Due to rising inflation, recently local SG banks have increased their interest rates for both savings accounts and fixed deposits which triggered saving frenzy among Singaporeans.

Moreover, this has also spiked interests among investors if now is a good time to buy SG banks with the rising interest rates.

In this blog article, we will deep dive into one of Singapore’s top 3 banks – DBS Bank Limited to learn more about how do the banks operate and generate income while also considering if we should invest our money into this Asia’s safest bank.

DBS BACKGROUND

DBS Bank Limited is a Singapore multinational banking & financial services corporation. It was founded by Singapore Government in 1968 as The Development Bank of Singapore Limited to take over the industrial financing activities from the Economic Development Board.

It has a credit-ratings of “AA-” by Standard & Poor’s and “Aa1” by Moody’s. Both credit ratings rated DBS as a high-quality bank with low risk of default on obligations. DBS is recognized as the “Safest Bank in Asia” for 13 consecutive years (2009-2021) and has received multiple accolades from Euromoney, The Banker and Global Finance.

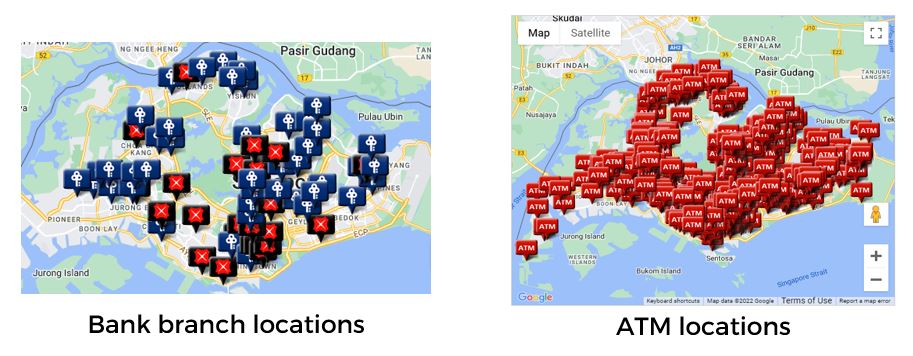

In 1998, DBS acquired POSB bank to expand their market share in Singapore where currently there are 25 DBS branches, 46 POSB branches and 691 ATM locations island-wide in Singapore (as of Sept 2022).

DBS also offered a wide range of financial products & services in 14 markets worldwide:

They have 6 key market operations located in these countries:

- Singapore

- Hong Kong

- India

- Indonesia

- China

- Taiwan

DBS is listed on the Singapore Stock Exchange (STI) with ticker symbol as D05.

PRODUCTS & SERVICES OFFERED BY DBS

DBS operated in 3 main CORE business segments to offer various banking products to individuals and corporates:

CONSUMER BANKING / WEALTH MANAGEMENT

For Consumer Banking, DBS provides everyday banking services to mass public to manage their finances and store their money in bank accounts. DBS also offer insurance, loans and investment services for the public.

Whereas for Wealth Management, DBS provides exclusive banking services to high-net-worth individuals and have financial advisers to manage their wealth, such as wealth planning. There are 3 tiers for the Wealth Management segment:

DBS Treasures

- Individuals with investible assets of more than $350K

DBS Treasures Private Client

- Individuals with investible assets of more than $1.5 million

DBS Private Bank

- Individuals with investible assets of more than $5 million

The diagram below listed out the banking services provided by Consumer Banking & Wealth Management segments.

*DBS Treasures does not include Wealth Planning services

INSTITUTIONAL BANKING

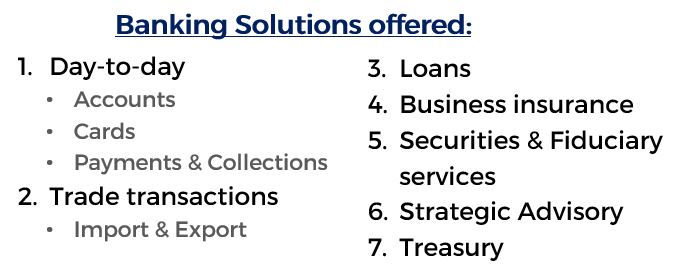

DBS also offers various banking solutions to corporates in 12 industries & SMEs in 3 industries as shown in the diagram below.

Some of the banking solutions offered to both corporates and SMEs that enhance their finance operations includes:

In addition, DBS also offer innovative digital solutions for their corporate clients, such as:

- Partior – Blockchain-based payment solutions

- DBS IDEAL – Integrated transactions platform

- FIX Marketplace – Automated fixed income execution platform, e.g. bonds

- DBS Digital Exchange – Online trading platform

TREASURY MARKETS

Treasury Markets is the investment banking division of the bank where they provide investments and risk coverage needs (such as hedging) to institutional and corporate customers.

Foreign Exchange

Interest rates

Investments

- Fixed income products (bonds)

- Equity / ETFs

- Structured products

Futures (Derivatives)

DBS REVENUE GENERATION

In this section, we will find out how does bank generate revenue from the banking solutions & services offered.

Banks generally earn money from two main sources of income:

- Interest Income

- Non-interest income

What do these 2 sources of incomes mean?

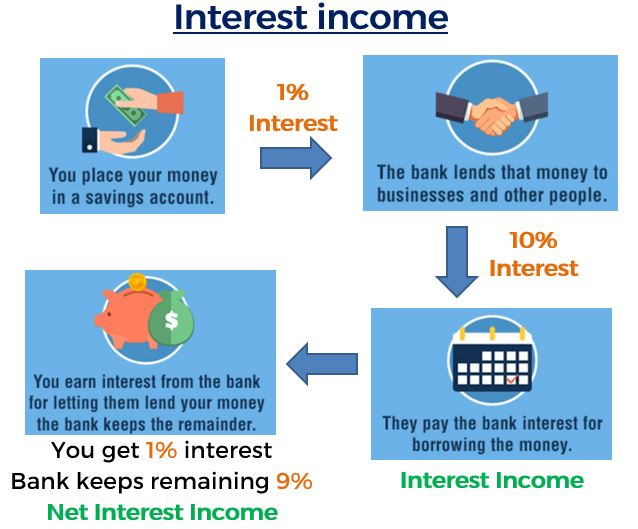

Interest income refers to the income that was generated by providing loans to individuals or businesses and charge interests for the money loaned to them. The chart below illustrates the process of how the bank generates interest income.

For Non-interest Income, the income is generated from fees or commissions of the services provided, such as:

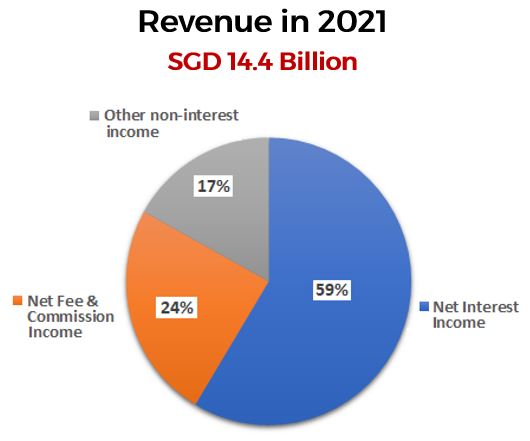

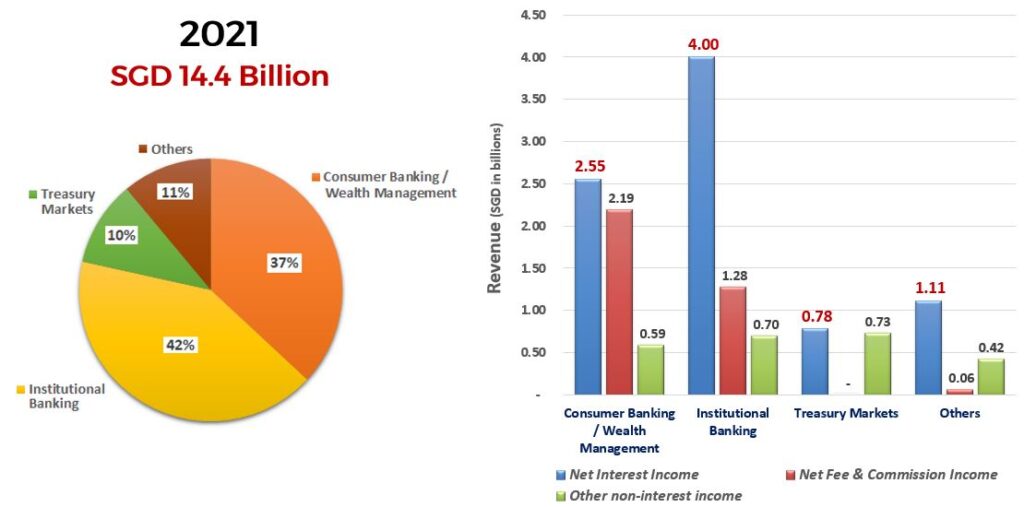

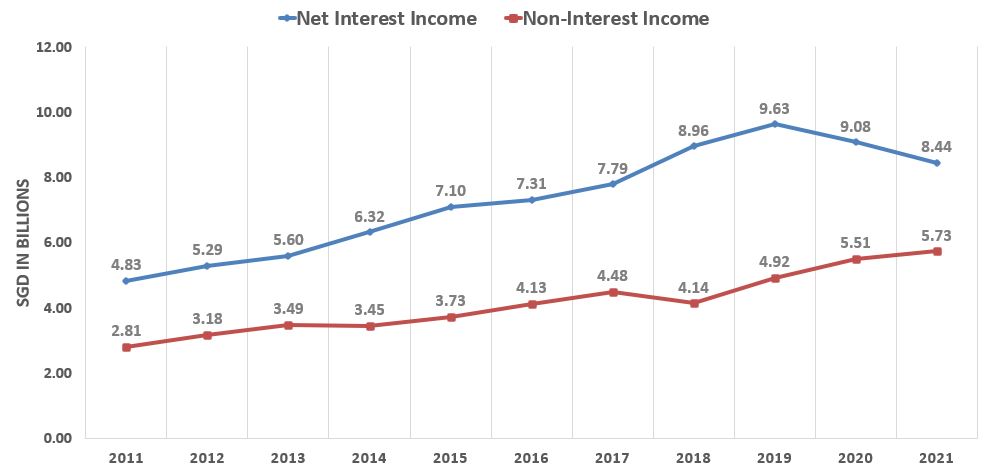

In 2021, DBS bank generated a total of SGD 14.4 billion, where 59% of the income came from Net Interest Income, 24% came from Net Fee & Commission Income and the rest (17%) came from Other Non-interest Income, such as income from investment securities or trading.

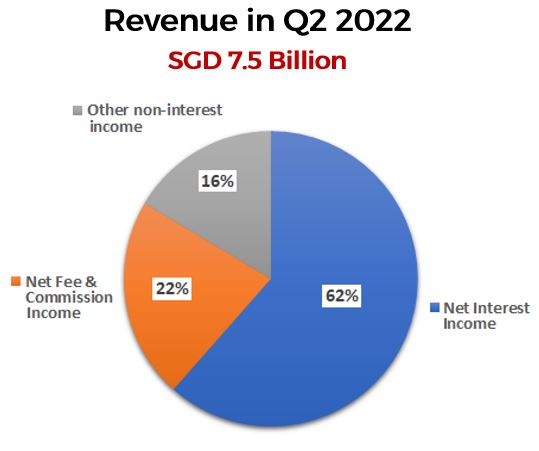

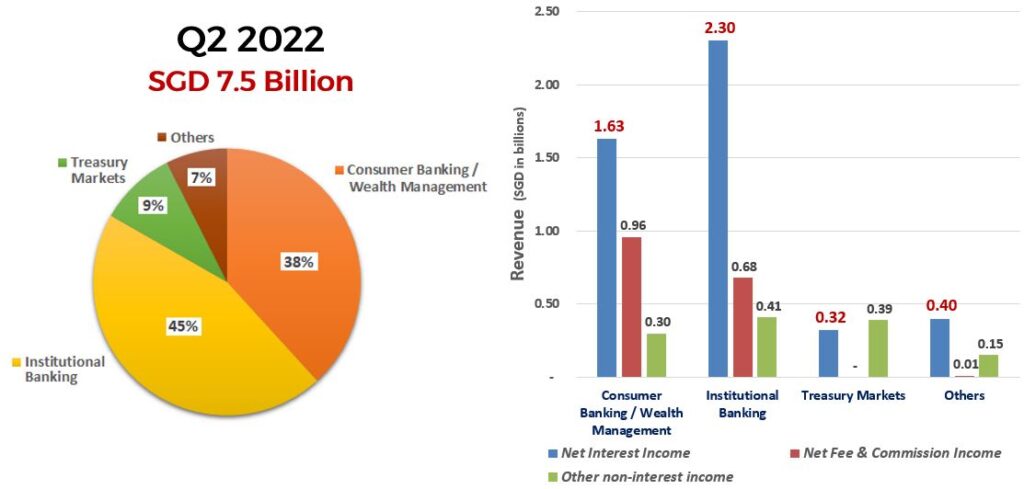

A total of SGD 7.5 billion was generated in Q2 2022. We observed that there was an increase in the Net Interest Income to 62% in Q2 2022. 24% of the revenue was generated from Net Fee & Commission Income and 17% was from Other Non-Interest Income.

In terms of business segments, 42% of the revenue was generated from Institutional Banking, followed by Consumer Banking / Wealth Management (37%), Others (11%) and Treasury Markets (10%) in 2021. Most of the income generated from Institutional Banking, Consumer Banking / Wealth management were from Net Interest Income as per shown in the chart below:

Revenue by Business Segments (2021)

In Q2 2022, Institutional Banking still contributed the largest portion of revenue, which makes up about 45% of the total revenue of SGD 7.5 billion. 38% of the revenue in that quarter came from Consumer Banking / Wealth Management, followed by Treasury Markets (9%) and Others (7%).

Revenue by Business Segments (Q2 2022)

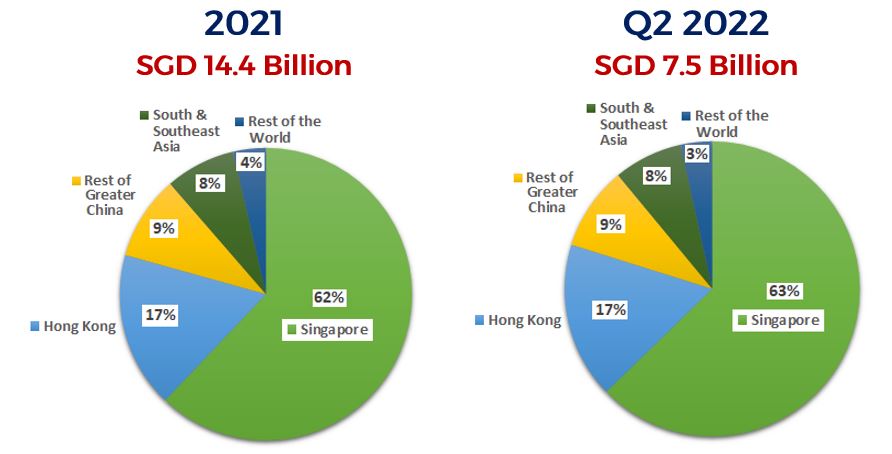

For geographical regions, a large portion of the revenue were generated from Singapore, approximately 62% and 63% respectively. The second largest portion of the revenue was contributed from Hong Kong (17% in 2021 & Q2 2022) and followed by the rest of Greater China (9% in 2021 & Q2 2022), South & Southeast Asia (8% in 2021 & Q2 2022) and rest of the world (4% in 2021 & 3% in Q2 2022).

Revenue by Geographical Regions

From the products & services offered by the 3 business segments, DBS provided a well-rounded banking solutions to both their individual & corporate clients! Furthermore, their stellar reputation as the best bank in the world has helped them to increase their institutional banking revenue from 42% to 45% between 2021 to Q2 2022!

Let’s get on with our deep dive to find out how DBS plans to expand their operations for the next few years and compete with the upcoming Fintech start-ups!

FUTURE PLANS OF DBS

DBS has made several strategic plans to expand their banking services not only to overseas regions but also adopting the latest technology to offer digital banking solutions.

DIGITALIZATION (TECHNOLOGY ADOPTION)

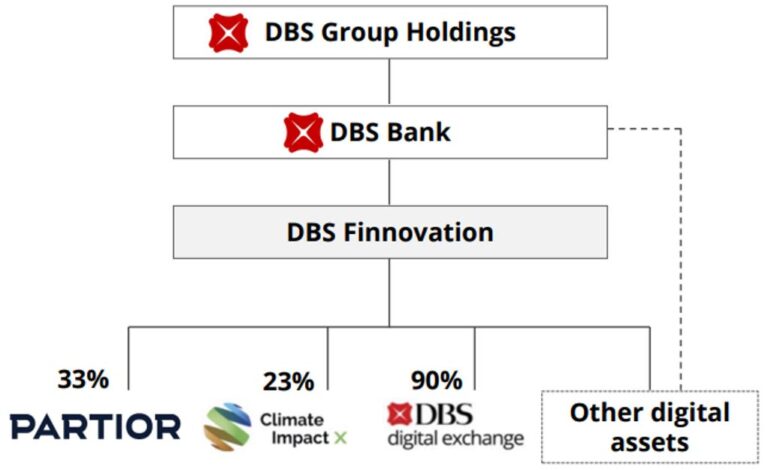

DBS Finnovation was set up in 2020 to offer innovative digital banking solutions to their corporate clients. Currently, there are Partior (blockchain-based payment system), Climate Impact X (carbon credit tracking) and DBS digital exchange (trading platform for digital assets) in operation.

DBS also incorporated DBS Tech India to fuel the next wave of digital transformation for the bank where they plan to adopt the latest technology to design and develop superior banking solutions for their clients. These are some of the technologies that they are exploring into:

OVERSEAS EXPANSION IN ASIAN MARKETS

Currently DBS has announced their overseas expansion plan in 4 Asian countries to strengthen their key market operations:

India

- Acquisition of Lakshmi Vilas Bank (LVB) to expand their presence in Southern India while scaling up the consumer & SME business offerings.

Shenzhen, China

- Invested 13% of stake in Shenzhen Rural Commercial Bank (SZRCB) to accelerate their growth in the Greater Bay Area (GBA).

Taiwan

- Acquisition of CitiGroup Consumer Banking to speed up DBS Taiwan’s growth.

Hong Kong

- Received approval for investment products to GBA customers as there are more than 6 million affluent households in the GBA region.

ECONOMIC MOATS

In order to provide banking services in Singapore or the rest of the world, a financial institution will need to obtain a banking license from the government. Otherwise, without a banking license, that financial institution is not allowed to help their clients to store or keep their money. As such, DBS owns a banking license as it is an established bank in Singapore since 1968.

In addition, DBS is a well-known bank, especially among Singaporeans as it was founded in 1968 and acquired POSB bank in 1998. Thus, it has a wide customer base and has brand loyalty where the clients trust DBS will keep their deposited money safe, not fearing the bank will go bankrupt and lost all of their hard-earned money.

DBS banking services is available in 14 markets worldwide, especially in 6 key markets where they provide various banking solutions to individuals and corporate clients. They are also expanding their digital ecosystem by providing new digital banking solutions to their clients which further increase their distribution network of banking services offered.

COMPETITORS

There are a wide range of traditional banks operating in Asia and the diagram below shows some of the well-known traditional banks in Singapore:

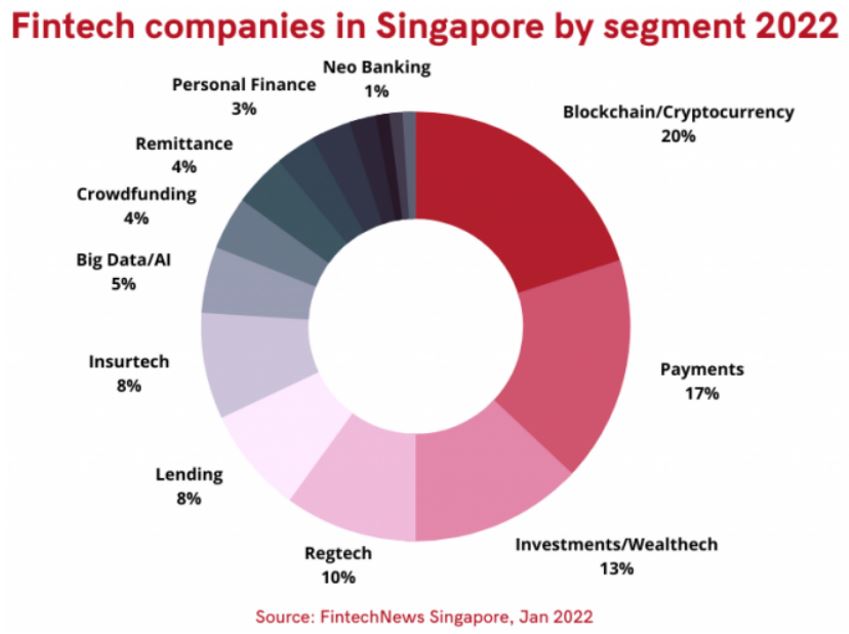

Other than traditional banks, DBS is also in direct competition with some Fintech start-ups that is involved in payments, lending, and the latest digital banks. We have also deep dive into one of the largest neobank in Latin America – NuBank.

In 2020, Singapore Government has awarded digital bank licenses to these uprising companies to provide digital banking services to the Singaporean community. As a result, the Singaporean community will have more selections to choose if they wish to save their money or perform financial matters in a traditional bank or a new digital bank.

FINANCIALS OF DBS

For this section, we will investigate the financial numbers of DBS to determine if this bank is good and worthy investment opportunity.

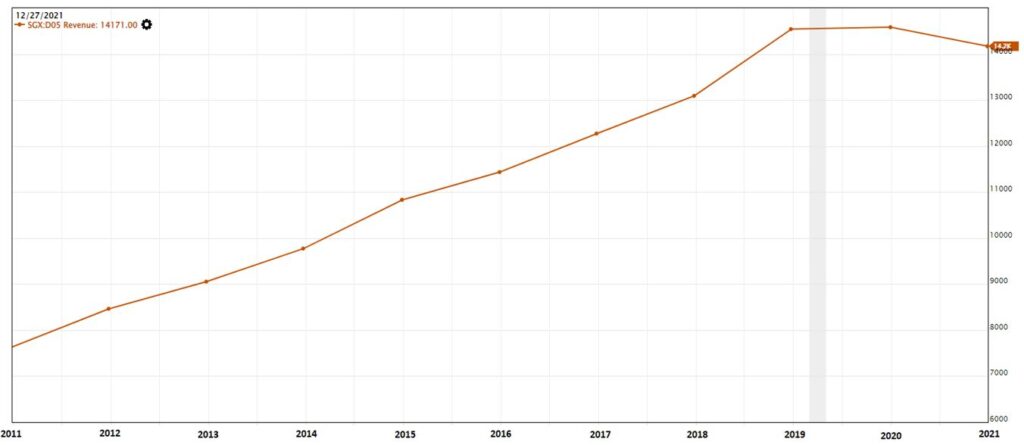

From 2011 to 2019, the Revenue for DBS has been on increasing trend. However, the revenue trend has been stabilized in 2020 and encountered a slight downturn in 2021. We are curious that why did this happened, and we checked into the revenue generation numbers of the bank, which is their Net Interest Income and Non-interest Income.

Both income sources have been in uptrend since 2011, but for Net Interest Income, it had been in downward trend since 2019. As almost 60% of the revenue generated in 2021 was from Net Interest Income, the drop in the Net Interest Income also affected the total revenue of DBS.

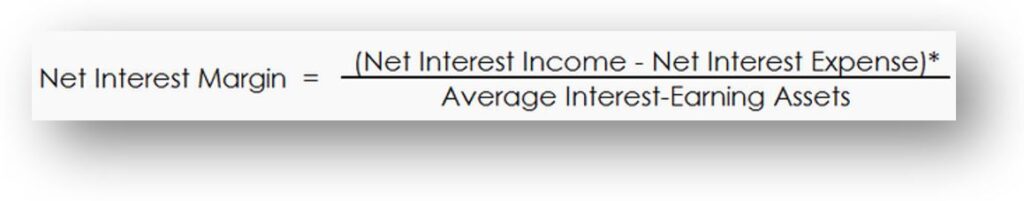

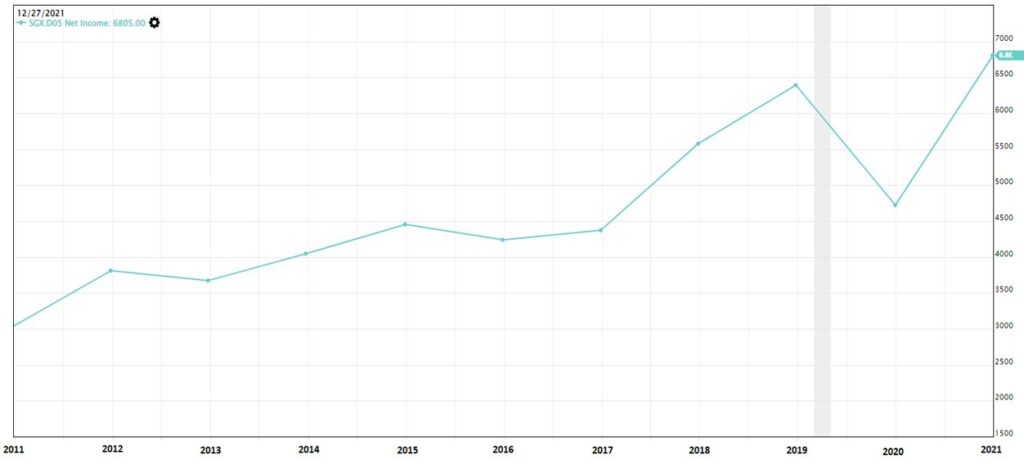

To further determine the profitability of the bank, we also look into another financial criteria – Net Interest Margin (NIM) % . NIM (%) measures the difference between the interest income generated and interest expense paid to their lenders or depositors. Based on the equation below, if there is an increase in the Net Interest Income, there will also be an increase in the NIM (%).

The chart below shows the NIM (%) of the three banks for the past 5 years.

Annual reports of 3 banks

Even though there is a drop in the NIM (%) in 2020 and 2021 during the COVID-19 pandemic for all 3 banks, DBS still has higher NIM (%) average compared to the other 2 banks.

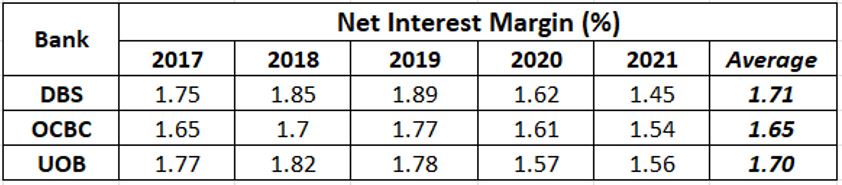

For the past decade, the Net Income for DBS has been on increasing upward trend, except for 2020. This was found out that in 2020, DBS had increased in allowances for credit, i.e. increase in loans and advances to customers during the COVID-19 pandemic. As a result, there was a sharp drop in Net Income for 2020.

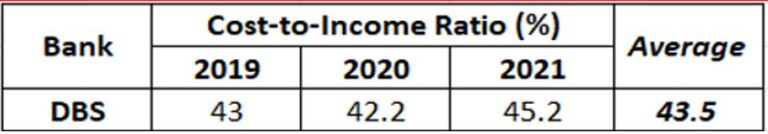

In this article, we will also explore 3 other financial criteria that are specifically being used to measure the financial performance of the bank. The first one is Cost-to-Income ratio.

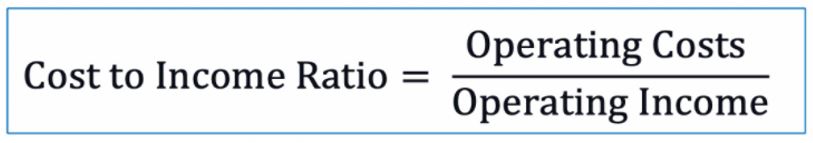

Cost-to-Income ratio assess the profitability of the bank and the mathematical formula is shown below:

When the operating costs decreases, this ratio will also decreases. Thus, the lower the ratio implies the higher profitability of the bank. The average ratio for banks is 0.4 – 0.6. For the past 3 years, DBS’s cost-to-income ratio is about 0.44% of 3 years average.

2021 Annual report and Q2 2022 Quarterly Report

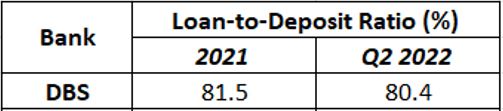

The next financial criteria we will check for bank is Loans-to-Deposit (LDR) ratio. As Net Interest Income is the major source of income for banks, it is crucial to know how effective is the bank lending out the deposited money to earn the interest income.

The ideal LDR ratio is 80%-90%, which means that for every $1 received in deposits, the bank loans 80-90 cents to borrowers. For DBS, the latest result in LDR is 81.5% (2021) and 80.4% (Q2 2022).

2021 Annual report and Q2 2022 Quarterly Report

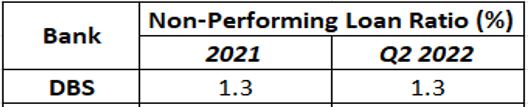

The third financial criteria to assess the bank financial performance is Non-Performing Loans (NPL), which measures the percentage of how much loans that the bank has loaned out (Total Loans) and the borrower has not been able to make repayments of principals or interests for at least 90 days (Nonperforming Loans).

The ideal ratio for NPL is less than 6%, which means that the lower the NPL ratio, the lower amount of non-performing loans that the bank has. The NPL for DBS is 1.3% for both 2021 and Q2 2022. Click here to compare the NPL of another bank!

2021 Annual report and Q2 2022 Quarterly Report

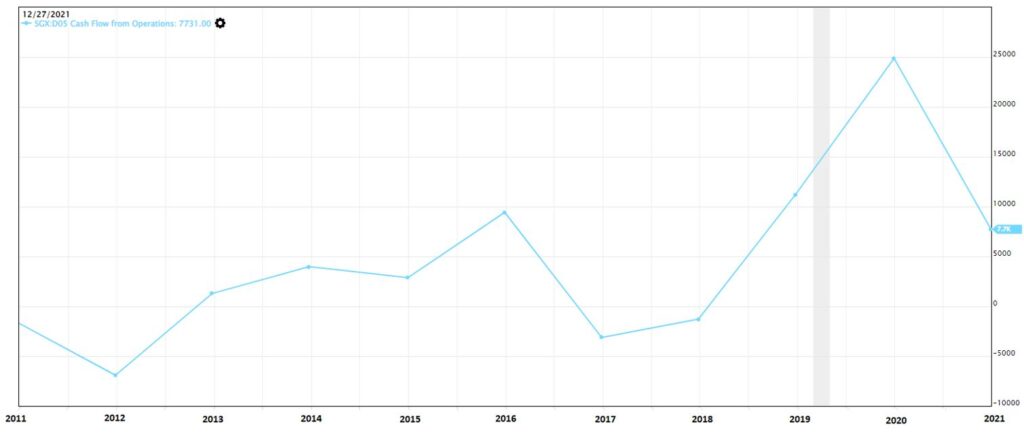

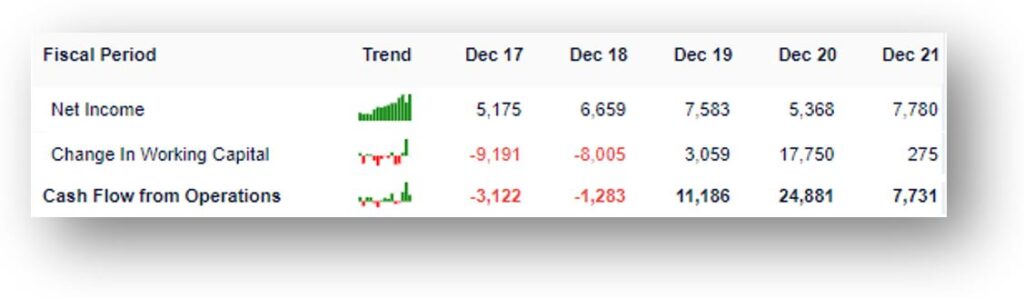

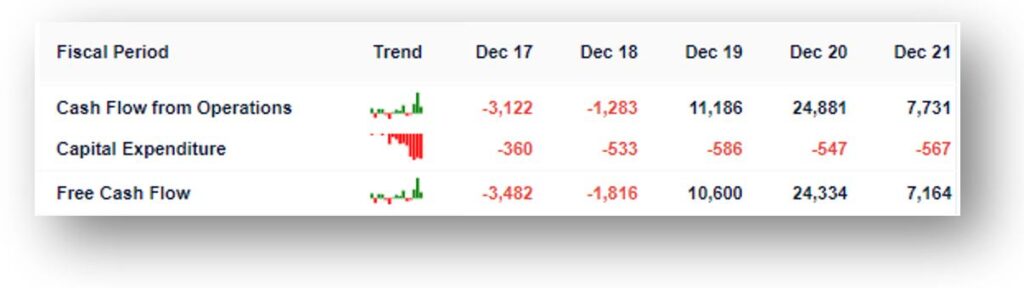

In addition, we also checked on the cash flow situation of the bank.

Since 2018, DBS has increasing Operating Cash Flow until 2020 before it had a drastic drop in 2021. Operating cash flow is the cash flow generated from the bank’s normal business activities. Investigations into their annual reports found out that in 2021, there was a sharp drop in their working capital, which is the capital used in day-to-day business operations. As a result of that, it severely affected the operating cash flow in 2021.

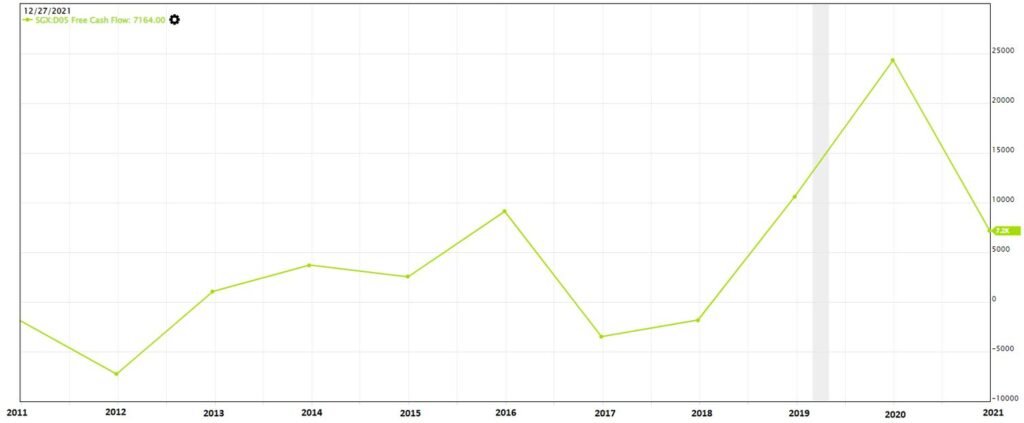

For the Free Cash Flow, which is the cash flow available for the bank to use after deduction of the Capital Expenditure, it has similar trend as the Operating Cash Flow, where there was a sharp drop in 2021.

In their financial report, we noticed that the sharp drop for Free Cash Flow in 2021 was due to the drastic decrease in their operating cash flow. Nevertheless, the capital expenditure (expenses used to purchase assets that will last more than 12 months) remains fairly stable for the past 5 years.

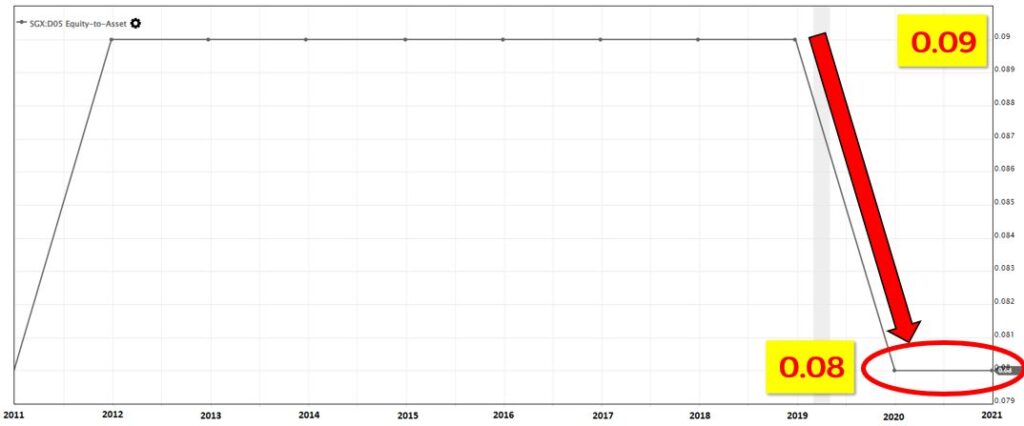

Finally, we also looked at the debt level of the bank. For this, the financial criteria that we used is Equity-to-Asset ratio. This ratio determines how much of the company’s assets are owned by investors and not leveraged. According to value investing philosophy, Equity-to-Asset ratio should be more than 0.07.

Although the ratio dropped from 0.09 to 0.08 in 2020, it had maintained at 0.08 in 2021. Based on the criteria mentioned above, this is considered a pass as the bank is not overly leveraged.

POTENTIAL RISKS

Even though DBS’s financial numbers are considered good based on the value investing methodology criteria, we also need to consider any potential risks that might be lurking in hidden places that we are not aware of.

One of the potential risks is the current high interest situation that the world is facing. When the interest rate is high, it is harder for borrowers to borrow money as they will need to pay higher interest for their loans, as per shown in the article below:

As a result, individuals or corporates might turn to other financial institutions to borrow money:

If there is a drop in number of borrowers for loans, this will also affect the bank’s revenue and net interest income as one of the income sources of bank comes from providing loans.

With the advancement of technology, more Fintech start-ups are being incorporated and providing even more convenient payment or banking solutions to the mass public.

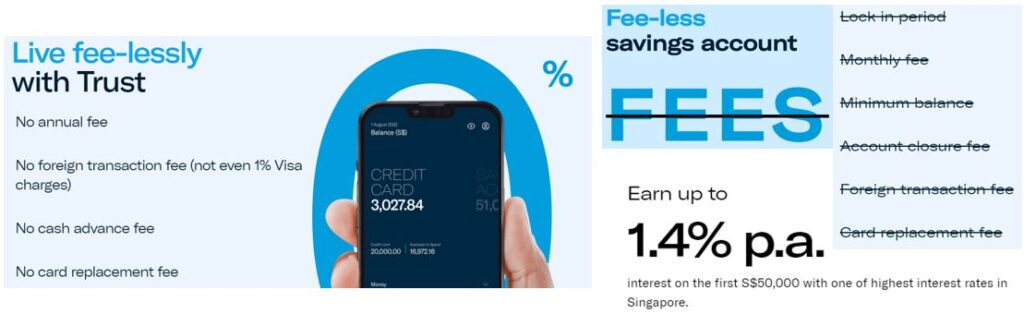

In Singapore, the latest digital bank – Trust Bank was launched on 1 September 2022, backed by combined partnership between Standard Chartered Bank and Fair Price Group. It has managed to reach 100,000 customers in just 10 days after the official launch.

Some of the attractive benefits offered by the new digital bank includes fee-less for credit card and higher interest rates for savings account (1.4%) might have attracted the mass public to start a banking relationship with Trust Bank.

The public may also consider changing from traditional banks who have lower savings interests to the newer digital banks that offer much more attractive perks.

CONCLUSION

As a conclusion, DBS is one of the top 3 banks in Singapore that has a credit-ratings of “AA-” and “Aa1” by both Standard & Poor’s and Moody’s which indicate that this is a high-quality bank with lower risk of default. Hence it is considered one of the safest and trustworthy banks in Asia region.

However, the high interest rates environment after the COVID-19 pandemic may further affect their interest income, which might directly impair their revenue and financial performance of the bank. In addition, although DBS is proactively involved in the digitalization of the banking solutions, it also faces stiff competitions against other FinTech start-ups that are growing rapidly in recent years.

All in all, DBS as one of the best banks in the world will have savers rest assured that their deposited money is safe with this bank. Nevertheless, investors are strongly encouraged to perform further due diligence to determine if this is a good company to invest in and add into their investment portfolio.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.