they come across Robo-advisors which can help them to plan for their financial future and invest to grow their wealth.

To determine which platform that best suits their needs, they compared various Robo-advisors that are available in the market. There are a few factors that one needs to consider before deciding the right Robo-advisor platform to invest in which will also be covered in this blog article.

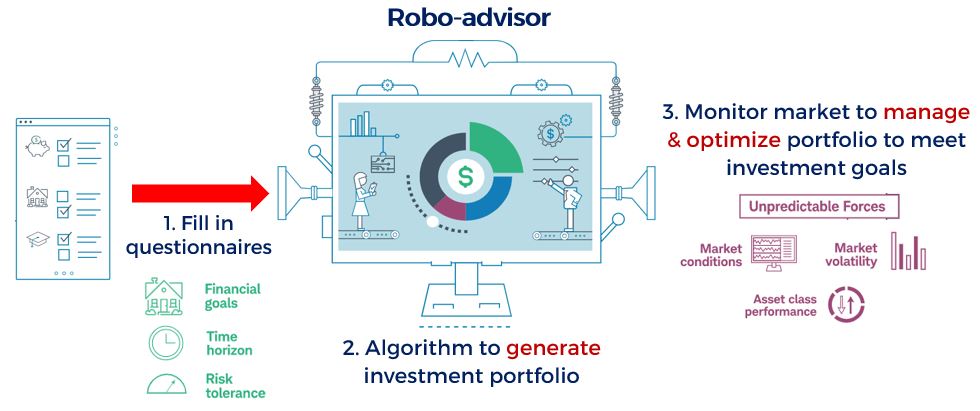

Once John & Jane have decided the right Robo-advisor to invest with, the first step is to fill in a series of questionnaires on the platform. The questionnaires include questions to find out their financial goals, time horizon, and risk tolerance that they can withstand in order for the Robo-advisor to suggest a suitable investing portfolio for them.

Based on their answers from the questionnaires, the Robo-advisor will use algorithms to generate a recommended investment portfolio that best suits their needs. At this stage, John & Jane can proceed with the recommended portfolio to start their investing journey with the Robo-advisor.

Along the way on their investment journey, there will be unpredictable forces in the stock market that may derail their financial goals, such as market volatility, recession or bear market. This is where Robo-advisors will automatically help their clients to monitor the current market condition to manage and optimize portfolios to keep John & Jane’s investment goal on track.

When the investment goal has been reached the time horizon as specified in the questionnaires, John & Jane can choose to continue their investment with the Robo-advisor or withdraw the money for their financial goals!

HOW TO CHOOSE A ROBO-ADVISOR?

So, how does one choose the robo-advisor that best suits their needs and financial goals?

Here, we listed out 7 factors for one to consider when exploring the right Robo-advisor for their investment goals.

- Management fees (approximately 0.2%-0.8% p.a.)

- Minimum investment amount to start investing. Varies with different Robo-advisor platforms (compared against 6 platforms in chart below)

- User experience on the platform for ease of using the platform interface and financial products available on the platform.

- Security of the Robo-advisor, such as storing personal details and financial information.

- License & regulation with the local authority, e.g. Money Authority of Singapore (MAS).

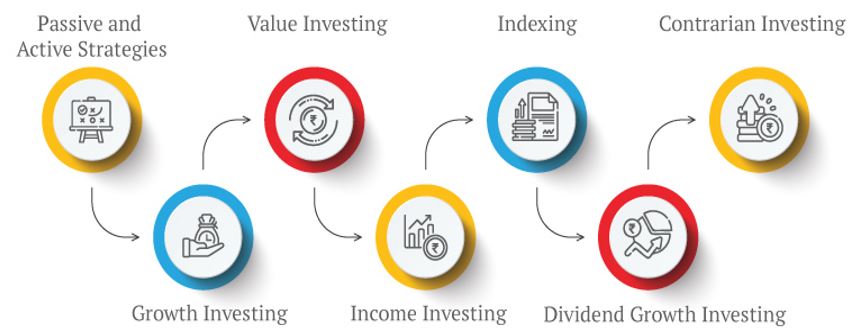

- Investing strategy applied by the Robo-advisor to invest money & grow wealth.

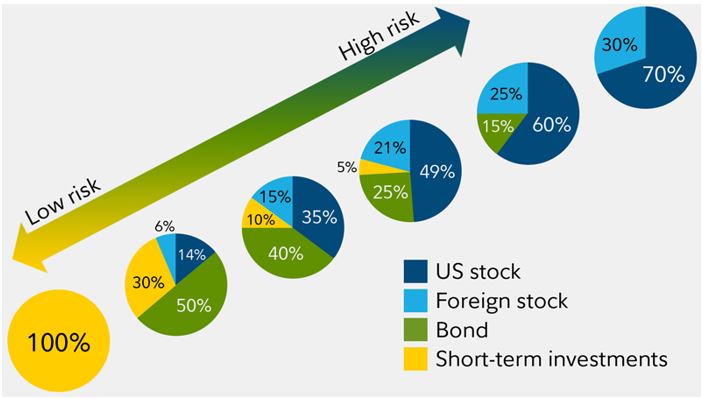

7. Portfolio diversifications based on time horizon and risk tolerance to generate the desired returns.

MANAGEMENT FEES

When we invest our money with financial advisors or Robo-advisors, there will be management fees imposed as the financial advisors are providing professional advice and helping us to manage our portfolio.

For traditional advisory, the management fees are usually an estimated 1%-2% of assets under management (AUM), whereas the management fees for Robo-advisors are usually below 1% of portfolio invested. This sounds not bad for a deal where all the hard work is done by professionals to grow our investments while we can relax and enjoy our lives!

Even though 1%-2% of management fees may not seem like alot (considering that we are keeping 98%-99% of our money to invest), nevertheless, it can compound to be a huge amount if we invest over a longer timeframe.

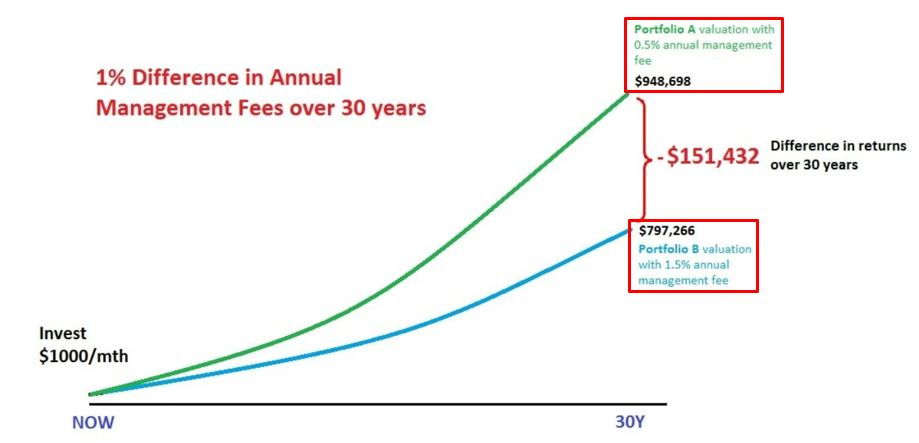

The example below illustrates the comparison of returns when 0.5% (Portfolio A) and 1.5% (Portfolio B) of management fees are imposed on our investments, assuming we start investing $1000 every month for the next 30 years.

Based on the chart above, we observe that there is a difference of $151,432 returns with a 1% difference in annual management fees over 30 years for Portfolio A and Portfolio B.

Thus, we can presume that the lower the management fees, the better our return is generated for the money invested.

However, won’t it be even better if there are no management fees imposed when we invest our money?

In our Value Investing Masterclass, we will show you how to invest and grow your money in a systematic and safe manner with no management fees. Click on the banner link above “MasterClass Registration” to find out more!

ROBO-ADVISOR THAT IS AVAILABLE IN SG MARKET

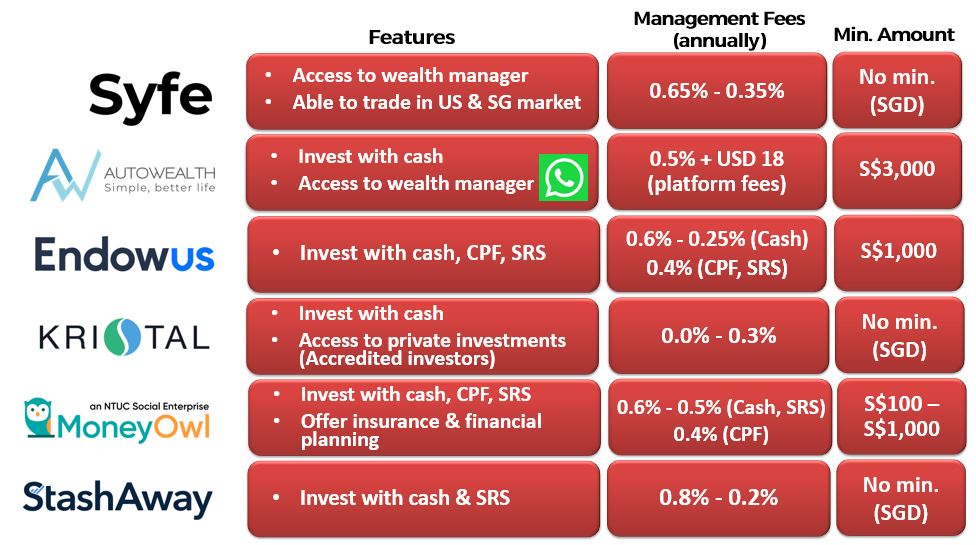

There are a number of Robo-advisors that are available in the Singapore market. Here, we have listed out 6 popular robo-advisors in Singapore:

The table below summarizes the unique features of the Robo-advisors, the management fees and minimum start-up capital that one needs to fork out when investing in these platforms (information as of Feb 2023).

PROS & CONS OF INVESTING IN ROBO-ADVISOR

In this section, we will also explore the pros and cons of Robo-advisors to further determine if this is a good platform for us to invest our money!

PROS

First, the onboarding process of Robo-advisor is easy and convenient as one can sign up over the app or PC. Personalized portfolios can be set up immediately based on personal investment goals and risk tolerance. Moreover, they have 24/7 access on the app or website which enables one to track their investments anytime, anywhere.

As these portfolios include various diversified assets, from ETFs to fixed income assets, it is able to spread out the risks and temper the market volatility, especially during market recession.

In addition, Robo-advisors offer an automated way for one to invest because Robo-advisors can automatically monitor and rebalance the portfolio every quarter or bi-annually, depending on the investment strategy applied by the different Robo-advisors.

CONS

For the disadvantages of investing in a Robo-advisor, there is limited personal interaction as it is operated on digital platforms. The recommended portfolio is generated based on algorithm and statistic data, instead of discussing face to face with a human financial advisor.

As the portfolios are generated from algorithms, it is usually a one-size-fits-all based on the overall statistics data gathered and one might not be able to customize their portfolio for their personalized needs.

In addition, most of the assets that Robo-investors invest in are tracking the index such as ETFs which is a form of passive investing strategy. It might have performance limitations and may be unable to generate higher return as active management over one’s portfolio.

CONCLUSION

To conclude, Robo-advisors offer an alternative way for the average Joe to invest their money in an automated manner based on their personal investment goals and risk tolerance with minimal start-up capital cost.

Even though it provides the convenience to kick-start one’s investment journey, the average Joe needs to take note that different Robo-advisor platforms will have different offerings for the products and services. Hence, one still needs to spend time to determine if the products offered suits their personal interest and financial goals.

For some who may prefer to invest on their own to generate the maximum return from the stock market instead of paying management fees and want to learn more about Value Investing in Singapore, click on the banner link above “Masterclass Registration” to find out more!

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.