Due to the increasing interest rates by the United States central bank to tame to surging inflation, various banks in Singapore have been hiking their savings accounts’ interest rates to woo the public to open an account with them.

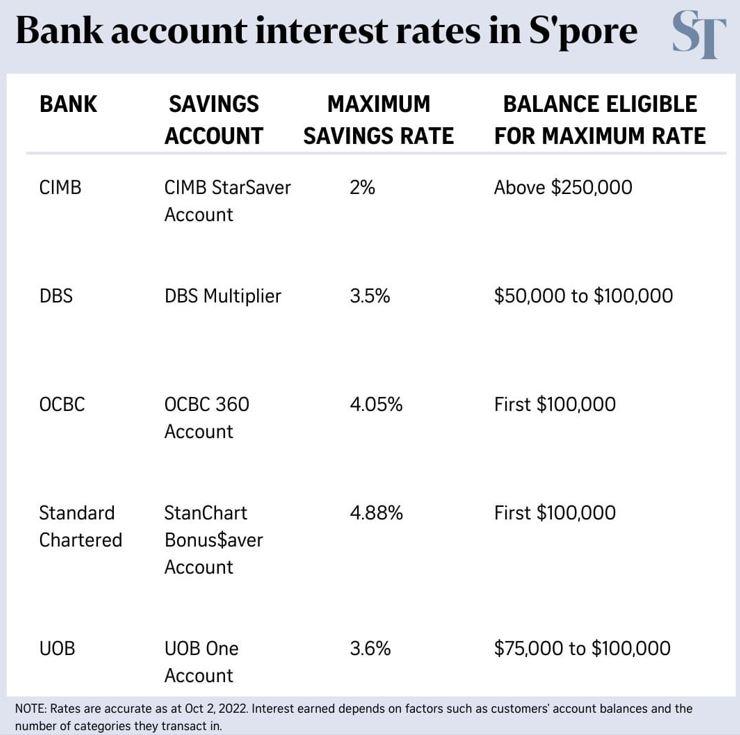

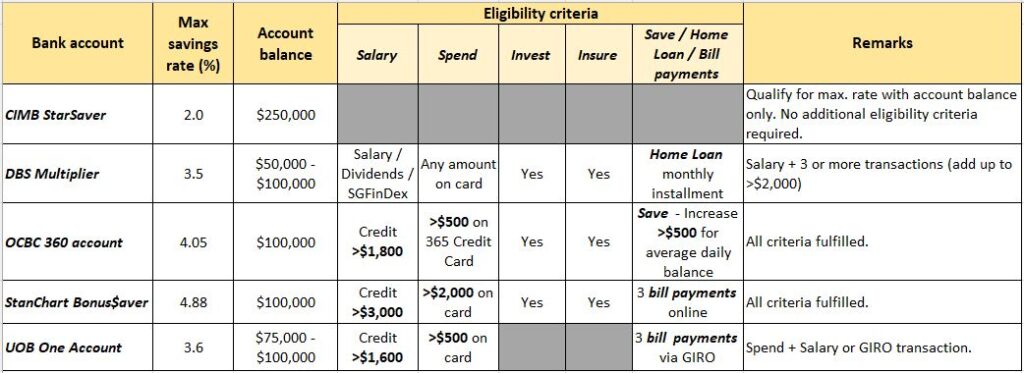

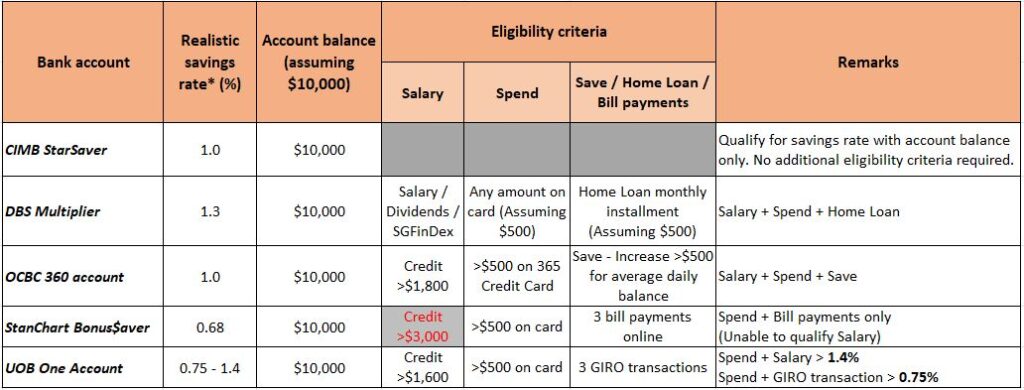

The chart below summarizes the 5 banks that have raised the interest rates for their savings accounts recently.

From the list, the highest maximum savings rate was offered by Standard Chartered for their Bonus$aver Account (4.88% per annum), followed by OCBC 360 Account (4.05% p.a.), and UOB One Account (3.6% p.a.). The remaining two banks, DBS Multiplier and CIMB StarSaver Account offered 3.5% p.a. and 2% p.a. respectively.

Even though, the carrot (high savings interest rate) dangles in front of us seems really attractive and too good to be true, one might consider what are the hidden terms and conditions required to earn that high savings interest rate.

In this blog article, we will dig through the various eligibility criteria for one to earn that max. savings interest rate. In addition, we will also consider about the more conservative (or realistic) interest rates that normal folks are able to qualify.

You can also read more on MAS bonds to compare against the banks’ saving interest rates!

MAX SAVINGS INTEREST RATE ELIGIBILITY CRITERIA

From the banks’ websites, the interest rates are categorized and offered at different rates according to the balance amount in the savings account. To keep things simple, we will be looking at the highest savings rate offered for this section.

There are 2 main criteria that the savers need to fulfil to earn the max. savings rate:

- Maintain average daily or monthly account balance

- Qualify for additional eligibility criteria

As different banks have different eligibility criteria requirements, we will deep dive into the 5 banks to determine how we can hit the max. interest rates!

CIMB STARSAVER ACCOUNT

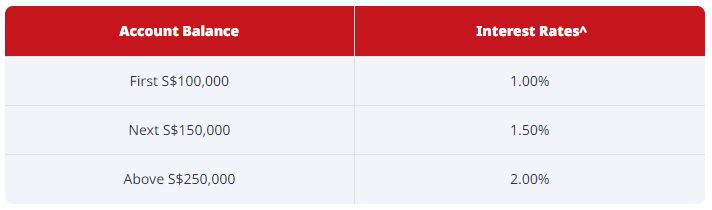

For CIMB StarSaver account, one need to maintain above $250,000 in their account to qualify for the 2.0% interest rates. But the good news is that the savers can continue to enjoy 2.0% p.a. interest with no cap.

Interest rates for CIMB StarSaver Account

Currently there are no other criteria required to qualify for the max. savings interest rates when compared to the other 4 banks (DBS, OCBC, Standard Chartered & UOB). By simple saving your money with CIMB StarSaver account, you can easily earn the max interest and let money work harder for you!

THINGS TO TAKE NOTE FOR CIMB STARSAVER ACCOUNT

- Initial deposit for account opening: $1,000

- Maintaining balance: $1,000

- Fall below fee of maintaining balance: Not stated on website

- Age for application: 16 years old (y.o.)

DBS MULTIPLIER ACCOUNT

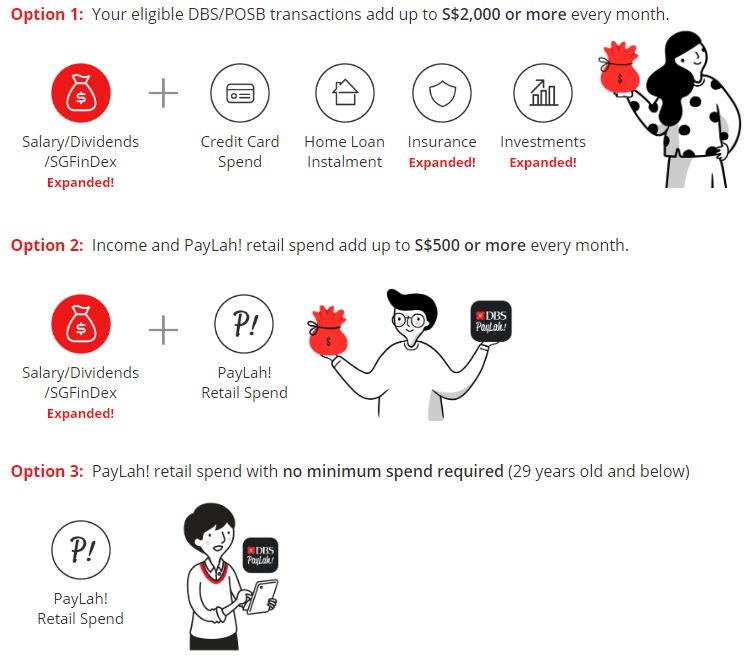

For DBS Multiplier, the public can choose either one of the 3 options provided to qualify for the higher savings interest rates. To simplify the comparison with other banks’ interest rates, we will be looking at Option 1. (The maximum interest rate offered for Option 2 & 3 is currently capped at 0.55%)

To unlock for the the max interest savings rate of 3.5% in Option 1, the first criteria to meet is to credit their salary (after CPF contributions), investment dividends or sign up SGFinDex for financial planning. Then, the second criteria to meet is to make transactions in 3 or more DBS/POSB product categories within that month from a choice of 4 categories offered:

- Credit Card spend

- Home Loan Instalment

- Insurance

- Investment

If the total eligible transaction amounts for both criteria exceeded $30,000 (as a lump sum), and their account balances is between $50,000 to $100,000, then they will earn the 3.5% interests. However, they have not set any minimum transaction amount for the 4 individual product categories as mentioned on their website.

THINGS TO TAKE NOTE FOR DBS MULTIPLIER ACCOUNT

- Initial deposit for account opening: None

- Maintaining balance: $3,000

- Fall below fee of maintaining balance: $5

- age for application: 18 y.o.

We have also did a deep dive analysis on DBS bank! Click to find out if this is a good bank to invest in!

OCBC 360 ACCOUNT

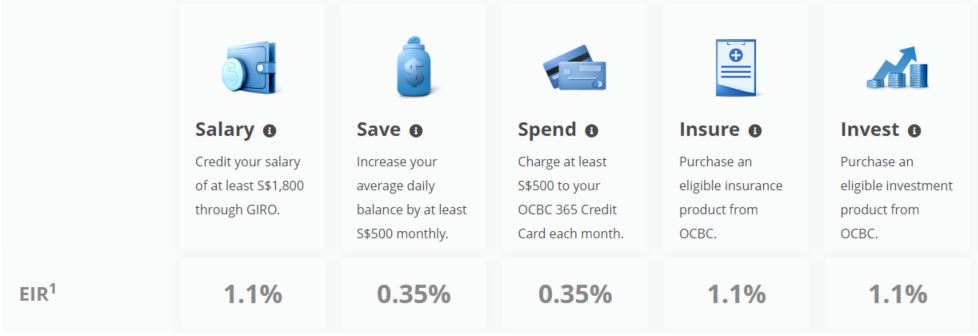

OCBC 360 Account offers 4.05% p.a. interest rate, which is the second highest savings interest offered at the moment. The eligibility criteria listed by OCBC is similar to DBS, but there are some min. spending amount requirements to unlock the high interest rates compared to DBS Multiplier account.

In addition to the usual base interest of 0.05% p.a., for your first $100,000 in savings account according to their website, when you credit your Salary (after CPF deductions) + Save (min. $500) + Spend (min. $500) + Insure + Invest, you will be earning a maximum estimated interest rate (EIR) of 4.05% a year.

THINGS TO TAKE NOTE FOR OCBC 360 ACCOUNT

- Initial deposit for account opening: $1,000

- Maintaining balance: $3,000

- Fall below fee of maintaining balance: $2

- age for application: 18 y.o.

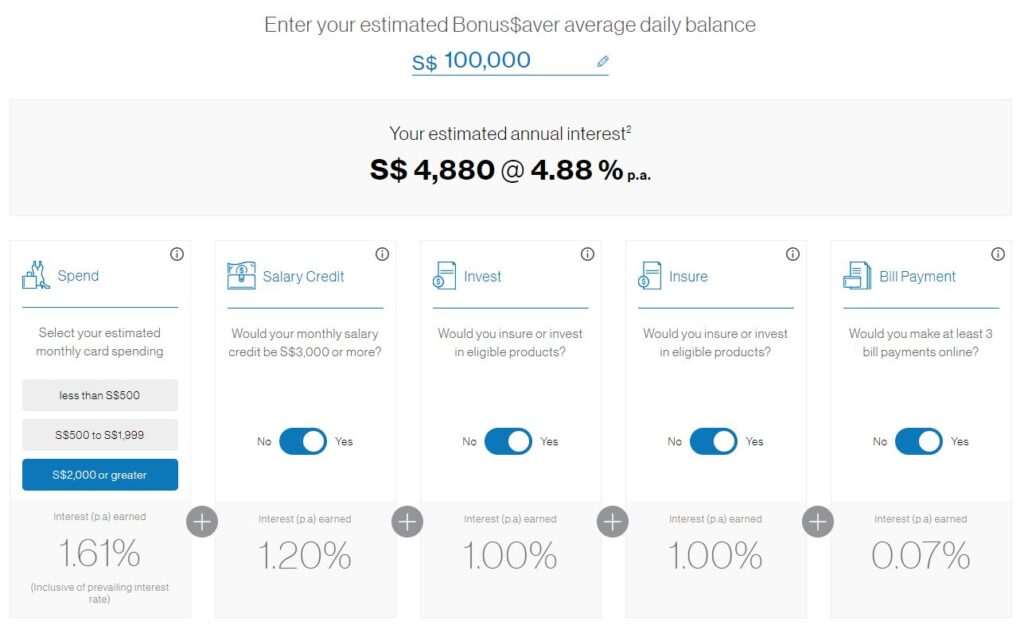

STANCHART BONUS$AVER ACCOUNT

Currently, Standard Chartered offered the highest savings interest rate compared to the other 4 banks, standing at 4.88% p.a.

This is really an attractive rate for most people at first glance, but when we dig deeper for the terms & conditions, we noticed that the bank has set a very high bar for one to achieve this rate.

In order to unlock this interest rate, one need to meet ALL of the 5 criteria for their first $100,000 daily average balance:

- Spend more than $2,000

- Credit monthly salary of $3,000 (after CPF deductions)

- Invest in at least one eligible product

- Insure in at least one eligible product

- Make 3 online bill payments of at least $50 each month from Bonus$aver account

If there is any one of the criteria unable to achieve, the interest rates will be lesser than 4.88% p.a., especially for card spending lesser than $2,000.

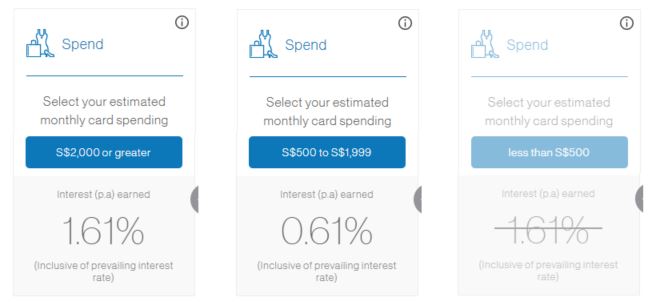

In the illustration below, one will noticed that they are able to earn 1.61% if they spent more than $2,000 on their StanChart credit card! However, the interest rate for spending dropped significantly when the card spending is between $500 to $1,999, which is 0.61% and there is no interest earned if the card spending is less than $500.

THINGS TO TAKE NOTE FOR STANCHART BONUS$AVER ACCOUNT

- Initial deposit for account opening: Not mentioned on website

- Maintaining balance: $3,000

- Fall below fee of maintaining balance: $5

- age for application: 21 y.o.

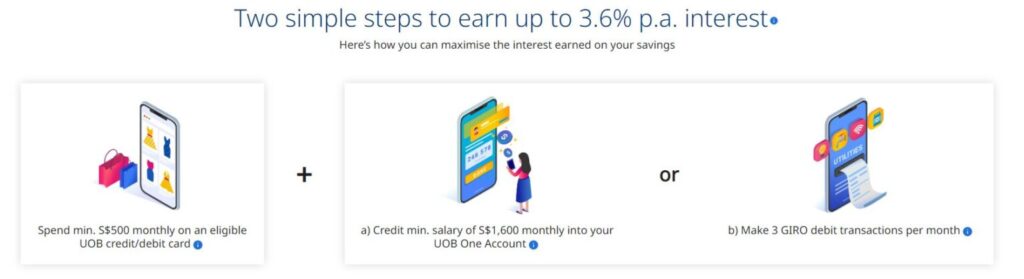

UOB ONE ACCOUNT

Finally, even though UOB offered 3.6% p.a. for their savings account – One Account, which is considered at mid-range when compared against the other 4 banks, it has the simplest eligibility qualifications for the high savings interest rate!

To qualify for the high interest rate, one has to spend $500 monthly on a UOB credit or debit card and choose either credit their salary via GIRO (3.6% p.a.) or make 3 GIRO transactions (2.5% p.a.), in addition to have between $75,000 – $100,000 monthly average balance in their savings account.

Another hidden perk for this account is that when a person spends more than $500 on their UOB One Credit Card, they will be able to enjoy an additional cash rebate capped to $200 per year!

THINGS TO TAKE NOTE FOR UOB ONE ACCOUNT

- Initial deposit for account opening: $1,000

- Maintaining balance: $1,000

- Fall below fee of maintaining balance: $5

- age for application: 18 y.o.

The chart below summarizes all the qualification required to earn the max. savings interest rates from the 5 banks.

REALISTIC SAVINGS INTEREST RATE ELIGIBILITY CRITERIA

From the looks of it, it seems very difficult for normal folks to hit the max. savings rate. Thus, we decided to lower the bar and set a more conservative expectation to find out what are the realistic interest rates that one can qualify.

We will exclude the Invest and Insure criteria for this section as most people might have their own personal insurance with external insurance company and invest their money with other security brokers.

The chart below listed out the realistic savings rate with assumption below that one has:

- $10,000 balance in savings account

- Credit salary of $2,500 (after CPF deductions)

- Credit card spending of $500

- Meet 1 eligibility criteria – Save or Home Loan instalment or Bill payments (depends on bank’s requirements)

From the table comparison, we noticed that all the rates have dropped drastically when we lowered the eligibility criteria. Nevertheless, these savings account are still able to offer attractive rates compared to the meagre base interest of 0.05% p.a.

Currently, the savings account that offered the highest interest is ranked as below:

- UOB One Account – 1.4%

- DBS Multiplier – 1.3%

- CIMB StarSaver & OCBC 360 Account – 1.0%

- StanChart Bonus$aver Account – 0.68%

Saving has been the sound advice and an admirable virtue that our parents had tried to imbue into us since childhood. However, with the latest report released by Money Authority of Singapore (MAS) in Aug 2022, Singapore’s core inflation is currently at 5.1%, edging closer to 14-year high since ’08-’09 Financial Crisis!

After going through all the latest savings interest rates offered, one might feel despair that how can they make their money work harder for them when the core inflation rate is much higher than the savings rate. If the money is left in the savings account, the purchasing power of the money will be eroded by the high inflation rate as time goes by.

DISCLOSURE

The above article is for educational purposes only. Under no circumstances does any information provided in the article represent a recommendation to buy, sell or hold any stocks/asset. In no event shall ViA or any Author be liable to any viewers, guests or third party for any damages of any kind arising out of the use of any content shared here including, without limitation, use of such content outside of its intended purpose of investor education, and any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages resulting from such unintended use.