When people talk about the most famous value investor, Warren Buffett is the first name that came to mind. His stock investments are highly followed by the public due to his stellar performance record.

Charlie Munger, Michael Burry, and Joel Greenblatt are renowned value investors. They, like Warren Buffett, have beaten the stock market with their investing strategies.

In this article, we will be learning more from these famous investors on:

- Their investing strategies to grow wealth

- Top holding stocks in their portfolio

- Latest stock purchase in 2022

Without further delay, let’s jump right in!

Warren Buffett

Warren Buffett is an American billionaire investor and business magnate. He is currently the chairman & CEO of Berkshire Hathaway, an American Multinational conglomerate holding company headquartered in Omaha, Nebraska, US.

He is also the world’s sixth wealthiest person and the most successful value investor of his generation.

Buffett amassed his fortune through value investing. This involved buying undervalued stocks of quality companies and holding them long-term, while also investing only in businesses he understood, known as the Circle of Competence.

PERFORMANCE & PORTFOLIO

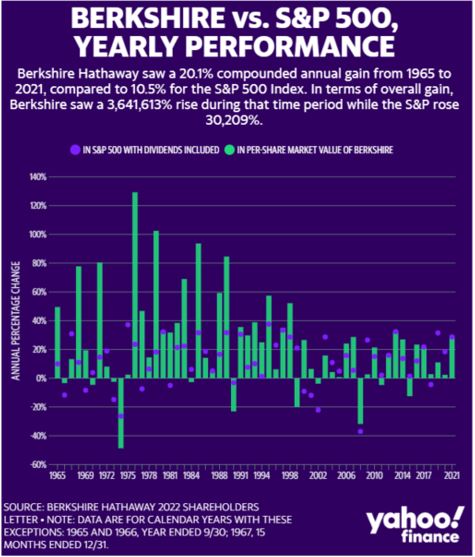

From 1987 to 2017, his portfolio generated a 14.9% annualized return. The latest Berkshire Hathaway Shareholders Letter revealed a 20.1% annual gain from 1965 to 2021, significantly outperforming the S&P 500’s 10.5% return.

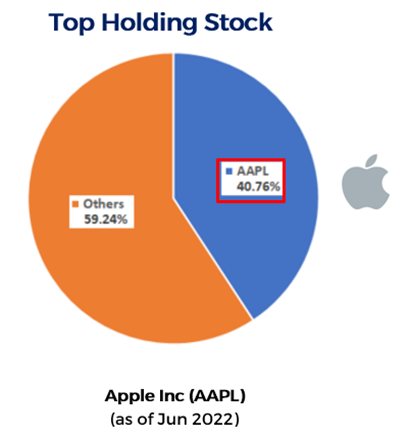

Buffett’s top holding stock in his portfolio is Apple Inc (AAPL), where it took up about 40.76% of his overall portfolio.

LATEST STOCK PURCHASE IN 2022

Buffett has made eight purchases of Occidental Petroleum (OXY) shares since June 2022. In September 2022, he acquired an additional 5.99 million shares, bringing his total OXY stake to 3.11%.

OXY is an American hydrocarbon exploration and production company where they produce energy and essential chemical products. The company has operations in North America, Middle East, Chile and Algeria.

It is operated in 3 business segments:

CHARLIE MUNGER

Charlie Munger is an American billionaire investor and the vice chairman of Berkshire Hathaway. He was a former real estate attorney before starting on his journey as a value investor. Munger is best known as Buffett’s closest business partner and right-hand man.

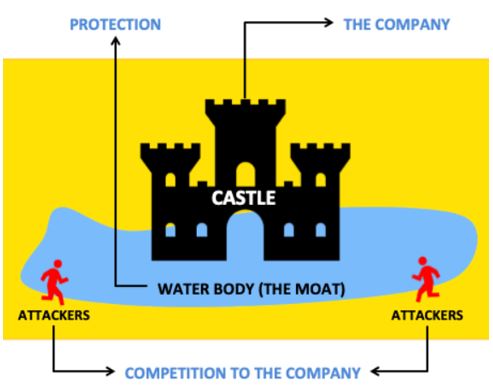

Like Buffett, Munger likes to invest in companies that have superior competitive advantage, known as economic moat. Companies with the ability to create strong economic moats outperform rivals by safeguarding market share and sales.

LATEST STOCK PURCHASE

Munger did not purchase any stock in 2022, but he famously purchased Alibaba Group Holding Ltd (NYSE: BABA) in 2021 when the share price was tumbling downwards.

Despite buying the stock three times as it fell, he had to sell half his stake in Q1 2022 to minimize losses. Nevertheless, Munger currently still owns 14.58% of BABA in his portfolio.

To find out why did Munger decided to purchase BABA in 2021, watch BABA’s financial analysis on our YouTube live!

BABA is a Chinese multinational technology company and the world’s largest online & mobile e-commerce platform. It provides consumer-to-consumer (C2C) and business-to-consumer sales platform under Taobao & Tmall.

The company also specializes in internet and technology where they offer shopping search engines, electronic payment services, and cloud computing services.

JOEL GREENBLATT

Joel Greenblatt is an American value investor, founder of hedge fund company – Gotham Capital and adjunct professor at Columbia University Graduate School of Business.

He is also the author of 3 investment books, and his famous book is “The Little Book that Beats the Market”. From this book, he has explained about his investing strategies, famously known as the “Magic Formula Investing”.

The Magic Formula Investing strategy allows an investor to look for cheap and good companies quantitatively with 2 main criteria:

- High earnings yield indicates that a company is cheap

- High return on capital indicates that a company is good

The investor evaluates companies based on two criteria, ranking them and adding the scores. Those with the lowest combined rank are deemed high-quality and undervalued.

PERFORMANCE & PORTFOLIO

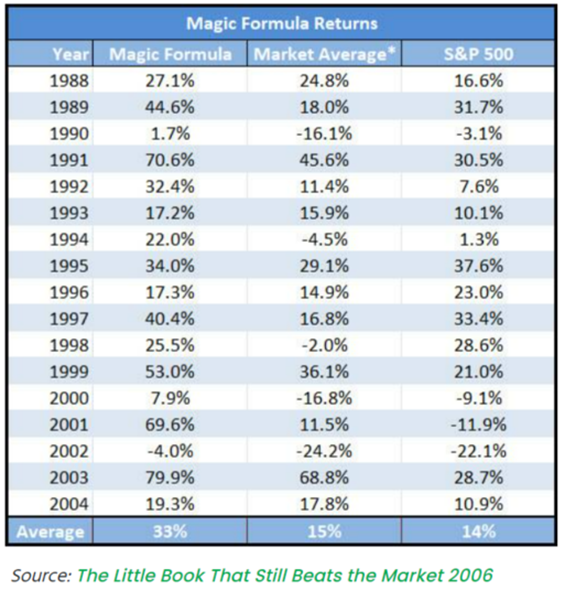

From 1988 to 2004, Greenblatt achieved an average annualized return of 33%, surpassing the S&P 500’s 14% return during the same period, as revealed in his book.

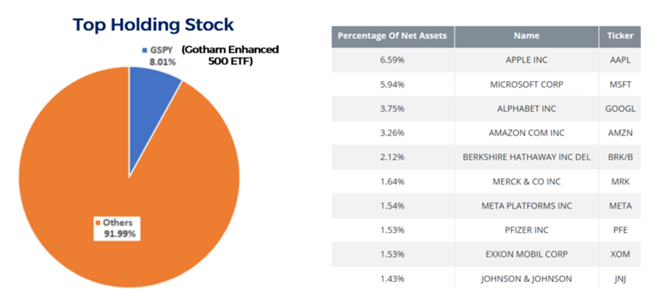

His current top holding position in his portfolio is his own fund’s ETF – Gotham Enhanced 500 ETF (GSPY), taking up approximately 8.01% of his overall portfolio. His top 10 holding stocks in the GSPY ETF is listed below that includes AAPL, MSFT and GOOGL, that has a slightly larger weightage compared to other companies.

LATEST STOCK PURCHASE IN 2022

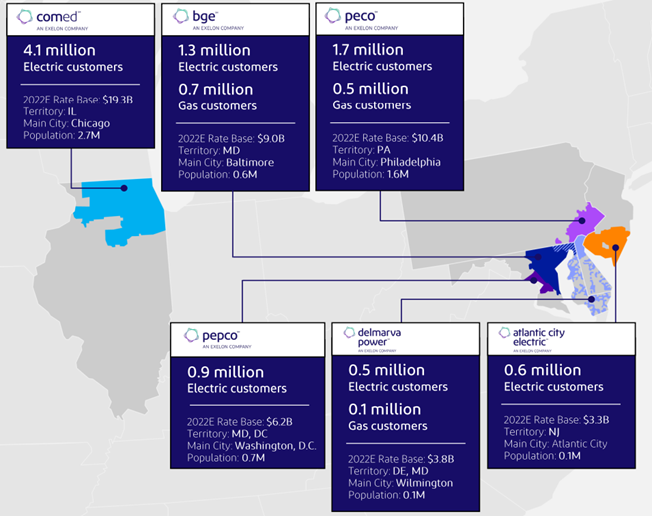

In Q2 2022, Greenblatt has bought about 373,000 shares of Exelon Corp (NASDAQ: EXC) at an average price of $47.02. EXC currently takes up about 0.63% of stake in his portfolio.

EXC is an American utility service provider company that provides electric power and natural gas to 6 states in the US.

MARC FABER

Marc Faber is a Swiss contrarian investor that is currently based in Thailand. He is also the publisher of Gloom, Boom & Doom report newsletter, which he is famously known as “Dr. Doom”.

When he invests, he likes to stick to investing with what he knows, which is his Circle of Competence. He will also analyse his investments based on risk to potential rewards and diversify his portfolio to minimize his risk exposure.

Asset diversification is a type of risk management where investors will minimize their risk by spreading out their investments in different asset class. Should one of the asset classes was badly affected during economic downturn, the other asset classes are not severely affected.

PERFORMANCE & PORTFOLIO

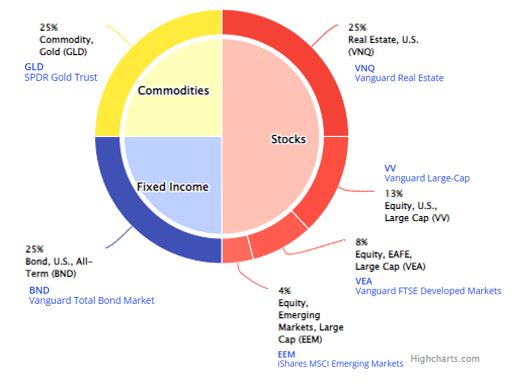

For the past 30 years, Marc Faber’s portfolio obtained a 7.35% compound annual return, where his portfolio is mainly made up of 6 ETFs:

- 50% on stocks

- 25% on bonds

- 25% on commodities, such as gold

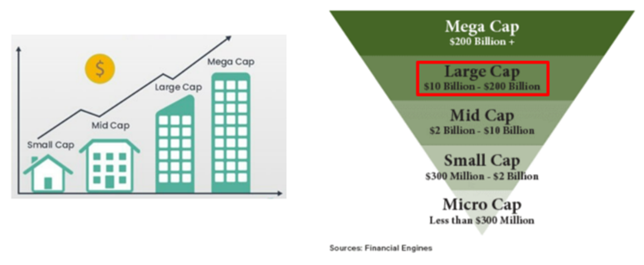

One of his ETF, Vanguard Large-Cap (VV) is made up of 584 large cap companies that covers 11 sectors of S&P 500.

Large cap companies are companies that have market capitalization value of $10 billion to $200 billion and highly preferred by investors due to their stability. (Market capitalization refers to the value of a company traded on the stock market, with the mathematical formula of multiplying the total number of shares by the current share price)

The ETF has generated an annual return of 12.65% for the past 10 years. The diagram below shows the top 10 holdings within the VV ETF.

MICHAEL BURRY

Michael Burry is an American investor who founded Scion Asset Management and a former physician. He is famously known for predicted and profited from the subprime mortgage crisis during 2007-2010. His story has also been filmed into a biographical comedy-drama movie in 2015 – “The Big Short”.

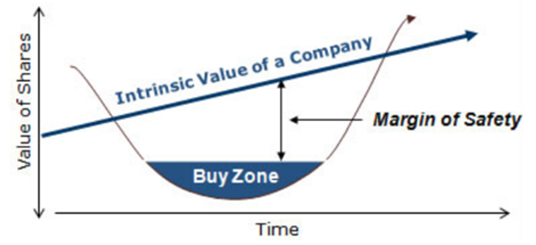

Michael Burry’s investing strategy is also based on Benjamin Graham’s classic value investing approach, as outlined in “Security Analysis”, which involves selecting stocks with a margin of safety.

Investors use margin of safety to protect against errors and limit potential losses. By researching a company’s background and calculating its intrinsic value, they can invest with confidence and reduce the risk of permanent capital loss.

PERFORMANCE & PORTFOLIO

His former hedge fund – Scion Capital had recorded a return of 489.34% between Nov 2000 to Jun 2008, beating S&P 500 that returned just under 3% over the same period. One of the reasons for the massive return success was due to his successful prediction on the collapse of the US subprime mortgage crisis in 2008.

He shut down Scion Capital in 2009 after the crisis and spent a few years as a private investor. In 2013, he started a new hedge fund – Scion Asset Management and managed to record returns of approximately 300% as of Jun 2022.

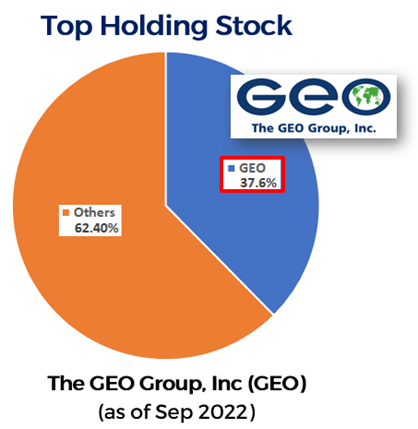

His current top holding stock in his portfolio is The Geo Group, Inc (GEO), which takes up 37.6% of his total portfolio.

LATEST STOCK PURCHASE IN 2022

In 2022, Burry made a bold move that shocked the investing community by selling all of the stocks in his portfolio and purchased only one stock, which is The Geo Group, Inc (GEO). He bought about 500,000 shares in Q2 2022, and further increased his stake in Q3 2022 to 2.02 million shares.

GEO is a real estate investment trust that specializes in detention facilities and community-re-entry centers. It has 102 facilities spanning across North America, Australia, South Africa and the United Kingdom.

The centers provide rehabilitation programs to individuals while they are in-custody and electronic monitoring devices after they are post-release into the community for behavioral tracking.

CONCLUSION

After going through the investing strategies of these 5 famous value investors, there are some common traits in these investors that we can learn from:

- They invest in good quality businesses that they understand, which is within their Circle of Competence.

- They only buy the company when the share price is cheaper than its intrinsic value – Undervalue.

- Different investors have their own risk tolerance and personal temperament when investing. As a result, there is no one-size-fits-all investing strategy.

Knowing which stocks famous investors have invested in is just one aspect of investment research. Performing due diligence on those stocks is essential to determine whether they are worth investing in. Understanding a company’s financial statements is a critical step for investors to make informed decisions about where to invest their money.

If you would like to know how to invest in good quality businesses and buy them at their intrinsic value, sign up for a Value Investing Masterclass and learn how to generate 3 streams of passive income for a lifetime!

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.