INTRODUCTION

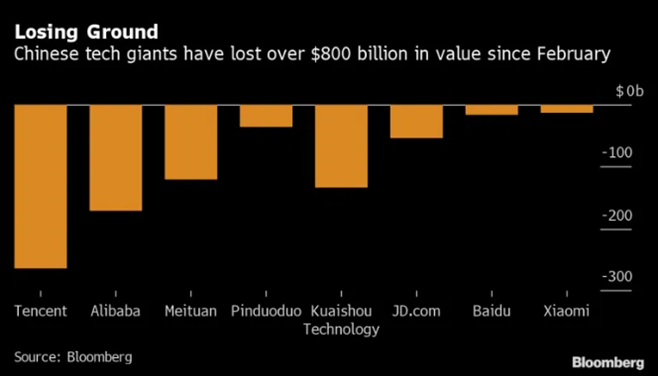

Today we explore the nail-biting, edge-of-the-seat saga of the Chinese regulatory clampdown where they have, among other measures, revoked approvals to go public, levied antitrust fines, forced a company to relinquish exclusive deals and worst of all, sent an entire industry sector to the guillotine.

We also analyze the situation from the investor’s perspective.

Let’s begin!

SO, WHAT’S HAPPENING IN THE INFAMOUS REGULATORY CRACKDOWN IN CHINA?

It all began with Jack Ma criticizing state-owned banks for having a “pawnshop mentality”. Next thing we see – the suspension of Ant group’s US$35 billion IPO in November. The company lost $70 billion in revenue. Not to mention, after this debacle, Ma disappeared from public sight.

Soon after, an anti-monopoly probe was launched against Alibaba after which it was fined 18.2 billion yuan ($2.8 billion) to punish their anti-competitive merchant exclusivity program.

Soon after, an anti-monopoly probe was launched against Alibaba after which it was fined 18.2 billion yuan ($2.8 billion) to punish their anti-competitive merchant exclusivity program.

Following this, at least 34 companies belonging to a range of sectors were fined 500,000 yuan ($75,000) each for failing to disclose mergers, signing exclusive contracts, misleading marketing tactics and other irregularities.

It doesn’t end there. Ride hailing company, Didi’s bumper IPO was the largest in the US by a Chinese firm since Alibaba’s 2018 listing. However, Didi’s decision to go public despite pushback from Chinese regulators did not bode well for the company:

- A review was launched.

- New user registrations were suspended.

- Didi’s apps were removed from the app stores.

- 7 Chinese regulatory authorities carried out cyber-security sweeps at Didi.

Continuing the embargo, the regulator issued new rules for the protection of the hard-pressed drivers of food delivery platforms like Meituan which was already facing anti-trust probes.

Further, Tencent’s plan to merge the country’s top 2 videogame streaming sites, Huya and DouYu, was blocked by regulators on anti-trust grounds.

If that wasn’t enough, Tencent and its affiliates were ordered to relinquish their exclusive music rights.

A draft rule released by cyberspace authorities requires platforms with more than one million users to submit to cybersecurity reviews before foreign IPOs. This could deter investors and companies from future listings. Sure enough, Bike sharing platform, Hello, and a Pinterest-like app, Xiaohongshu have put listing plans on hold after this update.

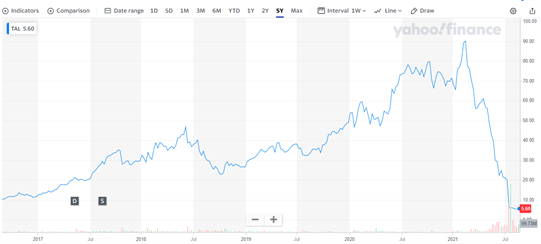

Continuing with the clampdown, the authorities now descended as hard as Thor’s hammer upon the ed-tech sector. Coming as a major blow to the country’s US$100 billion+ private education industry, all institutions offering tutoring on the school curriculum will be required to be registered as non-profit organizations, and no new licenses will be granted. They will no longer be able to raise capital abroad. Furthermore, classes on weekends and holidays will be banned.

This triggered a massive sell-off in the shares of companies including US-listed TAL Education Group and Gaotu Techedu. The sector tumbled more than 90% in a few days!

5-Year chart of TAL Education Group

BUT WHY IS BEIJING SLAUGHTERING ITS OWN “UNICORNS”?

The all-powerful CCP has its own reasons for this sweeping clampdown.

THE GENERAL REASON:

Keeping control reflexes and national pride aside, it appears that the entire tech crackdown has 3 main objectives:

- To curb monopolistic practices

- A complete overhaul of the data security of people

- To keep a check on capitalist “excess”

Beijing is keeping a tight rein on tech giants for the sake of national security and anti-trust concerns.

The CCP is uncomfortable with the mountain trove of personal data that the big tech is collecting through their “super-apps” and other technologies about aspects ranging from transport habits, spending habits (or how busy a CCP official is). By keeping the big tech giants in check, it wants to loosen their grip on the daily lives of consumers by reprimanding and fixing anti-competitive practices and protecting the personal information of the customers.

In China, you can be too big to fail, as well as too big to win!

REASONS FOR IPO SUSPENSION OF ANT GROUP:

Regulatory intervention was justified in the case of Ant group due to:

- Moral hazards

- Conflict of interests, and

- Predatory lending in the business model of Ant group.

The Chinese government was conscious of the possibility of a financial crisis if Ant was allowed to list with its current business model which includes: assessing the borrower’s creditworthiness through AI, originating the loan, and then offloading the loan to a partner bank which ultimately takes on the credit risk relying on the due diligence of Ant’s AI. This is much like the “originate-to-distribute” lending model which caused the 2008 sub-prime mortgage crisis.

REASONS FOR THE ANTI-MONOPOLY PROBE:

Big tech companies were increasingly employing monopolistic practices and enjoying too much pricing power. The CCP does not want giants like Alibaba & Tencent, which have super-app components to their model, to stifle the young entrepreneurial energy and innovation in the economy.

As mentioned earlier, Alibaba was fined because it abused its dominant position in the market by forbidding merchants to advertise wares on rival sites. This also reduces consumer choices.

The merger of Huya and Douyu was blocked because it would have given Tencent majority control over the combined entity. Tencent was also asked to relinquish its music streaming rights because it would enable Tencent to capture more than 80% of the domestic music streaming market.

The CCP wants to keep companies under a tight rein by curbing disorderly expansion of capital so that no singular company spirals out of control. It wants to ensure that there is fairness, equity and efficiency in the market and that all players grow in a healthy, self-regulatory environment which would allow the economy and society to grow with greater harmony.

DATA SECURITY AS A REASON:

A major threat worrying Chinese regulators is that digital platforms like Didi, WeChat, etc. collect an unprecedented amount of data – real names, detailed whereabouts, background, facial recognition, travel patterns, eating habits, and much more generated by the high volume of transactions on their online channels. This gigantic treasure-trove of data causes an enormous privacy risk and a national security risk.

Foreign IPOs also have a risk associated with them where “critical information infrastructure,” “important data,” or “a large amount of personal information” could be “influenced, controlled, and abused” by foreign governments. This is the reason why the authorities delayed the IPO of Didi which the company failed to adhere to.

SOCIAL, PUBLIC AND STATE PRIORITIES:

Food delivery platforms like Meituan and Alibaba’s Ele.me have been criticized in recent months over their treatment of workers, with issues ranging from low pay to a lack of rights. The new reforms have been introduced to address these issues and include:

- Workers’ income above minimum pay

- Relaxed delivery time limits

- Reasonable order volumes

- Abiding by the traffic rules by the riders, and

- Insurance

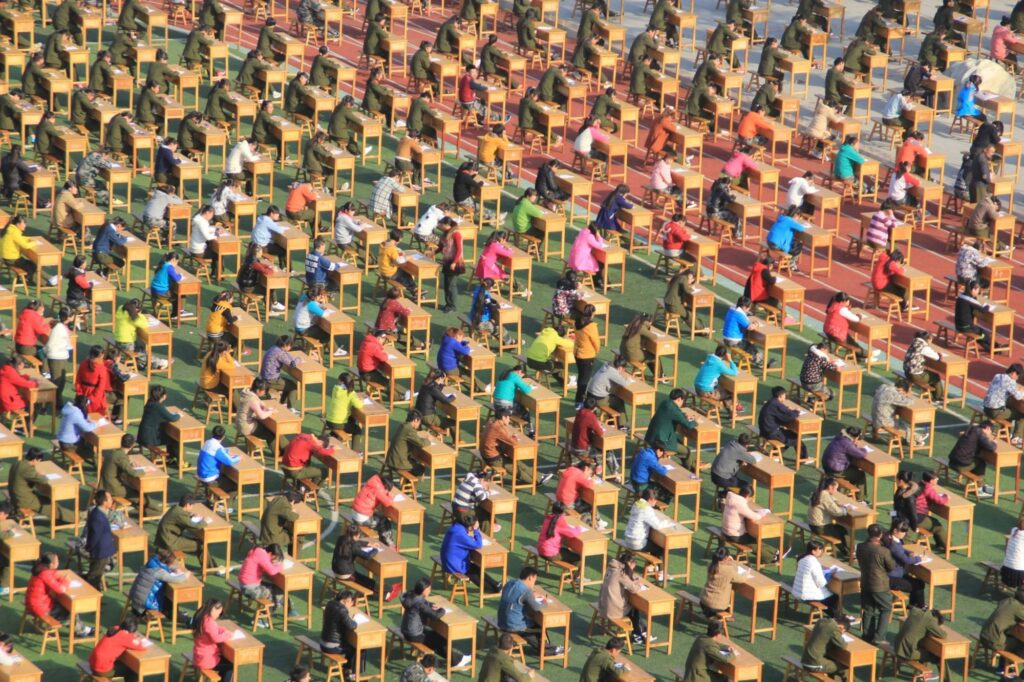

Now let’s look at the ed-tech industry. The Chinese culture has evolved to encourage increased competition in education which was causing undue pressure on school children and a huge cost burden to parents (who are now allowed to have 3 children instead of 2) trying to give their child a head-start and to get them into the best schools. It is not uncommon for children to study from 8am to 8pm in China.

All this was being exploited by the ed-tech industry. They were employing predatory pricing and charging increasingly higher amounts of money for services like test-prep, after school tutoring, etc.

Another concern was the gaping educational and social inequality originating from the fact that the privileged, wealthy class would be able to augment their child’s education by providing private tutoring. This would give them an added advantage in the rat-race of competing for better schools and better colleges as against the less affluent class.

With the latest government reforms, the Ed-Tech industry has been dealt a fatal blow. However, now it appears that the widespread social implications of this move, albeit bad for the investors, will remove unequal education access and will have desirable, long-term benefits for the empowerment, happiness and common prosperity of the people.

WHAT’S NEXT?

- This regulatory storm is a populist move which intends to alleviate inequality and curb risk. However, it could also slow innovation and change in sectors like wholesaling, retailing, transport etc. where there are ample opportunities for growth.

- However, the Chinese government remains “open to” and “supportive of” public listings overseas. It does not want to intervene in Chinese companies’ acquisitions of businesses overseas because it helps in increasing its influence worldwide.

- One of the goals in the CCP’s five-year plans is to become the world leader in tech and displace the US as the biggest global economy. It has laid down plans to speed up the development of advanced technologies like chips, artificial intelligence, quantum computing, robotics, 5G, gene editing, green energy, semiconductors, and in the space sector. So, it is unlikely that Beijing would want to disrupt the tech, healthcare, education and other crucial sectors which are basically the wheels of the economy.

- Yes, agreed that the current clampdown has wiped out around US$1.5 trillion of value from technology stocks, but it is an interim cost that must be paid to ensure the healthy long-term expansion of the digital economy.

WHAT DOES IT MEAN FOR INVESTORS?

- For Alibaba, the worst seems to be over. After the US$2.8 billion fine, the regulatory overhang on the company seems to have dissipated. It proves that the authorities merely want change, rather than disruption.

- The ed-tech firms may spin off their school-curriculum based businesses and focus on non-academic tutoring like art, computer coding, sport, music, etc. to keep their companies listed.

- Going forward, if the big tech companies under the regulatory microscope (For E.g., Tencent, Meituan, etc.) pledge to comply with regulations and rectify their business practices, they should turn out fine in the long term.

- When state control over a sector becomes too domineering, or erratic, it has the capability to injure entrepreneurial dynamism and investor confidence.

- Having said that, China is the second-largest world power at this point, and they are going to continue to innovate and grow. It is not possible to have a geographically diversified portfolio without including China in it. You can’t ignore them.

- As mentioned earlier, the long-term goals of the CCP to rival the US in advanced technologies, AI, 5G etc. present good investing avenues for long-term investors because these sectors are getting heavy regulatory support and subsidies.

WHAT ARE THE KEY LESSONS THAT INVESTORS CAN TAKE FROM THIS?

Follow the 5% rule of investing.

- This is a general investment philosophy which suggests that you should allocate a maximum of 5% of your total portfolio to any one investment security.

- This rule can be adjusted based on your risk tolerance.

- For example, if you would like to take on more risk for better rewards, you may want to increase exposure beyond 5% but you may do so at increments of 2.5%. Thus, you may increase the limit to 7.5% and then to 10% in a few months after observing the trends.

- As a measure of risk mitigation and diversification, it is always prudent to have not more than 10% exposure in a single investment security.

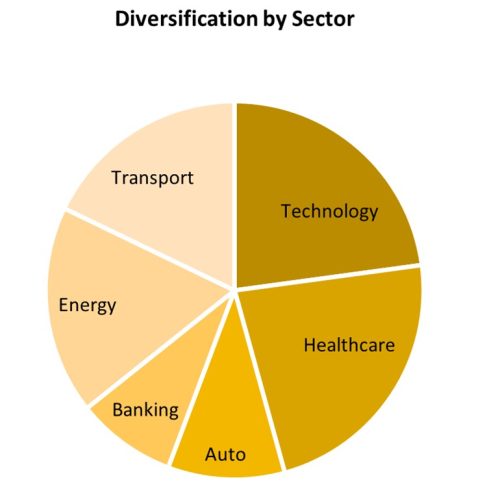

Diversify your portfolio by owning stocks from a variety of sectors/industries.

- This means you may hold a mix of technology, healthcare, auto, banking, etc.

- This ensures that if one sector is hit badly (like China’s Ed-Tech sector), then you have significant exposure in other sectors which will offset the loss from the declining sector

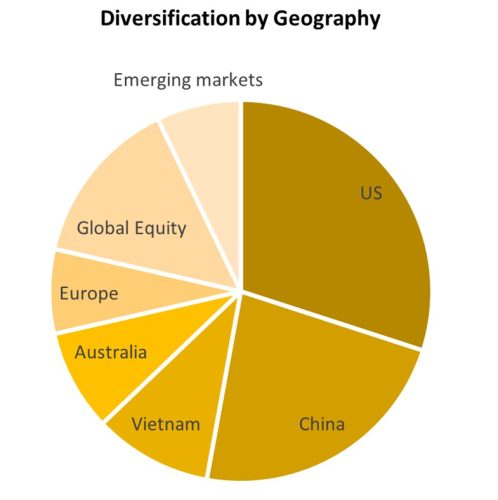

Diversify your portfolio across different geographical regions.

- This helps to compensate for the volatility of a single economic region.

- For example, the regulatory assault in China caused the investor sentiment in the region to nosedive along with stocks in sectors like ed-tech and e-commerce.

- Sure enough, diversifying can reduce the return potential from the portfolio, but it also reduces volatility and boosts preservation of capital by reducing the risk of a bad outcome. Otherwise, it’s all a big gambling portfolio rather than an investment

CONCLUSION

Although it is difficult to predict the CCP’s next move, the long-term China story remains intact. Giants like Alibaba & Tencent will not disappear overnight. And the CCP’s ambitions of making China a “superpower” will be the key driving force for innovation, new technologies and new entrepreneurial energy. One may exercise caution during the short-term black swan events. Crashes may be a value investing opportunity for the savvy long-term investor who is capable of navigating the uncertain, risk-prone and highly regulated Chinese market.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.