Overview

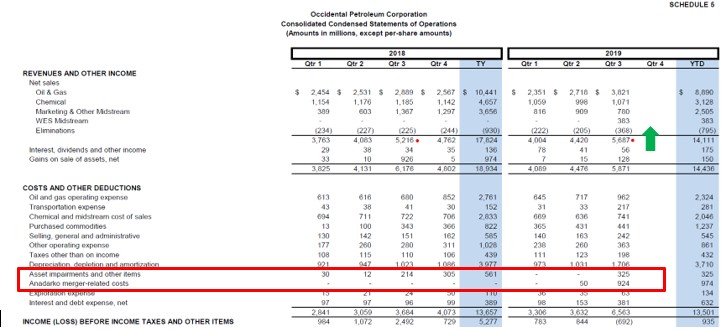

- Occidental Petroleum (OXY) misses earnings estimates for 2 consecutive quarters. Q2 GAAP EPS of missed by $0.08; Q3 GAAP EPS missed by $1.49 but revenue beats by $90m and $280m respectively (quoted from Seeking Alpha).

- The market sentiments seem to deem Anadarko’s take over as an over-paid good will which lead to the volatility of share price.

- However, Mizuho’s analyst quoted that OXY resumes generating a sustainable breakeven of $40/bbl. This give OXY to have more potential upside as crude oil prices move.

- Post 2014 span-off and 2015 sale of non-core operations, OXY has been generating positive cash flow from operation and net income.

Source: Google Finance (Jan 20, 2020)

What Business Occidental Petroleum Is in

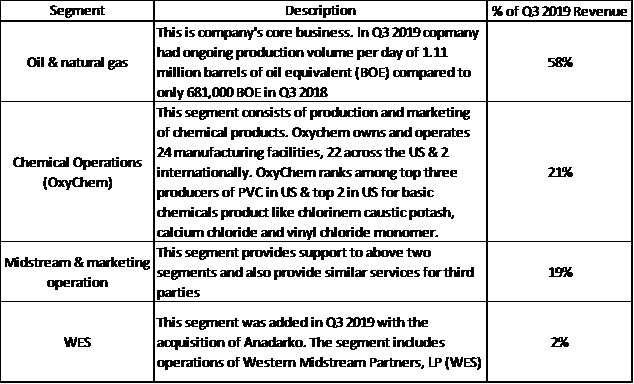

An international oil & gas exploration and production company with operations in the United States, Middle East and Latin America.

Occidental’s wholly owned subsidiary OxyChem manufactures and markets basic chemicals and vinyls.

Primary areas of focus include:

- Oil & gas

- Chemical

- Midstream and marketing that involves in purchases, markets, gathers, processes, transports and store hydrocarbons

- WES (an independent partnership)

What happened to Occidental Petroleum (OXY)recently?

It has been in the news lately and its share prices have been in the downward trend in 2019.

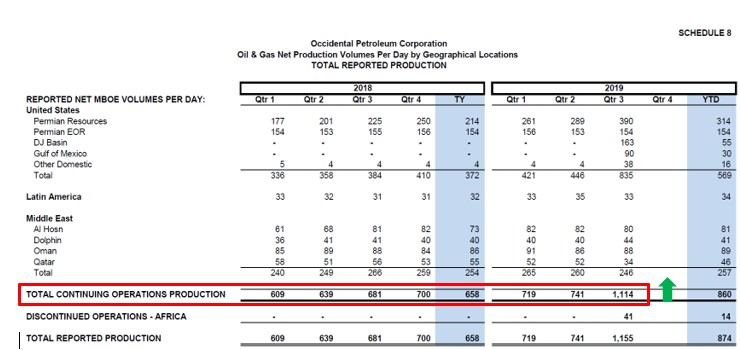

OXY reported earnings missed estimates for Q3 2019 which primarily due to the M&A cost from acquisition of Anadarko, however the total revenue were 3.2% better from estimate. The production volume also increased due to higher drilling activity and solid output from the Permian Resources region.

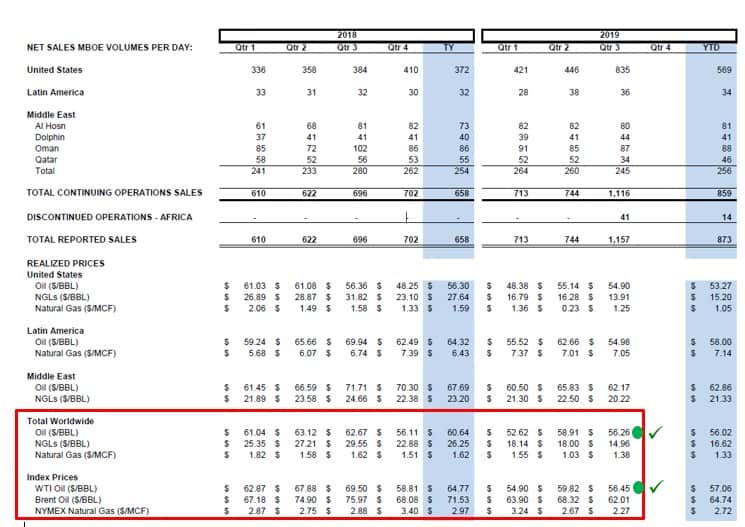

Nevertheless, world wide crude oil prices decreased 10.2% year over year to $56.26 per barrel which did not allow the company to realize full benefits of higher production and sales volumes in the reported quarter.

The acquisition deal with Anadarko Petroleum has be deemed as a bad move by theby investors, particularly activist investor Carl Icahn. Management believes it’s a good move. which cause the market sentimental to swing downward trend.

Source: https://www.oxy.com/investors/Documents/Earnings/OXY3Q19EarningsPressRelease.pdf

OXY has also been selling non-core assets, as well as embarked on a headcount reduction – these activities will increase cashflow and reduce operating costs going forward.

The market sentiment pretty much driven by the overwhelming lime lights the multi-millions dollar analysts shine on the company. Given that the share price has been downward trend since the decrease of crude oil prices; investors have been struggling to have faith especially post the acquisition of Anadarko with such a high price. The merger was controversial as it significantly raised Occidental’s debt levels which investors fear more on the maturity of the near-term debt.

However, based on the Q3 earning call, the CEO of OXY has clearly stated that the company has repaid $5bn in debt in the most recent quarter and has no maturities scheduled in 2020.

What will happen to OXY's future?

OXY revenue has been consistently increased from 2015 to-date.

Quoted: Seeking Alpha, Occidental Petroleum and left Brain

The company operates through the following segments:

The Q3 2019 sales volume has been trending upwards by >60% vs same period last year.

The OXY Worldwide Oil/BBL price vs WTI Index is not very far off which means once the synergy is recognized with the breakeven point of $40/BBL it will drive significant increase to the operating margin for the company.

OXY is reducing their stake in WES to under 50%. This paves the way for Oxy to pare down their stake in WES in future. Further, the reduction in shareholding means WES’ debt does not have to be consolidated into OXY’s books

Looking at the management, CEO Vicki Hollub with 30+ years career in Permian in various roles from Drilling Engineer to Area AP for OXY is absolutely the right person to integrate these companies. The acquisition of Anadarko (APC) will make OXY to be the largest market player in the industry.

Next, the Chairman Eugene Batchelder has a pretty good oilfield pedigree whom was the ConocoPhillips (COP) CFO in 2012 (COP is a role model of what a modern super major oil company should be).

OXY has a consistent track record of paying and growing dividends. Specifically, OXY has been increasing and paying dividends consecutively for the past 17 years. There are reasons to believe that OXY could be able to continue paying and increasing its dividend in the years ahead:

- OXY’s management team is committed to protect OXY’s ability to continue paying dividends. Management had consistently reiterated that one of their main goal is to ensure that shareholders’ dividends are protected. In a recent interview, CEO Vicki Hollub alluded to the following: “The substantial free cash flow we will generate in higher price environments, combined with our ability to pay a sector-leading dividend throughout lower commodity price environments, is unmatched”. This clearly indicates management’s commitment towards ensuring a sustainable and industry-leading dividend

- OXY has been diversifying non-core assets to pare down debt, reduce interest expenses and increase free cash flow from operations. In addition, OXY had previously offered a group of employees the option of voluntary termination, and had recently instituted a company-wide non-voluntary termination program, to ensure that it operates on a lean and efficient workforce. All these activities are likely to increase OXY’s free cash flow, which will go a long way towards ensuring dividend payments are not disrupted; and

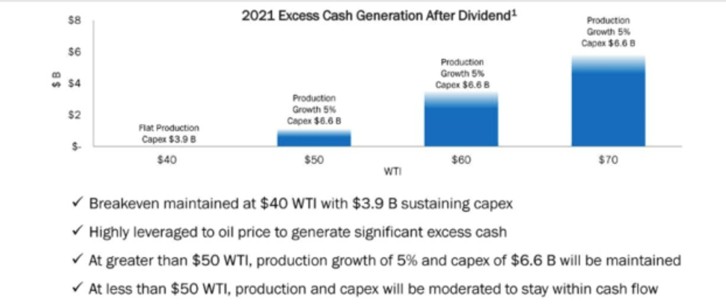

- OXY had put in place hedges to ensure that dividend targets can continue to be met even in an low oil price environment. In fact, at USD 40 bbl, OXY is able to breakeven and maintain dividends, while at USD 50 bbl, OXY is able to maintain dividends, as well as grew production at 5% to 8%. The low production cost is extremely important, as it allows OXY to remain profitable in low price environments while other drillers are struggling to stay afloat. Drillers that do not survive under harsh conditions will reduce the competition that efficient producers such as OXY have to face. This allows 1. OXY to potentially acquire distressed assets at fire-sale prices and 2. Reduce overall crude oil supply and drive prices upwards.

Source: OXY Presentations

Another reason to consider is that many shale producers are able to drill for crude oil, but do not have the capacity to transport the production obtained. OXY not only has sufficient pipeline takeaway and export capacity to transport its own production, but has spare capacity to derive revenue from transportation of production for other drillers.

Moreover, OXY’s current market cap is equivalent to its market cap prior to the acquisition of Anadarko. In a nutshell, at today’s prices, an investor is basically getting one company (i.e. Anadarko) for free.

My take is to hold OXY for now and watch out for the Q4 2019 earnings. Once the coast is clear, with the potential upside from the recent merger, and the consistency in dividend payout; OXY will be a company that I would like to add into my portfolio.

So, would you be keen to know more about a good growth, fair valued U.S company?