Summary

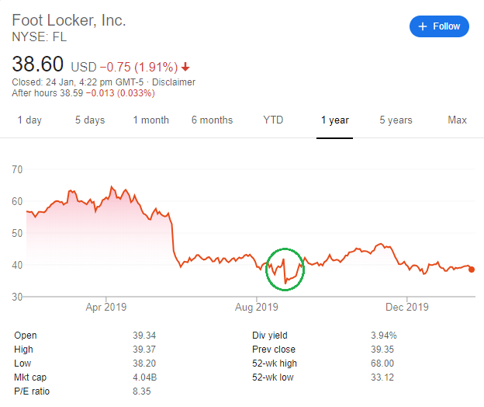

- Foot Locker’s share price has fallen tremendously since January last year.

- Despite beating earnings estimate in Q3 2019, the market is still pessimistic about Foot Locker Inc (FL) as its stock price fell about 4% since its release of Q3 quarterly report.

- Foot Locker Inc’s management combatted tough previous year with new investments, marketing efforts and slight changes in earnings guidance.

[Source: Google, 25 Jan 2020]

WHAT BUSINESS IS FOOT LOCKER INC (FL) IN?

- Foot Locker is a global retail distributor, partnering big brands like Nike, Adidas and a few other athletic brands in the business of shoes and apparel.

- They are based in New York City, and operates 3,160 retail outlets in 27 countries all over North America, Europe, Asia, Australia, and New Zealand, alongside websites and mobile applications.

- They own the brands Foot Locker, Champs Sports, Eastbay, Kids Foot Locker, Footaction, Lady Foot Locker, Runners Point, and Sidestep.

[Source: https://www.footlocker-inc.com/content/flinc-aem-site/en/home/about.html]

WHAT HAPPENED TO FOOT LOCKER INC (FL) RECENTLY?

- Foot Locker Inc had a rough 2019 and its share price reflected an approximate -32% since January 2019.

- FL has failed to meet its Q1 2019 estimates in both earnings and revenue. Alongside US-China trade war, the market was more reactive with retail stocks like Foot Locker Inc, which resulted in a dip in share price in May 2019.

[Source: Google, 25 Jan 2020; https://www.cnbc.com/2019/05/24/foot-locker-earnings-q1-2019.html]

- Despite meeting Q2 2019 earnings estimate, FL did not meet its revenue estimates. This caused the market to be pessimistic about Foot Locker Inc, as seen in the dip reflected below.

[Source: Google, 25 Jan 2020; https://sg.finance.yahoo.com/news/foot-locker-fl-meets-q2-120512662.html]

- In Q3 2019, FL exceed its earning estimate. However, it did not meet its revenue projection by analysts. This caused the market to react sceptically on Foot Locker Inc, as shown below.

[Source: Google, 25 Jan 2020; https://finance.yahoo.com/news/foot-locker-fl-earnings-beat-142602696.html?guccounter=1]

WHAT WILL HAPPEN TO FOOT LOCKER INC (FL) IN THE FUTURE?

- In general, FL have not been meeting market’s expectations for the past 3 quarter’s earnings release. This may not reflect very well on the name.

- To combat the challenges they had, FL have put in efforts to enhance their marketing & positioning, redirected their focus on youth culture and changed their guidance from quarterly to annually.

- To increase digital presence and competitiveness, FL have invested USD$100 million into a platform called GOAT. This aligns with their intention to focus more on youth culture and it is believed that this move will increase its market share through expanding both its digital and physical footprint besides its own brick-and-mortar outlets.

- To emphasize their presence in sneakers culture, FL have also collaborated with personalities of sneakers culture in Europe to market the culture for their 45th anniversary and to raise awareness through their Instagram account, a great channel of marketing directed at their target market – the youths.

- FL have also put in efforts to collaborate with new big brands, such as Champ Sports, in targeting eSports sector, relevant to its direction of focus in the youth culture.

- Another of FL’s effort to stick closure to youth culture is to launch an app called ‘Greenhouse’. This app focuses on working with aspiring creatives to come up with their crafts on footwears, apparel and other accessories.

- FL have also invested to increase its digital presence through investing in NTWRK.

- Besides diversifying in the above-mentioned channels, FL also has other minor investments in women’s, youth and kids athletic related brands.

- A positive news brought by Nike Inc is that they will no longer work with Amazon, which is beneficial for Foot Locker Inc, as it means one less competitor for the collaboration business with Nike Inc.

- FL have also worked with Nike to open some power stores, to improve on retail experiences. This will help to attract more consumers with enhanced retail experiences as their selling point.

[Sources: https://www.marketplace.org/2019/07/31/foot-lockers-plan-to-avoid-the-fate-of-american-malls/ & https://www.fool.com/earnings/call-transcripts/2019/11/22/foot-locker-inc-fl-q3-2019-earnings-call-transcrip.aspx & https://techcrunch.com/2019/02/07/foot-locker-invests-100-million-in-goat-group/ & https://www.complex.com/sneakers/2019/09/foot-locker-europe-45th-anniversary-sneakerheads & https://www.prnewswire.com/news-releases/foot-locker-inc-teams-up-with-champion-athleticwear-to-bring-esports-product-to-retail-300841867.html & https://www.complex.com/sneakers/2019/09/foot-locker-greenhouse-app-interview & https://www.prnewswire.com/news-releases/foot-locker-inc-announces-strategic-investment-in-ntwrk-300925058.html & https://www.barrons.com/articles/nike-stops-selling-on-amazon-com-why-thats-good-news-for-foot-locker-stock-51573655035 & https://digiday.com/retail/foot-locker-managed-turnaround/ & https://www.bisnow.com/national/news/retail/foot-locker-begins-aggressive-rollout-of-experiential-stores-100292]

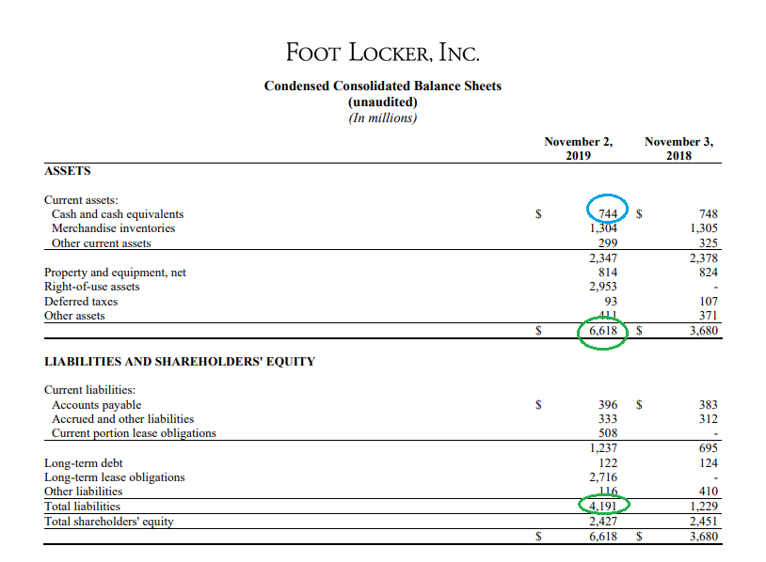

- In conclusion, I think that Foot Locker Inc is a stock that has potential. They have more assets than liabilities. Moreover, they have USD$744 million cash and cash equivalents on hand to use any time for any potential business opportunities.

So, would you be keen to learn on how to invest safely and consistently across the companies that you have come across?

You may join one of our upcoming Value Investing Masterclass to learn how expert investors do it and generate 3 sources of passive income for yourself. Reserve your slots today here.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.