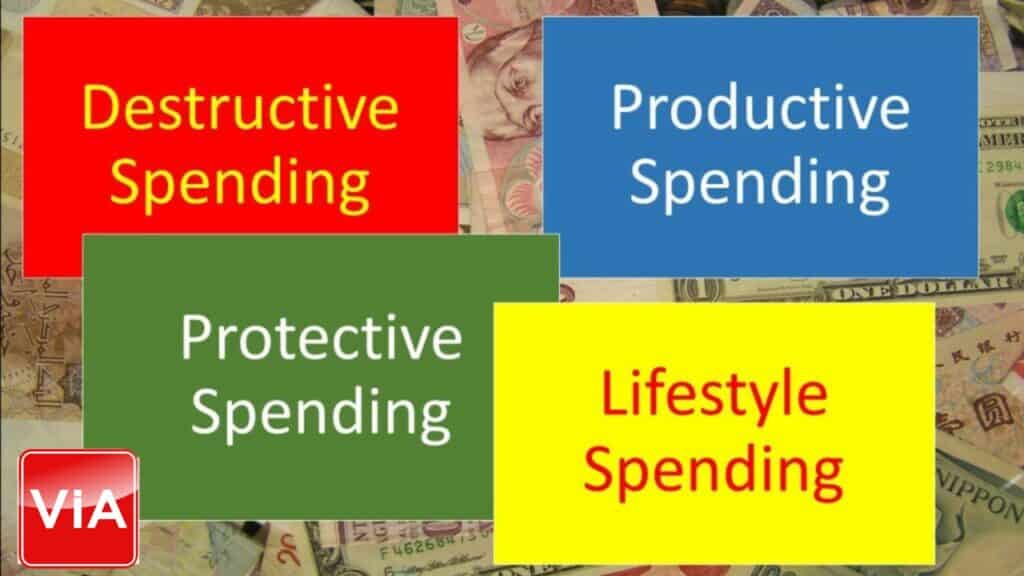

Here are the 4 ways to categorize your spending:

Jack’s financial situation was not looking good even after five years of being in the workforce. He spent most of his money on clubbing, holidays and women, leaving him with little savings and no investments. However, when he met Tianna, he realized that she was the one he wanted to spend the rest of his life with, and he needed to sort out his finances.

The story of Jack and Tianna is a common one. Many young people start their careers with a lot of energy, enthusiasm, and dreams. They want to enjoy life, travel, socialize, and have fun. They also want to make money and build a secure future. However, sometimes the balance between these two goals is lost, and they end up spending more than they earn, accumulating debt, and neglecting their financial health.

Instead of hiding his financial situation, Jack took a leap of faith and approached Tianna for advice. How did she do it? She was not rich but was certainly better off financially than him – and they had both been in the labour force for about the same number of years.

How did Tianna do it? Her advice was simple, “Categorize your spending and cull the non-essentials”. Apparently, she had read an article from a certain Garrett Gunderson, CEO of WealthFactory.com, and had followed the advice when she started working.

She suggests that Jack categorize his spending into four groups: destructive, productive, protective, and lifestyle. By doing so, Jack can see where his money is going and how he can make better choices.

Destructive spending includes all the expenses that harm one’s health, wealth, and relationships. These are usually impulsive, addictive, or harmful habits, such as smoking, drinking, gambling, overspending, and overeating. Jack realizes that he has been guilty of binge drinking and buying things he doesn’t need. He also realizes that these habits have been draining his energy, money, and time.

Productive spending, on the other hand, is the opposite. It includes all the expenses that generate income, growth, and well-being. These are usually investments in stocks, businesses, education, or health. Jack realizes that he has not been investing in anything except his pleasures. He has not been saving, budgeting, or planning for his future.

Protective spending is the third category. It includes all the expenses that provide security, safety, and peace of mind. These are usually insurance policies, emergency funds, or legal services. Jack realizes that he has been neglecting his protection, and he has not been insured or prepared for any unexpected events or disasters.

Lifestyle spending is the last category. It includes all the expenses that provide enjoyment, pleasure, and fulfillment. These are usually vacations, hobbies, gadgets, or personal care. Jack realizes that he has been living beyond his means, and he has not been able to differentiate between his wants and his needs.

Tianna’s advice is simple yet powerful. She suggests that Jack eliminate or reduce his destructive spending, increase his productive spending, optimize his protective spending, and balance his lifestyle spending. By doing so, Jack can save more money, invest in better opportunities, protect himself from risks, and enjoy life in a more sustainable and meaningful way.

Tianna also suggests that Jack learn about value investing, which is a method of investing in stocks that have a high intrinsic value but a low market price. By doing so, Jack can maximize his returns, minimize his risks, and build a diversified portfolio. Tianna explains that value investing is a long-term strategy that requires patience, discipline, and knowledge, but it can lead to financial security and freedom.

Jack is grateful for Tianna’s advice and support. He realizes that he has found not only a soul mate but also someone financially mature. He decides to follow her advice and learn more about value investing. He also decides to be more honest and transparent with Tianna about his financial situation and goals. He realizes that a true relationship is based on trust, respect, and communication, and that includes money matters.

In conclusion, Tianna’s advice is applicable to anyone who wants to improve their financial health and build a secure future. By categorizing your spending and focusing on value investing, you can make better choices, save more money, and achieve your goals. Remember that financial security and freedom are not only about money but also about meaning and purpose.

If you want to learn more about securing your financial future, you can sign up for a masterclass to learn about value investing and other financial strategies. By categorizing your expenses and investing in productive spending, you too can achieve financial freedom and live the life you want.